October 16, 2020

Gold remains in three week holding pattern

Author - Ben McGregor

Gold averages US$1,895/oz for past three weeks

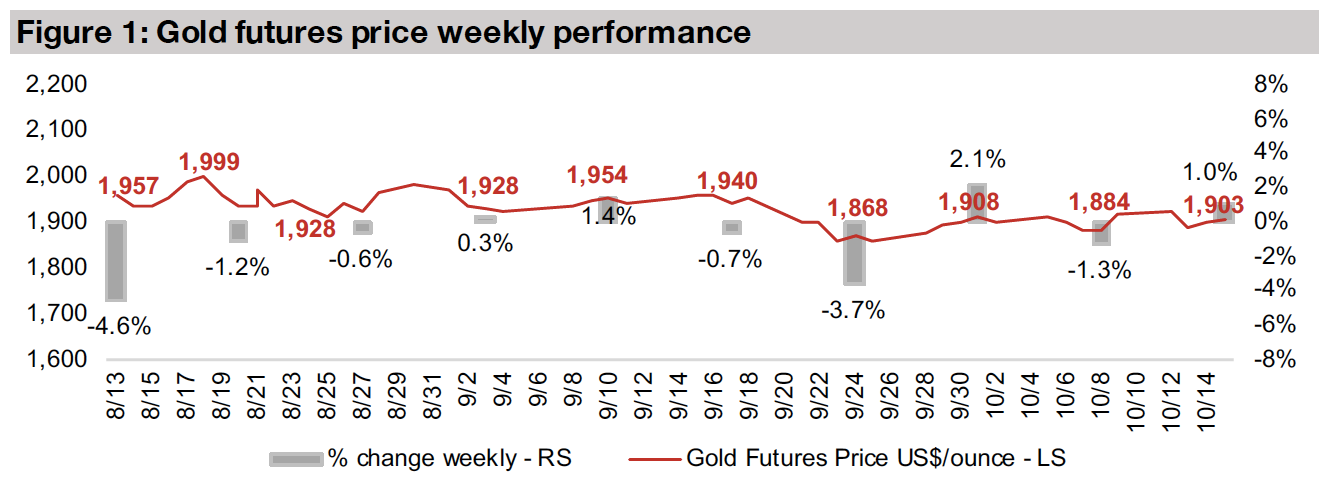

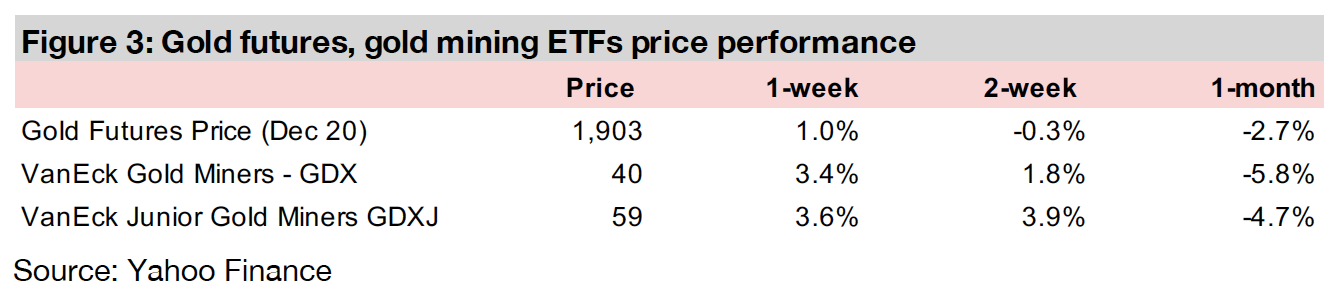

The gold price edged up 1.0% to US$1,903/oz, but has had some trouble breaking convincingly above the US$1,900/oz level for the past three weeks, averaging just US$1,895/oz, as the USD has gained and the market awaits the US election.

Producing and junior gold miners rise

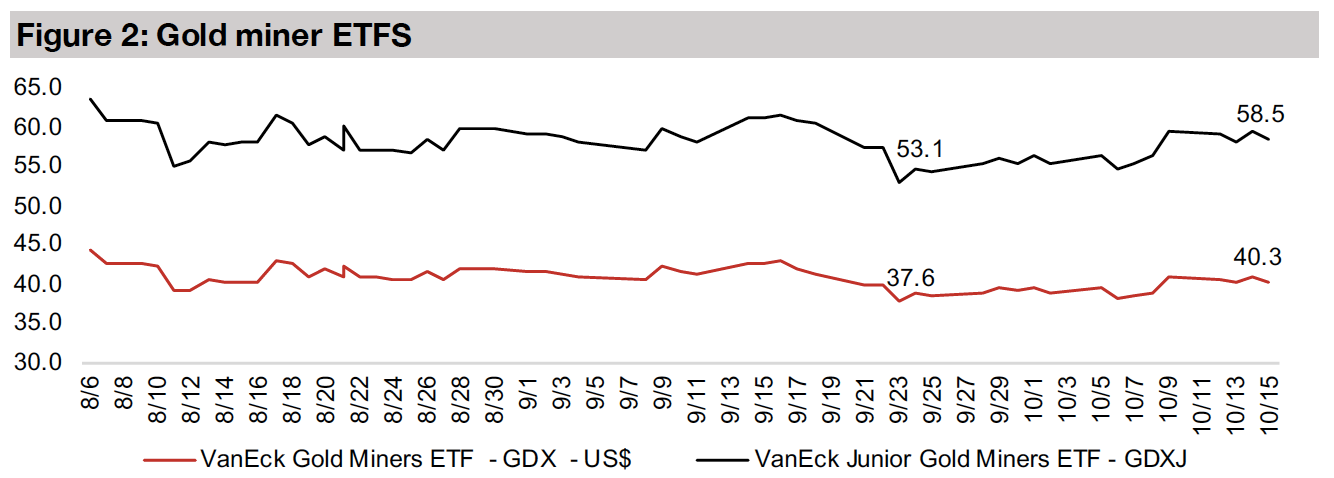

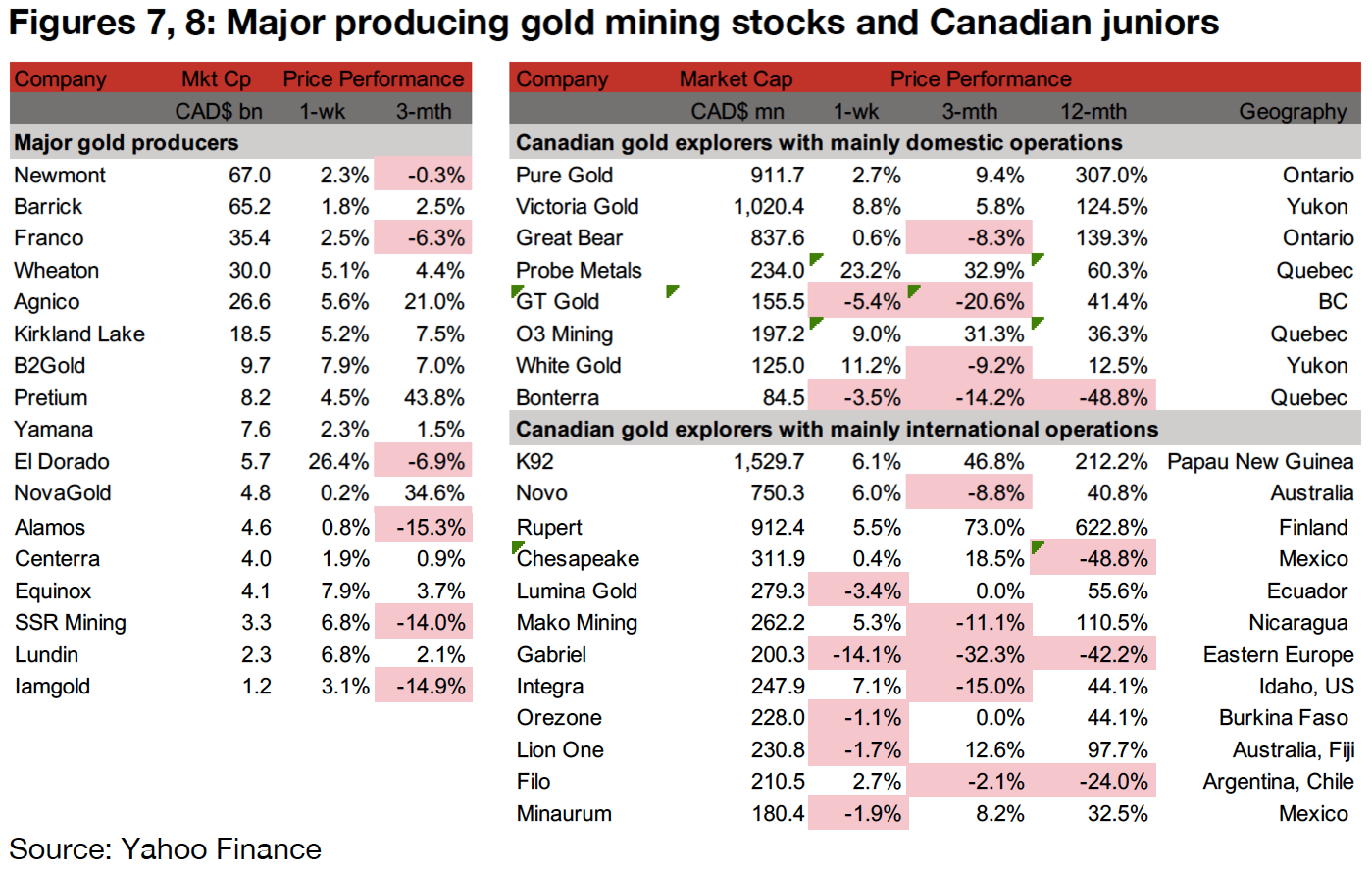

Producing miners and junior gold miners rose this week, with the GDX up 3.4% and the GDXJ up 3.6% as investors continued to buy gold stocks, although the Canadian juniors miners saw a mixed performance.

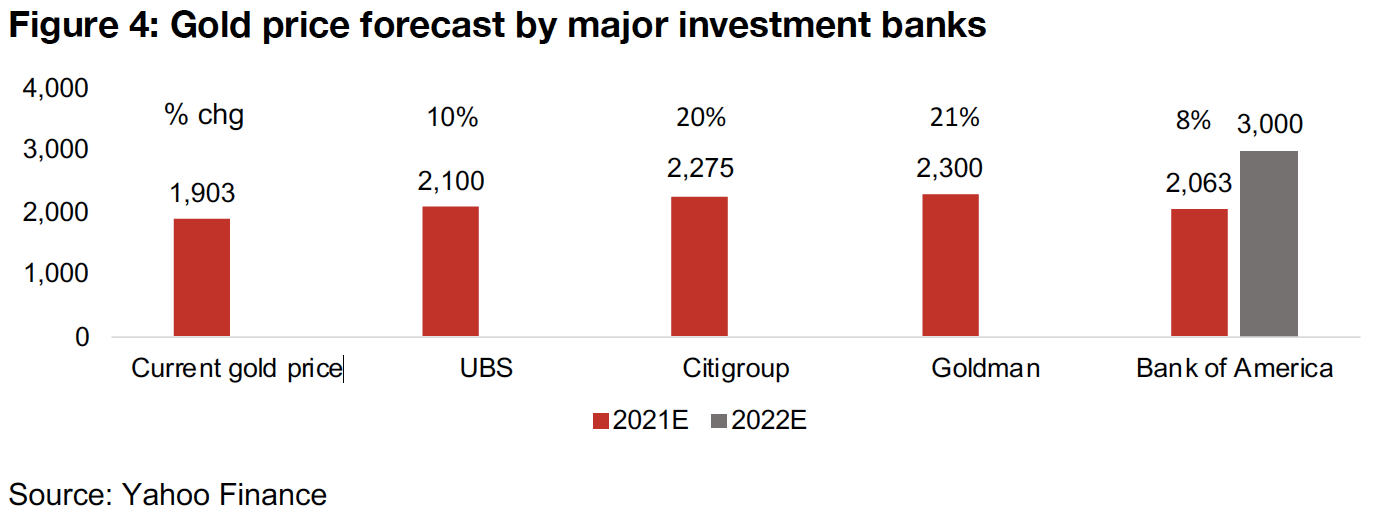

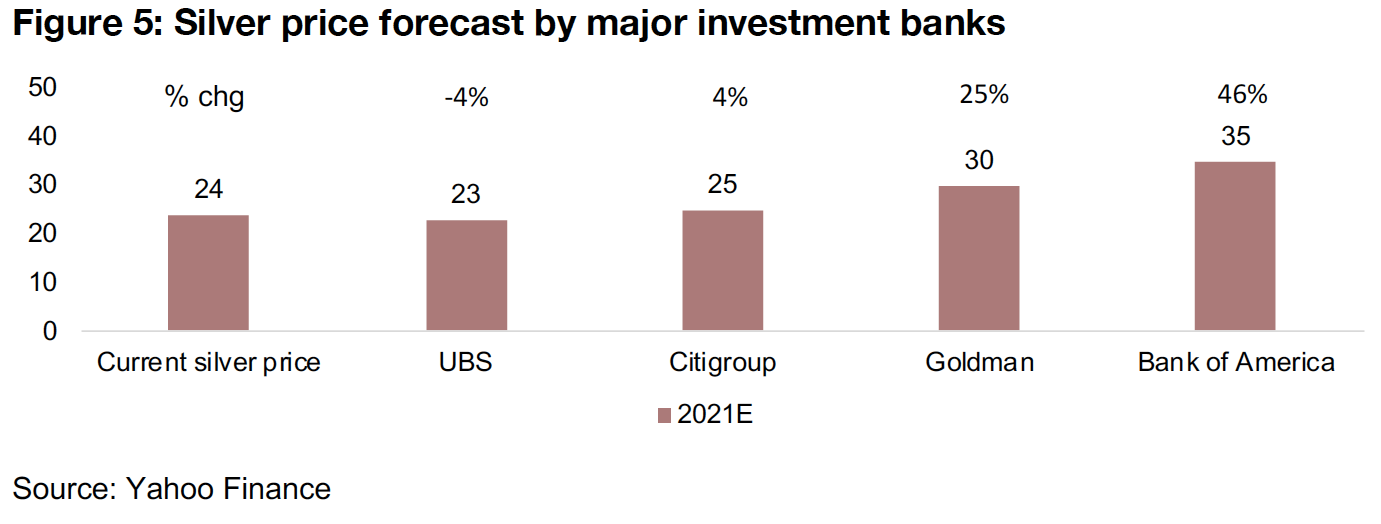

Market expecting upside for gold and silver in 2021E

While gold edged up 1.0% to US$1,903/oz this week, it has had some trouble breaking convincingly above US$1,900/oz for three weeks, averaging just US$1,895/oz, as the USD has been gaining, and investors await the outcome of the US election in early November. Beyond this short-term pause, however, the major investment banks continue to see upside for gold heading into 2021, as the global health crisis continues to affect most economies to varying degrees, and with monetary expansion being the major policy response, this should be bullish for gold (Figure 4). Forecasts for 2021 range from US$2,063/oz, or up 8%, from Bank of America (BoA), to US$2,300, or up 21%, from Goldman Sachs. While BoA is at the low end of the 2021 range, it is looking for a major surge to US$3,000/oz by 2022. Meanwhile, some forecasts among gold bulls are looking for US$5,000 over the next few years. The market also remains bullish generally on the outlook for silver, and while UBS's forecast of $US23/oz suggests a marginal dip, other banks are looking for a rise, to between US$25/oz, or up 4%, from Citigroup, and US$35/oz, or up 46%, for Bank America (Figure 5). If these forecasts are met, both gold and silver junior mining stocks would see a continued period of rising interest and improved access to capital for exploration activities.

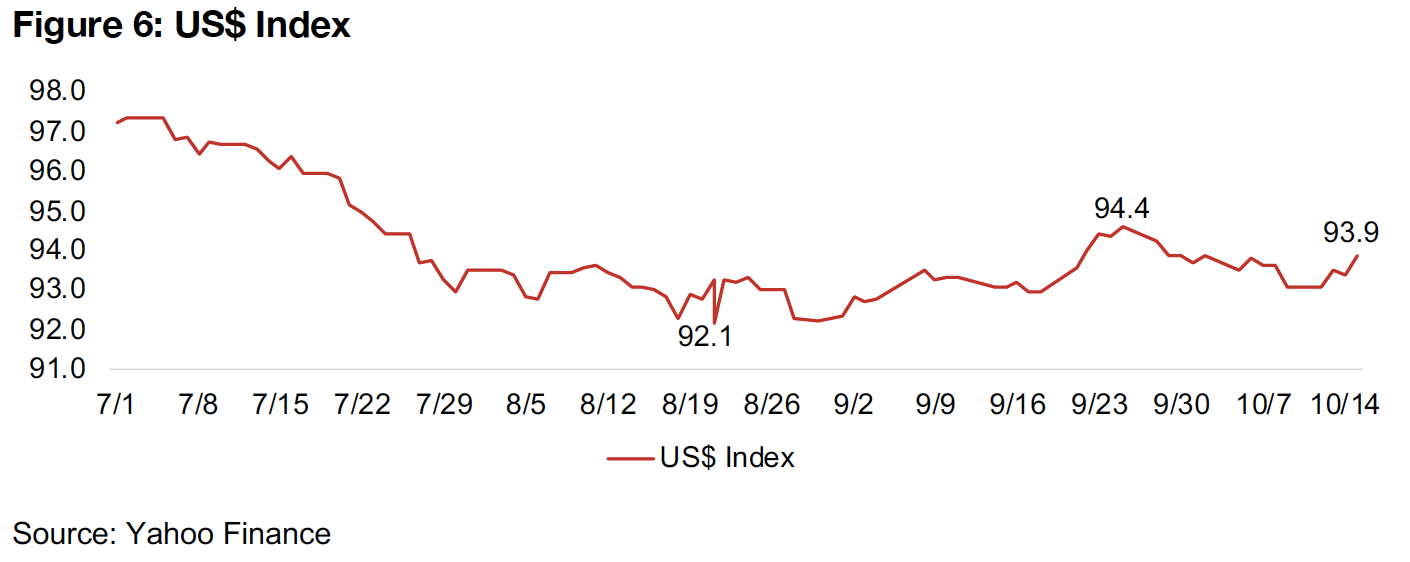

While over the past week, a pick-up in the US$ Index has pressured gold, overall this year the index has been weak, and while it has recovered off of lows of 92.1 in mid- August to reach 93.9, it is still down considerably from 97.2 at the start of July, 2020. In addition to the relatively large US monetary stimulus pressuring the US$ over the medium to long-term there is also the short-term factor of the US Election in November which could prove a major swing factor for the US$, and could have been leading traders to hold back on major directional bets over the past two months.

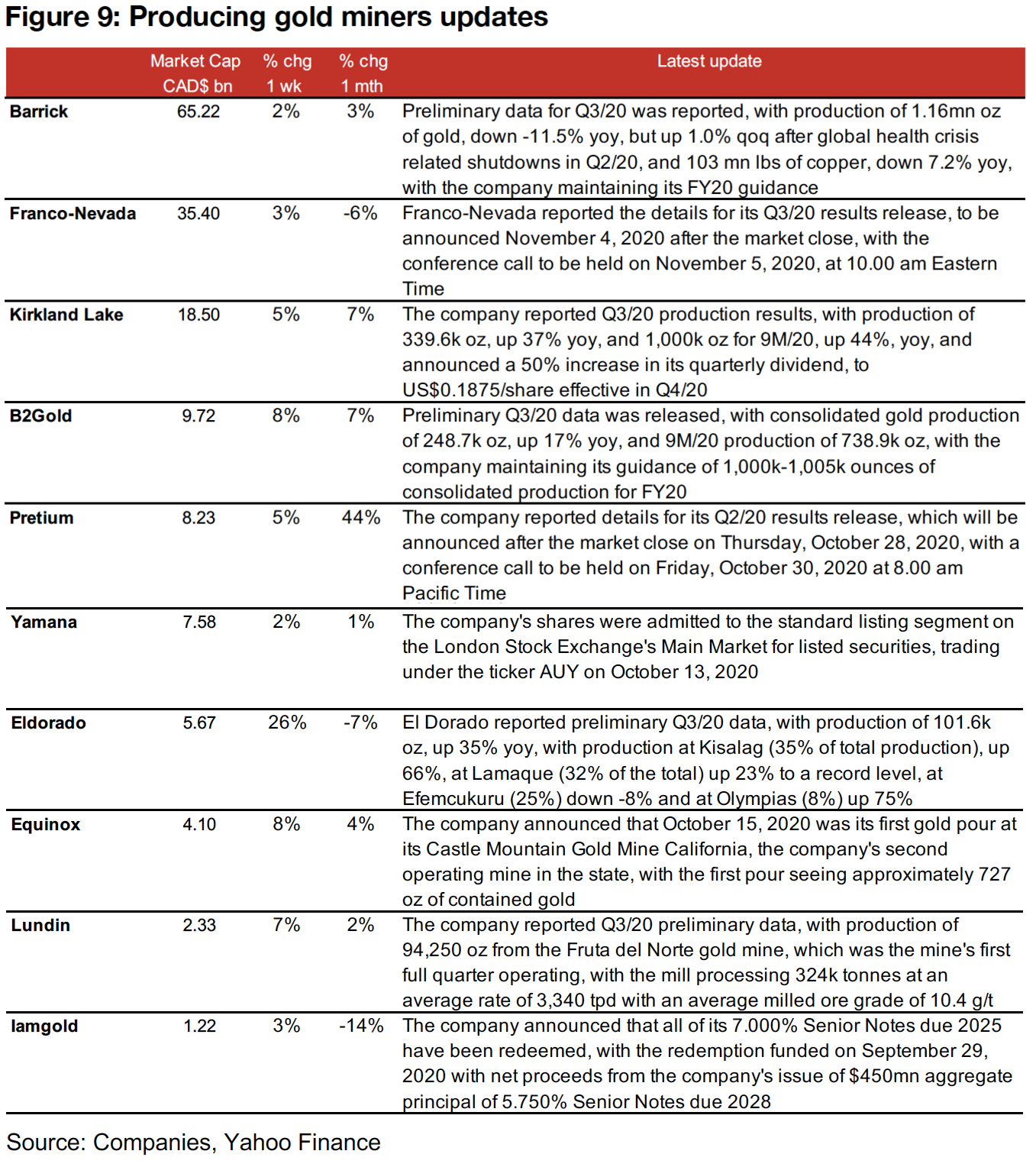

Producing gold miners reporting preliminary Q3/20

The producing miners were all up this week, as gold rose, and companies started gearing up for Q3/20 results (Figure 7). This included a series of preliminary Q3/20 production releases, including Barrick, Kirkland, B2Gold, El Dorado and Lundin, while Franco-Nevada and Pretium provided information on their Q3/20 results releases. Other news flow included Yamana's start of trading on the London Stock Exchange, Equinox's first gold pour at its Castle Mountain mine, and Iamgold's completion of the redemption of its previous Senior Notes through the issuance of new Senior Notes.

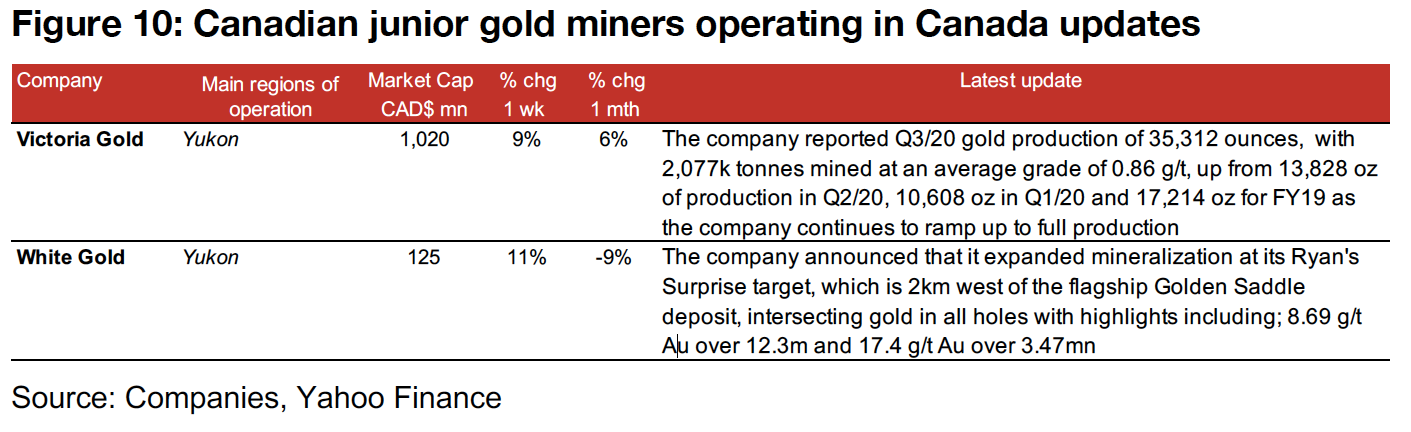

Canadian gold juniors operating domestically mixed

The Canadian juniors operating domestically were mixed this week (Figure 8), with Victoria Gold up 9% after reported a continued ramp up to full production at its Eagle mine, with output of 35,312 ounces for Q3/20. White Gold was up 11% on a report of expanded mineralization at its Ryan's Surprise target, which is two kilometres west of its flagship Golden Saddle project (Figure 10).

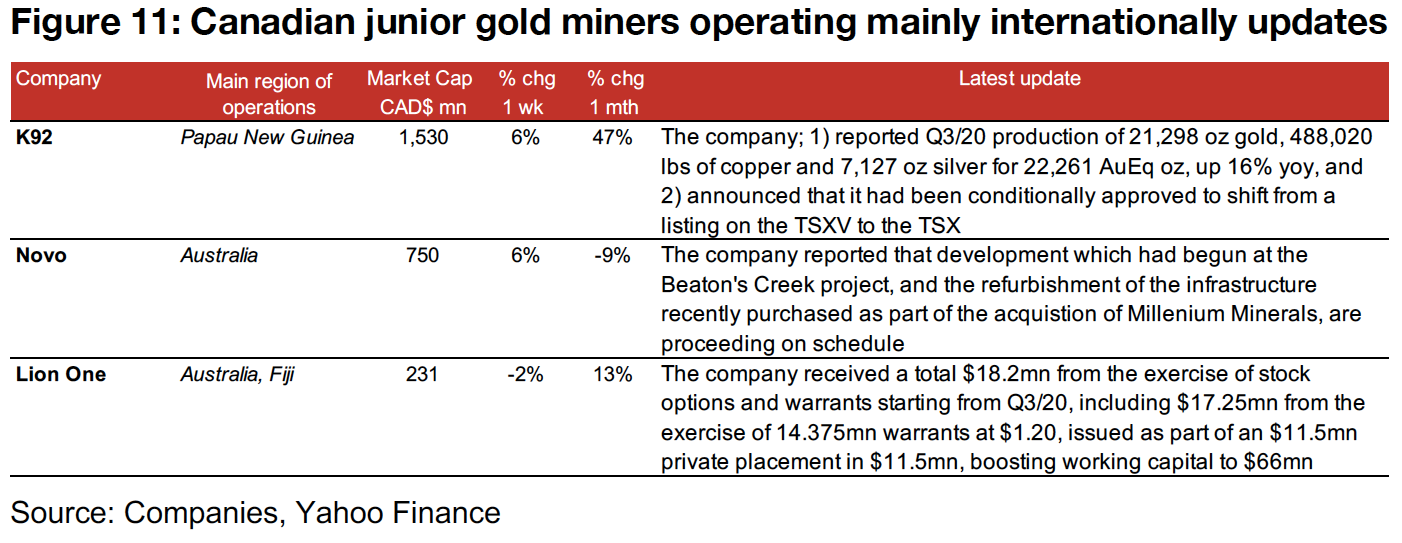

Canadian gold juniors operating internationally also mixed

The Canadian juniors operating internationally were also mixed (Figure 8), with K92 up 6% on Q3/20 production of 21.2k oz of gold, 488.0k lbs of copper and 7.1k oz of silver, for 22.2k oz AuEq, up 16% yoy (Figure 11). Novo rose 6% on updates of the development process at its Beaton's Creek project, including the refurbishment of the infrastructure acquired as part of its purchase of Millenium Mineral. Lion One was down -2% even as it reported $18.2mn in new funding from the exercise of stock options and warrants since the start of Q3/20.

In Focus: Top Canadian junior gold stocks of 2020

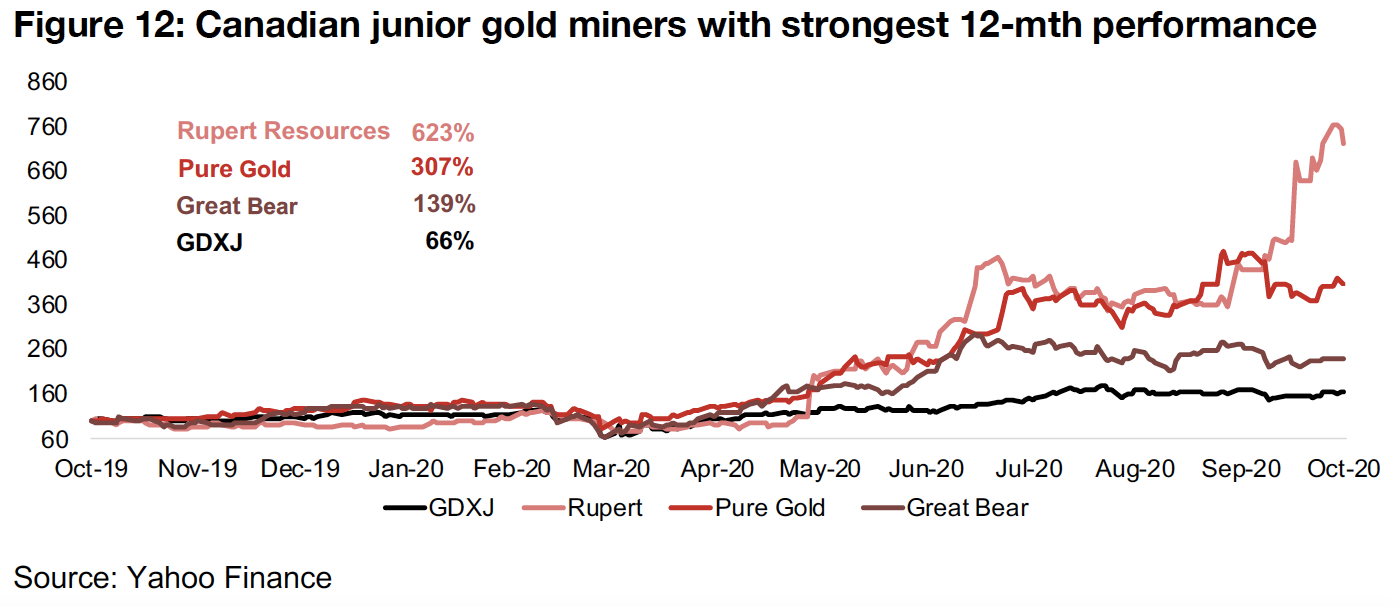

Rupert Resources and Red Lake's Pure Gold and Great Bear lead

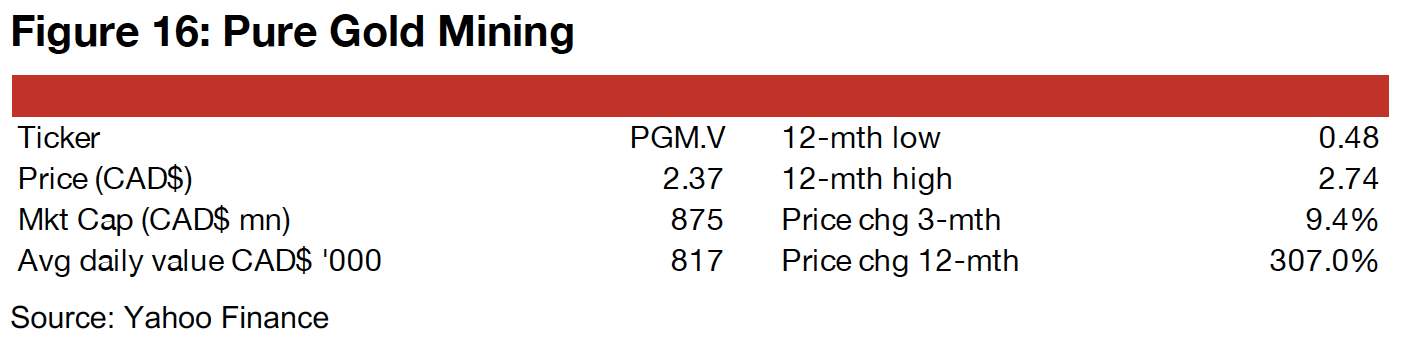

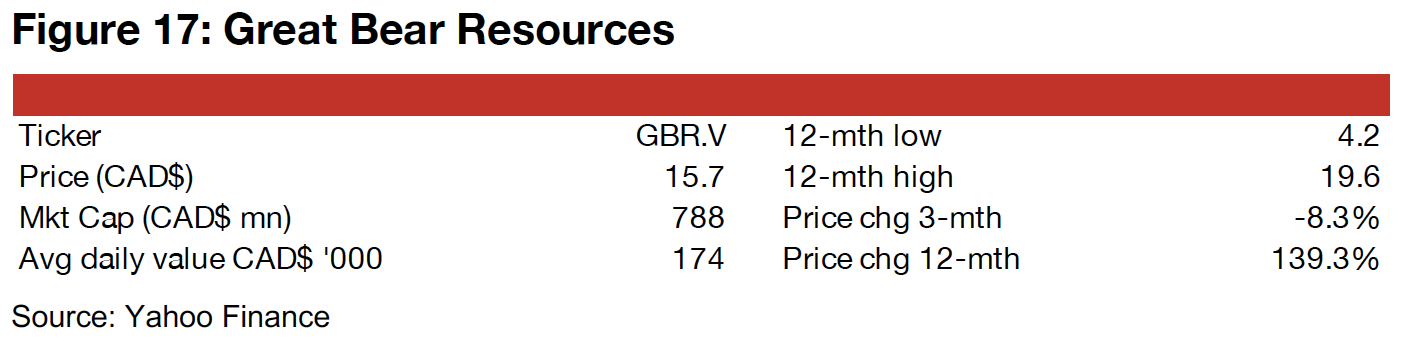

In Focus this week are the major Canadian junior gold mining stocks that have far outpaced the rest of the industry over the past twelve months, with Rupert Resources, operating the Pahtavaara project in Finland having far and away the strongest performance, up 623% over the past twelve months. The other two stand outs both operate in Ontario's Red Lake District, Pure Gold Mining, up 307%, and Great Bear, with its flagship Dixie Project, up 139% (Figure 12). Putting this into the context of an already very strong junior mining sector using the GDXJ, an ETF tracking global junior gold miners, as the proxy, we see a significant outperformance by all three stocks.

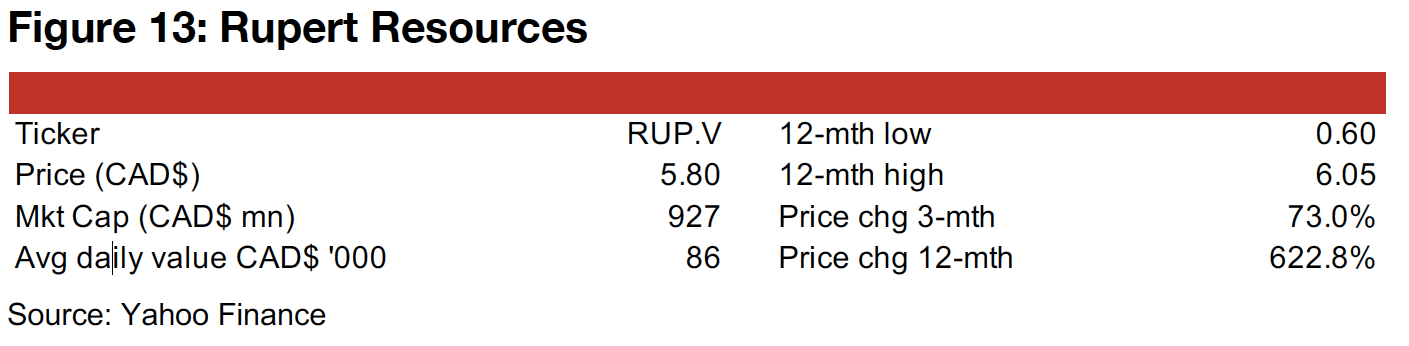

Rupert Resources

Exploring in Finland and Canada, with Pahtavaara the flagship

Rupert Resources has five projects, with its flagship, Pahtavaara in Finland, the focus of its exploration over the past year. It has two other projects in Finland, Hirsikangas and Osikonmaki, with Inferred resource estimates of 89k ounces and 276k ounces respectively, and two very early stage projects in Canada, at Red Lake in Ontario, and at Surf Inlet in British Columbia.

New Ikkari find at Pahtavaara driving major share price gains

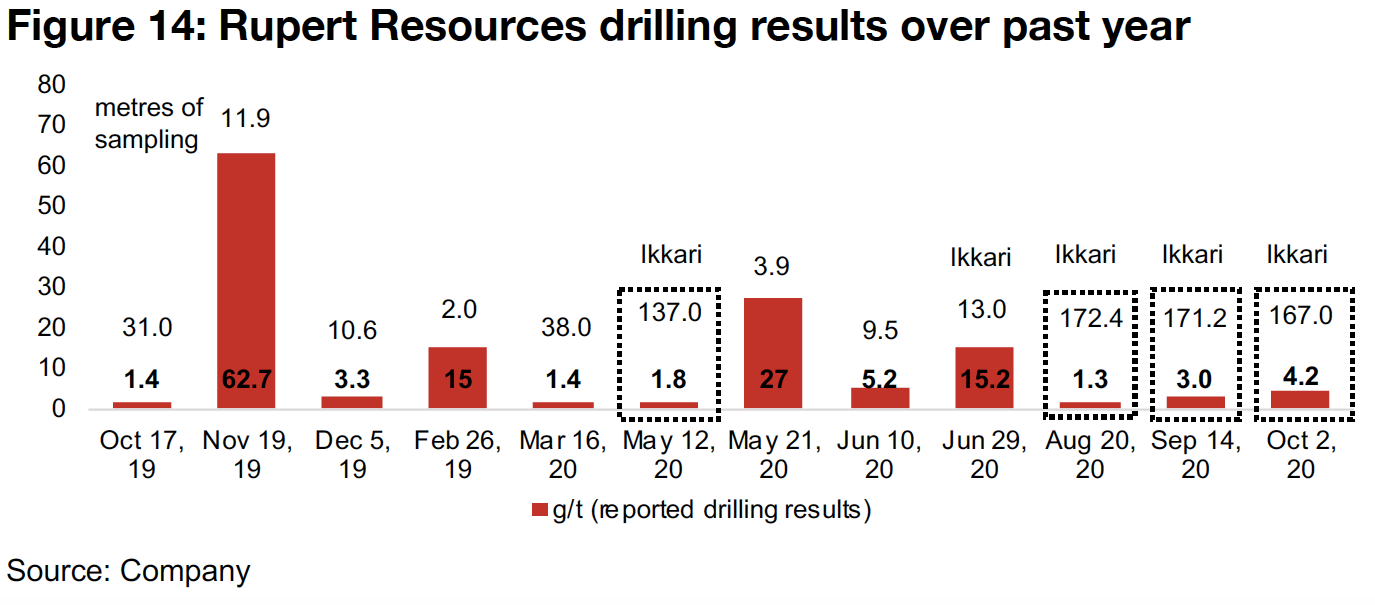

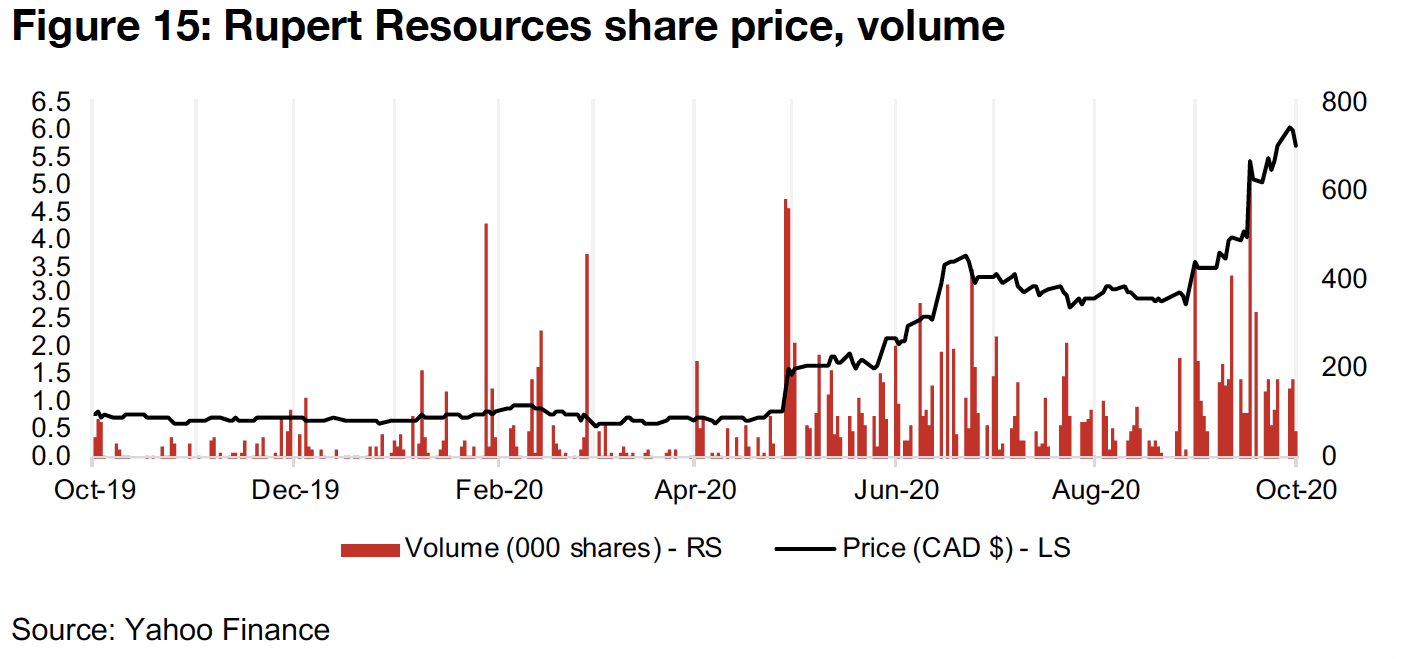

While the company has been operating an extensive drill program through 2019 and 2020 at its flagship Pahtavaara project in the Central Lapland Greenstone Belt in Finland, these had not led to a major rise in the share price in the year to end-April 2020 (Figure 15). However, on May 12, 2020, the company released drilling results from a newly identified target, Ikkari, at the Pahtavaara project (Figure 14), which drove an 85% increase in the share price in the two days following the announcement, as the find, although not of a particularly high grade, at 1.8 g/t, had a very large width of 137m. The share price has continued to see major gains related to the Ikkari find, as three similarly wide intervals were reported over the past three months, with two having grades much higher than the find reported on May 12, 2020.

Red Lake: Pure Gold Mining, Great Bear

Pure Gold outpacing Great Bear at Red Lake, although both strong

The two other outstanding performers of the major Canadian junior mining stocks this year are both based in Red Lake, Ontario, Pure Gold Mining (PGM), and Great Bear Resources (GBR). While Great Bear Resources had actually been a bigger story earlier in 2020, with its share price at times outpacing Pure Gold, GBR is at an earlier stage of exploration, while PGM has already reached the PEA stage, and in the end, the certainty of a defined resource seems to have won out, with PGM up 307% over the past 12-months, with the less quantitatively defined progress of GBR driving a gain of 139% over the period.

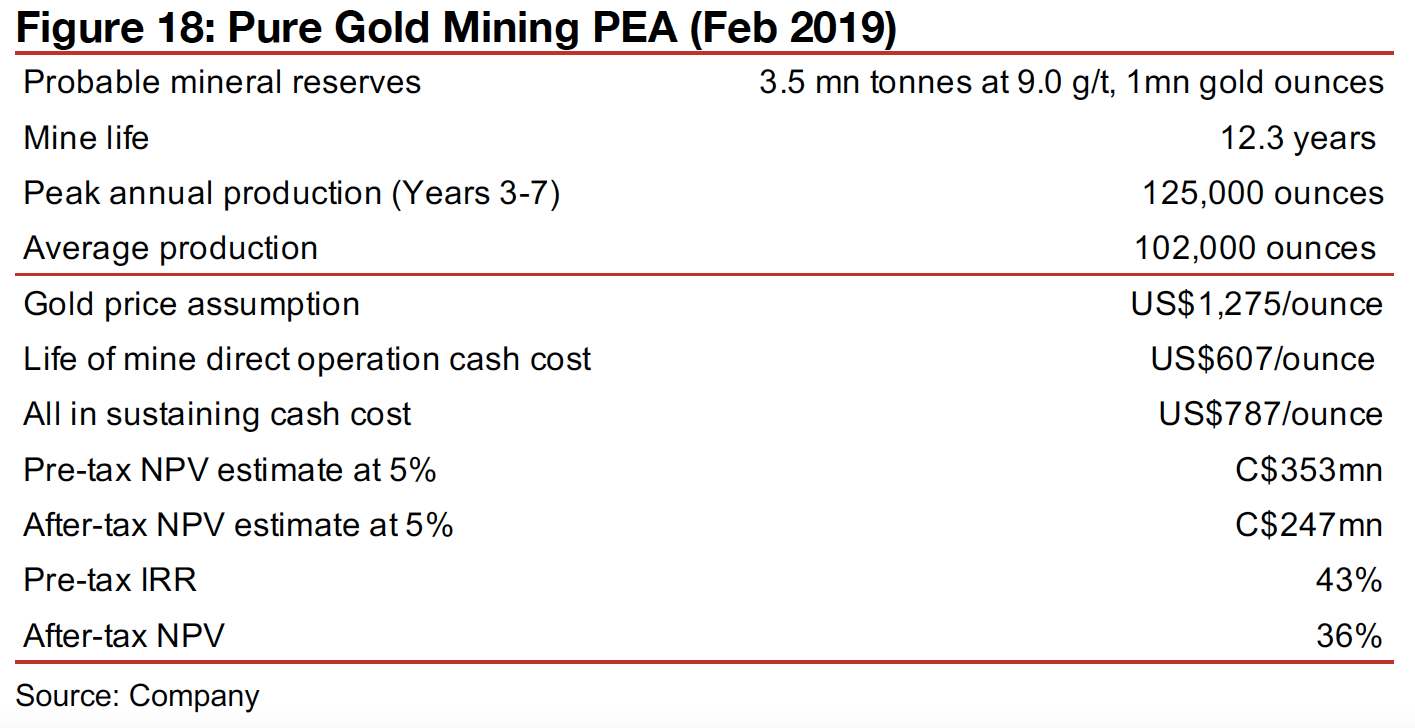

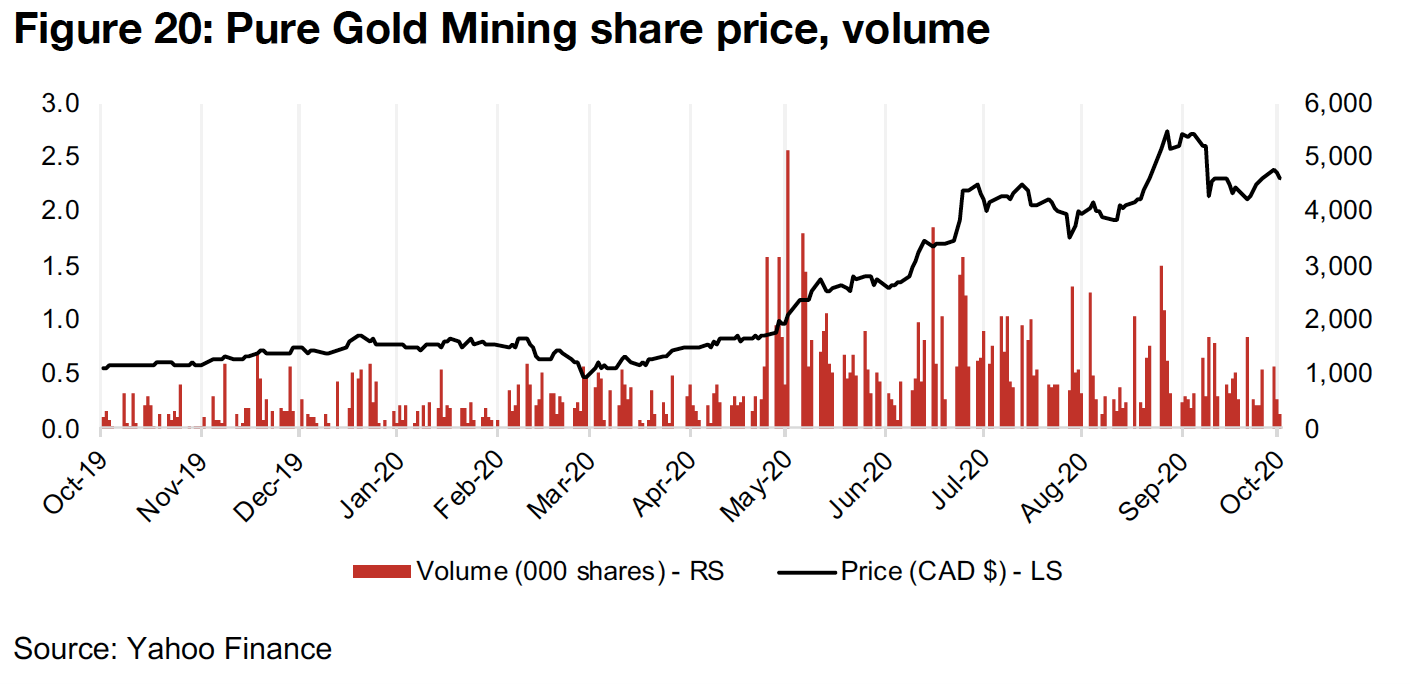

Pure Gold targeting first gold pour by Q4/2020

Pure Gold is targeting the first gold pour from its Pure Gold Mine project in Red Lake by the end of Q4/20, with the PEA released in February 2019, looking for a 1mn oz gold resource, with a 12.3 year mine life, and average production of 102k oz per year, a cash cost of US$607/oz and AISC of US$787/oz, with an after-tax NPV of $247mn, at a US$1,275/oz gold price. While this after-tax NPV is less than a third of the company's CAD$875mn market cap, the US$1,275/oz gold price is looking low given the gold price rebound over the past year, and assuming a gold price near the average of the past seven months around US$1,824/oz, the value of the project would be much closer to PGM's current market cap. The most recent announcement from Pure Gold was on August 18, 2020, with Anglogold Ashanti exercising warrants worth $5.0mn holding in the company, showing continued support from a major firm.

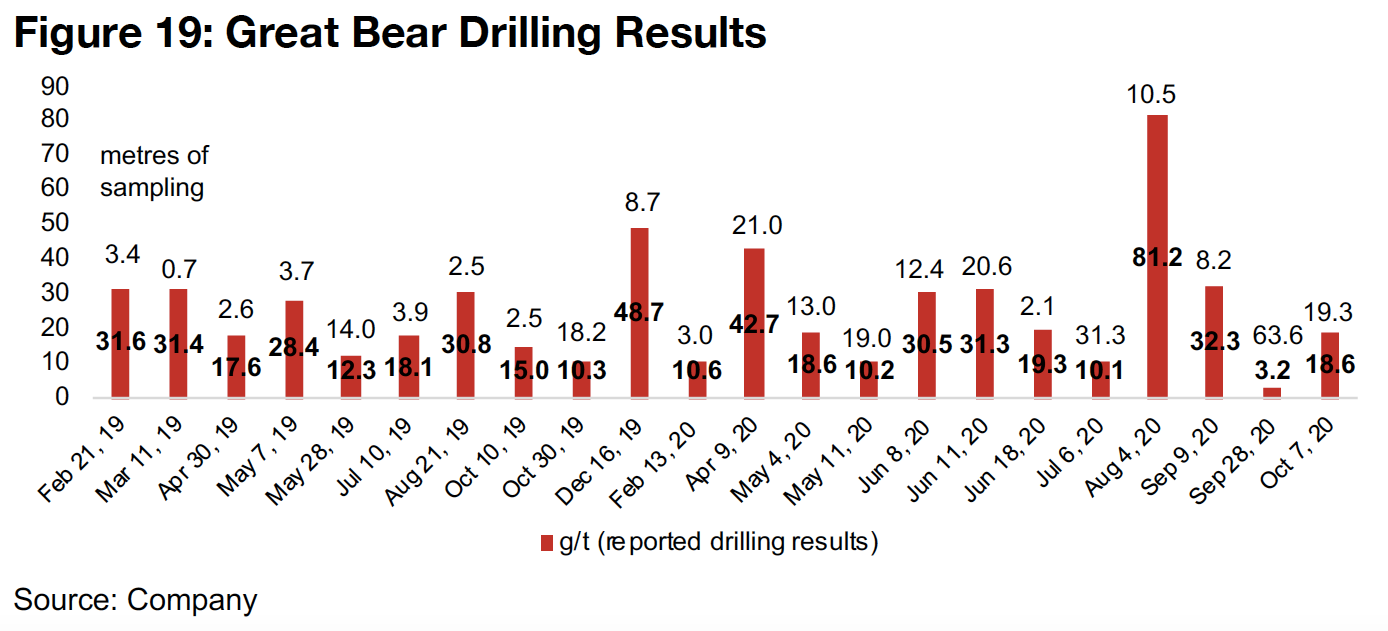

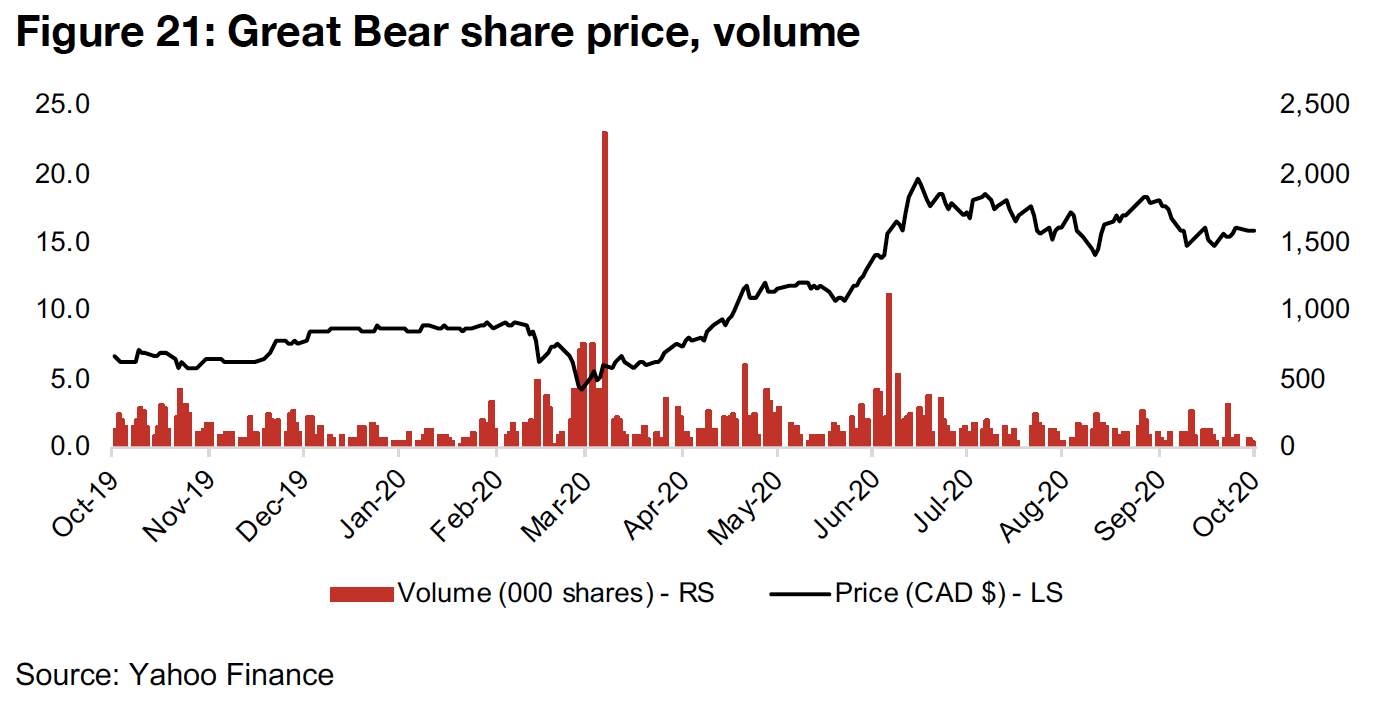

Great Bear continues to deliver strong drilling results from Dixie

Great Bear Resources continues to report strong drilling results, having released a total twenty-two drilling results since 2019, mainly from its Dixie Project in Red Lake, with its three strongest results over the past twelve months seeing 81.2 g/t over 10.5m, 48.7 g/t over 8.7m and 42.7 g/t over 21.0m, reported on August 4, 2020, December 16, 2019, and April 9, 2020, respectively. However, it has lost the lead that it had earlier in the year on PGM, and the stock has been relatively flat for four months. GBR may need to show the market that it is moving closer to a maiden resource to help drive the share price, making its progress a bit more concrete for investors, as has been the case for PGM, which has nearly reached its first gold pour.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.