February 02, 2026

Metalmadeggon

Author - Ben McGregor

Metals prices crash as speculators driven out

Gold dropped -5.3% to US$4,714/oz, plunging from over US$5,300/oz, with silver, platinum and palladium down more severely, with the ostensible driver a hawkish new Fed chairman, but the underlying cause a reversal of major speculative inflows.

Broad slump in metals stocks

All of the major metals stocks declined, with most of the gold, silver, platinum and palladium large caps down over 10%, but the base metals stocks outperforming with more moderate losses, with many having exposure to the nearly flat iron ore price.

Metalmaggedon

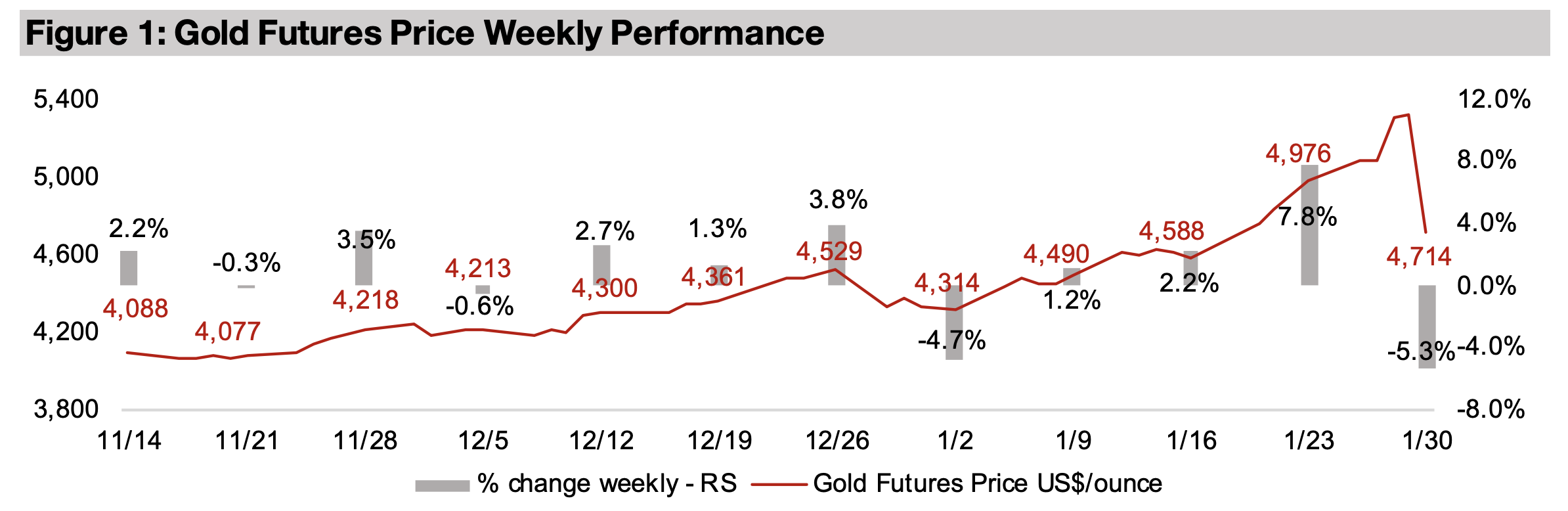

The gold futures price dropped -5.3% to US$4,714/oz after shooting up as high as

US$5,318/oz on Thursday, before plunging -11.4% in a single day on Friday. This

slump actually outperformed the other precious metals, however, with silver futures

crashing -31.3% and platinum and palladium down -22.4% and -15.4% on the last

day of the week. We wrote last week on gold that “for now we do not expect that just

crossing US$5,000/oz will necessarily slow it down. This could actually even propel it

further, as more speculative money starts to chase the trend” but also that “the

continuation of such a parabolic move will eventually set up a significant pullback.”

Technically we were correct on both, as the gold price did continue to surge, rising

US$342/oz, or 6.9% in just four trading days from the January 23, 2026, closing price

on which our comments were based, while silver added another US$13.1/oz, or 12.9%

before collapsing. However, we had certainly expected this cycle to take much longer,

even months, rather than transpire at hyper speed in the space of just one week.

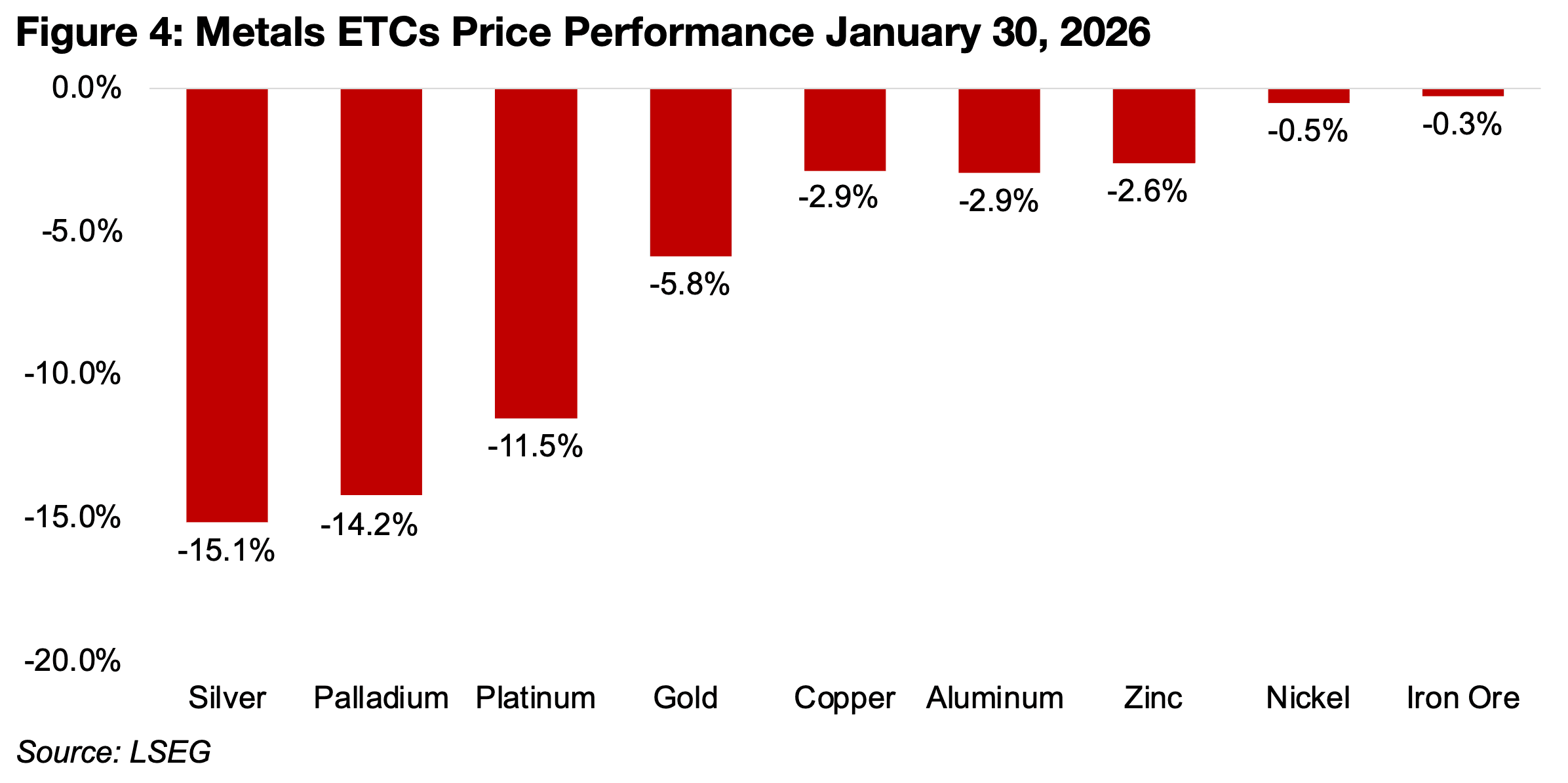

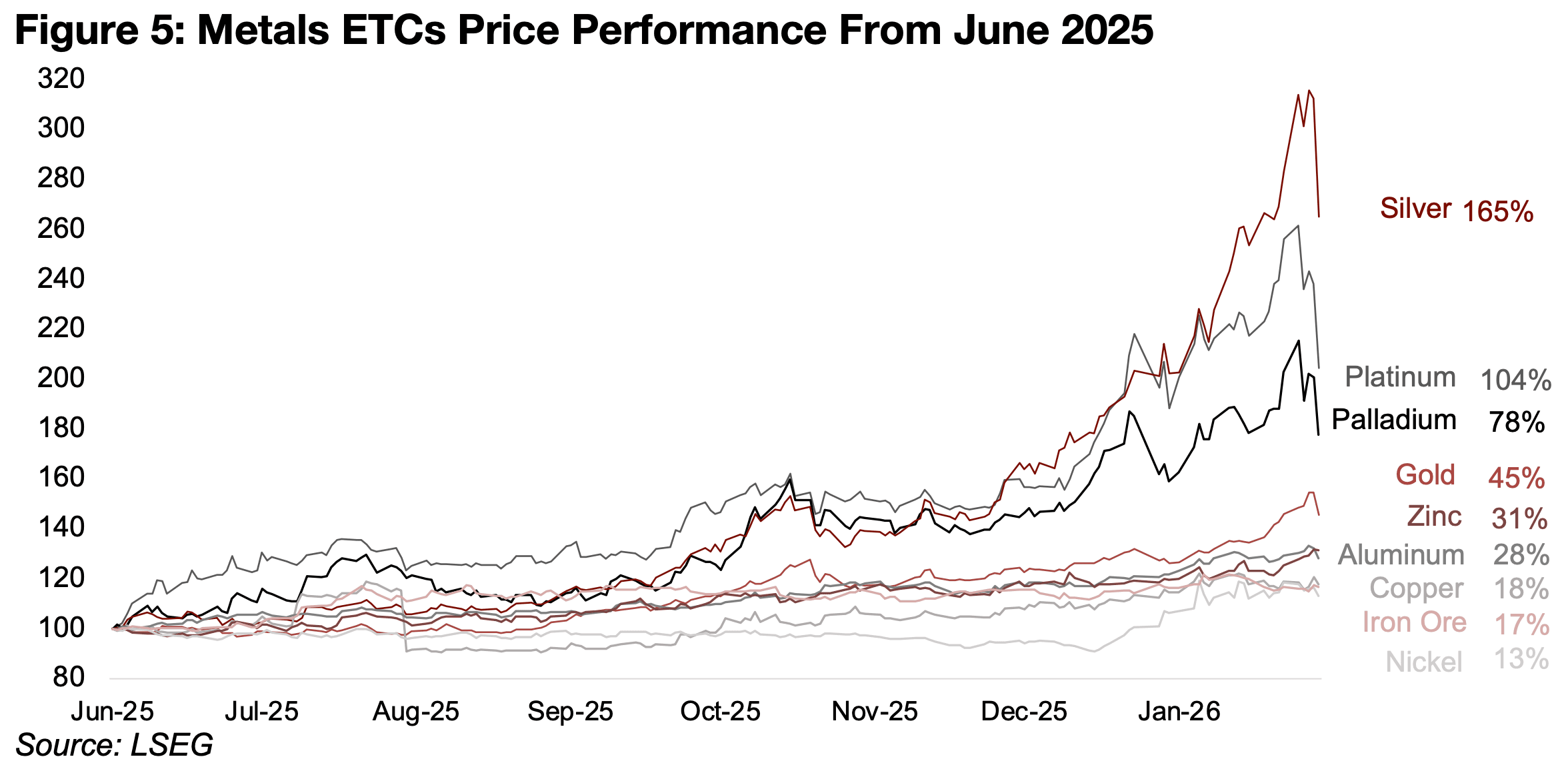

The mania and subsequent metalmageddon was also not limited to just the precious

metals, with the copper price ETC also seeing over a 3.6% gain on Thursday, January

29, 2023, and then a -2.9% reversal on Friday (Figure 4). While normally this would

have been viewed as quite volatile, in the context of the precious metals’ moves, it

seems subdued. The other base metals did not see such extreme moves, but still

declined, with aluminum down -2.9% and zinc dropping -2.6%, and nickel and iron ore

only edging down by -0.5% and -3.0%. Overall the drop so far has only set the precious

metals back about month, to their gains near the start of 2026, and all of the major

metals have still seen strong gains since June 2025 (Figure 5). Silver is up 165%,

platinum 104%, palladium 78% and gold 45%, even the weakest performer, nickel,

has gained 13%, with zinc, aluminum, copper and iron ore up 31%, 28%, 18% and 17%

since the middle of last year.

It remains to be seen if the crash cools sentiment, as it is the first substantial pullback

in the precious metals upswing of the past year. It did expose that some of the recent

severe moves in these metals had in fact been driven by speculators, as we had

previously suspected. Their bets can often be leveraged, which magnifies both gains

and losses, and the rapid exit of these positions can cause the type of extreme

movement seen at the end of last week. The collapse in the sector last week will

definitely have caused speculators to be much more cautious on the sector and may

have also given a shock to retail interest in the sector. Such a lull may not actually be

a bad thing as the recent moves appeared to be overly volatile and not indicating a

sustainable bear market, but a mania with shaky foundations.

For gold we continue to still see sufficient drivers to drive a rebound back to

US$5,000/oz this year, but there could be a significant pullback first. The silver price

could have further to fall based on the gold to silver ratio, which had plummeted to the

bottom of a forty-year range, implying a decline in the metal bring this ratio back up

towards medium-term averages. Platinum and palladium have also had such a severe

run, that while partially backed by fundamental drivers, including their use as a

monetary substitute and strong demand from the auto industry for use in autocatalysts,

also likely has a significant speculative component.

Immediate trigger for crash was new Fed Chairman pick

While the metals crash was likely mainly caused by build up of speculative positions,

the immediate ostensible trigger was the reported selection of a new Fed Chairman,

Kevin Warsh, who was widely viewed by the market to be hawkish. This could imply a

lower likelihood of faster US rate cuts, and therefore higher rates for longer, in turn

implying slower growth in the money supply, which is the key underlying driver for the

gold price. It also implies that real bond yields could remain relatively high, if we

assume inflation remains low, and these move inversely to yield-less gold.

A more muted decline in US rates versus other countries could also boost the dollar,

which also tends to move inversely to gold, and the new Fed pick did drive a rebound

in the currency. A potentially hawkish new Fed Chairman seems an interesting choice,

given that the US President has repeatedly criticized the current Chairman for not cut

rates quickly enough. Presumably the President believes that he will have more

leverage with new Fed Chairman in getting quicker reductions in interest rates.

However, the markets were apparently skeptical over the ability of the President to

turn the new Fed Chairman more dovish, with the S&P 500, Nasdaq and Russell 2000

weak overall, with a 0.3% gain, -0.3% drop and -2.2% fall, respectively, for the week.

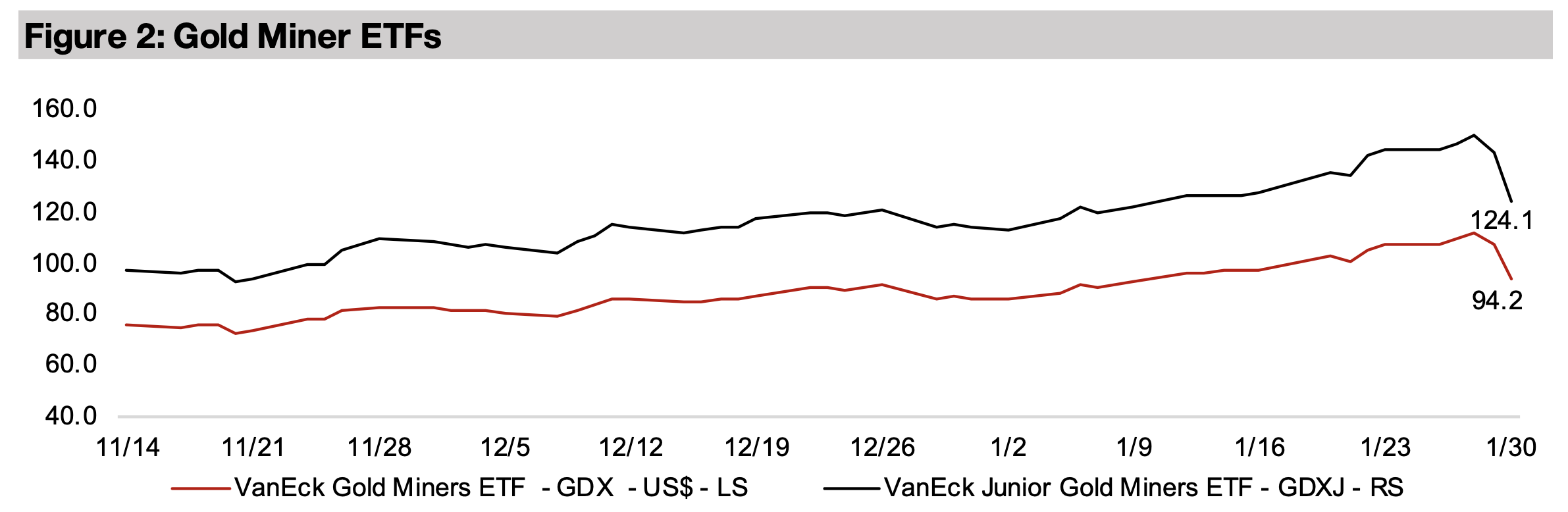

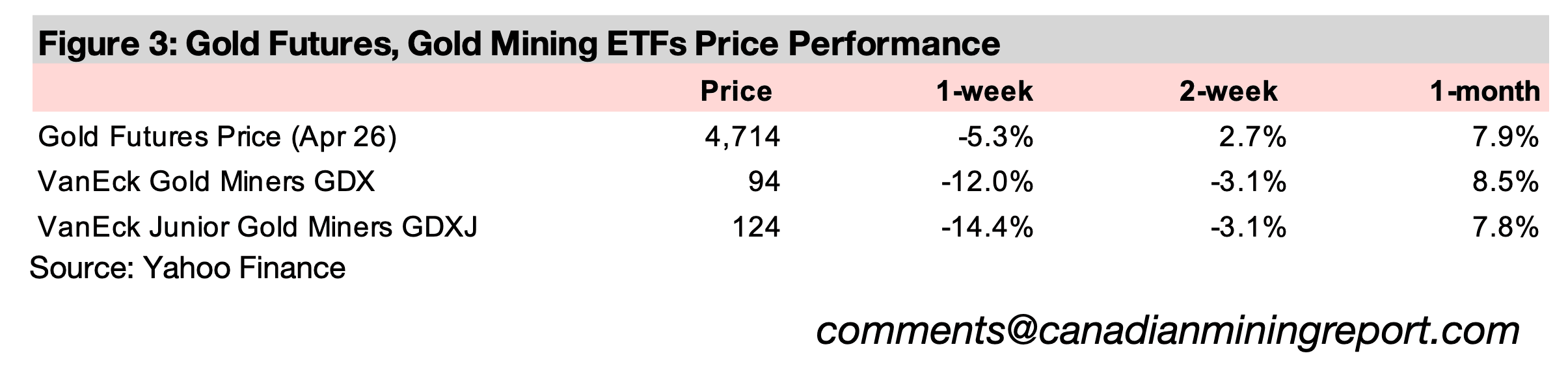

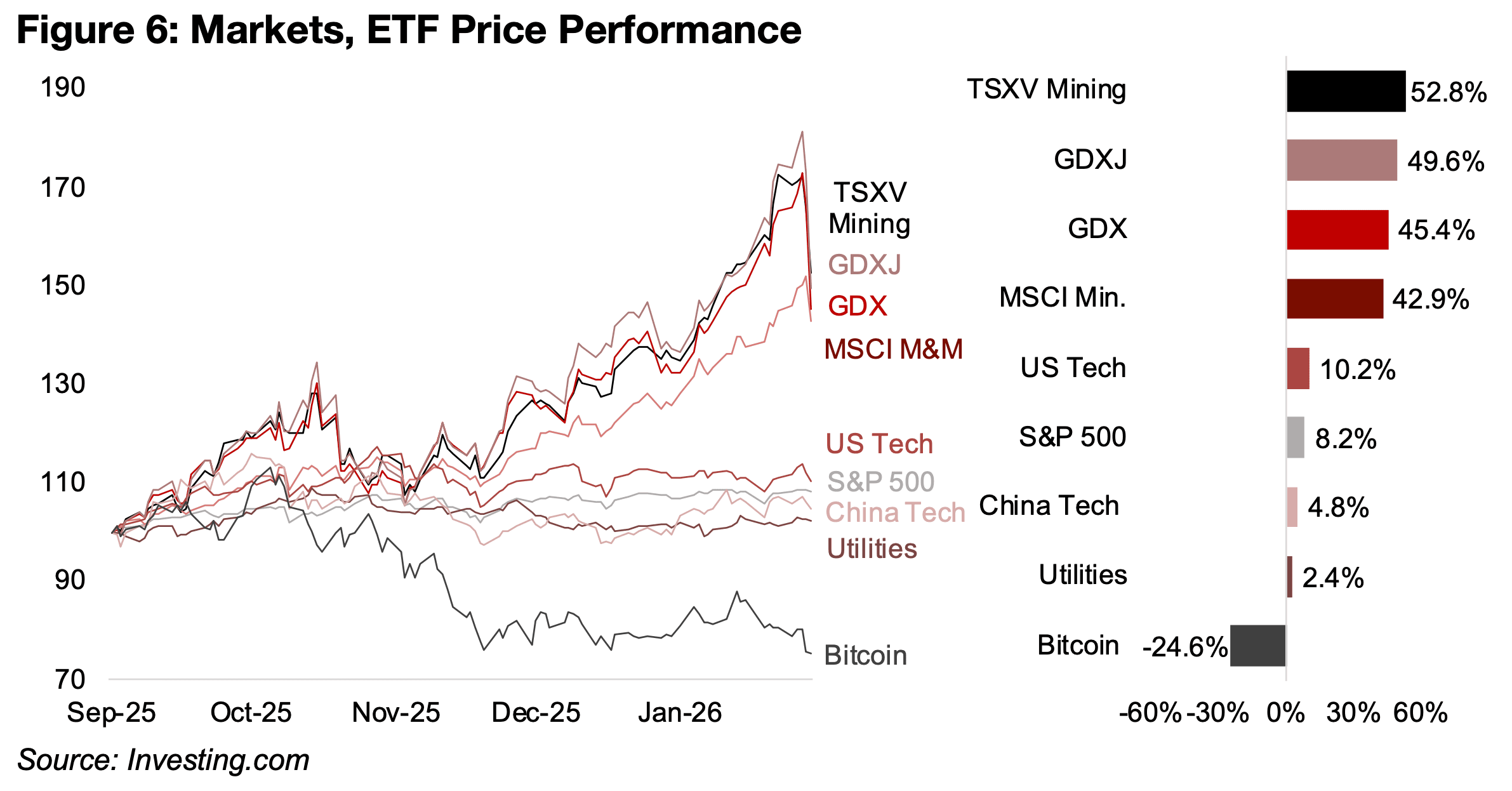

While gold stocks dropped, with GDX down -12.0% and the GDXJ losing -14.4%,

similar to the major metals, they lost only about a month of gains, and are back to

levels near early January 2026, and still up 45.4% and 49.6% from September 2025

(Figure 6). The TSXV Mining and MSCI Mining and Metals indices also dropped

significantly, but are up 52.8% and 42.9% since September 2025, far outperforming

the tech sector, which was up just 10.2% in the US and 8.2% in China.

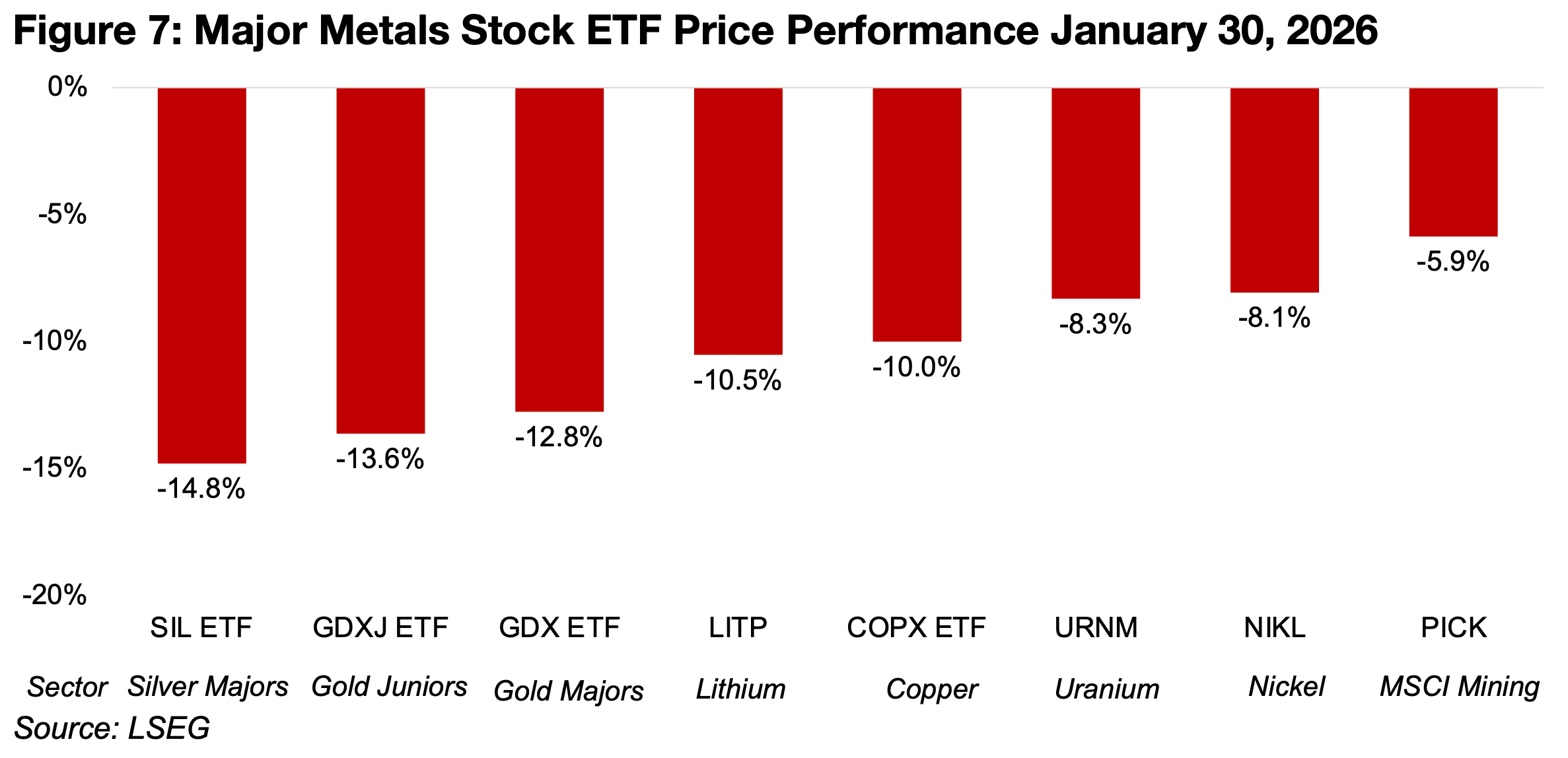

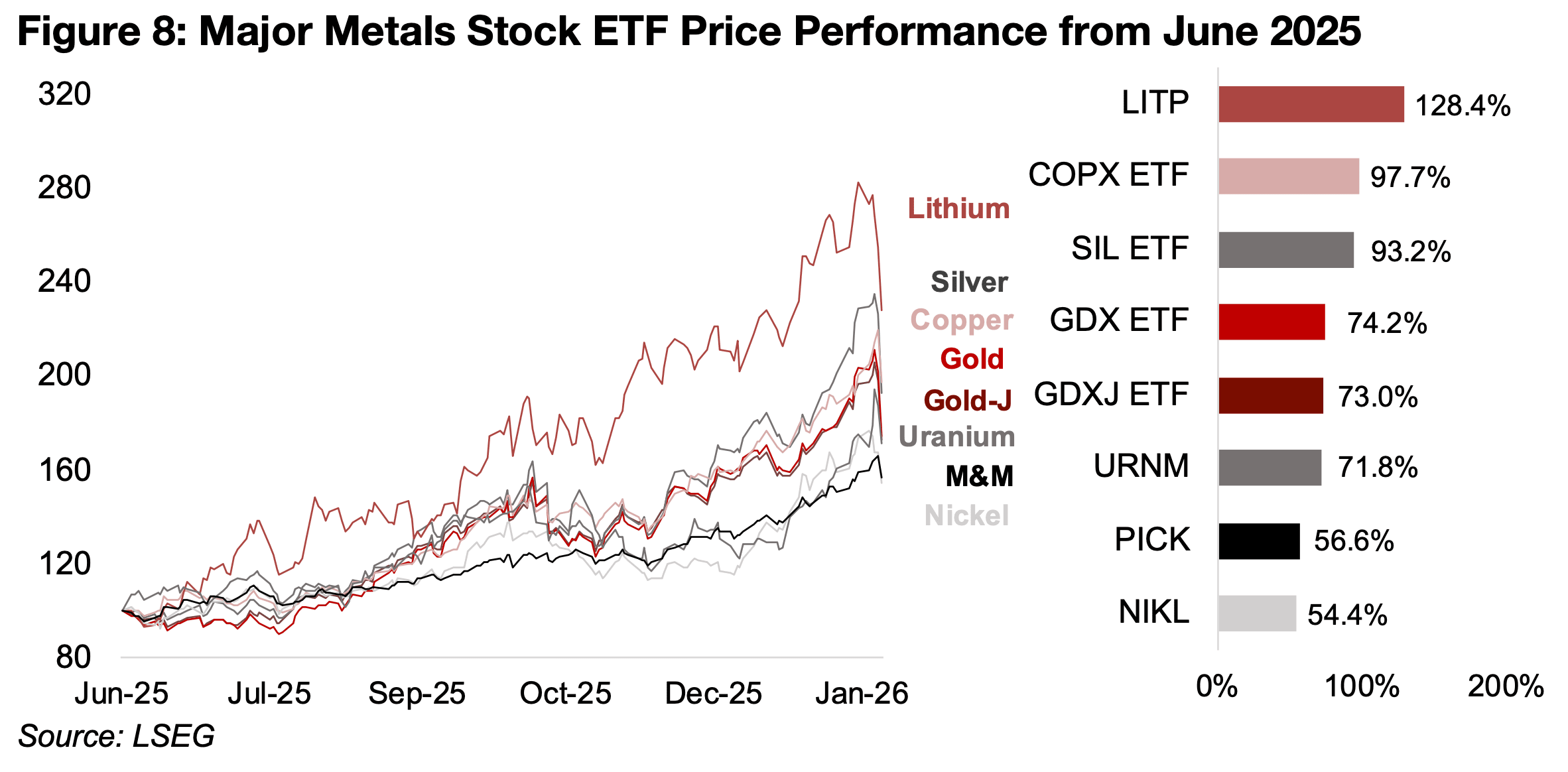

Stocks for all major mining sectors hit by metals slump

The metals crash on Thursday dragged down the stocks of all the major mining sectors, with silver the worst hit, with the SIL ETF of silver producers down -14.8%, followed by the GDXJ and GDX, down -13.6% and -12.8% (Figure 7). The LITP and COPX lithium and copper producer ETFs dropped over -10.0% and the URNM and NIKL ETFs were down -8.3% and -8.1%. The PICK ETF, which tracks the MSCI Metals and Mining Index, was down just -5.9% given its major exposure to companies producing iron ore, which was one of the only metals to hold up relatively well in the crash. However, even with the slide, the major metals stocks ETFs still all have major gains since June 2025, ranging from over 50% up to nearly 130% (Figure 8).

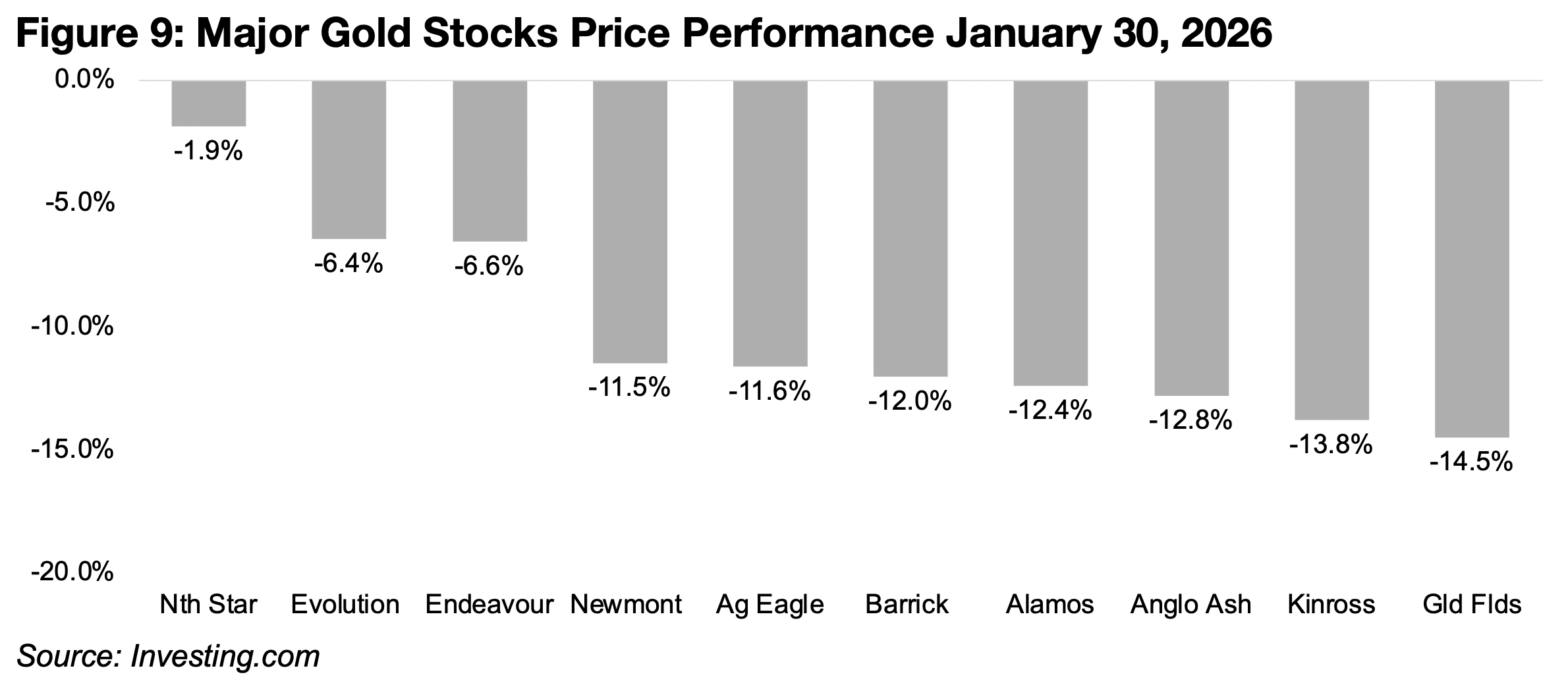

The drop in the gold price hit the largest stocks in the sector somewhat uniformly on

January 30, 2026, with seven of the ten down between -11.0% to -15.0% (Figure 9).

The outperformers included Endeavour and the two major Australian producers,

Evolution and Northern Star, with the latter down only -1.9%. The resilience of

Northern Star is partly because it still has quite a low valuation versus the sector, with

a price to book only around 2.6x, while most of the other majors are well over 3.0x.

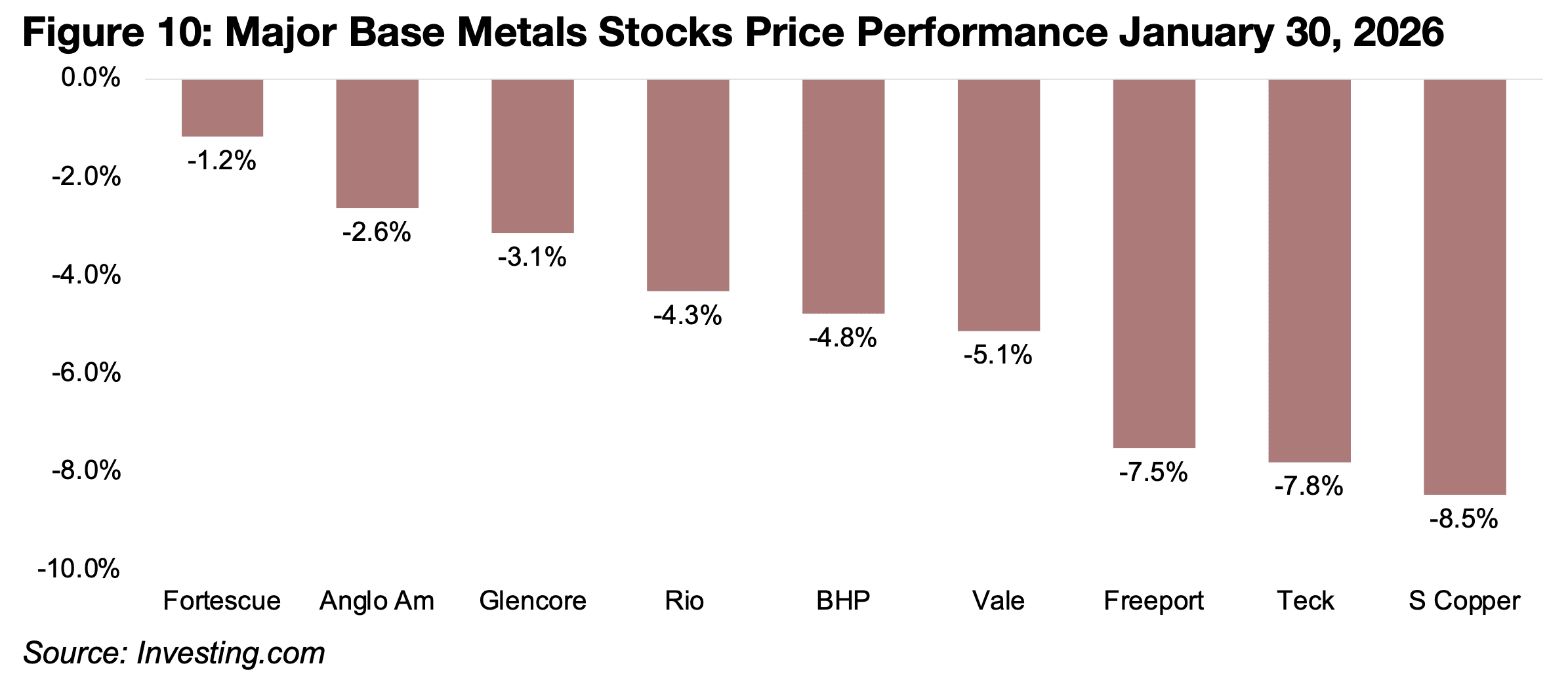

For the major base metals stocks, Freeport McMoran, Teck and Southern Copper

saw the largest drops of -7.5%, -7.8% and -8.5%, as they are all copper producers

and this metal saw the largest slump in this sector (Figure 10). The major iron ore

producers, Rio, Vale and BHP, were down -4.3%, -4.8% and -5.1%, even though the metal price was near flat, as all they also have major contributions from copper and

other base metals. The only near pure play iron ore producer, Fortescue, declined

just -1.2%, Anglo American dropped -2.6%, with mixed operations across several

metals, and Glencore was down -3.1%, with major copper and fossil fuel production.

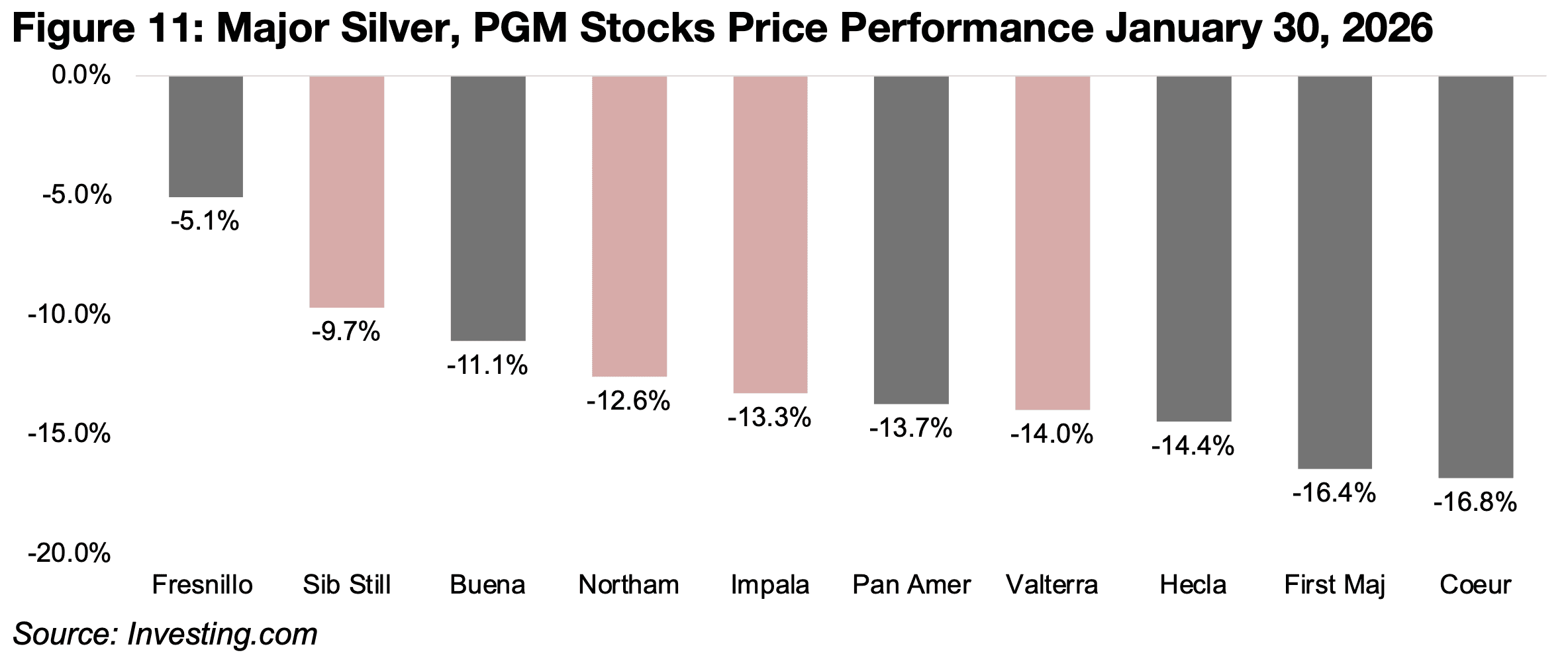

The silver and platinum and palladium stocks saw the largest declines, but not by as

much as might have been expected, given the much more severe decline in their

underlying metals prices. For the major silver stocks, this is partly because often the

majority of their revenue actually comes from gold production, not silver, and the gold

drop was not as severe. However, three silver stocks saw the largest declines, with

Hecla, First Majestic and Coeur down -14.4%, 16.4% and -16.8%, with Fresnillo

relatively strong with a -5.1% loss (Figure 11). The platinum group metals stocks all

dropped significantly, with Sibayne Stillwater, Northam Platinum, Impala Platinum

and Platinum declining -9.7%, -12.6%, -13.3% and -14.0%, respectively.

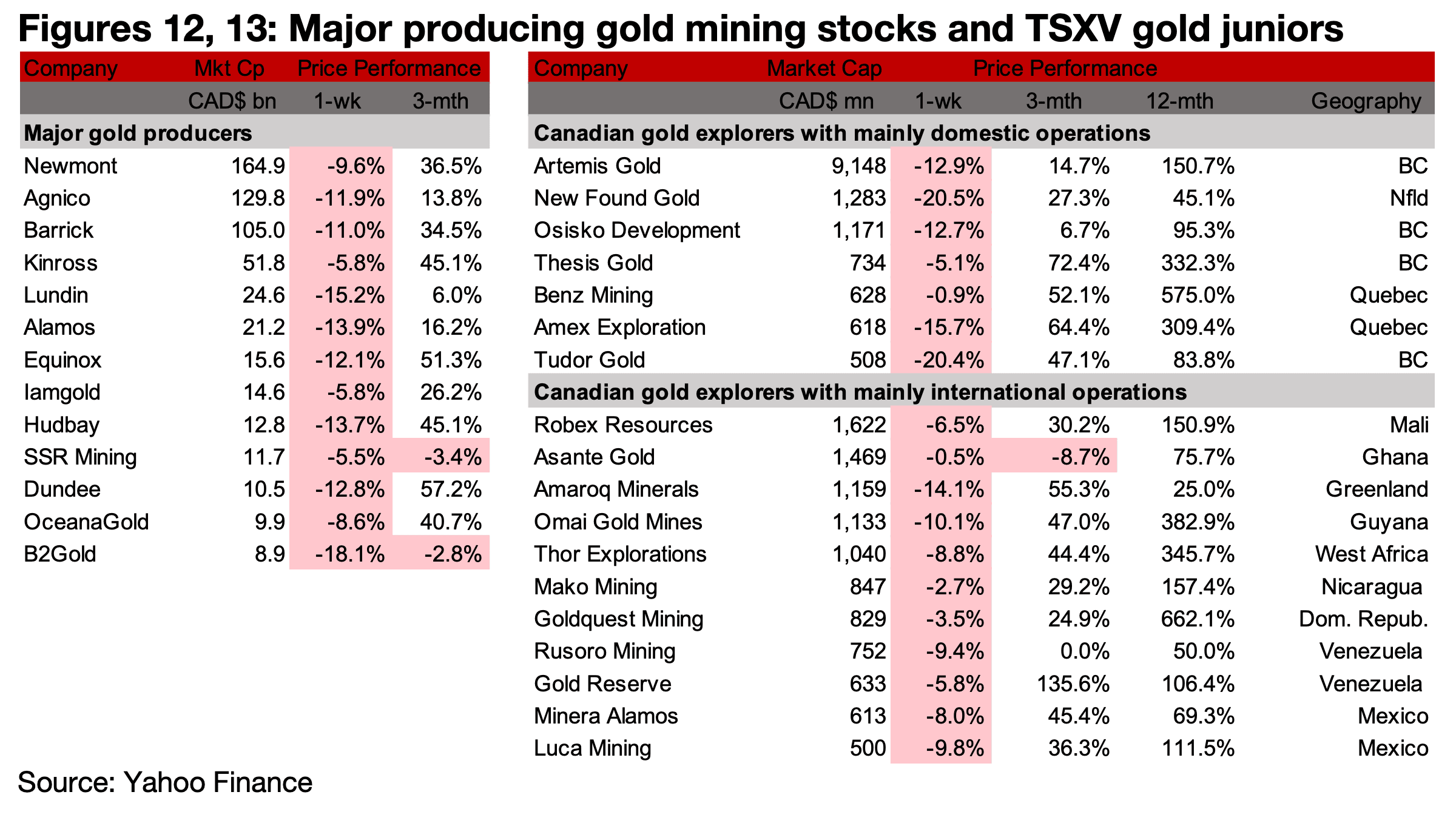

All major producers and TSXV gold slump

The major producers and TSXV gold all crashed on the plunge in the metal price

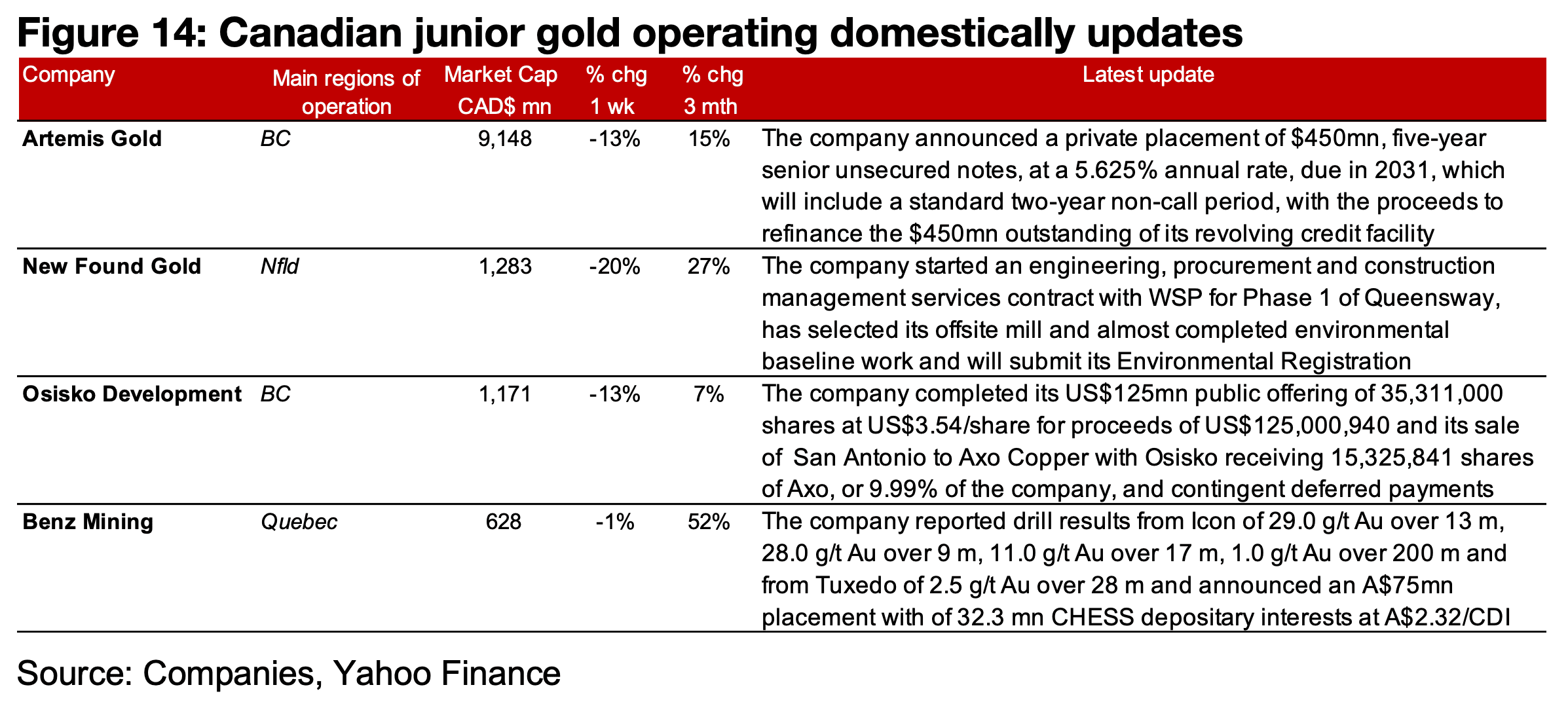

(Figures 12, 13). For the TSXV gold companies operating mainly domestically, Artemis

Gold announced a private placement of unsecured notes to refinance its revolving

credit facility and New Found Gold started an EPCM contract with WSP for

Queensway Phase 1, selected its offsite mill and advanced its environmental work.

Osisko Development completed its US$125mn public offering and the sale of San

Antonio to Axo Copper and Benz Mining reported drill results from Icon and Tuxedo

and a A$75mn placement of CHESS depositary interests (Figure 14).

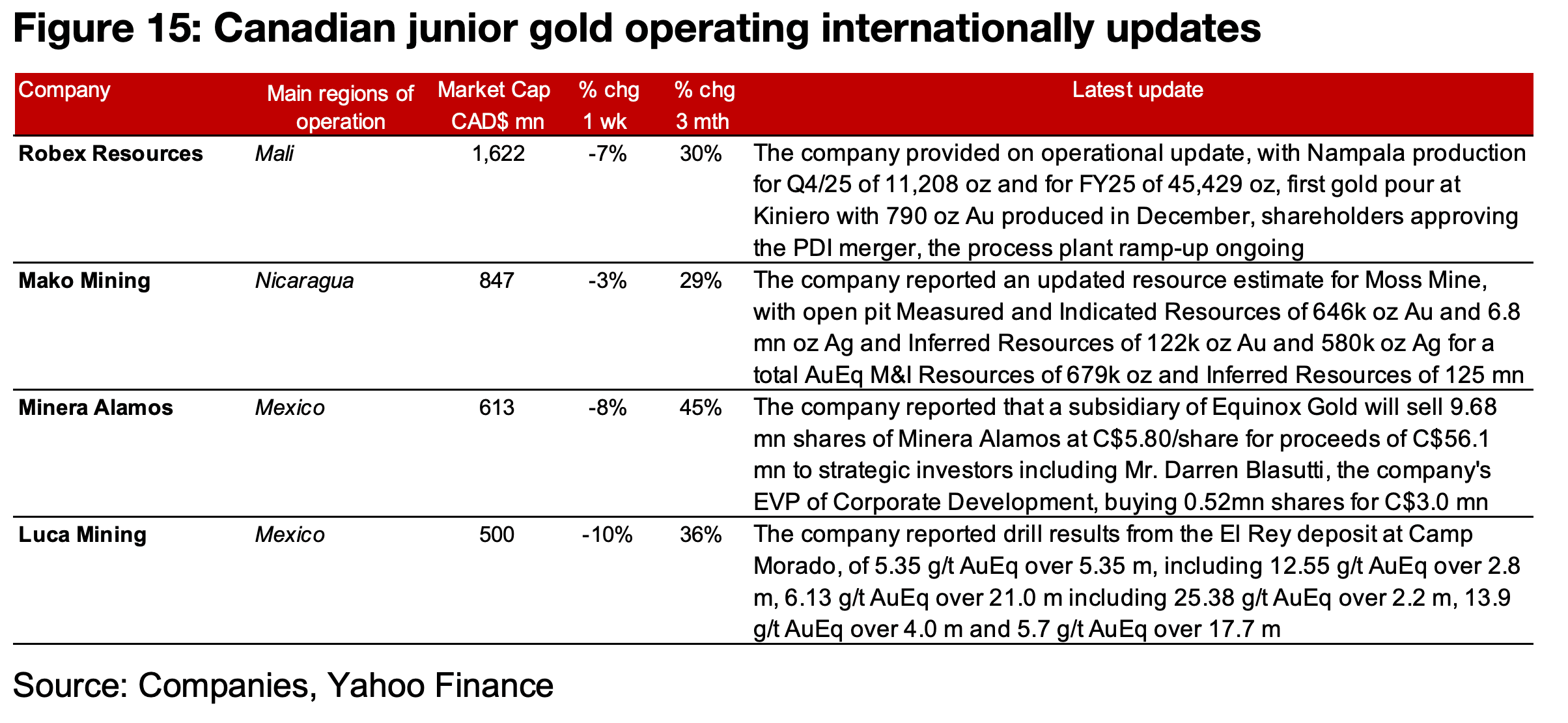

For the TSXV gold companies operating mainly internationally, Robex reported a

Q4/25 operational update with production from Kiniero and Nampala and Mako

reported an updated resource estimate for Moss Mine. Minera Alamos announced

that a subisidary of Equinox Gold will sell a significant share of the company to

strategic investors, including the EVP of Corporate Development, and Luca Mining

reported drill results from the El Rey deposit of Camp Morado (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.