October 02, 2023

Gold Smashed by Dollar and Yields

Author - Ben McGregor

Gold has worst week since late 2021 on high dollar, yields

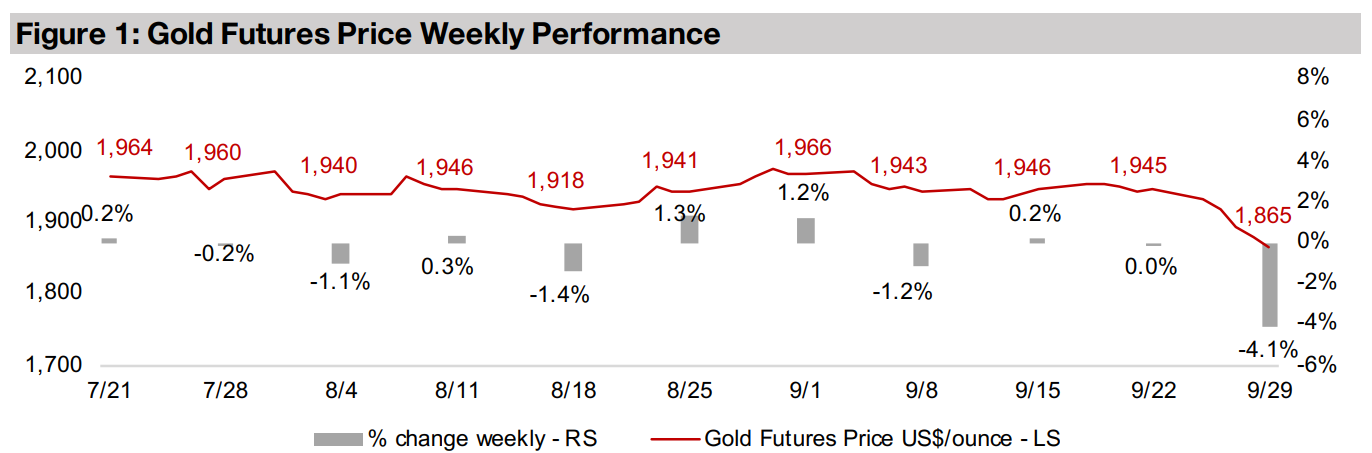

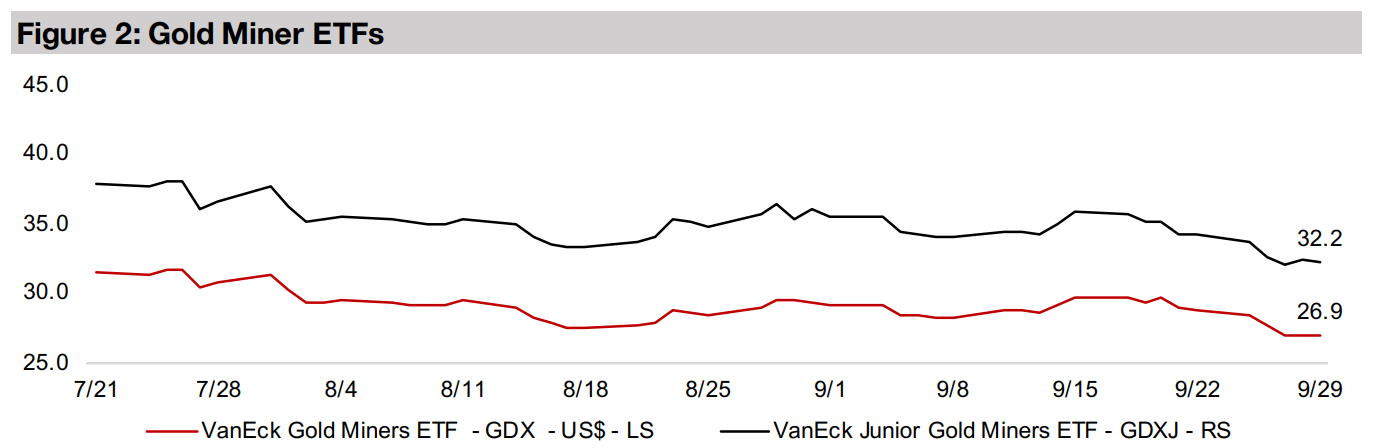

Gold was hit hard this week, down -4.1% to US$1,865/oz, its worst weekly loss since November 2021, with the market finally pricing in rising real yields and a surging US$ and seemingly abandoning its thesis of a soon-to-be-more dovish Fed.

Gold Smashed by Dollar and Yields

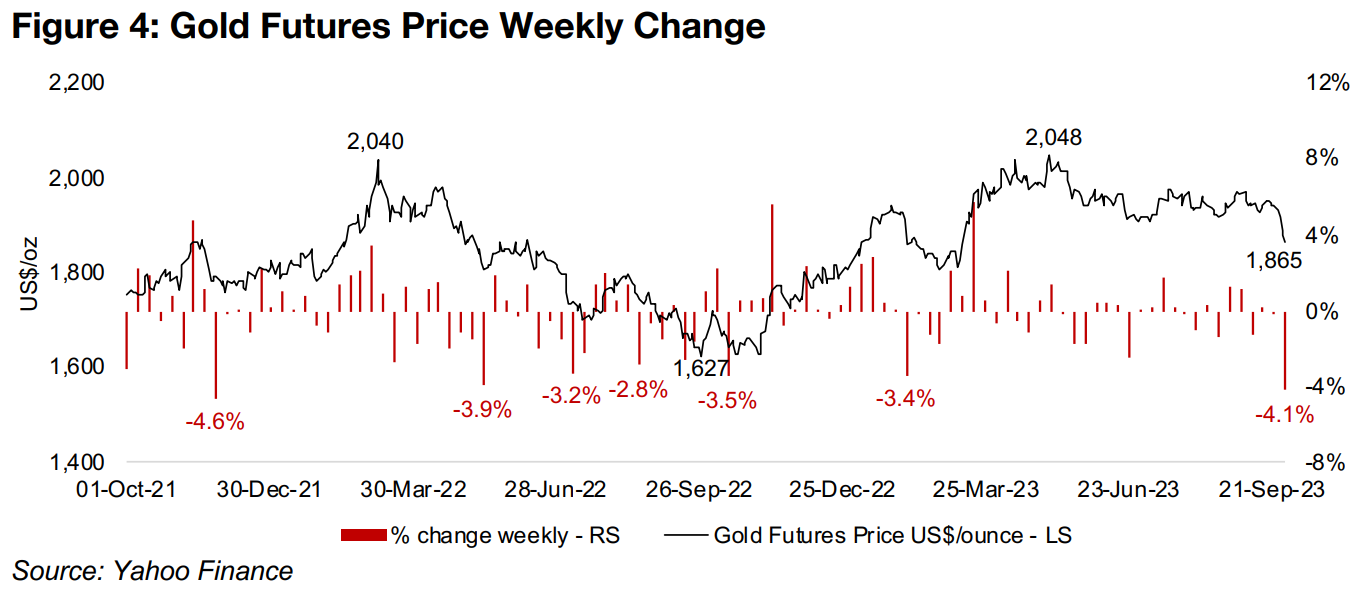

Gold was hit hard, down -4.1% to US$1,865/oz, its worst week since late 2021, and quite a severe decline in the context of the past two years. Gold has had a weekly drop of more than 3.0% in just seven weeks since October 2021, and only one other down move more than 4.0%, a -4.6% fall in November 2021 (Figure 4). While the degree and abruptness of the move was a bit of a shock, we had been highlighting in recent months the resiliency of the gold price even in the face of rising real yields and a resurging US$, which fundamentally should have been leading to downward pressure. We had suspected that perhaps that broader economic and geopolitical risks had been high enough to offset the rising real yields and dollar.

Market seems to have abandoned 'soon-to-be-dovish-Fed' thesis

While we believe that such factors remain prevalent and are likely currently still baked

into the gold price, the US$80/oz loss in gold this week is likely mainly from the loss

of a premium for previous expectations that the Fed would soon turn more dovish.

Recent Fed comments that rates could rise further and will certainly be maintained at

high levels for a very extended period, seems to have finally dashed these hopes.

Currently the market expects over a 4.5% US Effective Federal Funds Rate until end-2024, which is very high in the context of the past thirty years.

We might have expected that if the drop in gold was partly because of a more hawkish

Fed, that stocks would have declined along with gold, but the S&P 500 only edged

down -0.52% this week, and the Russell 2000 small cap index actually rose 0.93%.

This may partly be because stocks already had a very rough month, with the S&P 500

down -5.04% and the Russell 2000 dropping -7.07%, while gold had remained

remarkably flat over the first three weeks of September until the big decline this week.

Investors perhaps had reduced their gold holdings only after selling down equities

first, with the metal finally also losing its ‘dovish-Fed’ premium.

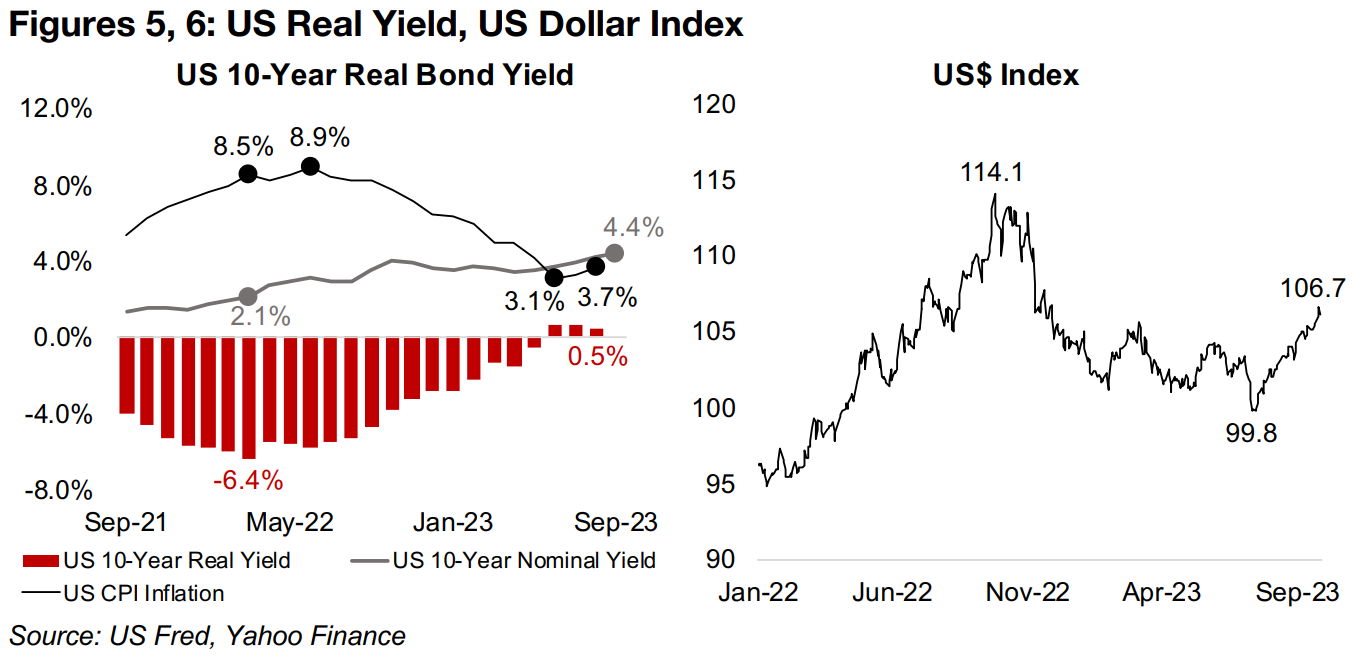

US 10-year real yields turn positive since June 2023

Rising real yields can pressure the gold price because alternative safe assets like bonds become more attractive than yield-less gold. Real yields were heavily negative through 2022, reaching a low of -6.4% in March 2022, with CPI inflation at 8.5% and the nominal US 10-year bond yield at just 2.1% (Figure 5). This meant that the opportunity cost of holding gold, with either physical storage or ETF fees at around 1.0-2.0%, was low. However, CPI inflation peaked at 8.9% in June 2022 and the US 10-year yield continued to rise and real yields turned positive in June 2023, reaching 0.5% in August 2023. This had made holding bonds versus gold far more attractive than a year ago, and with the gold stock valued at US$3trn, versus a US$133trn bond market, a small rise in interest in the latter could drive large outflows from the former.

Dollar resurging as US again pulls ahead in rate hike race

In addition to real yields, a surge in the US$ has also likely helped drive down the

gold price, with the two assets tending to move inversely. The US dollar index spiked

through 2022 to a high of 114.1 in September 2023 as the US raised rates more

quickly than the rest of the world to combat inflation, causing strong fund flows into

the dollar (Figure 6). Through the first half of 2023, however, the rest of the world

started to catch up with hikes of their own, and the index bottomed in July 2023 at

99.8. Over the past quarter the dollar has rebounded, as the US again outpaces the

rest of the world with rate hikes, drawing in funds, and pushing up the dollar.

The move in gold this week was severe enough that it may have ‘caught up’ in pricing

in the building pressure from the rising yields and dollar, and we believe that a boost

could still come from economic or geopolitical fallout over the next year. The data of

the past two years suggest that such severe down weeks for gold are usually followed

by more moderate losses, or even gains, so cooler gold price action is likely.

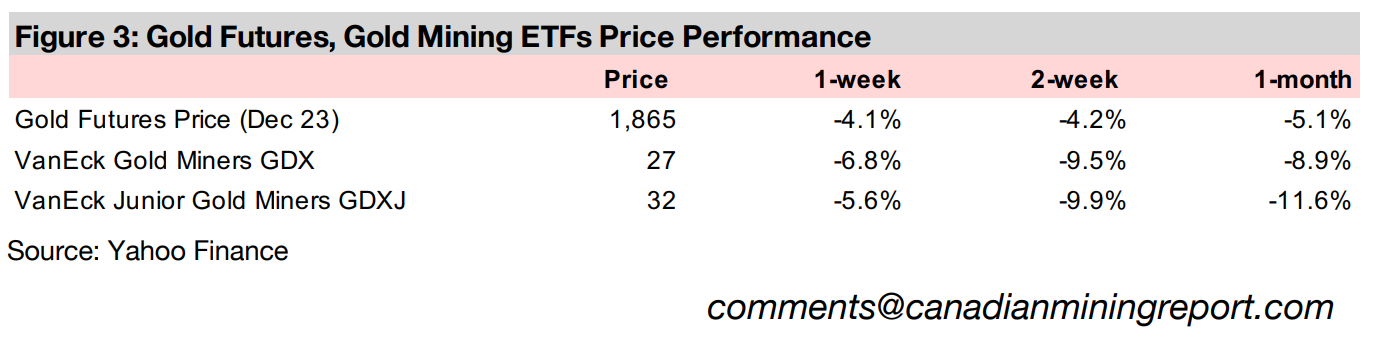

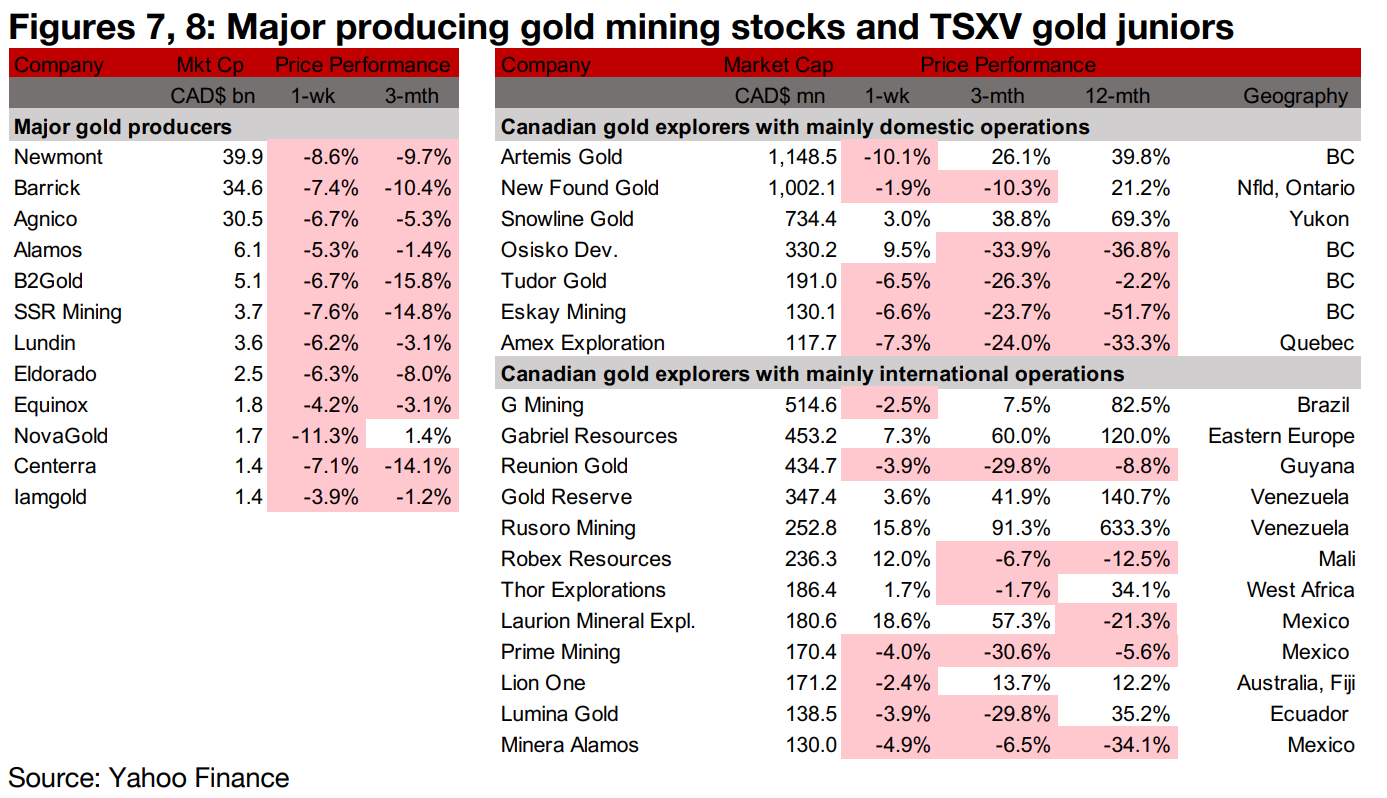

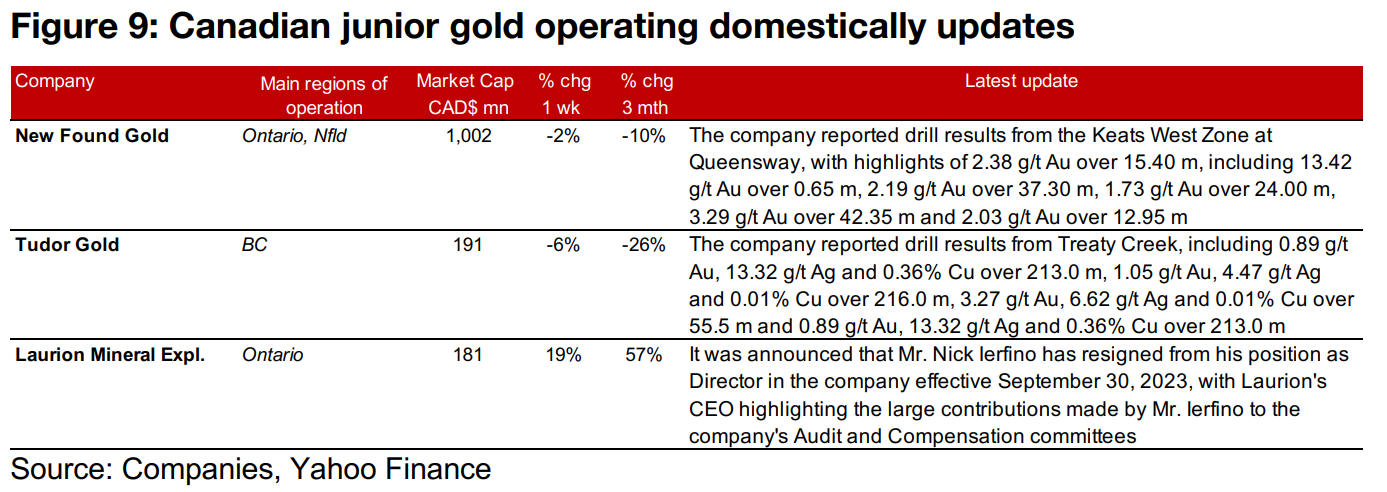

Gold producers slump and TSXV gold mixed with strong gains and losses

The major gold producers slumped, with most down over 5.0%, and larger TSXV gold was mixed with some heavy losses, but also 10.0% or more gains for a few names (Figures 7, 8). For the TSXV gold companies operating domestically, New Found Gold reported drill results from Keats West, Tudor Gold announced drill results for Treaty Creek and Laurion saw the resignation of one of its directors (Figure 9). There were no major updates from the TSXV gold companies operating internationally.

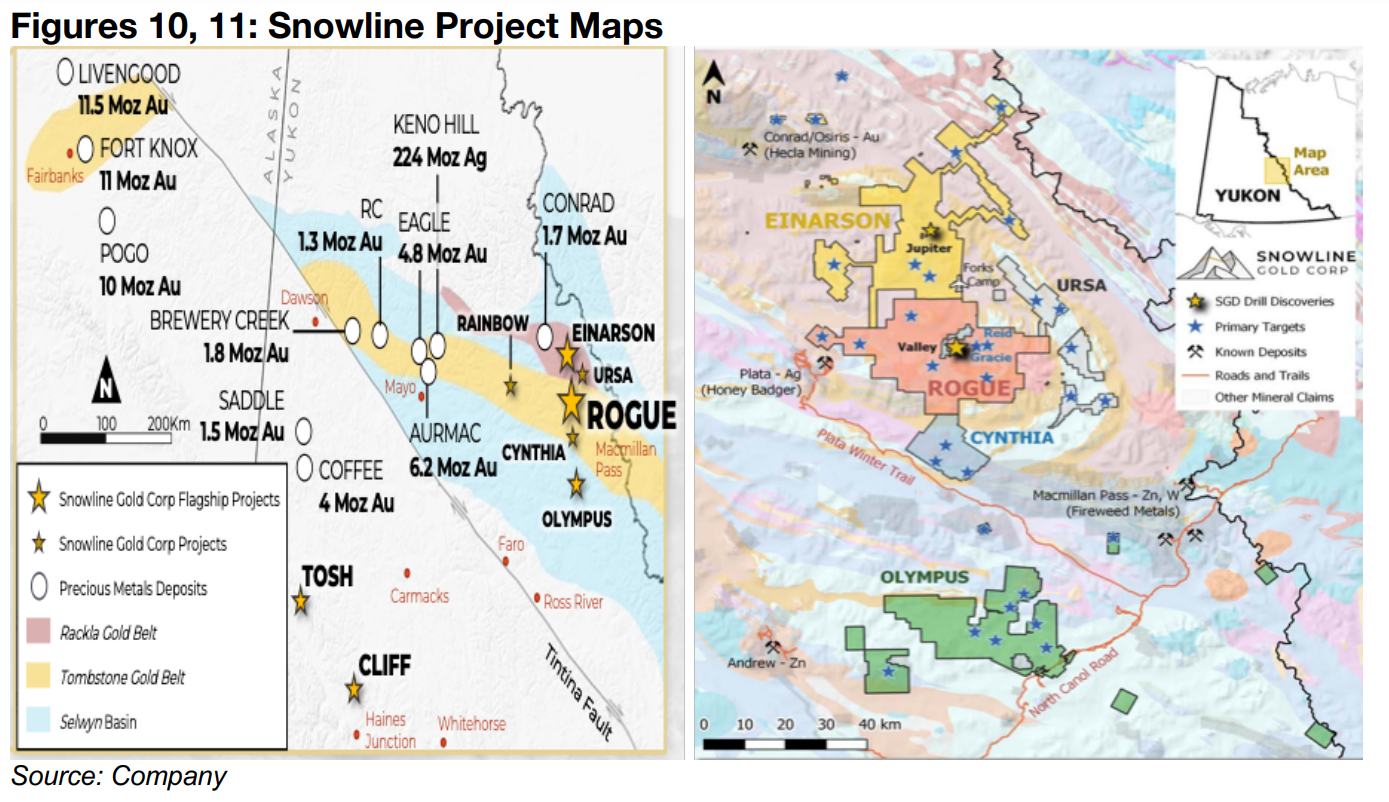

In Focus: Snowline Gold

Snowline becomes one of largest TSXV gold stocks

Snowline Gold has become one of the largest TSXV gold stocks this year, reaching a

market cap of CAD$734mn, coming in at number three after Artemis Gold at

CAD$1,149mn and New Found Gold at CAD$1,002mn. This has been driven by

strong drill results over the past year from its project in the Yukon, which lies near the

intersection of two major gold trends, the Rackla Gold Belt and the Tombstone Gold

Belt, in the emerging Selwyn Basin district (Figure 10). The two belts already have

several gold deposits totalling over 15 mn ounces and in the area immediately around

Snowline’s projects are several known deposits.

Rogue project has been focus of exploration since 2022

The focus of the exploration over the past two years and the source of the impressive drill results has been the Valley Zone of the potential open pit, bulk tonnage Rogue Project, with the first hole reported on January 2022 (Figure 11). The company had earlier focused on drilling at the Jupiter Zone of the adjacent Einarson Project through most of 2021, and started an 8,000 m drill program at Rogue in June 2022. A portfolio of assets was acquired from StrikePoint Gold in October 2022, including the Olympus project, to the south of Rogue. In June 2023 the company announced the acquisition of several claims in and adjacent to the Rogue project, including the Reid target, which has some promising historical drill results. In September 2023 the company completed an oversubscribed CAD$16.5mn financing, leaving it well funded to continue exploration into 2024.

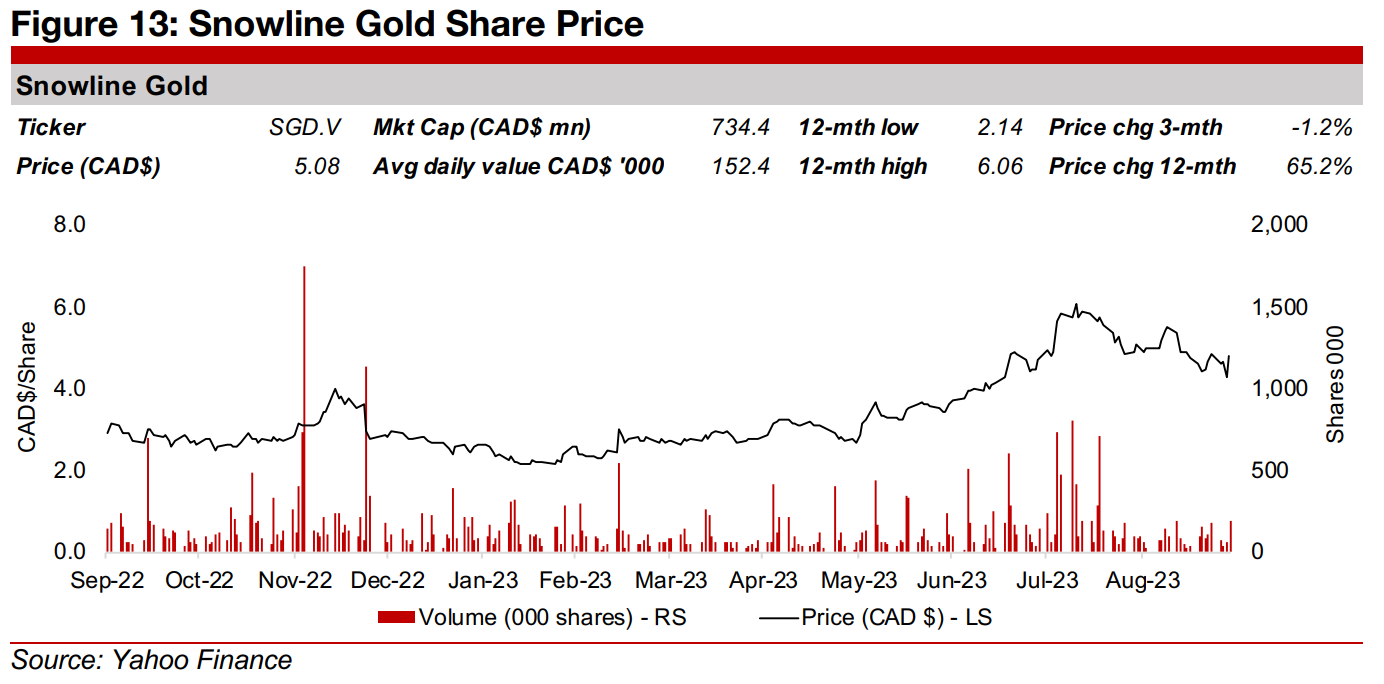

Share price picked up from June 2023 with peak drill result in August 2023

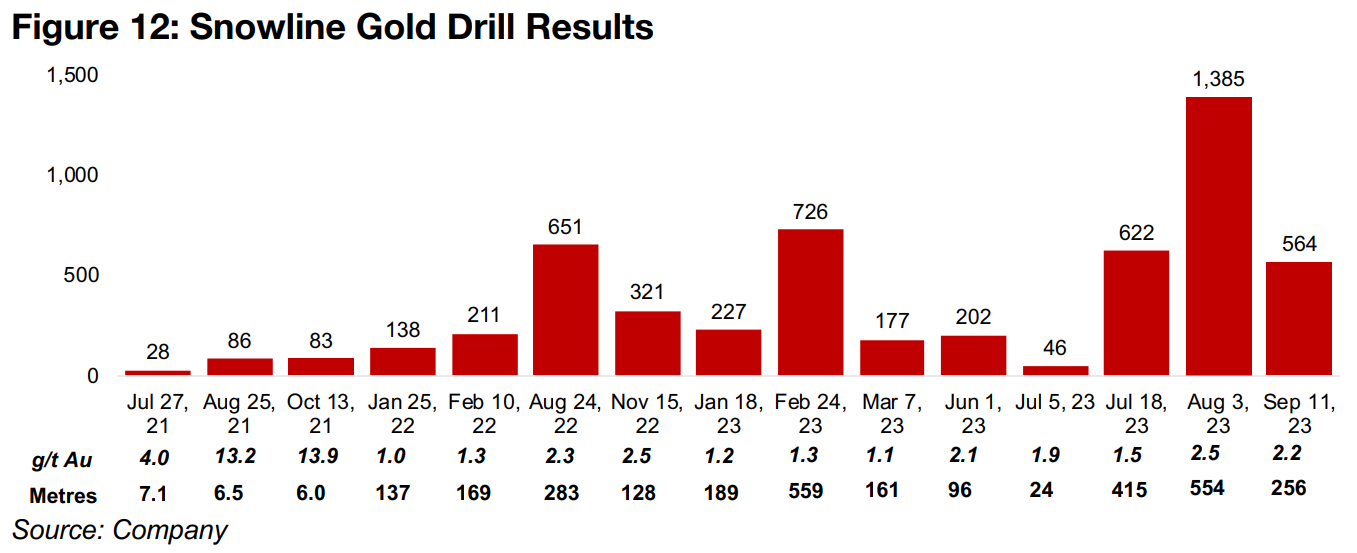

While strong drill results were reported from Rogue as early as mid-2022, with a grams-thickness of 651 (2.3 g/t Au x 283 m) on August 24, 2022, and again in early 2023 with 726 (1.3 g/t Au x 559 m) on February 24, 2023 (Figure 12), the share price remained relatively flat over this period (Figure 13). The big share price pickup began in June and July 2023, with the company reporting a grams-thickness of 622 (1.5 g/t Au x 415 m) on July 18, 2023 and its peak result so far of 1,385 (2.5 g/t Au over 554 m) on August 3, 2023, and this has been followed by 564 (2.2 g/t Au over 256 m) on September 11, 2023.

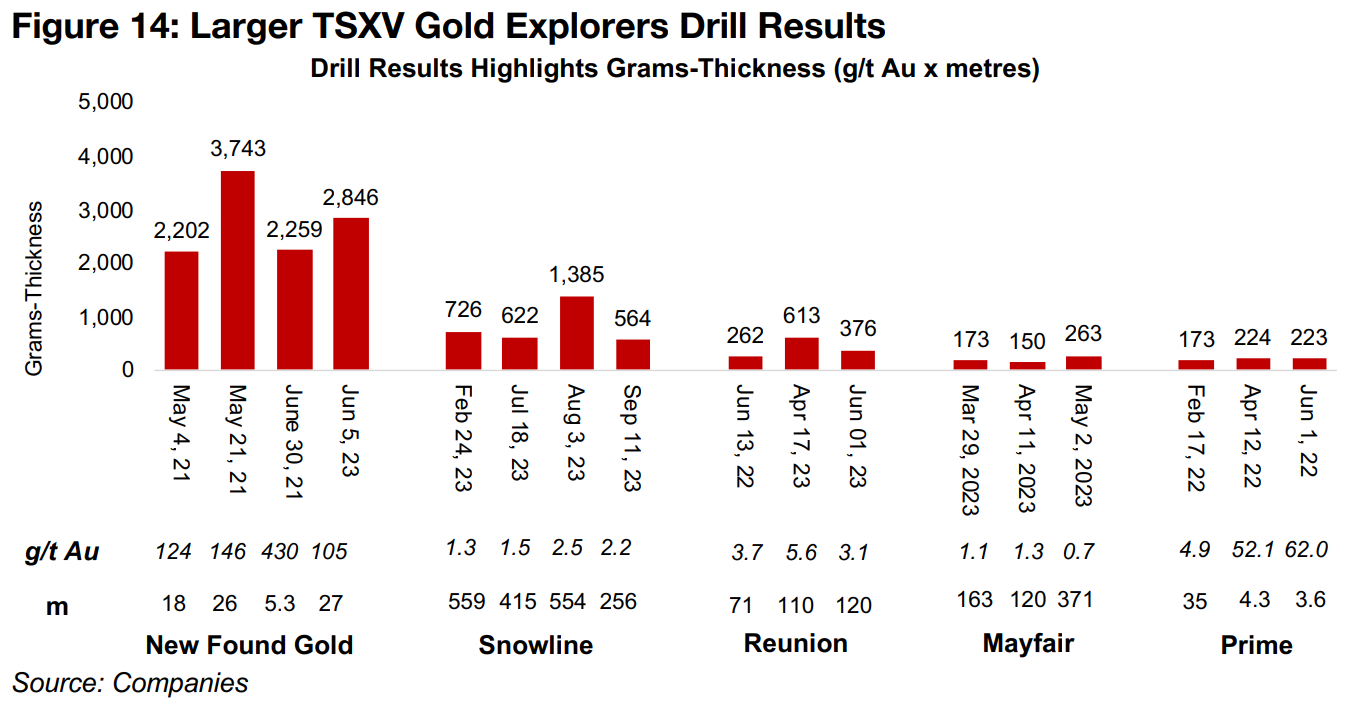

Strong results versus other large TSXV gold explorers

Snowline’s drill results have been strong in the context of the other large TSXV explorers over the past year, coming in second to only New Found Gold, with a 2,846 grams thickness (105 g/t Au x 27 m) reported on June 5, 2023. Snowline’s strongest grams thickness of 1,385 is over twice the 613 (5.6 g/t x 110 m) reported by Reunion Gold on April 17, 2023, and over five times the 263 (0.7 g/t Au over 371 m) reported by Mayfair on May 2, 2023 and Prime’s best grams thickness of 223 (62.0 g/t Au x 3.6 m) on June 1, 2022. The company has also reported that of the top ten drill results for potential open pit, bulk tonnage gold projects since 2022 from Canadian or US listed companies, it had the top seven, and tenth best, with results from Rupert Resources at number eight and from Montage Gold at number nine.

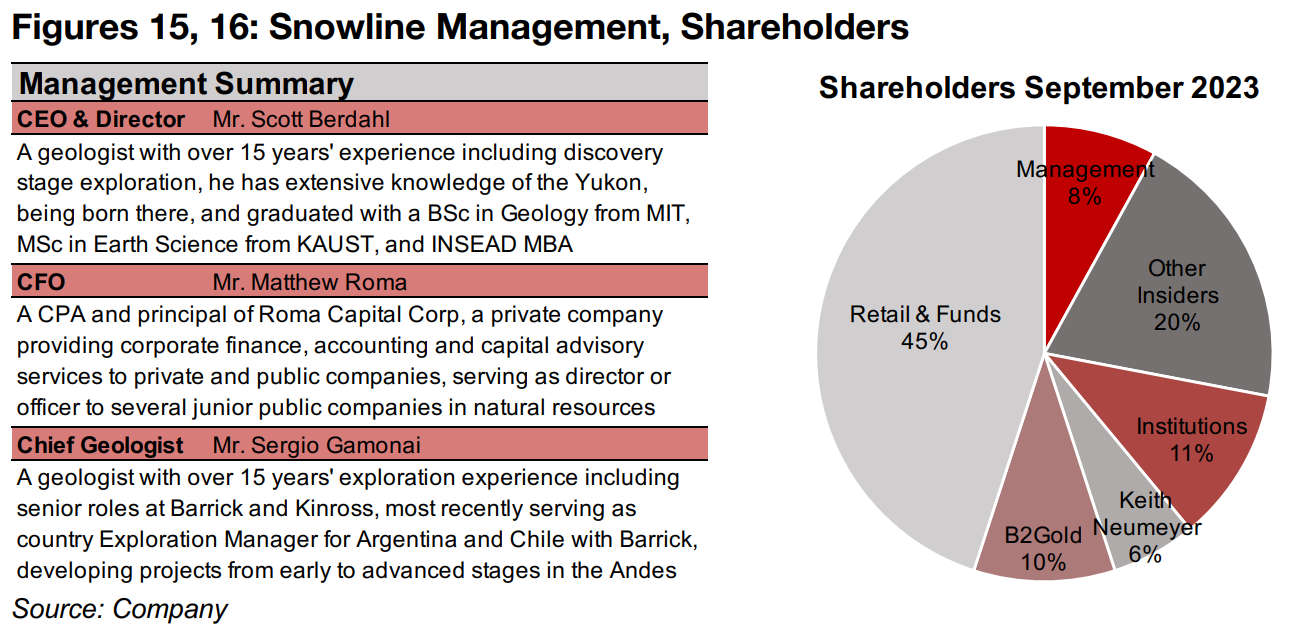

Management with history in Yukon, B2Gold has purchased significant stake

Snowline Gold’s CEO, Mr. Scott Berdahl, has a direct link to the Yukon, having been born and raised there, and has over 15 years’ experience as a geologist, and graduated from leading global universities (Figure 15). Snowline’s Chief Geologist Mr. Sergio Gamonai also has over 15 years’ experience in exploration and development, including senior roles at Barrick and Kinross, most recently in South America. The company’s CFO is Mr. Matthew Roma, who provides business services to junior natural resource companies through his company Roma Capital Corp. Management and other insiders have a significant holding in the company, at 28%, and B2Gold, one of the largest global gold producers, purchased a strategic 10% stake in March 2023 (Figure 16). The other major shareholder is Mr. Keith Neumeyer, with 6%, while other institutions hold 11% and retail and funds 45%.

Snowline outperforming most other large TSXV gold explorers

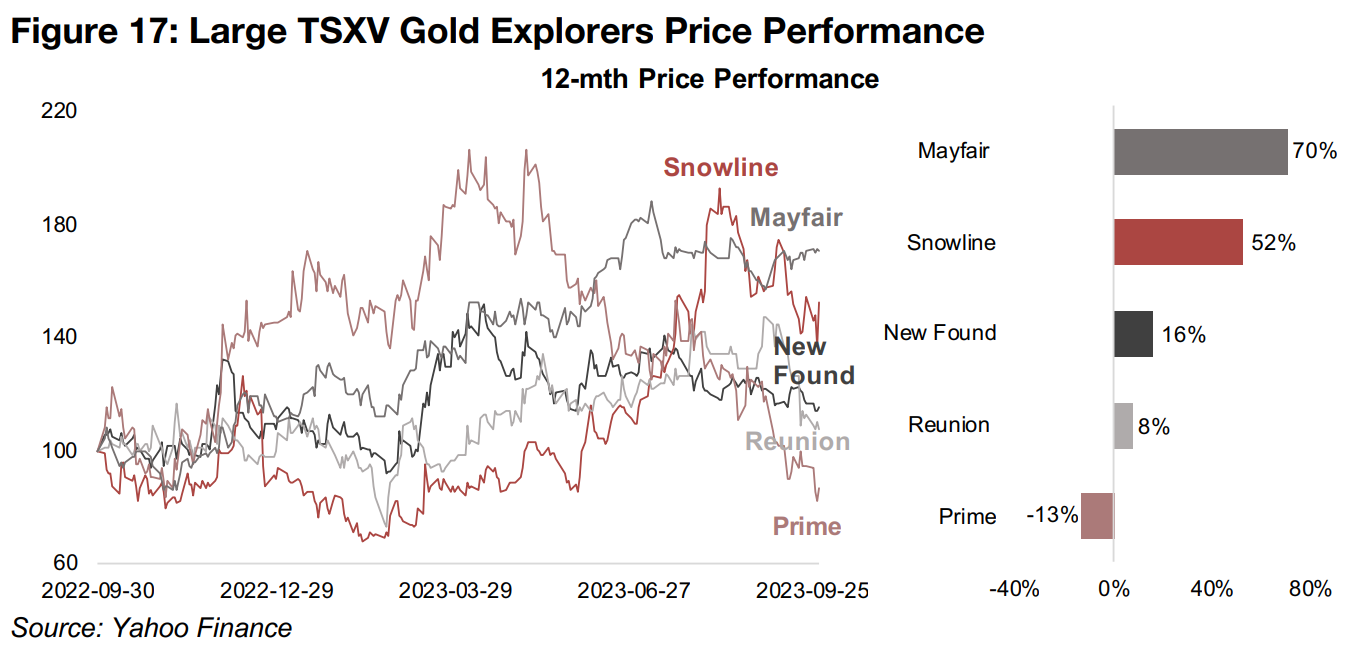

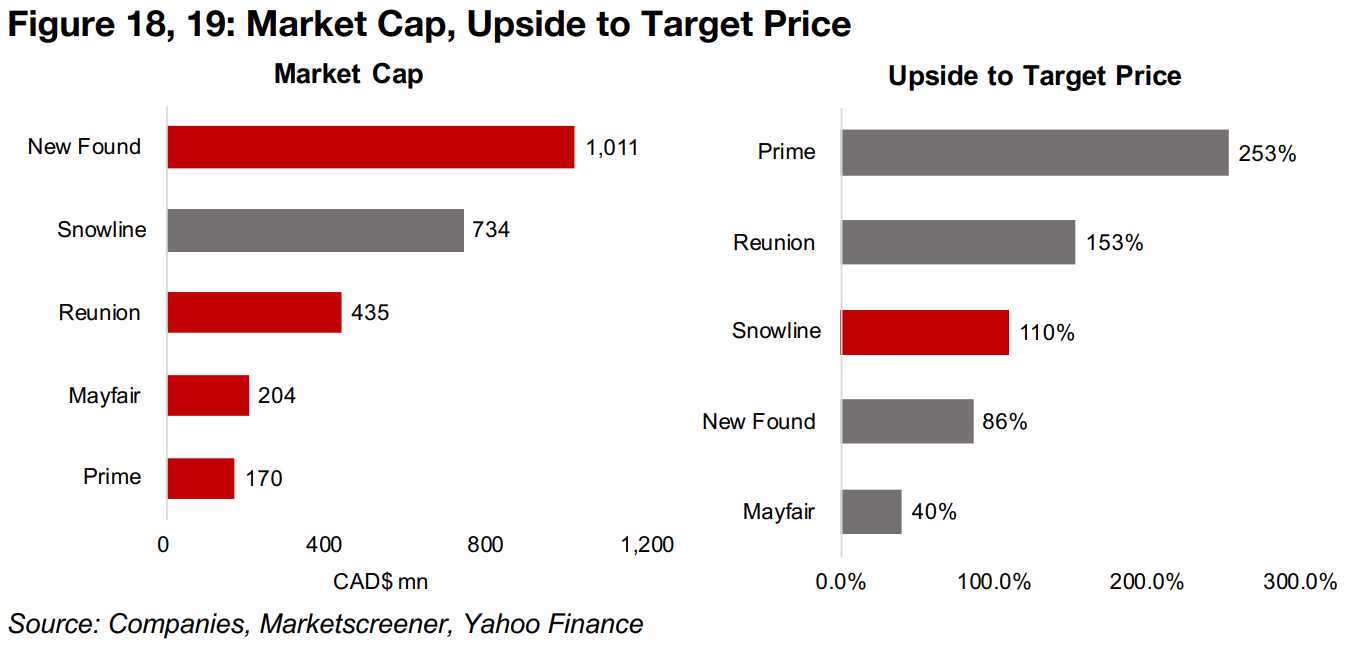

Snowline has outperformed most other larger TSXV explorers over the past year, up 52%, only outpaced by Mayfair Gold, up 70% over the last 12-months (Figures 17, 18). Mayfair is a relative newcomer to the TSXV which was publicly listed in March 2021, and has been driven by strong drill results from its Fenn-Gibb project in Ontario, Canada, which saw an updated resource estimate in April 2023. New Found Gold is still pre-resource estimate, and has gained 16% as it continues to expand its Queensway project and report the strongest drill results of the larger TSXV explorers. The remaining two stocks are at the Resource Estimate Stage, with Prime Mining, developing the Los Reyes project in Mexico, down -13% over the past year and trading at 24% of its peak reached in November 2021. Reunion Gold is developing Oko West in Guyana, and is up 8% over 12-months, pulling back from a peak in August 2023, after rising ten-fold since mid-2021.

Market targets strong upside for larger TSXV gold explorers

The market expects strong upside to consensus target prices for all the large TSXV gold explorers, with Snowline in the middle of the group, at 110% (Figure 9). This has followed a series of target price upgrades for the company, rising from CAD$5.80 as of May 2023 to CAD$10.67 currently. Higher upside is expected for both Prime Mining and Reunion Gold, of 253% and 153%, after both of their prices have faced a pullback in recent months. The target price of Prime has dropped 40% from mid-2022 while Reunion Gold’s target has remained near flat. New Found Gold still has a strong 86% upside, with its target price also near flat over twelve months, and Mayfair Gold has 40% upside, with its target edging up 7% in the past year.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.