March 20, 2020

Junior Gold Miner Weekly

Author - Ben McGregor

Gold showing grace under pressure

After holding up well in the first two weeks of the current market crisis, gold was hit this week, falling 10%, but has declined much less than equity markets and other major commodities over the past month.

Some larger gold miners are still nearly flat even after crash

While the Van Eck gold miners ETF is down 28% over the past month, a few of the larger cap TSX-listed pure play gold miners have held almost flat, with major falls concentrated among relatively smaller cap stocks.

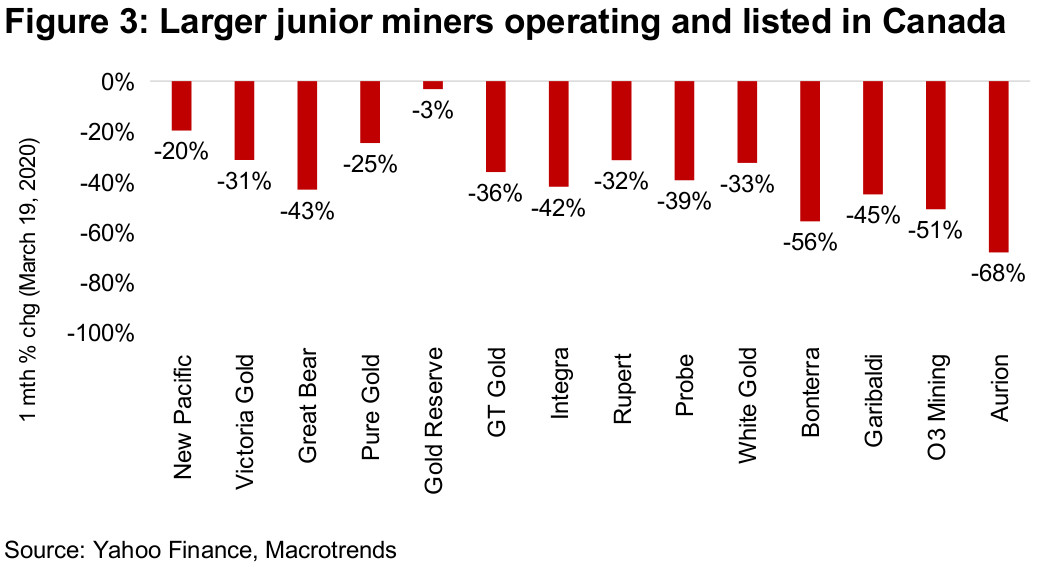

Big hit to Canadian junior miners lighter than global decline

A group of large Canada listed and operating junior miners is down 32% over the past month, hit hard, but still less so than the -41% drop in Van Eck's global junior gold miner ETF, and lower market caps are correlated with more severe declines.

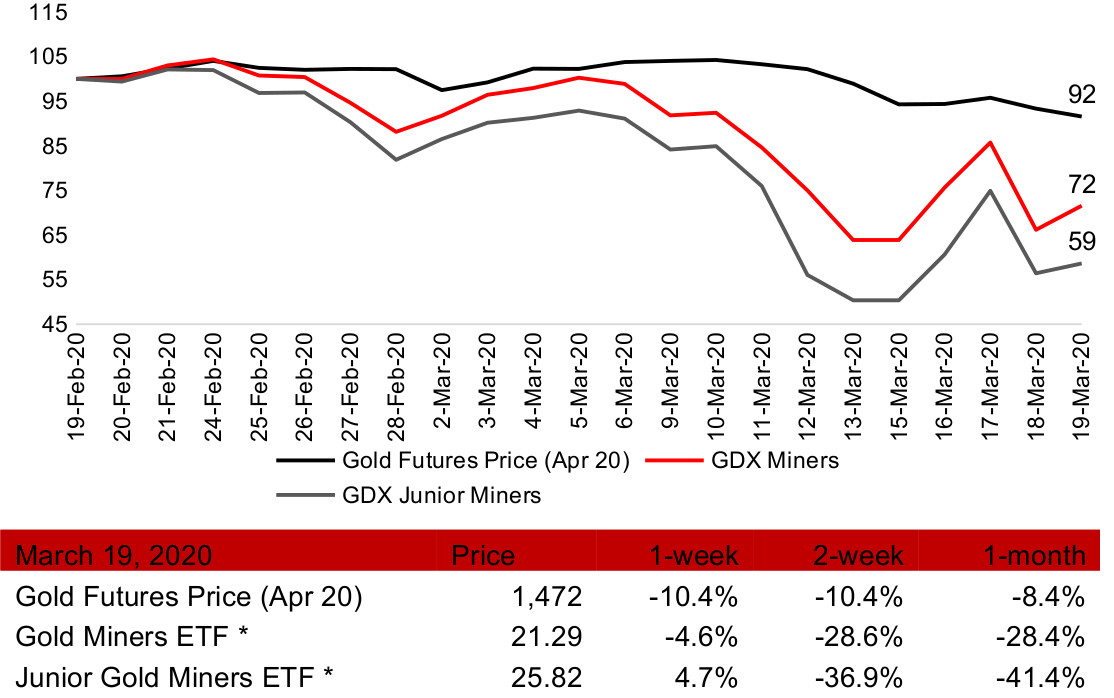

Gold price and gold mining ETFs

Source: Yahoo Finance, *Van Eck

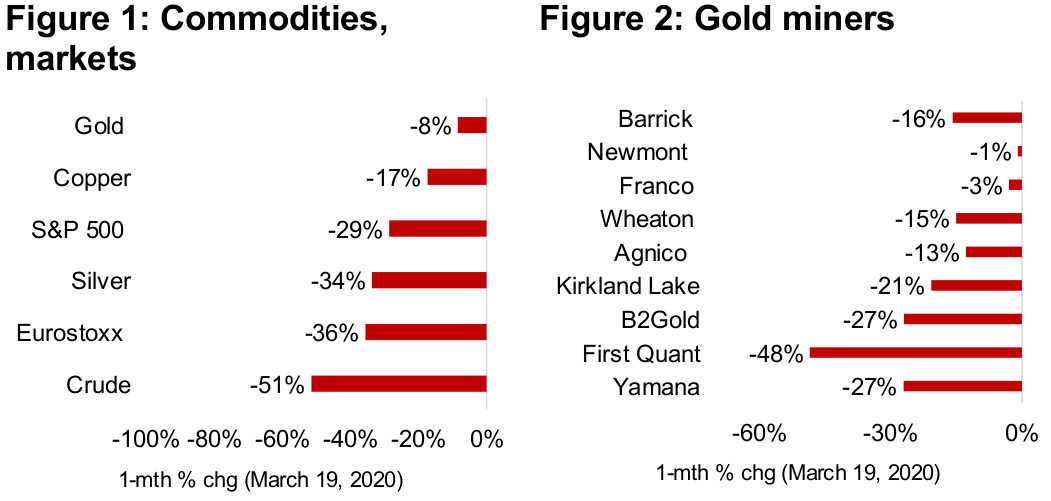

Grace under pressure: Gold relatively strong

While gold had held up well in the first two weeks of the market decline, rising demand for liquidity finally pushed investors to sell this week, driving a -10.4% drop. However, in relative terms, gold looks robust compared to the collapse in equity indices and other major metals and commodities. Over the past month, gold is down just -8% compared to - 17% for copper, -29% for the S&P 500, -34% for silver, -36% for the Eurostoxx 600 and a dramatic -51% decline for crude oil (Figure 1). Clearly gold is being sold last, and being sold lightly, so far.

Some larger gold miners holding nearly flat

While the Van Eck gold miners ETF is down -28% over the past month, this has not hit all the miners equally. A look at the major TSX listed pure play gold miners (in order of highest to lowest market cap in Figure 2) shows larger market cap stocks Newmont and Franco Nevada remaining nearly flat over the past month, demonstrating that that the market is not indiscriminately selling all gold miners. As we move down in market cap, the losses become larger, indicating that the market could be concerned with the risks that relatively smaller gold miners may have more issues with raising capital in an extreme risk off environment.

Big hit to Canadian juniors lighter than global decline

We also see this trend in a group of the largest Canadian listed miners with operations focused in Canada (ranked from highest to lowest market cap in Figure 3). In general, as we move down in market cap, the stock price declines tend to get larger. It appears that while the market is factoring in the relative strength in gold, it might be giving a higher weighting to the risk that companies will have difficulty accessing capital in this environment to continue and expand their operations, even if the gold price does hold up. While this group of Canadian juniors in Figure 3 has seen a quite severe combined market cap decline of 32% over the past month, in a global context, this is a relative outperformance versus the 41% decline in Van Eck's global junior miner ETF.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.