November 24, 2025

Gold Near Flat As Drivers Mixed

Author - Ben McGregor

Gold edges down on stronger US$, geopolitical risk easing

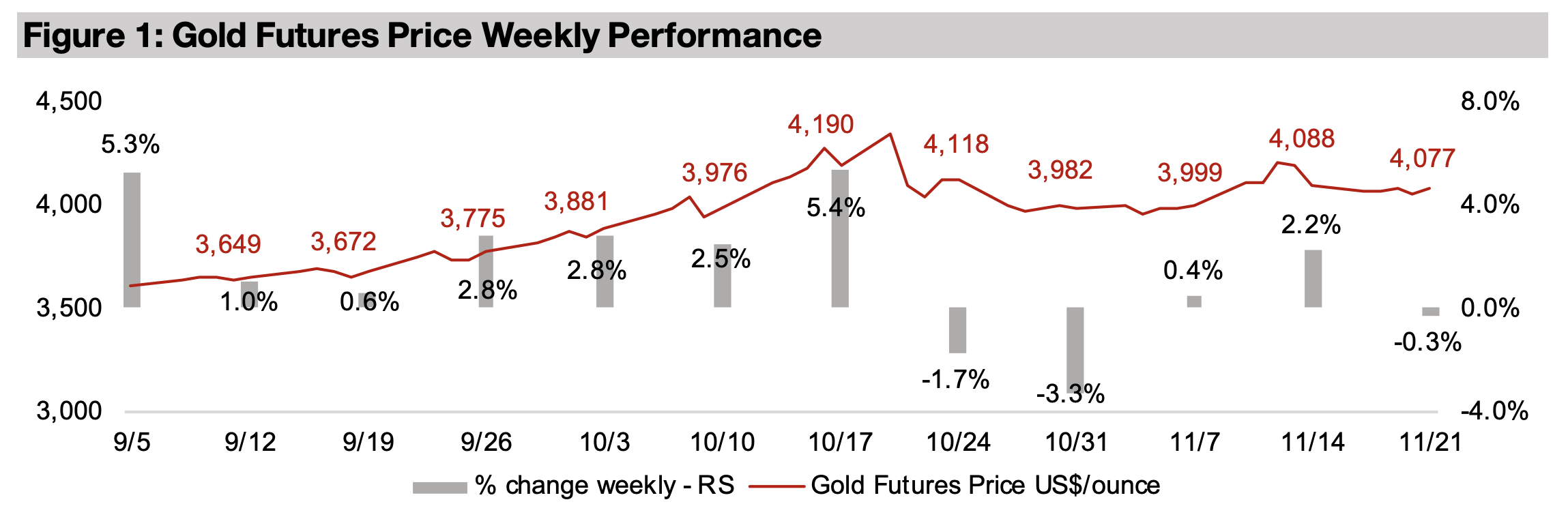

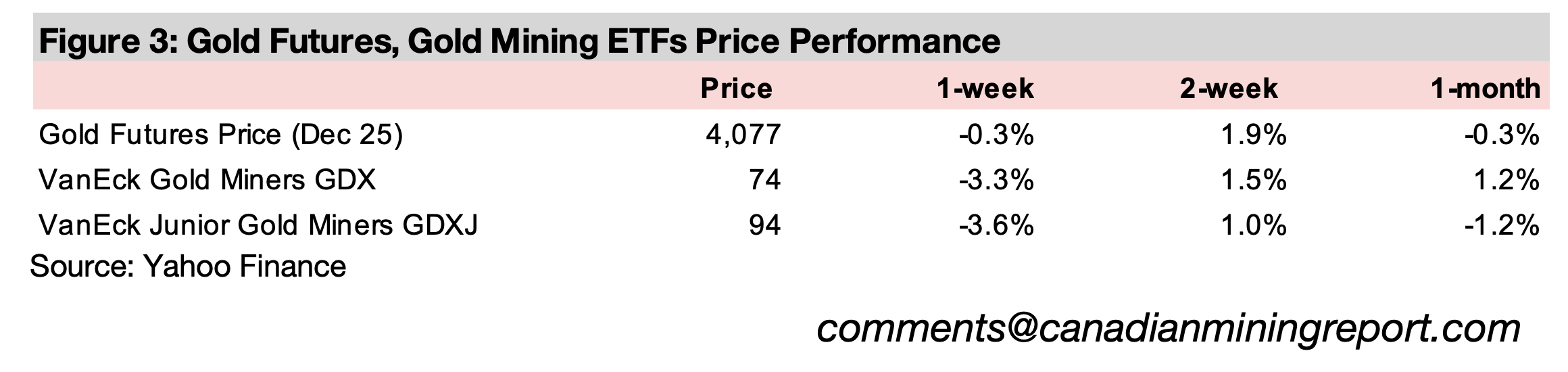

Gold had a muted decline of -0.3% to US$4,077/oz as drivers were mixed with downward pressure from a stronger US$ and declining geopolitical risk on Russia- Ukraine peace talks but upside from a flight to safety on a slump in equity markets.

Gold Near Flat As Drivers Mixed

The gold price saw a muted declined -0.3% to US$4,077/oz as the drivers of the

metal were mixed. There was some downward pressure from a decline in geopolitical

risk after Russia-Ukraine peace talks and a strengthening of the US$, given that it

tends to move inversely to the currency. However, there was likely some support from

a flight to safety on the slump in equities markets, with the S&P 500 down -1.7% and

the Nasdaq losing -2.3%, although the Russell 2000 small index declined only -0.5%,

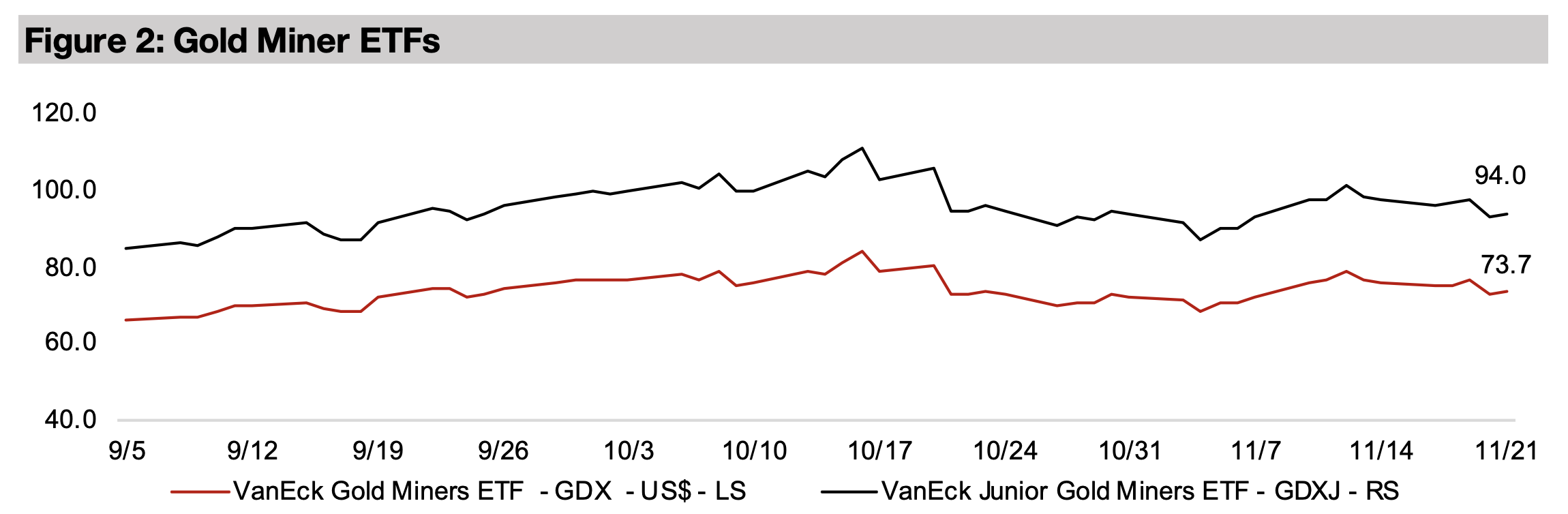

indicating that the decline was mainly driven by big tech. The gold stocks declined

on the combination of a decline in the metal and equities, with the GDX down -3.3%

and GDXJ losing -3.6%.

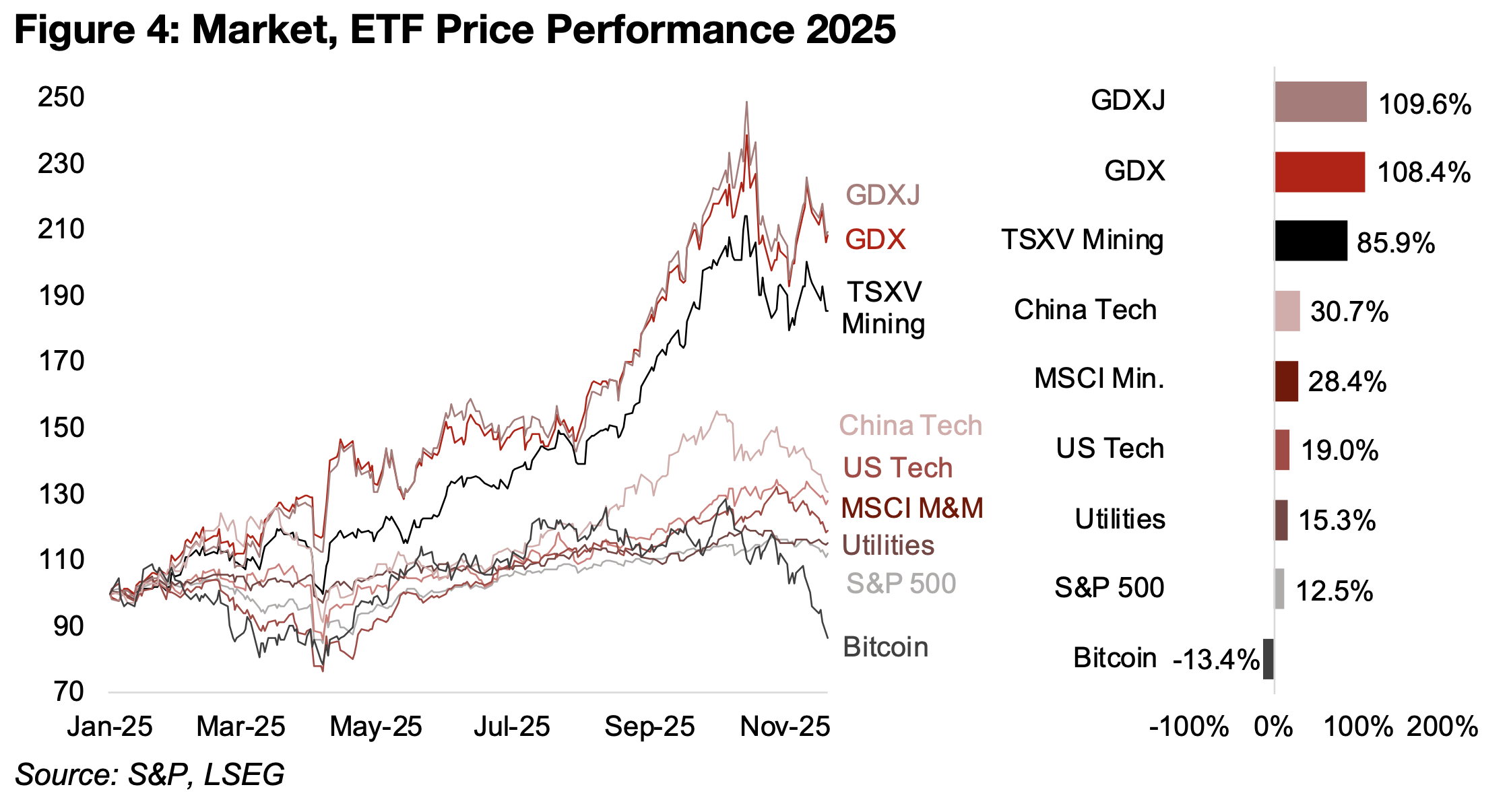

The volatility of gold stocks has increased substantially since the peak in mid-October

2025, with a major slump, a recovery and another drop this week, leaving the sector

at similar levels to about two months ago. The TSXV Mining index has followed a

similar pattern as it has a high exposure to the gold sector. The MSCI Metals and

Mining Index has dropped given a large proportion of the index in iron ore and copper

stocks, with the prices of these metals flattening over the past two months.

The gold stocks and TSXV Mining continue to far outpace the major markets and

other sectors this year, including tech in the US and China, which both declined over

the past week. While the defensive utilities sector is being outpaced by tech, it is still

ahead of the S&P 500, which along gold sector strength, suggests the market may

be hedging risk more than in recent years. Another sign of a broader risk-off stance

in markets has been the major slump in Bitcoin over the past month.

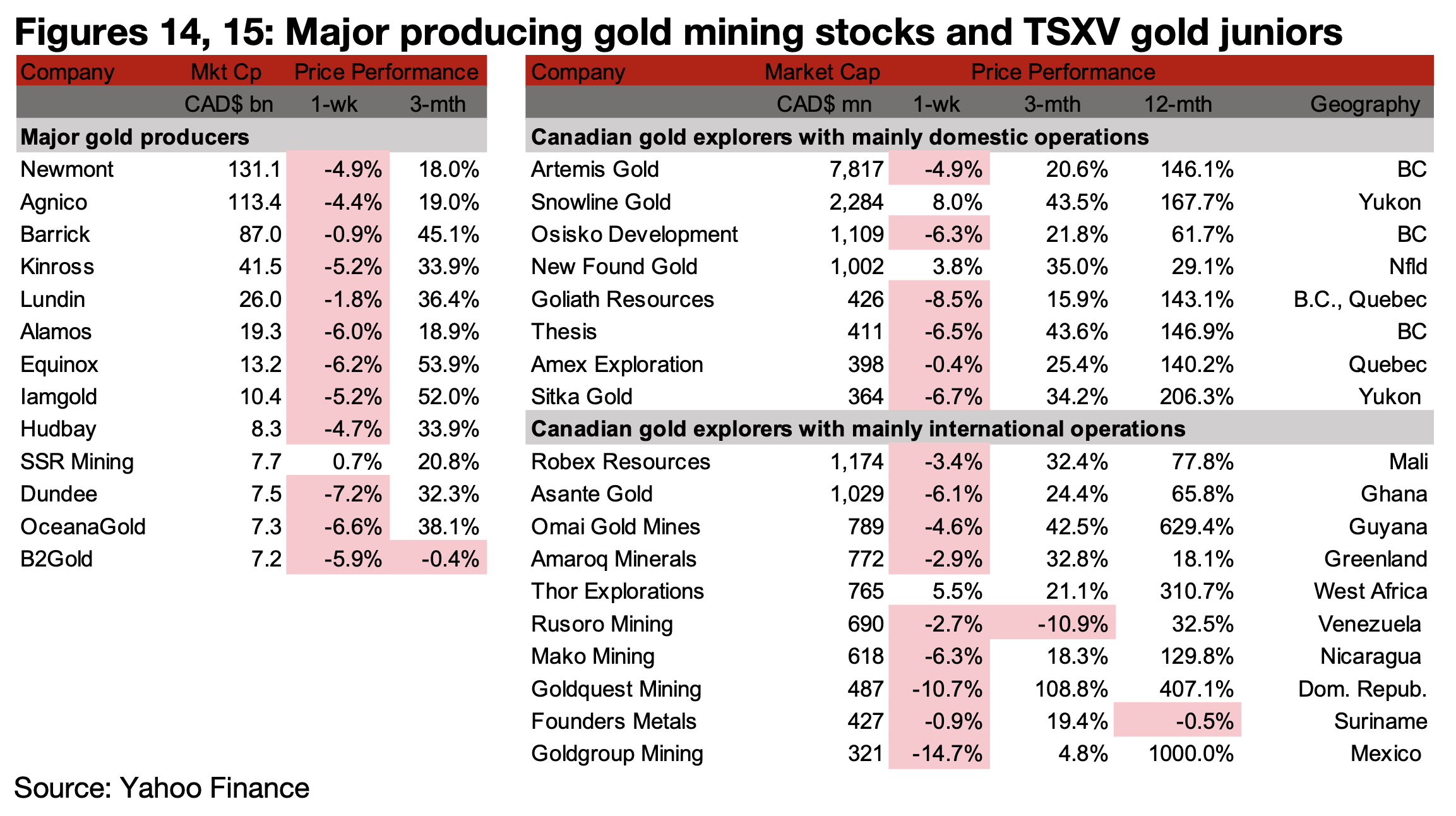

Several new entrants to TSXV large gold, including producer Asante

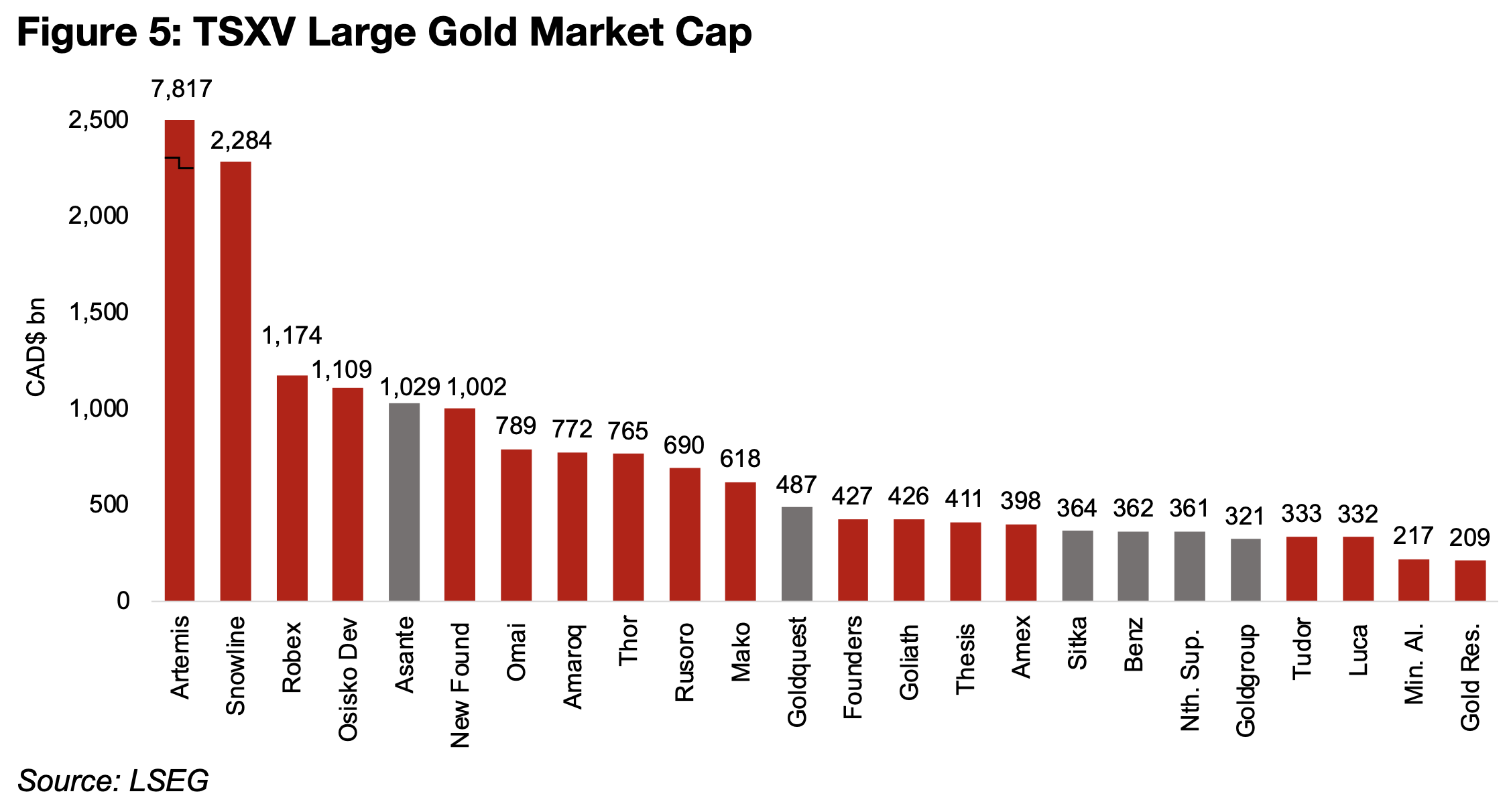

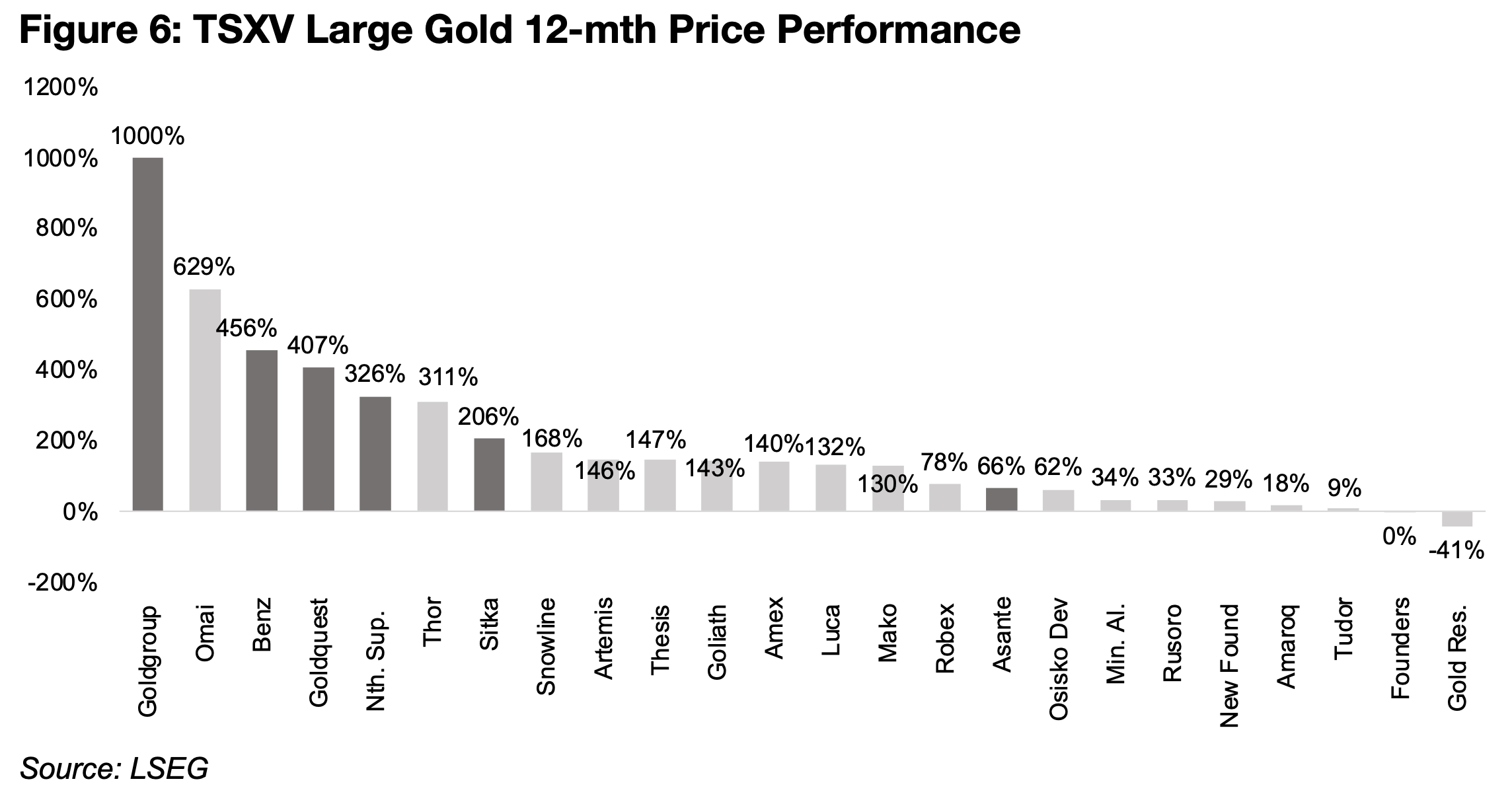

There have been several new entrants into TSXV large gold by market cap over the past year. The largest is Asante Gold, which has the fifth highest market cap of the group at CAD$1.03bn, up 66% over the past year, and moving to the TSXV from the CSE in September 2025 (Figures 4, 5). Goldquest’s 407% gain has increased its market cap to CAD$487mn, with the next three new entrants having nearly the same market cap, Sitka Gold, Benz Mining and Northern Superior Resources, just above a CAD$360mn, after gains of 206%, 456% and 326%. Goldgroup is just below this at CAD$321, after by far the largest gain over the past year, up 1000%.

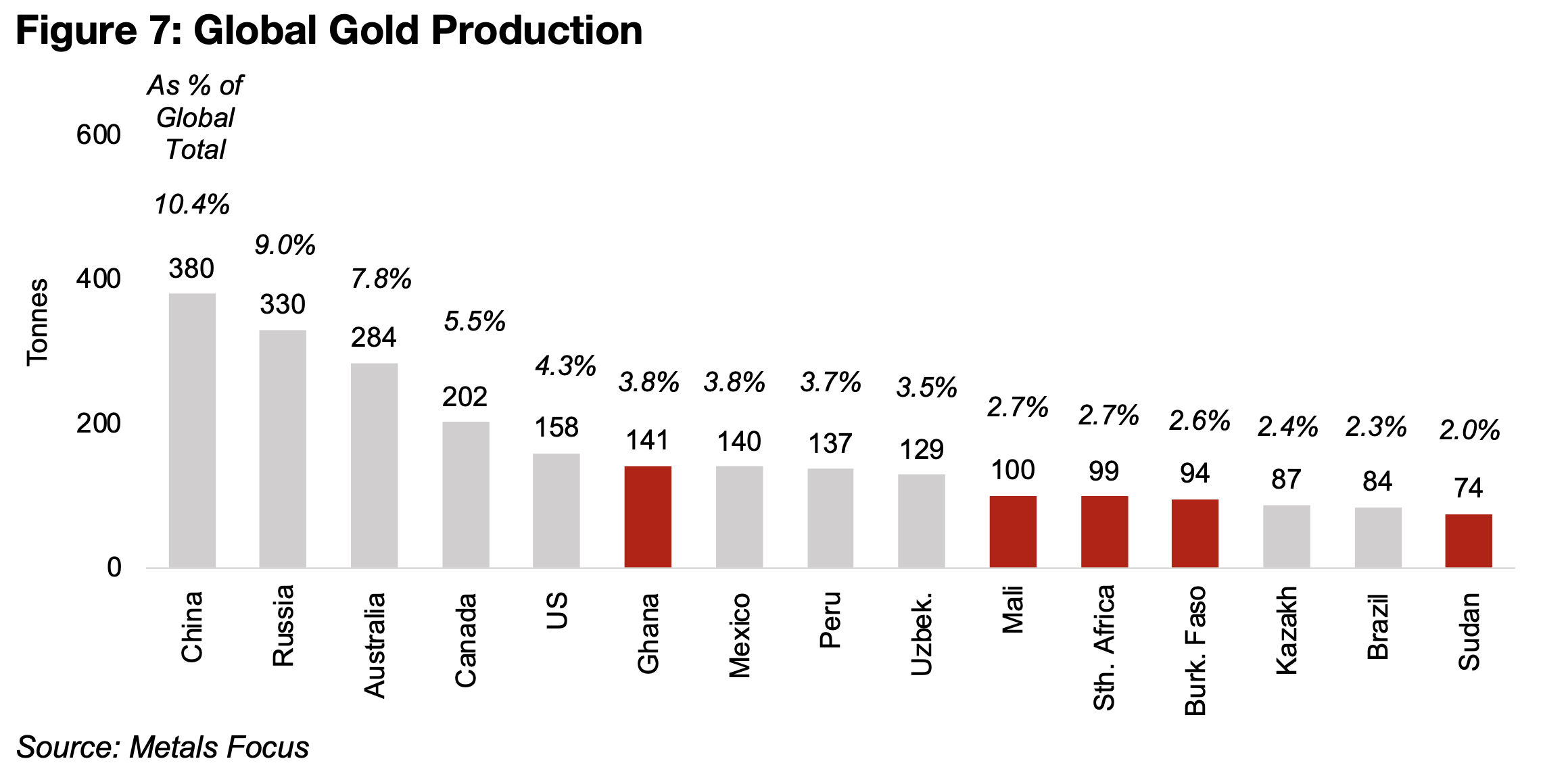

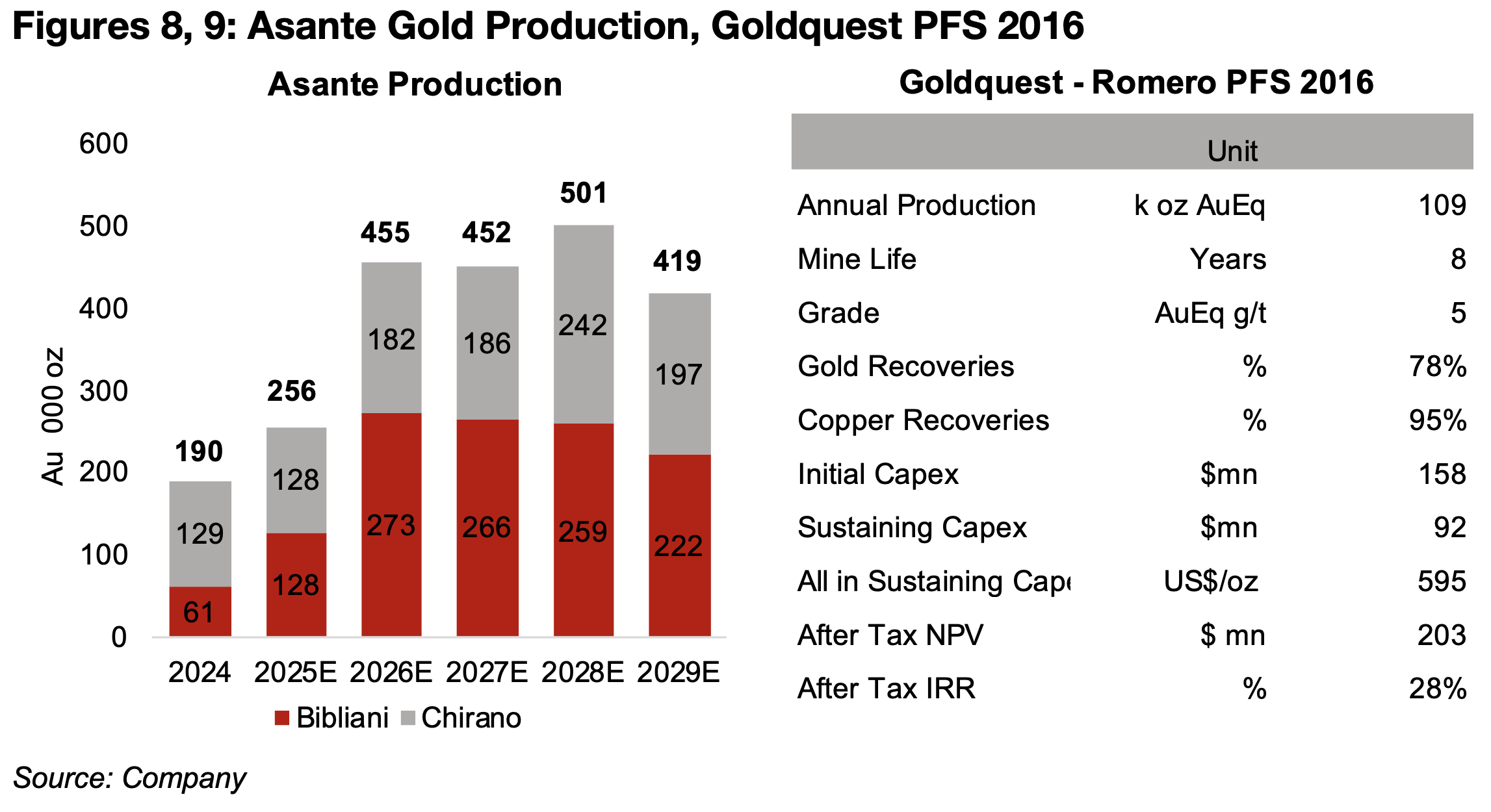

Asante Gold is already producing at two projects in Ghana, Bibliani and Chirano, which was the leader for African gold and had the sixth highest output globally in 2024, at 141 tonnes, or 3.8% of the world total (Figure 7). Combined production is expected at 256k oz Au in 2025E, up 35% from 190k oz Au in 2024, split evenly between the two projects (Figure 8). Production is expected to jump further in 2026E, up 78% to 455k oz, with Bibliani output forecast to increase 113% to 273k oz Au and Chirano to increase to 182k oz Au, up 42%. Output is expected to be roughly flat in 2027E and then peak in 2028E based on the current mineral reserves.

Goldquest updating FS, Sitka and Benz at resource estimate stage

Goldquest operates the gold-copper project Romero in Dominican Republic, and

while it has a Pre-Feasibility Study, it was issued in 2016 leaving most of the

assumptions very dated and subject to significant revision (Figure 9). The main

catalyst for the share price over the past year appears to have been the

announcement that the company had started to prepare a Bankable Feasibility Study

for Romero. From this announcement on August 26, 2025, the share price nearly

tripled to its peak at the end of October 2025, and has still more than doubled since,

even after the share price pulled back considerably in November 2025.

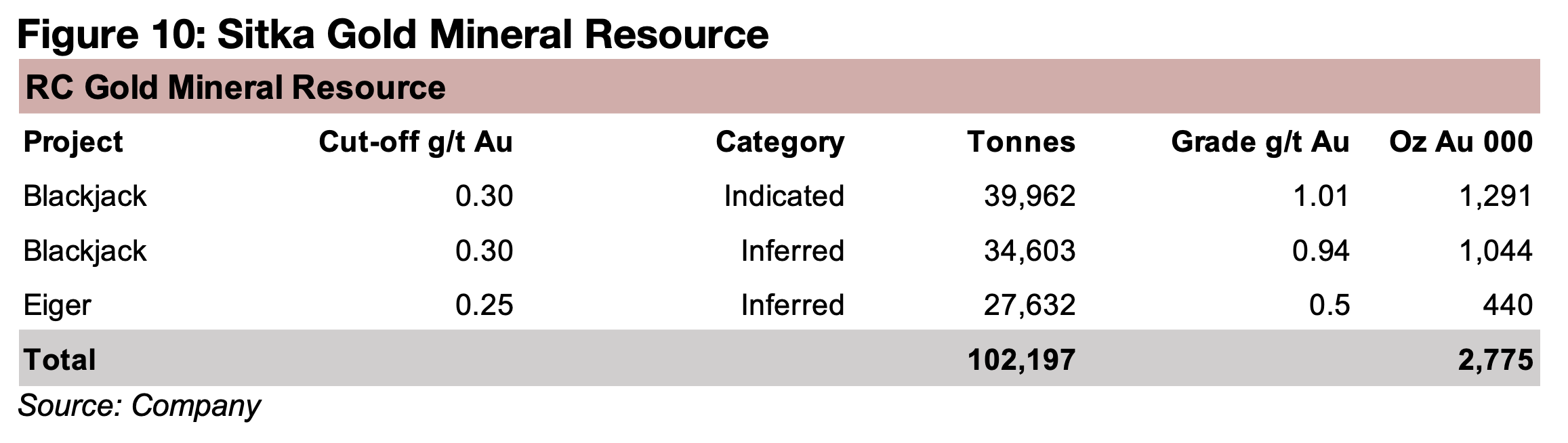

Sitka operates the RC Gold project in the Yukon, which has a Mineral Resource

Estimate of a total 2.77 mn oz Au (Figure 10). The main news flow driving the share

price appears to have been several sets of drill results from RC announced this year,

and a 50,000-60,000 m drill program is planned to start in early 2026. The share price

also seems to have been supported by the overall rise in gold stocks from July 2025

through to mid-October 2025, and has pulled back from a peak over the past month,

inline with the sector. The company also operates the Copper River copper project in

Nunavut, which was at the sampling stage before the first drill program was started

in July 2025. The company also has two projects permitted for drilling, Alpha Gold in

Nevada, at the early drilling stage, and Burro Creek gold project in Arizona, with a

historical resource of 5 mn oz Au.

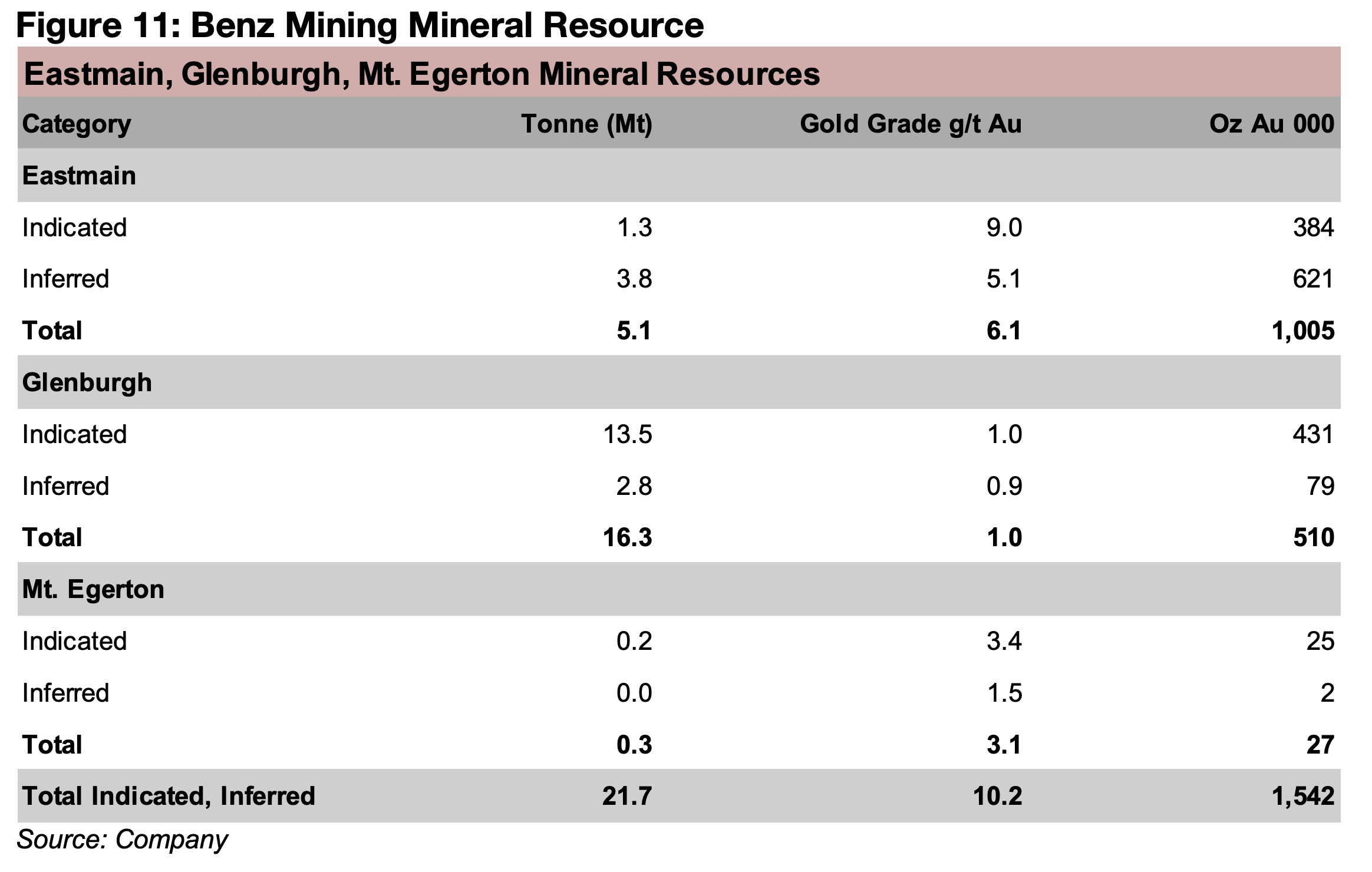

Benz Mining operates three projects, which all have resource estimates, Eastmain in Quebec Canada, with 1.0mn oz Au, and two projects that are geographically close in Western Australia, Glenburgh, with 0.5mn oz Au and Mt Egerton, with 0.03mn oz Au (Figure 11). The main driver of the share price gains from Benz over the past year appears to have been strong drilling results from Glenburgh, with it also boosted by the gains in the sector overall from July 2025 to mid-October 2025. A 30,000 metre drill program was started in May 2025 and strong assays started to be released from the end of June 2025, followed by continued outstanding results in each of the next fourth months. The company acquired the remaining 25% of both the Eastmain project and Ruby Hill project in Quebec that was held by Fury Gold in October 2025, giving it whole ownership of the projects.

Northern Superior acquired, Goldgroup targeting major expansion

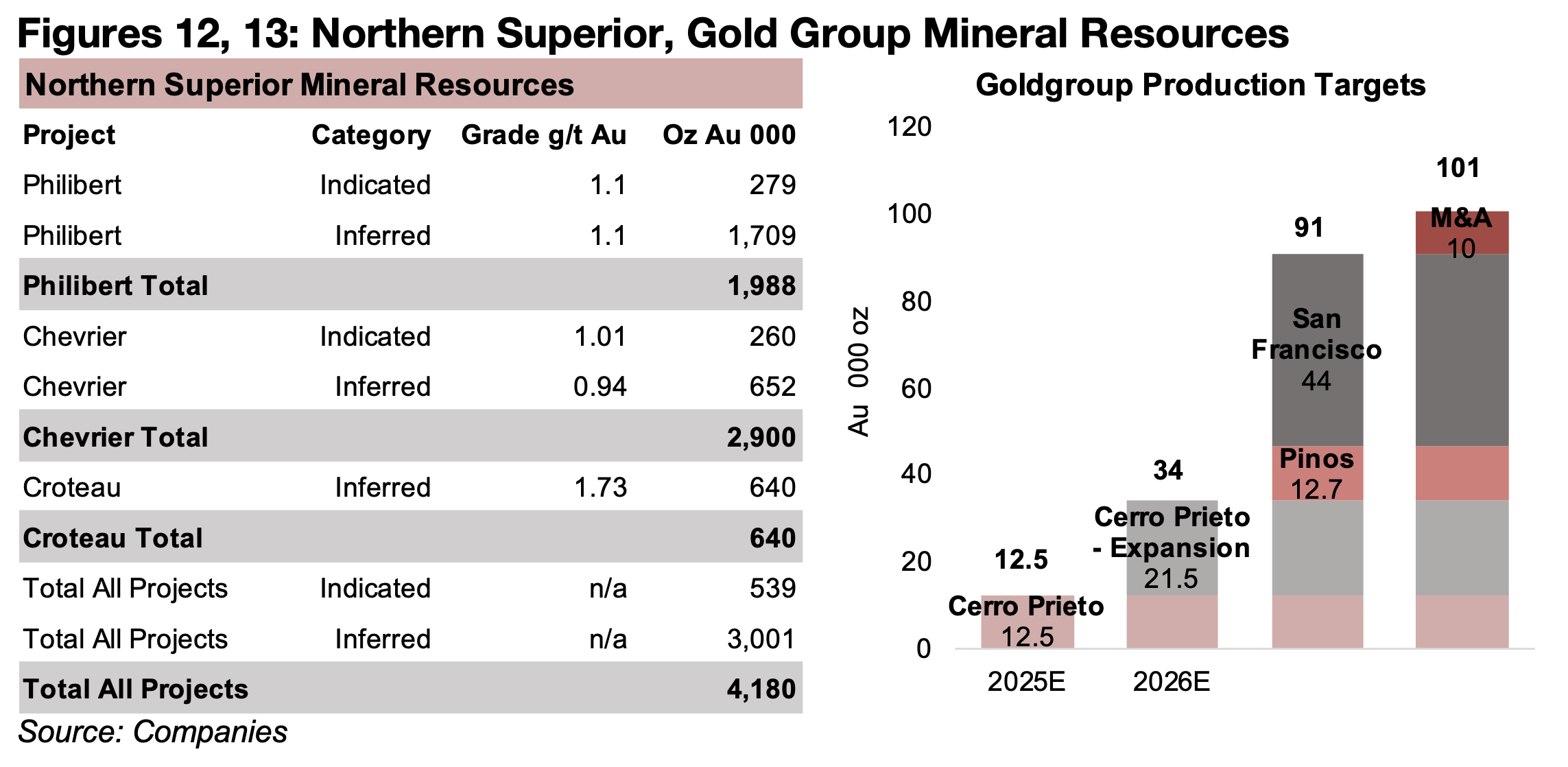

Northern Superior’s share price rose along with the sector from July 2025, but saw a significant boost from the announcement in October 2025 that it would be acquired by Iamgold. The company operates three projects, Philibert, Chevrier and Croteau, with resources of 1.99 mn oz Au, 2.90 mn oz Au and 0.64mn oz Au, respectively, all in the region of Quebec that Iamgold also has major projects (Figure 12).

Goldgroup operates two projects, Cerro Prieto, Pinos, and is the process of acquiring a third, San Francisco, all in Mexico. Cerro Prieto is already in production, with the company targeting as high as 12.5 k oz Au in output in 2025 and an expansion to 34.0k oz by 2026 (Figure 13). The company acquired historical producer Pinos March 2025, which is expected to eventually add 12.7 k oz of production, and this appears to have been a major driver for the share price. In September 2025 the company acquired over 50% of the creditors rights for the company holding the San Franciso project, which is also a historical producer, with a plan to become full owner, which could increase production by 44k oz Au. The company also expects a further 10k oz from M&A, increasing production to over 100k oz Au.

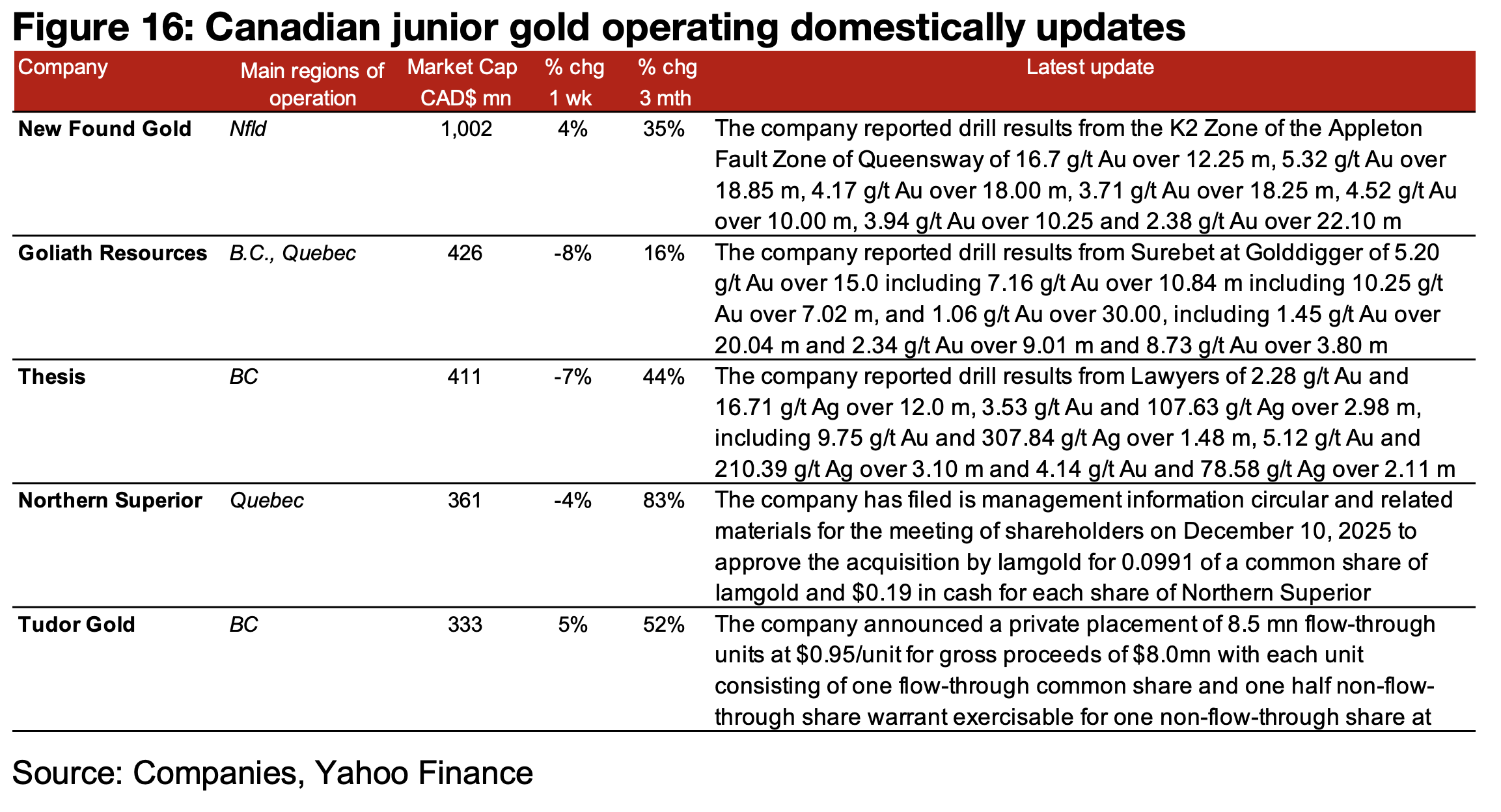

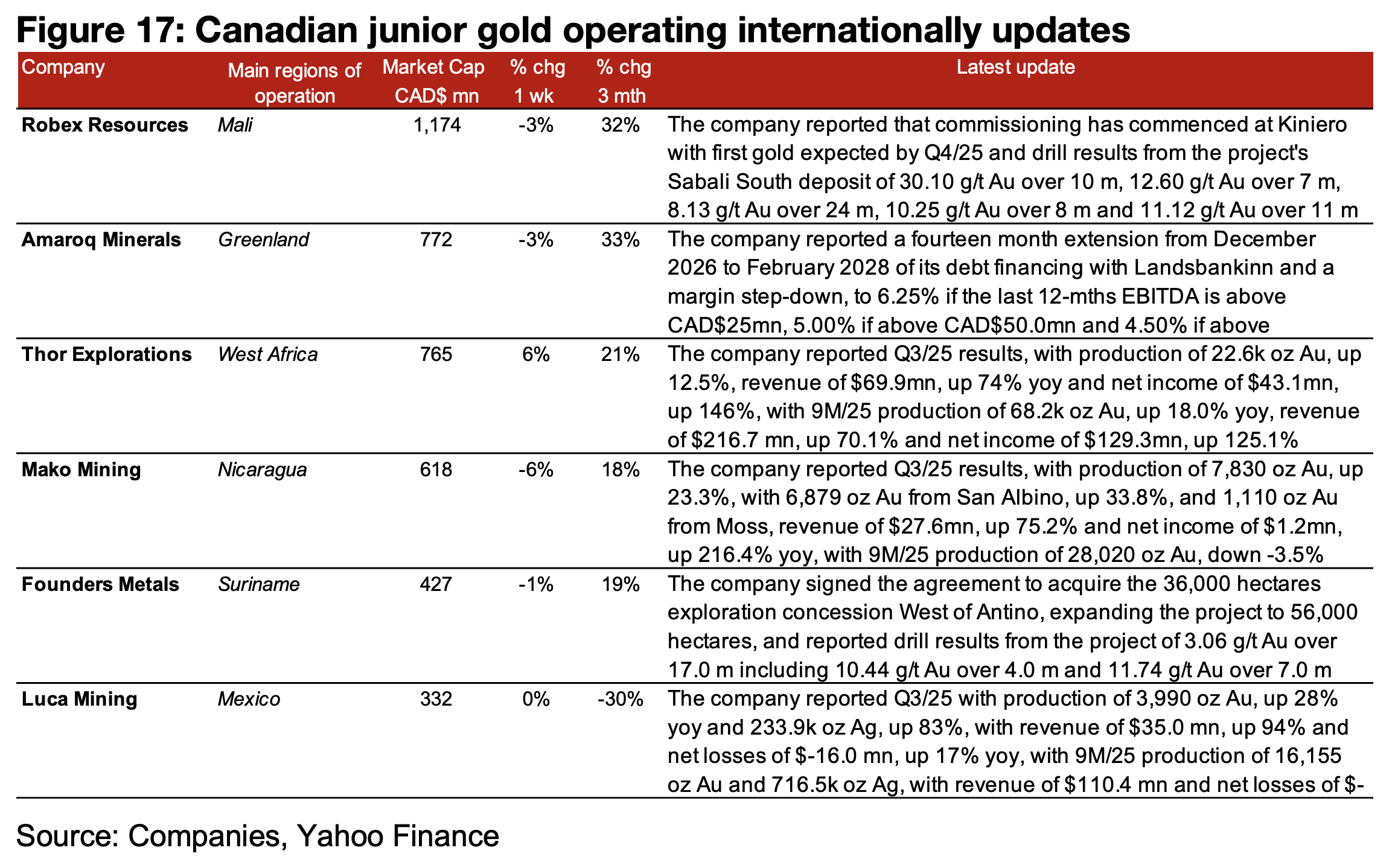

Most of major gold producers and TSXV gold slide

All but one of the major gold producers and most of TSXV gold declined on the drop in gold price and weakening equity markets (Figures 14, 15) For the TSXV gold companies operating mainly domestically, New Found Gold, Goliath and Thesis reported drill results, Northern Superior filed the management information circular for the special shareholders meeting on December 10, 2025, to approve the acquisition by Iamgold and Tudor Gold announced a private placement (Figure 16). For the TSXV gold companies operating mainly internationally, Robex started commissioning at Kiniero with first gold expected by Q4/25 and reported drill results and Amaroq announced an extension and margin step down of its debt financing with Landsbankin. Thor, Mako and Luca reported Q3/25 results and Founders signed the agreement to acquire 36,000 hectares next to Antino, expanding the project to 56,000 hectares, and reported drill results from the project (Figure 17).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.