October 13, 2025

Gold Climbs and Trade War Resumes

Author - Ben McGregor

Gold up and trade war resumes on China rare earth restrictions

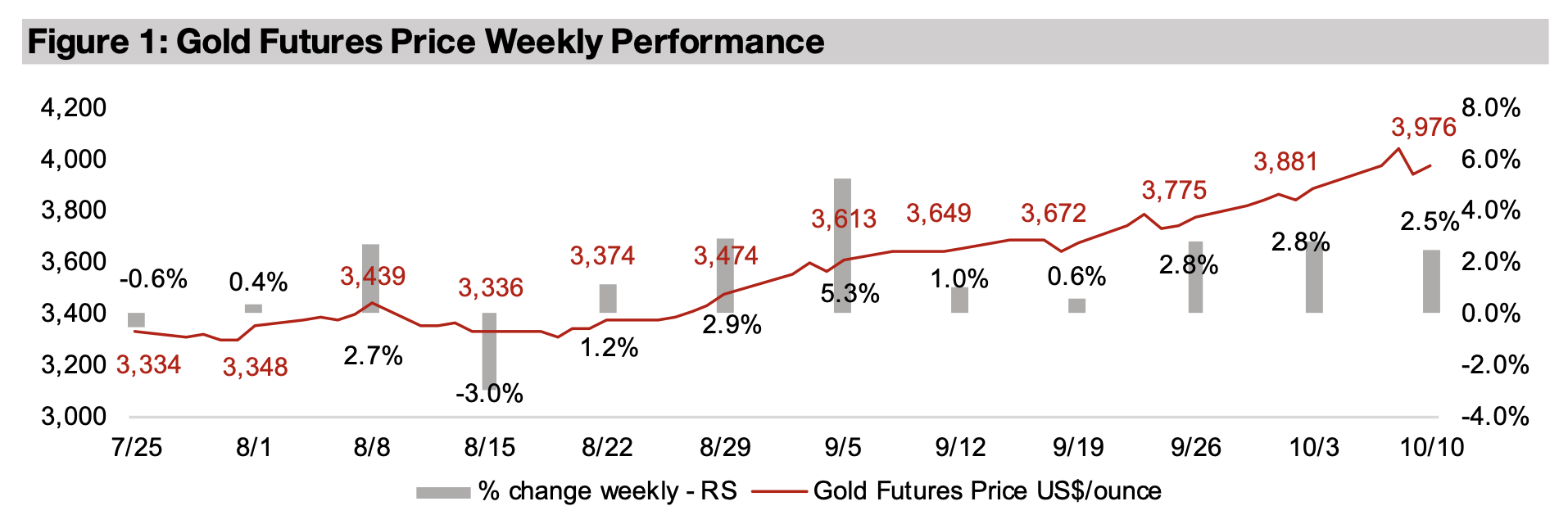

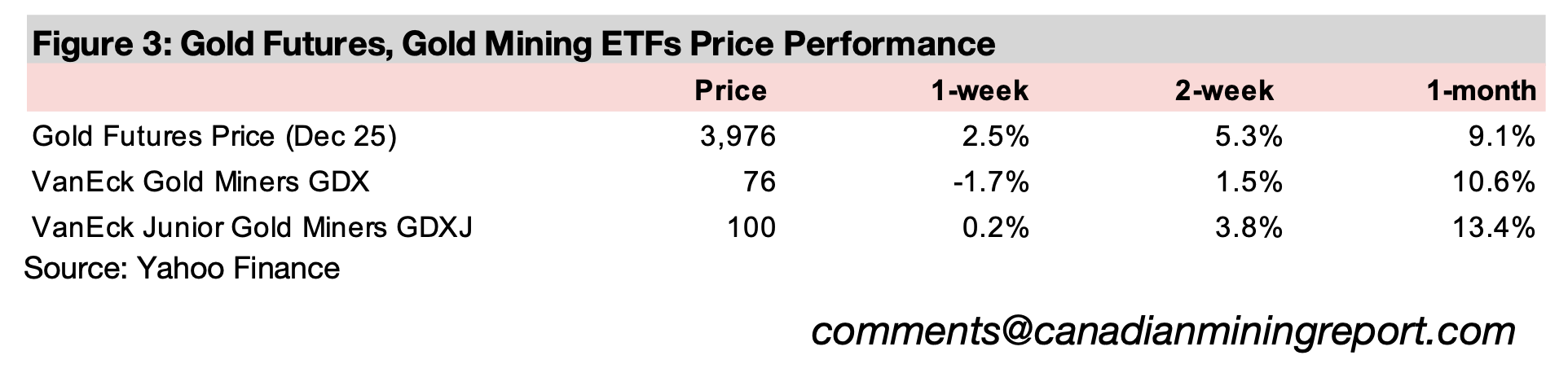

Gold rose 2.5% to US$3,976/oz and the trade war resumed after the US reacted to more rare earth restrictions from China with a major tariff hike on the country, causing an equities slump and crypto plunge, although most major metals held up.

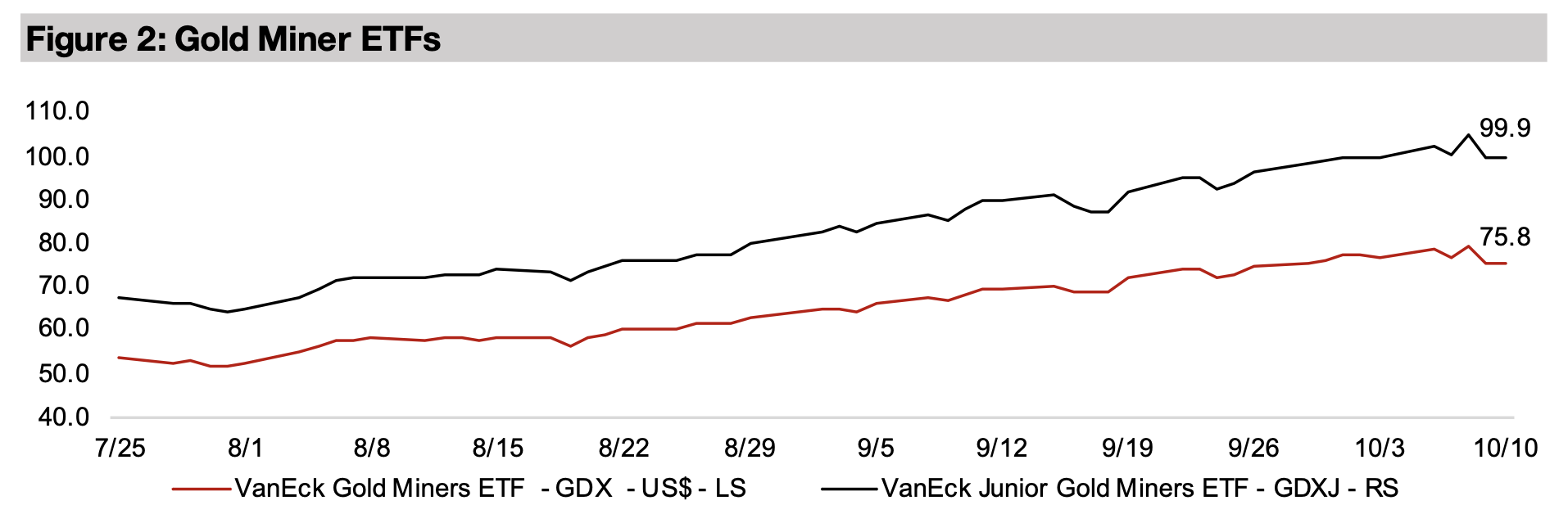

Gold stocks weaker but outperform slump in other sectors

The gold stocks were weak in the context of huge gains in recent weeks with the GDX down -1.7% and GDXJ up just 0.2%, but this still far outperformed broader equities with the S&P 500 down -2.7%, Nasdaq off -3.0% and Russell 2000 losing -3.8%.

Gold Climbs and Trade War Resumes

The gold price rose 2.5% to US$3,976/oz, pulling back from all-time highs above

US$4,000/oz, with several political developments starting from mid-week driving

volatility in markets. The first was the announcement of a ceasefire in the Middle East

conflict on Wednesday, October 8, which drove a decline in the gold price on a drop

in political risk. However, this was followed by China’s announcement of further

restrictions on the export of rare earth metals on Thursday, October 9. This led the

US to respond with an announcement of potential additional tariffs of 100% on the

country on Friday, October 10, which resulted in a pickup in gold as a hedge and a

major slump in both the equities and crypto markets.

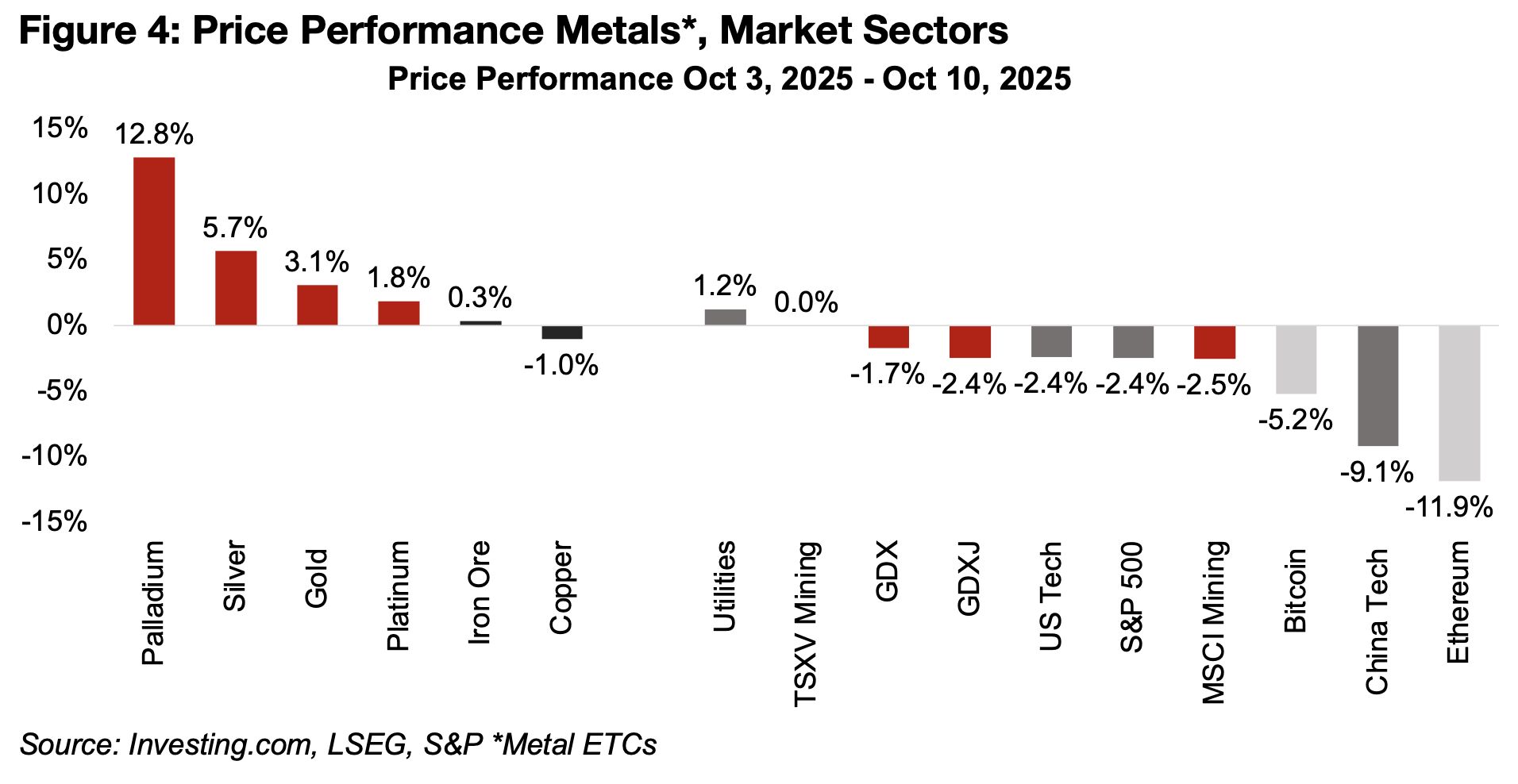

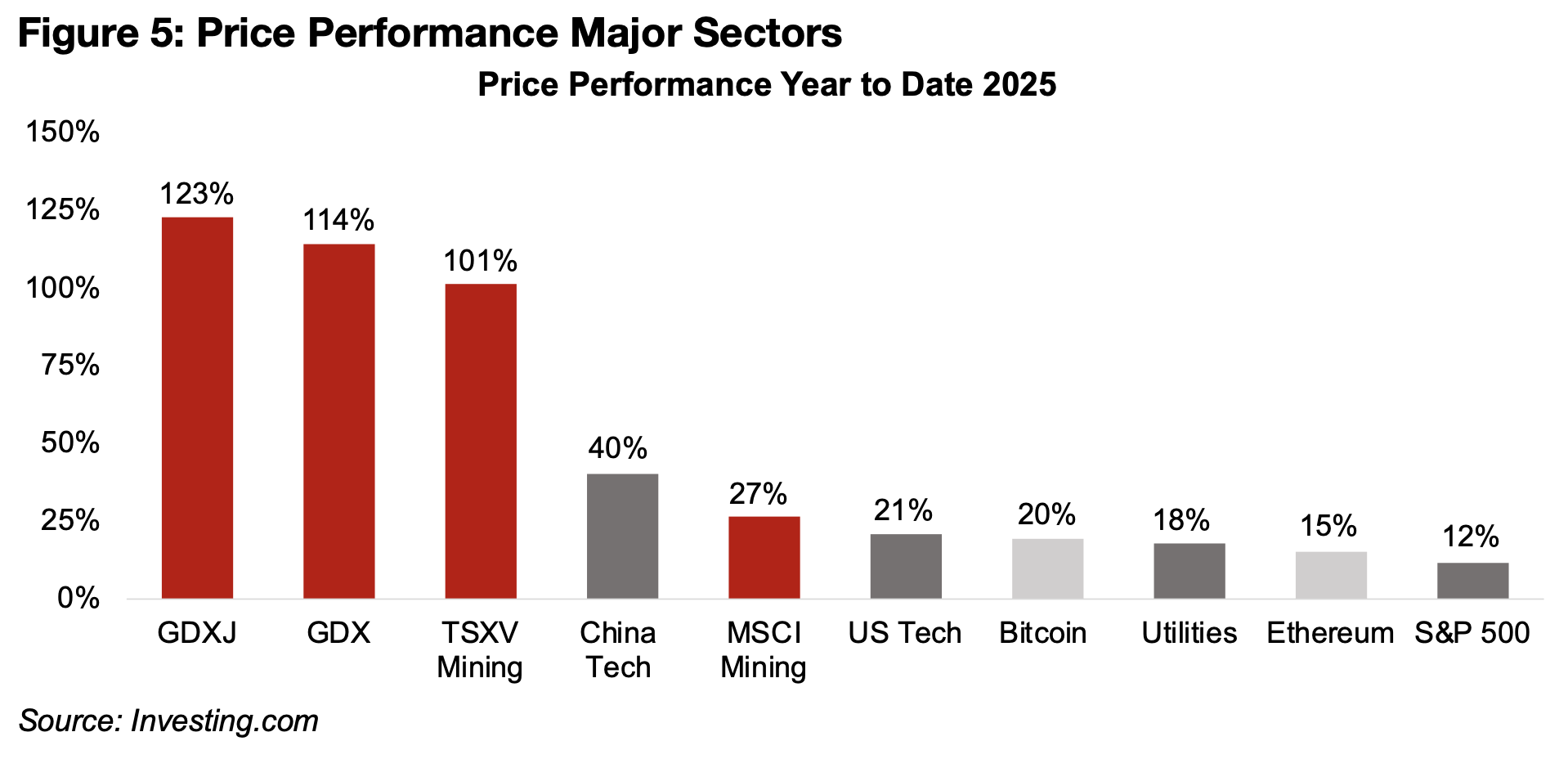

The S&P 500 dropped -2.4%, dragged down by US Tech, with Nasdaq falling -3.0%

and the Russell 2000 off -3.8% (Figure 4). These markets had become increasingly

precarious, with high valuations incorporating a low probability of adverse events,

leaving them open to a decline on negative news flow. China Tech plunged -9.1% as

the US tariffs were expected to hit the sector, although it is still up 40% this year

(Figure 5). This is nearly twice the US Tech gain of 21%, which is muted versus recent

years, as the center of the global sector boom shifted more to China this year.

Utilities outperformed, up 1.2%, as would be expected in such a significant risk off

move, with a year to date gain of 18% just behind US tech, indicating that markets

continue to hedge riskier positions with defensive sectors. While the also defensive

gold stocks underperformed, with the GDX down -1.7% and GDXJ losing -2.4%, this

follows huge gains year to date of 114% and 123%, respectively, and some of the

decline this week could be from profit taking to cover losses in other sectors.

The crypto market also took a massive hit, with Bitcoin down -5.2% and Ethereum

plunging -11.9% for the week, with most of the losses on Friday after the tariff

announcement. This raises again the question of whether crypto is more a store of

value or a major risk asset, and whether it may tend towards the former long-term

but the latter short-term. It certainly does not seem to be correlated to movements in

and precious metals, and is likely not a substitute for this sector, as has sometimes

been hypothesized, but rather a very distinct asset class.

While gold outperformed in the crash, with its ETC rising 3.1%, it was far

outperformed by silver, up 5.7%, which saw its gain reach 49.7% year to date,

outpacing the 48.0% gain for the former. Palladium surged 12.8%, and is now up

55.8% for 2025, nearly catching up with sector leader platinum, up 1.8% this week

and 61.8% year to date. Even the major base metals, iron ore and copper, did

relatively well, up 0.3% and down -1.0%, respectively, given the negative implications

of the tariff increases for global economic growth.

Middle East conflict gold premium reduced, China rare earth risk rises

Based on gold’s gains at the start of the Middle East conflict and the Russia-Ukraine

war, we estimate at least US$400/oz in the price between these two conflicts.

Assuming a roughly even split between the two issues, the US$100/oz decline on

October 9, 2025 would be about half of the premium for the Middle East conflict. This

suggests that the market sees the risk in the region having been reduced significantly,

but not entirely, by the tentative resolution. The dip also needs to be considered in

the context of a nearly uninterrupted US$663/oz gain in the metal over the past eight

weeks, making some degree of pullback likely. This rise also shows that the ongoing

global rate cutting cycle, which the US again joined last month after a long hiatus,

seems to be a much more significant driver of the metal than geopolitics.

While rare earth metals is a relatively small sector of the mining industry in terms of

revenue, especially versus the four giants iron ore, gold, copper and aluminum, it can

have an outsized political effect given the current industry structure. China dominates

the sector, producing 69% of rare earths metals in 2023, although this has declined

from almost all of global production, or 98% of the total on average from 2005-2012.

This has come as many countries seek to reduce the country’s influence over these

critical resources, as both recent geopolitical tensions and the global health crisis

have shown the risks with having supply concentrated in a single supplier.

The US sees particularly major risks in relying on China so significantly as a rare

earths supplier because the metals have critical uses in the defense industry. Over

40% of demand for rare earth metals is for permanent magnets, 15% is from catalysts

and 10% from polishing powders, which all have a wide range of defense technology

uses. This potential effect of the rare earth limitations on US defense explains the

level of severity of the proposed tariff increases on China in reaction to developments

in what is overall a minor segment of world trade.

This issue had become more prominent since late 2023 when China started to limit

the export of technology for processing in the sector, followed in April 2025 by

restrictions on exports of seven rare earth metals. The announcement last week saw

China require foreign firms to obtain licenses to export magnets containing 0.1% of

rare earth metals sourced from the country. However, certainly long-term, and even

medium-term, this will likely result in the development of more rare earth mining and

processing capacity outside China, further decreasing its share of the industry.

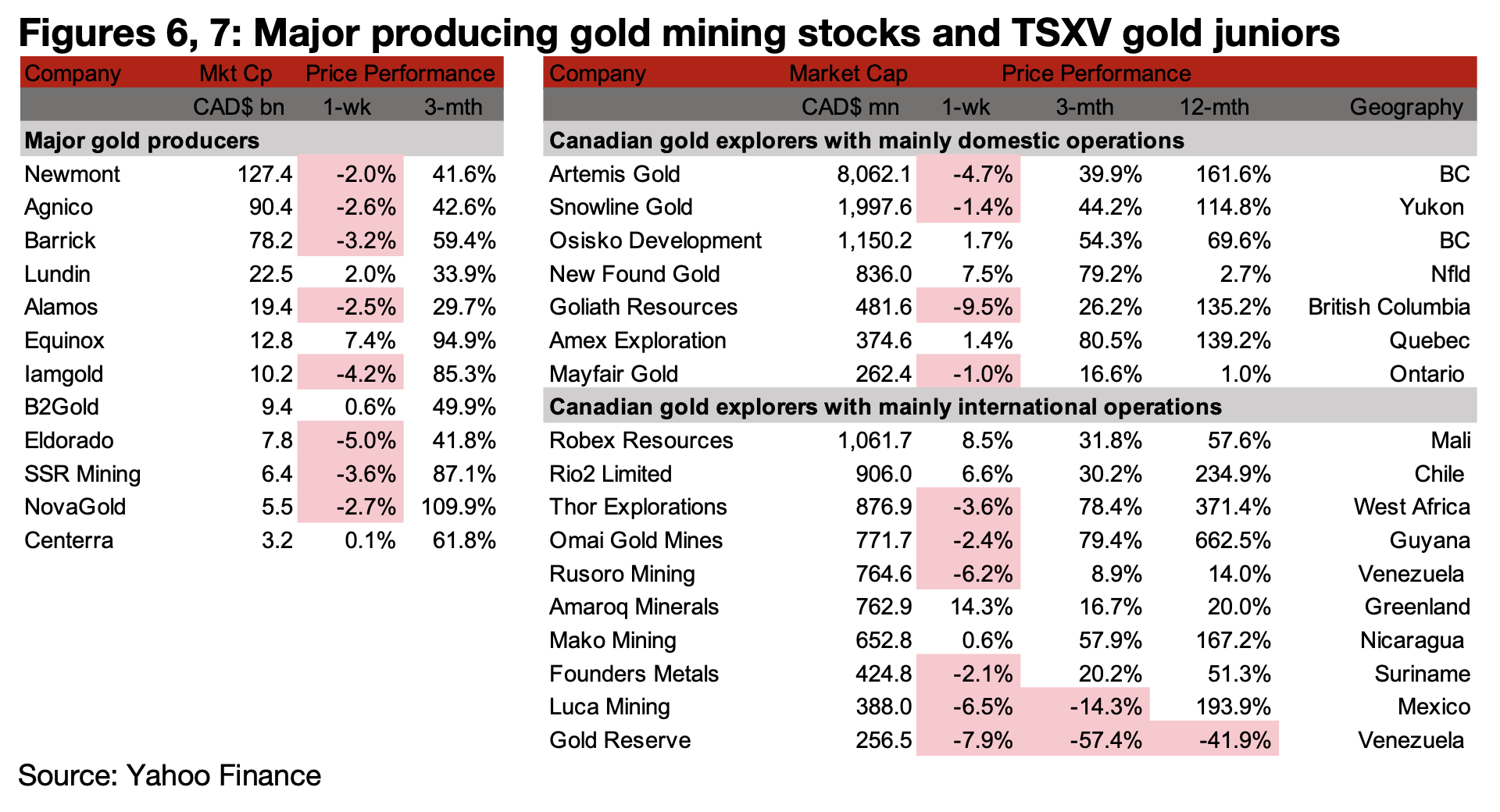

Most major producers and TSXV gold decline

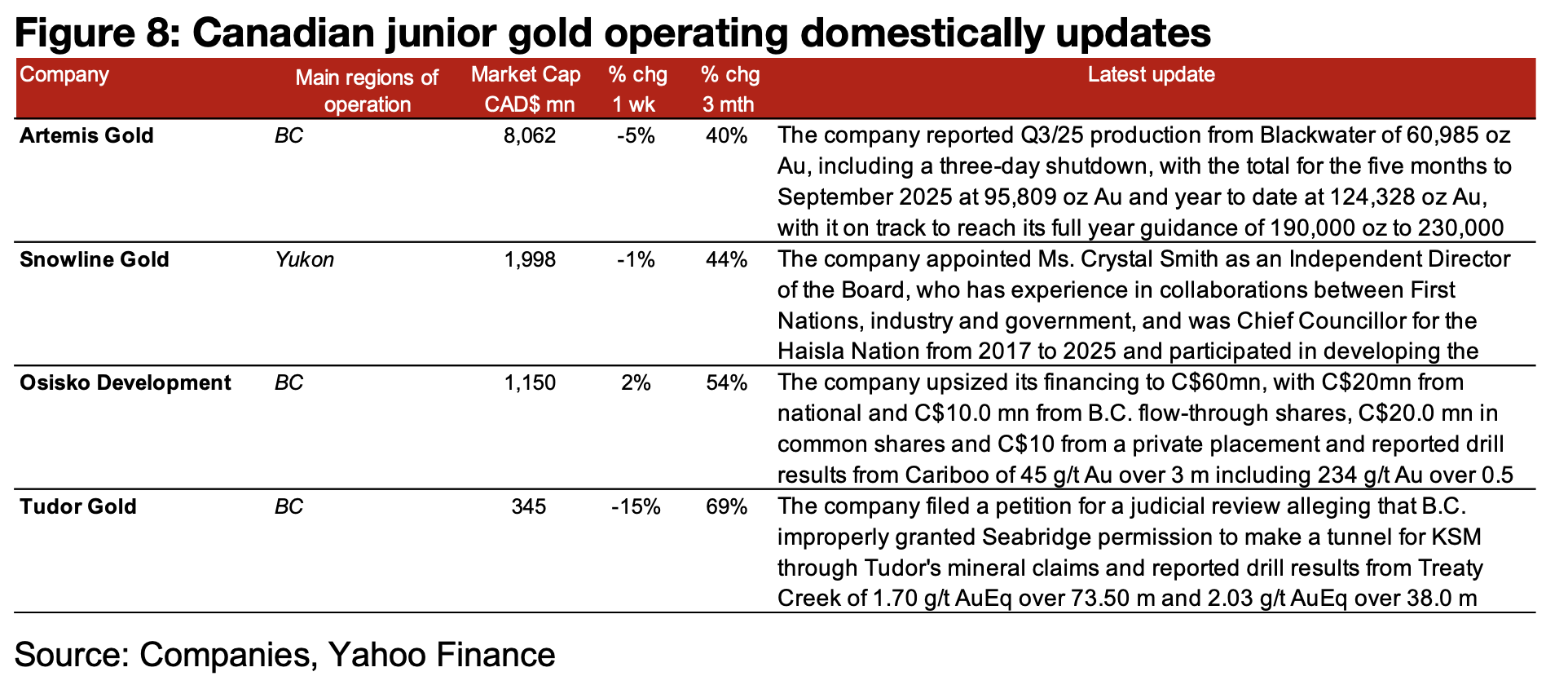

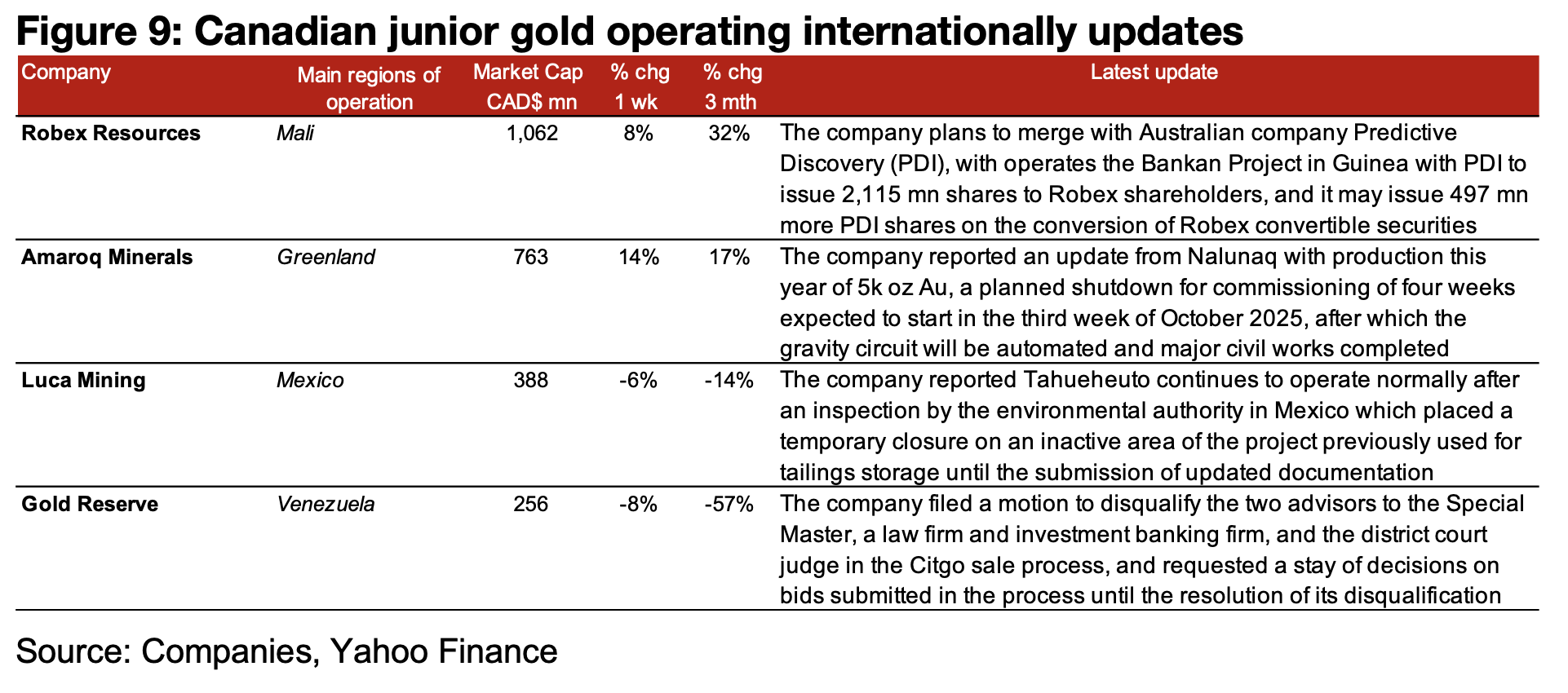

Most of the major producers and TSXV gold declined as a broader equities slump offset a rise in gold (Figures 6, 7). For the TSXV gold companies operating mainly domestically, Artemis reported Q3/25 production from Blackwater, Snowline Gold appointed a new independent director, Osisko Development upsized its financing to C$60mn and Tudor Gold filed a petition for a judicial review against B.C. over Seabridge’s KSM tunnel through Tudor’s mineral claims and reported drill results from Treaty Creek (Figure 8). For the TSXV gold companies operating mainly internationally, Robex Resources announced plans to merge with Australia’s Predictive Discovery, which both operate gold projects in the same region of Guinea, Amaroq Minerals provided an operational update on Nalunaq, Luca reported that operations have continue normally at Tahuehueto after an inspection by Mexico’s environmental authority and Gold Reserve filed a motion to disqualify two advisors to the Special Master in the CITGO sales process (Figure 9).

Robex and PDI merger to form potential significant Africa gold producer

Robex announced a planned merger with Australia’s Predictive Discovery (PDI) which

would see these two relatively large junior gold miners both focused on West Africa

combine to form an intermediate producer over the next few years. The companies’

key development projects, Kiniero for Robex and Bankan for PDI, are in the same

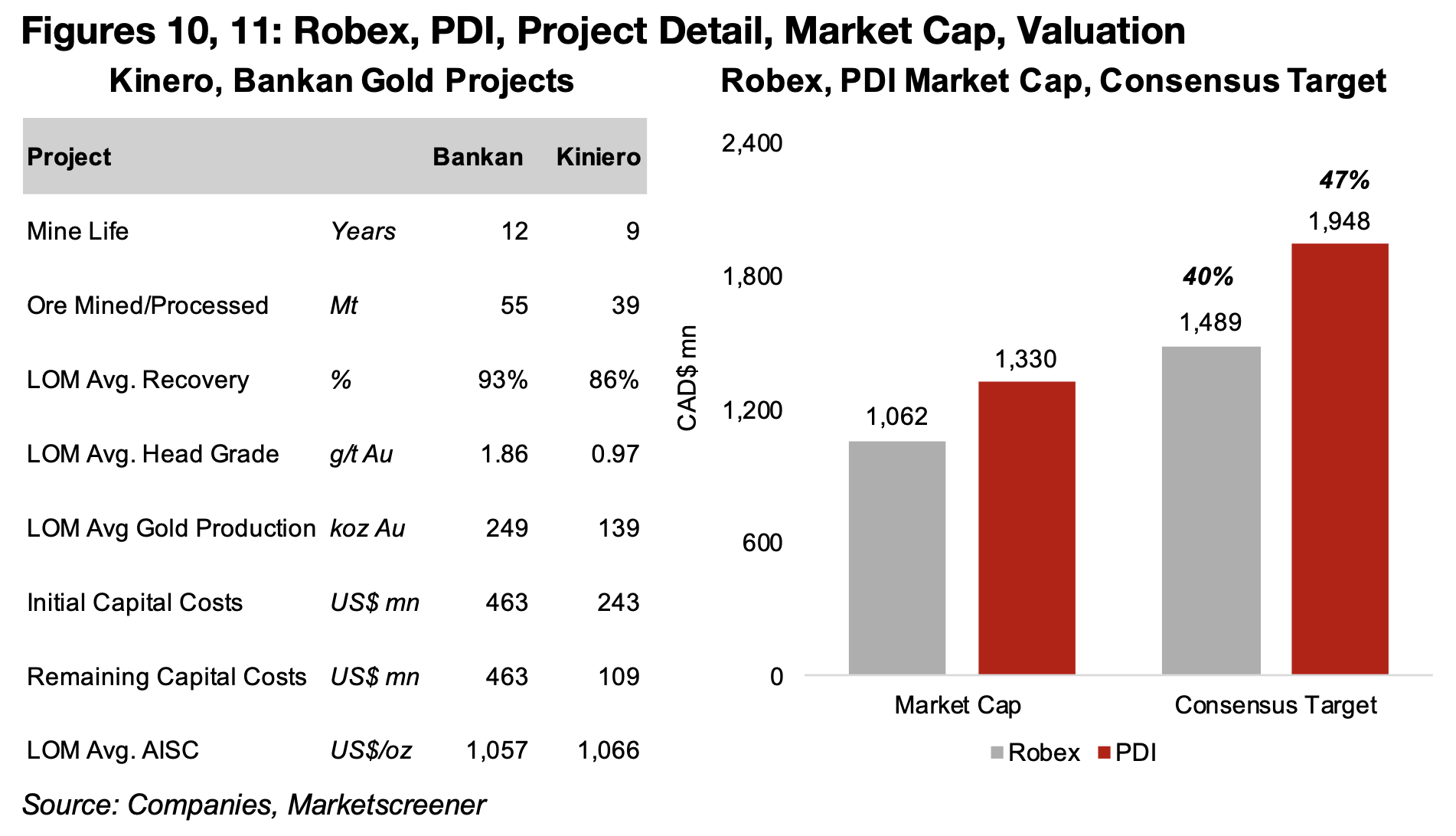

gold producing region of Guinea in West Africa. Kiniero is expected to have a 9-year

mine life, 139k oz Au average annual gold production, initial capital cost of $243mn,

remaining capital costs of $109mn and an AISC of US$1,066/oz (Figure 10). Bankan

is expected to have a 12-year mine life, 249k oz Au annual production, initial capital

costs of $463mn, remaining capital costs of $463mn and an AISC of US$1,057/oz.

The combined market cap of the companies is CAD$2,392mn, with Robex at

CAD$1,062mn and PDI at CAD$1,320mn (Figure 11). Based on consensus price

targets, the value is expected to rise to CAD$3,437mn, with Robex rising 40% to

CAD$1,489mn and PDI up 47% to CAD$1,948mn. A major reason for the merger is

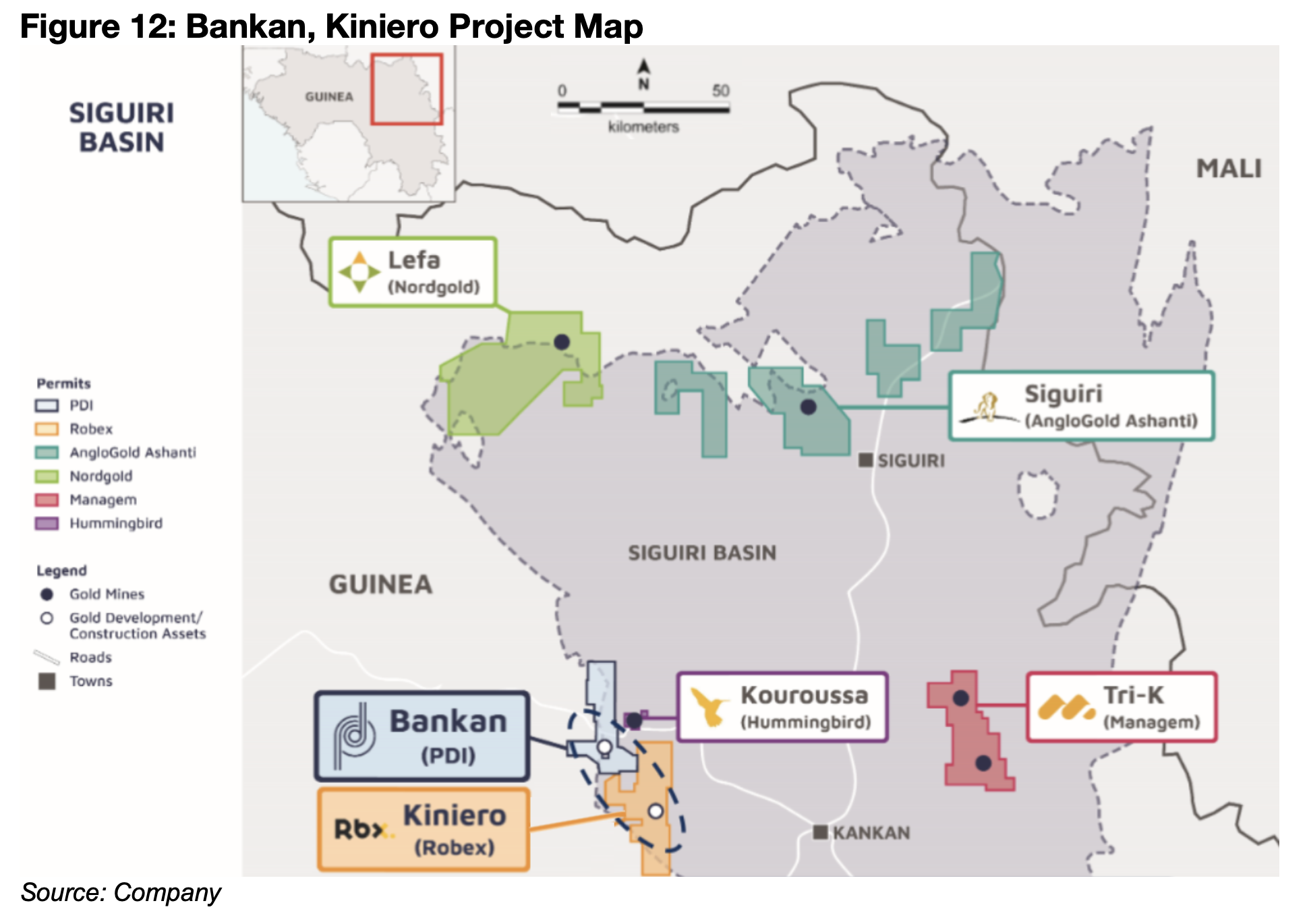

that Kiniero and Bankan are beside each other in the Siguiri Basin of Guinea, which

has existing gold projects, including Siguiri of Anglogold Ashanti (Figure 12).

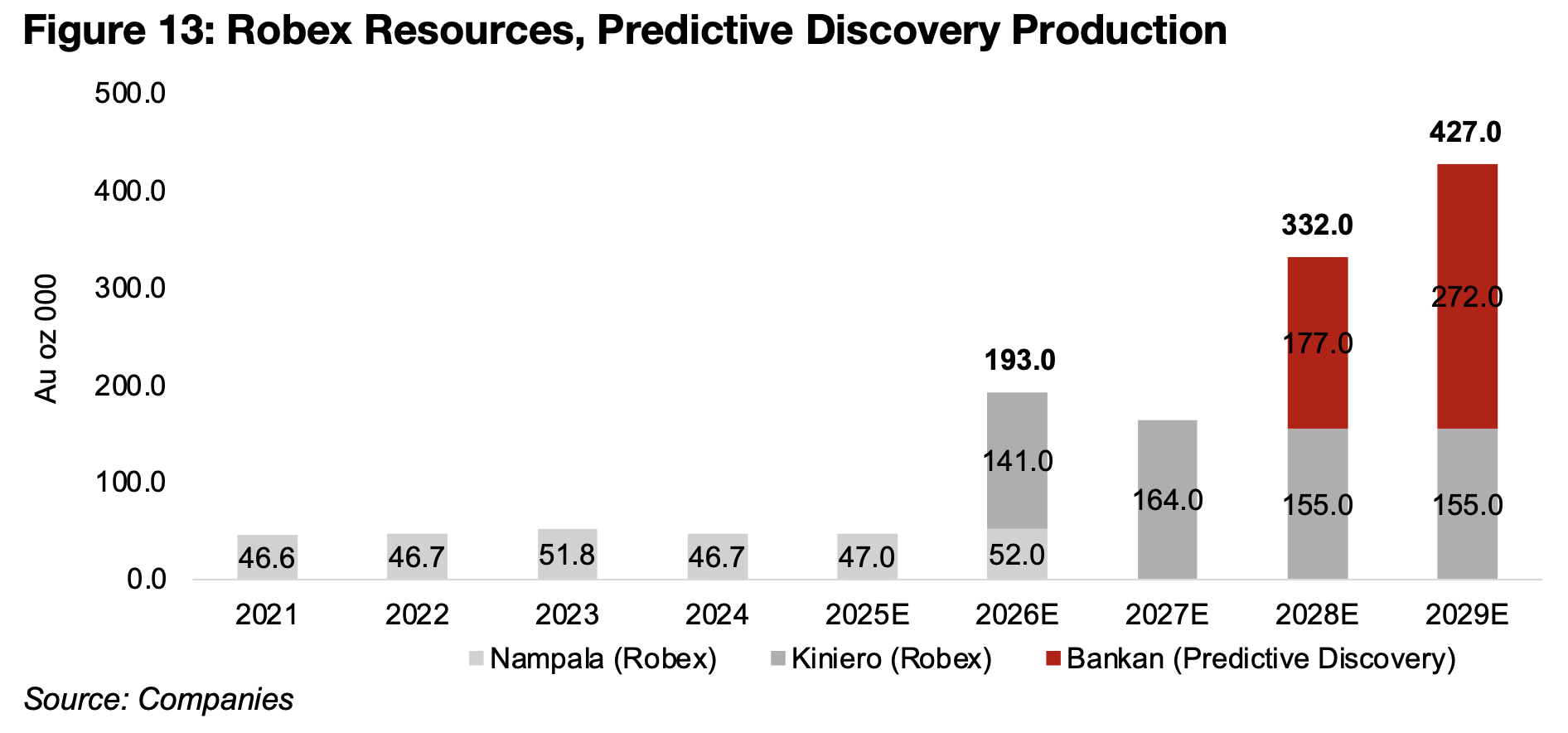

Robex already operates the Nampala gold project in Mali which has been producing

for several years, with guidance for 2025E at 46.0k oz Au to 48.0k oz Au for an

average of 47.0k oz Au. The project is expected to operate until the end of 2026,

producing 52.0k oz Au, and generating cash flow to fund Kinero and Bankan if the

merger is completed.

Kiniero is expected to produce 141k oz Au oz in 2026E, 164k oz Au in 2027E, and

155k oz from 2028E-2029E (Figure 13). Bankan is estimated to have output from

2028E, at 177k oz Au, for 332k oz Au production for the combined company, ramping

up to 272k oz Au in 2029E, for a total output of 427k oz Au.

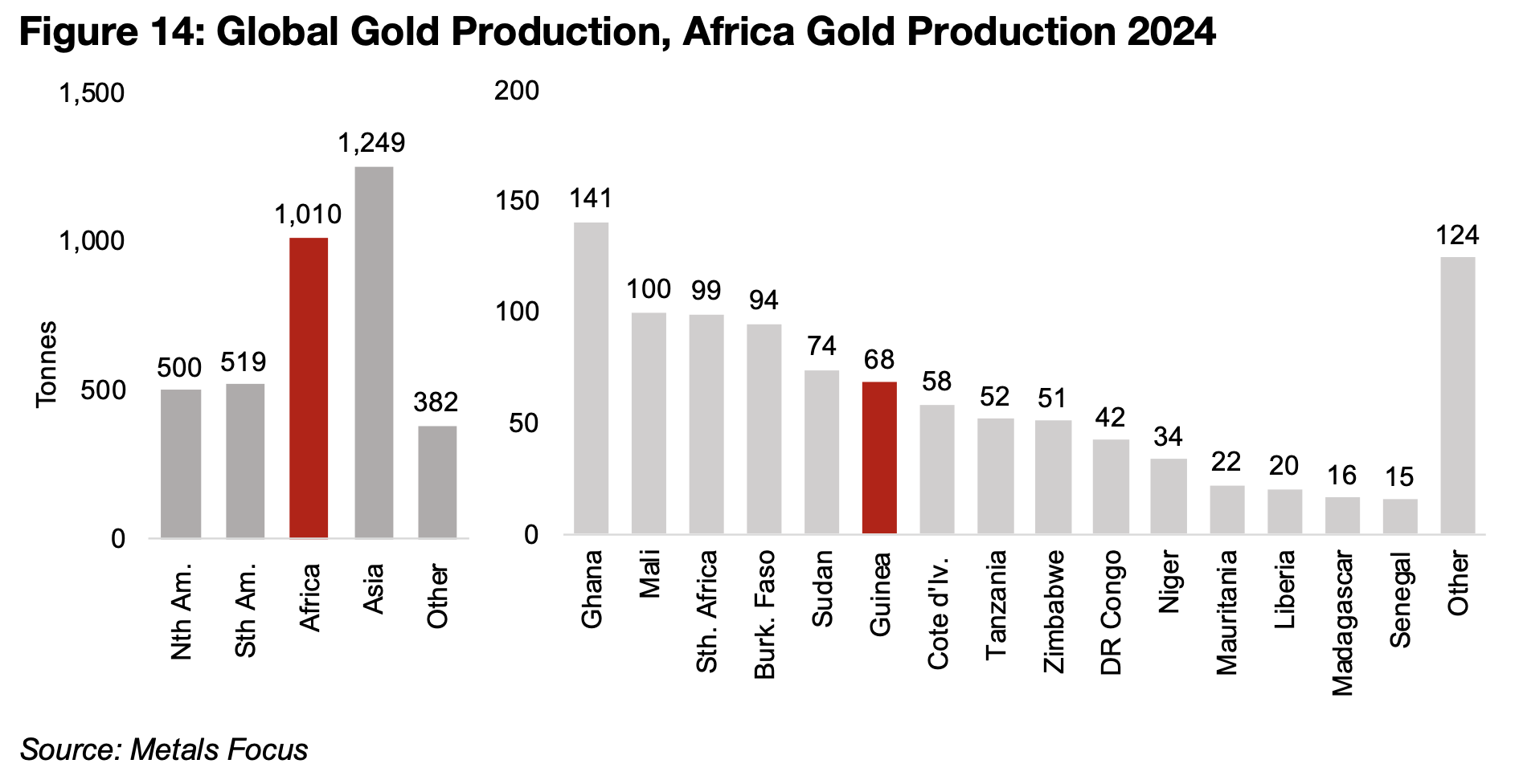

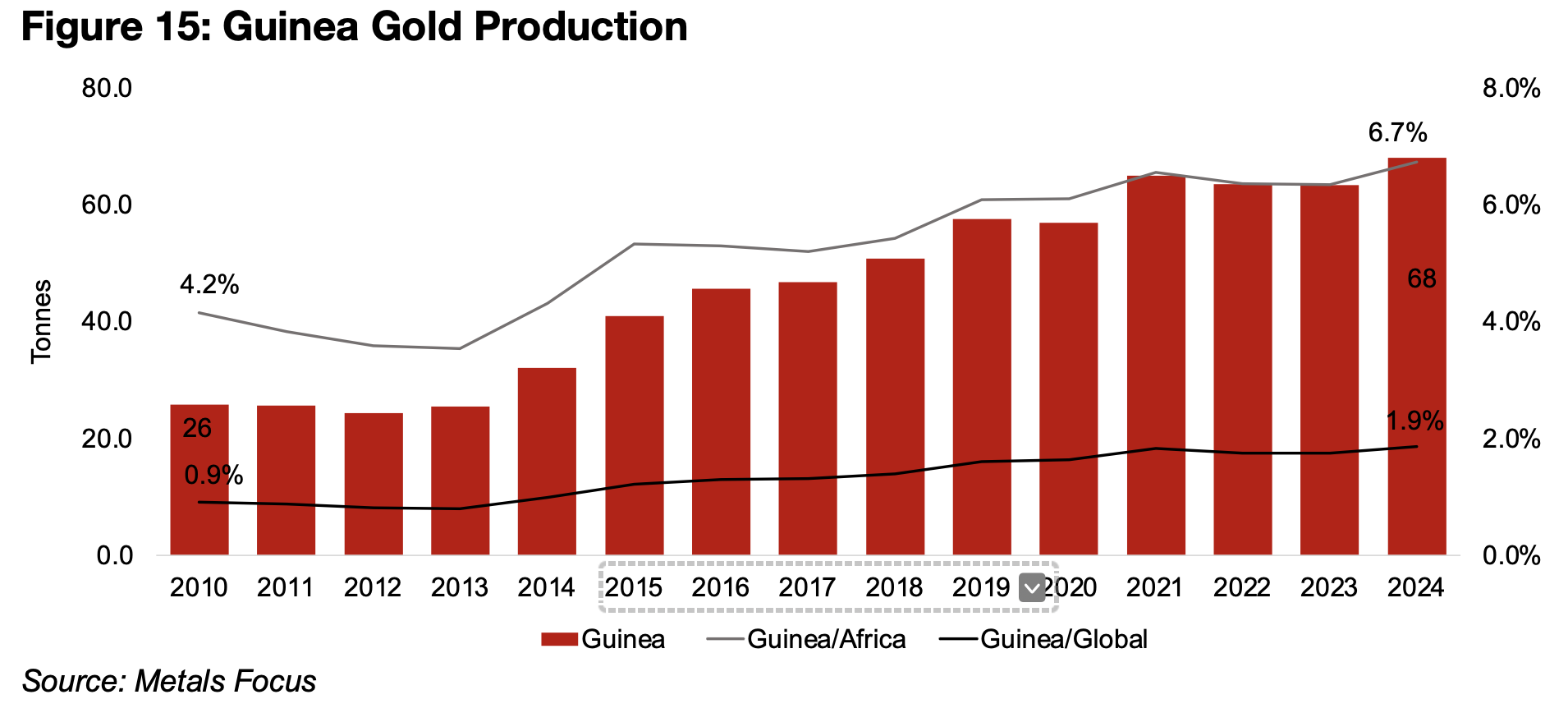

The projects should leave the company well positioned for further development in Guinea and West Africa, with Africa overall the second largest gold producer in 2024, at 1,010 tonnes, after Asia at 1,249 tonnes. Guinea was the sixth largest gold producer in Africa, at 68 tonnes in 2024, around the middle of the major producers for the continent. This has risen from just 26 tonnes in 2010 and seen the country’s share of African production rise to 6.7% and of global production rise to 1.9%, up from 4.2% and 0.9%, respectively, in 2010.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.