September 22, 2025

Gold Rise Slows After Fed Hike

Author - Ben McGregor

Gold ascent moderates as Fed makes expected cut

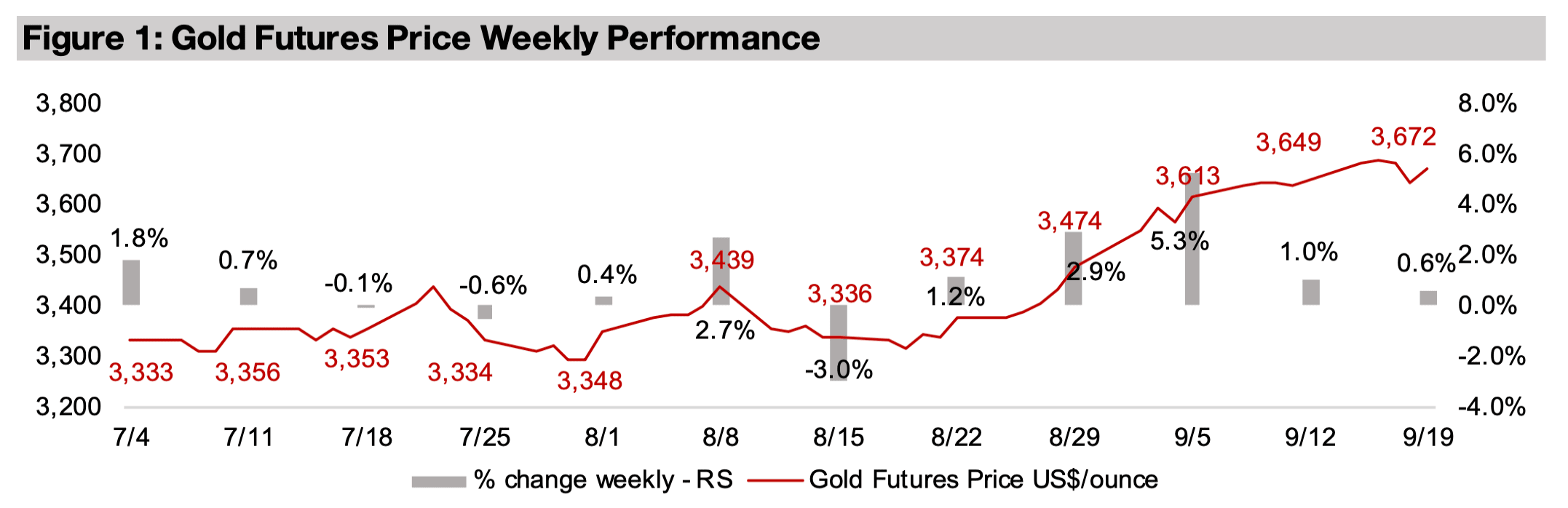

Gold rose 0.6% to US$3,672/oz, with the rate of increase slowing for the second week, after the Fed cut rates 0.25% as widely expected, which had likely largely been priced into the metal already, along with two more quarter-point cuts this year.

Gold Rise Slows After Fed Hike

The gold price edged up 0.6% to US$3,672/oz, with the rate of its ascent slowing for

a second week after a major month-long run has seen it finally exit a previous

US$3,200/oz-US$3,400/oz range that had lasted four months. This came even as the

US Fed cut rates by 0.25% and finally joined other major central banks which have

all made major rate reductions over the past year. While it might have been expected

that the move would have given the metal more of a boost, it was widely expected

and likely priced in, as are an additional two 0.25% cuts this year. This is the second

week that metal has neared the US$3,700/oz level, which could prove to be the new

benchmark for gold for the time being.

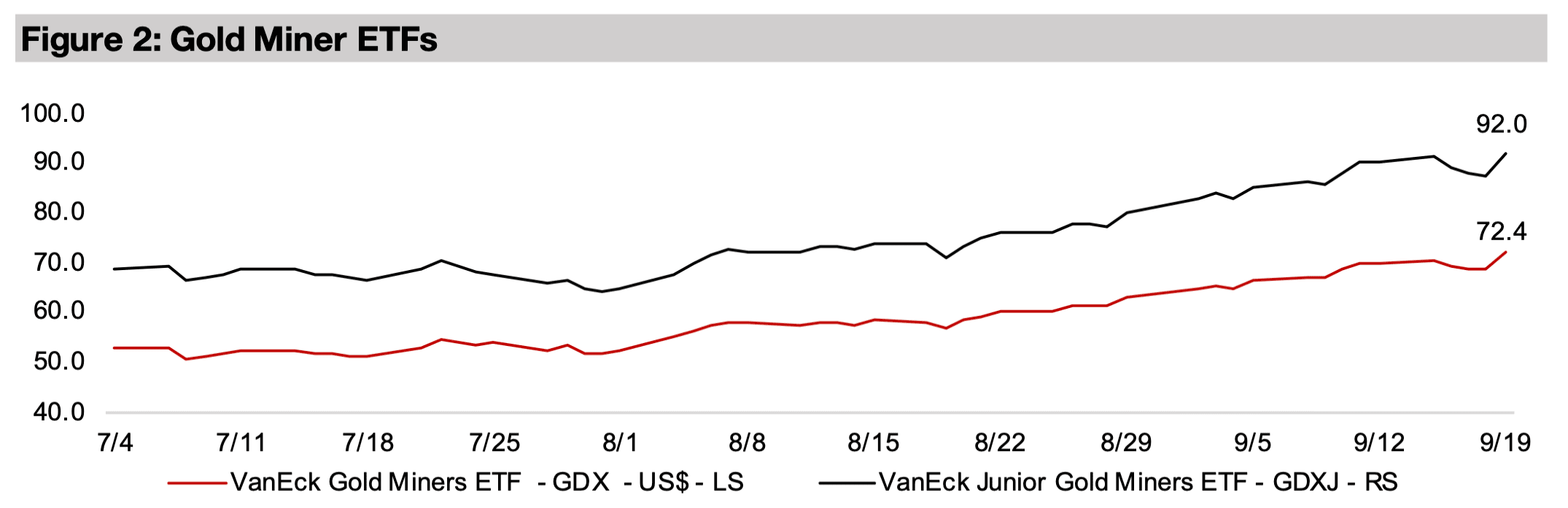

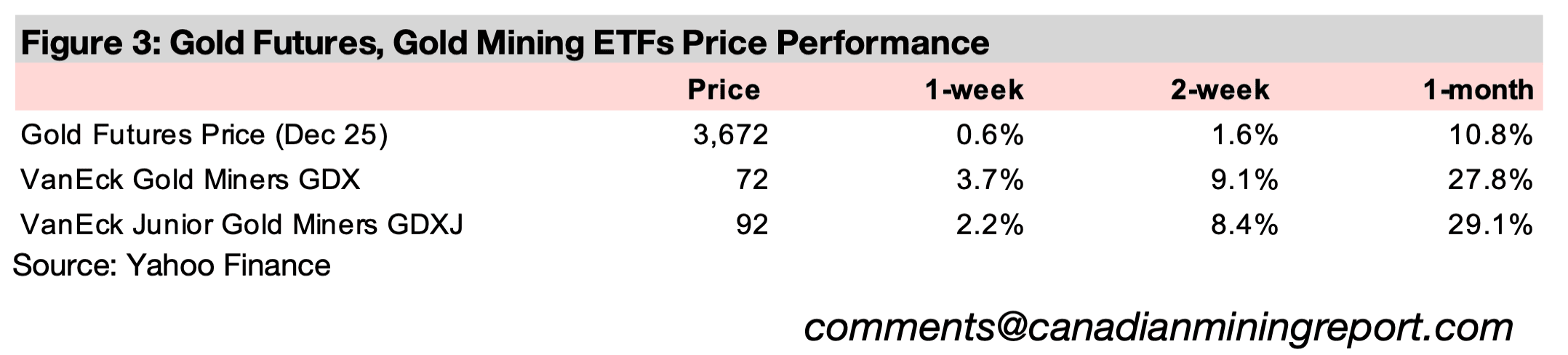

Equities rose, with the S&P 500 up 0.9% and both the Nasdaq and Russell 2000

jumping 1.8%, for the third week of a risk on rally. However, the markets continued

to hedge with gold stocks, with the GDX up 3.7% and GDXJ rising 2.2%, with both

outperforming markets and hitting new highs. While two of the other precious metals,

silver and platinum, outperformed gold, up 1.2% and 0.8%, palladium declined -5.0%.

The palladium slump came mainly after weak economic data from China, which

accounts for the largest proportion of the metal’s demand. The base metals did not

get significant relief from the cut overall, with iron ore up 0.6%, but copper near flat,

up 0.1%, aluminum down -0.6% and nickel declining -0.7%.

Silver outpaces major metals in recent months

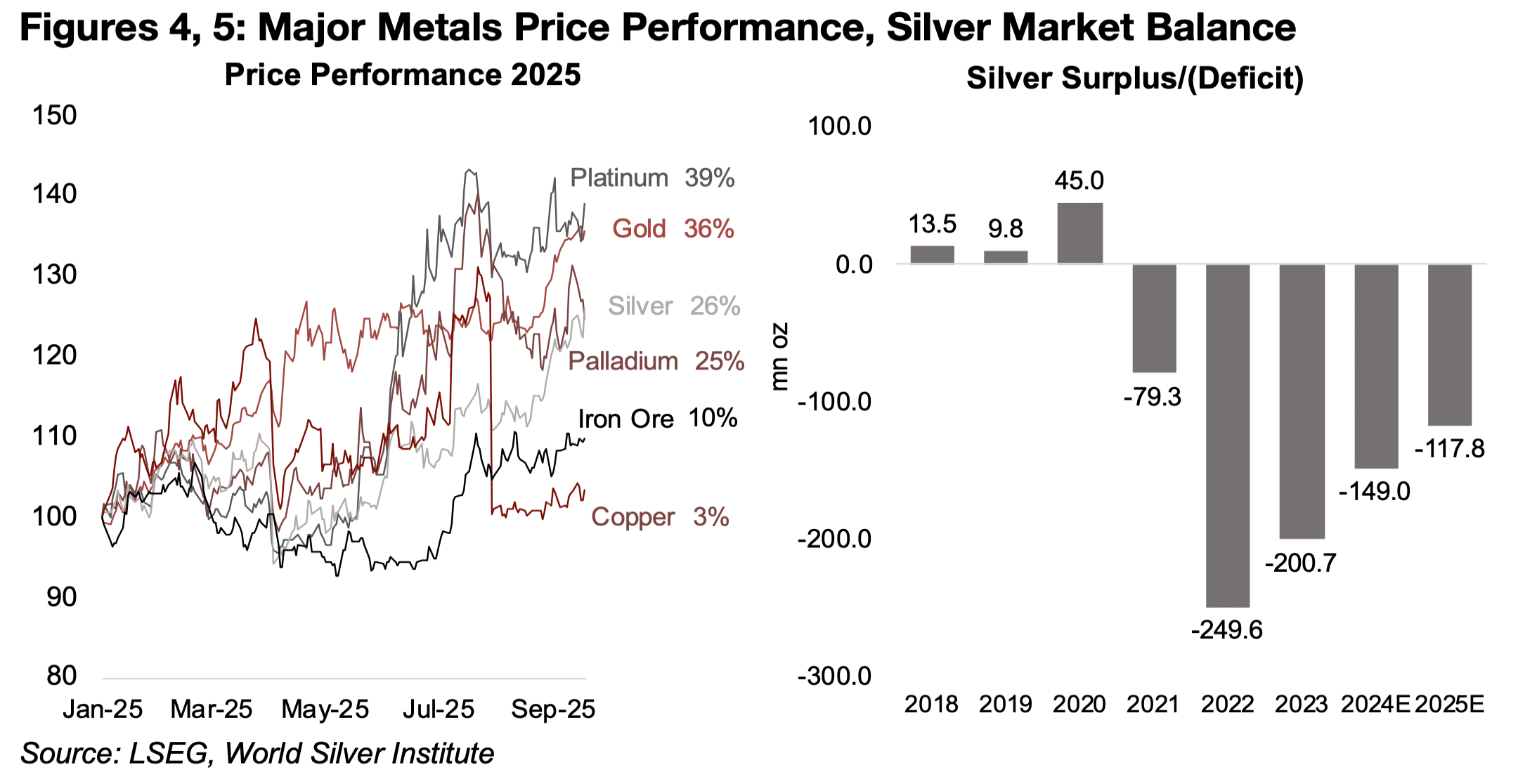

Even with gold’s 10.3% move over the past month, it has still been outpaced by silver,

which is up 13.2%, doubling the 6.5% gain in platinum and quadrupling the 3.1% rise

in palladium. This has led to a 26% rise in silver year to date, now just ahead of

palladium’s 25% gain, but still below the 36% rise in gold and 39% surge in platinum

(Figure 4). Silver had been a significant laggard earlier this year, and even as of May

2025 was far behind gold, driving the ratio between the metals to extremely high

levels. This fundamental ratio was a major signal at the time that these metals prices

were likely to converge to bring them more towards historical averages. This has

occurred in dramatic fashion over the past three months through a 15% rise in silver,

with gold up 9% after spending the first two months of this period in a holding pattern.

While the surge in silver has been driven partly by the same monetary drivers that

have propelled gold, the metal also has a substantial component of its demand

coming from industrial factors. Overall this year, the industrial component could be

considered a drag overall on the price, as the other base metals which are mostly

entirely driven by these factors, including iron ore, copper and aluminum, have

struggled this year. However, there has been a significant offsetting factor for silver

compared to these other base metals, which is a major expected deficit in the market

for the fifth consecutive year. A deficit of -117.8 mn oz is forecast for 2025, which

while only about half the peak of -249.6 mn oz in 2022, is still large in absolute terms

(Figure 5).

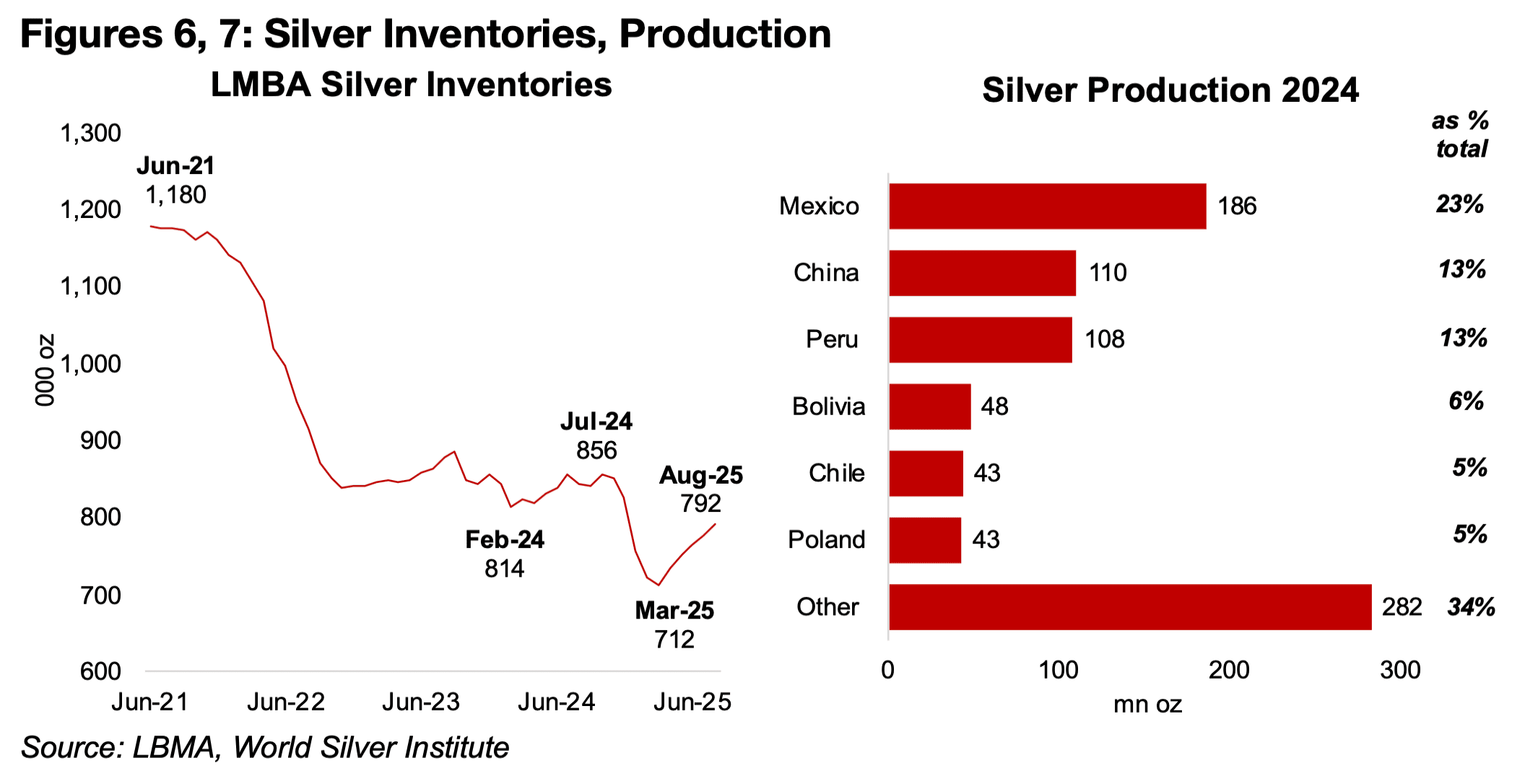

The most recent data on the metal is the silver inventories reported by the LBMA, which have increased to 792k oz as of August 2025 from 712k oz as of March 2025 (Figure 6). However, they are still -33% down from June 2021 levels of 1,180k oz and moderately below the 832k oz average since 2023 (Figure 6). While this indicates that industry production has been strong enough to pull inventories out of a major decline earlier this year, overall the silver market remains under considerable pressure on the supply side, as it has been for several years. Any significant inventory rebuild will likely rely heavily on the world’s largest producers of silver, Mexico, China, Peru, Bolivia and Chile, which comprised 60% of 2024 global output (Figure 7).

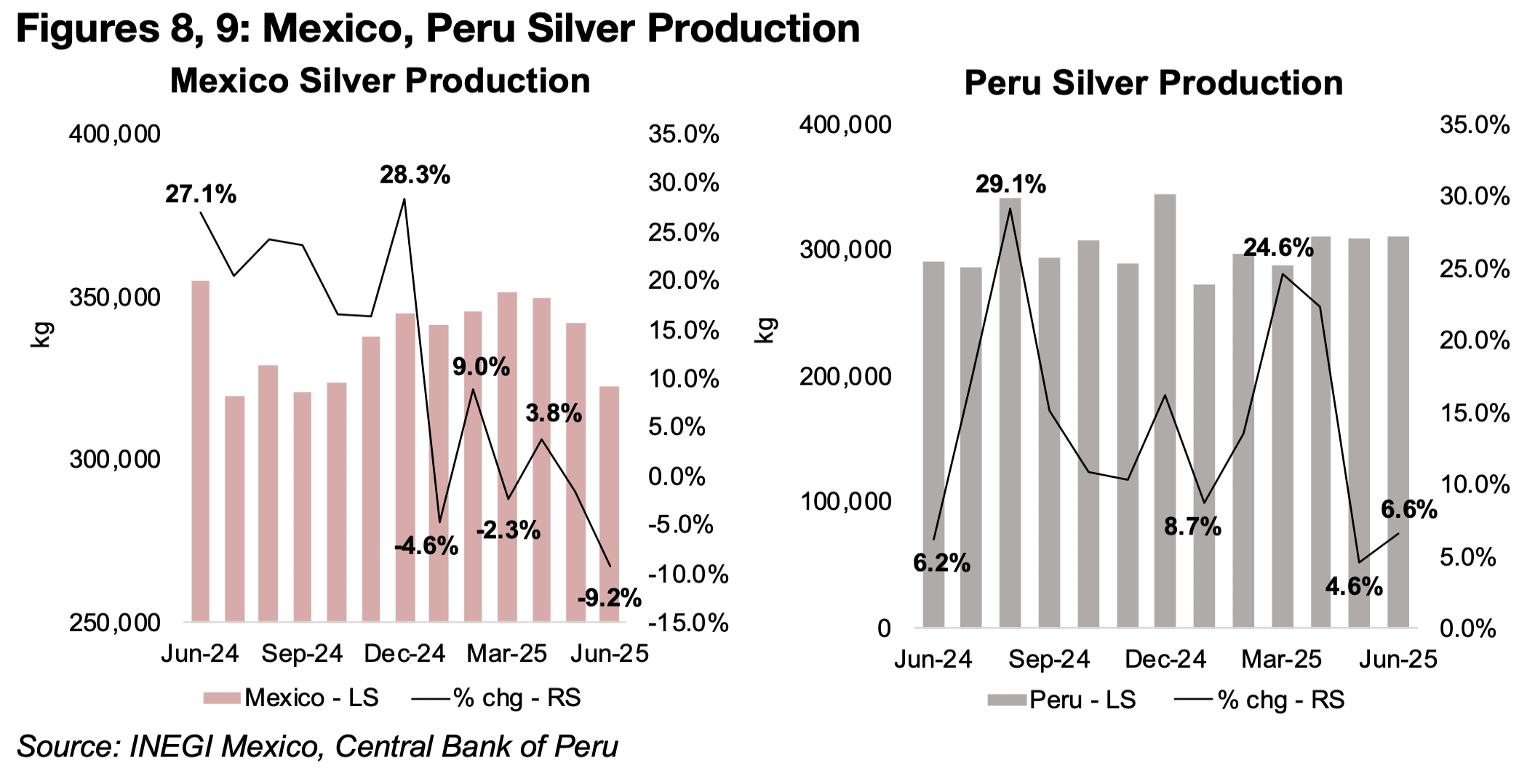

Two of the top three global producers, Mexico and Peru, accounting for 23% and 13% of silver output in 2024, report monthly production silver production statistics, with the most recent data from June 2025. Silver production in Mexico, the largest global producer, declined significantly in June 2025, down -9.2%, and has been relatively weak for most of 2025 (Figure 8). Output from Peru was still expanding in June 2025, by 6.6%, up from a low for the year of 4.6% in May 2025, but it is well off its highs of 24.6% growth in March 2025, and the trend so far this year has been downward overall (Figure 9). While these two countries only represent about a quarter of global production, this data does not contradict the broader expectations for a major silver deficit this year.

Surging silver drives up sector stocks

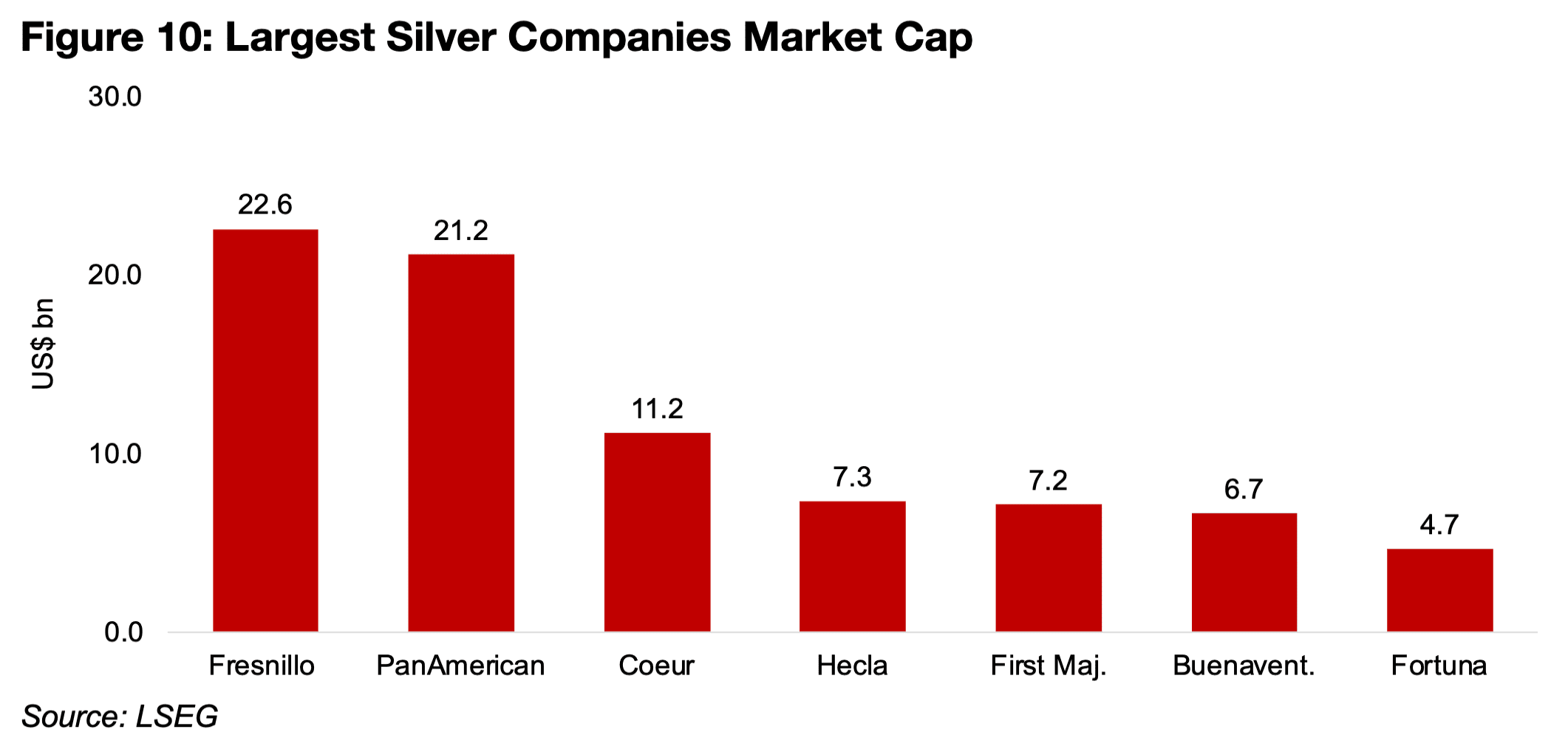

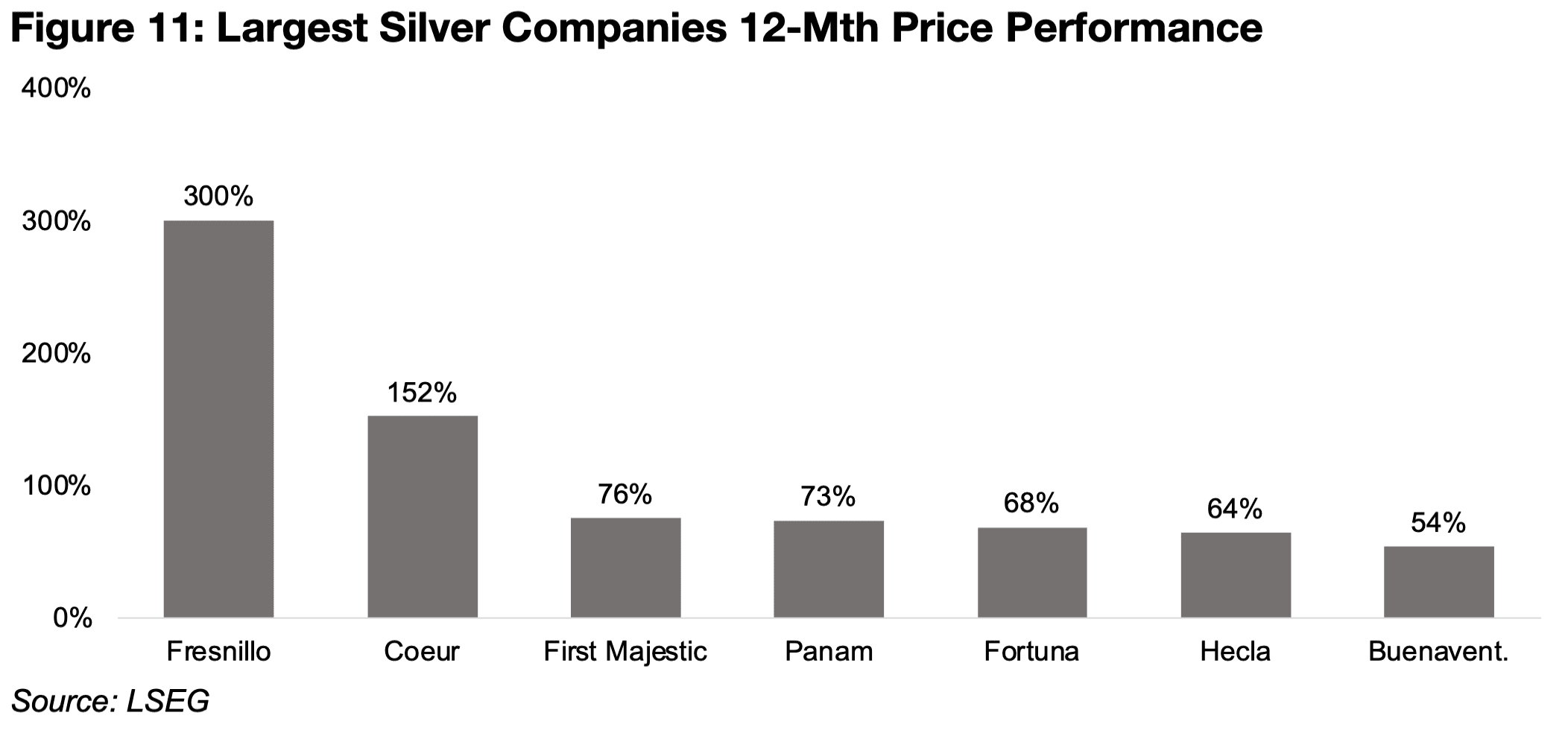

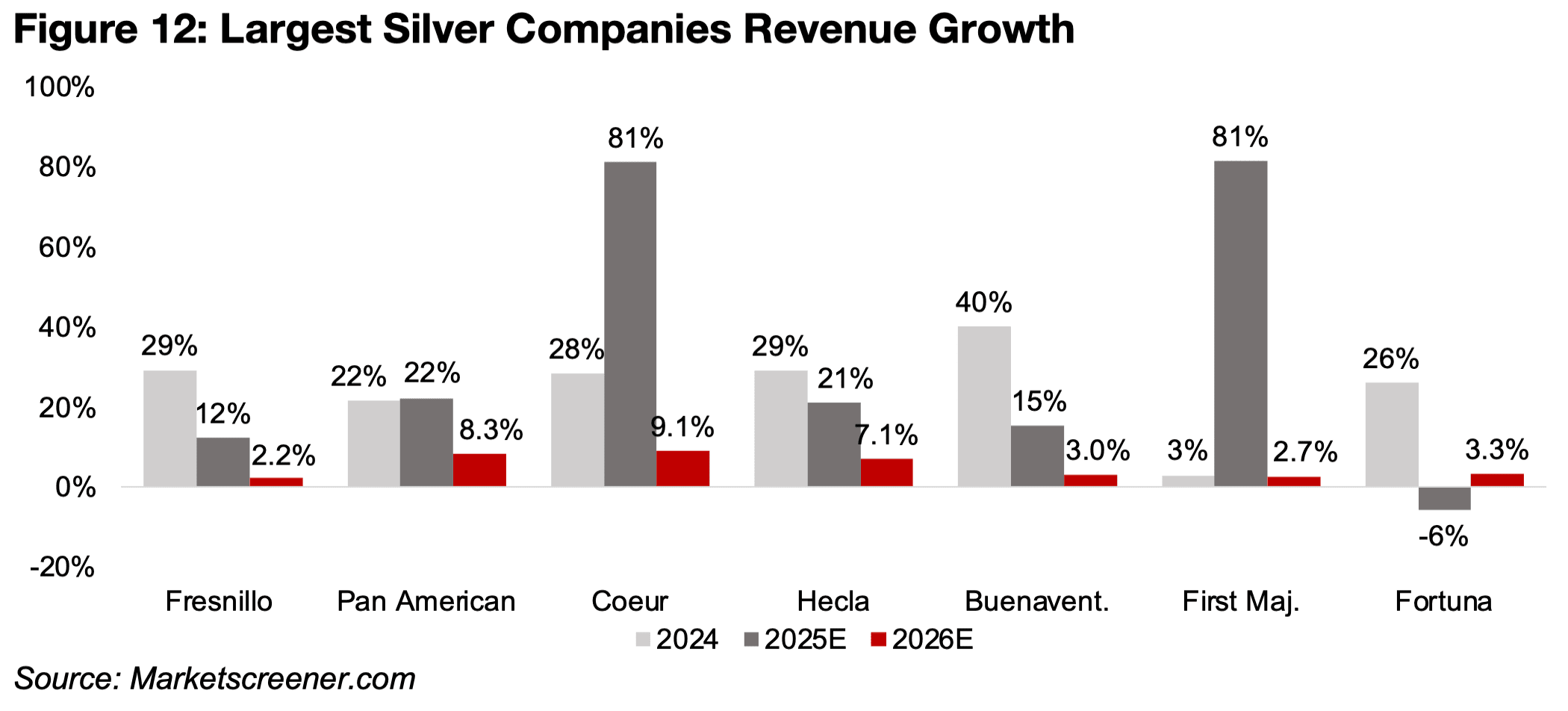

The jump in the silver price has driven up stocks in the sector substantially, with all

of the major producers up over 50%, and two of the largest by market cap, Fresnillo

and Coeur, up 300% and 152%, respectively (Figures 10, 11). Revenue growth is

actually expected to be relatively moderate for most of the sector this year, especially

in contrast to the gains for gold companies, with most at between 10%-20%, with

only Coeur and First Majestic standing out with sales forecast to increase by over 80%

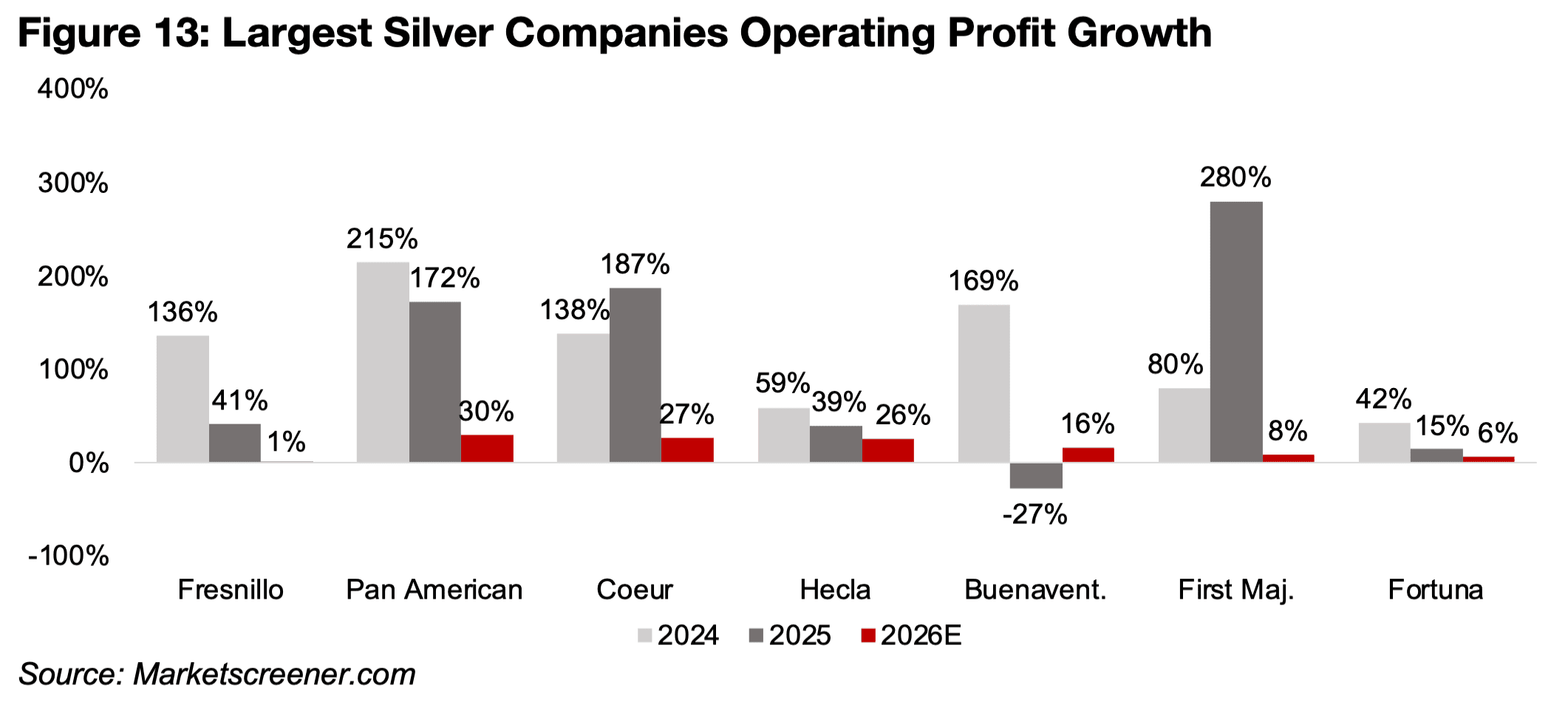

(Figure 12). Even given the high leverage of the sector to a rising silver price, operating

growth expectations are mixed for 2025, again in contrast to the very high estimates

for the gold sector. Three companies have operating profit growth forecasts ranging

between 15%-40%, one has expected losses near -30% and three are expected to

increase over 150% (Figure 13). The expectations for next year are subdued, with

revenue growth ranging from only 2%-9% and operating profit growth from flat to

around 30%.

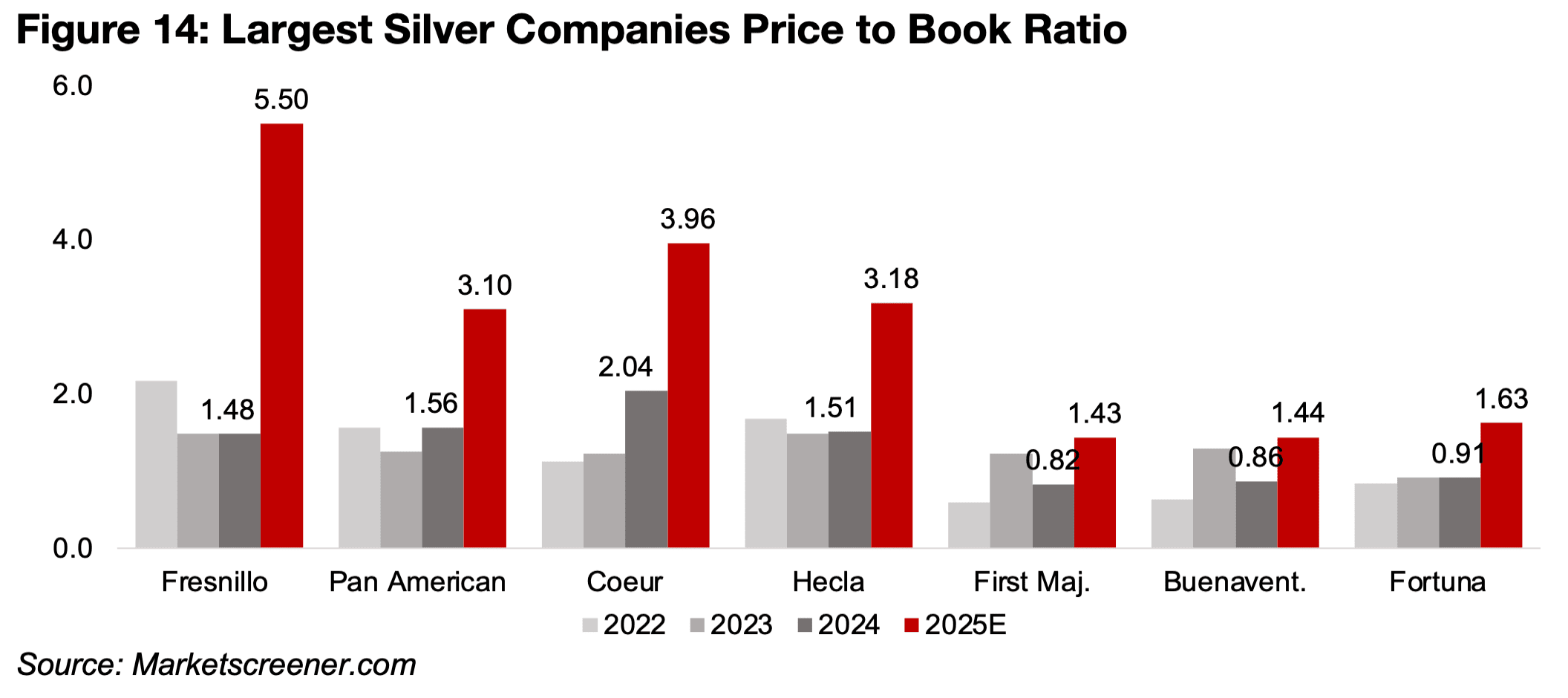

Valuations for the sector have jumped this this year compared to 2024, with several

companies no longer clearly inexpensive, with their price to book (P/B) multiples

ranging from 3.0x-5.5x, up from 1.5x-2.0x last year. However, some of the silver

majors still have relatively low PBs ranging from 1.4x-1.6x, up from below 1.0x last

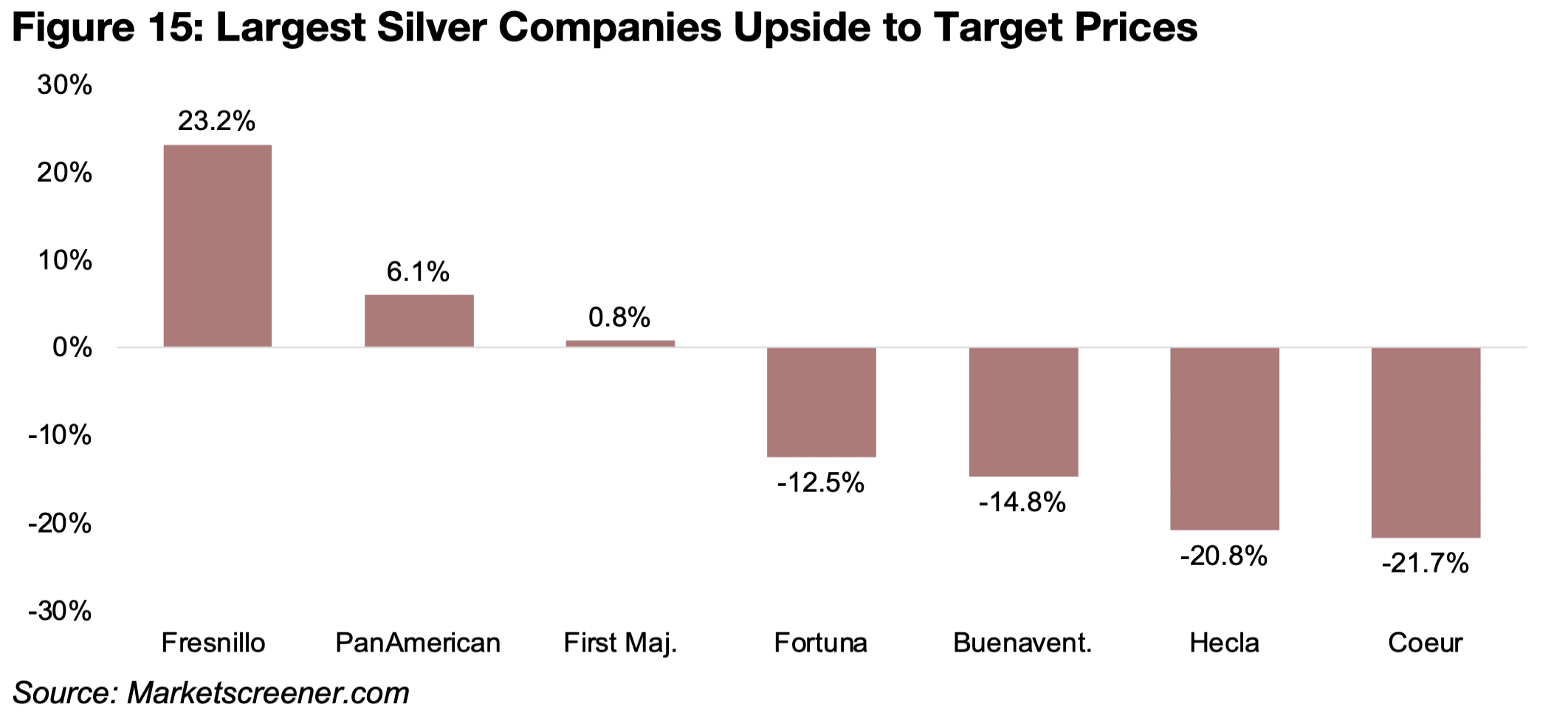

year (Figure 14). Given the relatively low revenue and operating profit growth

expectations for next year and major multiple expansion, the market is viewing many

of these companies as overvalued, with several having substantial downside to their

target prices, with only Fresnillo standing out for its upside, and even this is only just

over 20% (Figure 15).

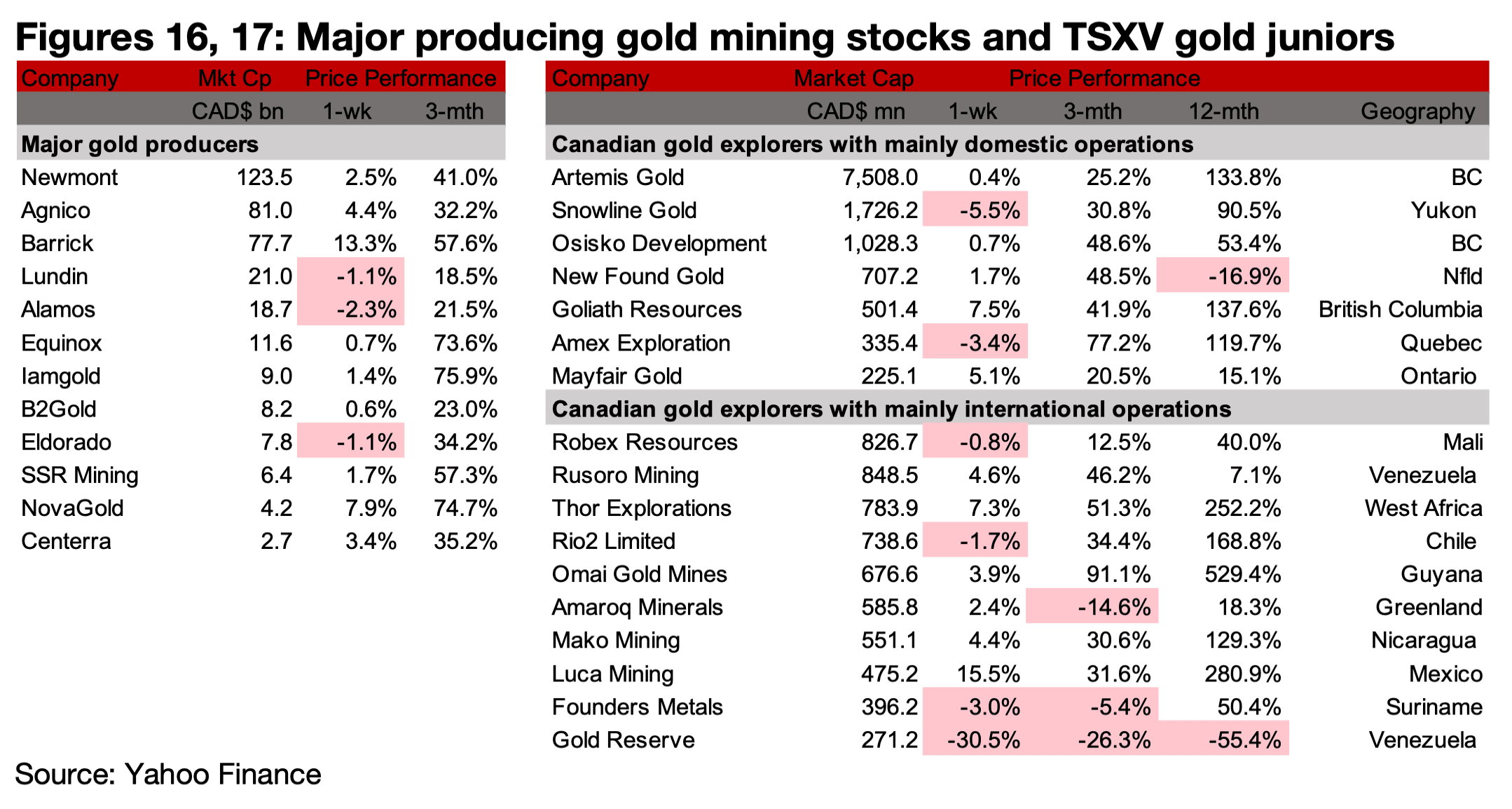

Most major producers and TSXV gold gain

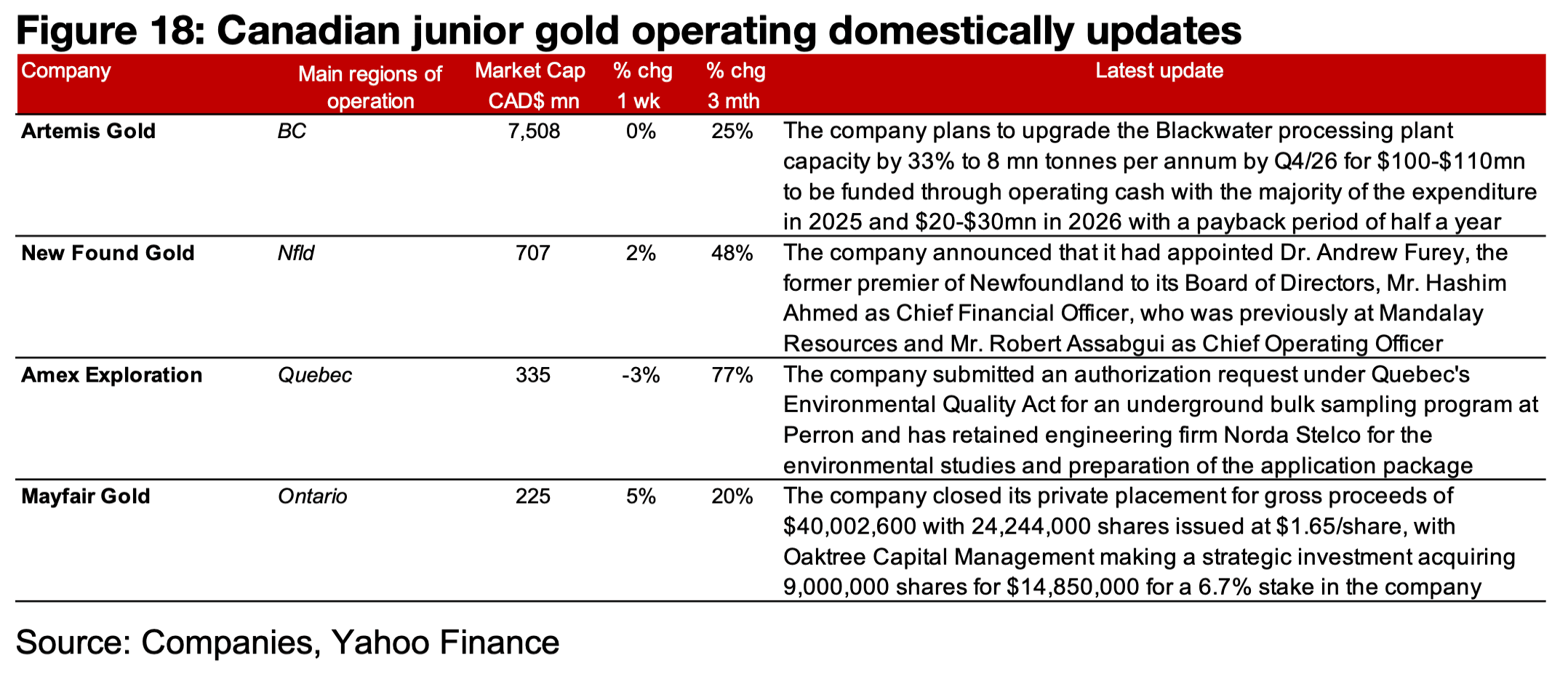

Most of the major producers and TSXV gold increased on the rise in the metal (Figures

16, 17). For the TSXV gold companies operating mainly domestically, Artemis Gold

announced an upgrade of the Blackwater processing plant’s capacity, New Found

Gold made new Board and management appointments, Mayfair closed its placement

for proceeds of $40.0mn, including a 6.7% strategic investment from Oaktree, and

Amex submitted an authorization request under Quebec’s Environmental Quality Act

for a bulk sampling program (Figure 18).

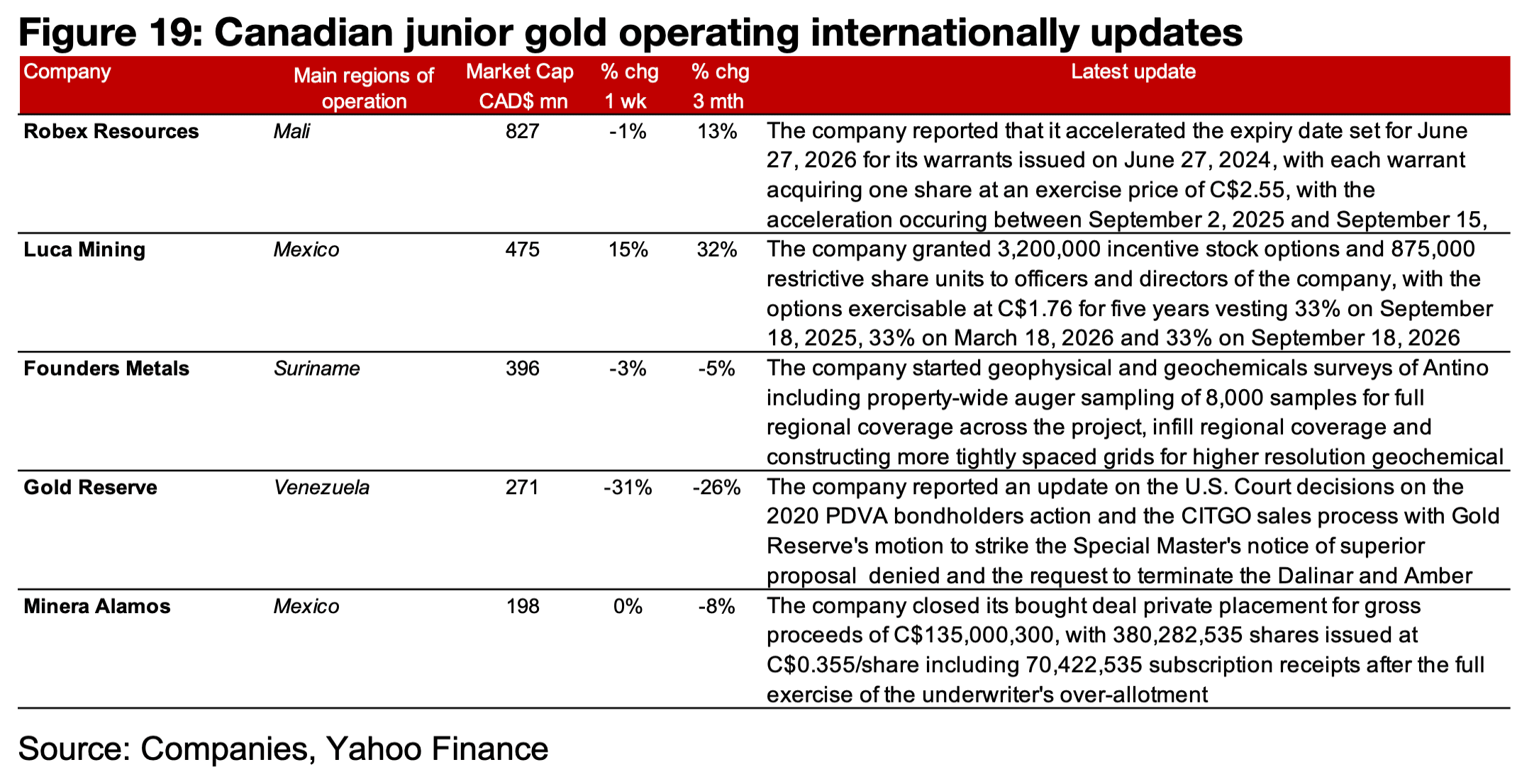

For the TSXV gold companies operating mainly internationally, Robex reported an

accelerated expiry date for its warrants, Luca granted incentive stock options,

Founders started geophysical and geochemical surveys of Antino, Gold Reserve

reported an update on U.S. Court decisions on the PDVA bondholders action and

CITGO sales process and Minera Alamos closed its C$135mn private placement

(Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.