November 10, 2025

Gold Flattens

Author - Ben McGregor

Gold roughly flat for a second week

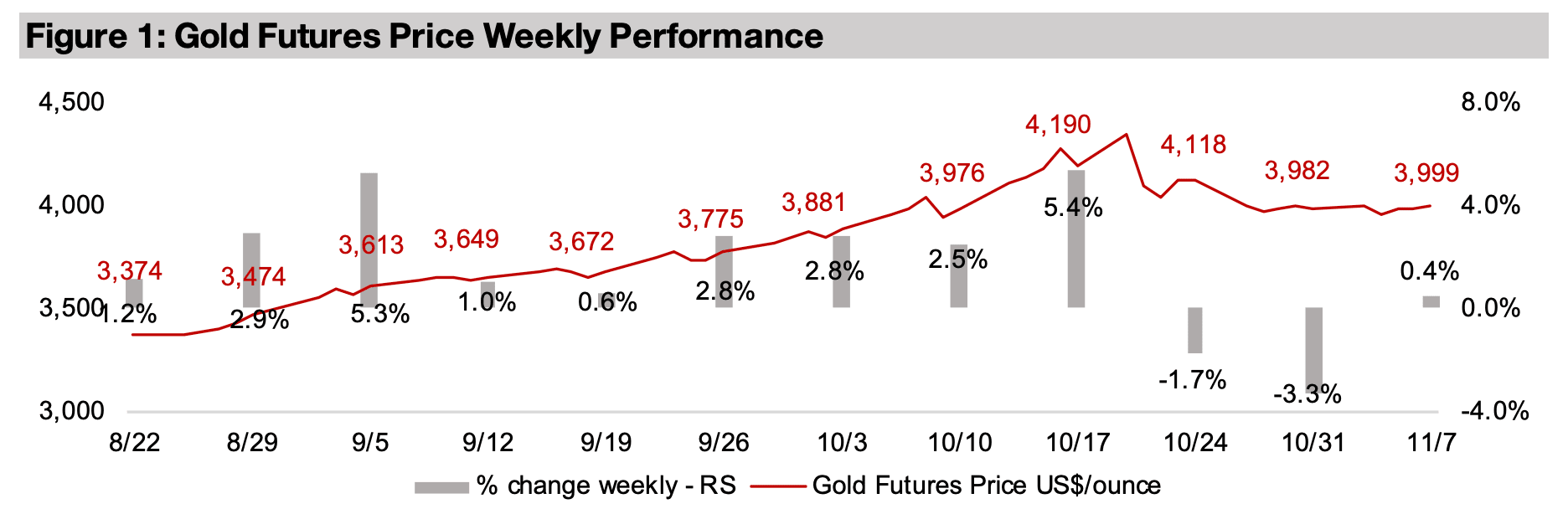

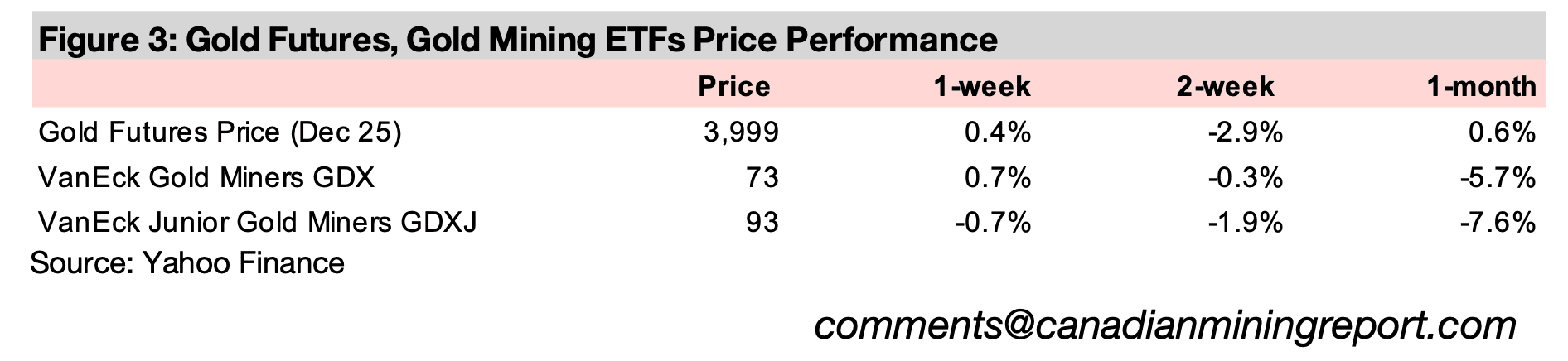

Gold rose 0.4% to US$3,999/oz and has been near flat for most of the past two weeks just under the US$4,000/oz level, with the price cooling after a three-month parabolic rise from mid-July 2025 and then major pullback in the second half of October.

Two major institutions boost metals price forecasts overall

Both Australia’s Office of the Chief Economist and the World Bank have released new forecasts in October 2025, with increases for most of the major metals, but the gold price seeing an especially strong rise in estimates for 2025 and the next two years.

Gold Flattens

The gold price rose 0.4% to US$3,999/oz and has been roughly flat for most of the

past two weeks at just under the US$4,000/oz level. The metal has cooled after a

three-month parabolic boom that started in mid-July was followed by a major

pullback in the second half of October 2025. Major economic data was mixed, with

better than expected US jobs data for October 2025, a weak US consumer sentiment

index, and low China manufacturing PMI. The equities markets dropped, with the

S&P down -2.2%, Nasdaq slumping -4.0% and the Russell off -1.9%, with concerns

again rising about the sustainability of the AI boom driving US and global tech. The

other metals were weak, with silver flat, and platinum and palladium continuing to pull

back from parabolic moves in recent months, down -1.4% and -3.1%, respectively.

The base metals dropped, especially on the weak China data, with copper, iron ore

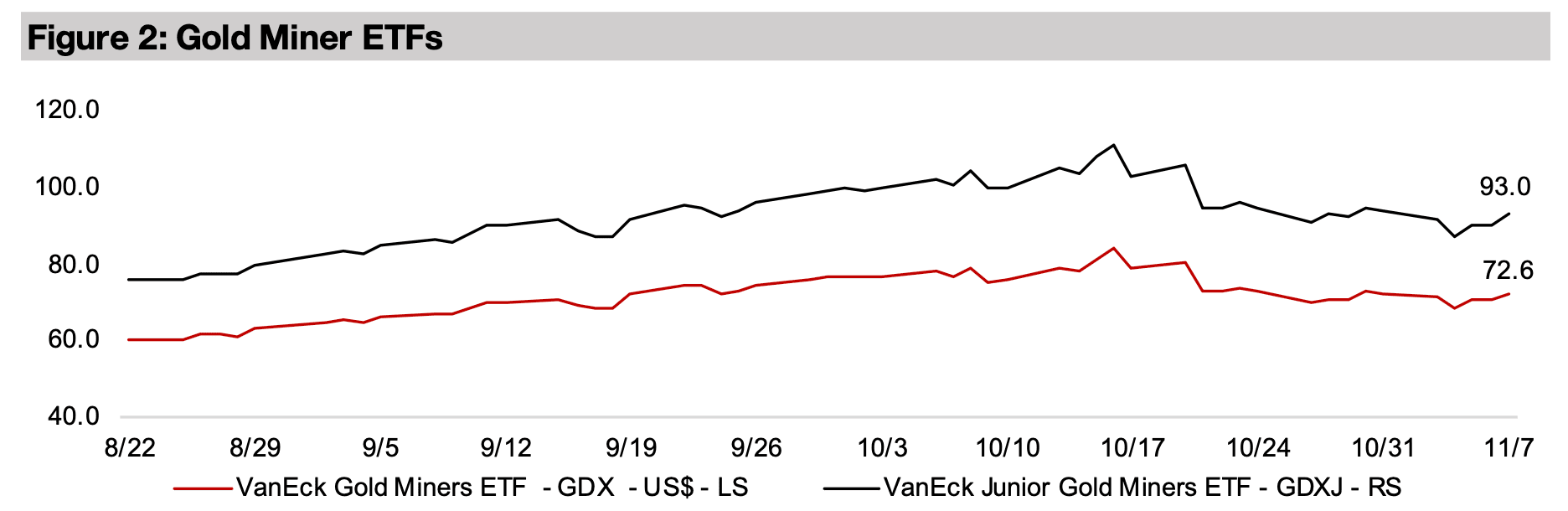

and aluminum down -3.0%, -2.4% and -1.2%. While gold stocks were mixed, they

significantly outperformed equities, with the GDX up 0.7% and GDXJ down -0.7%.

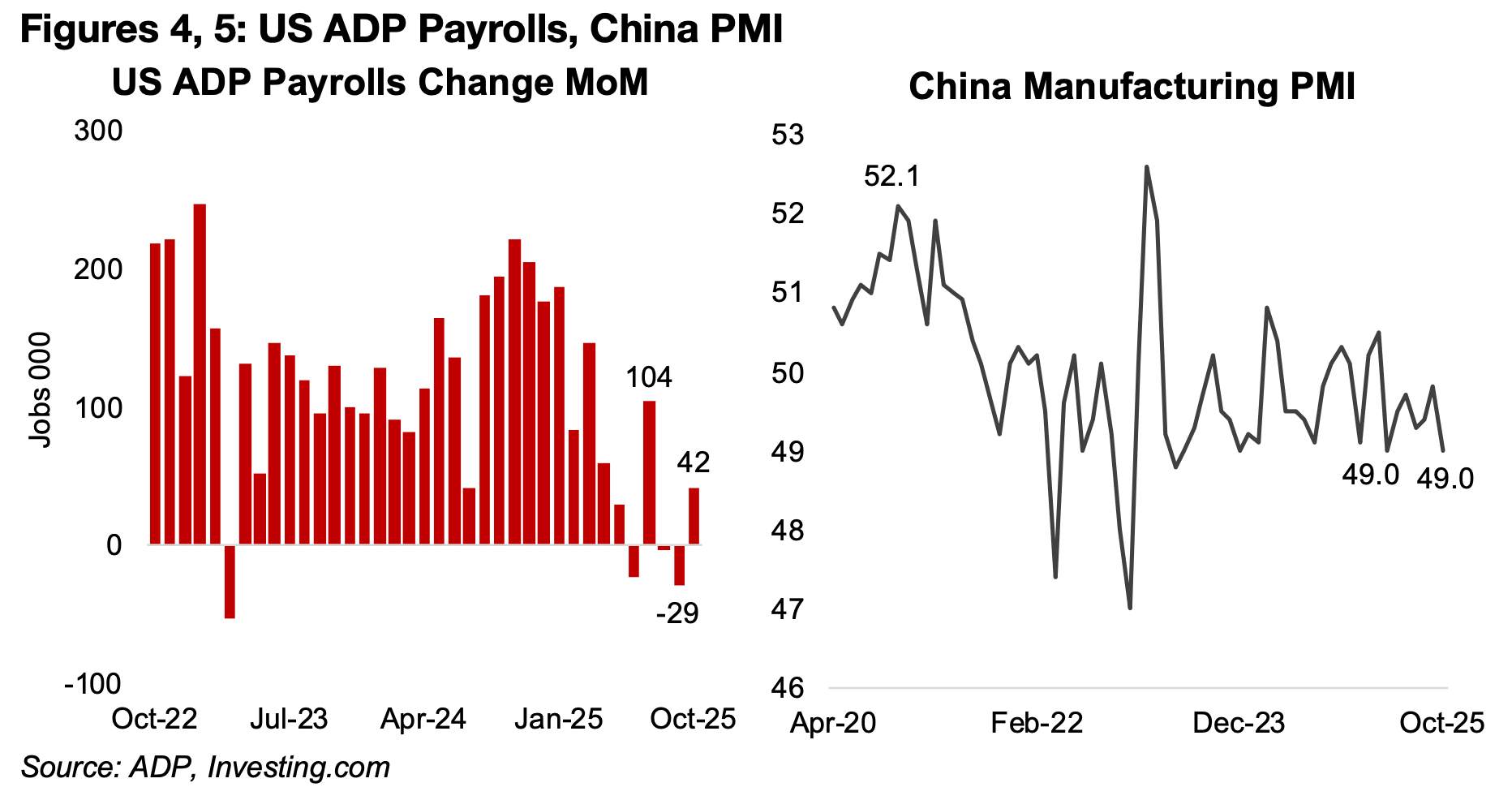

The US ADP payrolls in October 2025 came in higher than expected, at 42k versus

forecasts for 22k, and improving from a -29k decline in September 2025 (Figure 4).

While the US nonfarm payrolls report usually provides a point of comparison for this

data, as it tends to be released the same week, it has not been available because of

the ongoing US government shutdown. The rise last month was a major decline from

the 221k increase in October 2024, with the US unemployment situation clearly

deteriorating over the past year. There has been weakness in ADP figures for six

months, with mom declines in three months, an average of 20k additions per month

and only July 2025 clearly strong over the period, with a 104k rise. This compares to

an average 139k additions per month over Q1/25 and 144k per month in 2024.

The US unemployment rate spiked to 4.3% in August 2025, after averaging 4.2% in

the twelve months to July 2025, with no data for two months from the government

shutdown. The unemployment rates in the EU and China have been more stable,

averaging 5.9% and 5.1% in the year to September 2025. US unemployment may

have risen further over the past two months, given the job cuts reported by US

Challenger. These spiked to 153k in October 2025 from 54k in September, after

averaging 79k from March-August 2025, although this is down from 275k highs in

March 2025. The jobs slowdown will likely have been a major factor in the decline in

the US Consumer Sentiment Index to 48.7 in October, its lowest since 52.3 in June

2022, with an overall downtrend from 2020, after averaging 96.6 from 2017-2019.

The global growth outlook has also been in question after the China manufacturing

PMI, at 49.0 in October 2025, came in below expectations for 49.3 and was at its

lows for the past two years (Figure 5). China’s PMI has averaged 49.6 in 2025, down

from 49.8 in 2024. The outlook for China is key for many major metals, as the country

accounts for the majority of production of refined copper and aluminum and is a major

source of global demand for these metals and also iron ore.

AOCE and WB boost gold targets for 2025 significantly

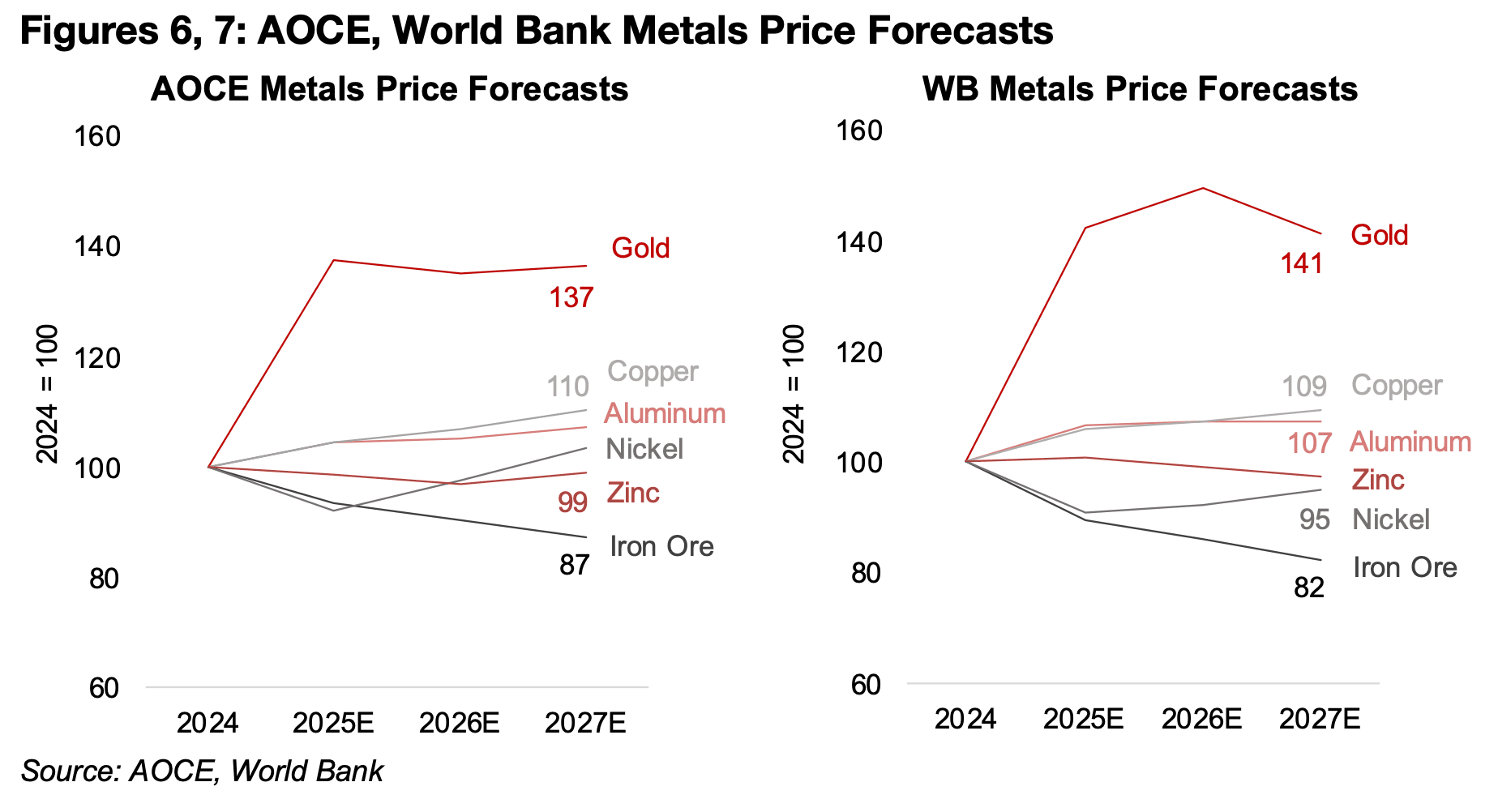

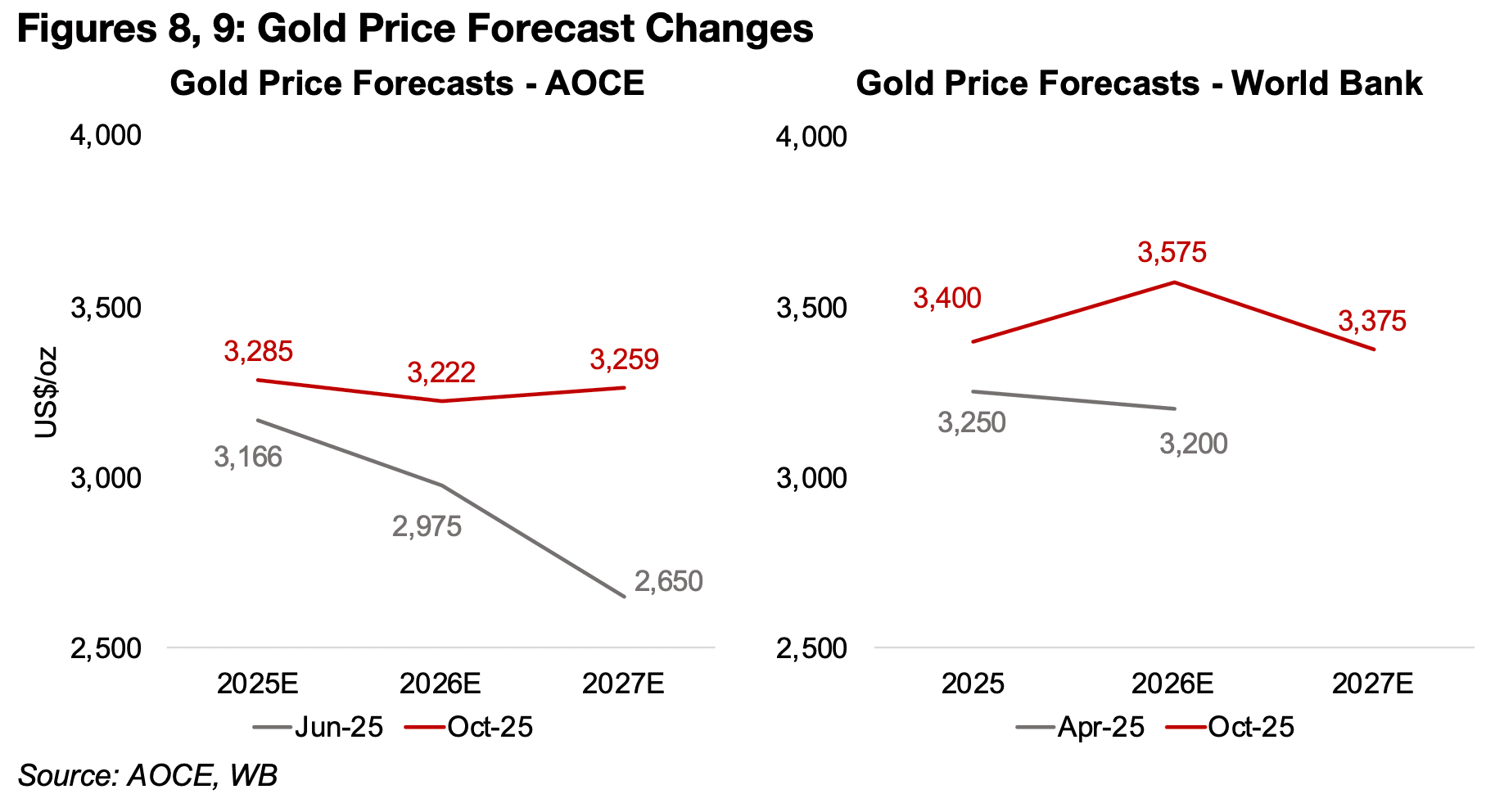

The two institutions that provide regularly updated forecasts for metals prices, Australia’s Office of the Chief Economist (AOCE) and the World Bank (WB), both released new estimates in October 2025 (Figures 6, 7). For both there were major upgrades to their gold forecasts for 2025, although the AOCE expects it to flatten over the next two years, and the WB estimates a rise in 2026 and decline in 2027. They have similar forecasts for a gradual rise in copper and aluminum prices, a pickup in nickel and decline in iron ore, with zinc roughly flat.

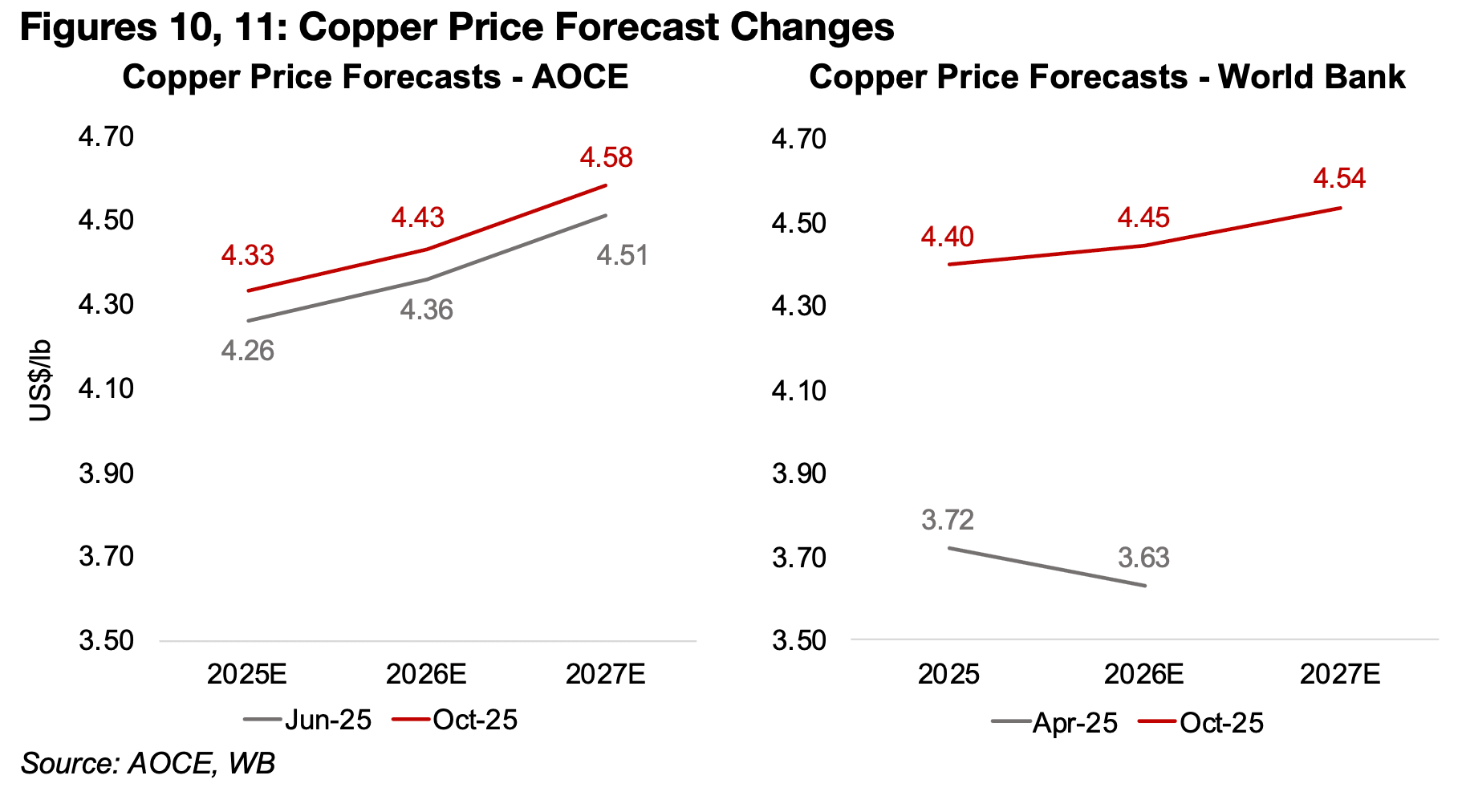

The AOCE’s gold forecasts have seen a major upgrade from June 2025, especially for 2027E, while WB has only released 2027 forecasts in the October 2025 report (Figures 8, 9). While the AOCE’s copper forecasts have been upgraded marginally for 2025E to 2027E, the WB has increased its estimates substantially, indicating a significant change in outlook (Figures 10, 11). The rise for both was likely partly driven by a decline in expected supply after the shutdown of the Grasberg in Indonesia, the second largest global copper producer. However, the WB’s new estimates also seem to incorporate a major change in demand expectations compared to earlier this year.

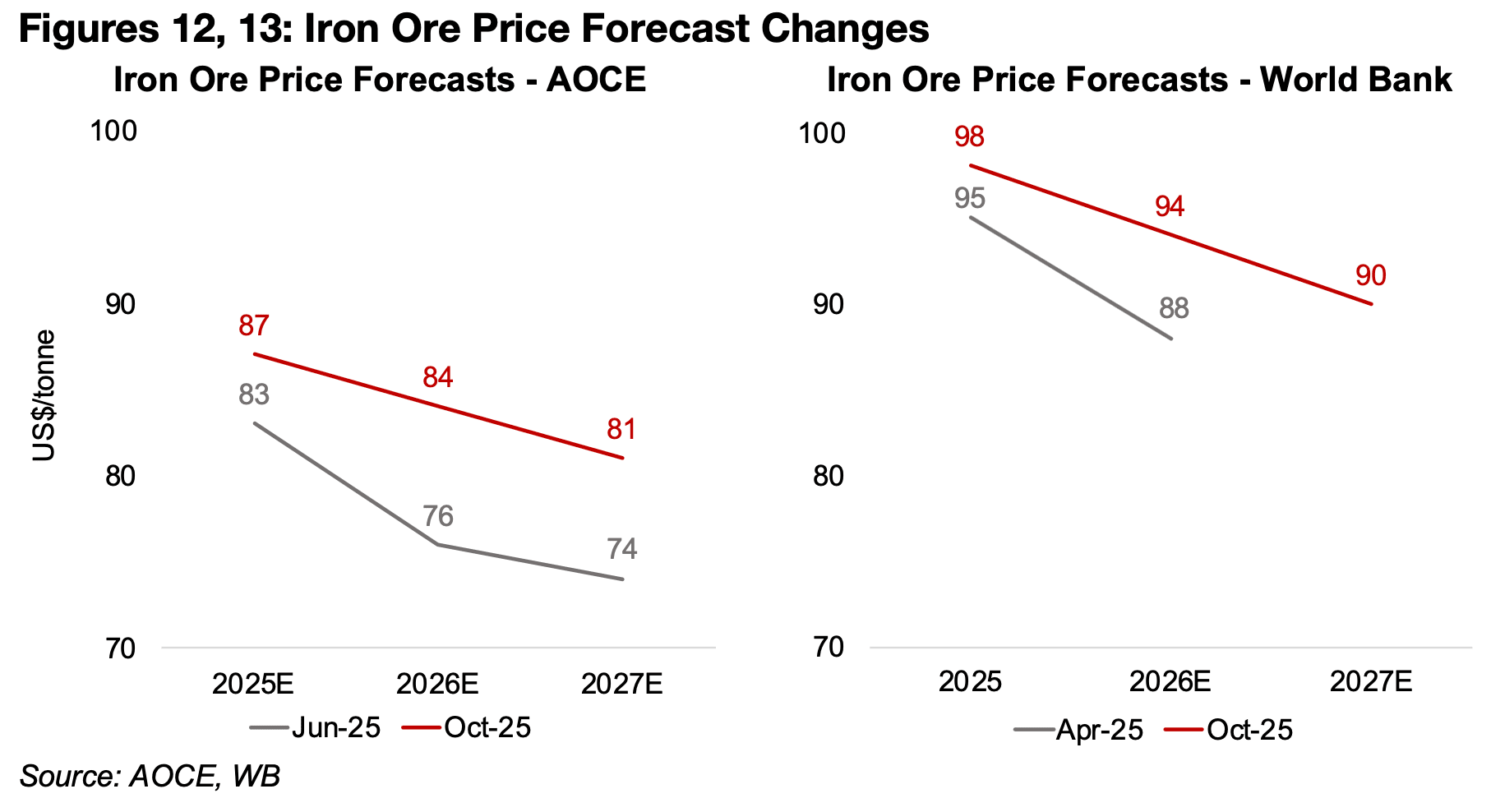

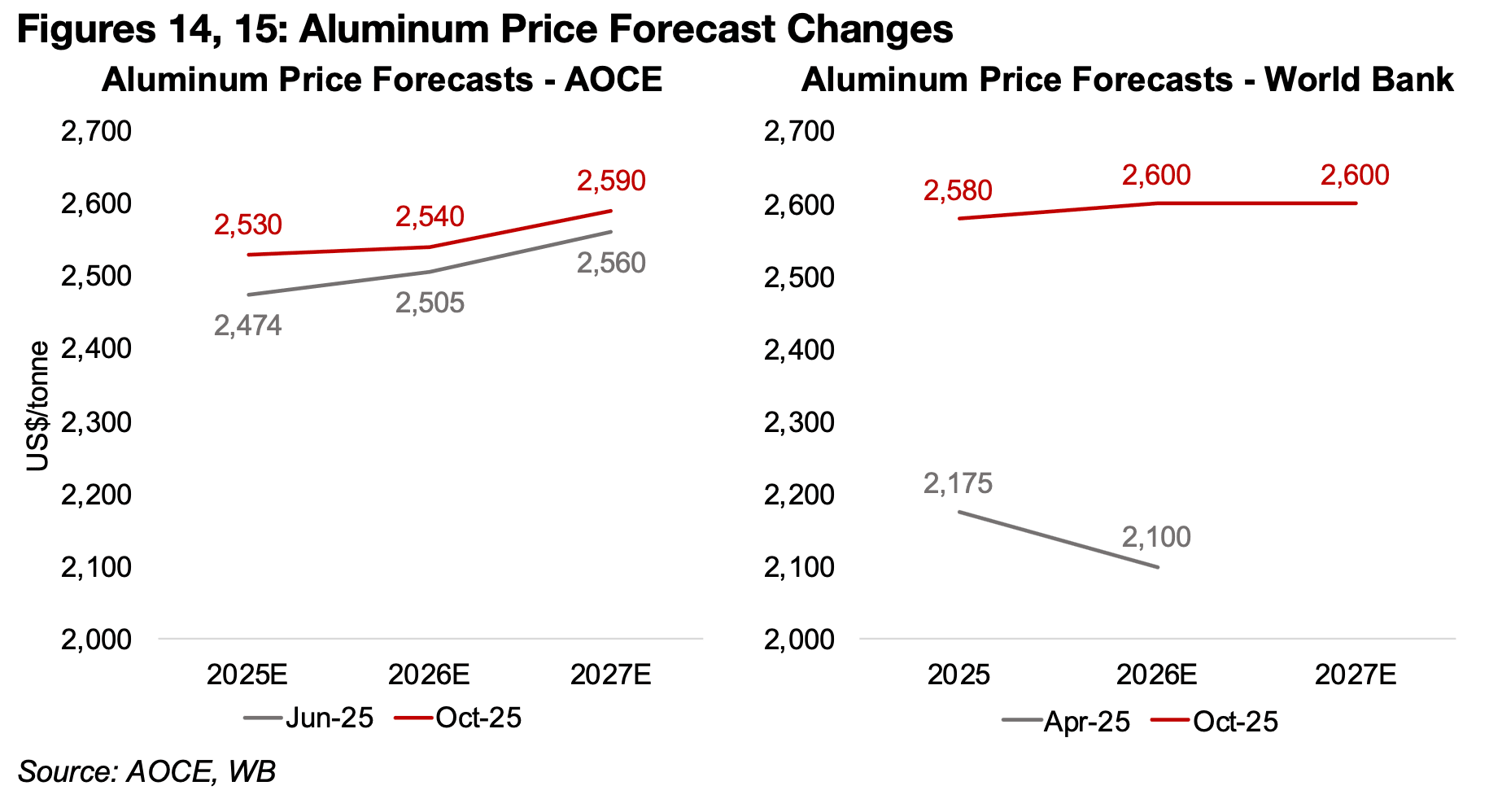

While the AOCE and WB have upgraded their iron ore forecasts, they are both still looking for a substantial decline in the metal price over the next two years, especially on expected weakness in the global steel sector, which comprises almost all of the demand for the metal (Figures 12, 13). The AOCE has boosted its aluminum forecasts marginally, and expects a gradual pickup up over the next two years, while the WB has made major upgrades, but expects a rise in 2026, with the price flat in 2027 (Figures 14, 15). These changes are similar for both to their copper upgrades, and again seem to imply a major increase in demand expectations from the WB.

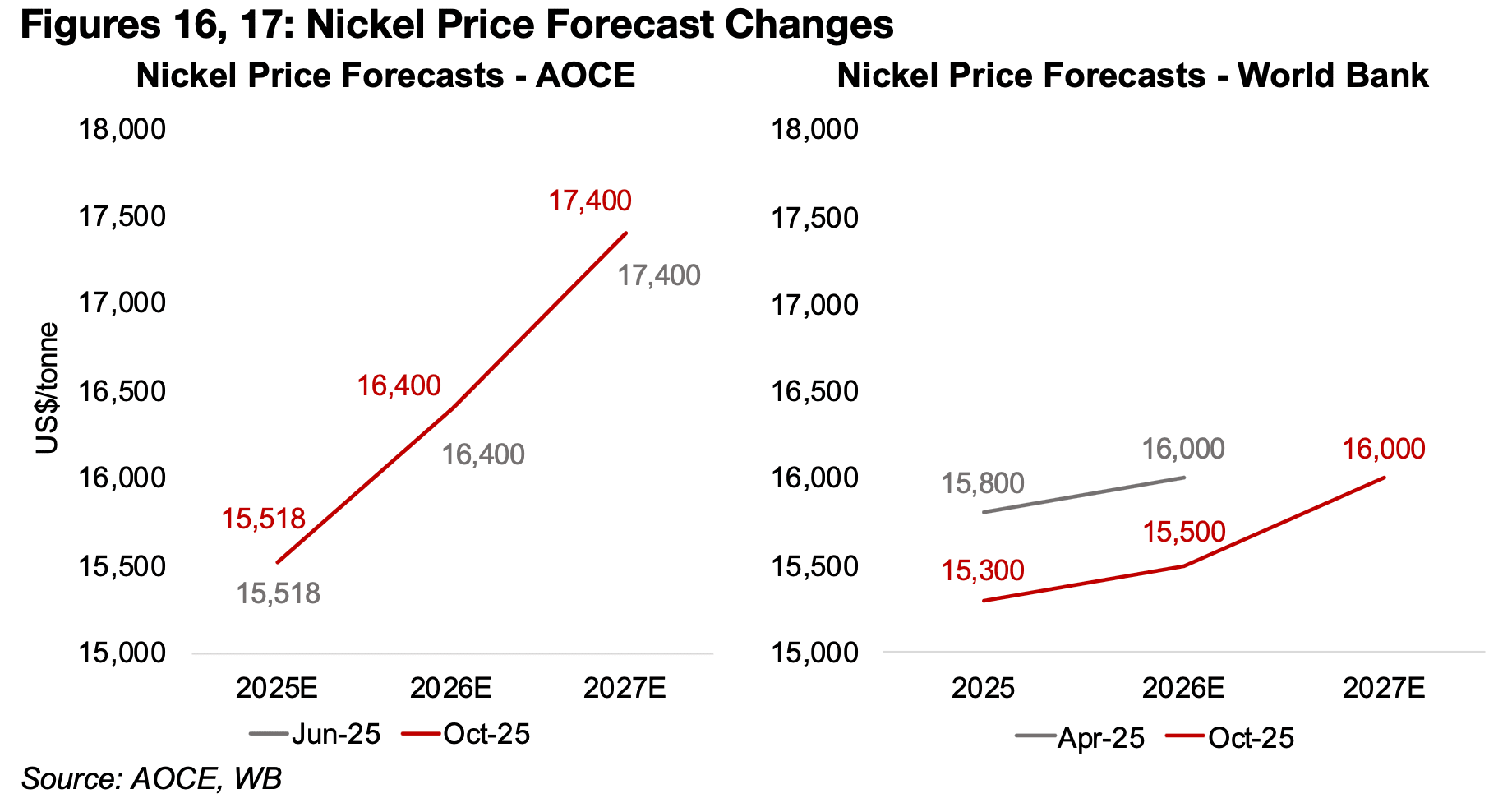

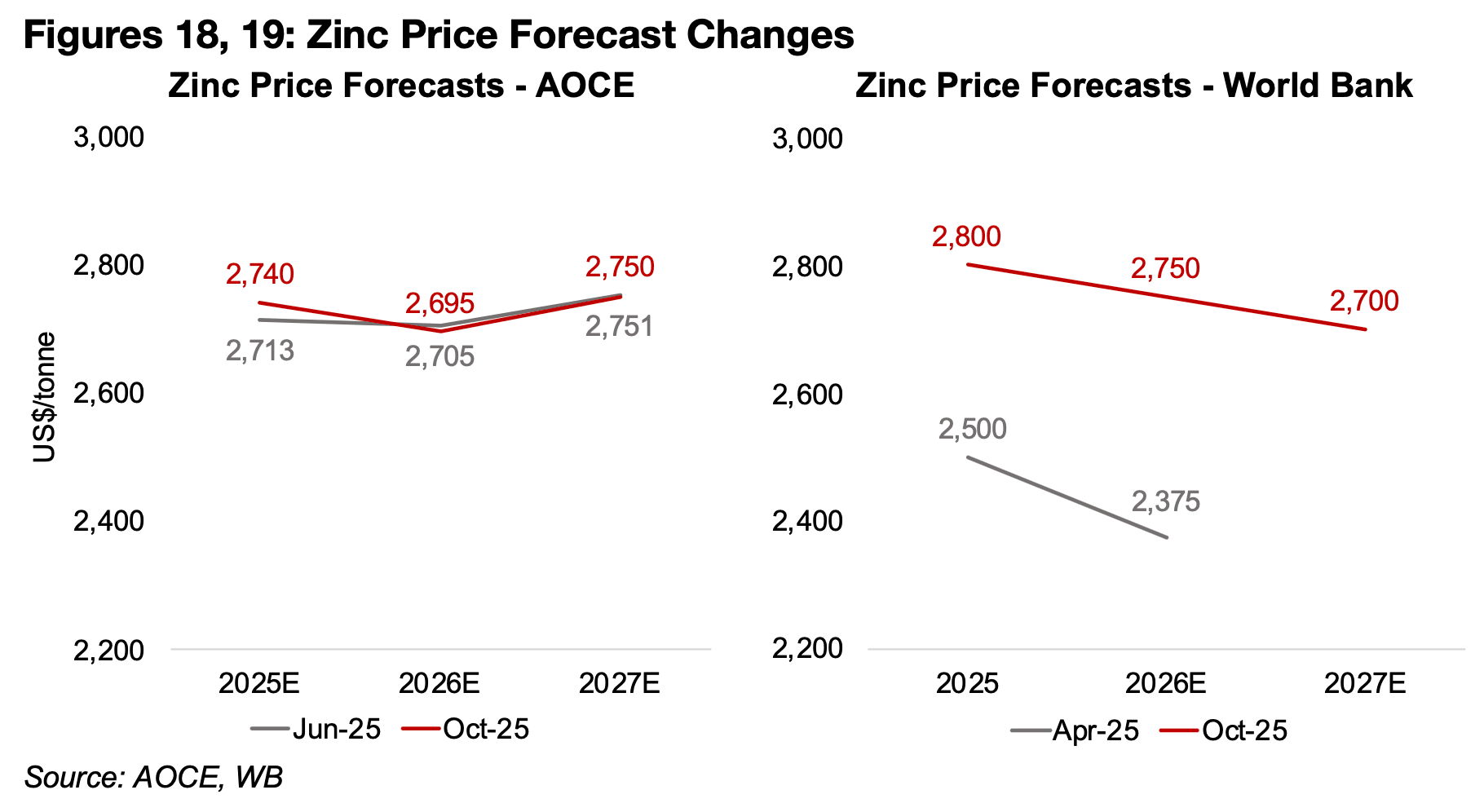

AOCE maintains nickel forecasts, WB cuts nickel, boosts zinc

The nickel and zinc price forecasts from the AOCE have not changed much, for the former, they are exactly the same, and for the latter the estimates have edged up for 2025, ticked down for 2026, with 2027 flat (Figures 16, 18). The AOCE forecasts a major rebound in the nickel price over the next two years, in contrast to WB, with only a moderate rise and the estimates downgraded (Figure 17). While the WB’s zinc forecast has been boosted considerably, both estimates indicate a decline over the next two years, in contrast to the more flat outlook from the AOCE (Figure 19).

The nickel market remains in a huge oversupply, mainly from an increase in capacity in Indonesia, which producers more than half of the world output of the metal. However, there are some measures being implemented by the Indonesian government to limit further increases in nickel supply, and the low price has driven many global producers to halt nickel production. This could boost the price from next year, assuming demand holds up, which is driven mainly by steel production and EV batteries, with the AOCE implying greater supply constraint and demand than WB. Zinc demand is about half from galvanizing steel and the outlook for global growth in this sector remains relatively weak on China’s slow infrastructure and property sectors, which had been a main driver of steel demand in recent decades.

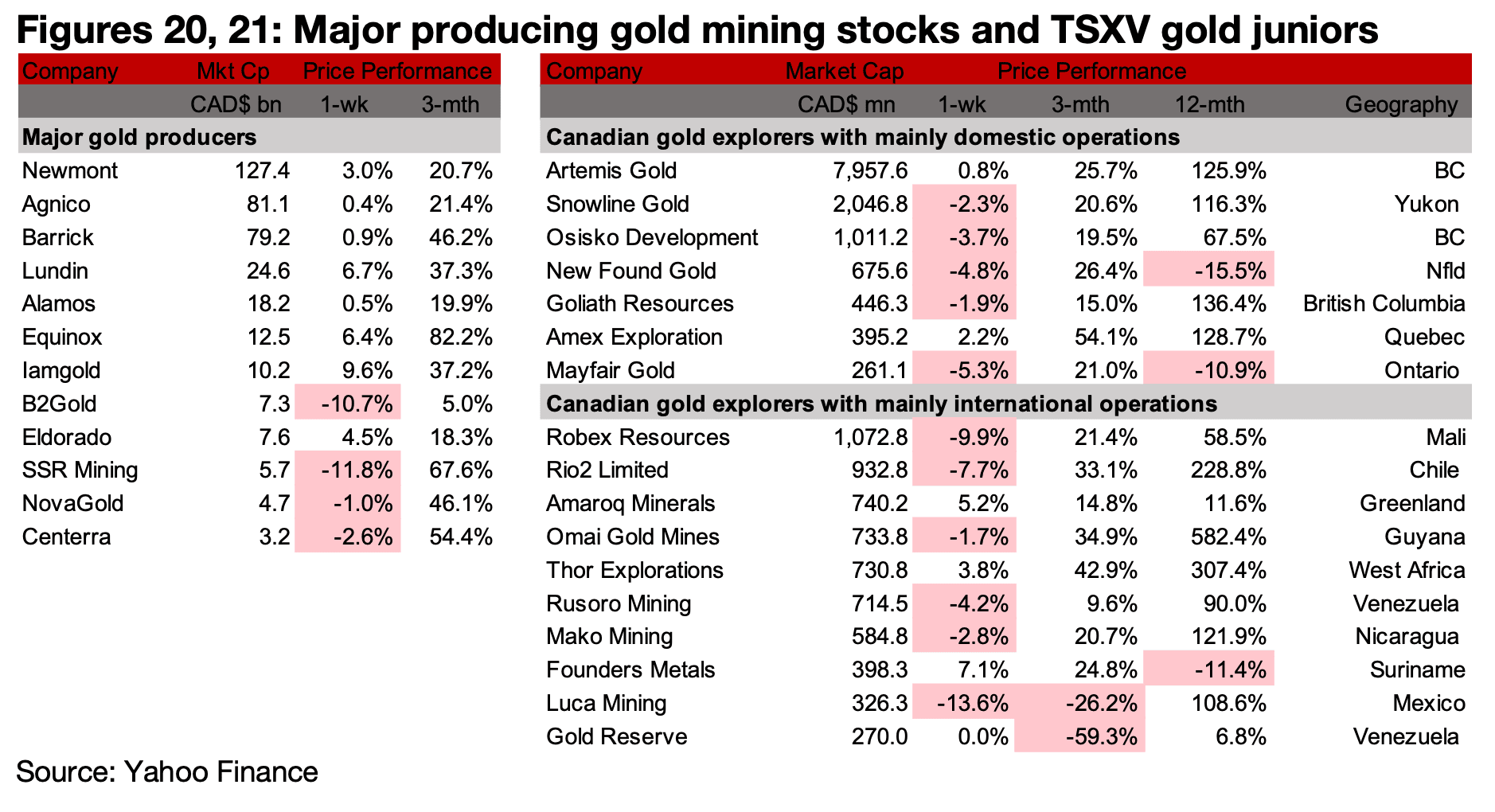

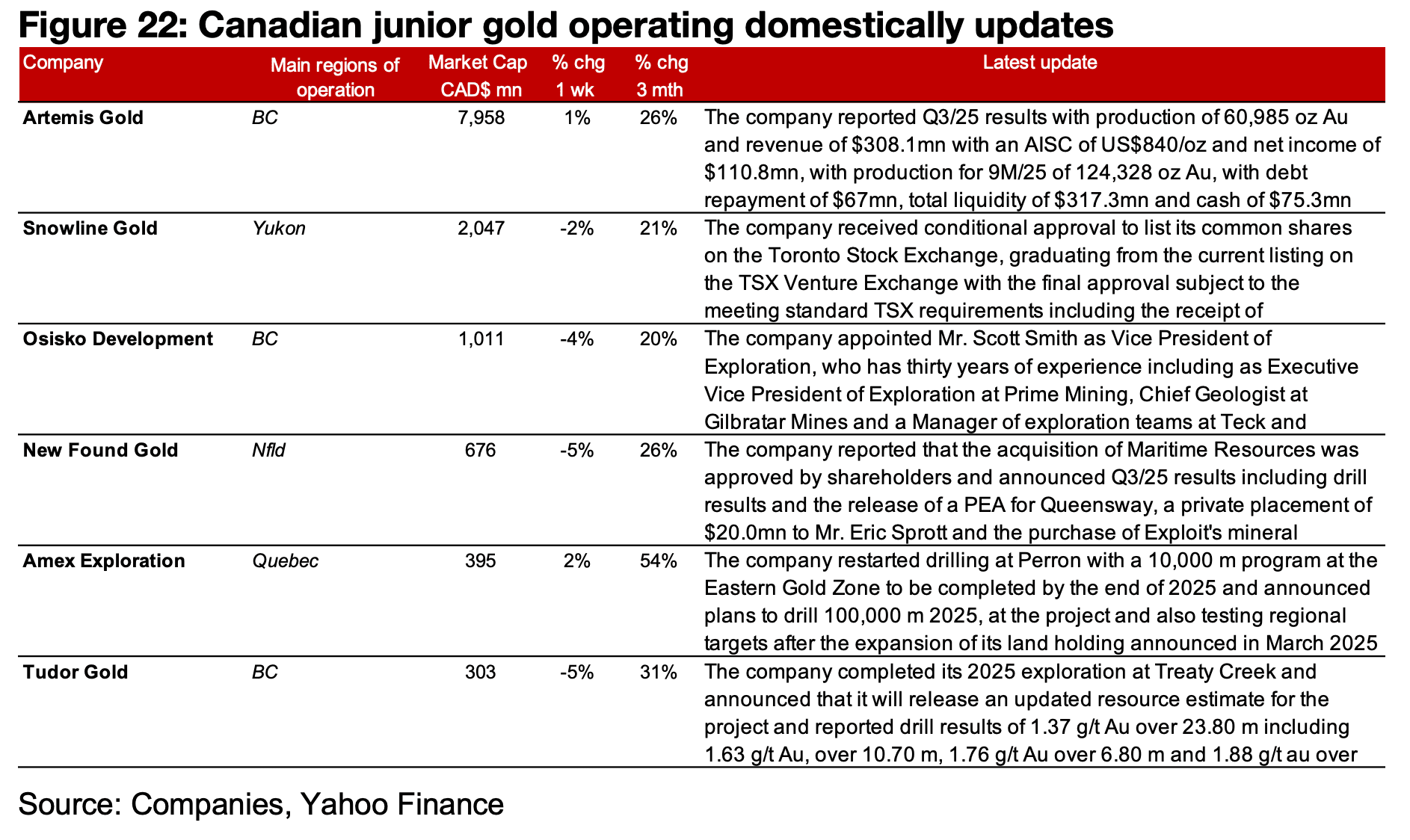

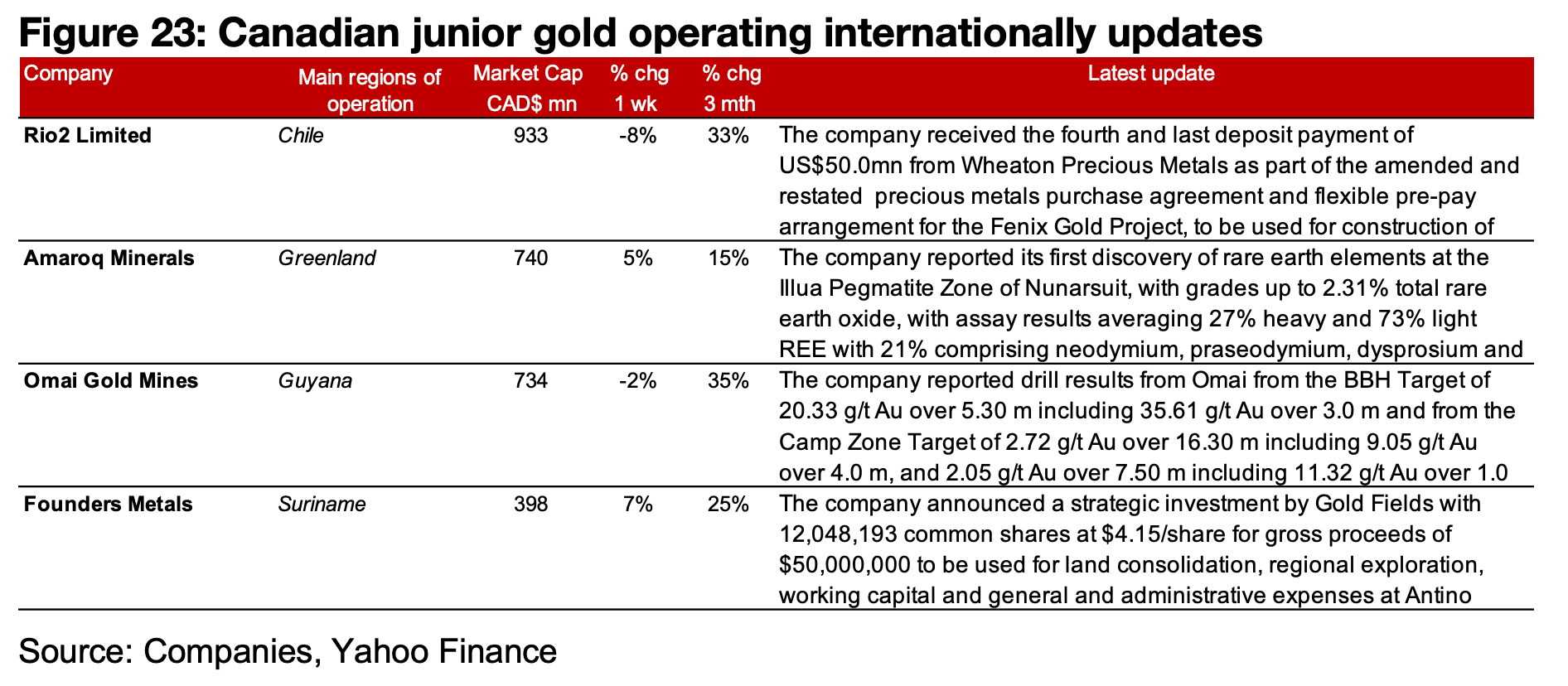

Major gold producers mixed, TSXV gold mostly down

The major gold producers were mixed, with large caps up but some mid-cap stocks down, and TSXV gold mostly dropped (Figures 20, 21) For the TSXV gold companies operating mainly domestically, Artemis Gold reported Q3/25 results, Snowline Gold received conditional approval for a TSX listing, Osisko Development appointed Mr. Scott Smith as Vice President of Exploration and New Found Gold’s acquisition of Maritime was approved and it reported Q3/25 results. Amex announced its drill program from the remainder of 2025 and 2026 and Tudor Gold completed its 2025 exploration program at Treaty Creek (Figure 22). For the TSXV gold companies operating mainly internationally, Rio2 Limited received the fourth and last US$50.0mn payment from Wheaton for Fenix, Amaroq reported its first REE discovery at the Ilua Pegmatite Zone of Nunasarit, Omai reported drill results and Founders Metals announced a $50.0mn strategic investment by Gold Fields (Figure 23).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.