September 02, 2024

Gold Break Out

Author - Ben McGregor

Gold breaks decisively out of persistent range

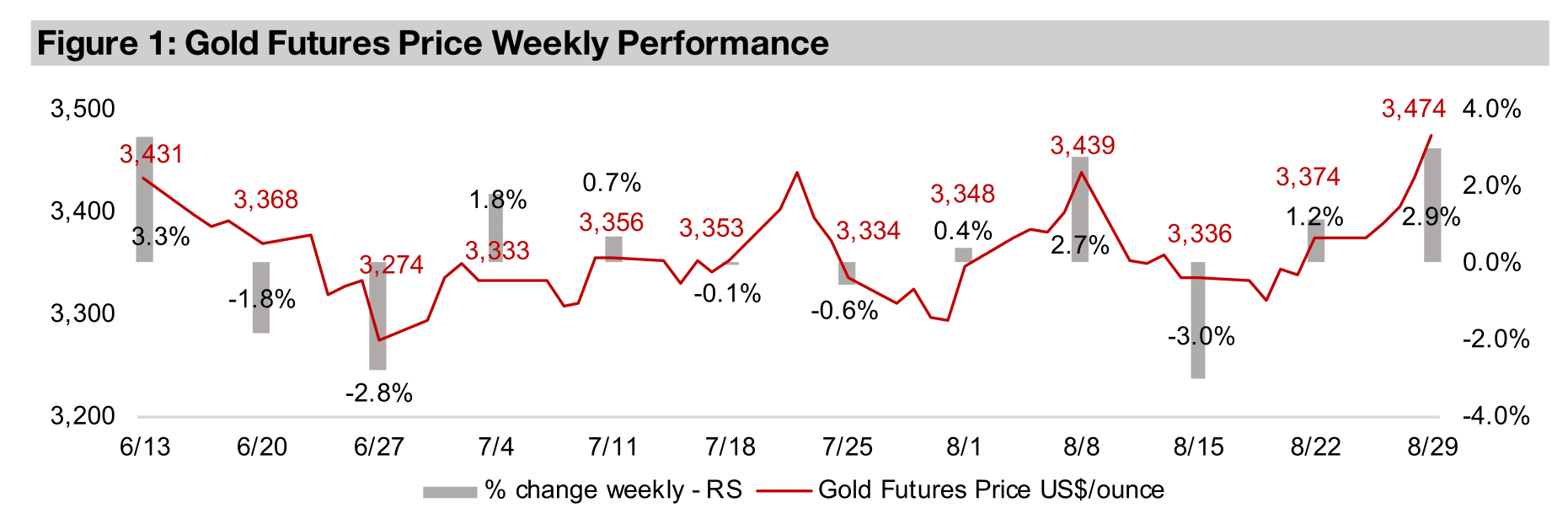

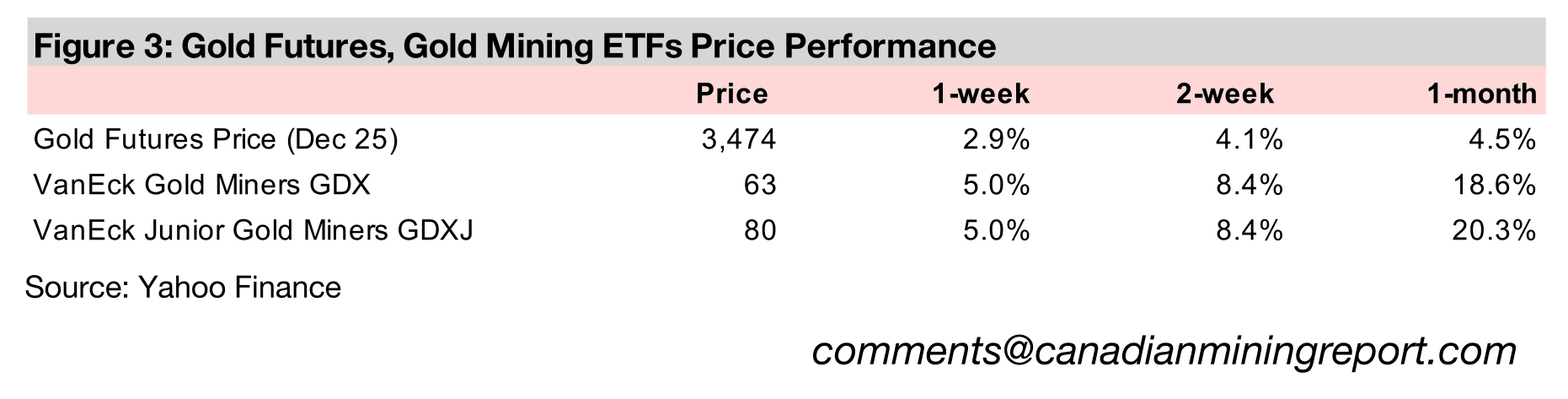

Gold rose 2.9% to US$3,474/oz last week, and briefly hit over a US$3,500/oz all time high over the weekend, finally breaking out of the US$3,200-US$3,400/oz range of the past four months, with prior moves above this lasting one or two days.

Gold Break Out

The gold price rose 2.9% to US$3,474/oz, finally decisively breaking out of the

US$3,200/oz-US$3,400/oz range that had held for over four months. While the three

previous moves above US$3,400/oz during this period lasted one or two days, the

metal held above this benchmark for several days this week and even surpassed

US$3,500/oz over the weekend, an all-time high. This appears to have been driven

mainly by expectations that the Fed will finally join the central bank rate cutting cycle

at its September 2025 meeting. The Fed has maintained its base rate at 4.33% in

2025, which is now the highest of all the major central banks, with only the UK close,

at 4.00%, and the ECB having already slashed rates to 2.15% from a 4.50% peak.

Icon and logot

Other major economic news included US Q2/25 real GDP growth of 3.3%, which

came in above expectations, and the July 2025 personal consumption price (PCE)

index, ticking up to 2.9% from 2.8% in June 2025 and inline with market forecasts.

While the PCE index was relatively neutral, it remains above the Fed’s 2.0% target,

and the strong GDP figure could be viewed as inflationary overall, with the two

combined also possibly driving up gold. However, this did not indicate price

pressures to a degree that would likely see the Fed dissuaded from the rate cut.

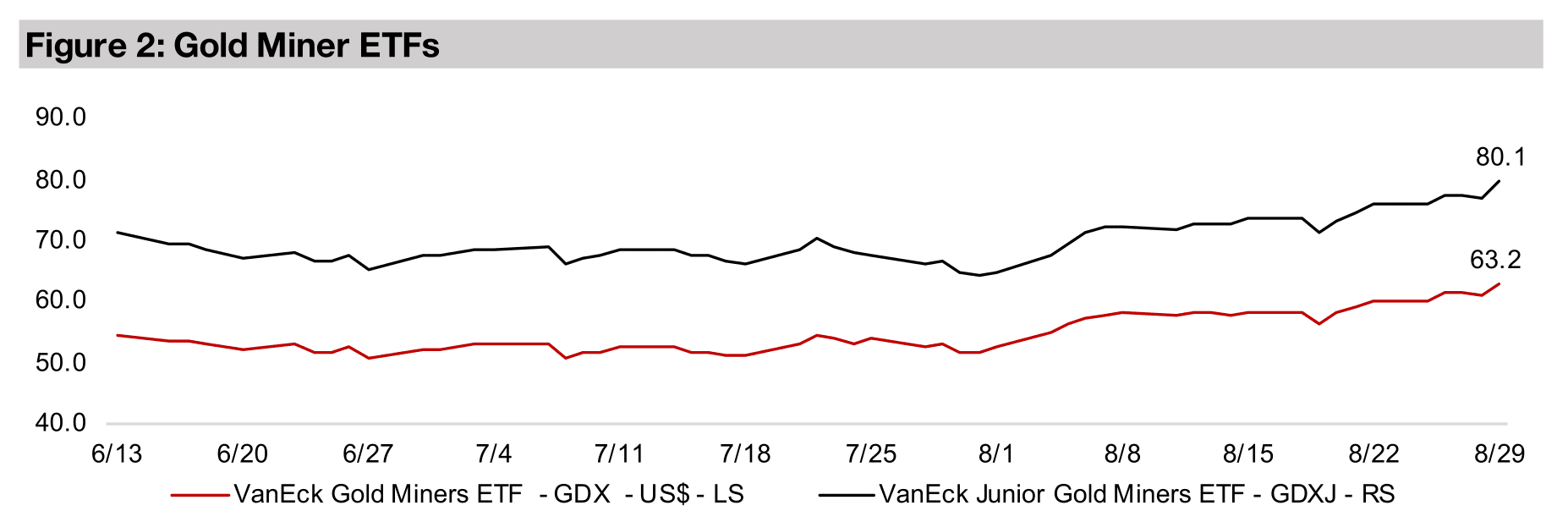

The gold stocks jumped to new highs, with both the GDX and GDXJ rising 5.0% on

the gain in the metal price. The sector may have also benefited from some signs of a

risk off move in equity markets, with the S&P 500 still gaining 0.6%, but the Nasdaq

down -1.2% and the Russell 2000 off -0.5%. For the other precious metals, silver

also rose, up 1.3%, although platinum and palladium were down -1.9% and -2.5%,

respectively, with both continuing to pullback from recent surges. Most of the major

base metals rose, with iron ore and nickel both gaining 2.2%, copper up 1.1%, and

zinc edging up 0.2%, with only aluminum down slightly, dropping -0.3%.

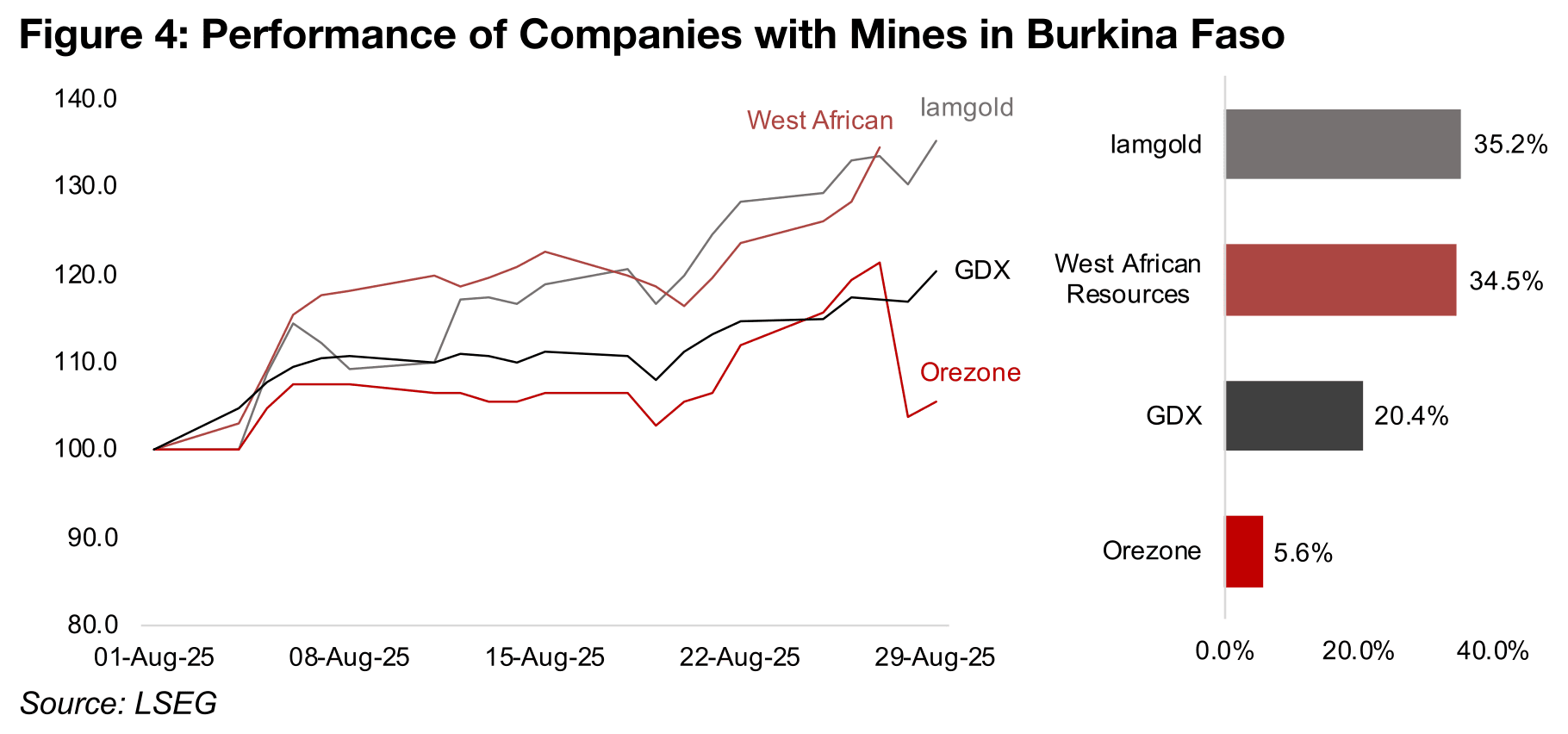

Some mining stocks exposed to Burkina Faso take major hit

While most gold stocks rose this week, two with major exposure to Burkina Faso were hit substantially. This included Australia’s West African Resources, which operates the Kiaka mine in the country, with trading halted on Thursday and not resumed on Friday, and Orezone from Canada, operating the Bombore mine, which slumped -14.5% on the day (Figure 4). Both companies had actually been outperforming the GDX ETF of gold miners in August 2025 prior to the announcement. These moves came after the Burkina Faso government announced it would take an additional 35% of the Kiaka mine from West African Resources, increasing its holding to 50% including its current 15% free-carry stake. This led to fears that Orezone could potentially face a similar forced acquisition of a large stake of Bombore, and the company reported that it contacted the government to discuss the matter. While Iamgold also operates the Esskane mine in Burkina Faso, its share price pulled back only briefly on Thursday and recovered by Friday, as its exposure to the country is a much smaller proportion of the total operations than for these other two stocks.

This development has followed from a new mining code in Burkina Faso which was

released in July 2024 that permitted the newly established state-owned industry

vehicle Societe de Participation Miniere du Burkina (SOPAMIB) to acquire at least 30%

of mining projects, in addition to the previous 15% free-carry stake. This followed the

transfer in June 2025 of five assets, including two gold mines already in production,

Boungou and Wahgnion, and three licenses for exploration, operated by the UK’s

Endeavour and Lilium Capital, to the Burkina Faso government. An original plan for

Endeavour to divest of the assets with Lilium as the buyer had not been completed

and saw the projects transferred to SOPAMIB.

This is part of a broader political movement in the region, with Mali, Burkina Faso and

Niger forming the Alliance of Sahel States (AES), and exiting the Economic

Community of West African States (ECOWAS). The followed military takeovers in Mali,

Burkina Faso and Niger, in 2021, 2022 and 2023, respectively. These new regimes

have seen the Alliance’s political relations with France decline and a shift towards

support from Russia. The three countries have plans to integrate further, and possibly

even start a new common currency apart from the Western African CFA Franc now

used in Western African Economic and Monetary Union, which also includes Benin,

Cote d’Ivoire, Guinea-Bissau, Senegal and Togo. Gold is also by far the majority of

the export value of all three countries, making controlling the operations of the metal

particularly significant to financing of these new regimes.

This political shift has led to a similar disruption of the gold mining industry in Mali,

with a new code in 2023 giving the government a 10% stake in mining projects, an

additional 20% holding in the first two years of production, with a further 5% to other

domestic interests. The changes eventually drove a conflict between Mali and Barrick,

which had operated the Loulo-Gountoko project in the country, with some executives

arrested in November 2024 over a tax payment claim dispute that is still ongoing.

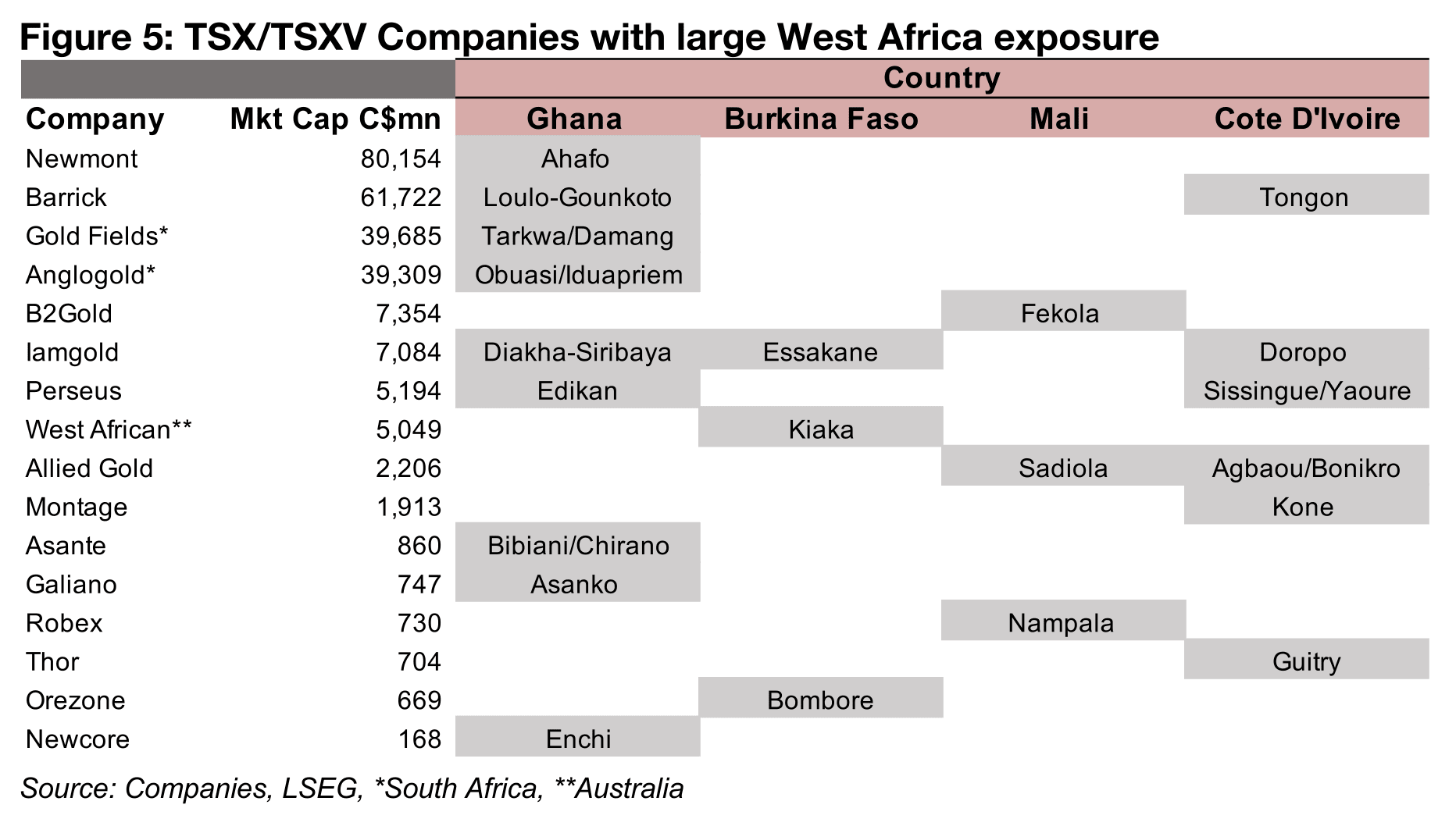

TSX and TSXV companies continue to have significant exposure to the region in

addition to Burkina Faso, although much of this is in Ghana and Cote d’Ivoire, which

are not part of the AES. However, several companies are operating in Mali, including

B2Gold, Allied Gold, and Robex Resources, with their Fekola, Sadiola and Nampala

mines (Figure 5). Especially for the latter two companies, Mali comprises a large

proportion of their operations and further aggressive resource nationalization could

remain a major risk. Africa is the second largest destination for Canadian mining

investment, with the country’s assets in the continent at CAD$37bn as of early 2025,

with large investments in the copper sector in addition to gold.

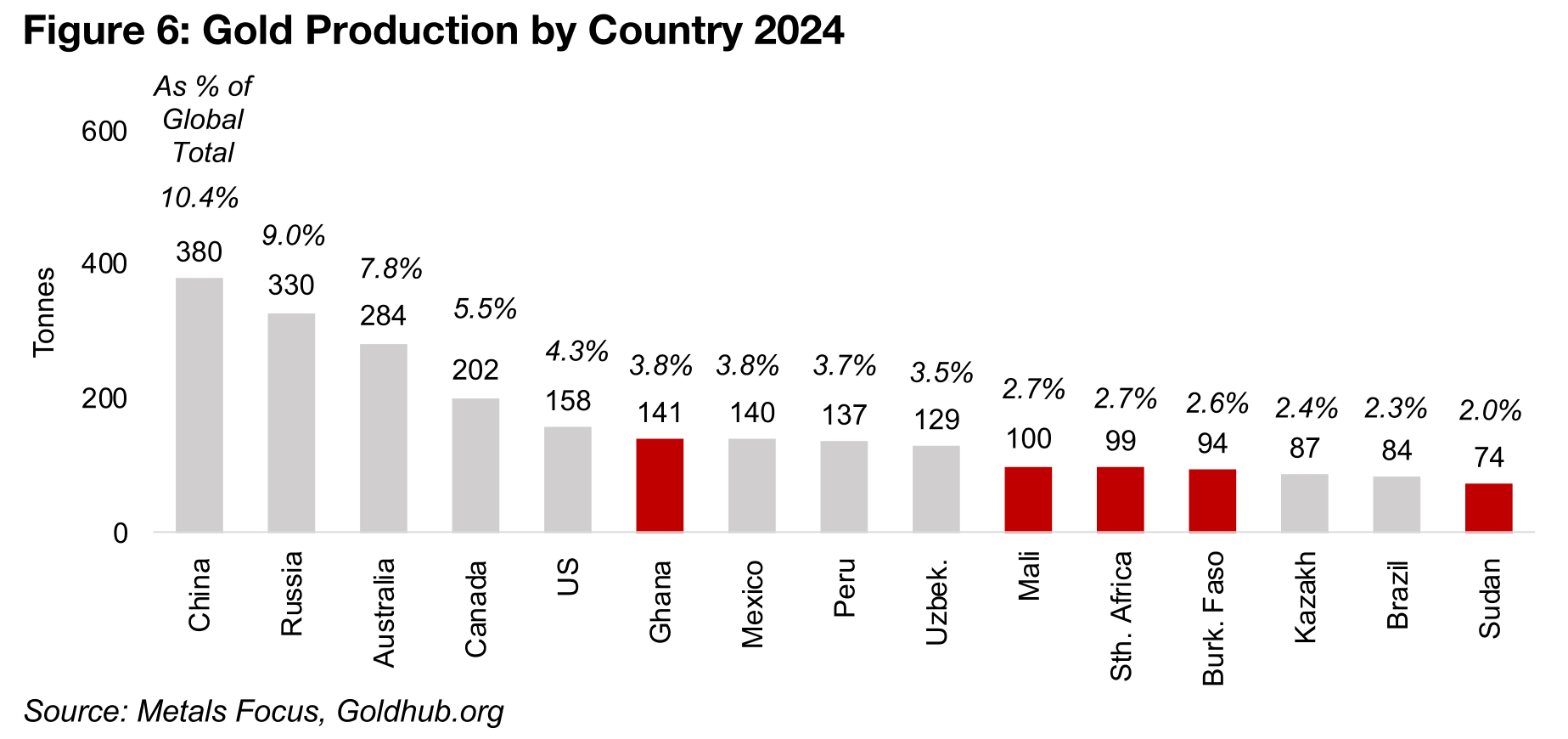

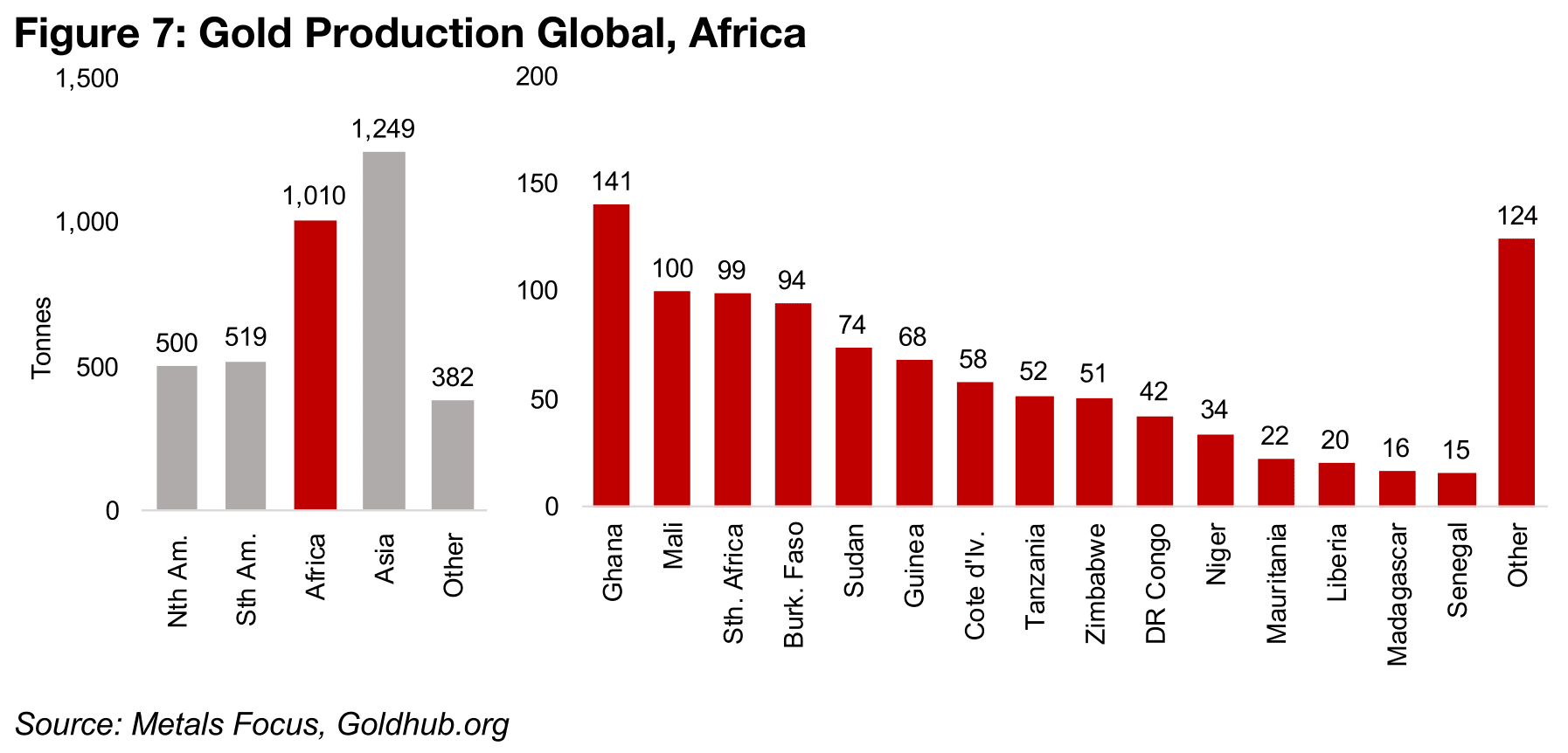

West Africa producing large and rising share of global gold

Political developments in Africa overall, and specifically the Western part of the continent, have been increasingly important for the global gold industry. Three countries there, Ghana, Mali and Burkina Faso, are now the sixth, ninth and eleventh largest gold producers globally in 2024, at 3.8%, 2.7% and 2.6% of the total (Figure 6). Africa overall has become the second largest global producer overall, with 1,010 tonnes in 2024 putting it only behind Asia, at 1,249 tonnes, and just below the total production of North and South America combined at 1,019 tonnes (Figure 7). Beyond West Africa’s top three, Guinea, Cote d’Ivoire, Niger, Liberia and Senegal also all have a relatively large gold output. Africa also has several other major producers from other regions on the continent including South Africa, Sudan, Zimbabwe, the Democratic Republic of Congo and Mauritania. The continent could also see significant growth in mining assets with exploration and other development in many of these countries having been limited in recent decades because of political conflict or low national income.

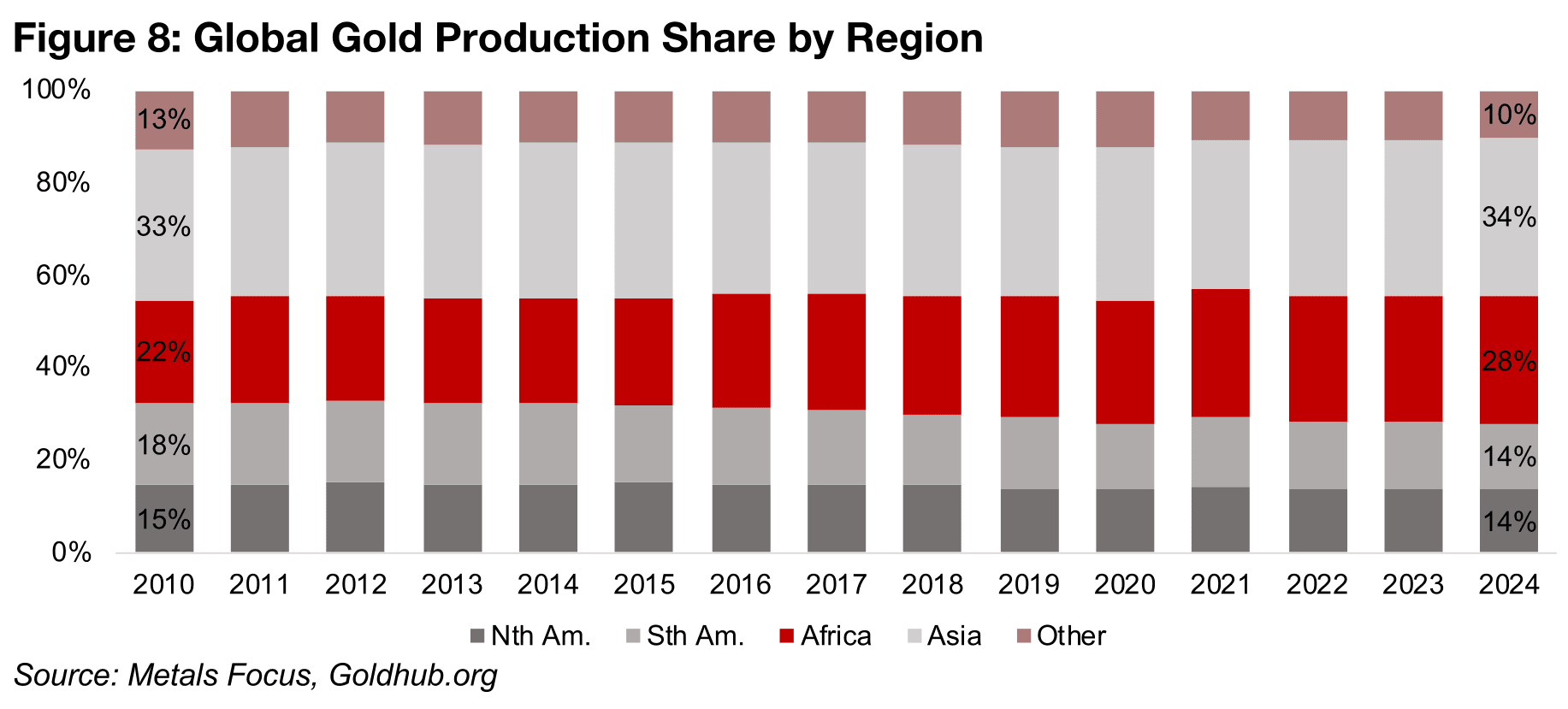

The region has risen to 28% of total global gold production in 2024 up from 22% in

2010, with Asia roughly flat at 34%, down from 33%, with North and South America

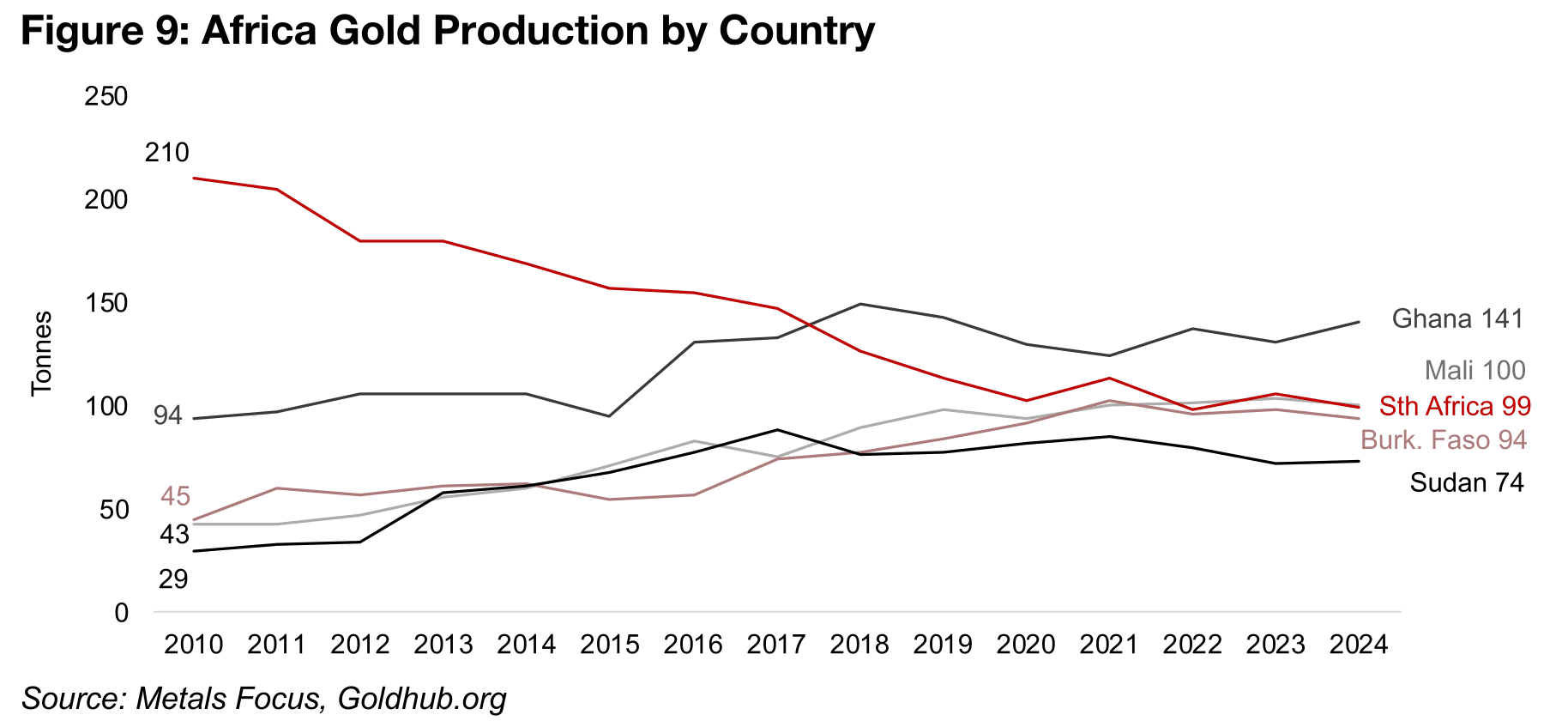

at 14%, down from 15% and 18% (Figure 8). There has also been a major shift in the

production within Africa from the southern to western part of the continent. While

South Africa had been the clear leader for Africa’s gold output in 2010, at 215 tons,

this has declined by more than half to just 99 tons in 2024 (Figure 9). In contrast,

Ghana’s production rose by 46 tonnes to 141 tonnes in 2024 from 94 tonnes in 2010,

making it by far the leader for Africa. While the output of the second and third largest

players, Mali at Burkina Faso, were lower, at 100 and 94 tonnes, the increases for

both since 2010 of 57 and 50 tonnes have been larger than Ghana. The other large

African producer, Sudan, saw gold output rise 44 tonnes since 2010 to 74 tonnes in

2024.

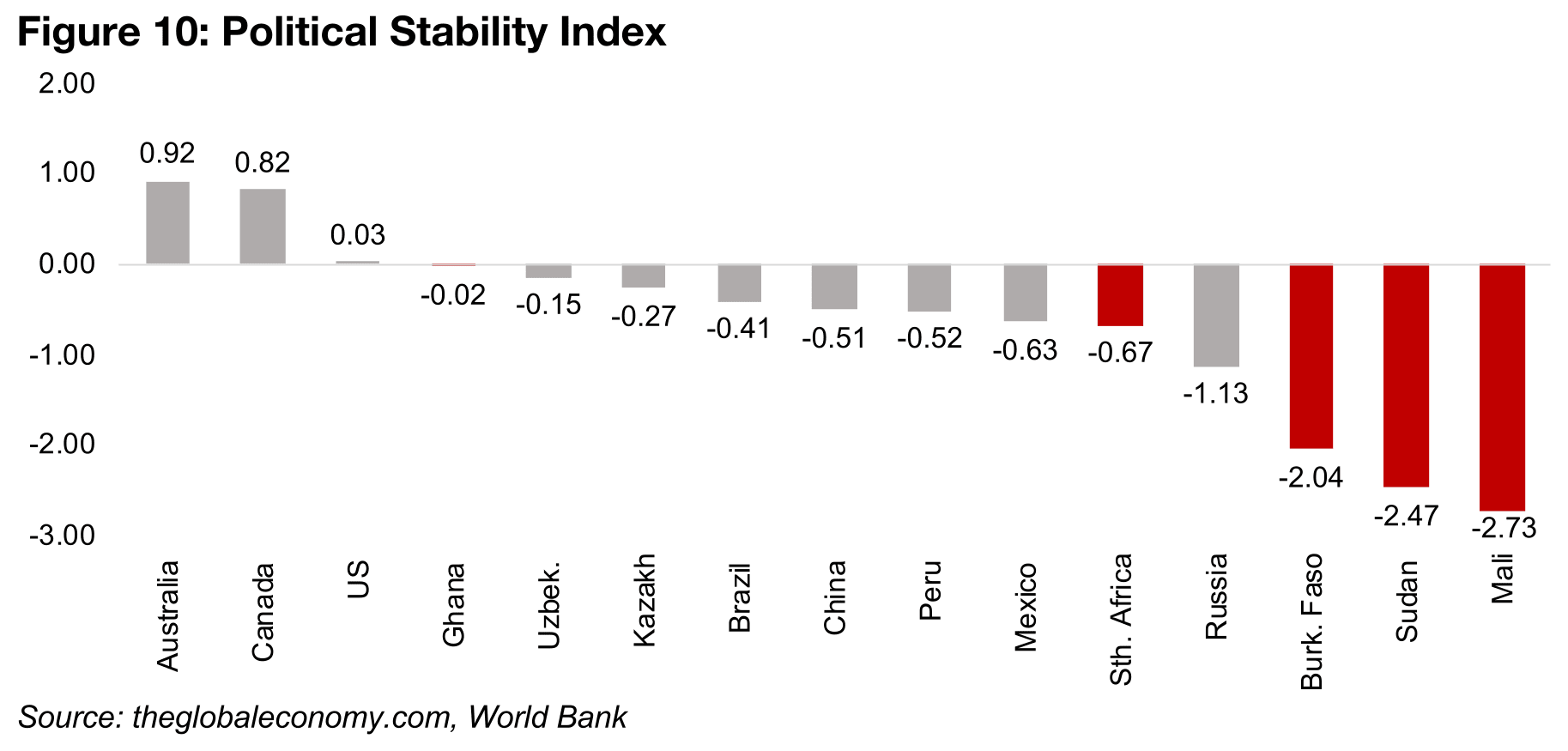

The recent developments in the AES countries will have particularly brought the

political risk of developing projects in Africa and other developing regions into focus.

The World Bank ranks the political stability of countries, with 2.5 considered strong

and -2.5 considered weak. Of the major global producers shown in Figure 6, Burkina

Faso, Sudan and Mali clearly have the lowest ratings, at -2.04, -2.47 and -2.73, and

while South Africa is far above this, it is still negative at -0.67 (Figure 10). Ghana has

a much higher rating, near zero at -0.02, indicating a relatively neutral political

situation, which is near the 0.03 of the United States. However, clearly Canada and

Australia stand out among the largest gold mining countries for political stability at

0.82 and 0.92, respectively. While Canadian mining companies are very likely to

continue to invest in Africa overall given the huge opportunity still there, this could

shift more towards more politically stable countries given these recent developments

and a trend of rising resource nationalism globally.

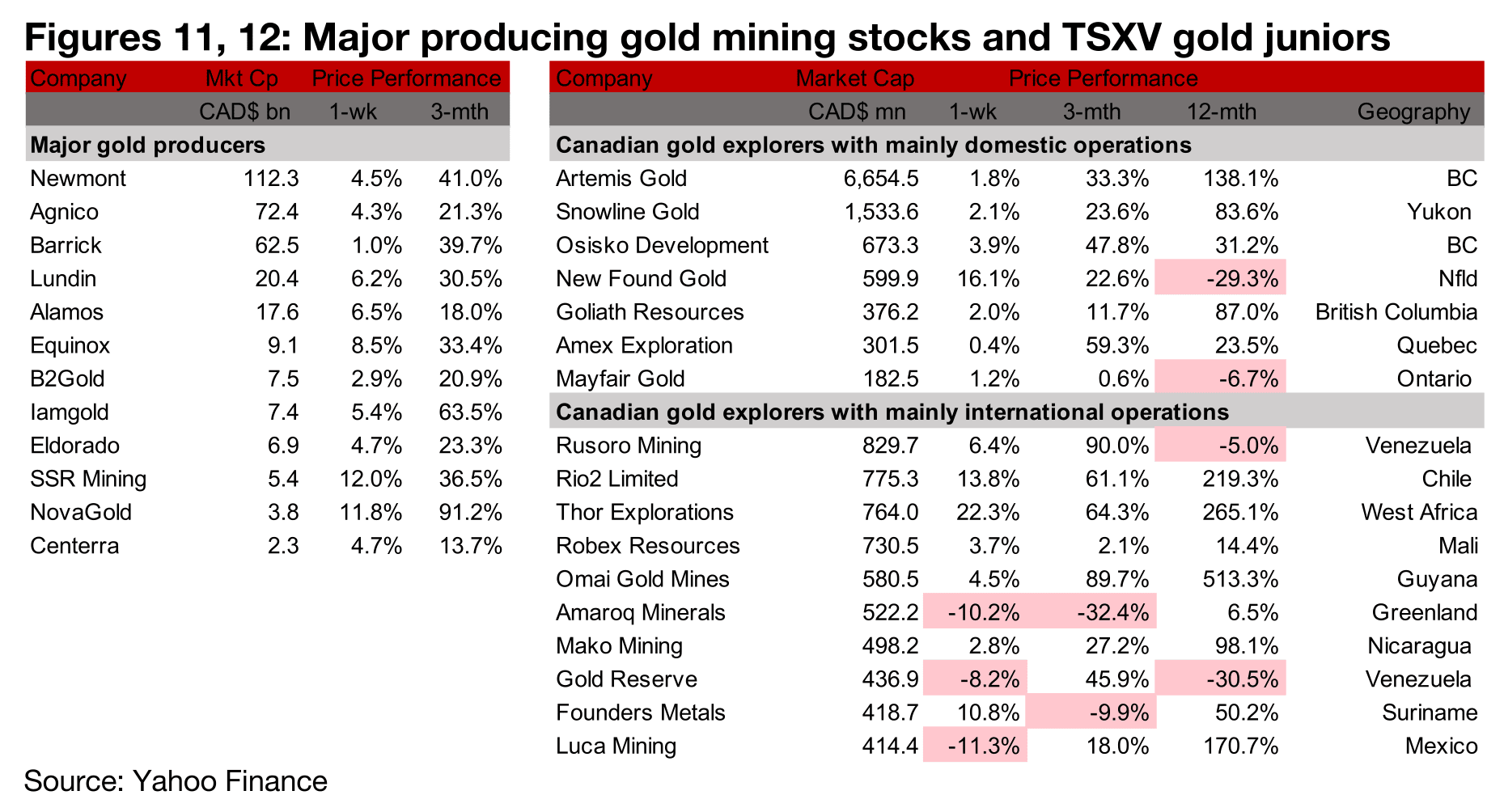

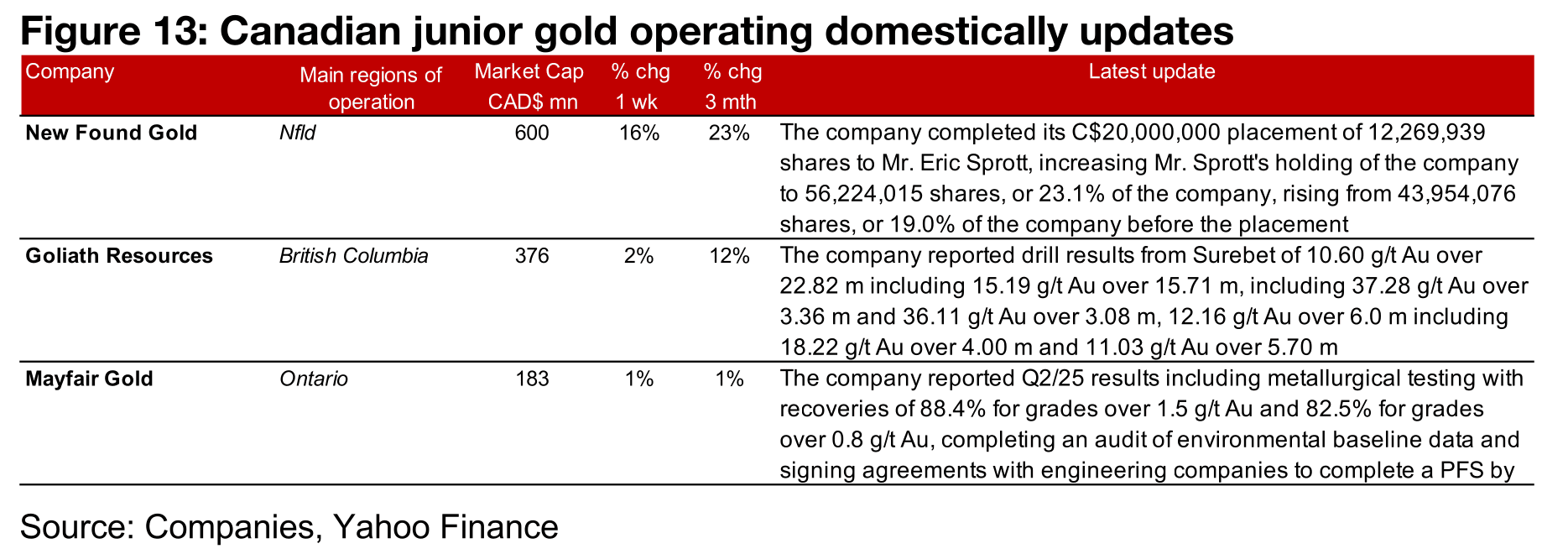

Major producers and most of TSXV gold gain

The major producers and most of TSXV large gold saw substantial gains this week

on the jump in the metal price (Figures 11, 12). For the TSXV gold companies

operating mainly domestically, New Found Gold completed its C$20.0mn placement

to Mr. Eric Sprott, increasing his stake to 23.1% of the company, Goliath Resources

reported drill results from Surebet and Mayfair Gold reported Q2/25 results with

metallurgical testing and an audit of baseline environmental data completed and

agreements signed with engineering companies to advance a PFS (Figure 13).

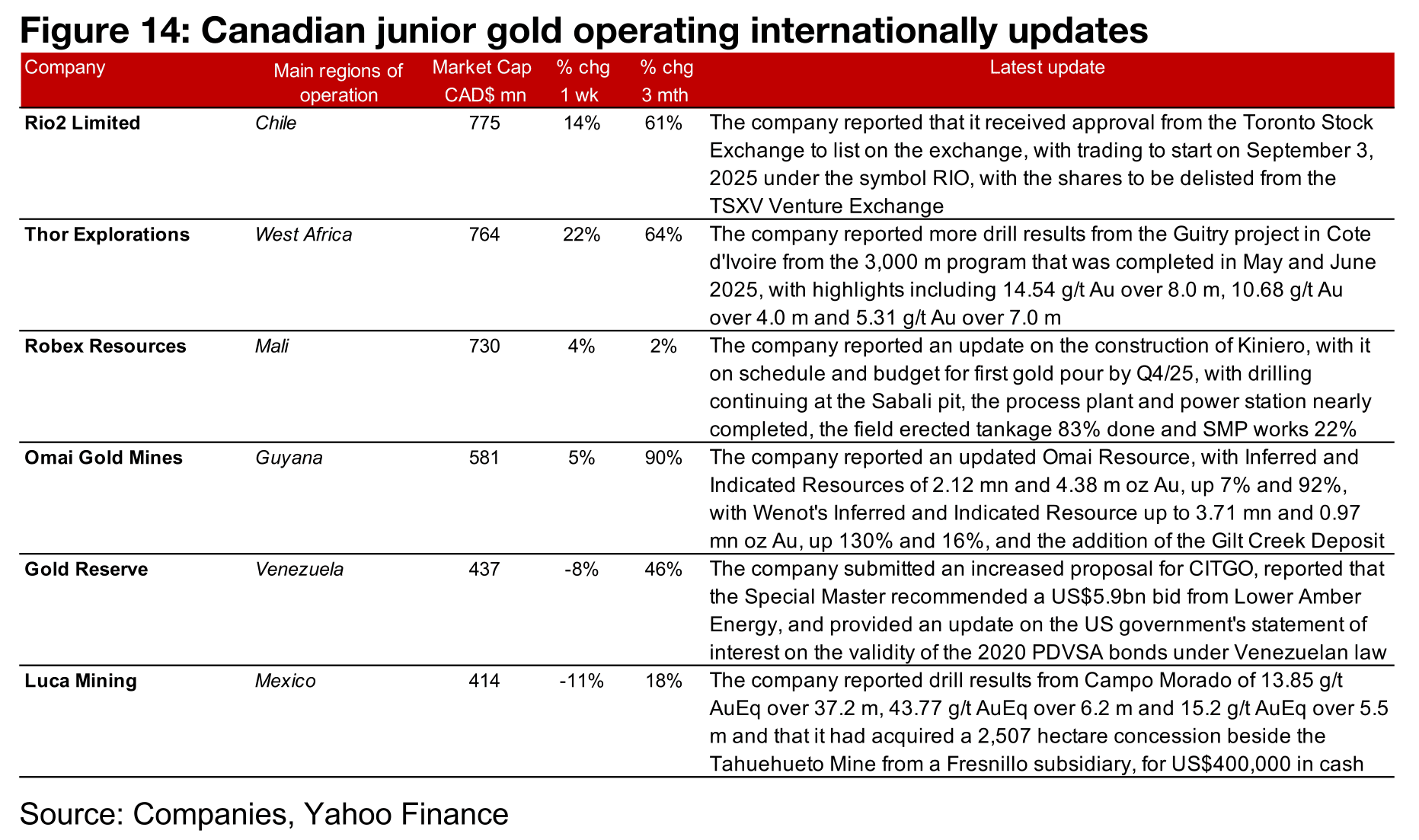

For the TSXV gold companies operating mainly internationally, Rio2 will begin trading

on the TSX this week, Thor Explorations reported drill results from Guitry and Robex

Resources provided an update on construction at Kiniero. Omai Gold reported an

updated resource estimate with an increase for Wenot and the addition of the Gilt

deposit, Gold Reserve submitted a new higher bid for CITGO, was informed by the

Special Master of a new lower bid from Lower Amber Energy and provided an update

of the US government’s statement of interest on the validity of the 2020 PDVSA bonds

and Luca Mining reported drill results from Camp Morado (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.