February 09, 2026

Gold Rebounds, Tech Slides

Author - Ben McGregor

Gold rebounds from brief slump

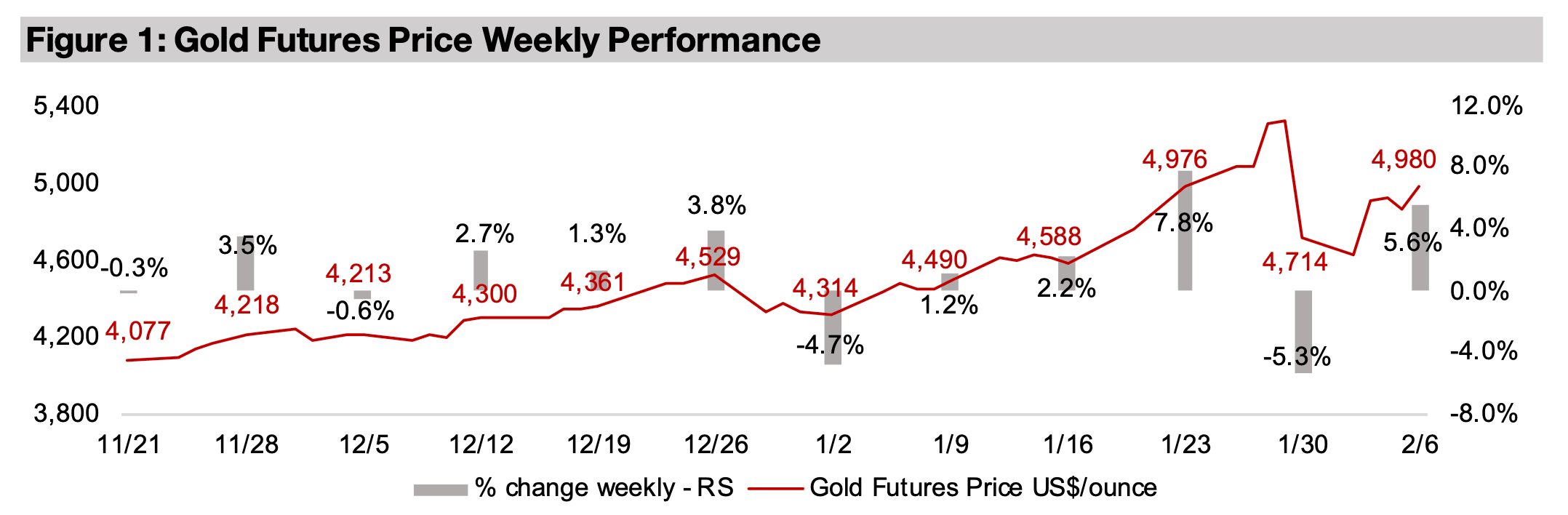

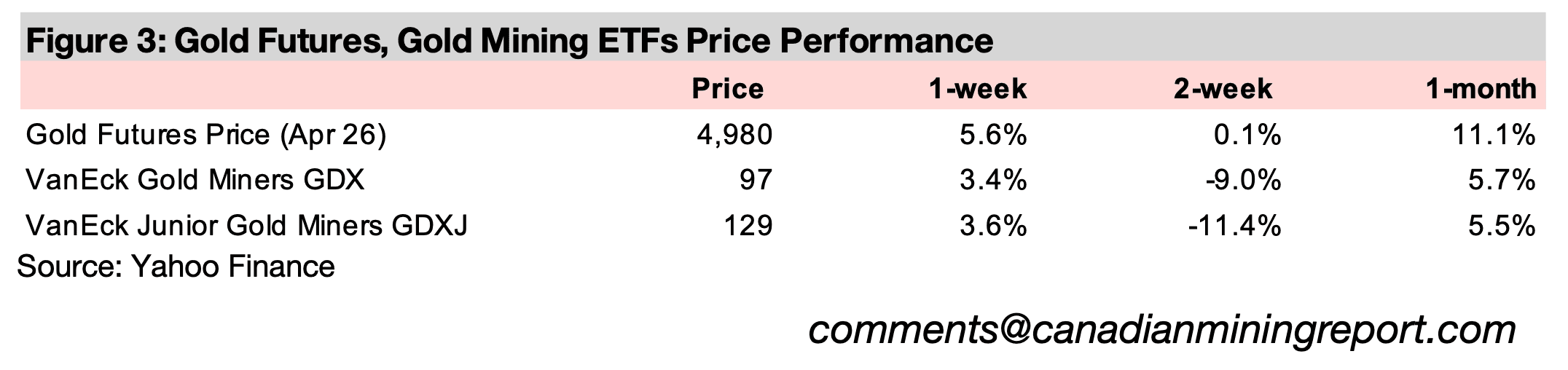

Gold rose 5.6% to US$4,980/oz, heading back up towards US$5,000/oz after plunging over -5.0% last week following a brief rise above U$5,300/oz, and while silver declined, the gold to silver ratio was still well below the medium-term average.

Gold Rebounds, Tech Slides

The gold price rebounded 5.6% to US$4,980/oz, after an over -5.0% slump last week,

but was not able to breach US$5,000/oz, after a brief run above this key level in the

previous week, surpassing US$5,300/oz, ended with a severe pullback. The other

precious metals had also plunged last week, but did not have a significant rebound,

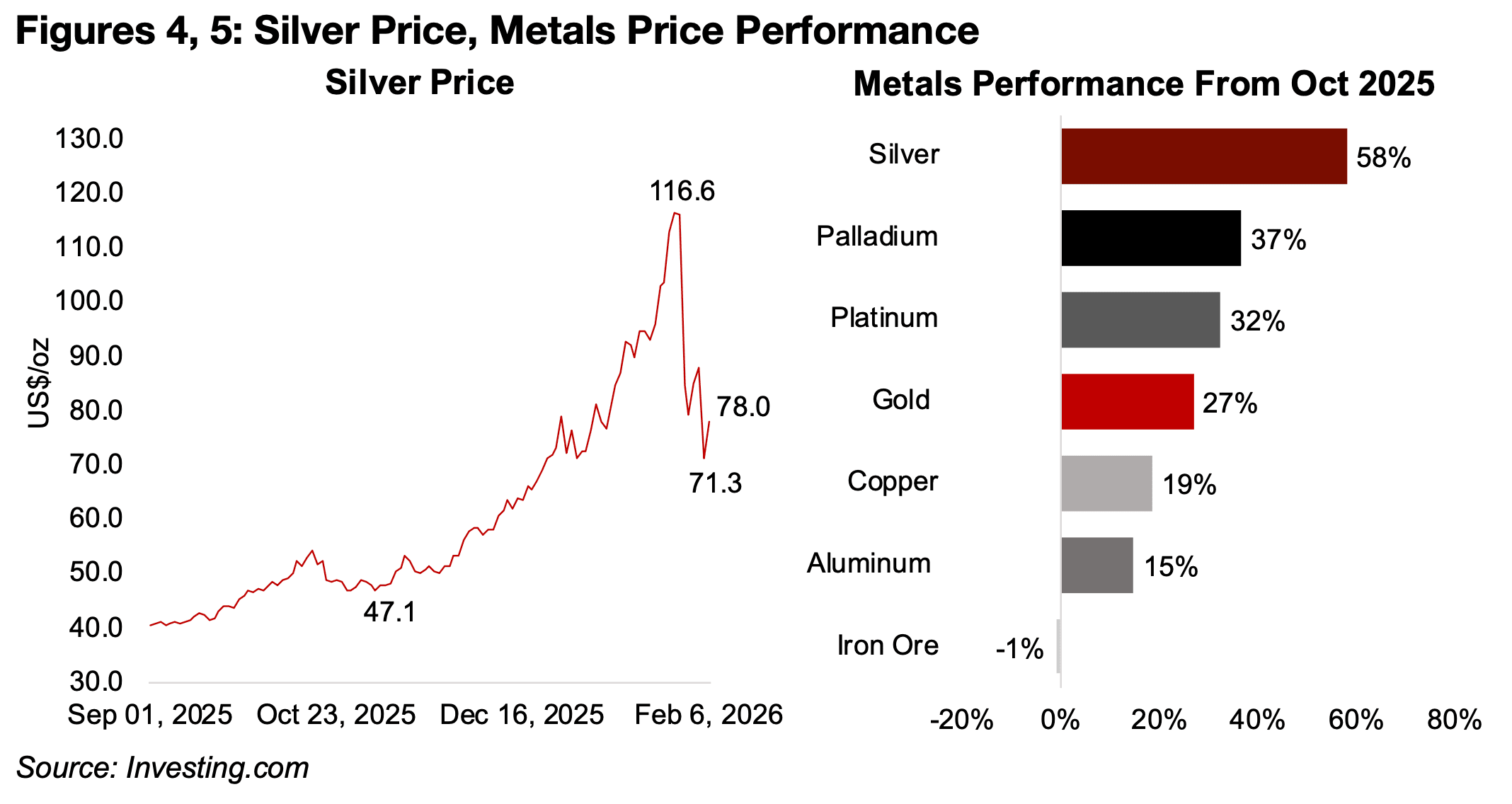

with especially silver continuing a major slide (Figure 4). While silver’s rise has been

partly driven by strong fundamentals, with major supply constraints in the market, the

gains in December 2025 and January 2026 had looked increasingly speculative. The

gold to silver ratio had plunged to just 48x at silver’s recent highs, which was the

bottom of a forty-year range. This implied that silver had become far overvalued

relative to gold, with the medium-term average of the ratio from 2021-2025 at 82.0x,

and the ratio even after the recent decline still relatively low at 64.0x.

The platinum and palladium prices also continued to decline, after they both had

increases, along with silver, that far outpaced gold over the past year. Even after the

plunge, silver, palladium and platinum are still up 58%, 37% and 32%, respectively,

ahead of the 27% rise in the gold price (Figure 5). While both copper and aluminum

have had reasonably strong gains of 19% and 15%, they still have lagged the gains in

precious metals. There may also be a similarly speculative component to the precious

metals in their more recent increases, with prices even in many of the smaller metals

markets also spiking over the past two months. This suggests that the markets turned

much more bullish over on metals in the past month, but as the slump last week shows,

the upswing had become too strong to be sustainable. Only iron ore has remained flat,

down just -1.0% since October 2025, as growth in global steel production, which

accounts for nearly all of the metal’s demand, has continued to weaken.

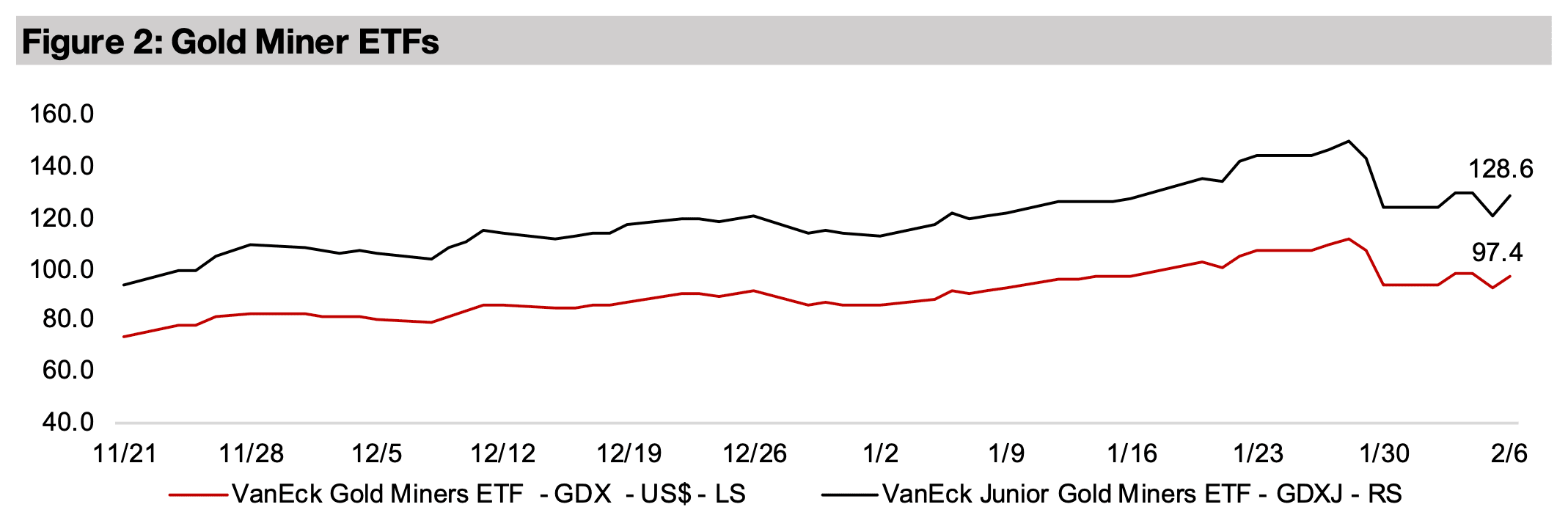

The macroeconomic data this week included ADP payrolls for January 2025, which came in below expectations, while the BLS non-farm payrolls released was delayed by the short government shutdown. The S&P 500 was near flat, up 0.2%, the Nasdaq dropped -1.5%, indicating the neutral stance of markets on broader large caps and bearishness on tech. However, the Russell 2000 small cap index gained 2.5%, showing that the market is still taking on risk, but that it is no longer as heavily concentrated in tech as it was in 2024 and 2025. The gold stocks outperformed the main indices, with the GDX and GDXJ up 3.4% and 3.6%, respectively.

Metals far outpacing tech over past year

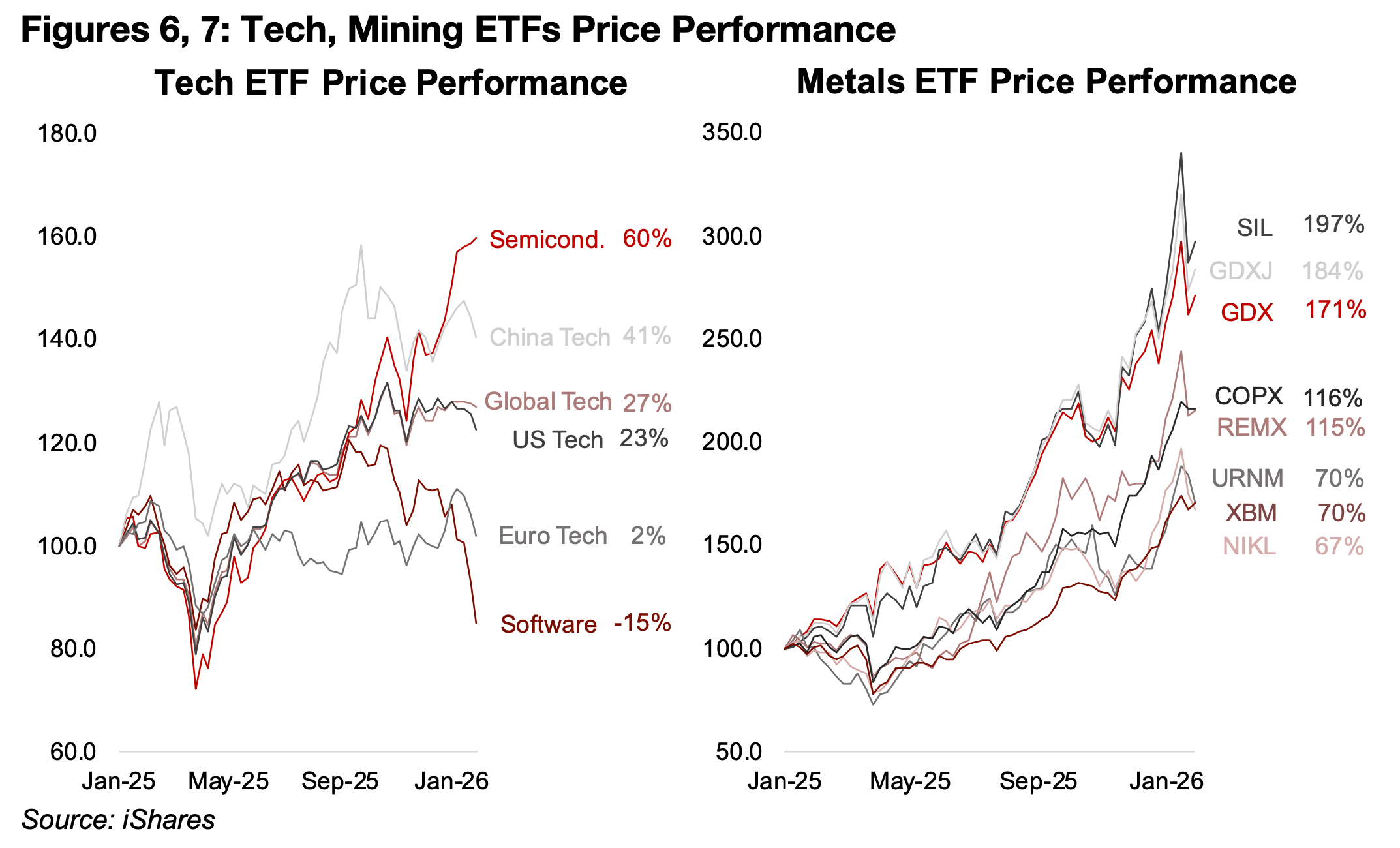

The rotation out of the tech sector that had started gradually last year, after it seemed

to completely dominate the focus of the market in 2023 and 2024, has become more

extreme in recent months. This week a slowdown in the software segment of tech that

had already been ongoing since H2/25 became a collapse, with the sector now down

-15% over the past year, by far the weakest segment (Figure 6). While global tech has

still gained 27% since the start of 2025, this has been driven especially by

semiconductors and China, up 60% and 41%, respectively.

While US tech has seen reasonable gains, up 23%, it was no longer the juggernaut

like 2023 or 2024 when it rose 64% and 32%, respectively. The European tech sector,

which is heavily weighted to software, with a low weighting to semiconductors, has

been weak, up just 2.0%. The semiconductor sector is also heavily weighted to Nvidia,

leaving much of the gain in the sector over the past year heavily exposed to just one

company, which has had the sustainability of its earnings growth under scrutiny.

The mining sector has clearly benefited from this rotation out of tech, with a surge in

all of the major stock ETFs since 2025, even accounting for the recent slump in many

metals. The silver stock ETF SIL and gold and gold junior stock ETFs GDX and GDXJ

are still up 197%, 184% and 171% over the past year (Figure 7). These gains are so

extreme that they make even the huge absolute rise of the copper stock ETF COPX,

up 116%, and the rare earth metals ETF REMX, up 115%, seem relatively low. Even

the laggards in the sector, the uranium stock ETF URNM and base metals stock ETF

XBM are up 70%, with the weakest performer, the nickel stock ETF NIKL, still up 67%.

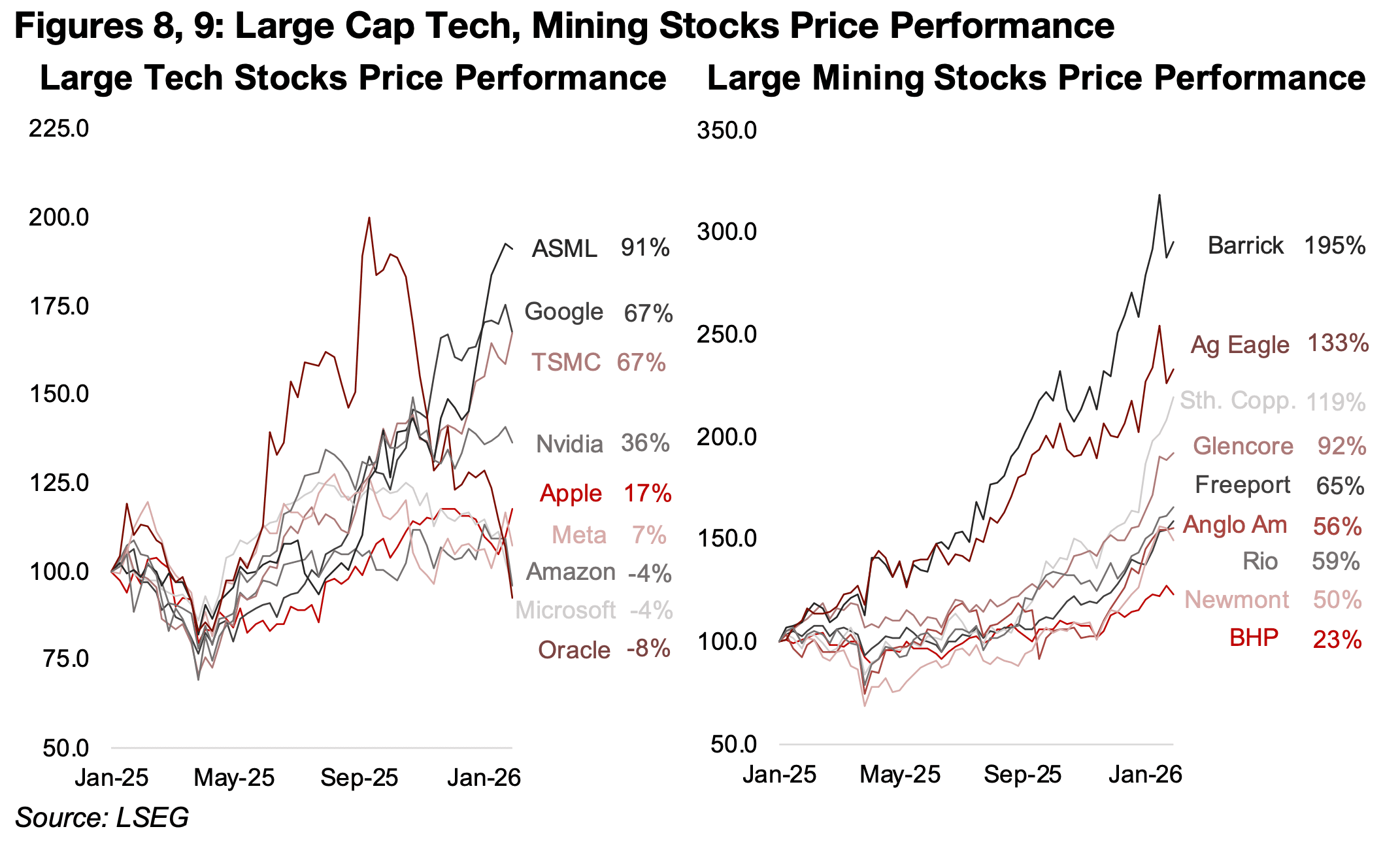

Of the largest cap tech stocks, three out of the four top gainers have been

semiconductor producers, ASML, TSMC and Nvidia, up 91%, 67% and 36%, further

highlighting the reliance tech gains have overall on this segment (Figure 8). The largest

software company of large cap tech, Oracle, has slumped since Q4/25 after surging

for the first nine months of the year, and is now down -8% since the start of 2025.

While Apple has seen reasonable gains of 17%, the other large cap tech stocks have

struggled, with Meta up 7%, and Amazon and Microsoft both down -4.0%

In contrast, none of the largest mining stocks have declined, and the largest gainer, Barrick, up 195%, more than twice the level of the strongest tech stock (Figure 9). Both Agnico Eagle and Southern Copper are also up well over 100%, with 133% and 119% increases, respectively, with Glencore just below this, up 92%, with much of the gain after it was announced the company could merge with Rio Tinto. Several of the other major miners are up by 50% or more, including Freeport McMoran, Anglo American, Rio Tinto and Newmont, with even the laggard BHP up 23%.

Tech valuations still excessive, mining multiples gaining

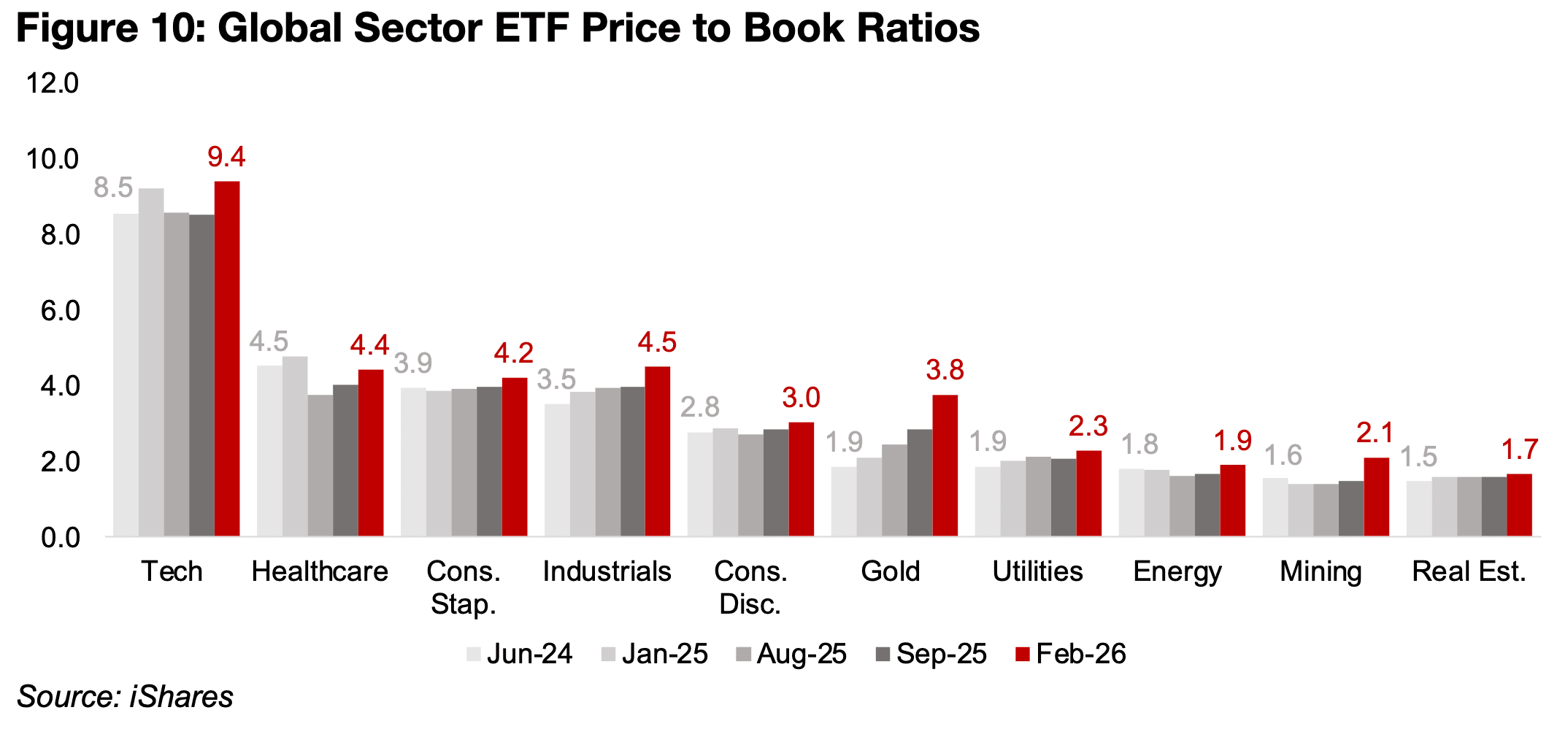

The pullback in the tech sector has still not seen valuations decline, with the price to

book (P/B) actually rising from late 2025 to 9.4x currently. This implies that earnings

estimates have been reduced somewhat, even as share prices of the sector have

continued to rise overall. This is still twice the level of the sectors with the next three

highest P/Bs, healthcare, consumer staples and industrials, at 4.4x, 4.2x and 4.5x,

respectively, with only the former declining since June 2024, and the other two both

increasing (Figure 10). One of the most significant increases in multiples has come

from the gold stocks, doubling to 3.8x from just 1.9x in June 2024, while the mining

sector, which is heavily weighted to iron ore and copper stocks, has risen to 2.1x from

1.6x. However, this still leaves the multiples of the miners far below tech, with the

convergence so far from a gain for the former, not a decline for the latter.

The P/B for the utilities sector has also increased, to 2.3x from 1.9x, while partly from

a greater shift into defensives, is also related to rising demand for electricity from tech.

The energy and real estate sectors have seen relatively low and flat valuations, with a

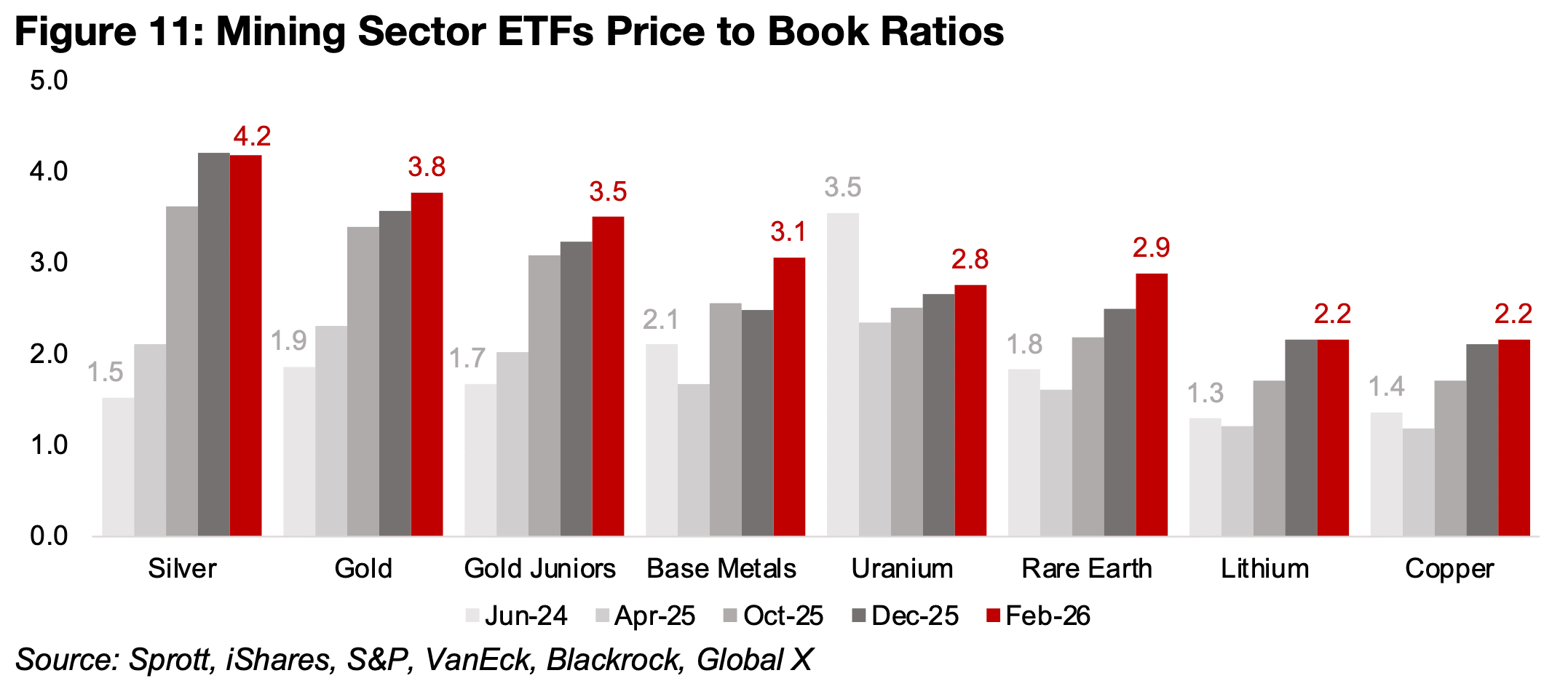

rise in P/B from 1.8x to 1.9x and from 1.5x to 1.7x, respectively. The P/B of the SIL

ETF of silver stocks has held steady at around 4.2x since December 2025, with this

chart not showing January 2026, when it briefly jumped far above this level (Figure

11). The GDXJ ETF of junior gold miners has also jumped, from 1.7x to 3.5x, with it

slightly lower than the GDX of gold producers given the higher risk of these smaller

stocks. The valuation of the rare earth stocks has risen to 2.9x from just 1.8x, with

lithium and copper have both risen to 2.2x, from 1.3x and 1.4x respectively. Only the

uranium stocks have seen a decline in the P/B to 2.8x from 3.5x in June 2024, when

the metal price had been extremely high, which had eased significantly by April 2025,

driving a decline in the multiple.

Major risks to mining from a tech crash

A further rotation out of tech could benefit the mining stocks if some of the flows

continue to be directed there. However, a tech crash could also mean significant risks

for the mining sector. The broader equity markets have clearly been supported by high

tech valuations, and if these stocks drop, it could diminish the wealth effect in the

market. This could mean that capital becomes more scarce and that there is an

increase risk aversion, which has already been rising considerably over the past two

years. This could particularly hit junior miners with projects at the earliest stages

projects which are constantly seeking capital to continue exploration activities.

For now metals prices are likely more than high enough to support the capital raising

of juniors with more advanced projects. However, even these miners may face more

caution from investors than they might have just a few months ago, given the sudden

reversal especially in the silver, platinum and palladium prices, but also the significant

volatility in the copper price. The producing miners could fare better in terms of raising

capital, given extremely wide margins, but this also provides them significant operation

cash flows leaving them with less need to raise funding than juniors in perpetual need

of new capital.

However, there are also direct risks to the producing miners’ operations from a tech

crash. The rise in demand for copper, aluminum, silver, platinum and palladium have

all been partly driven by the electrification of the economy, including demand for data

centers for AI. This has likely been a major driver especially of the gains in the copper

price, which could be hit by a slowdown tech, although a significant proportion of its

growth is also expected to come from the energy transition. While platinum and

palladium do have use in tech, the largest component of their demand is for use in

autocatalysts, which is also considered part of the energy transition.

While aluminum does have some use directly in the tech industry, it is lower than for

copper, although its demand in the energy transition may actually be higher than for

copper, given its extensive use in power infrastructure. Silver has broad use across

the industrial sector, including tech and the energy transition, but it is a much smaller

market than copper or aluminum. Of the major metals, only iron ore has low direct use

in the tech sector, although it could be considered to have indirect exposure as it is

used in the construction of data centers and other infrastructure used by the tech

sector.

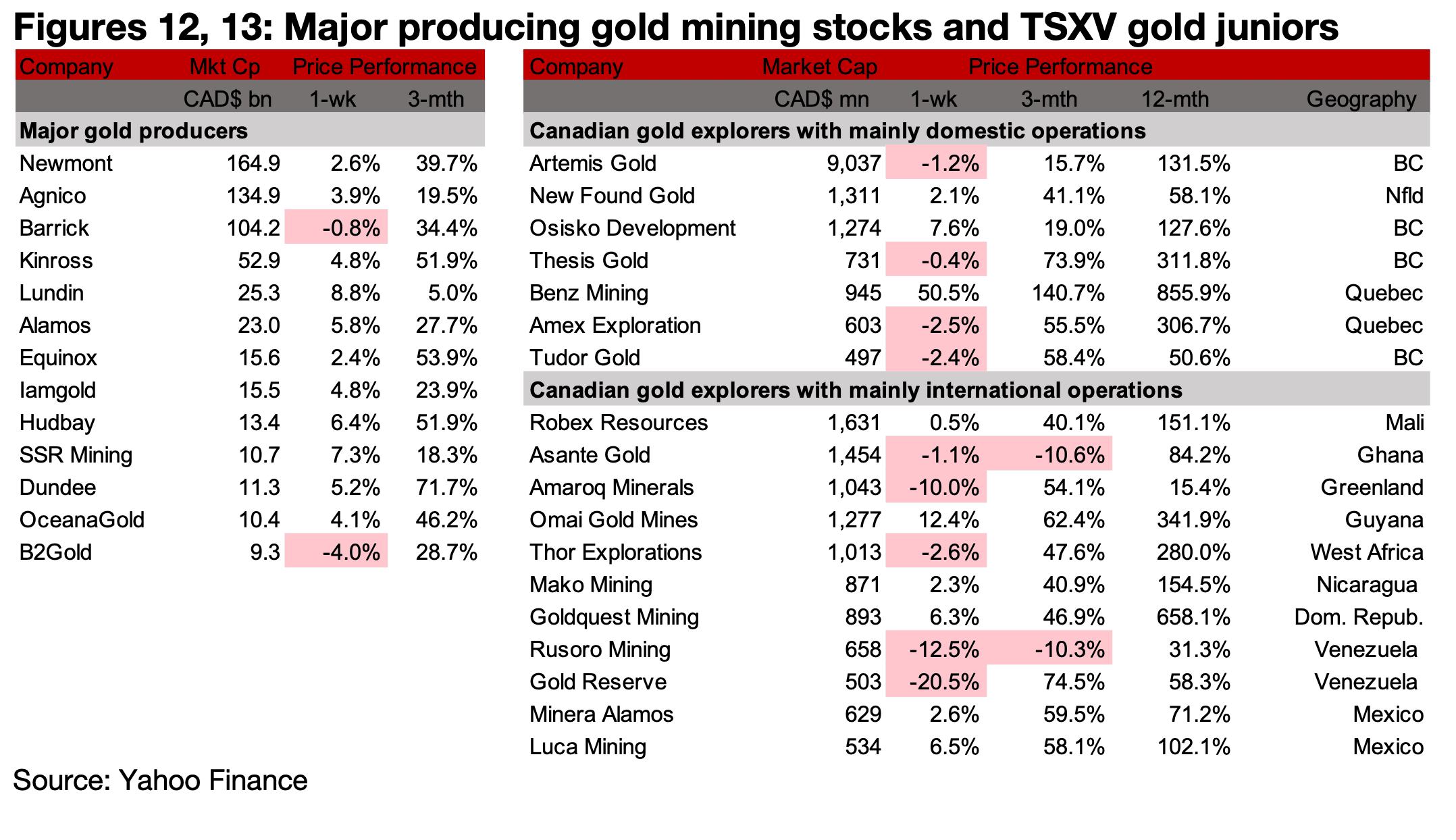

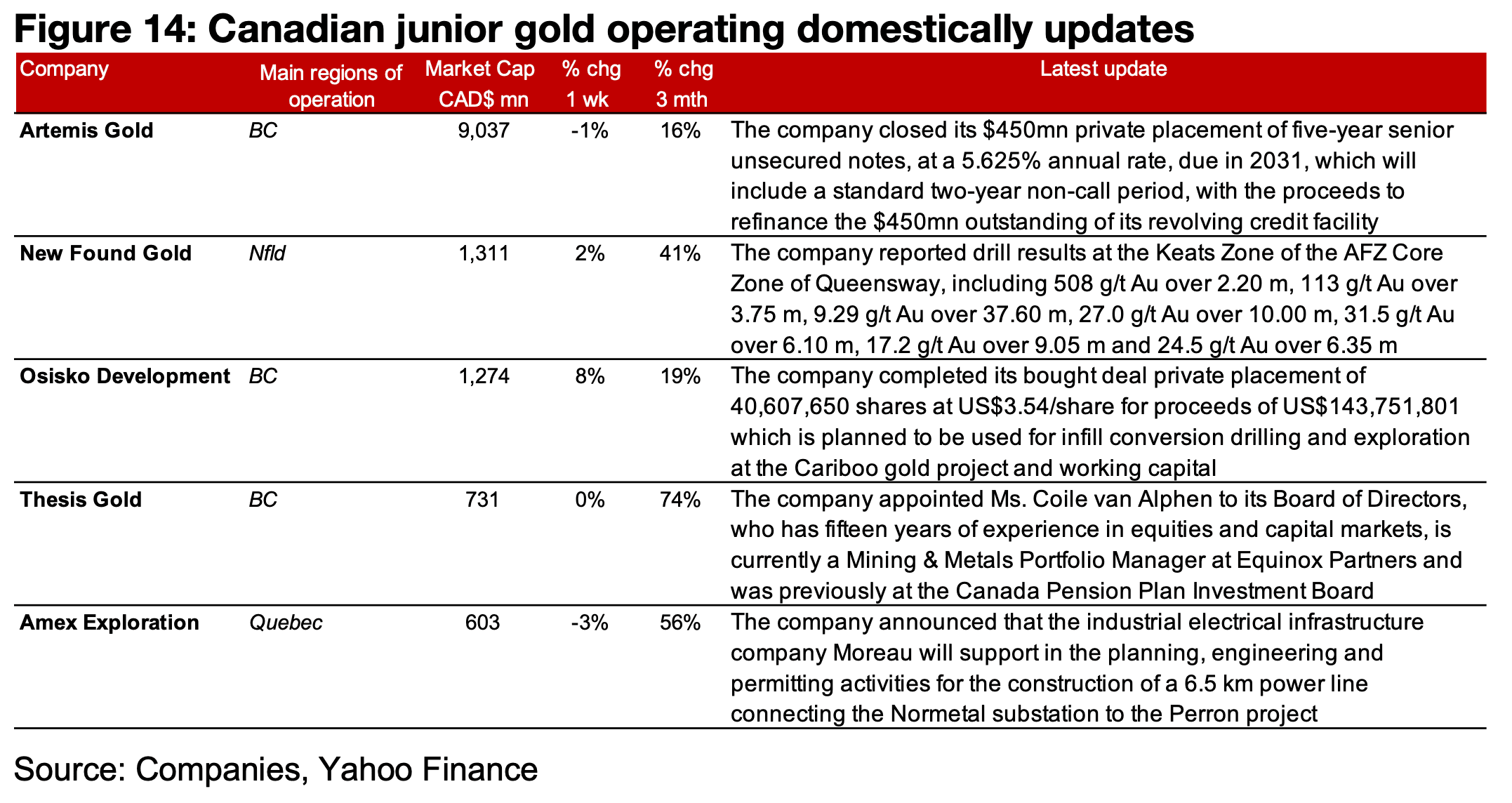

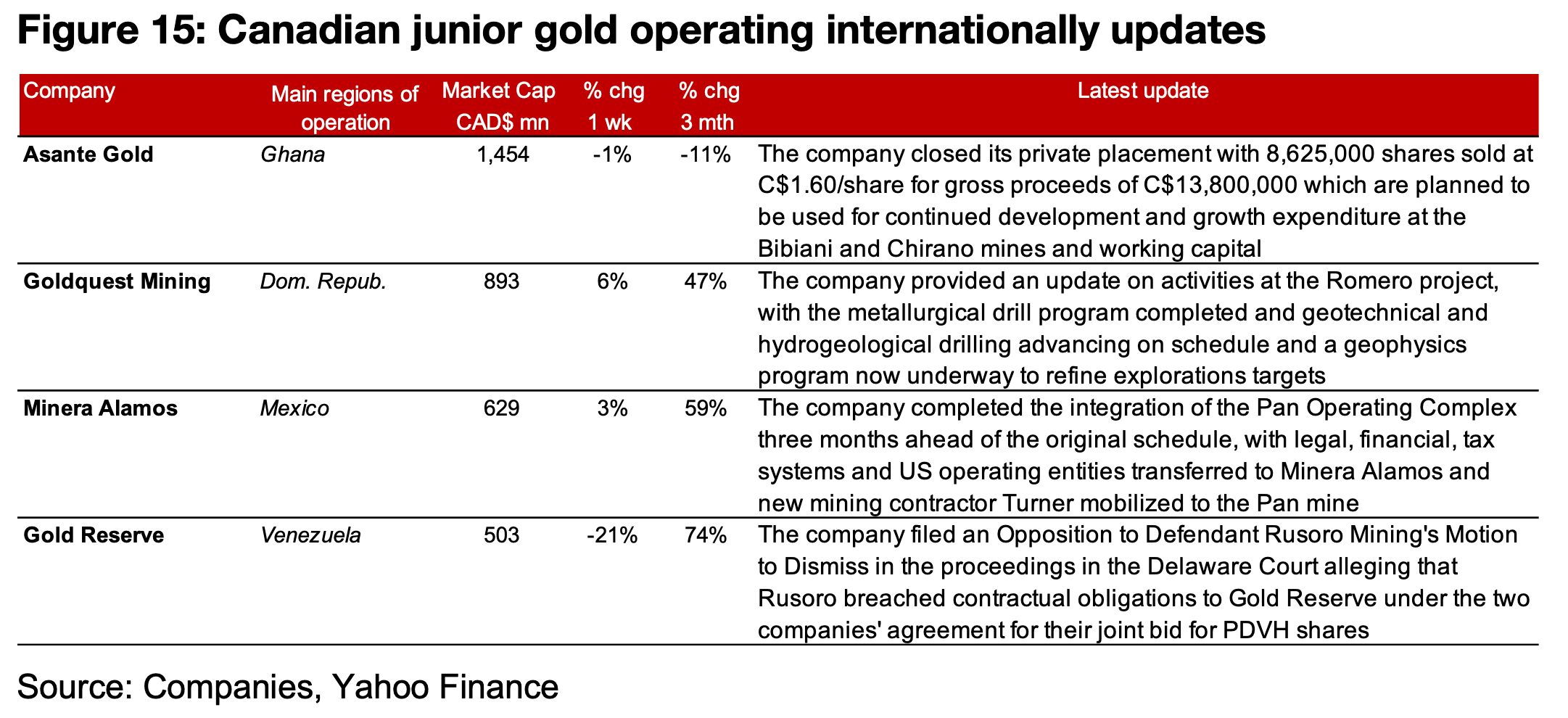

Most major producers rise and TSXV gold mixed

The major producers almost all gained and TSXV gold was mixed as the metal price rose (Figures 12, 13). For the TSXV gold companies operating mainly domestically, Artemis closed its placement of $450mn in senior debentures, New Found Gold reported drill results from the Keats Zone of Queensway, Osisko Development completed its US$143.8mn private placement, Thesis Gold appointed Ms. Coile van Alphen to its Board of Directors, and Amex Exploration announced that Moreau would support the construction of a power line for the Perron project (Figure 14). For the TSXV gold companies operating mainly internationally, Asante Gold closed its C$13.8mn private placement, Goldquest provided an update on operations at Romero, including the completion of the metallurgical drill program and advancing or starting other exploration, Minera Alamos completed the integration of the Pan Operating Complex three months ahead of schedule and Gold Reserve filed an opposition to Rusoro’s motion to dismiss a claim of breach of contract with the company at the US Court (Figure 15)

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.