August 22, 2025

Gold Demand Surges—Miners to Follow?

Contents

- The Market’s Verdict Is Clear

- Inflation Misinformation

- Leverage Your Gold Bets with Mining Companies

Gold is trading close to its all-time nominal highs. But there’s still room to run.

Don’t take it from us: the market has consistently pushed the price of the yellow metal higher.

And it continues buying.

Here at Canadian Mining Report, we have been forecasting a strong, multi-year secular gold bull market for years.

Back in November 2023, we wrote:

As a result [of a growing distrust in the financial system], alternative assets and safe havens such as gold have a really good chance of advancing further.

The slightest hint of a potential recession would only strengthen the thesis that gold is the number one asset during times of war, shocks, and volatility.

There are multiple catalysts driving the price of gold. Some of the most important ones are aligned to continue pushing the price of the yellow metal upward.

Not to put too fine a point on it, but we weren’t wrong.

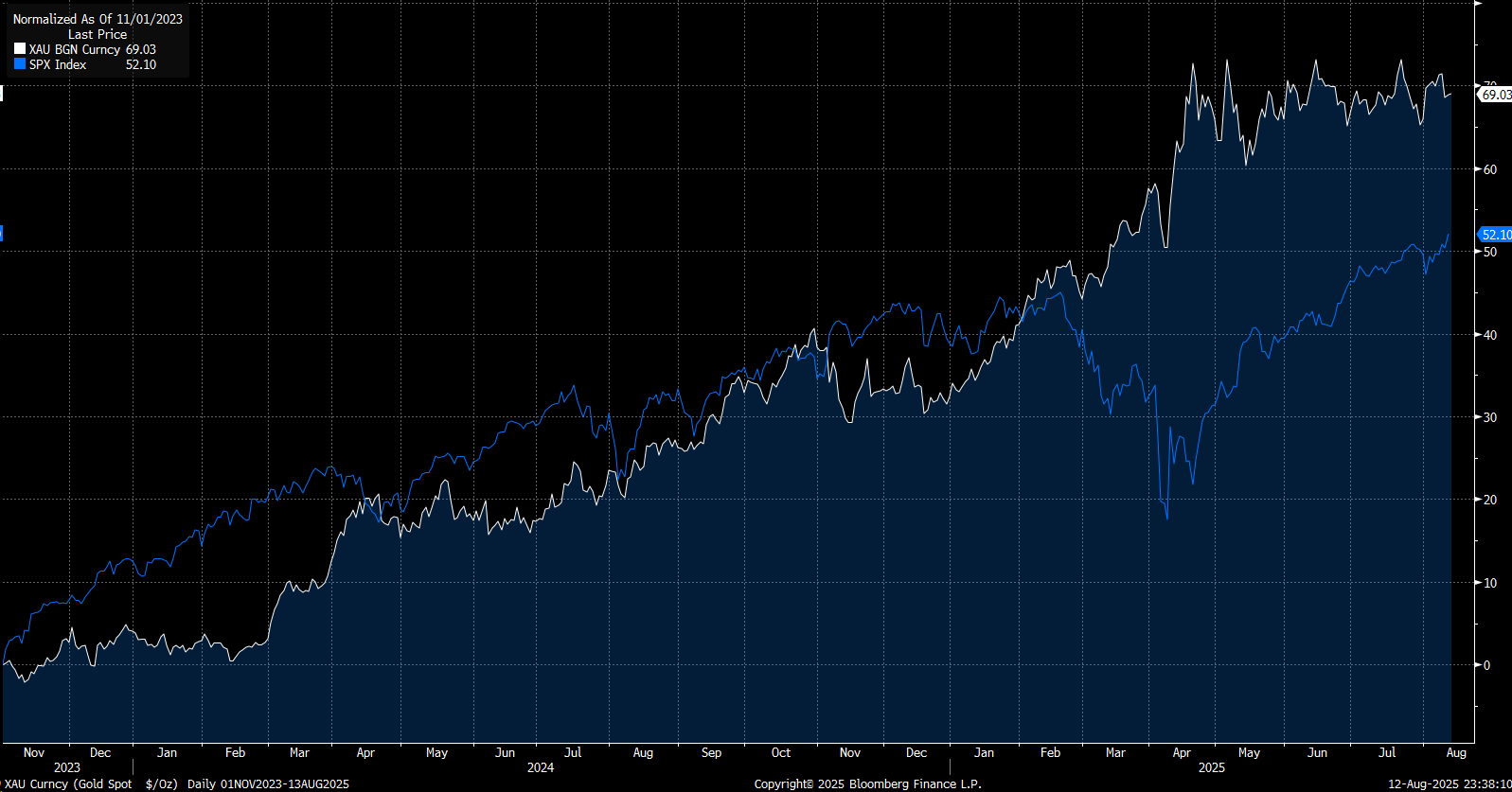

Since November 2023, the gold price has soared by almost 70%, while the S&P 500 has grown by just 52%.

Broad indexes have done well, but gold, which is one of the oldest investment classes in history, has handily outperformed them since we published that article.

Did our thesis change? A lot has happened since, so it’s a good time to review our premises and conclusions.

Should you continue buying or holding gold—or are there better options?

The Market’s Verdict Is Clear

The latest data tell us that the market is still craving gold.

Global demand for gold in the second quarter surged 10% compared to last year. This is according to Heraeus Precious Metals, a precious metals industry specialist.

Most recently, the White House’s erratic tariff policy supported this long-term gold bull market. The latest gaffe—a poorly communicated message that imported gold bars would be subjected to tariffs—sent the yellow metal’s price surging within hours.

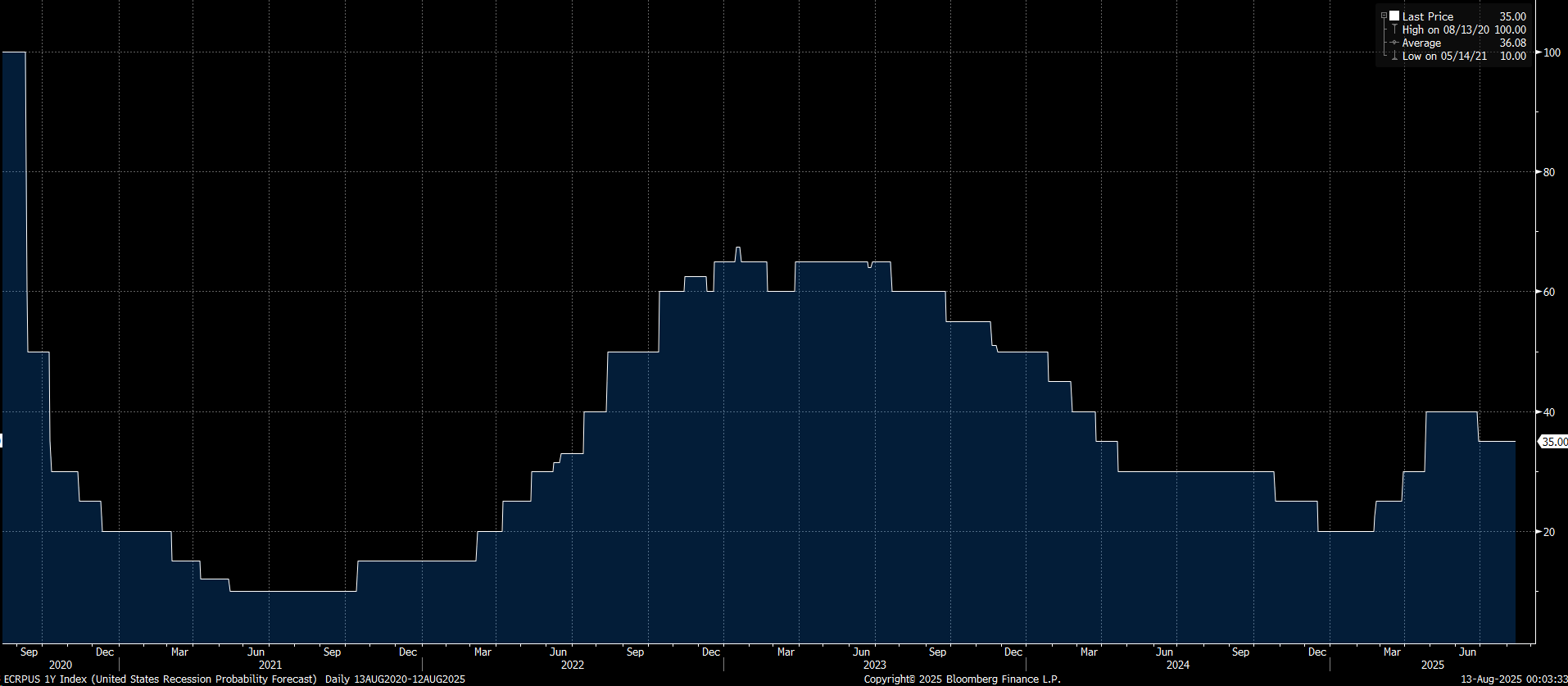

The market is on edge, in other words. A looming risk of recession is back. The chart below tracks Bloomberg’s United States Recession Probability Forecast. After falling at the beginning of the year, the probability of a recession is creeping back up.

Inflation Misinformation

You probably heard the story: Donald Trump didn’t like the latest unemployment numbers (and the way numbers for the two months before were revised down) and fired the head of the Bureau of Labor Statistics.

Never mind the fact that quite a few of those lost jobs were due to the US President’s and Elon Musk’s DOGE initiative. The numbers looked bad to the decision-makers, and heads rolled.

The new head of the BLS, EJ Antoni, has a mandate to prove that the US economy is booming—or else.

So let’s be clear here. If Mr. Antoni takes his assignment seriously, we will see perfect numbers for inflation (low) and job growth (high)—the BLS is responsible for reporting both consumer price indexes and employment statistics.

But in that case, nobody will know what’s really going on with the labor market and with inflation—two critical economic parameters.

This is bad in many ways, but it’s good for gold.

Why?

Any confusion about the state of the economy creates fear. And investors react to fear in predictable ways.

If you don’t really know how high inflation really is, you’ll assume it’s out of control.

If you don’t know the true (or the closest you can get to that) employment numbers, you may miss early signs of recession. In fact, you won’t be wrong assuming that a recession is around the corner. Otherwise, why would the government hide the numbers?

And on, and on, and on…

What Should Investors Do?

Leverage Your Gold Bets with Mining Companies

While gold is up 27% since the beginning of the year, gold juniors have soared by almost 70%.

They have delivered a 2.6x leverage to the price of their underlying commodity.

As the gold bull market continues, gold juniors should continue outperforming the metal itself.

In fact, a lot of them have multiple catalysts that, in our opinion, could help them perform spectacularly well in the coming months and years.

One of them is Volcanic Gold Mines Inc. (TXSV:VG, Frankfurt:CKC1). We have recently prepared a deep dive report on Volcanic Gold, which, in our opinion, could be one of the most promising companies to keep an eye on during the ongoing bull market.

Sign up to receive our future articles and updates.

Disclosure

The Canadian Mining Report has been retained by Volcanic Gold Mines Inc. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Volcanic Gold Mines Inc.. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Volcanic Gold Mines Inc. and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More