August 18, 2025

Gold Down on High US PPI

Author - Ben McGregor

Golds drops on pickup in US PPI inflation, no tariffs

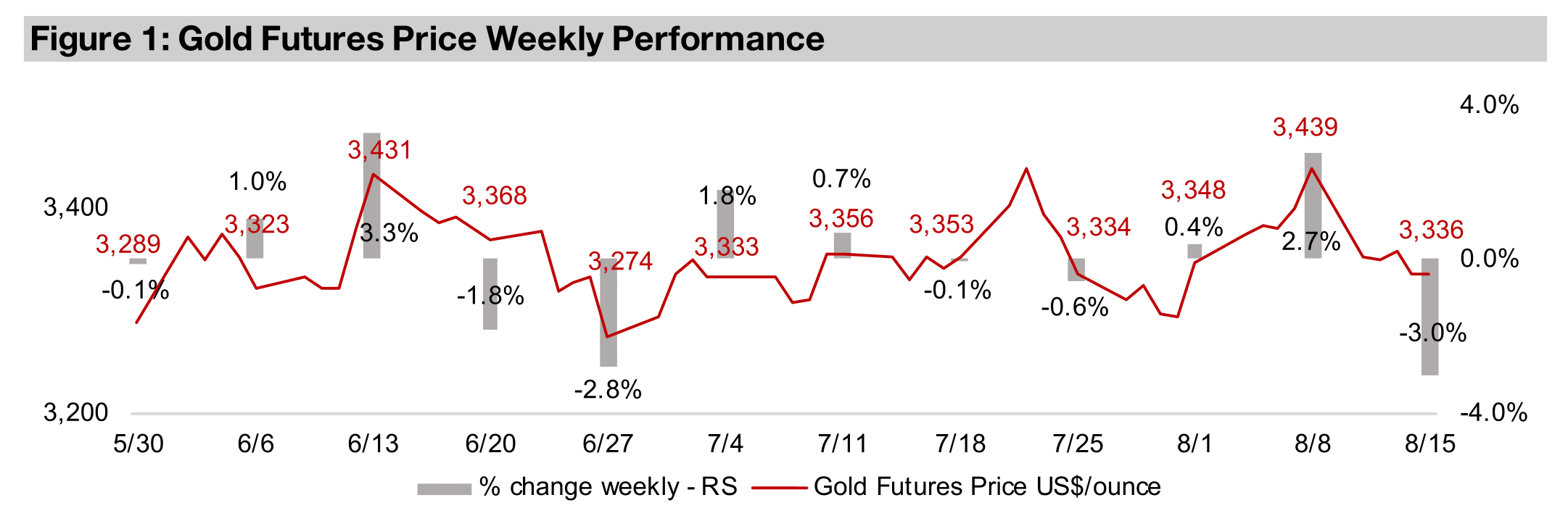

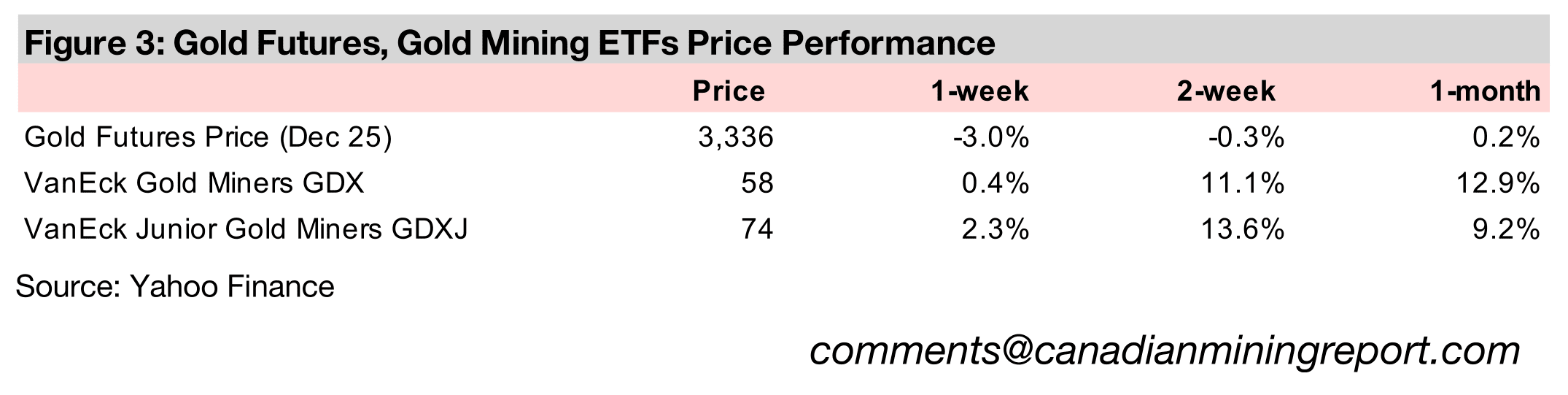

Gold fell -3.0% to US$3,336/oz, as high US PPI inflation drove fears that this would eventually push up consumer inflation and could lead the Fed to hold off on rate cuts, and the US government announced that there be no major increase in gold tariffs.

Another huge quarter for the world’s largest gold stocks

All the world’s largest gold stocks had another huge quarter in Q2/25, with a major jump in revenue yoy and even larger gain in net income, although this has driven up share prices close to target prices and valuations are no longer clearly inexpensive.

Gold Down on High US PPI

The gold price declined -3.0% to US$3,336/oz, briefly trading above US$3,400/oz

before it dropped right back to the middle of the US$3,200/oz-US$3,400/oz range

that has now held for four months. There have been three moves in this period above

this range, reaching around US$3,330/oz-US$3,340/oz, but they have lasted only one

or two days. The market seems to continue to view the up and downside drivers for

the metal as quite balanced, and a big shift out of this status quo could require either

a clear rise or fall in economic or geopolitical risk.

The main economic drivers dragging down gold this week were a higher than

expected US producer price index and announcement by the US government that

there would be no major new tariffs on the metal, as had been feared last week. There

has also been a potential decline in geopolitical risk over the weekend, with apparent

progress on the Russia-Ukraine conflict. Given that we estimate a US$200/oz

premium in the gold price for this issue, based on the metal’s gains when it started,

a clear resolution could hit the price. However, it could be an extended period before

the market is fully confident in the peace enough to drive the premium to zero.

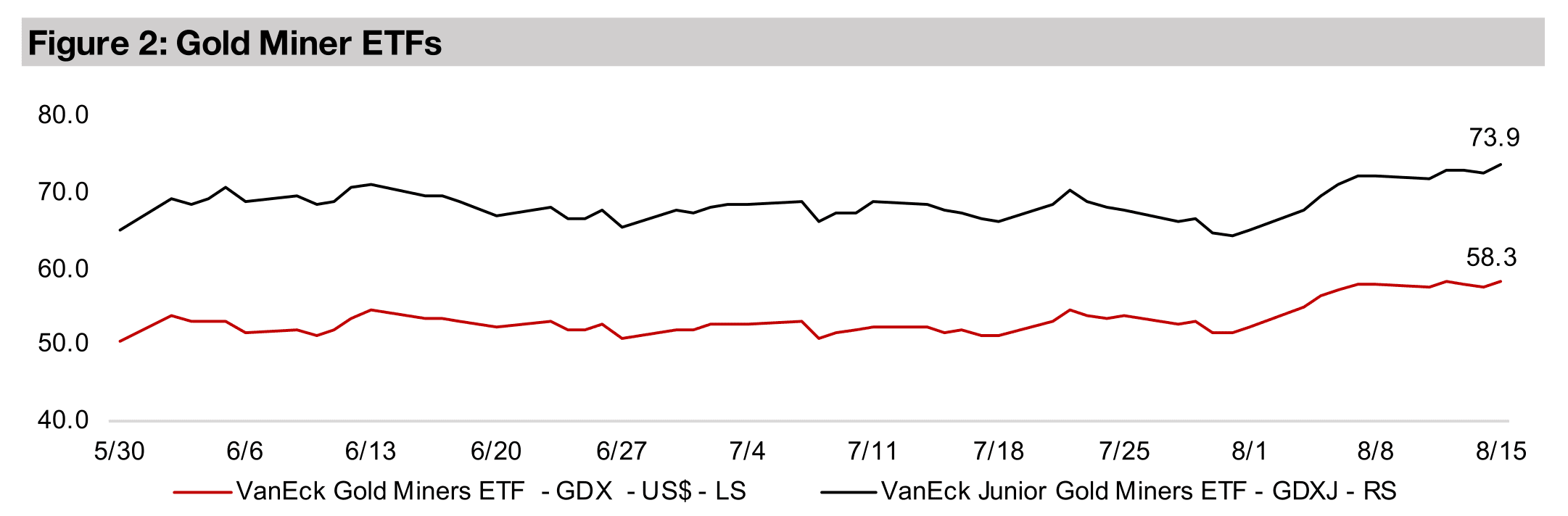

Gold stocks actually rose even with a pullback in the metal for the second time in a

month, with the GDX and GDXJ up 0.4% and 2.3%, partly because of extremely

strong Q2/25 results, but also on rising equities, with the S&P 500 up 0.9%, the

Nasdaq rising 0.8% and the Russell 2000 gaining 2.9%, with strength in the latter

small cap index partly explaining the outperformance of the GDXJ. The other precious

metals also declined last week, with palladium, silver and platinum down -1.6%, -1.5%

and 0.3%, although they are still up substantially year to date, by 22.1%, 12.4% and

32.3%, respectively. The base metals were more muted, with nickel and copper flat

and iron ore edging up, and aluminum edging down, by 0.3% and -0.2%, respectively.

US PPI hints at rising inflation, but rate cut next month still expected

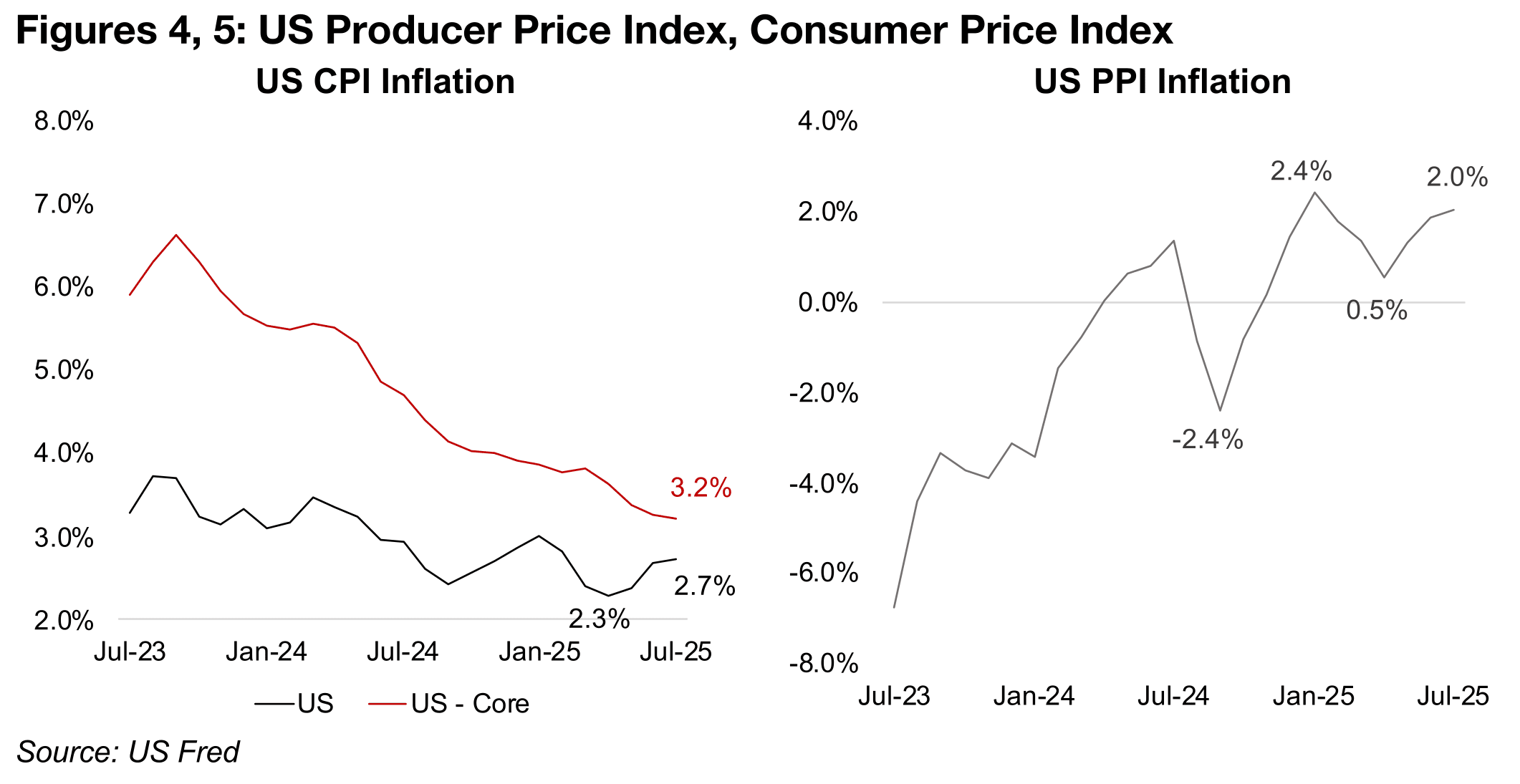

While US CPI inflation was also released earlier this week it actually came in below

expectations and was therefore not a major driver of markets like the surprise US PPI.

The headline figure for July 2025 was near flat, rising to 2.73% from 2.67% in June

2025, versus estimates of 2.8%, while core inflation edged down to 3.23% form 3.26%

over the same periods (Figure 4). The US producer price index (PPI), not seasonally

adjusted, rose 2.0% yoy in July 2025, picking up for the third month in row from its

most recent lows of 0.5% in April 2025 (Figure 5).

This drove market concerns that the rising prices earlier in the supply chain

represented by the PPI could eventually also reach consumer prices and drive the US

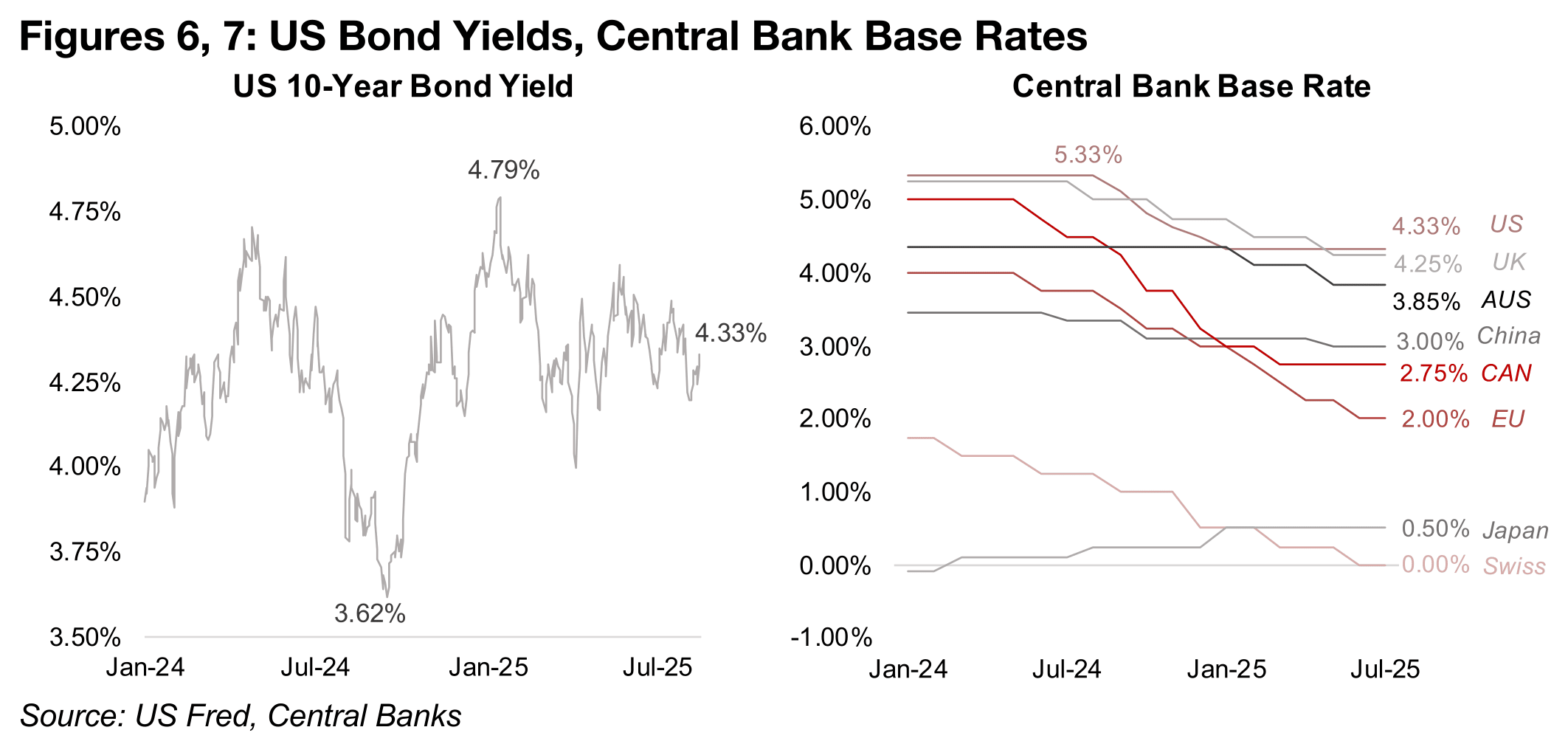

Fed to hold off on rates cuts. However, the US 10-year yield rose moderately, and at

4.33% is still well off its 4.79% highs at the start of the year, and the market still

expects an 84.8% probability of a rate cut at the September Fed meeting, with it the

only major central bank that has not cut rates in 2025 (Figures 6, 7).

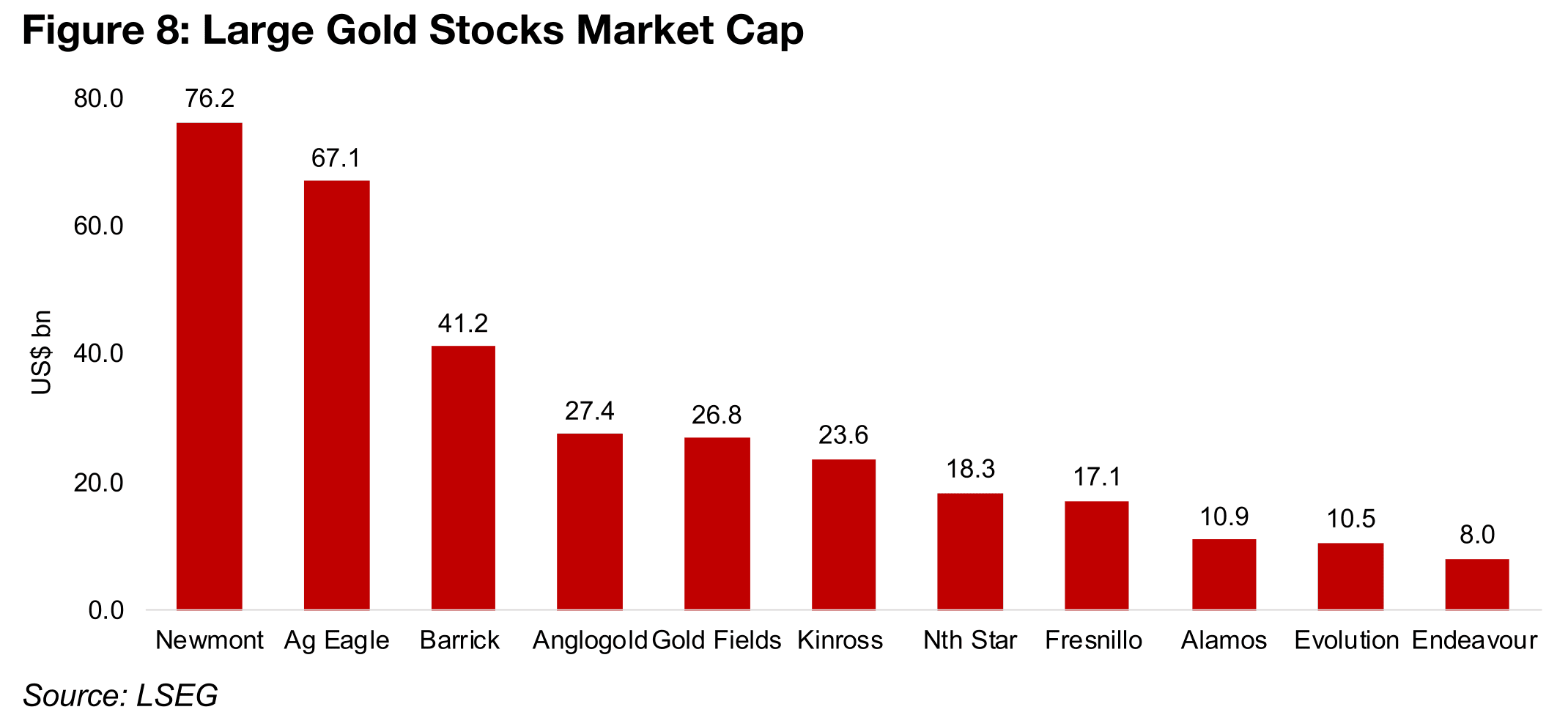

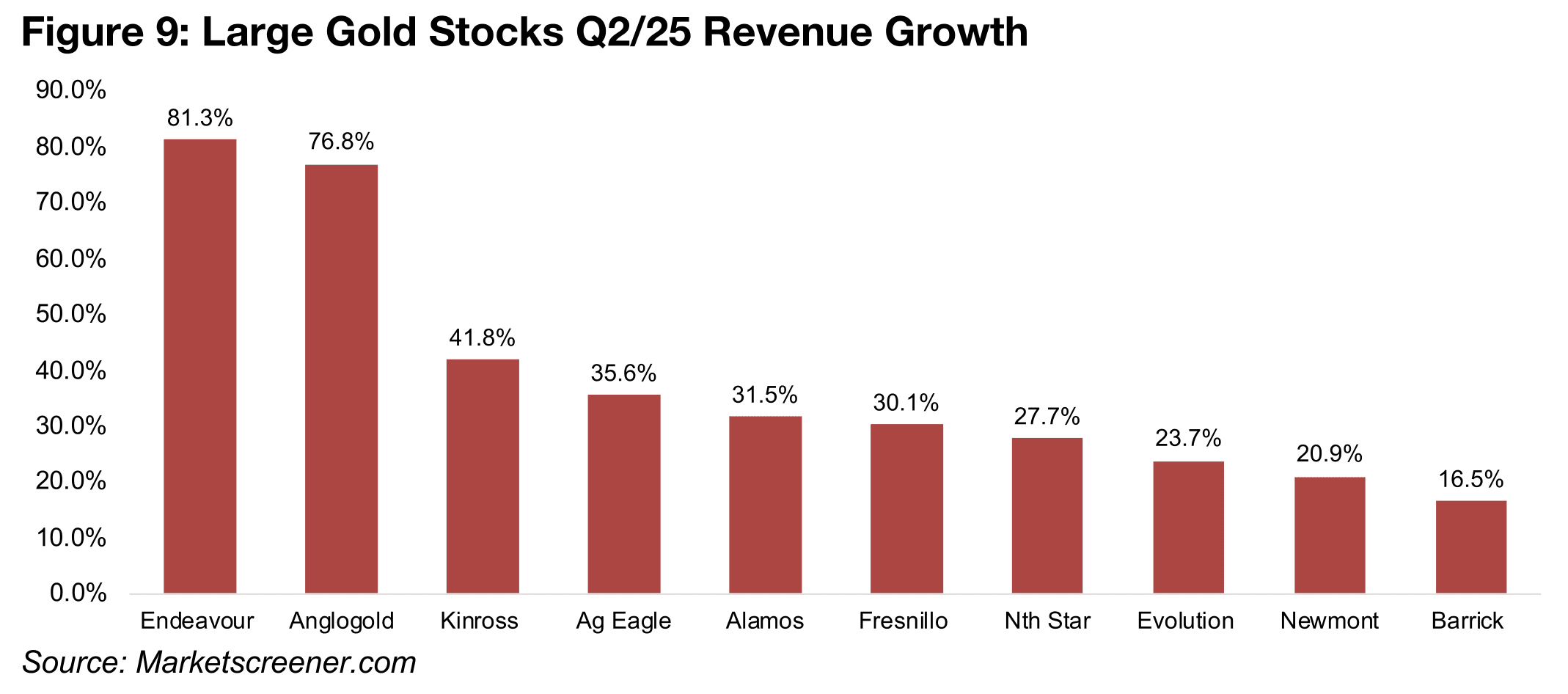

Largest gold stocks have extremely strong Q2/25 results

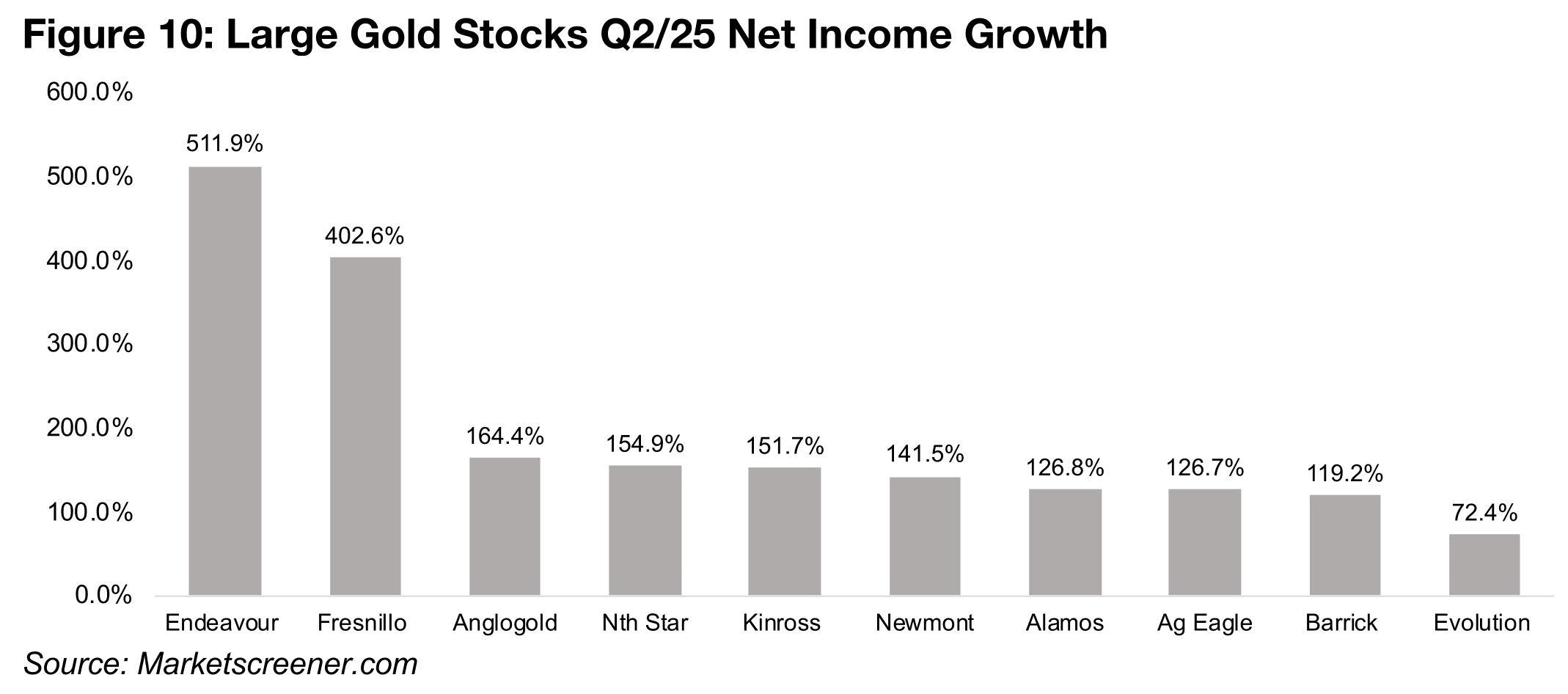

The largest global gold stocks posted another set of outstanding results in Q2/25 (Figure 8). Revenue growth was strong especially on the rising gold price yoy, with two companies, Endeavour and Anglogold up around 80% yoy, four up between 30%-40%, three between 20%-30% and even the weakest gain, from Barrick, still above 15% (Figure 9). This revenue rise dropped to the bottom line, with even the lowest net income growth for Q2/25 yoy, from Evolution, still over 70%, with seven companies ranging from around a 120%-170% increase (Figure 10). While Endeavour and Fresnillo saw net income jump over 500% and 400%, respectively, this was mainly because earnings had been near zero in the comparable period.

Market sees gold sector nearing full value overall after target upgrades

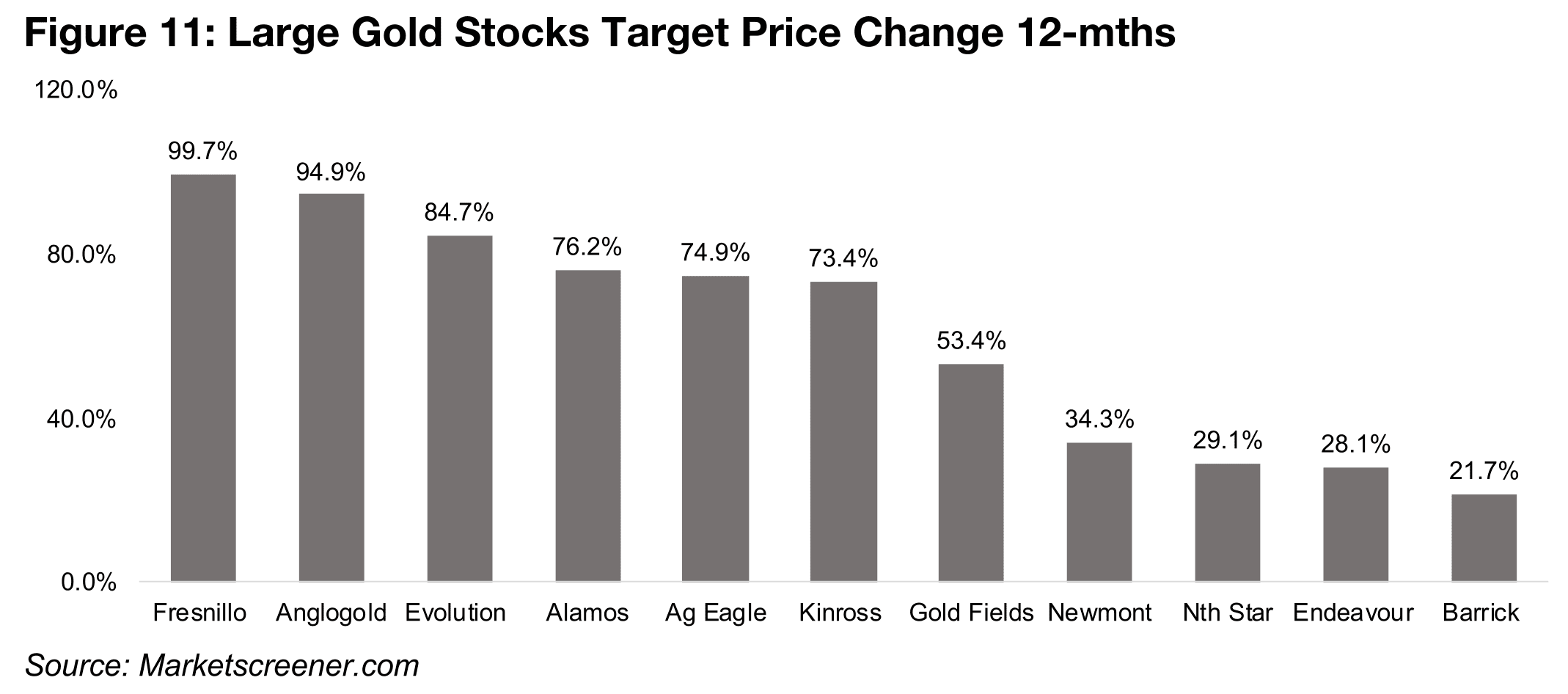

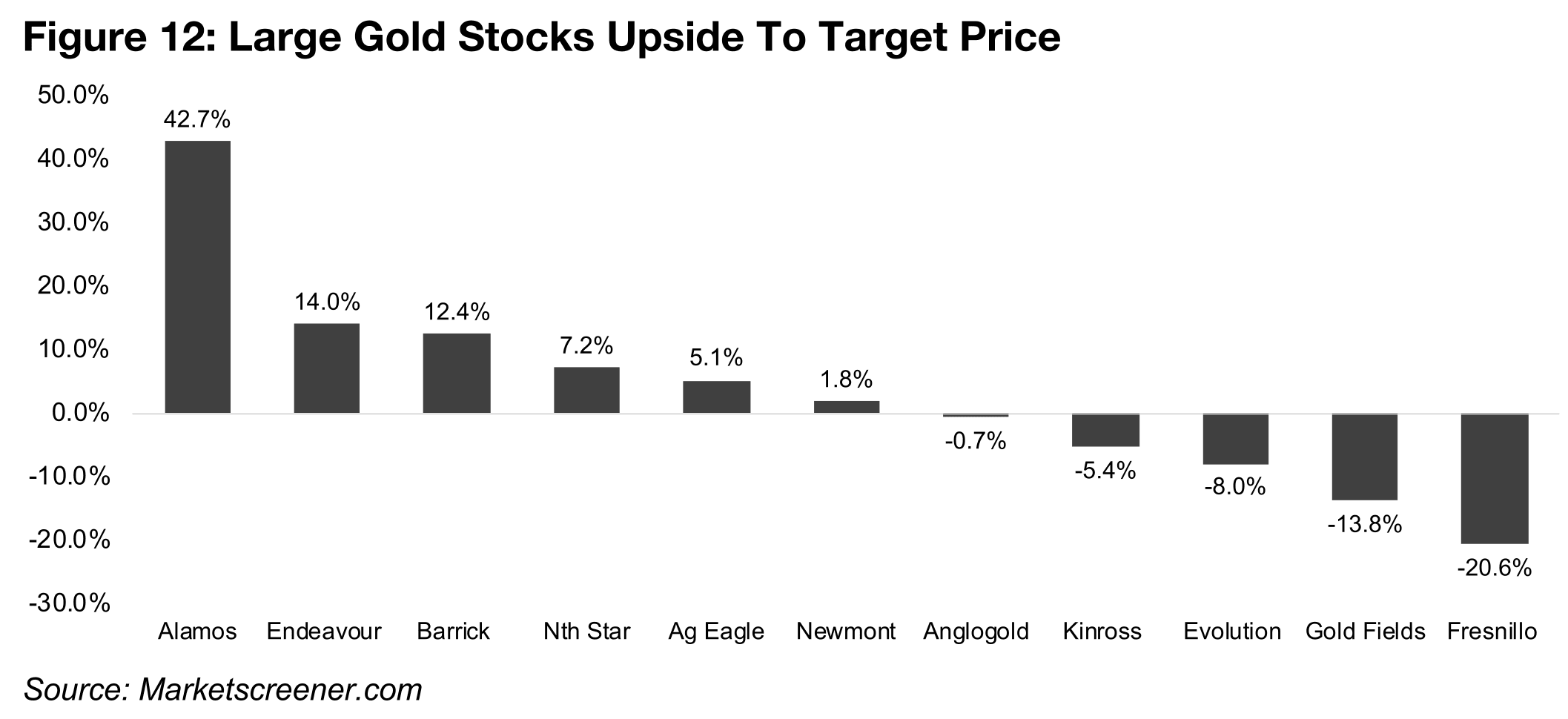

The continued strong results for the sector have finally driven major gains in the shares prices of the sector in recent months. The market appears to have remained quite cautious on pricing in the rise in the gold price even well until H1/25, but it has finally been catching up over the past three months. This has also driven the market to make major upgrades of its target prices for the sector. There has been a 70%- 100% increase in the targets of five companies, one is up around 50%, and four have increased between 20%-35% (Figure 11). However, for the sector overall, the market may now view these targets as having finally incorporated the improved prospects of the companies, as there is only substantial upside to the target price of one stock, Alamos Gold (Figure 12). There is more moderate upside expected for five more gold stocks, and downside to the consensus targets of another five. Overall, it does not indicate a particularly bullish outlook on the gold sector from the market.

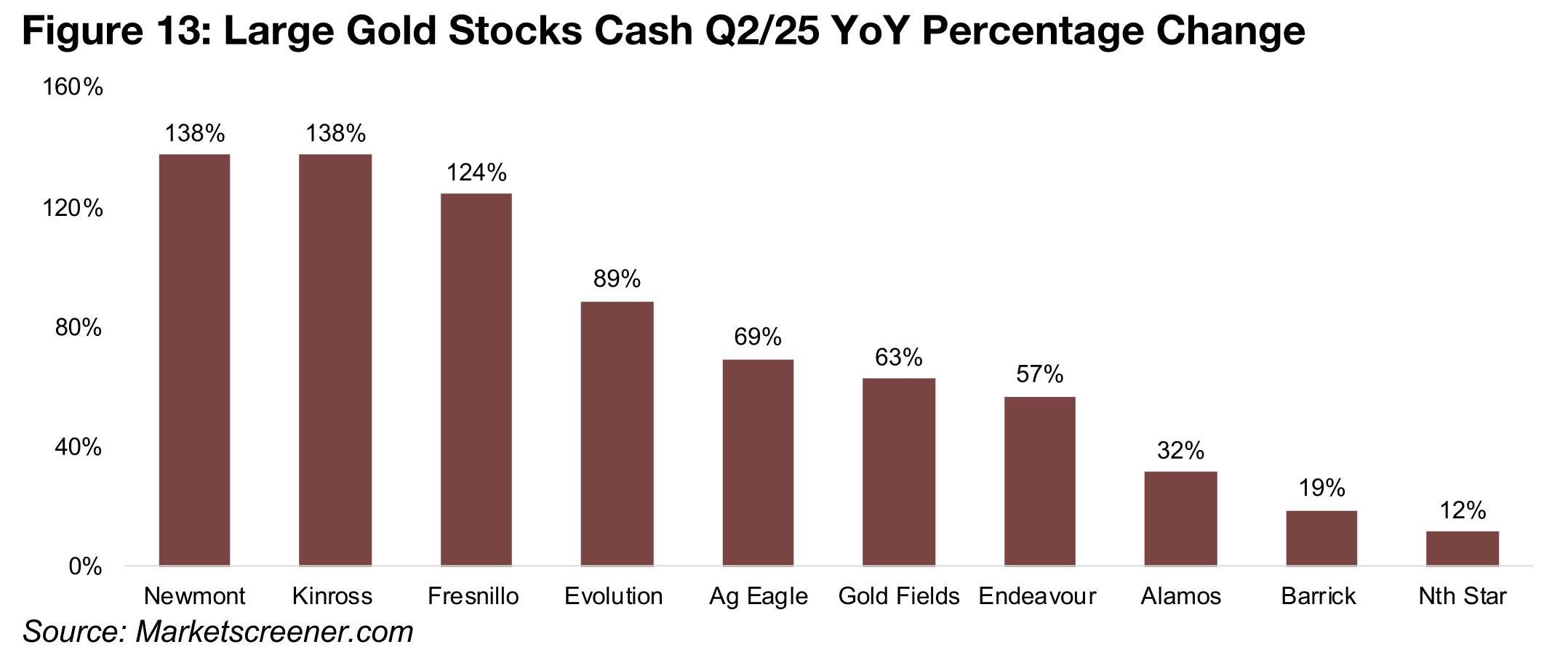

Increase in cash of majors could reach more advanced junior miners

The continued strong sector results have driven a major rise in the cash holdings of

the large gold companies, with three up well over 100%, four rising between 60%-

90%, and even the three lowest Alamos, Barrick and Northern Star, still up 32%, 19%

and 12% (Figure 13). While some of this may be returned to shareholders and used

for capital expenditure for ongoing projects, a proportion will also go into sourcing

new projects, as these companies all face the perpetual problem of reserve depletion.

This could have a good read across for the junior mining sector, especially for those

companies with more advanced projects, given that there has been rising risk

aversion in market over the past year. We have seen evidence of this in a decline in

the proportion of early exploration stage companies in the TSXV Top 20 gold stocks’

market cap this year, to below 10% from over 30% in recent years. However, the

major producers need to source new resources, and most tend towards acquisition

of somewhat advanced projects over investing directly in early-stage exploration.

Gold sector valuations no longer clearly inexpensive

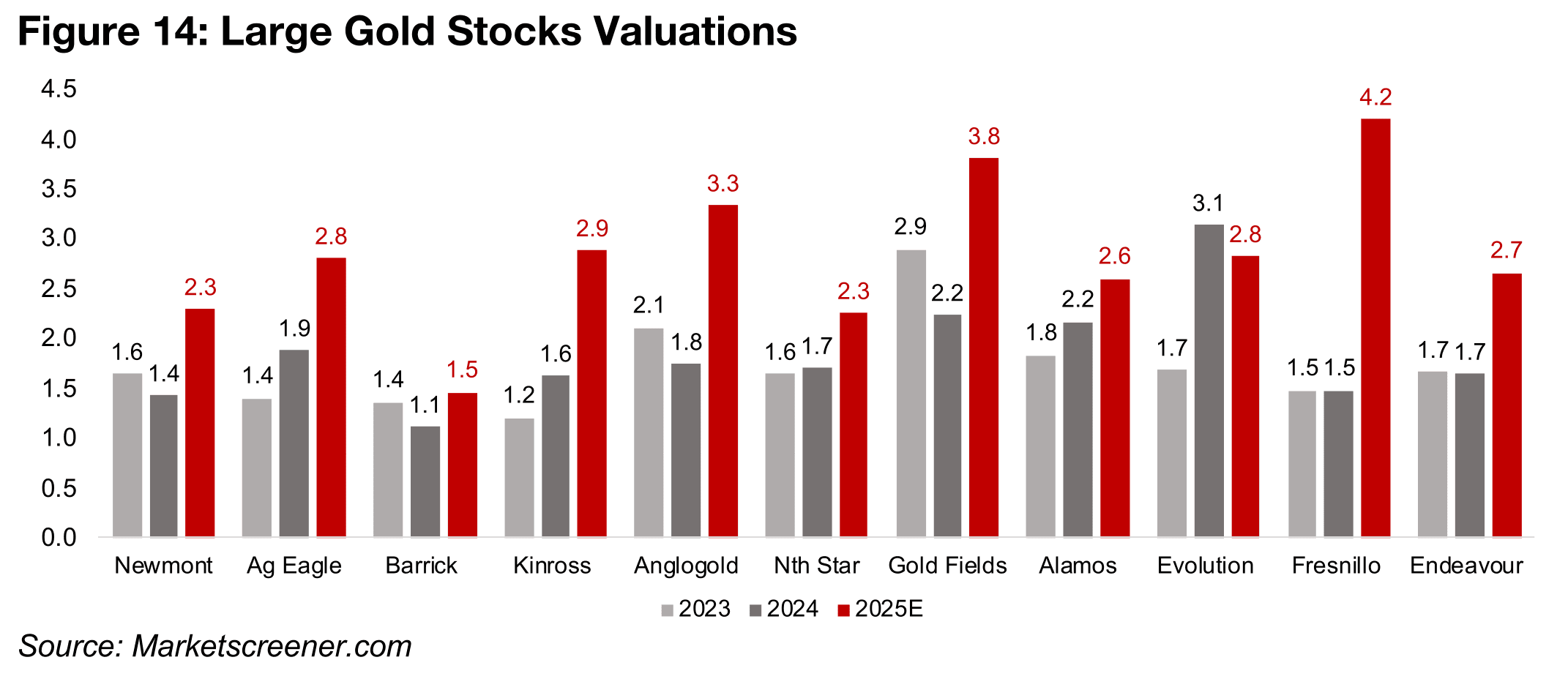

The rise in the large gold stock share prices have also driven up their valuations, and for the first time in years, the sector is no longer clearly inexpensive, although it also does not look significantly overvalued. The price to book (P/B) values for the sector traded in a range of between 1.1x to 2.2x for 2023 and 2024, but have jumped to a range of 2.3x to 4.2x for 2025E, with the exception of Barrick (Figure 14). Companies with P/B ratios below 1.0x are generally considered inexpensive for companies not in financial distress while those with multiples above 3.0x can be starting to move into relatively expensive territory. Three of the large cap gold companies are now significantly above 3.0x, five are between 2.7x to 2.9x, and two are at 2.3x, with Barrick now the only company with a clearly low multiple, at 1.5x.

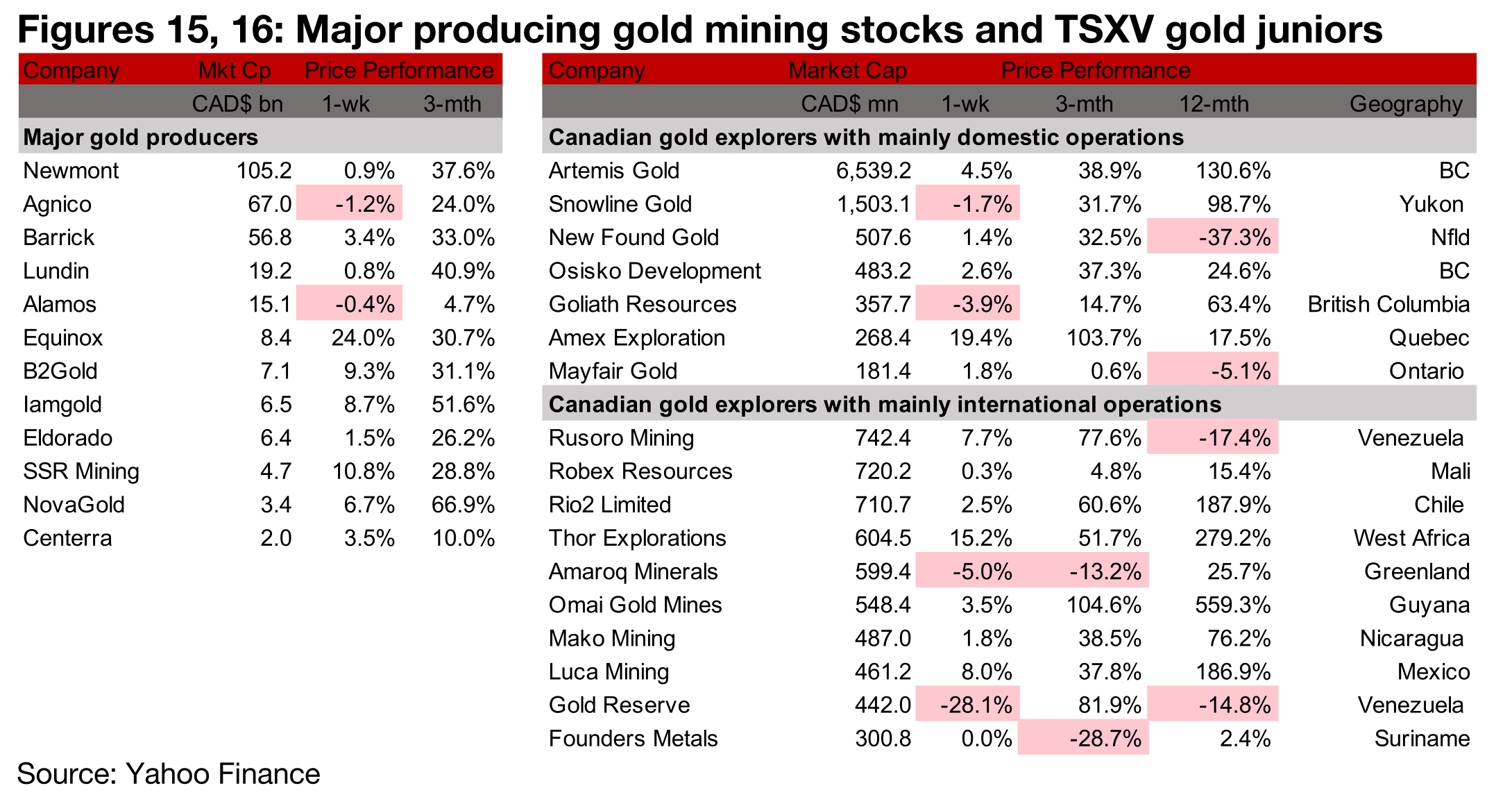

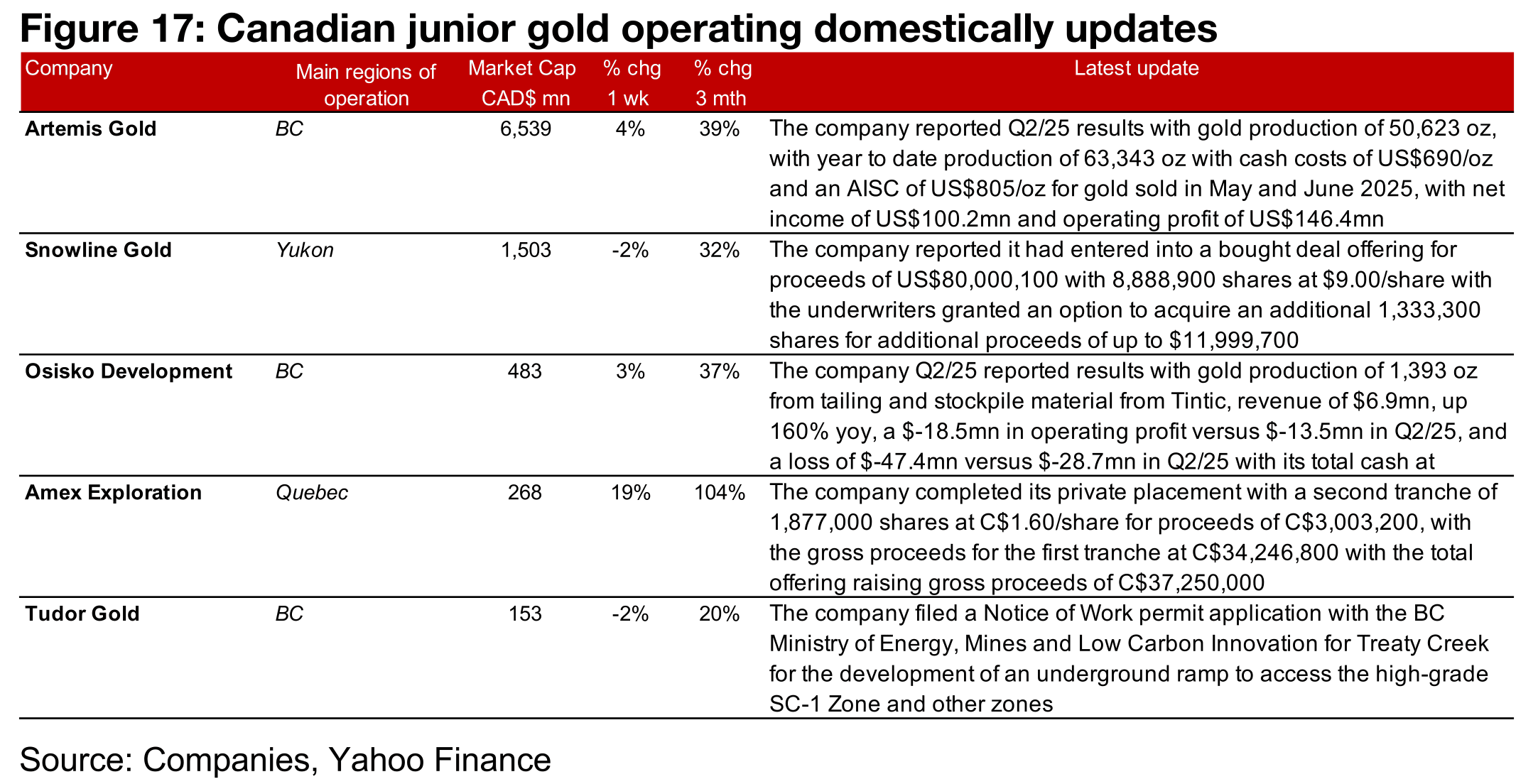

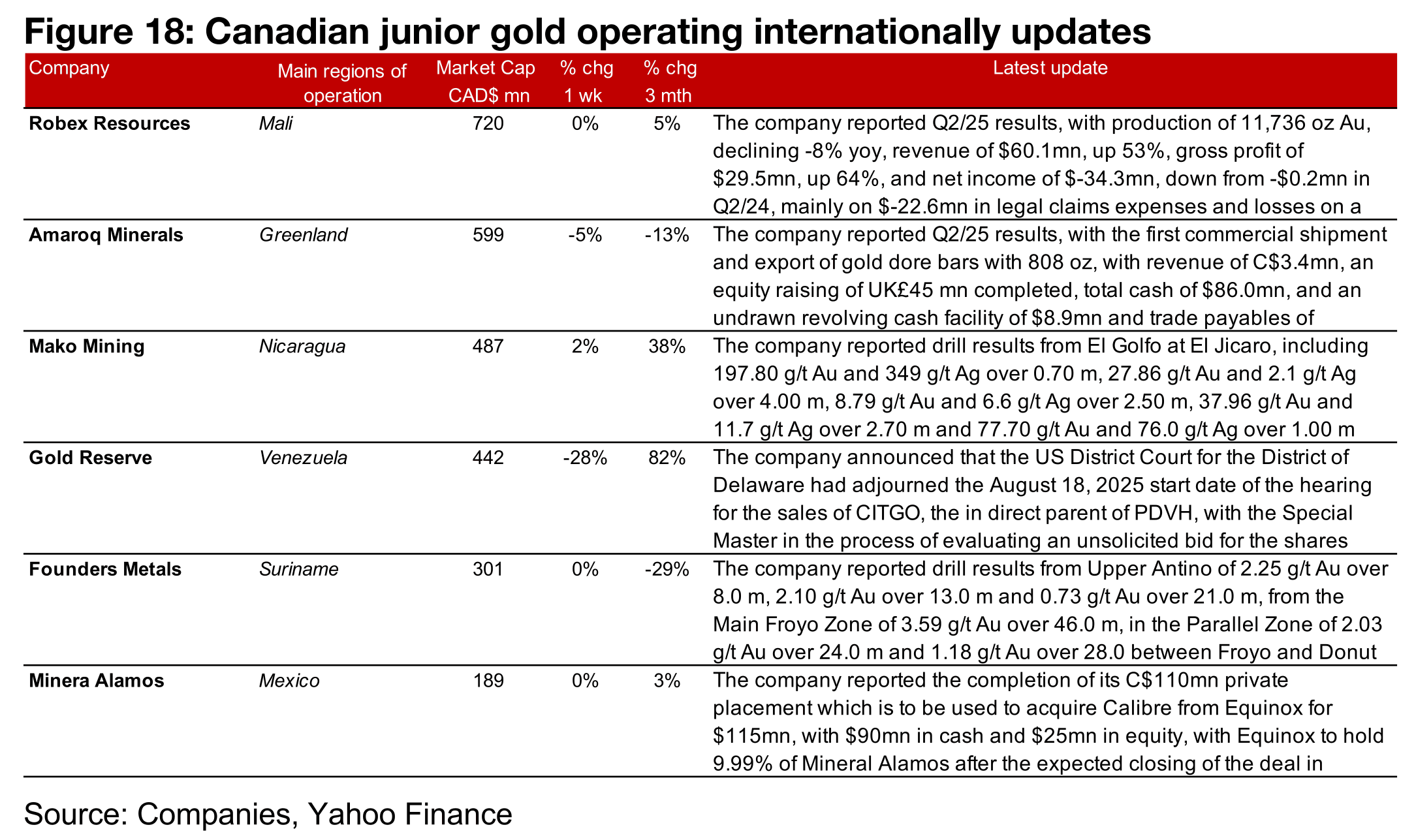

Most large producers and TSXV gold rise

Most of the large producers and TSXV gold rose even as the equity markets declined (Figures 15, 16). For the TSXV gold companies operating mainly domestically, Artemis Gold and Osisko Development reported Q2/25 results, Snowline Gold entered a US$80mn private placement and Amex completed the second C$3.0mn tranche of its financing, with a C$34.3mn first tranche for a total C$37.3mn in proceeds. Tudor filed a Notice of Work permit application with the B.C. government to develop an underground ramp to access SC-1 and other Zones (Figure 17). For the TSXV gold companies operating mainly internationally, Robex and Amaroq reported Q2/25 results, Mako reported drill results from El Golfo at the El Jicaro concession and Gold Reserve announced a US Court adjourned the August 18, 2025 start date of the CITGO sales process, with the Special Master evaluating an unsolicited bid. Founders reported drill results from Antino and Minera Alamos completed its C$110mn private placement which is to be used for its acquisition of Calibre from Equinox (Figure 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.