September 29, 2025

Gold Resumes Ascent

Author - Ben McGregor

Gold jumps again after slower two weeks

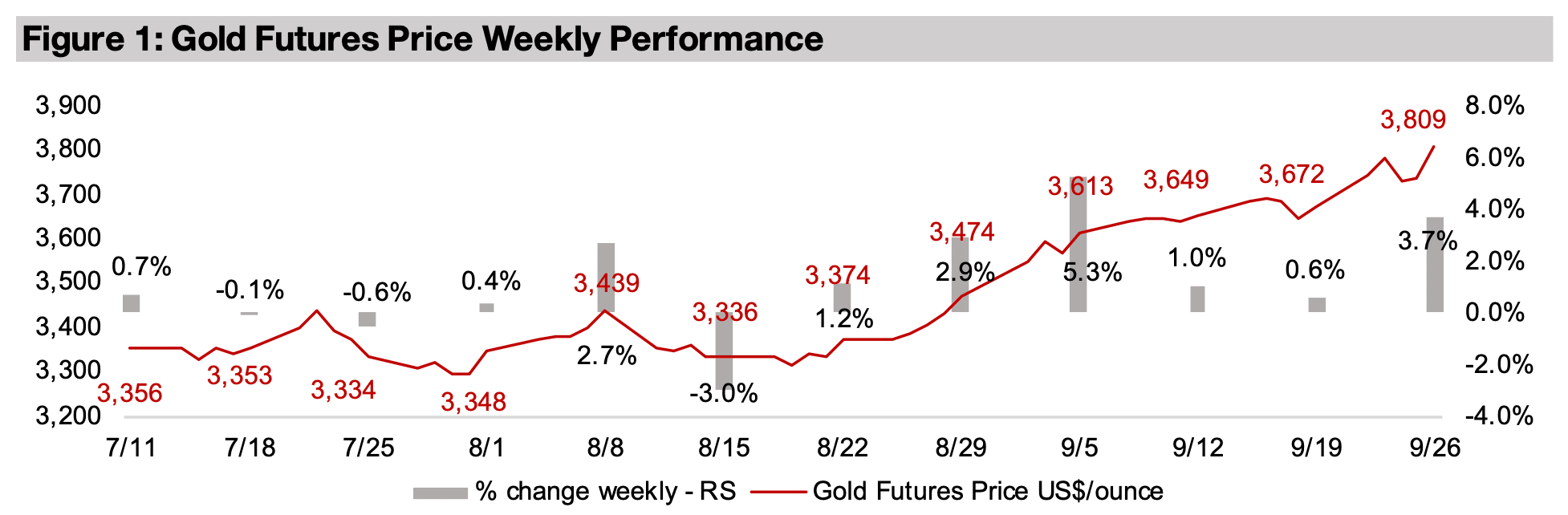

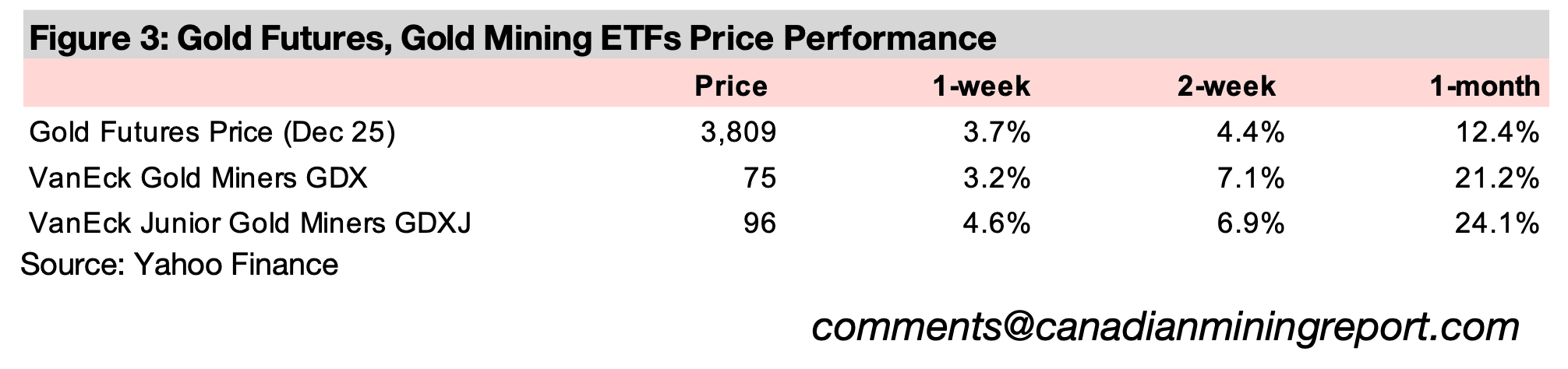

Gold jumped 3.7% to US$3,809/oz, once again seeing strong gains after a more moderate rise in the previous two weeks, as markets may have been seeking hedges after equities slipped and could still be pricing in an expected Fed rate cutting cycle.

Gold Resumes Ascent

The gold price jumped 3.7% to US$3,809/oz, again rising strongly after muted gains

for the past two weeks, and it is now up nearly US$500/oz from the most recent lows

of US$3,313 on August 19, 2025. We had earlier expected gold could take a pause

after its only muted gain when the 0.25% Fed rate cut finally came through on

September 18, 2025. This seemed to suggest the start of a rate cutting cycle by the

US, which had been a major driver of the strong gains in gold from mid-August to

mid-September, may have been largely priced in by the market. However, this week’s

move indicates the market might have not fully incorporated the upside from two

more 0.25% cuts at the October and December meetings that are widely expected.

Another factor likely driving the move was some hedging of the decline in equities

with the metal. While the drop for the week was not that severe, with the S&P 500

down -0.2% and the Nasdaq and Russell 2000 losing -0.5%, this was after a rebound

from the lows mid-week. US equities remain positioned for downside pressure partly

because of increasingly excessive valuations. The market cap to GDP ratio for the

country has reached 218%, by far its highest level ever, with the ratio rarely getting

above 150% prior to 2020. The Shiller Price to Earnings Ratio (P/E), which adjusts for

average earnings and inflation, is also extreme at 39.84, its second highest level ever,

after the 43.21 peak in November 1999 during the dot.com boom. An almost

uninterrupted rally for the S&P, Nasdaq and Russell 2000, by 33%, 47% and 38%,

respectively, from their April 2025 lows, also suggests the risk of a pullback.

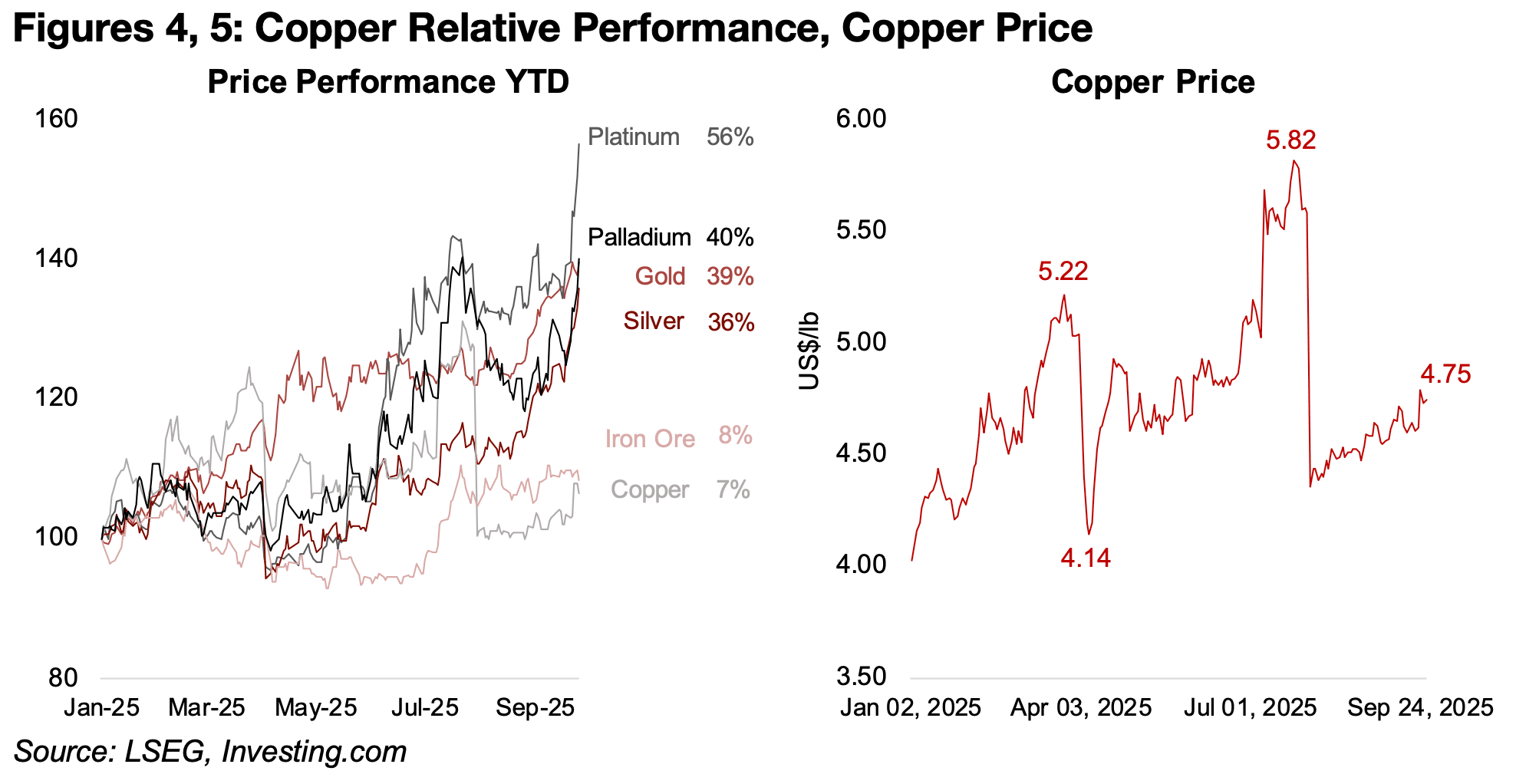

Platinum, palladium, copper gain on green China, supply constraints

Platinum and palladium saw especially strong gains this week, up 12.5% and 12.2%,

mainly on an announcement from China of plans for a continued major push towards

green energy, with both metals having a range of key uses in this transition. Platinum

has been particularly strong this year, surging 56%, as the metal is expected to face

a major deficit, compared to a relatively balanced market for palladium, which is up

40% this year, just ahead of gold’s 39% gain (Figure 4). The copper price also saw a

relatively strong move this week, up 3.0%, as the fallout from the mudslide tragedy

at the Grasberg mine in Indonesia continued to cause concerns over supply in the

industry. This has boosted the gradual upward trend in the copper price after the

slump in late July 2025 following US clarifications on tariffs for the metal (Figure 5).

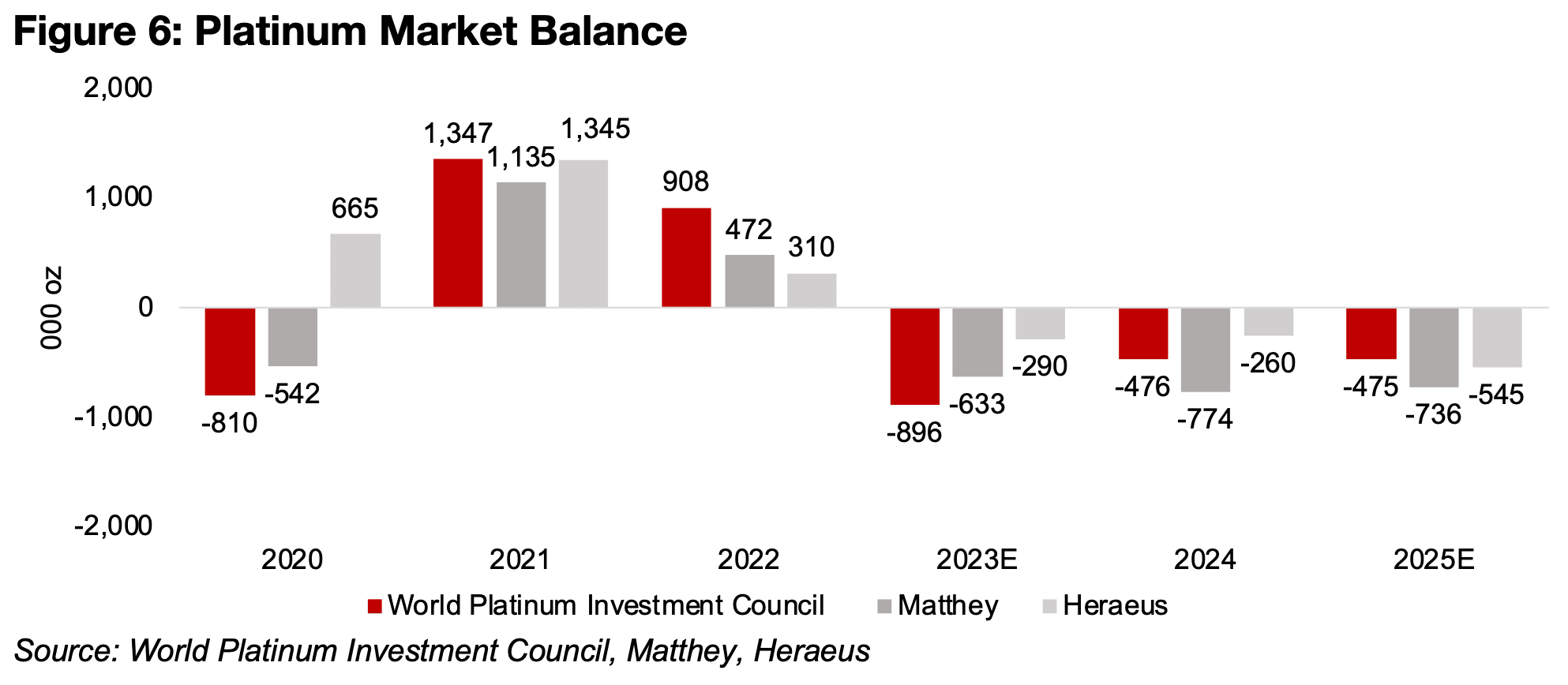

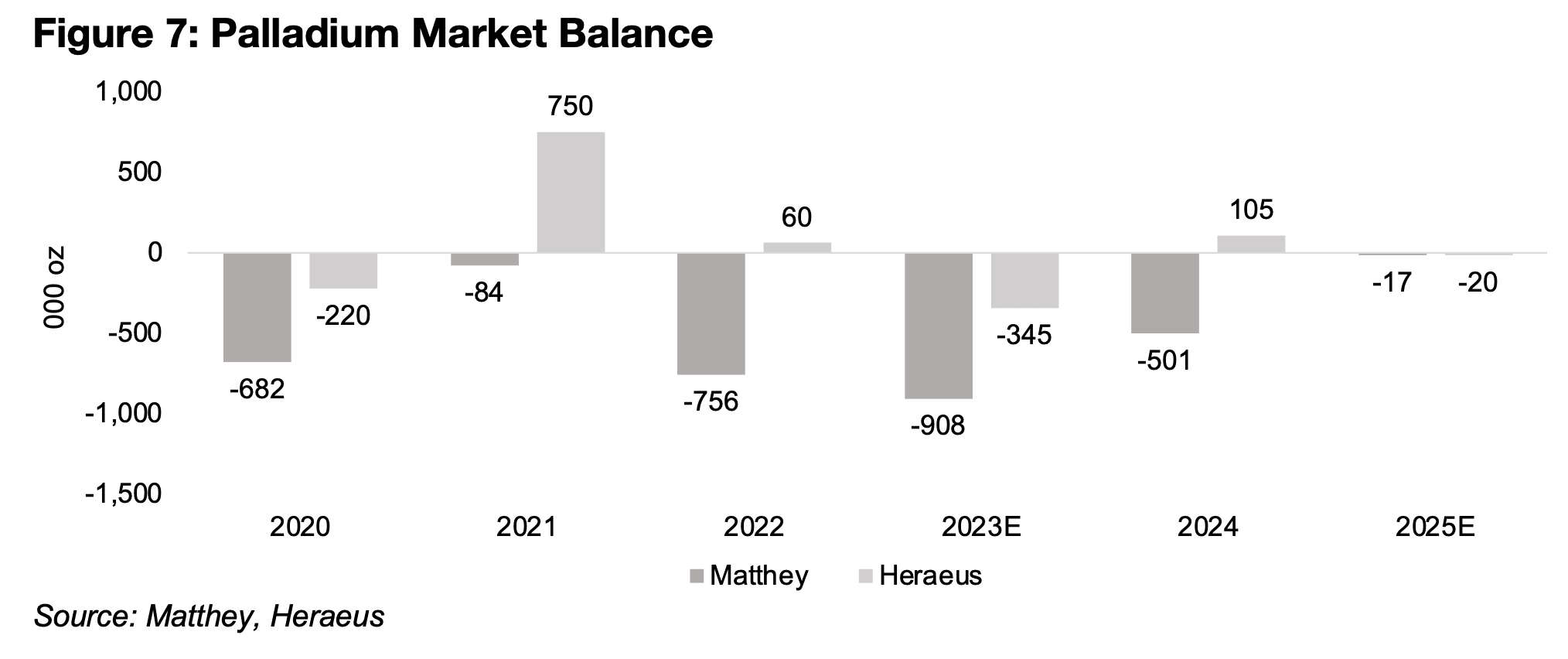

All of the major forecasters of the platinum market are estimating wide deficits in

2025E for the third consecutive year, with the World Platinum Investment Council

expecting -475k oz, Matthey -736k oz and Heraeus -545k oz (Figure 6). The palladium

market is expected to be roughly balanced, in contrast, with Matthey forecasting a

small -17k oz deficit, almost exactly inline with Heraeus’ estimate of -20k oz (Figure

7). While both metals have the largest proportion of their demand from the auto

industry for use in autocatalysts to reduce emission, this sector is more key for

palladium, where it is over 80% of the total, compared to just 40% for platinum.

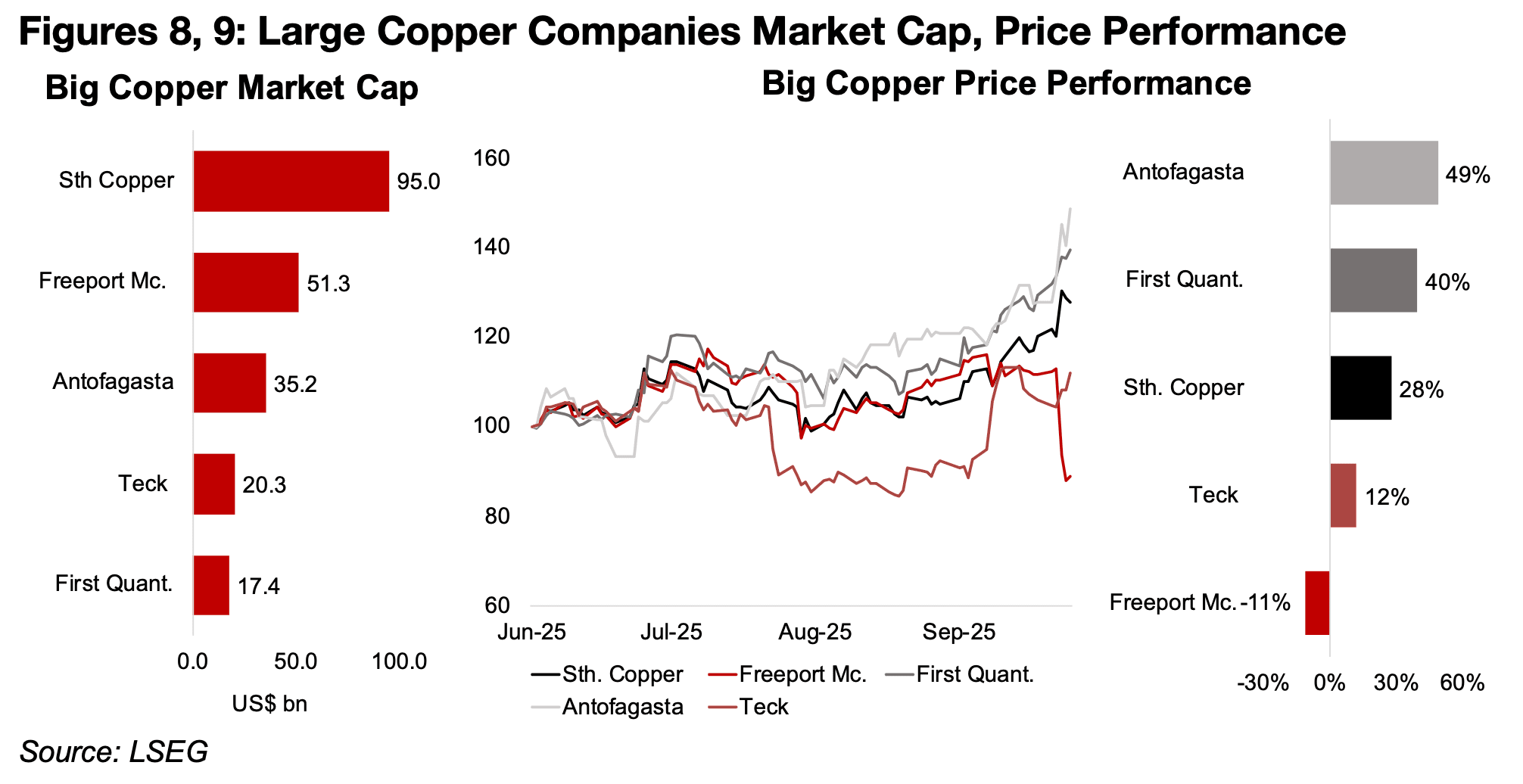

Freeport McMoran slumps, other big copper stocks gain

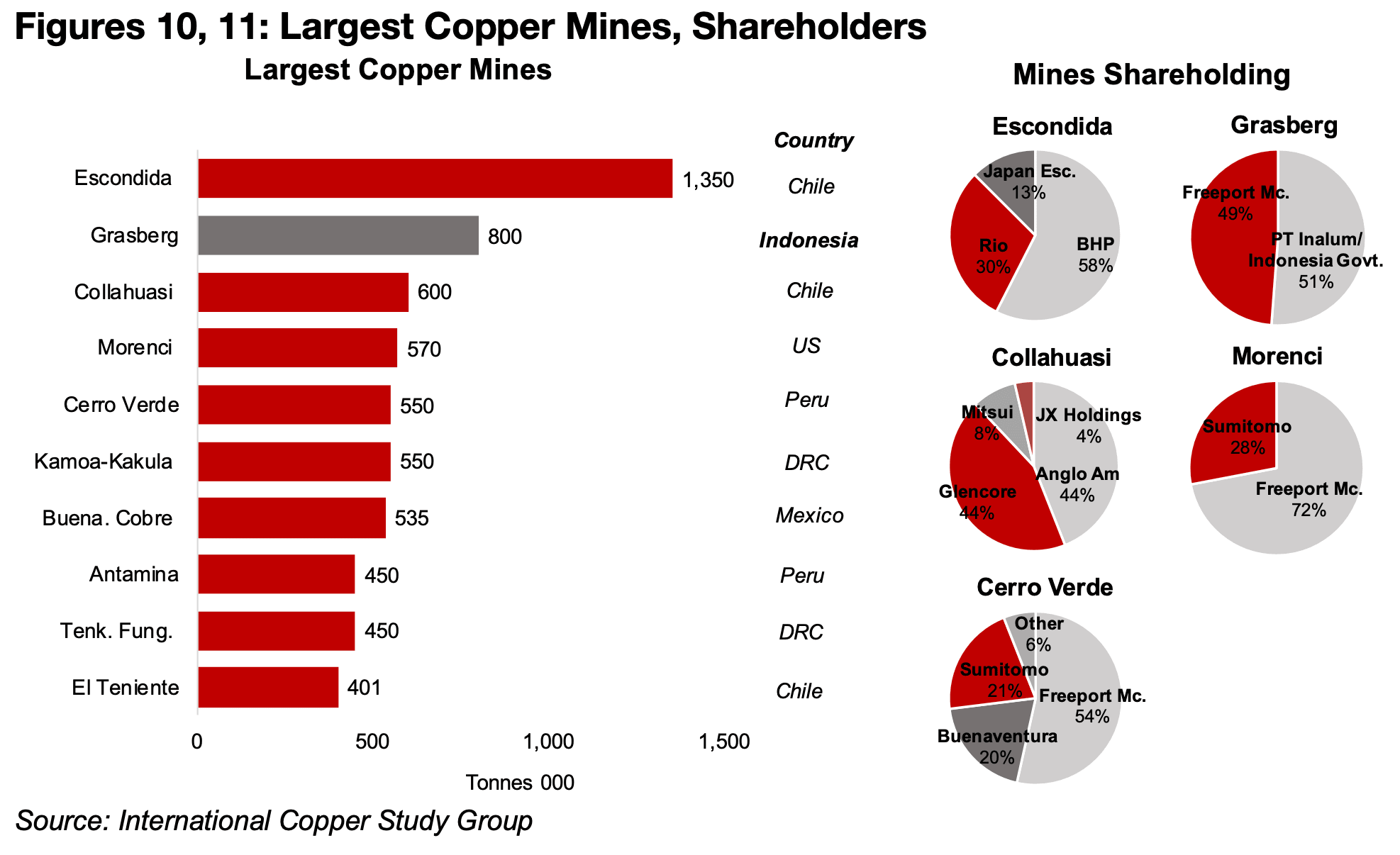

While the rise in the copper price boosted most of the large stocks in the sector, Freeport McMoran slumped, and is now down -11% since June 2025, compared to 49%, 40%, 28% and 12% gains for Antofagasta, First Quantum Minerals and Southern Copper and Teck (Figures 8, 9). This is because the company is a major shareholder of the Grasberg mine which suffered the mudslide, the second largest copper mine in the world, with an 800k tonne capacity (Figure 10).

Freeport McMoran’s share of Grasberg is 49%, with PT Inalum and local

governments in Indonesia holding 51% (Figure 11). Production was halted at

Grasberg on September 8, 2025, after the mudslide to allow for rescue efforts for

workers. The company this week declared ‘force majeure’

, which was the main driver

of the over -20% decline in its price. This allows companies to not deliver on contracts

in the case of extreme events that that cannot be controlled, including natural

disasters. The company also expects that copper output from the mine will be very

low for the rest of this year as even the parts of the mine not affected by the mudslide

will not be able to restart operations until the middle of Q4/25.

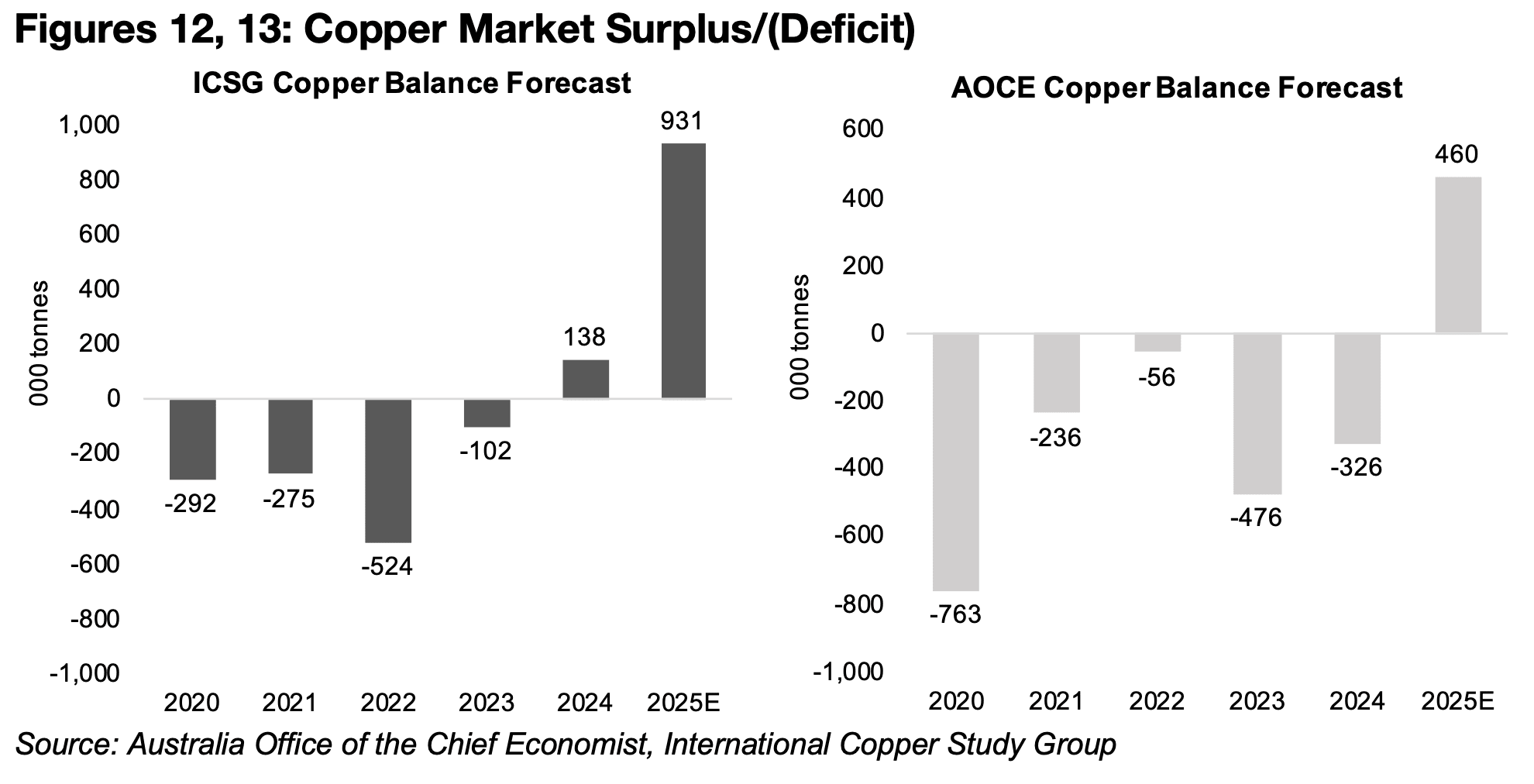

This has led to many market estimates for global copper output in 2025 and even into

2026, to be reduced substantially, and return to normal only in 2027. Currently the

International Copper Study Group (ICSG) forecasts a surplus for the copper market

of 931k tonnes and Australia’s Office of the Chief Economist (AOCE) estimates a 460k

tonne surplus (Figures 12, 13). However, these estimates were released prior to the

Grasberg mudslide and are likely to be revised down substantially. Some estimates

are for a 200k-tonne or more decline in output from Grasberg this year, which would

cut the AOCE surplus for 2025E nearly by half, although the ICSG forecast would

remain relatively high, at around 700k tonnes.

However, there has also been a temporary shutdown of other major copper capacity,

Hudbay Minerals’ Constancia mill in Peru after political protests, which has around

100k tonnes of output per year, and could further reduced the copper market surplus.

Overall there could be upward pressure on the copper price from the supply side for

the rest of year. However, we still see a chance of weaker than expected global

growth over the next year, which could reduce the demand for copper, and potentially

balance out the expected decline in supply.

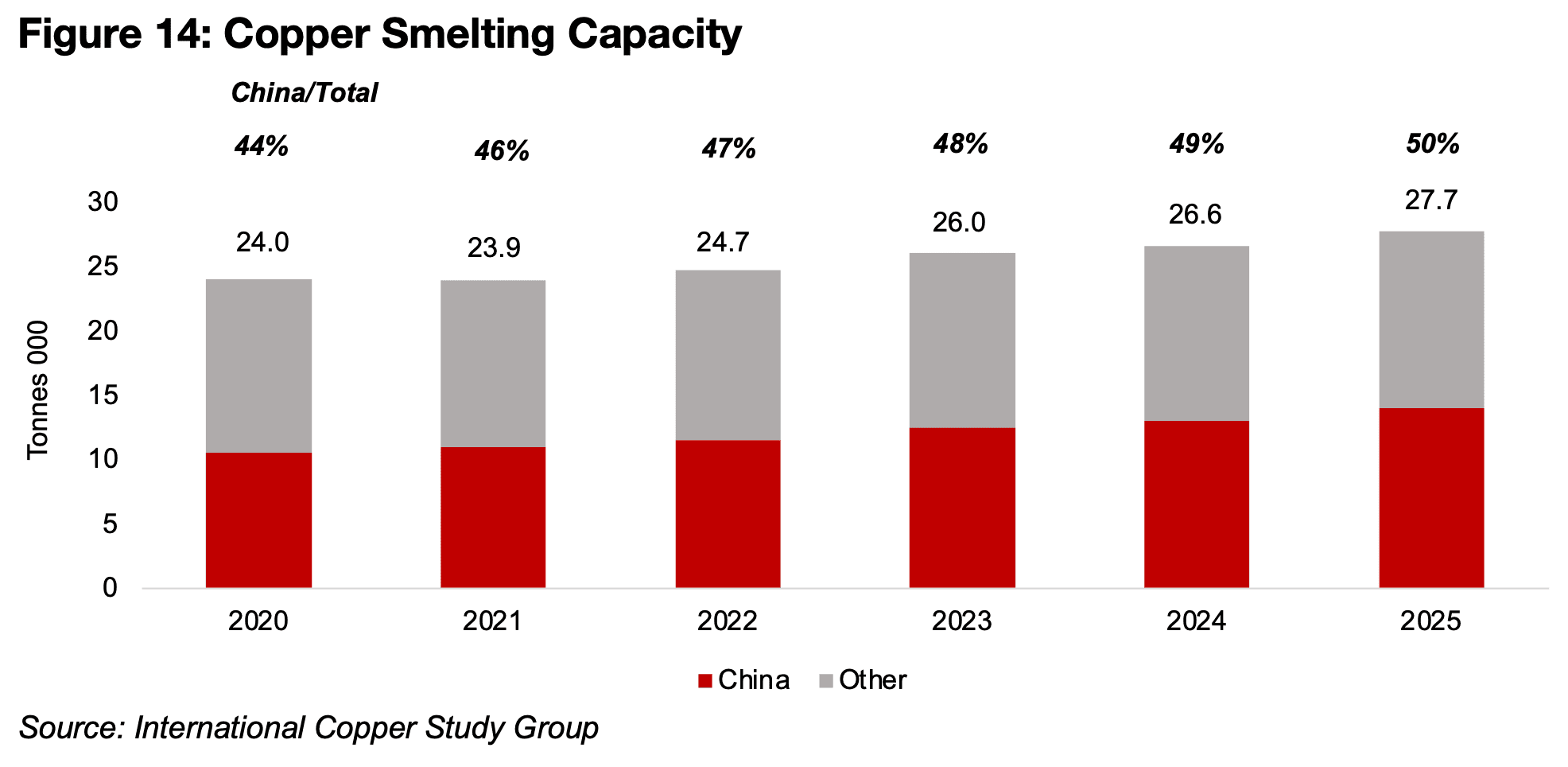

China looks at curbs on copper smelter capacity

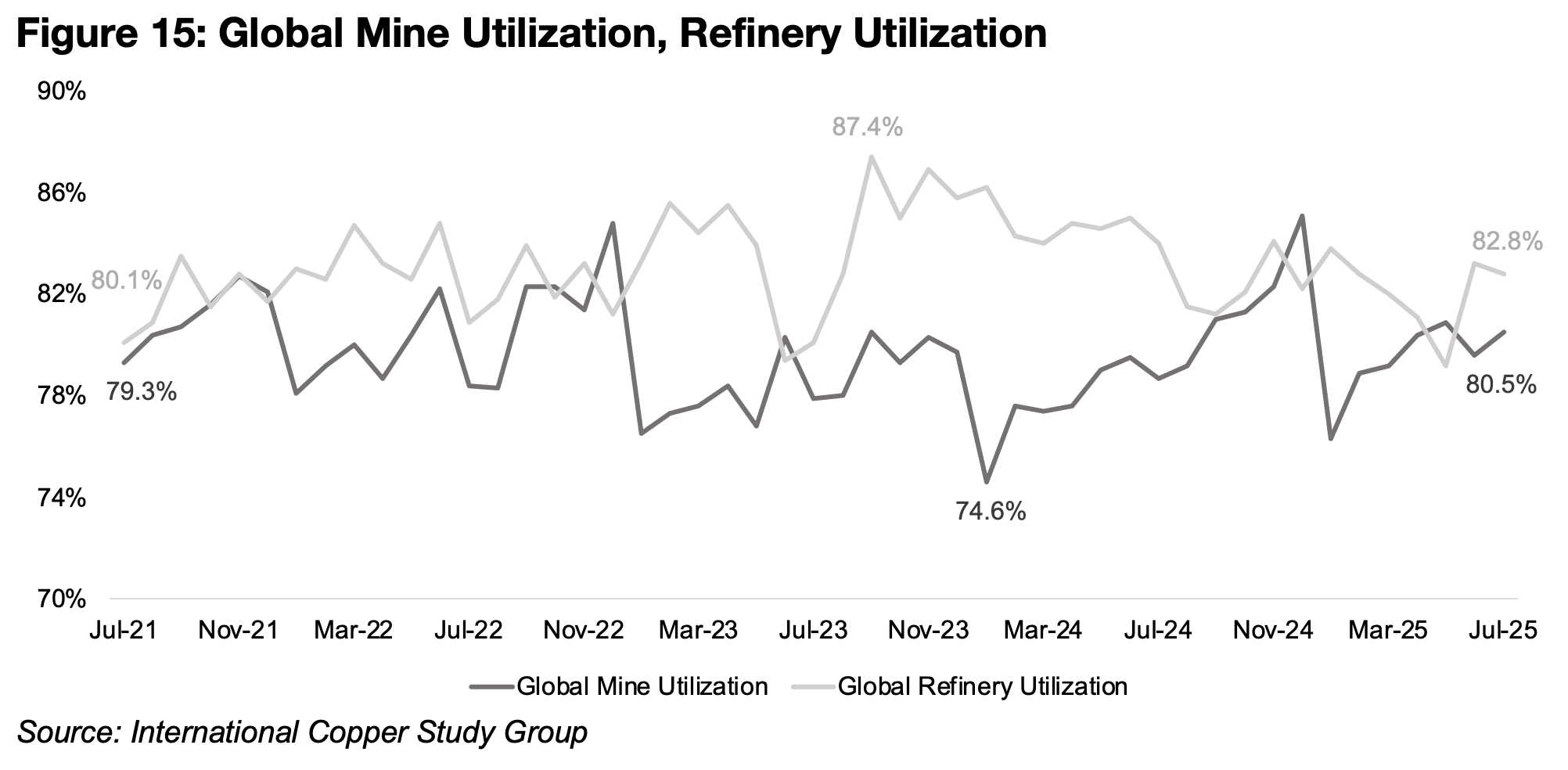

In addition to the disruption to copper mine supply this week, there were also discussions this week in China about difficulties in other parts of the industry, specifically copper smelting capacity. There has been a huge ongoing expansion of capacity in China’s smelter capacity, which is expected to see it rise to 50% of the global total this year, up from 44% in 2020 (Figure 14). For the industry step prior to smelting, which is the extraction directly from mines, global utilization rates have risen from recent lows of 74.6% in January 2024 to 80.5% as of July 2025, although this figure will be likely to decline substantially from September 2025 on the Grasberg shutdown (Figure 15). For the step after smelting, refining, utilization has declined from a recent peak of 87.4% in September 2023 to 82.8%.

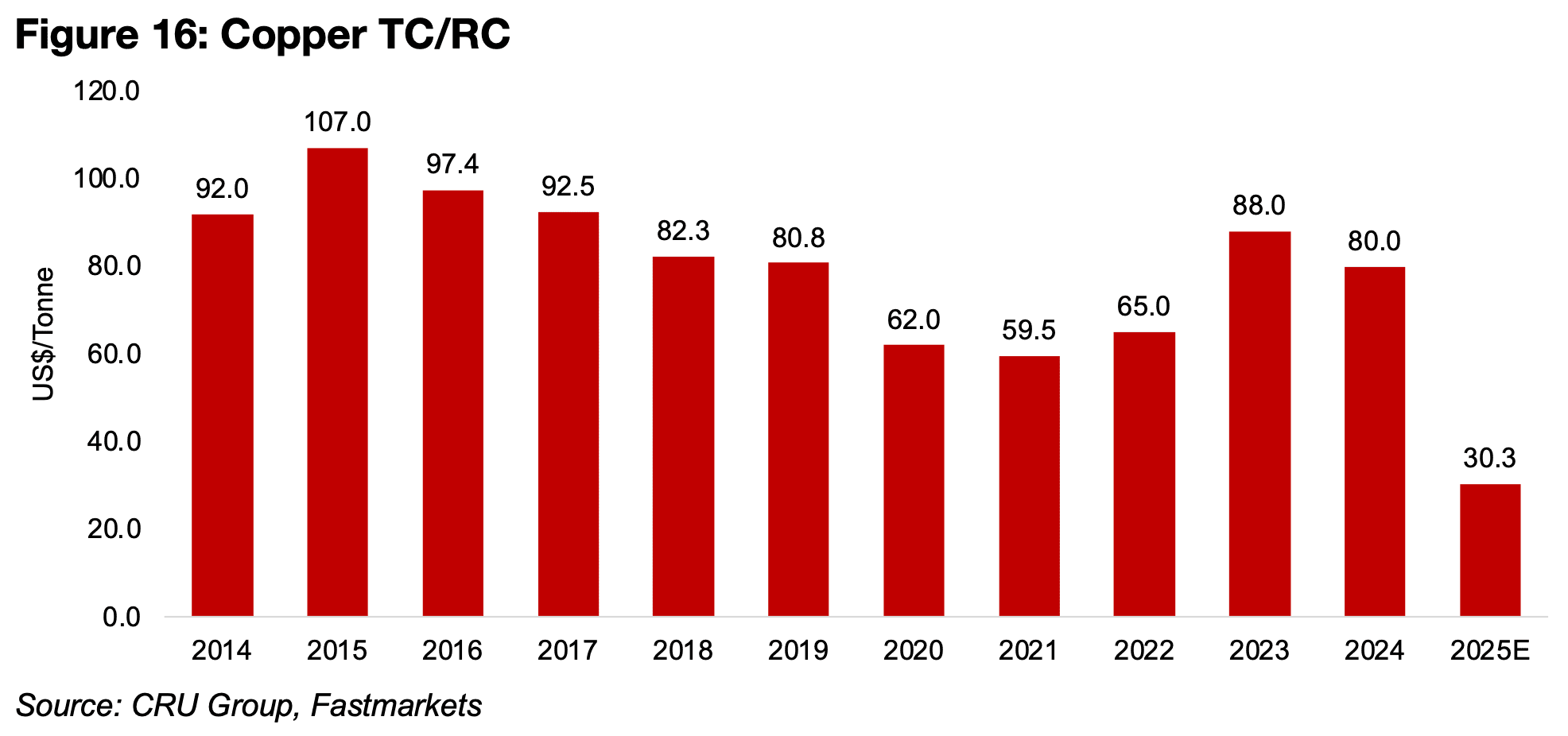

The oversupply of China’s smelting capacity has put major pressure on global copper Treatment and Refining Charges (TC/RC), which are expected to decline to just US$30.3/tonne in 2025 (Figure 16). This is about half the previous lows of around US$60/tonne in 2020 and 2021, which was driven by the global health crisis, with TC/RC historically usually at US$80/tonne or above over the past decade, and peaking at US$107/tonne in 2015. These low rates have led to many smelters operating below profitable levels and driven them to suspending or shutting down capacity. This could further exacerbate the issues of low supply that are likely to be generated by the Grasberg shutdown for the rest of this year and into 2026.

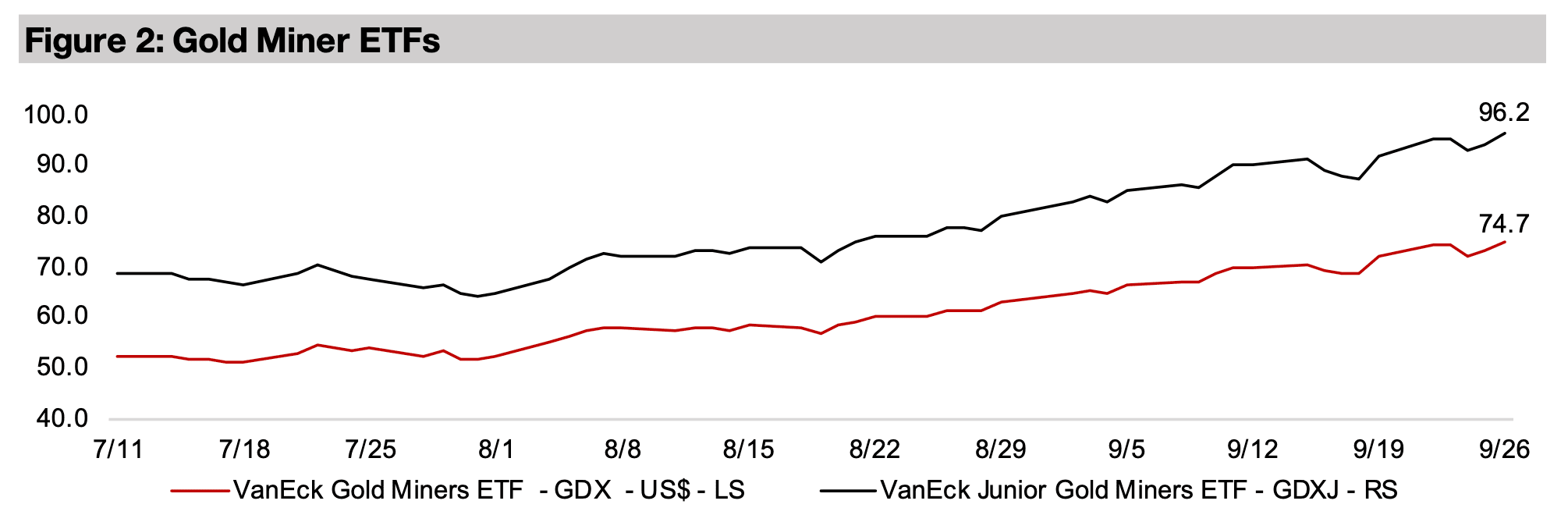

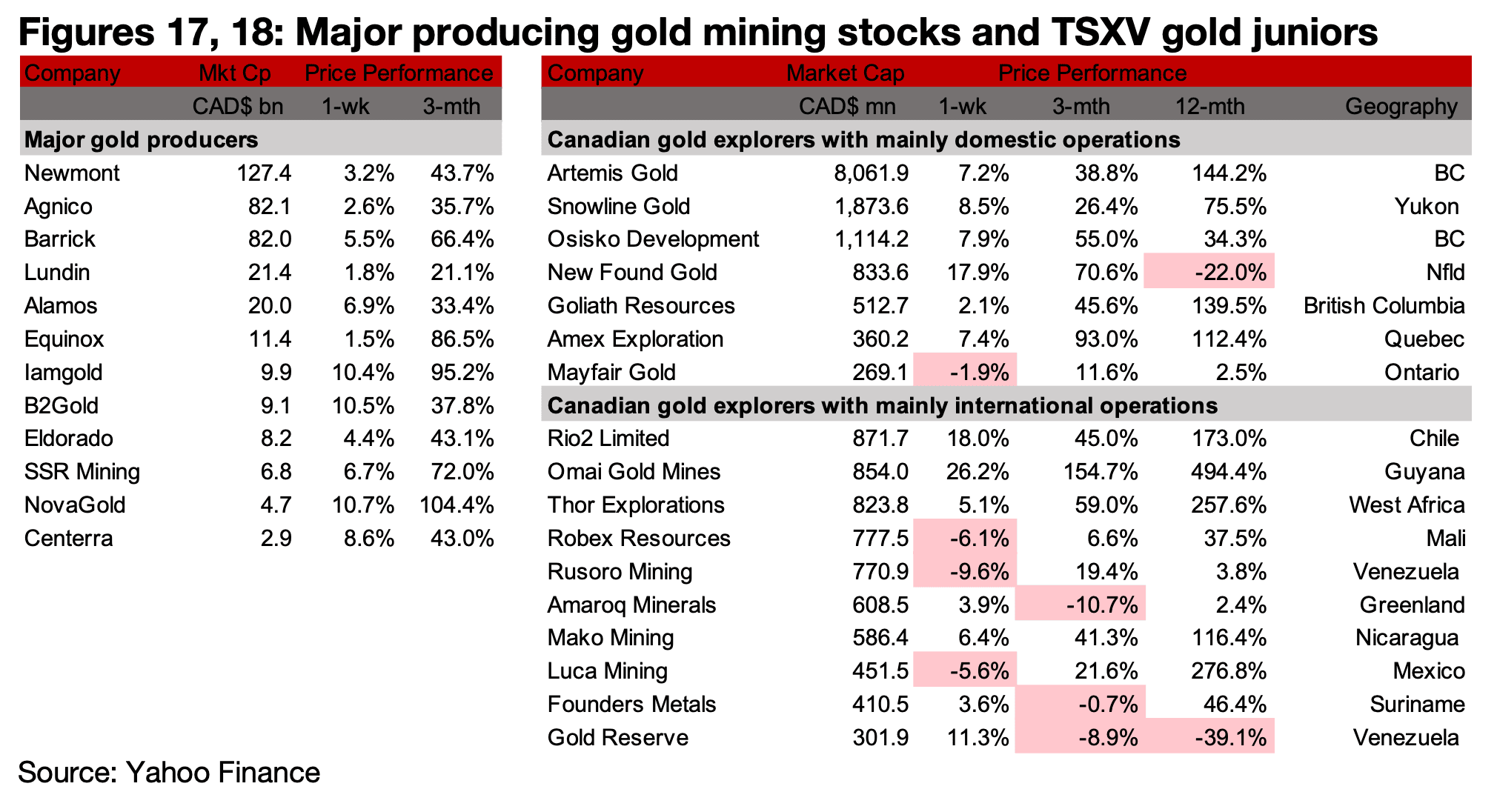

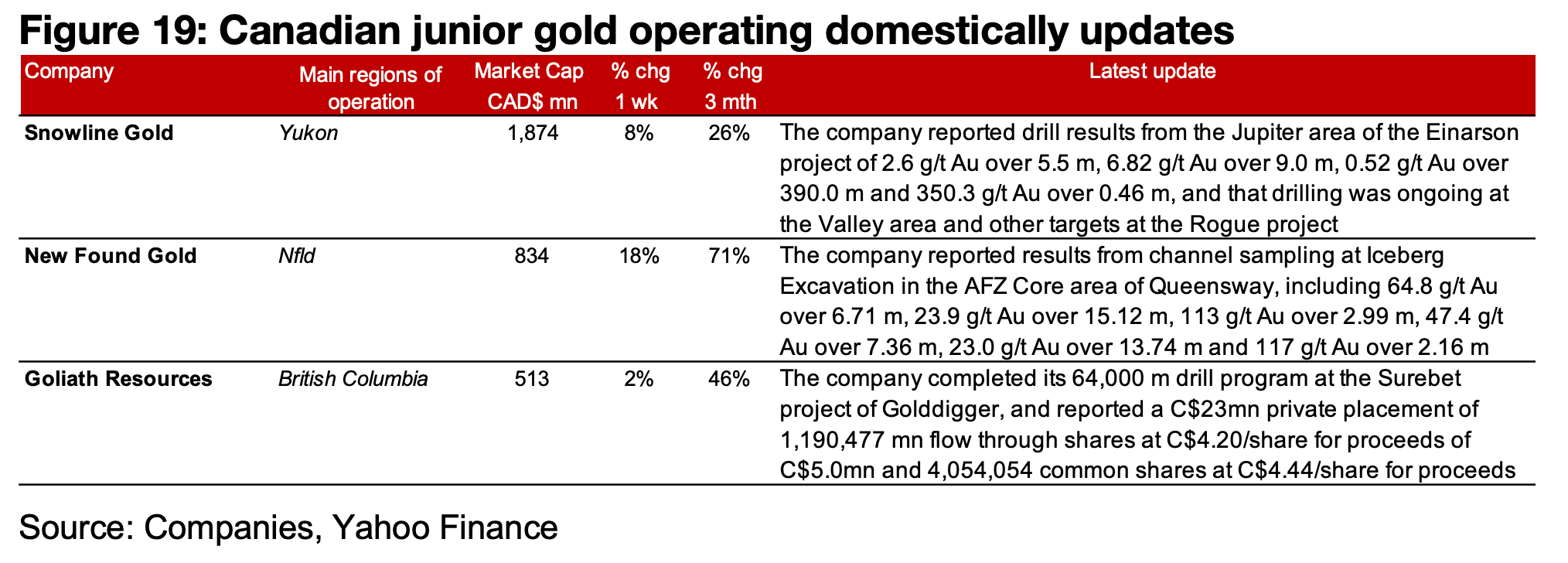

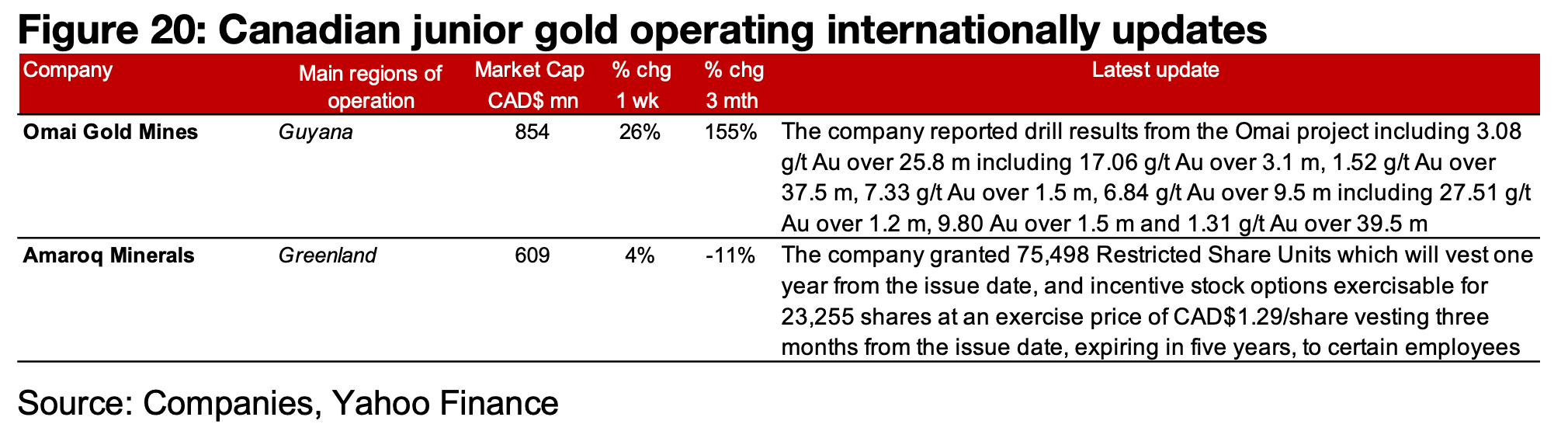

Major producers and most TSXV gold rise

The major producers and most of the TSXV gold stocks were up on the gain in the metal price (Figures 17, 18). For the TSXV gold companies operating mainly domestically, Snowline Gold reported drill results from Jupiter at Einarson and provided an update on drilling at the Valley and other targets of Rogue. New Found Gold reported channel sampling from Iceberg Excavation in the AFZ Core area of Queensway and Goliath completed its drill program at the Surebet project of Golddigger and announced a C$23mn private placement (Figure 19). For the TSXV gold companies operating mainly internationally, Omai reported drill results and Amaroq granted Restricted Share Units and incentive stock options (Figure 20).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.