September 15, 2025

Mining Mega-Merger

Author - Ben McGregor

Gold breaks out for entire month

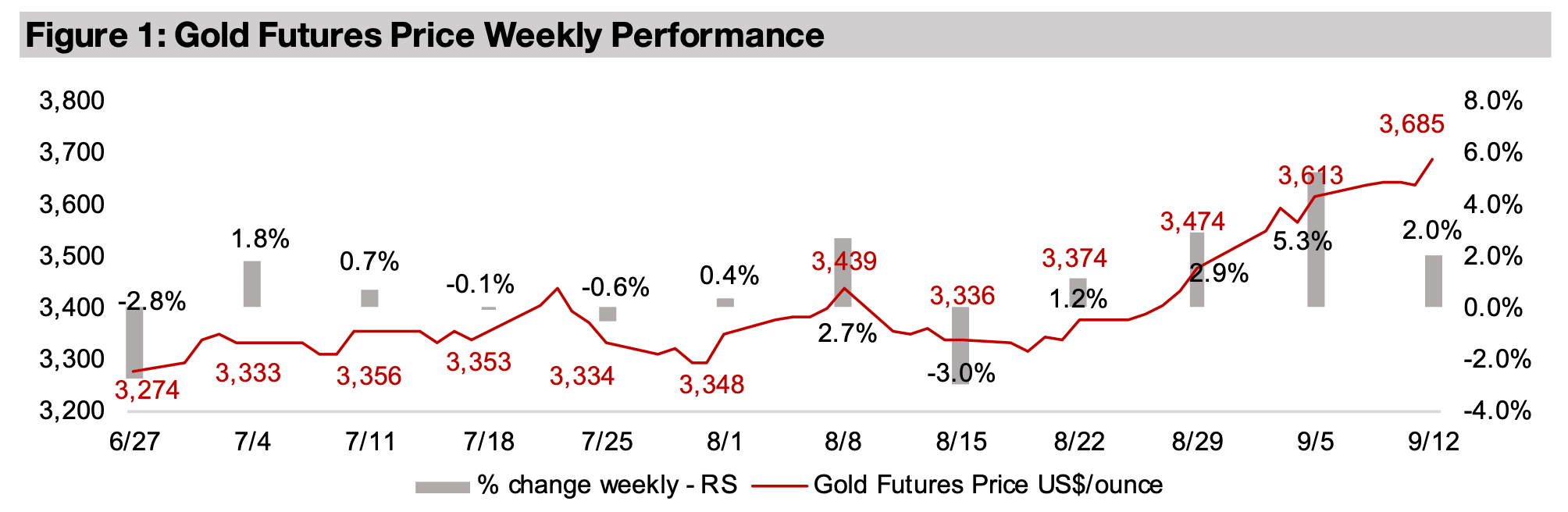

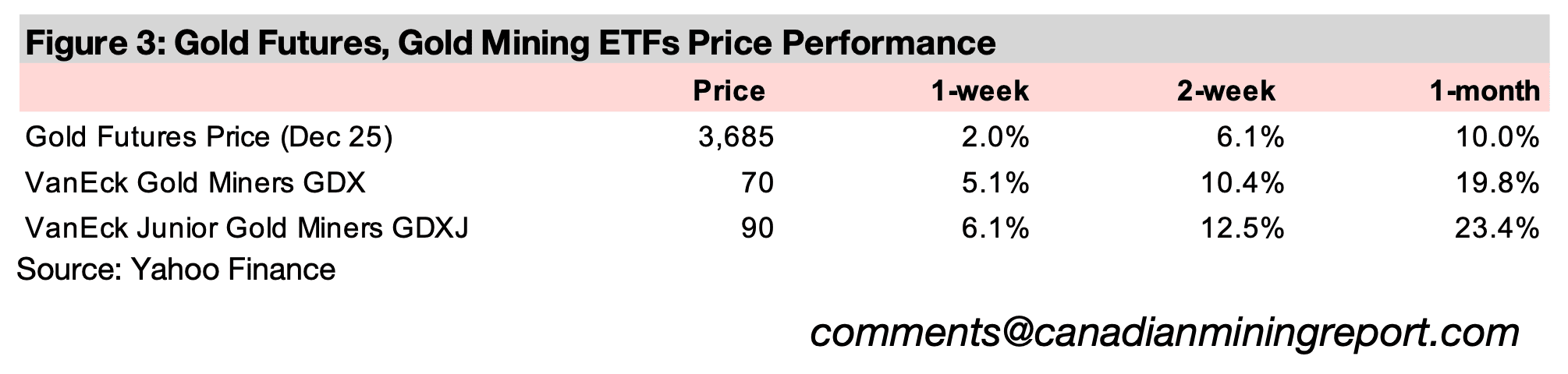

Gold surged 2.0% to US$3,640/oz and has gained 10.4% in a month, clearly exiting the $3,200-US$3,400/oz range of the four months before the breakout, which has been driven by expectations that a Fed rate cutting cycle would start this month.

Another mining mega-merger, with more room for M&A in sector

The Anglo American-Teck merger is largest mining deal since 2013, and there is room for continued M&A in the sector, including gold, with the majority of large companies holding high levels of cash and many potential targets still at low valuations

Gold Break Out Continues

The gold price gained 2.0% to US$3,685/oz, and has risen 10.4% in just four weeks,

clearly exiting the US$3,200/oz-US$3,400/oz range that had held for around four

months prior to this breakout. The key driver for this seems to have been the market’s

expectations that the US Fed would finally capitulate and reduce rates this month,

after maintaining its base rate flat the entire year even as all other major central banks

made significant cuts. The rate decision will be made at the Fed’s September 17-18,

2025 meeting, with the markets seeing a 93.4% probability for a 0.25% cut to the

4.00%-4.25% range from the current 4.25%-4.50%.

The market is anticipating that this will be the start of a major rate cutting cycle for

the Fed, with a 79% chance of a further 0.25% cut at the October 2025 meeting to a

3.75%-4.00% range, and a 74.0% probability of another quarter point reduction to

3.50%-3.75% at the December 2025 meeting. The market is less convinced of further

cuts heading into early next year, with only a 38.7% probability of a further 0.25% cut

to 3.50%-3.75% at the January 2026 meeting and a 43.4% chance of an additional

0.25% cut to 3.25%-3.50% at the March 2026 meeting.

This would imply a total reduction of about 1.25% over six months, which is not that

severe compared to the other major central banks. The ECB has already reduced

rates 2.00% from a 4.00% peak, the Bank of England is down 1.25% to 4.00% and

the Bank of Canada has made the largest absolute cut by 2.25% to 2.75%. The Bank

of Australia has reduced rates 0.75% to 3.60% and the Swiss National Bank has

already cut to zero from 1.75%. While the base rates for all these banks peaked in

2024, Bank of China had its highest rates in 2022 and have cut only 0.70% to 3.00%.

Only the Bank of Japan has hiked rates, by 0.60% to 0.50% from -0.10% in 2024.

That there is only a somewhat moderate rate cut priced in for the US does give some

room for interest rates to fall further and faster than currently expected by the market.

This could come from weak employment numbers and a continued decline of inflation,

which would give the Fed justification for more aggressive cuts. This in turn would

imply a faster rise in the money supply, potentially lower US$, and lower real yields,

if interest rates fall more quickly than inflation. All of these tend to be upward drivers

of the gold price.

Additional broader trends in support of gold are continued net purchases by central

banks and gold ETF inflows which are on track for by far their highest year ever.

Geopolitical risk also remains high, and domestic political tensions in the US have

ramped up considerably over the past week, with gold a key hedge against both of

these issues. All these factors taken together would seem to suggest the gold bull

market could still have significant room to run. The main risks are a sudden

resurgence inflation and strong economic growth, and neither seem particularly likely

currently.

Even given the potential supportive trend medium-term for gold with the backing of

so many drivers, short-term the run could pause from here, given such an aggressive

move in just a month. The market will have largely priced in the expected rate cuts

outlined above and even some of the deteriorating US employment situation, so some

further quite negative news flow could be needed to keep the rally going, especially

at its recent pace. This could take the form of weak US jobs data, which could move

those expectations for 0.25% cuts to 0.50% for some of the Fed meetings.

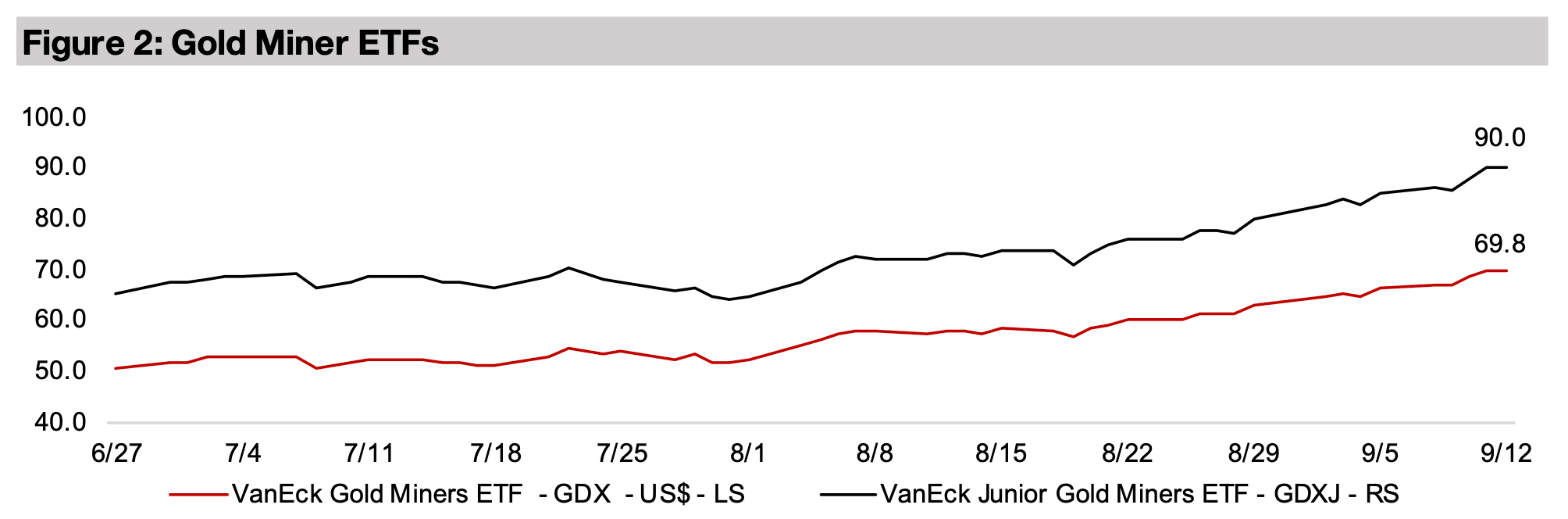

The gold stocks continued to surge, with the GDX up 5.1% and GDXJ gaining 6.1%,

significantly outpacing equities, with the S&P 500 adding 1.3%, the Nasdaq up 1.5%,

and Russell 2000 near flat, up 0.1%. While the valuations of these two ETFs have

continued to rise, neither has breached the key 3.0x price to book (P/B) level, which

could be considered the start of relatively expensive valuations. The GDX trades at a

P/B of 2.85x, and the GDXJ at 2.50x, still well below the 5.02x P/B of the S&P 500,

which has been driven up US tech, trading at 11.15x.

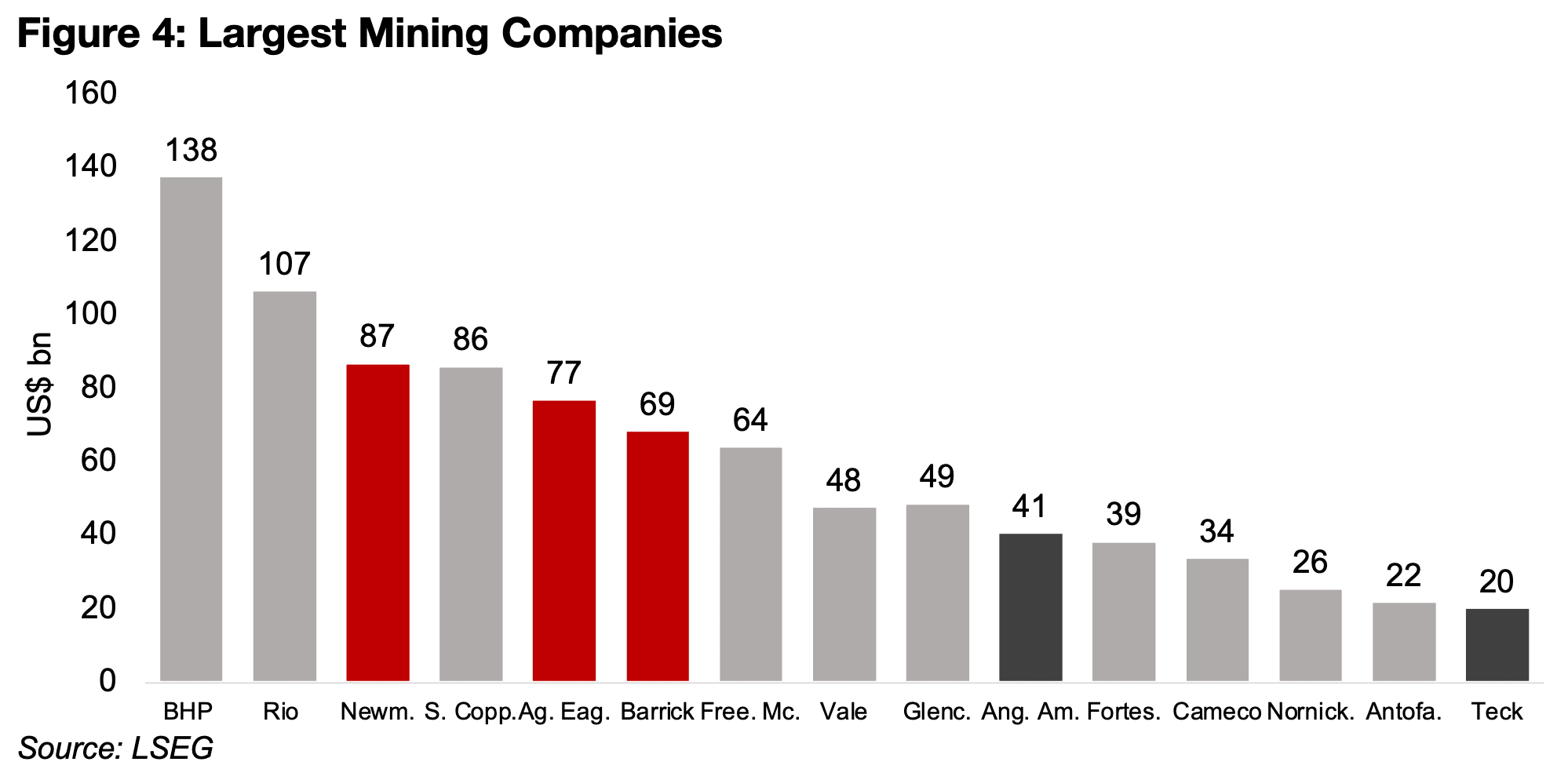

Anglo American-Teck merger the second largest ever mining deal

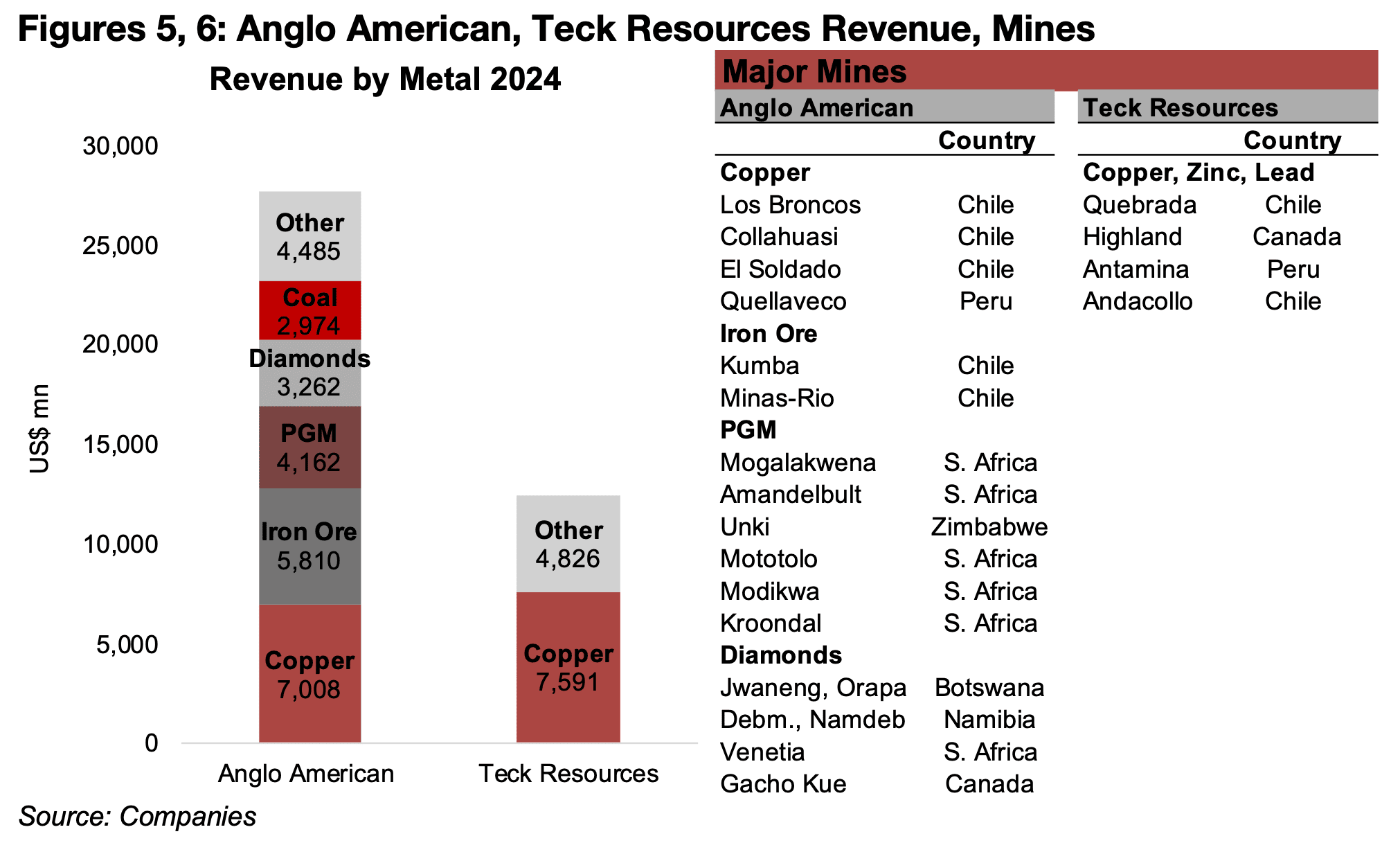

Significant mining M&A activity has continued this year, with the sector’s second ever largest merger announced this week, a combination of Anglo American and Teck Resources. Taking the current market caps of the two companies at US$40bn and US$20bn would imply a company of around US$60bn, just below the US$64bn market cap of Freeport McMoran and just above the US$48bn market cap of Vale (Figure 4). The companies have similarly sized copper businesses in terms of revenue, at around US$7.0bn in 2024, although this is a much smaller proportion of the total for the more diversified Anglo American, at just 25%, than Teck, at 61% (Figure 5).

The copper segments match geographically, with both focused on Chile and Peru (Figure 6). Anglo American also has a large contribution from iron ore in Chile, with its other major segments by revenue, platinum group metals (PGM) and diamonds, operating mainly in Africa, including South Africa, Zimbabwe, Botswana and Namibia.

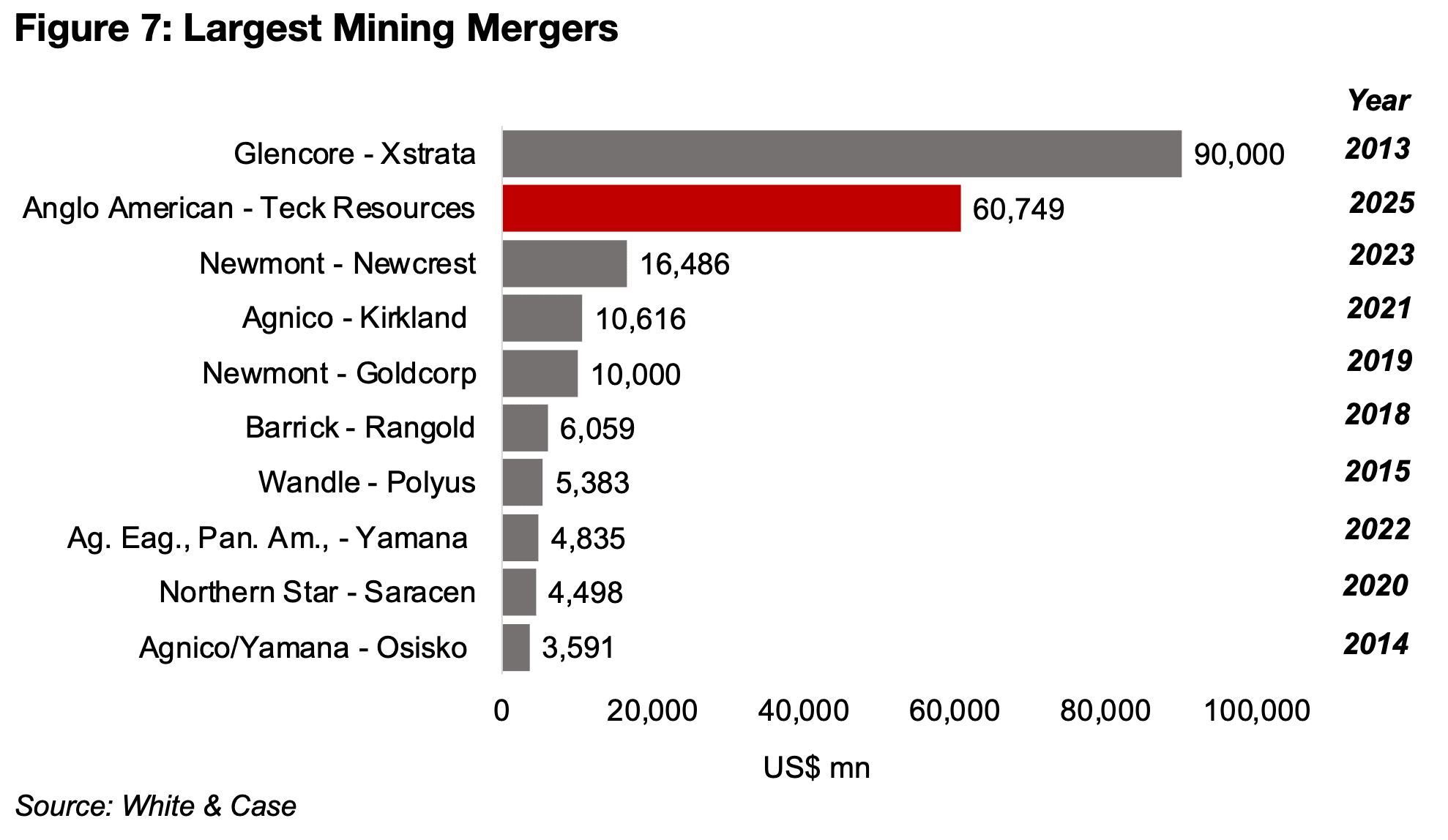

The largest ever M&A deal in the sector was over ten years ago, base metals and energy producer’s Glencore’s massive US$90bn acquisition of Xstrata in 2013, which adjusted for inflation would have an even larger gap with the other major deals (Figure 7). The third largest deal was in the gold sector, Newmont’s US$16bn acquisition of Newcrest, about a quarter the Anglo American-Teck Resources merger size, which would only be slightly higher adjusted for inflation, given that it was completed in 2023. There were also two more deals around US$10bn deals in recent years, both in the gold sector, with Agnico Eagle acquiring Kirkland and Newmont purchasing Goldcorp. With three huge megadeals in the space of just four years, gold M&A of this size in such rapid succession seems unlikely to be repeated anytime soon.

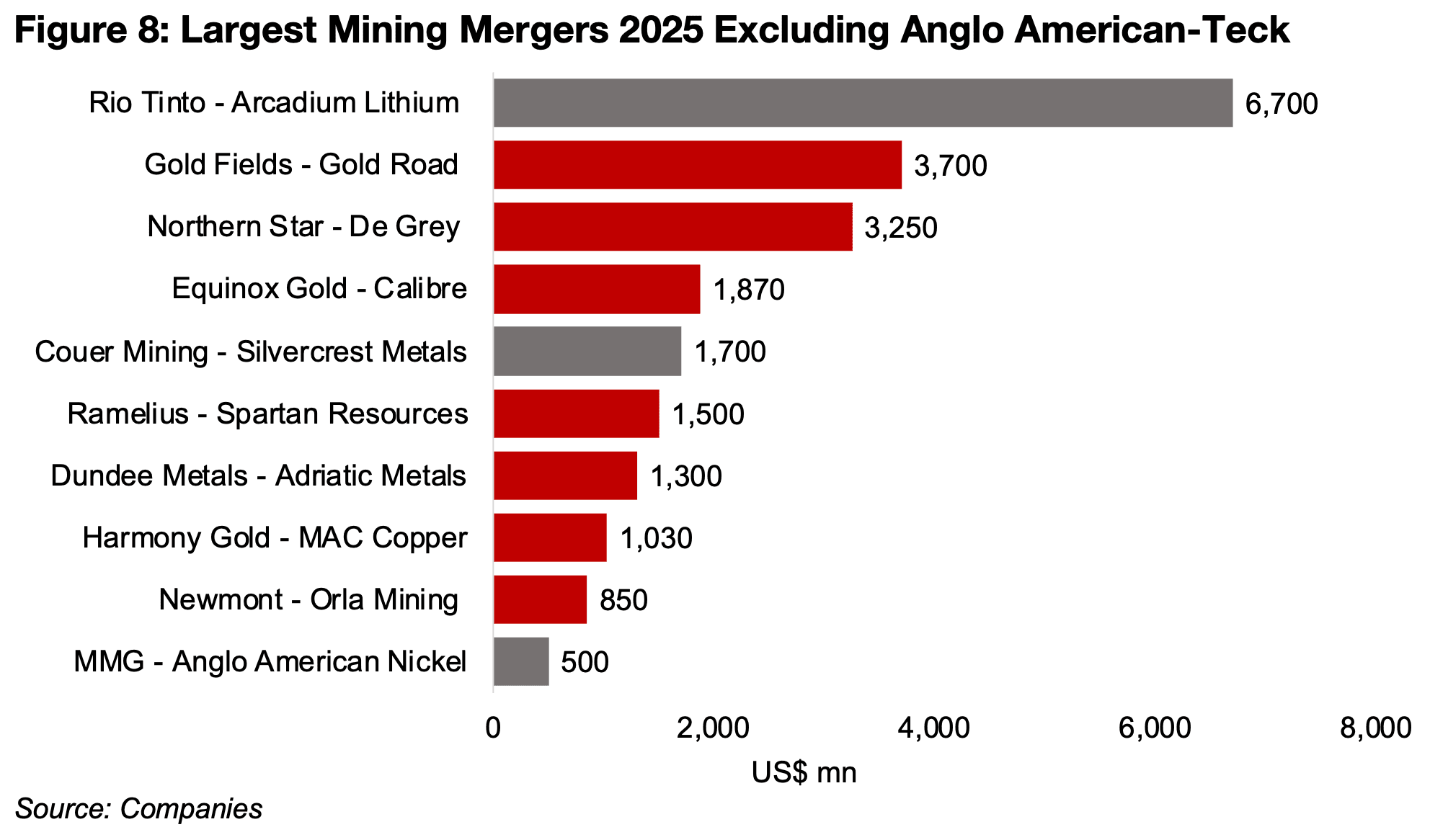

The largest mining mergers in 2025 beyond the Anglo American-Teck Resources deal so far this year has been base metals producer Rio Tinto’s acquisition of Arcadium Lithium for US$6.7bn (Figure 8). The largest gold deals have been only around a third the two previous gold megadeals, with Gold Fields acquisition of Gold Road at US$3.7bn and Equinox Gold’s acquisition of Calibre at US$1.9bn. The gold sector has still had most of the large deals this year, accounting for seven of the top eleven. These included the Ramelius acquisition of Spartan for US$1.5bn and Newmont purchasing Orla Mining for US$0.9bn. There have also been gold companies making acquisitions in other segments, with Dundee Metals purchasing the silver and lead producer Adriatic Metals for US$1.3bn, and Harmony Gold acquiring MAC copper for US$1.0bn. The third largest base metals deal was in the silver segment, Couer Mining’s acquisition of Silvercrest Metals for US$1.7bn.

Major mining M&A could continue with cash high and valuations low

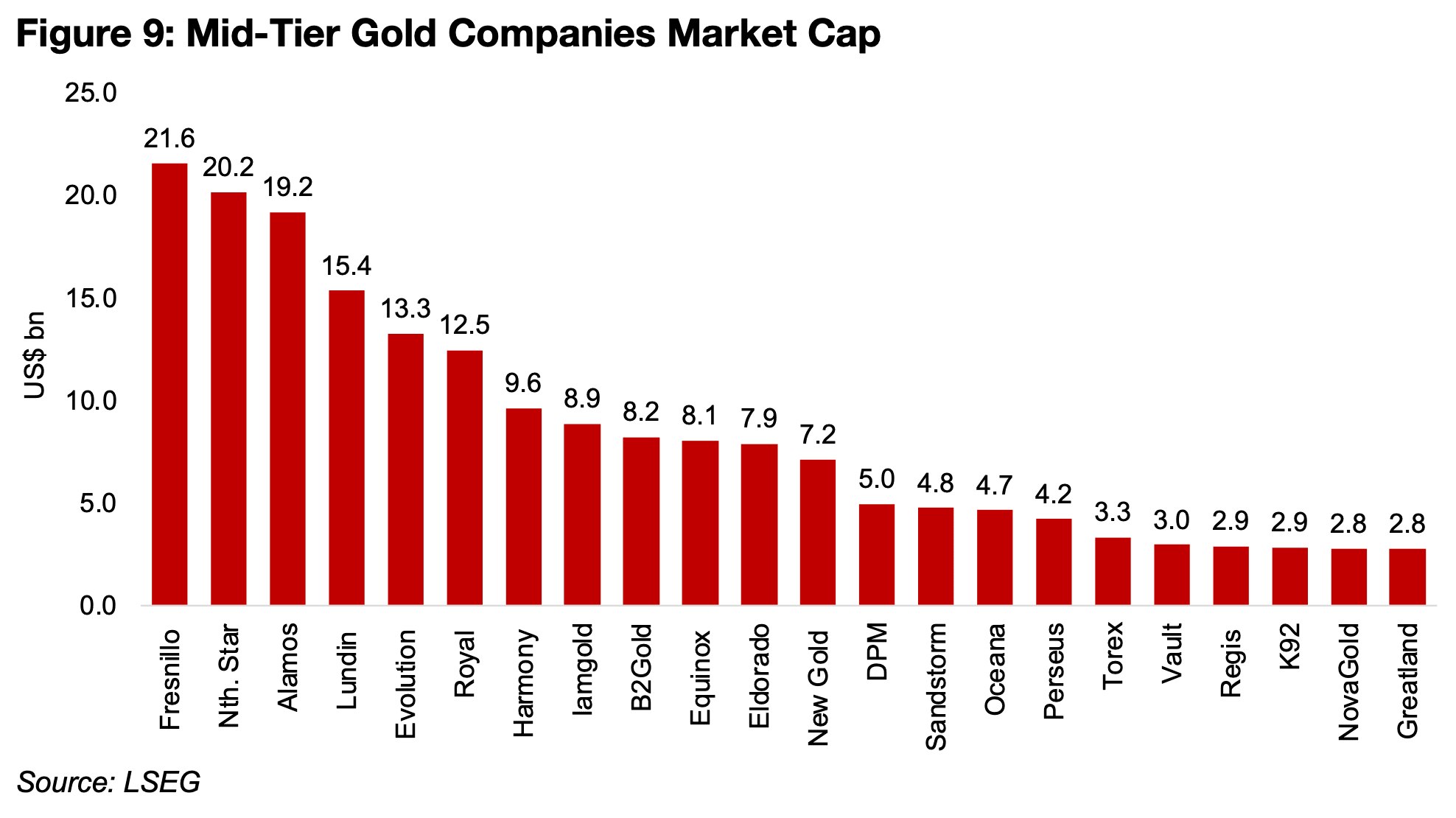

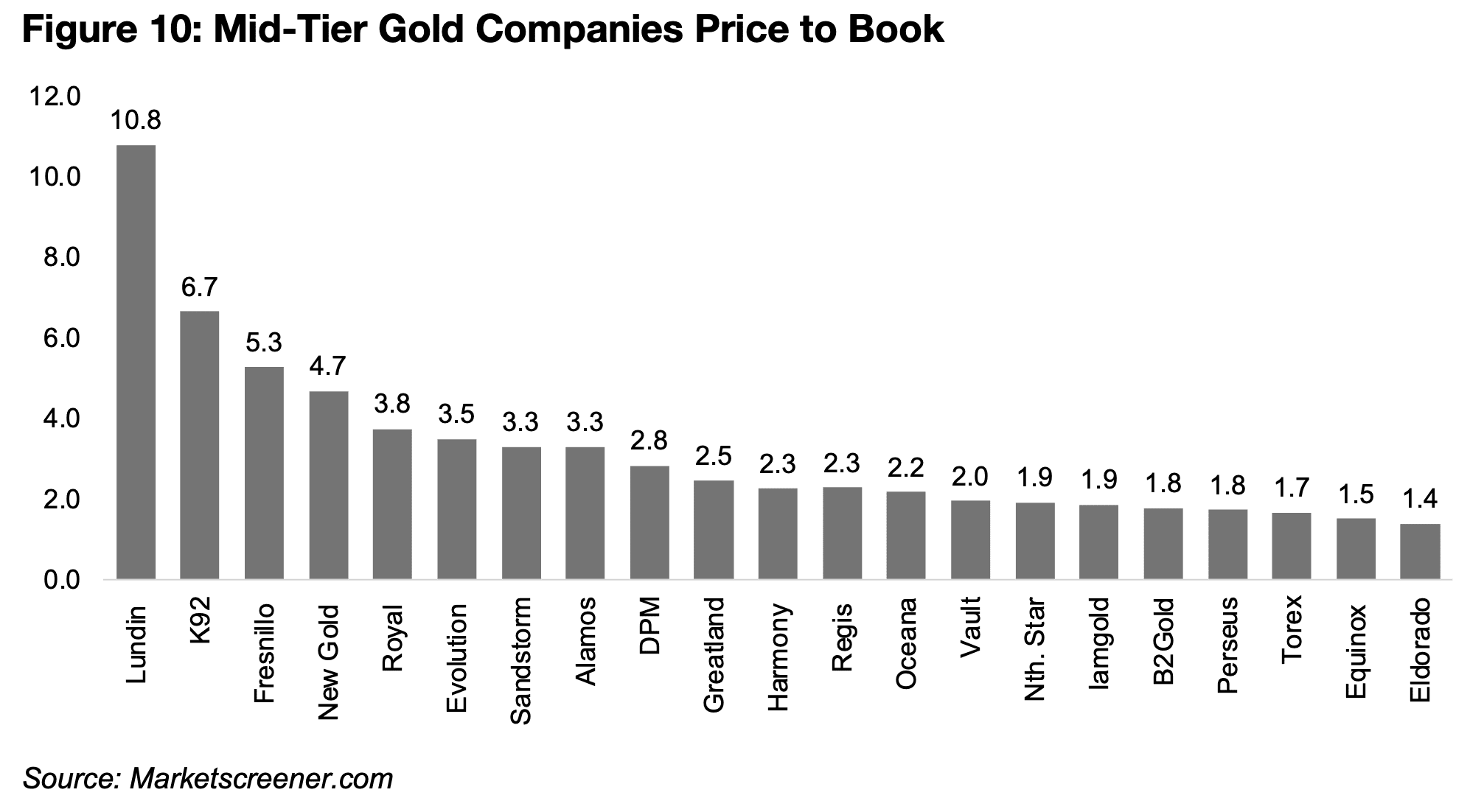

There continues to be substantial room for more relatively large scale M&A in the gold sector, with twenty-two companies with market caps ranging from US$21.6bn to US$2.8bn, which could be targets for the majors (Figure 9). Most of this group have from relatively to low valuations, with sixteen with a price to book of 3.3x or below, and eight with a P/B under 2.0x (Figure 10).

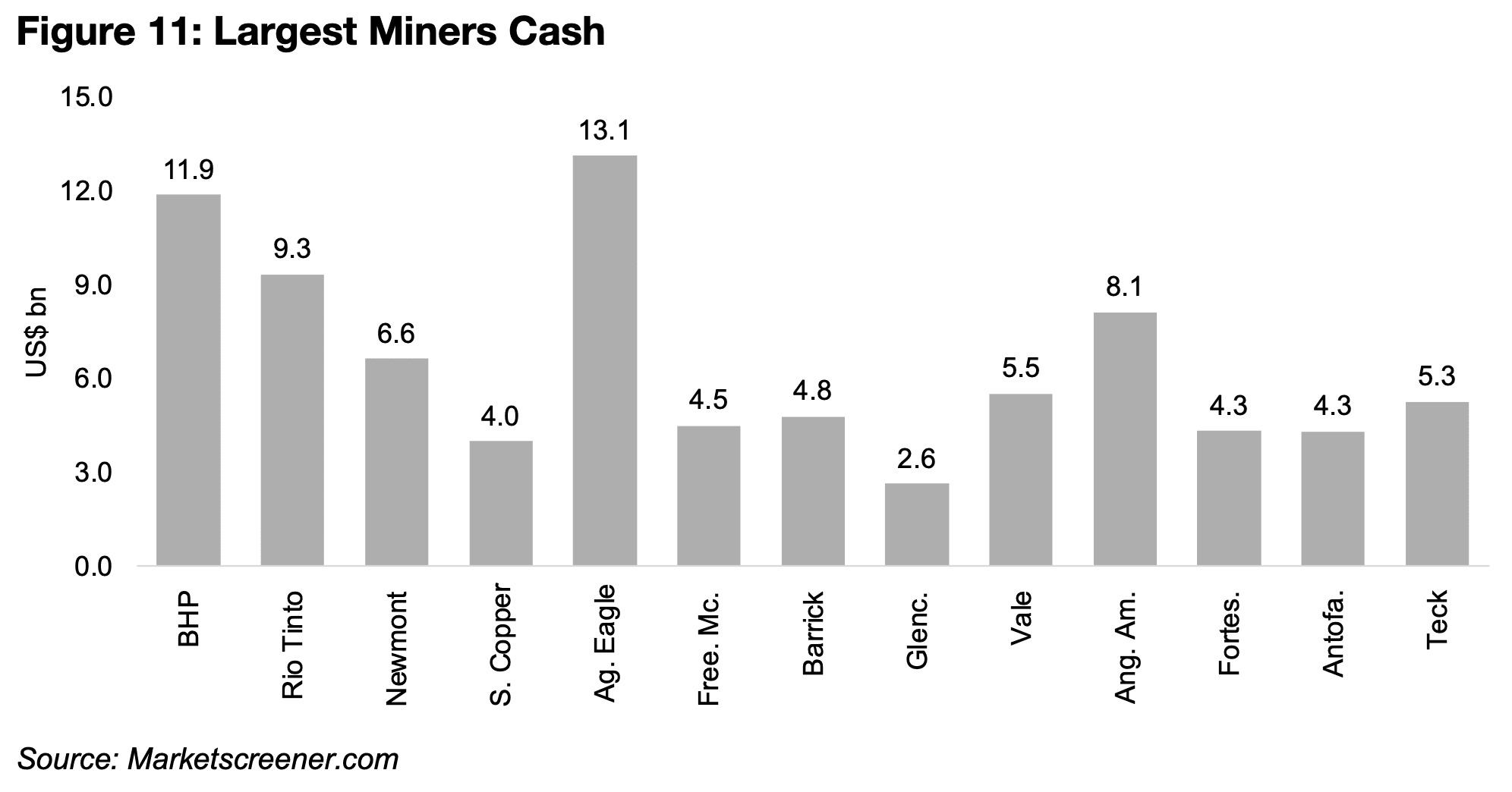

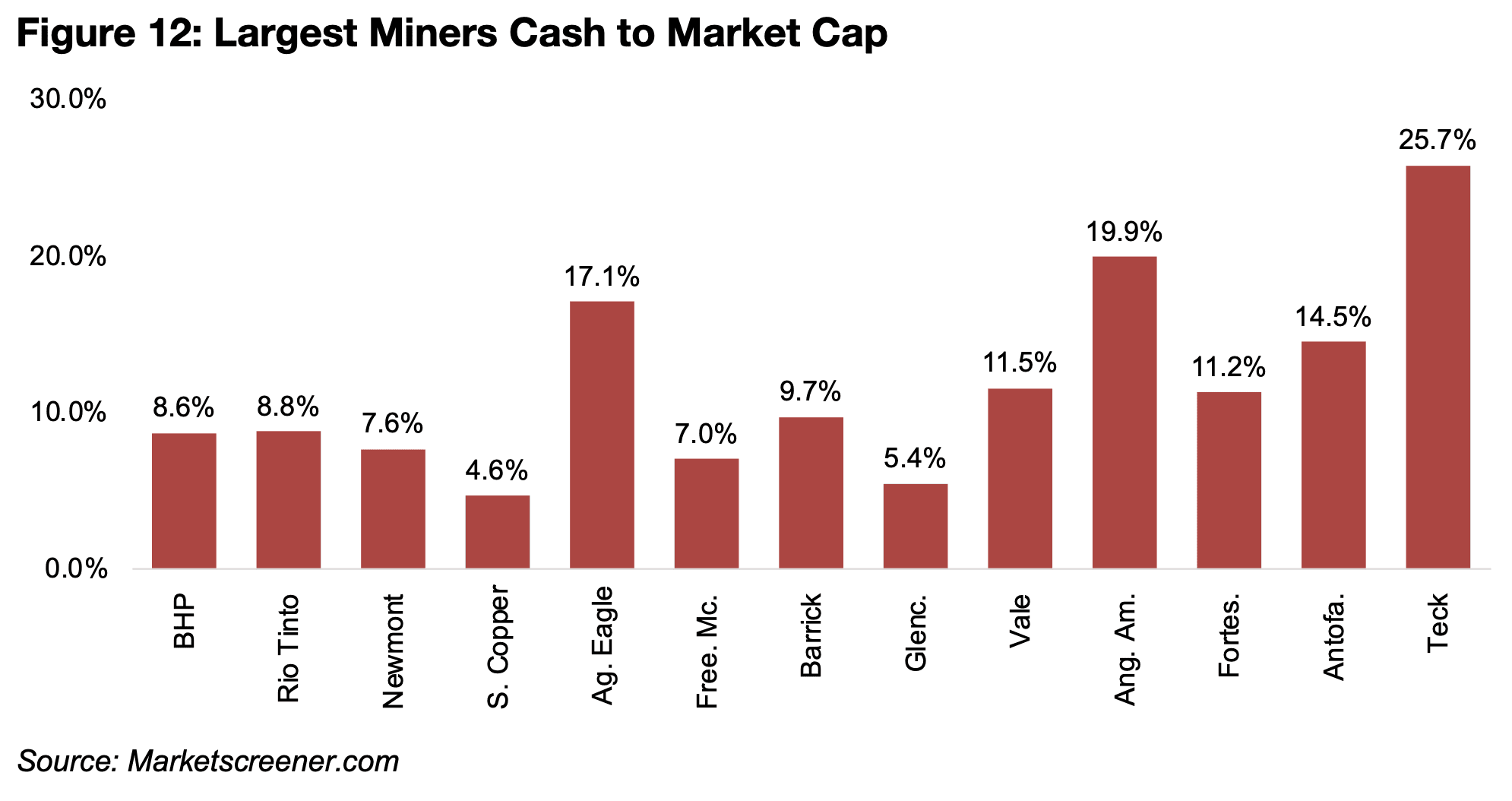

The largest miners have also built up considerable cash which would allow for many mid-tier acquisitions, with the entire group except for Glencore able to make a US$4.0bn purchase just with their current liquid resources (Figure 11). The entire group has cash of 5.0% of its market cap or more, and for most the ratio is over 9%, leaving significant room for M&A (Figure 12). For both Anglo American and Teck Resources this ratio particularly stands out, at 19.9% and 25.7%, respectively, with such substantial cash likely a key reason for their merger.

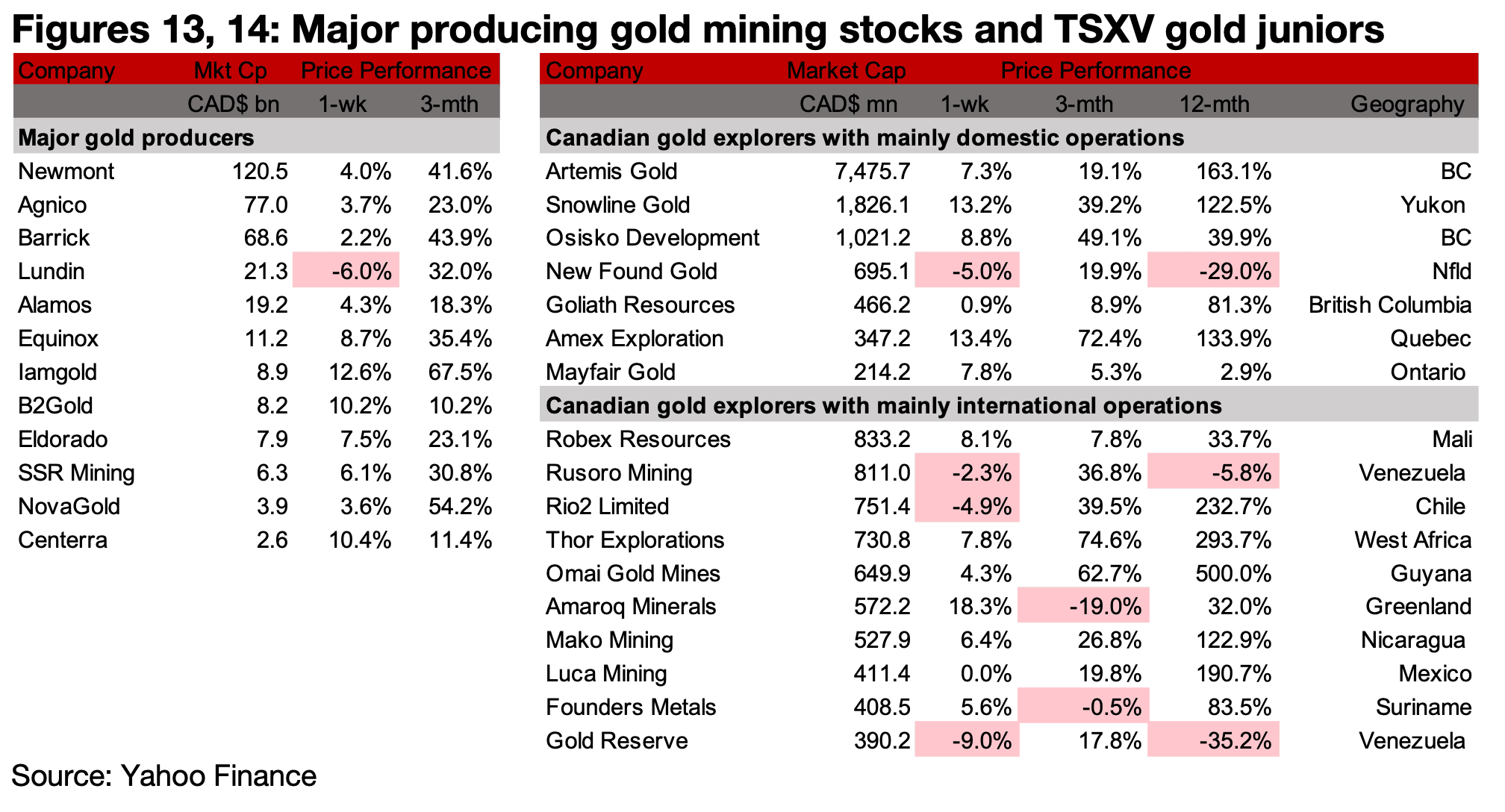

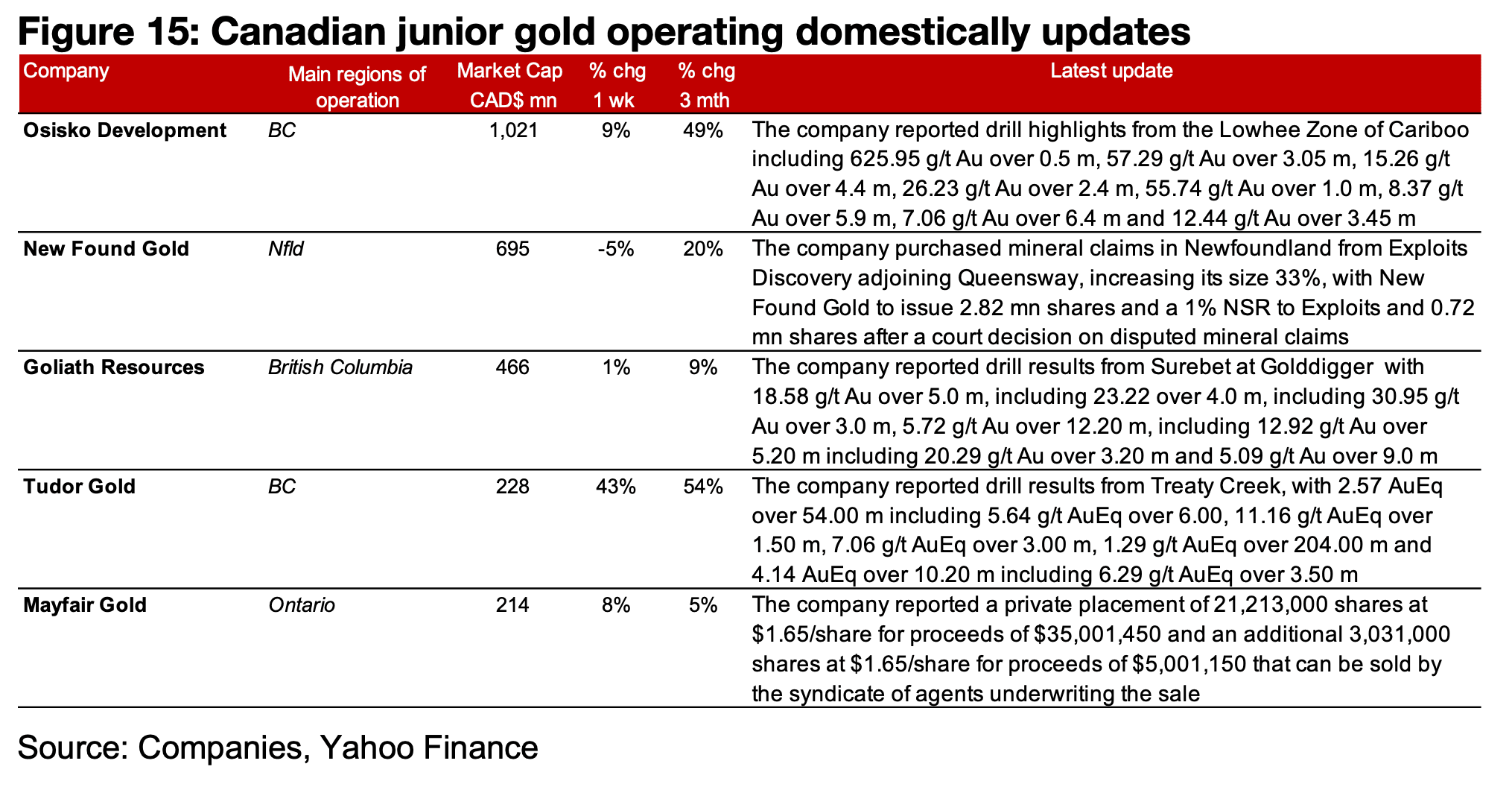

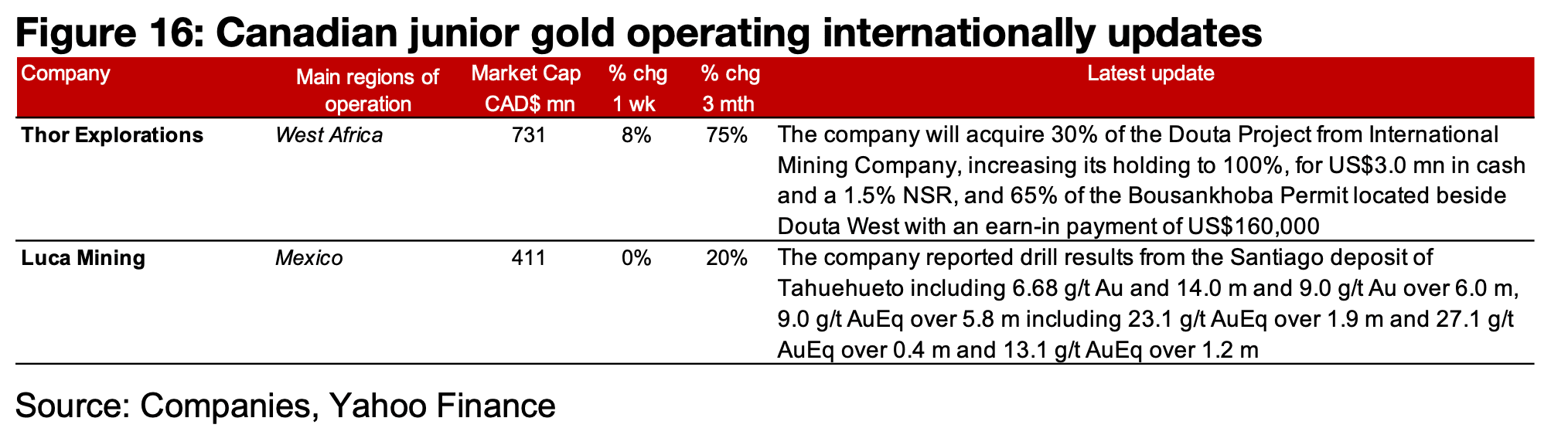

Nearly all major producers and most of TSXV gold gain

Nearly all the major producers rose, with only Lundin declining, while most of the TSXV gold stocks rose on the increase in the metal price (Figures 13, 14). For the TSXV gold companies operating mainly domestically, Osisko Development reported drill results from the Lowhee Zone of Cariboo, New Found Gold purchased mineral claims from Exploits Discovery, and Goliath Resources announced drill results from Surebet at Golddigger (Figure 15). Tudor Gold reported drill results from Treaty Creek and Mayfair Gold announced a private placement for proceeds of $35.0mn with an additional $5.0mn allotment to the syndicate of agents. For the TSXV gold companies operating mainly internationally, Thor Explorations acquired 30% of Douta, increasing its stake to 100% and the Bousankhoba permit beside Douta West and Luca Mining reported drill results from the Santiago deposit of Tahuehueto (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.