January 30, 2024

New Recommendation: Defense Metals (TSX-V:DEFN, OTC:DFMTF)

Contents

- China Chokes the Global REE Supply Chain

- REEs Are Critical for the Modern War Technology

- Defense Metals Makes Progress at Its Wicheeda Project

- Wicheeda’s Excellent Economics

- Exploration Experts

- What’s Next for Wicheeda?

A global war for critical minerals is underway.

China has just escalated its export restrictions for a technology used to produce magnets for high-technology, biotech, and defense industries.

These magnets are made of a critical group of minerals called rare earth elements (or REEs)…

Before that, China banned technologies to extract and separate REEs…

It’s one technology ban after another… and it concerns one of the most critical yet overlooked groups of minerals.

China is home to about 70% of the global REE supply, and that’s a problem for the rest of the world.

The country’s government can single-handedly halt the output of REEs. And it looks like it has been taking steps in that direction.

Read on to learn more about what is going on… and how you can benefit from this crisis.

China Chokes the Global REE Supply Chain

On December 21, 2023, the Chinese Ministry of Science and Technology and the Ministry of Commerce updated their catalog of technologies subject to export bans and restrictions.

It was a Christmas “gift” for the West and an escalation in a trade war that few investors are aware of.

This “war” has been going on for months. Back in July 2023, China imposed restrictions on gallium and germanium. (Gallium is used to produce heat-resistant semiconductor wafers; germanium is used as a semiconductor.)

In November, China introduced restrictions on the export of graphite, a mineral widely used in electric vehicle batteries.

And now rare earths are on the list…

It could only get worse in the future. The geopolitical tensions between China and the West are at their multi-decade highs. And the looming war in Taiwan makes both parties worried about advanced military technologies and the components they need.

The global rare-earth-element supply chain could crumble under the weight of this global confrontation.

REEs Are Critical for the Modern War Technology

If you have been following the latest conflicts, you have noticed that drones have become a critical weapon for both surveillance and attack.

From Ukraine to Iran and Gaza, drones are used to detect targets and direct precision-guided munitions.

They are cheap to manufacture and expensive to take down… they are a perfect weapon.

There is only one problem. Drones need rare earth elements for navigation and flight control, as well as path planning and obstacle avoidance.

Rare earth elements are also a critical element of magnets used in all sorts of high-tech applications, from electric vehicle motors to fighter jets. For example, an F-35 fighter jet is estimated to contain about 920 pounds of REEs.

The magnets made from REEs are powerful and light. And there is no direct and economically viable substitute for them available yet.

By some estimates, the U.S. military needs about 3,000 tons of REE-based magnets per year.

Including other uses, the country may need up to 15,000 tons of REE magnets per year.

And there is no robust domestic supply chain for this important technology yet.

However, this massive need for REE technology has started a revolution in the North American mining industry.

In response to this insatiable demand, mining juniors and large global mining companies have started to target this potentially strategic and lucrative market…

Defense Metals (TSX-V:DEFN, OTC:DFMTF) is one of the more advanced companies working in this area.

It could provide investors with direct exposure to the upside created by China’s latest policy and the West’s response to it.

Defense Metals Makes Progress at Its Wicheeda Project

There are several ways investors can play the “global rare earth war.”

They could either get exposure to these commodities through an exchange-traded fund (or an ETF) or invest in individual companies focused on the exploration and development of REE properties.

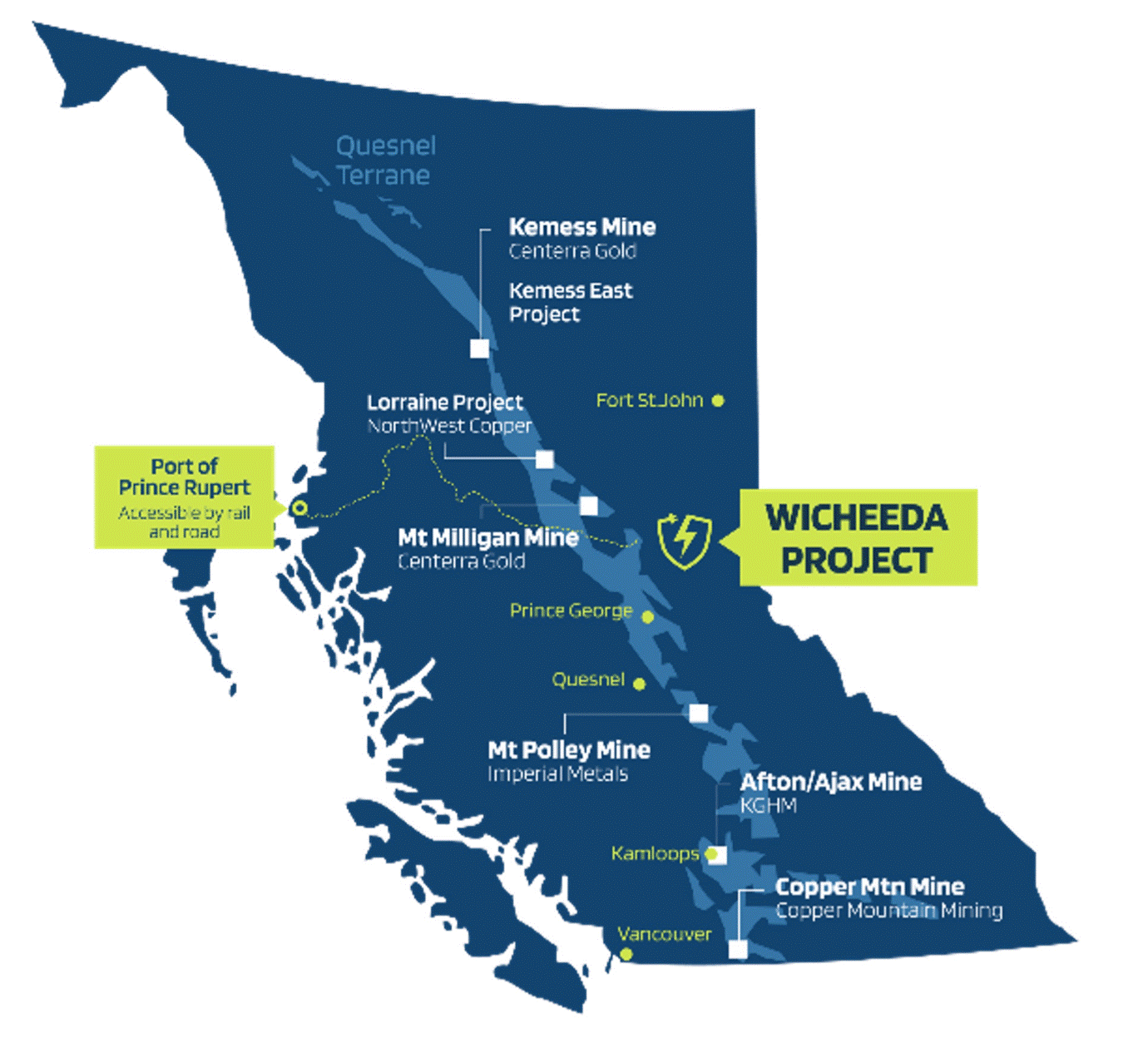

Defense Metals owns the Wicheeda rare-earth project in British Columbia, Canada.

It is believed to be one of the most advanced REE projects in North America.

It is easily accessible by road and rail with ample power infrastructure and access to a deep-sea port.

Wicheeda is also technically strong. The company has dedicated a lot of resources to understanding the project’s geology and profit potential.

The company announced that it expects to complete a pre-feasibility study on its Wicheeda REE project in Q2 2024.

In October 2023, the company announced it shipped samples of mixed rare earth oxide and mixed rare earth carbonate to interested parties, including Ontario-based Ucore Rare Metals, Inc. These samples were generated during 2023 hydrometallurgical piloting test work performed on concentrate produced by earlier flotation pilot plant testing of a 26-tonne bulk sample taken from the company’s wholly owned Wicheeda rare earth element (REE) deposit.

Defense says that Wicheeda could potentially become an open pit mine with conventional (meaning, simpler) metallurgy.

This is one of the best features of this project. Some REE properties require unique processing solutions, which makes them riskier from an economic standpoint. So far, the company’s work at Wicheeda has indicated that these more complicated solutions may not be required.

(Disclaimer: the company is working to ascertain the project’s economic value and profit potential right now. Wicheeda is an advanced-stage project, but it’s not a producing mine yet. The company expects to complete its pre-feasibility study in Q2 2024.)

Defense has made significant progress at Wicheeda.

Recently, it filed an NI43-101 report that outlined a Measured and Indicated Resource of 34.2 million tonnes averaging 2.02% total rare earth oxide (TREO).

Importantly, this resource represents a 101% conversion rate from an earlier estimate that included resources in the Indicated and Inferred categories. (As a reminder, Measured resources have a higher degree of certainty and less risk than Indicated and Inferred resources.)

Overall, the updated 2023 resource estimate increased the amount of contained metal by about 17%, or 31%, on a tonnage basis.

To achieve this, Defense added over 10,000 meters of drilling to its database.

Note that the company has managed to make this progress despite challenging market conditions. High interest rates made it more difficult for junior mining companies to raise capital. The fact that Defense managed to deliver this impressive resource update is a testament to its team’s ability to raise funds and technical prowess.

In January 2024, Defense announced that it had signed a groundbreaking partnership with the McLeod Lake Indian Band (MLIB). (Wicheeda is located on the traditional territory of the McLeod Lake Indian Band.)

As part of the agreement, MLIB has purchased an equity stake in Defense, which aligns the financial interests of MLIB and the company.

Defense and MLIB also signed a Co-Design Agreement, according to which MLIB will be an integral part of the design and decision-making process in regard to the development of Wicheeda.

This agreement, in our opinion, is an important milestone for Wicheeda. It confirms an amicable and collaborative relationship between the company and the First Nation on whose territory the project is located.

Wicheeda’s Excellent Economics

In 2022, the company filed a preliminary economic assessment (or PEA) for Wicheeda.

The project’s estimated value is about US$397 million on a post-tax basis, according to the PEA. This means that taxes were excluded from the income that the project could generate. It is a more conservative estimate of the project value than the one that doesn’t exclude taxes.

Its internal rate of return (or IRR) is 18%, and the payback period is five years.

Its total net revenue could amount to US$4 billion, and the project’s operating margin could reach 60%.

If REE prices increase over time, which we think is likely, these numbers could be even better.

Wicheeda’s economics depend on a lot of factors, but the price of the underlying commodities is the key one. And, given the high demand and lagging supply, the price of rare earth elements could increase significantly from their current levels.

In addition to this leverage to the underlying commodity price, the project has another catalyst.

The reason is simple. The PEA was based on the 2021 resource estimate, which included 4,249 meters of drilling. And in 2023, the company updated Wicheeda’s NI-43-101 compliant resource, as we discussed above.

It grew bigger, which bodes well for the project’s economics.

Exploration Experts

In the mining industry, specialization is key.

This is why we like the fact that Defense’s CEO has experience in exploration. Mr. Craig Taylor, the company’s CEO and Director, was involved in the exploration side of the mining business for decades. The company also works with SGS and SRK on the Wicheeda REE Project.

Both companies are well-respected in the mining sector.

And before the “green transition” trend began and EVs became as huge as they are right now, Mr. Taylor had focused on these promising sectors already.

Between 2007 and 2016, he was a director of Advantage Lithium Corp.

He was also involved with Clear Mountain Resources, now named Patriot One Technologies.

The company’s team is growing, and one of the latest additions is John Robins. He is the co-founder and principal of Discovery Group, of which Defense is a part.

Mr. Robins was involved in several high-profile discoveries, such as the Coffee Gold deposit in Yukon and the Great Bear project in Ontario.

He was instrumental in over C$3 billion in mergers and acquisitions (M&A) activity in the mining sector. He was also involved in generating over C$1 billion in mineral exploration expenditures in Canada, Latin America, and Australia.

One of the largest transactions that Mr. Robins was involved in was the C$1.8 billion sale of Great Bear Resources to Kinross, a gold mining major.

The company’s team is focused on exploration and development and has experience in high-profile deals in the mining space.

This is the combination of skills an exploration and development mining company needs.

And this is why we think that Defense is one of the best companies focused on rare earth elements trading in North America.

What’s Next for Wicheeda?

Defense continues de-risking its Wicheeda project.

It is in the process of completing a preliminary feasibility study (or PFS).

A PFS is a document that details the technical, economic, and social impact of a mineral property.

It is one of the most critical milestones that a mining junior can reach as part of de-risking its property and estimating its potential value.

Based on the fact that Defense is working on a PFS right now, we would expect the company to have it ready in Q2 2024, as it has indicated. We are not aware of any exact dates, of course.

But investors should note this potentially huge catalyst for the company. There are not many companies in North America that are rapidly advancing a quality rare-earth project.

In fact, only one project is in commercial production (Mountain Pass, owned by MP Materials).

And they may not need to wait too long…

In addition to the upcoming prefeasibility study, the company, we believe, will benefit from the unfolding of the global “REE war.”

The Chinese government has released its updated policies just in time for the holidays. A lot of investors won’t notice this massive catalyst for the REE space…

But as the implications of these decisions permeate the markets, we will not be surprised to see a lot of interest in the North American critical minerals space.

And Defense Metals is a standout player in this area.

The company is constantly providing updates and progress on its Wicheeda REE project.

(Visit www.defensemetals.com and www.sedarplus.ca for further information).

Do your own research and due diligence, as always… But keep in mind that just over the past five years, Defense Metals…

- has produced resource estimates,

- completed several metallurgical tests,

- drilled the project several times,

- created a mutually beneficial relationship with the local First Nations, and

- built a strong board of directors, management, and technical teams.

We believe this is a one-of-a-kind opportunity.

This is why we are adding Defense Metals (TSX-V:DEFN, OTC:DFMTF) to the Canadian Mining Report portfolio.

Sign up to receive our future articles and updates.

Disclosure / Paid Services

The Canadian Mining Report has been retained by Defense Metals Corp. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Defense Metals Corp. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Defense Metals and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Sources

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient.

Read More