March 26, 2024

Mining Valuations Drop as Metals Rise

Author - Ben McGregor

Gold flat as Fed holds rates steady

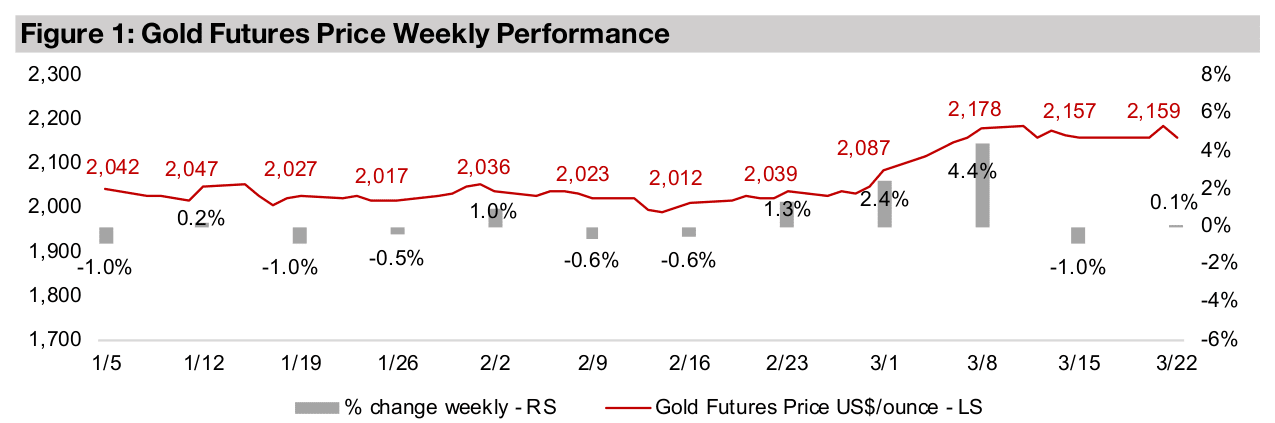

Gold was near flat, up 0.1% to US$2,159/oz, as the US Fed held rates steady as expected, but presented a slightly more dovish outlook than had been anticipated, indicating that the decline in inflation towards its 2.0% target has been satisfactory.

Mining valuations down even as many major metals rise

This week we look at the continued decline in mining stock valuations, occurring even as many major metals have risen substantially this year, suggesting that the market remains bearish on the sector, especially in contrast to ongoing tech euphoria.

Mining Valuations Drop as Metals Rise

Gold was near flat, up 0.1% to US$2,159/oz, although it briefly reached over

US$2,200/oz mid-week, a new all-time high, suggesting the breakout from a four-

year trading range centered around an average US$1,850/oz continues. The big

economic driver was the US Fed’s meeting, where it held rates flat, as was widely

expected, while the ‘dot plot’ forecasts of individual Fed Board members indicated

three 0.25% rate cuts by the end of 2024. As there had been some concern that Fed

would be more hawkish, this brought some relief to markets overall.

Gold initially jumped on the news, but this had faded by week’s end. Equities actually

declined at first, but rebounded on later comments by Chairman Powell that while

some price measures were coming in hot this year, movement overall towards the

Fed’s 2.0% inflation target was satisfactory. While gold was near flat, US equity

markets charged ahead, with the S&P 500 up 1.5%, the Nasdaq gaining 1.7% and

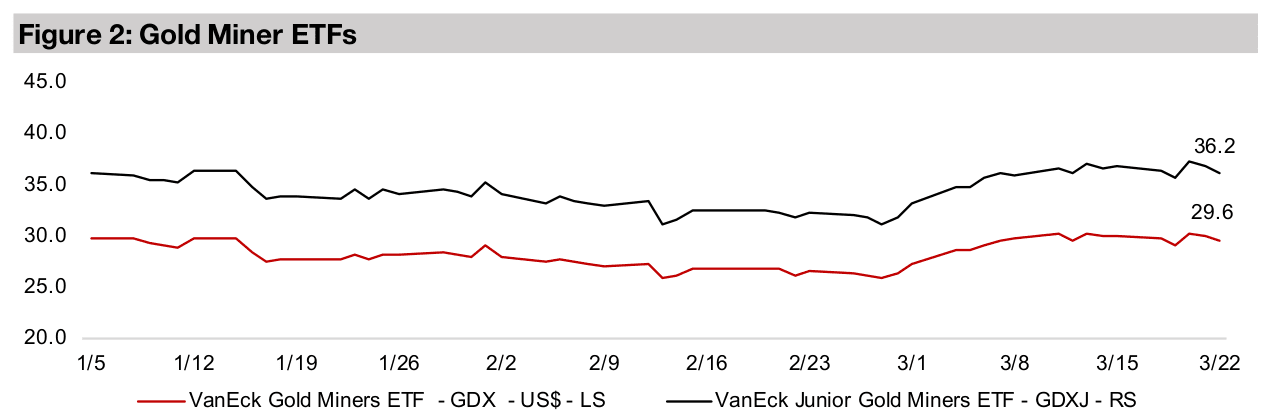

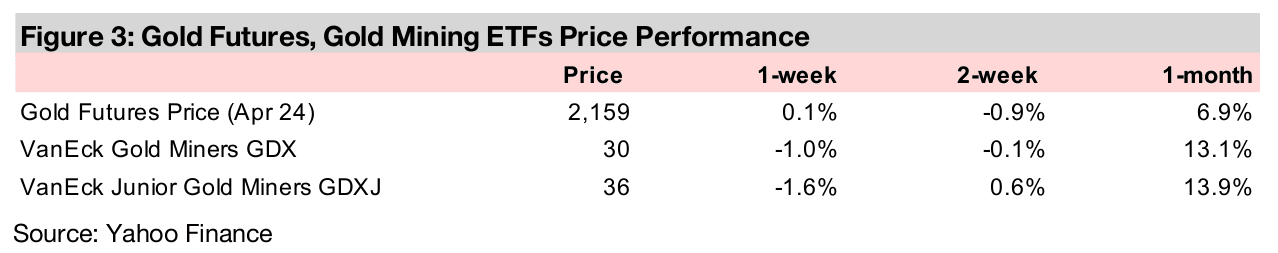

Russell 2000 rising 1.5%. Gold stocks did not participate in the sudden risk-on rally,

with the GDX and GDXJ edging down -1.0% and -1.6%.

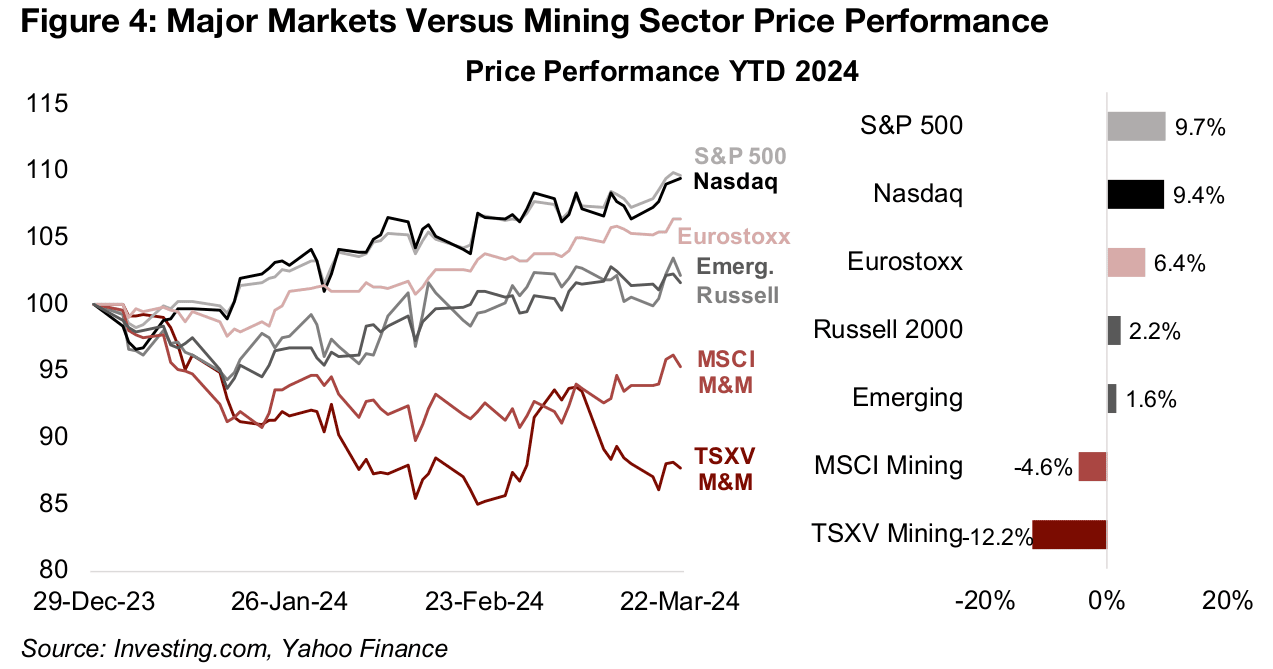

This brought the S&P 500’s gains to 9.7% so far so 2024, interestingly ahead of the

9.4% gain in the Nasdaq (Figure 4), with the latter substantially outperforming the

former in recent years. This suggests some rotation away from tech may have finally

started. European large cap stocks are also not dramatically behind the US market

performance year to date, suggesting greater movement into international equities.

However, these moves seem have been more concentrated in large caps, with the

Russell 2000 and Emerging Markets indices of mostly smaller cap stocks continuing

to lag these larger-cap developed markets.

Any larger cap sector rotation has not reached the major mining stocks yet, with the

MSCI Metals and Mining Index down -4.6% for the year, although it picked up over

the past month. The performance hasn’t been helped by a heavy weighting of the

index to BHP and Rio Tinto, which are the two largest stocks in the index, comprising

18% and 9%, respectively. Both these stocks have a high proportion of their revenue

from iron ore, and a slump in this metal price on weakening demand from China has

dragged down their share prices over the past month.

Major miner ETFs’ performance lagging gains in underlying metals

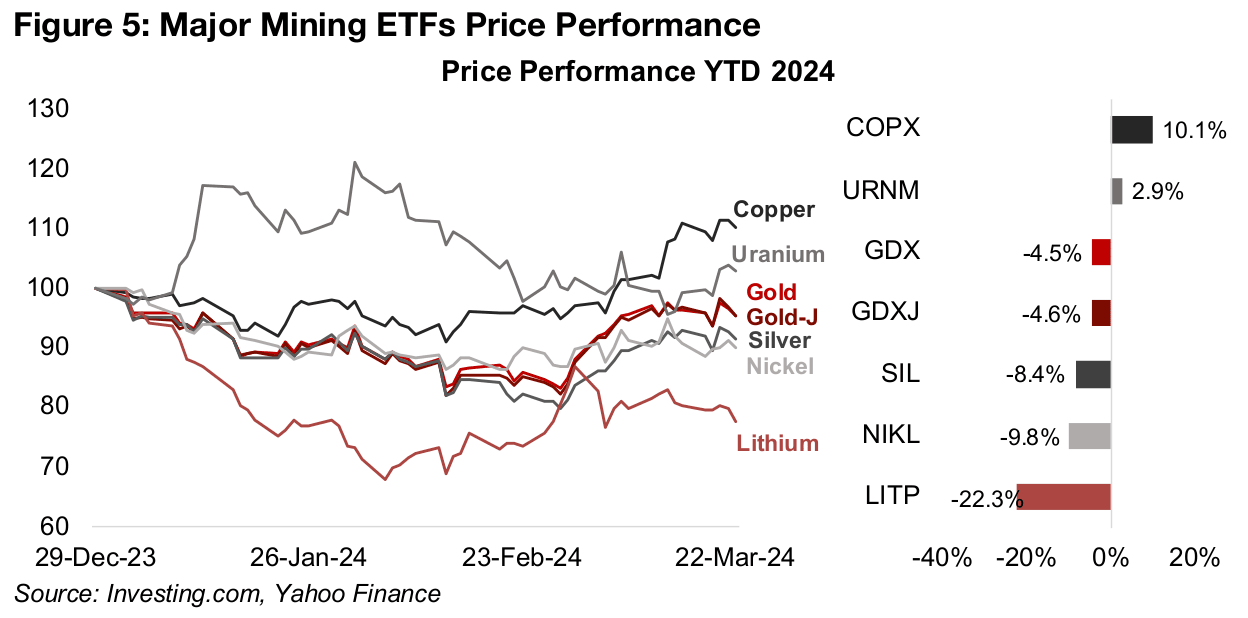

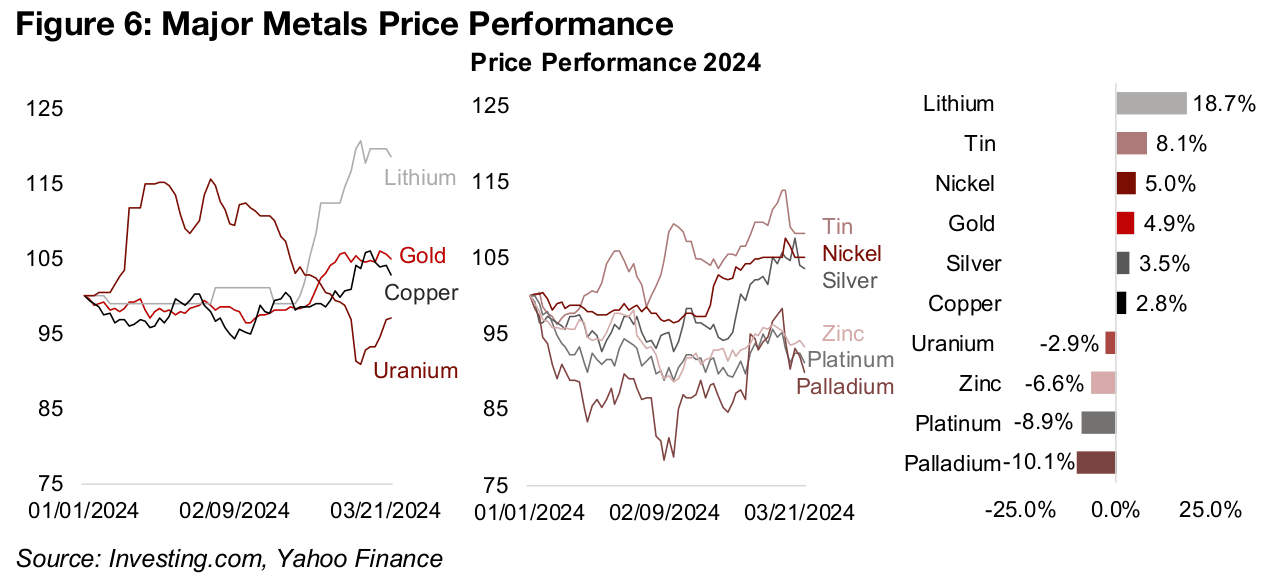

For the major mining stock ETFs, copper has been the big outperformer, with the

COPX ETF up 10.1% year to date (Figure 5) on a sudden rebound in metal price on

supply side concerns, leaving it up 2.8% for the year (Figure 6). The only other gainer,

URNM, the uranium Miner ETF, is up just 2.9% as the uranium price has pulled back

in recent months after going nearly parabolic in 2023 and is down -2.9% in 2024.

Both the GDX ETF of gold producers and GDXJ ETF of gold juniors have struggled

this year, down -4.5% and -4.6%, with the market still not pricing in gold’s recent

gains as sustainable long-term.

There is a similar trend with the SIL ETF of silver producers and NIKL ETF of nickel

producers, down -8.4% and -9.8%, respectively, even as their underlying metals

have risen, with silver up 3.5% and nickel 5.0%. The lithium producer ETF, LITP, is

down -22.3% so far this year, even as the lithium price has rebounded 18.7% this

year after plunging 75% in 2023 as new supply came online in China and EV sector

demand started to cool.

Unpacking recent volatility in the TSXV Mining Index

The S&P/TSXV Metals and Mining Index has struggled even more than the large cap MSCI Metals and Mining Index, down -12.2% year to date, given that it is almost entirely small caps, and this sector has been struggling overall. Also, even within the context of the already volatile small cap space, TSXV Mining stocks can be even riskier given that they are almost entirely pre-revenue junior miners. However, to the upside, TSXV Mining did jump in the second half of the February 2024 and into early March 2024 before giving up its gains, showing at least some signs of increased investor interest, even if only fleeting so far.

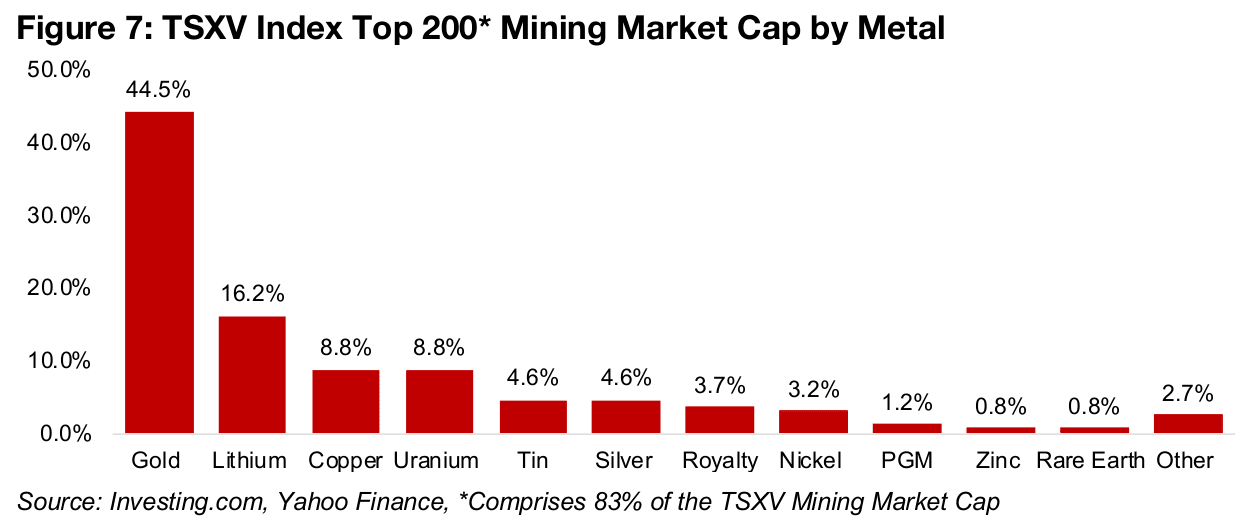

Big moves in the prices of the main metals driving the TSXV Mining explain some of

this recent volatility. The Top 200 market cap TSXV Mining stocks comprise 83% of

the total market cap of TSXV Mining and are therefore a good proxy for the overall

index. These stocks are most heavily concentrated in gold, at 44.5% of the index’s

market cap, lithium, at 16.2%, and copper and uranium, both at 8.8% (Figure 7). The

gains in gold, copper and lithium prices therefore explain much of the rise in the TSXV

in the period from late-February to early-March 2024.

However, tin, nickel, silver, zinc, platinum and palladium, which while individually a

small proportion of the TSXV Mining market cap, together are a sizeable 15.6% of

the TSXV Mining market cap, or twice the level of copper or uranium. All of these

metals were trending from up from late-February to early-March 2024 and would have

also been propelling the index. However, all of them, with the exception of nickel,

have pulled back over the past two weeks, along with copper, while gains in gold and

lithium have flattened, which has likely been the main cause of the pullback in the

index. Uranium was the only major TSXV metal going against this broader trend,

falling through from mid-February to mid-March 2024 and then rising over the past

week

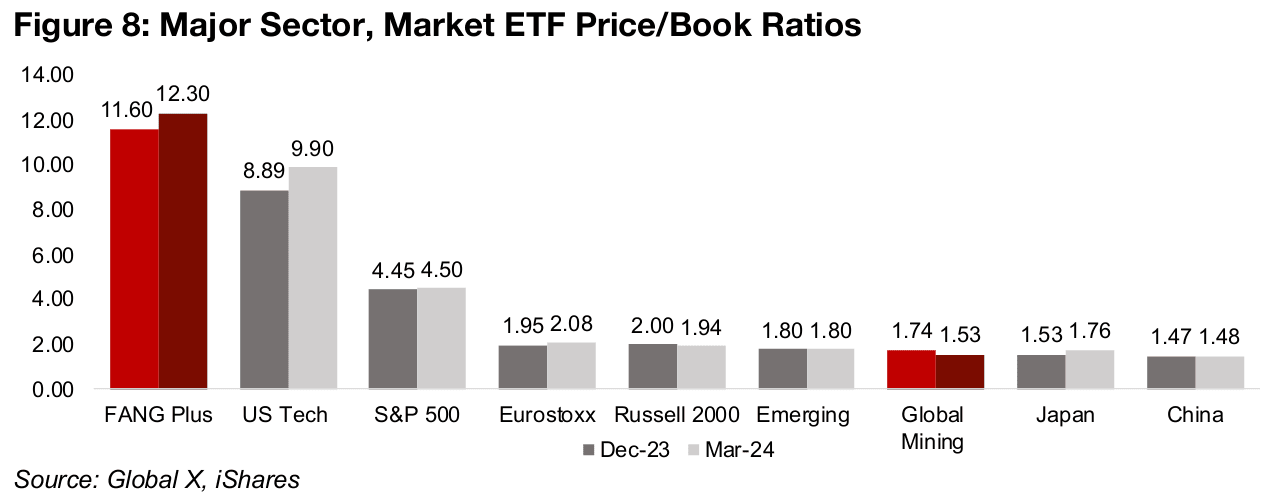

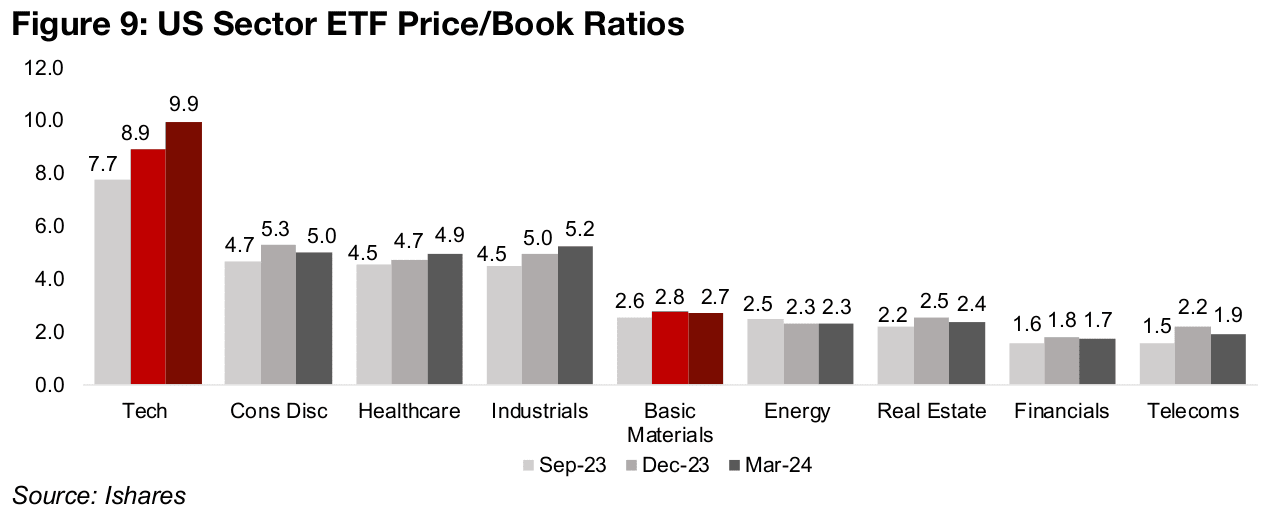

Mining valuations continue to decline while tech gains

Even with the prices of many major metals picking up for about the past month and a half, mining valuations have still been declining overall. Some mining stocks have certainly rebounded, especially those with heavy exposure to the gains in copper and gold so far this year. However, as outlined above, heavy exposure to a drop in iron ore among some of the largest stocks in the sector have weighed on valuations. Overall the price to book multiple of the iShares Global Metals and Mining Producers ETF declined to 1.53x as of March 2024, from 1.74x in December 2024 (Figure 8). This leaves it stuck around the level of iShares MSCI China, a particularly underloved market at the moment, at 1.48x.

The only other major market that has seen valuations decline over the past three

months is the Russell 2000, because of broad concerns over small cap risks. Tech

valuations have continued to not only be dramatically higher than other major markets,

but also have increased by the largest amount. The price to book of the FANG ETF

of the largest US big tech stocks has jumped to 12.30x in March 2024 from 11.60x in

January 2024, and the broader US Tech ETF to 9.90x from 8.89x.

The tech sector has also had a big hand in pushing up the S&P 500 multiple, but the

move has been much more moderate, to 4.50x from 4.45x, implying that the

valuations for the rest of the market have been more flat. This is evident in a sector

breakdown of price to book multiples from September 2023 to March 2024 (Figure

9). While tech has jumped over two points in terms of price to book, only three other

sectors have seen substantial multiple expansion, and this has still been far lower

than the tech move. Healthcare is up 0.4, industrials, 0.7, and telecoms, 0.4, and the

multiple gains for the rest of the sectors have ranged from 0.1 to 0.3, including basic

materials, under which lies the mining sector, with the energy P/B declining by 0.1.

This shows just how susceptible the overall performance of the S&P 500 has become

to any contraction in the tech valuations, which have now gone so far that a reversal

could drag down the whole market. However, it also shows that the multiple for basic

materials certainly seems to be far from the euphoria stage, and as we have outlined

in recent weeks, the probability of an eventual rotation out the pricey tech sector and

towards lower multiple sectors including basic materials is likely rising.

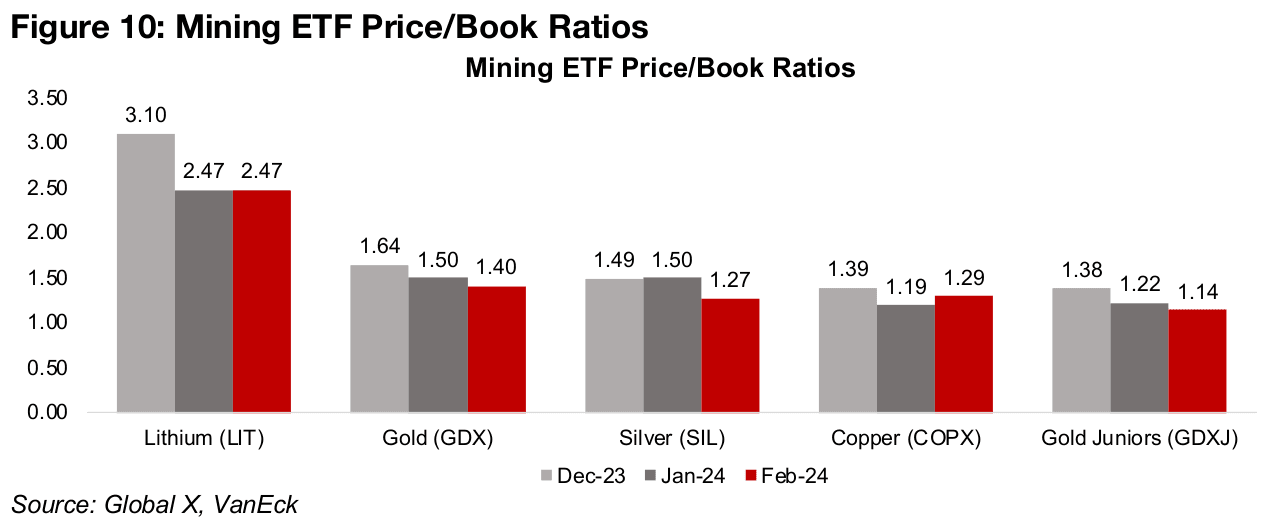

Miner ETF multiples slide even as underlying metal prices gain

Looking more closely at the decline in mining valuations through the miner ETFs of

specific metals shows that it is not just stocks with heavy iron ore exposure facing

drops. The price to book multiples for the gold, copper, lithium and silver ETFs have

all declined from December 2023 to February 2024, even as the prices of all four of

these metals have picked up substantially (Figure 10). This suggests that the market

is not pricing in that these higher prices will be sustained. While a case could be made

that a downturn in the industrial cycle could pull down copper, silver or lithium, we

expect that there is more than enough economic and political risk to propel gold

further.

The gold junior multiples have gotten particularly low, with the GDXJ ETF price to

book just 1.14x, and P/Bs at or below 1.0x generally considered to be inexpensive

for most stocks. The majority of the GDXJ exposure is not to highly risky, pre-revenue

juniors like those on the TSXV, which could admittedly warrant some investor caution

in the current environment. Most of the GDXJ comprises companies that are already

in production and generating cash flows, which therefore have quite low financing

risk, and have decent-sized market caps.

This suggests that the main reason for the multiple decline in the GDXJ has been low

expectations for the gold price. Given gold’s propensity to outperform market

expectations over the past several years, and evidence so far this year that this could

be repeated in 2024, these multiples seem to be incorporating some overly bearish

scenarios. The P/Bs of the gold, silver and copper larger producer ETFs, GDX, SIL

and COPX, at 1.40x, 1.27x and 1.29x, also seem to be pricing in quite difficult times

ahead for these sectors. Given the complete opposite outlook for tech, which

according to current valuations has a near permanent rosy economic path ahead, the

probability that the chasm between tech and mining multiples will narrow seems high.

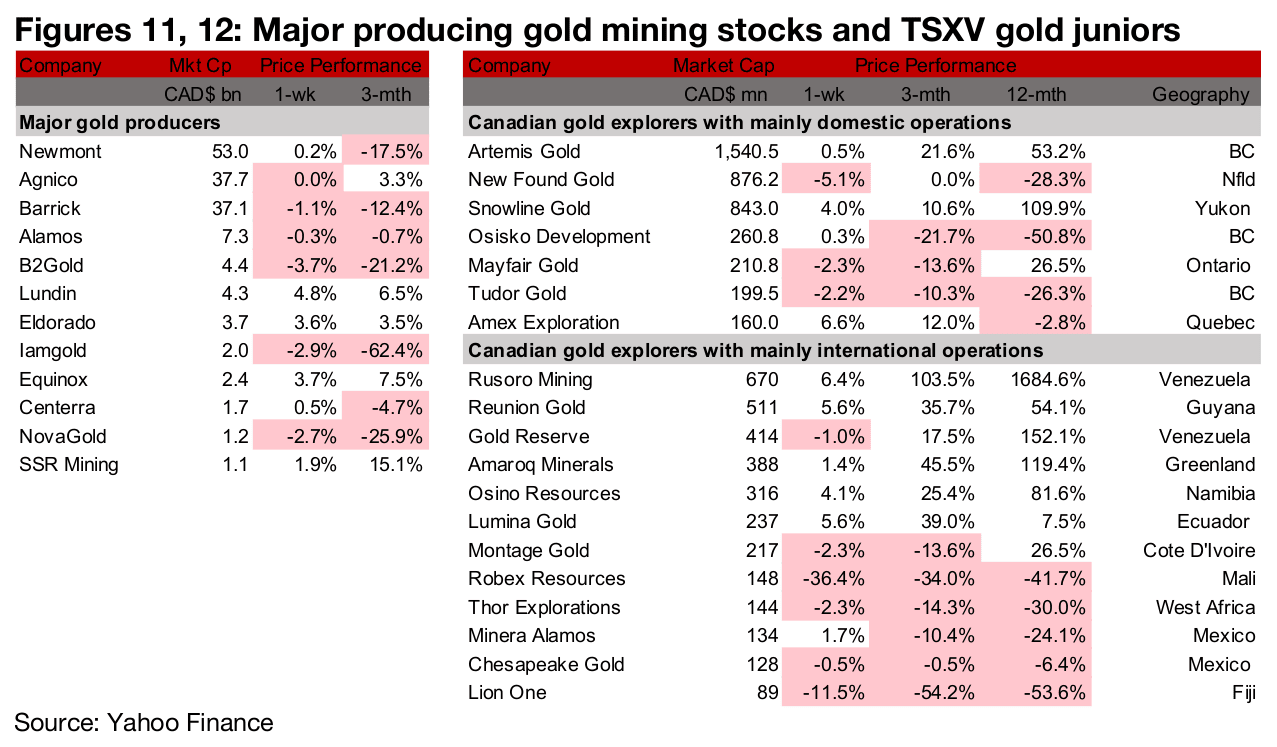

Gold producers and TSXV gold mixed

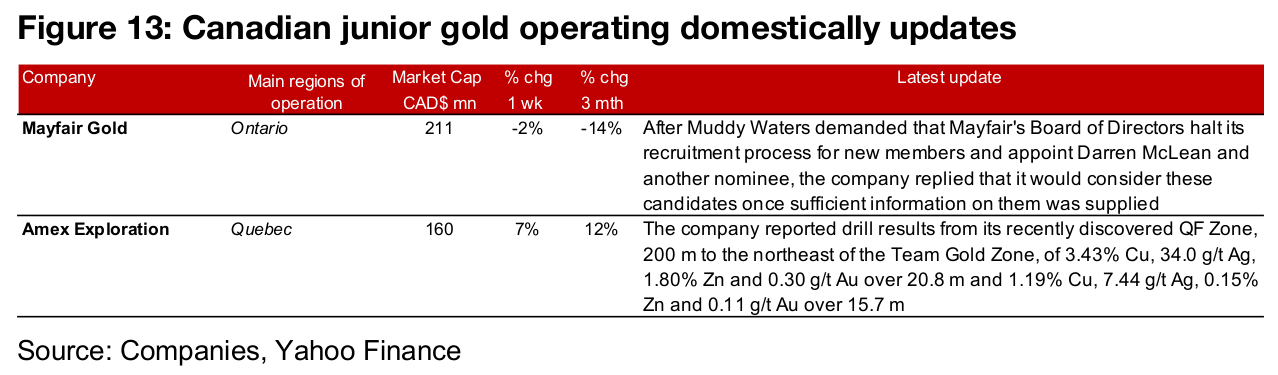

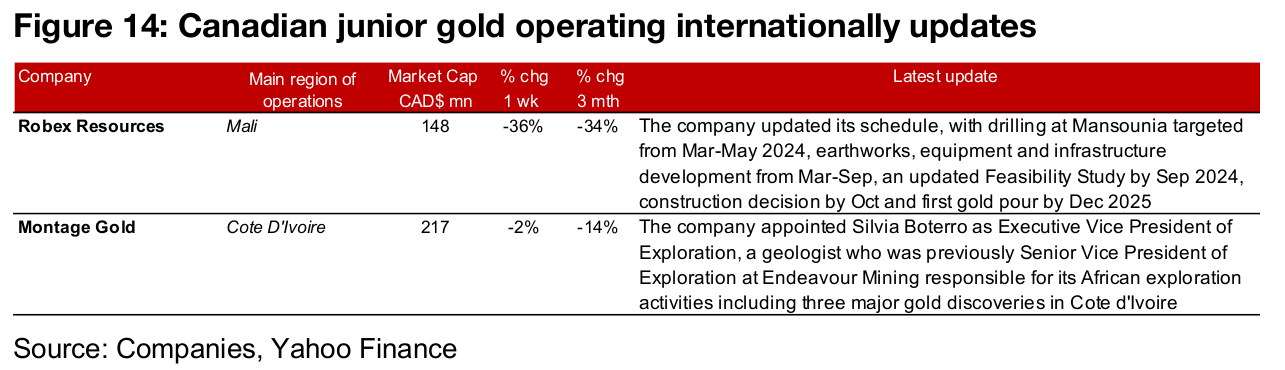

The large producers and TSXV large gold stocks were mixed as the gold price was flat and equities rose (Figures 11, 12). For the TSXV gold companies operating domestically, Mayfair Gold responded to activist investor Muddy Water’s request for changes to its Board of Directors and Amex Exploration reported drill results from the QF Zone (Figure 19). For the TSXV gold companies operating internationally, Robex Resources updated its development schedule and Montage Gold appointed an Executive Vice President of Exploration (Figure 13).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.