January 26, 2026

On The Verge of US$5,000/oz

Author - Ben McGregor

Gold boom nears US$5000/oz

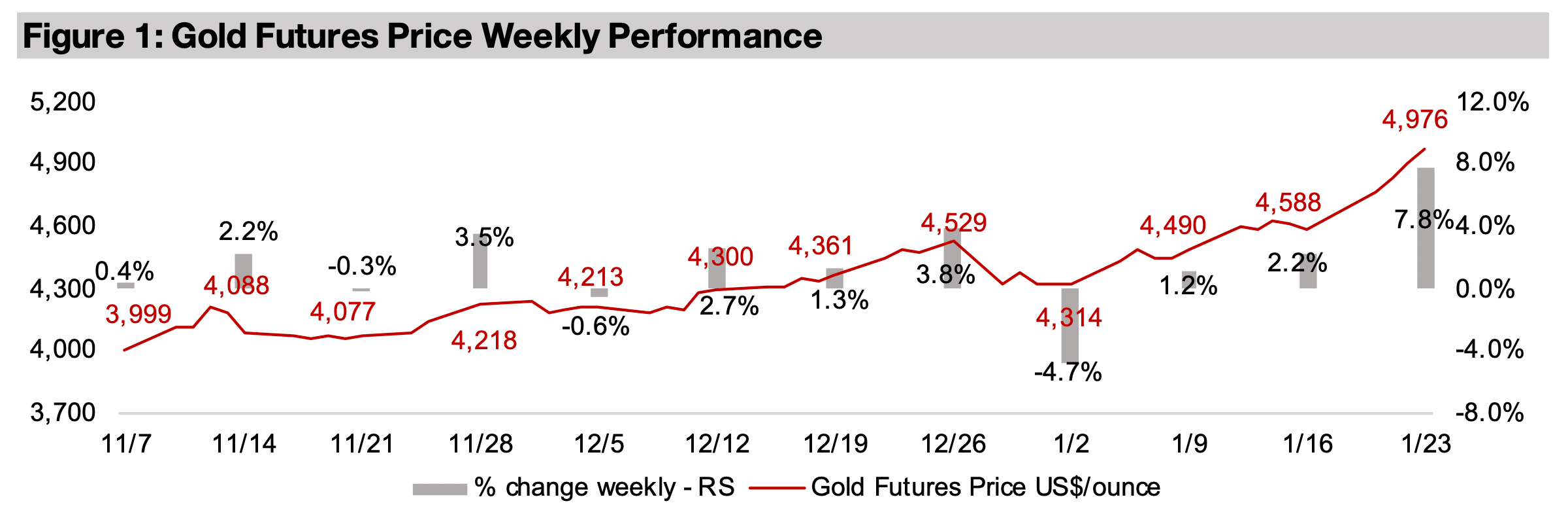

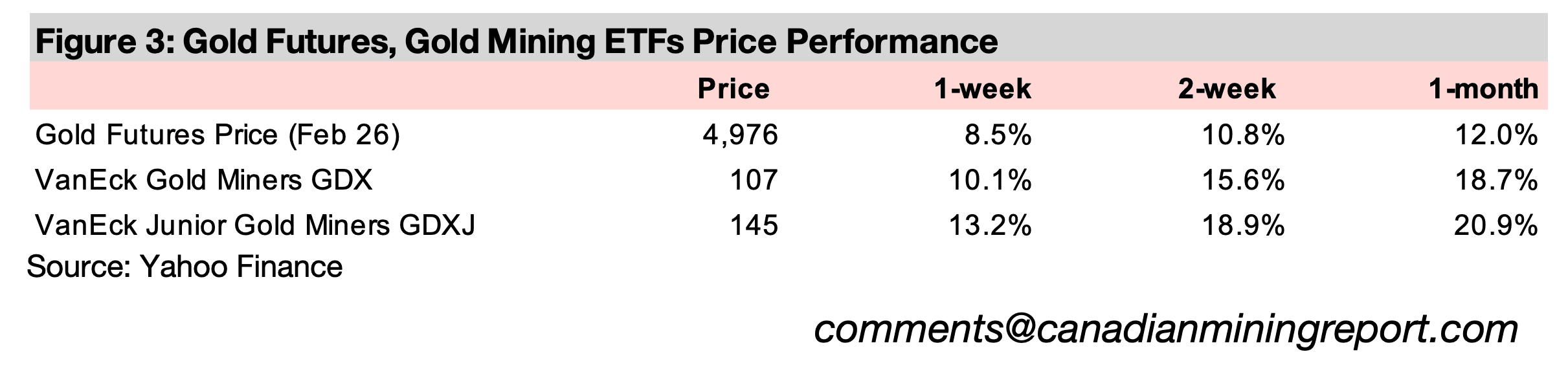

Gold rose 7.8%, up nearly US$400/oz to US$4,976/oz, and looks set to soon reach US$5,000/oz, as the metal continues to have strong fundamental support but has also been catalyzed by likely rising speculative flows into the precious metals boom.

On The Verge of US$5,000/oz

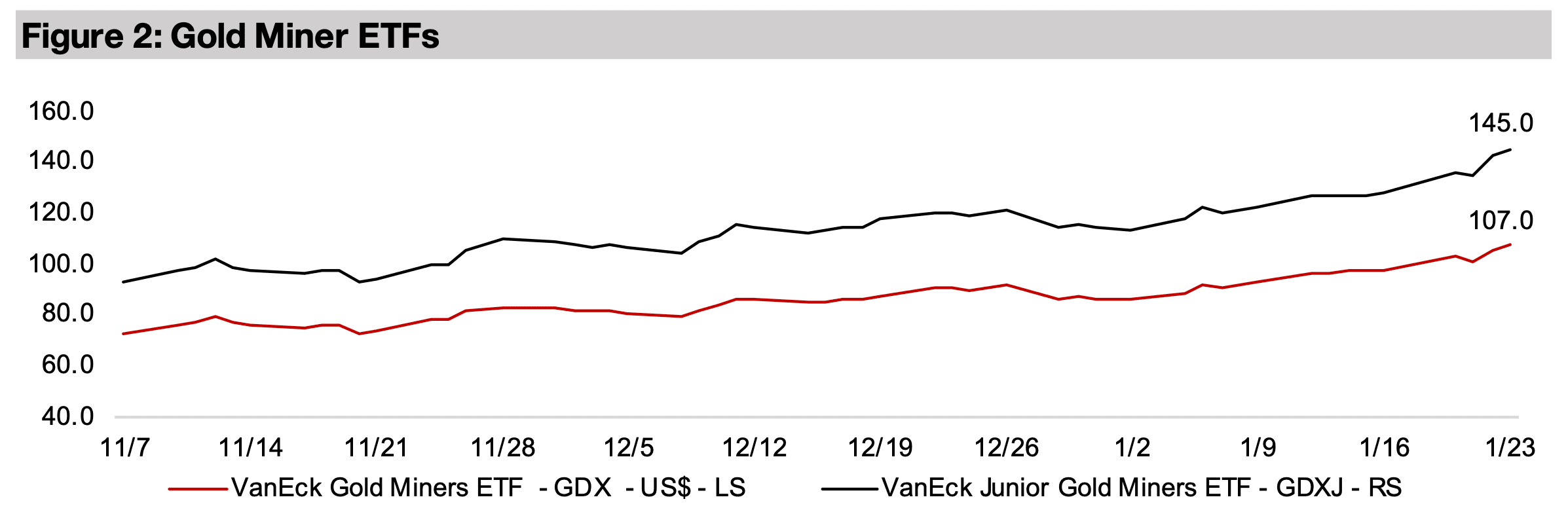

The gold price rocketed up 7.8%, or nearly US$400/oz, to US$4,976/oz and appears likely to reach US$5,000/oz soon given the current trend. The main driver this week appears to have been a rise in political risk, specifically related to the US push for control of Greenland. This drove a slump in equity markets early in the week as Europe had reacted by sending forces to the country, although the drop eased after a speech by President Trump at Davos appeared to rule out a military takeover. The S&P 500 declined -0.7% for the week, the Nasdaq gained 0.3% and the Russell 2000 small caps index fell -1.8%, far outpaced by gold stocks, with the GDX up 10.1% and the GDXJ surging 13.2%.

Is the gold market starting to turn ‘irrationally exuberant’?

While usually we would view gold reaching such a critical benchmark as a warning

sign of potential consolidation soon, the current run seems particularly frothy and is

seeing increasingly widespread backing from the market. While the continuation of

such a parabolic move will eventually set up a significant pullback, for now we do not

expect that just crossing US$5,000/oz will necessarily slow it down. This could

actually even propel it further, as more speculative money starts to chase the trend.

Some with more conservative views on the metal may have also exited in the -5.0%

consolidation in the price straddling the end of 2025 and start of 2026 and more ‘hot’

money may have entered the market.

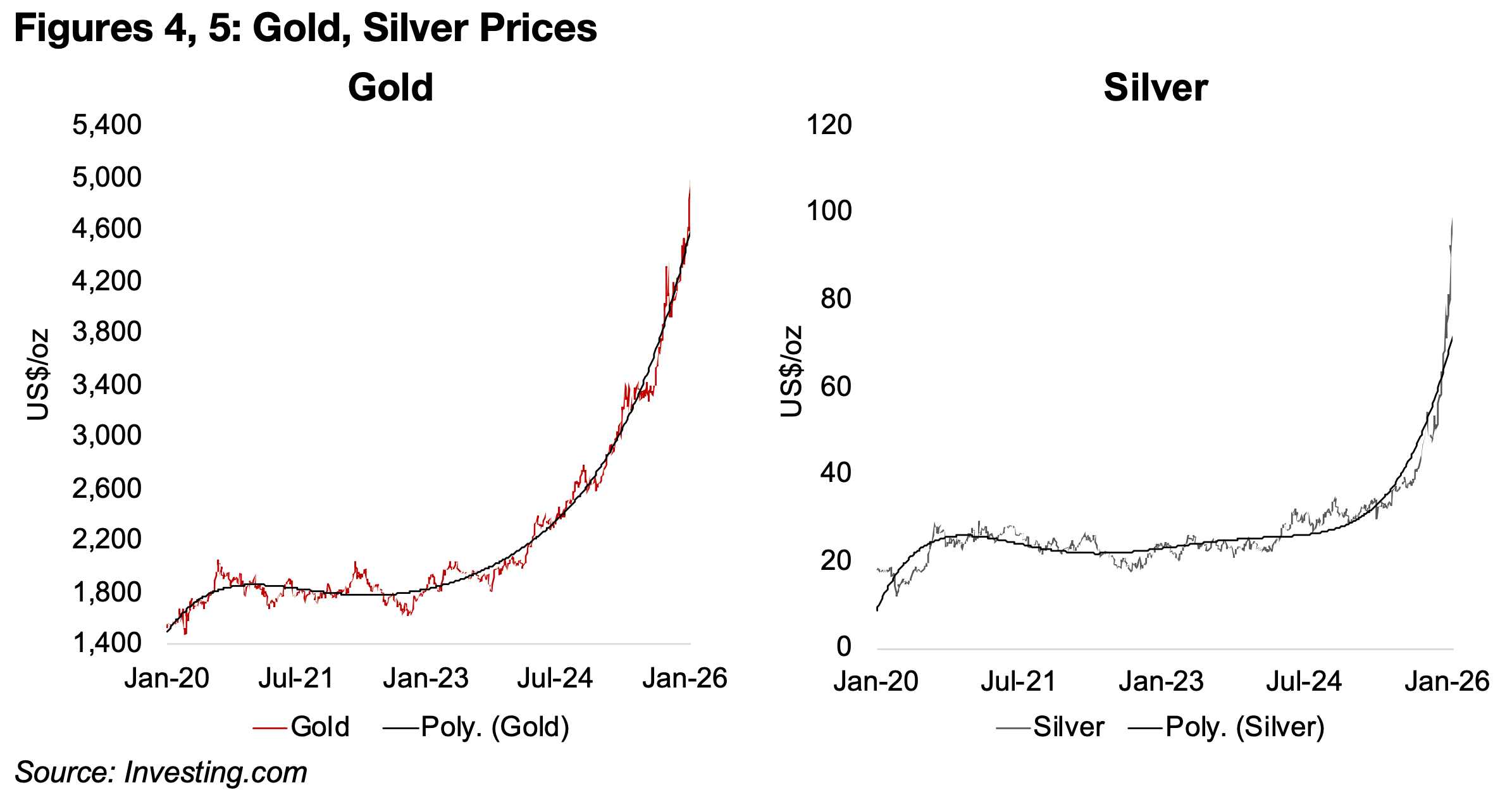

We have certainly long exited the more gradual early stages of the gold bull market,

which ran from around 2021 to 2024 after an initial jump in 2019 to 2020 (Figure 4). A

more parabolic phase started in 2025 and has gained pace in recent months.

However, the big move since last year had had fundamental support, especially from

the resumption of a major monetary expansion by major global central banks, as well

as surging economic risks following rising global trade tariffs and elevated

geopolitical risk. The question now is whether the price moves so far that it starts

getting obviously ahead even of the strong fundamentals. The move this week was

so extreme that the gold bull market could be entering an ‘irrationally exuberant’

phase. However, it may still only be near the start of this phase, and such moves can

be quite extended before reversing.

Gold has clearly become a consensus trade in the market, and many investment

banks already have US$5,000/oz gold forecasts for this year, which seem likely to be

breached soon, and some have already boosted their targets now significantly above

this level. This may actual be a warning sign that a bubble could be developing, as

these banks had consistently lagged the realized gold price from 2019-2025. This

year could be the first in the six-year gold bull market that their estimates catch up

with, or even get ahead of, the actual gold price. These seems to indicate the metal

is no longer mainly the domain of long-term gold buyers and central banks, as it was

from 2021-2024, but an increasingly mainstream trade.

With increasingly hot money moving into gold, one factor that could drive a pullback could be an increase in leveraged speculative bets on the metal, which could exit quickly at the first signs of a decline. There is also likely major retail money surging into gold ETFs, which may not necessarily be leveraged, but could also could flow out as quickly as it enters. A rise in real bond yields could move against the metal, but rates have been declining with inflation near flat, decreasing the opportunity cost of a position in yield-less gold. A major pullback in the global monetary expansion could hit gold, but this seems highly unlikely, as does a major decline in economic and geopolitical risks.

Gold to silver ratio down to lows of forty-year range

The bull market has also not been constrained to gold, with the other precious metals

far outperforming it since 2025, especially silver. While gold had a steady uptrend

overall through 2023 and 2024, silver actually remained quite flat through this period,

although it more than made up for this with a surge in 2025 that made even gold’s

huge gains last year appear relatively subdued. As with gold, this has had strong

fundamental drivers, with silver entering its fifth year of deficit.

The deficit appears to have become particularly acute in Q4/25, with inventories at

the LBMA only held up by a doubling in monthly imports from China as of November

2025 versus the H1/25. This depleted stocks of silver in China and led to a major

spread in the price in the country over the UK. This is partly from rising industrial

demand, and there has been a similar trend in other smaller metals markets, including

cobalt, lithium and tin, where prices suddenly spiked after downturns of several years.

However, while real underlying demand may have started these moves, it appears

that more recently there has been an increasingly speculative component in the gains.

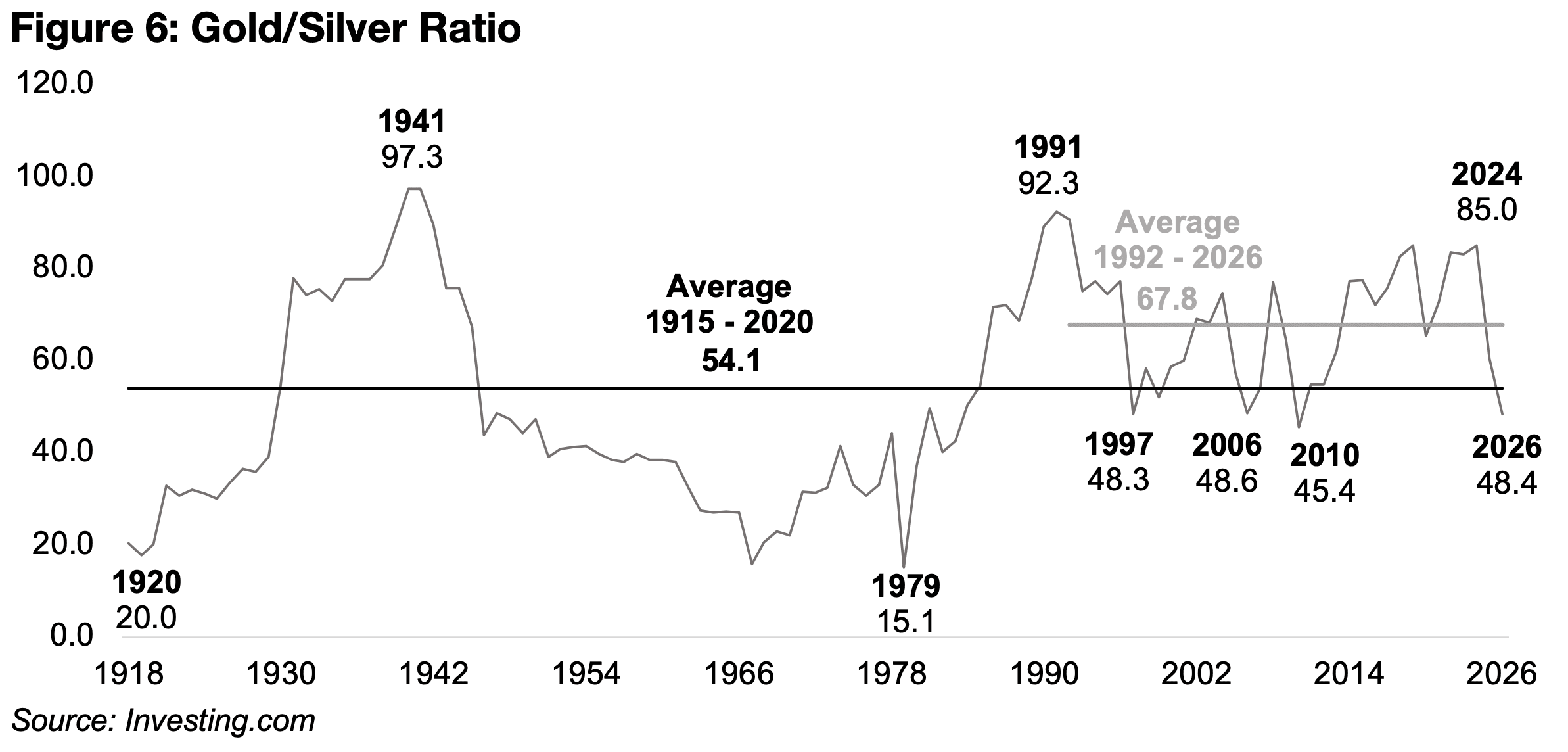

The rise in silver has driven the gold to silver ratio down to extremely low levels of

48.4x, which is at the bottom of the forty-year range, with it only lower than the current

level in 2010, at 45.4x (Figure 6). A return to the average since 1992 of 67.8x would

imply a significant pullback in silver, or further huge rise in gold. The 54.1x long-term

average from 1915-2020 may not be applicable currently as there have obviously

been major structural shifts in the precious metals industry since over the past one

hundred years, but even a return to this level implies a drop in silver or jump in gold.

The historically severely low ratio seems to suggest that a correction in the silver price

could follow, especially if the most recent gains have been mainly speculative.

Gold, silver and PGM stock valuations could remain elevated

The surge in the precious metals has driven up valuations of stocks in the sector

considerably in 2025, and while many looked quite inexpensive in 2023 and 2024,

this is no longer the case. While the gold price rose gradually through 2023 and 2024,

valuations in the sector still remained low, as the market apparently expected an

eventual pull back in the metal. However, by last year, it was increasingly clear that

gold had shifted into a much higher sustainable average, and this was finally priced

into stocks.

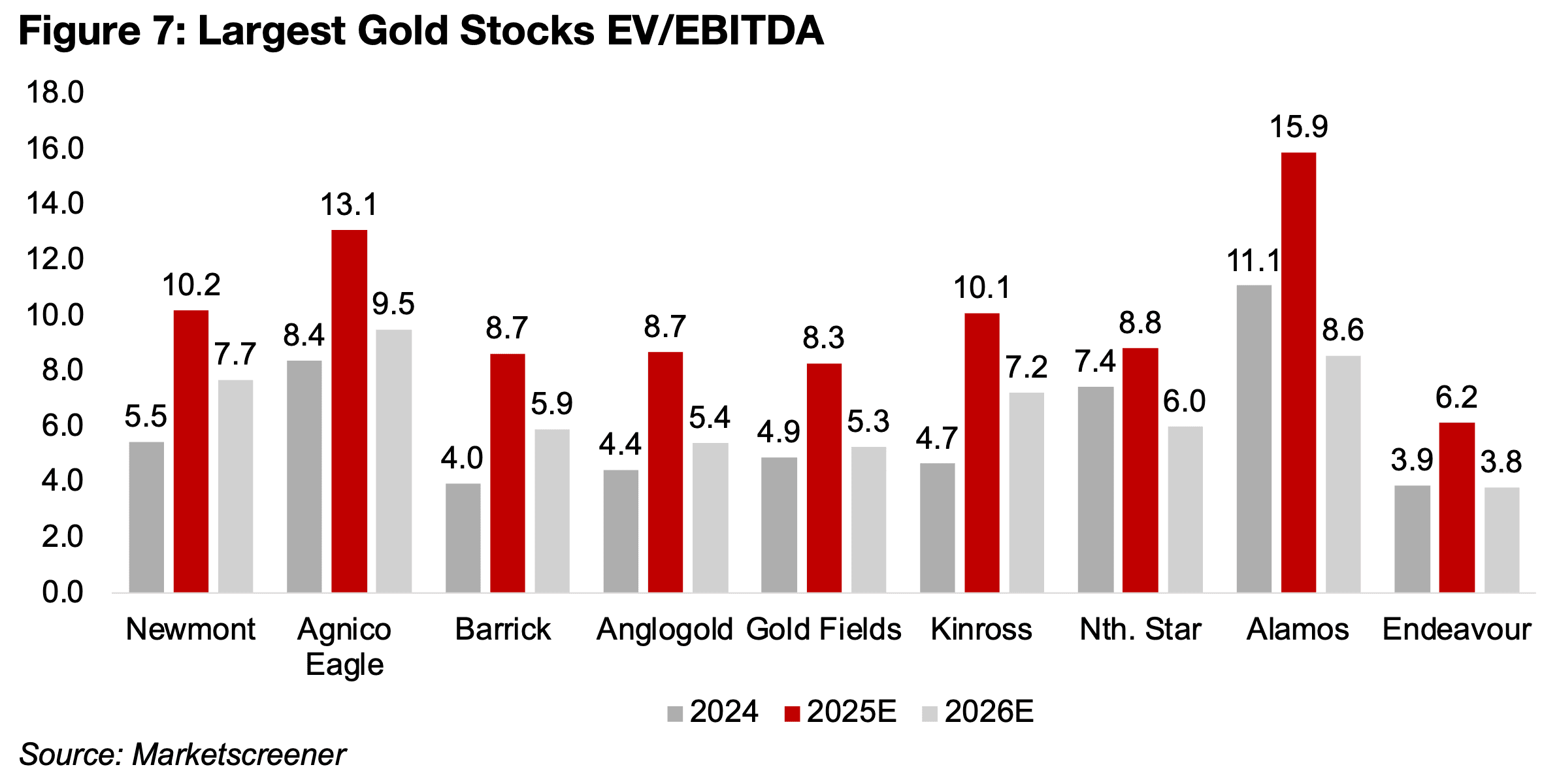

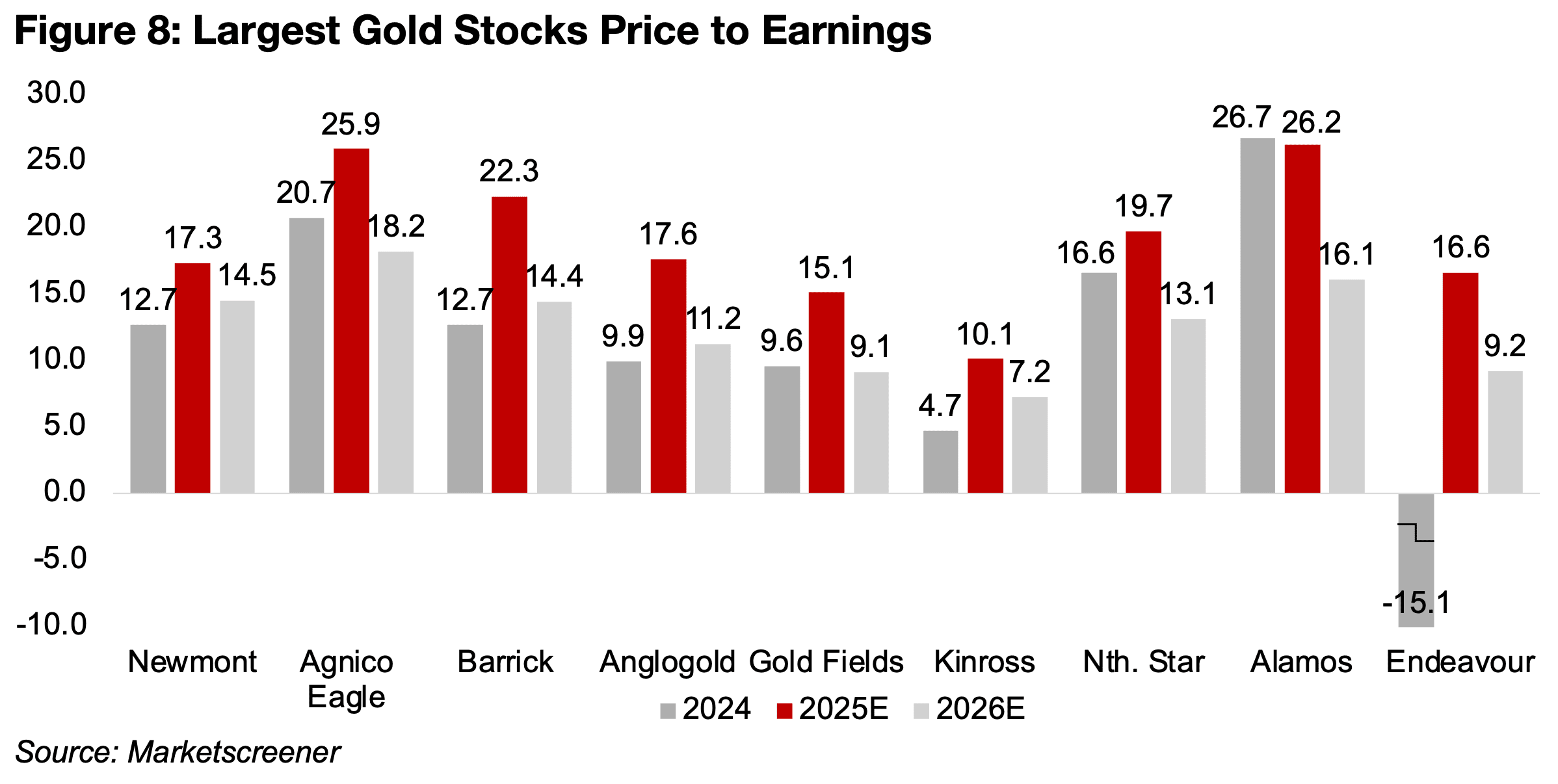

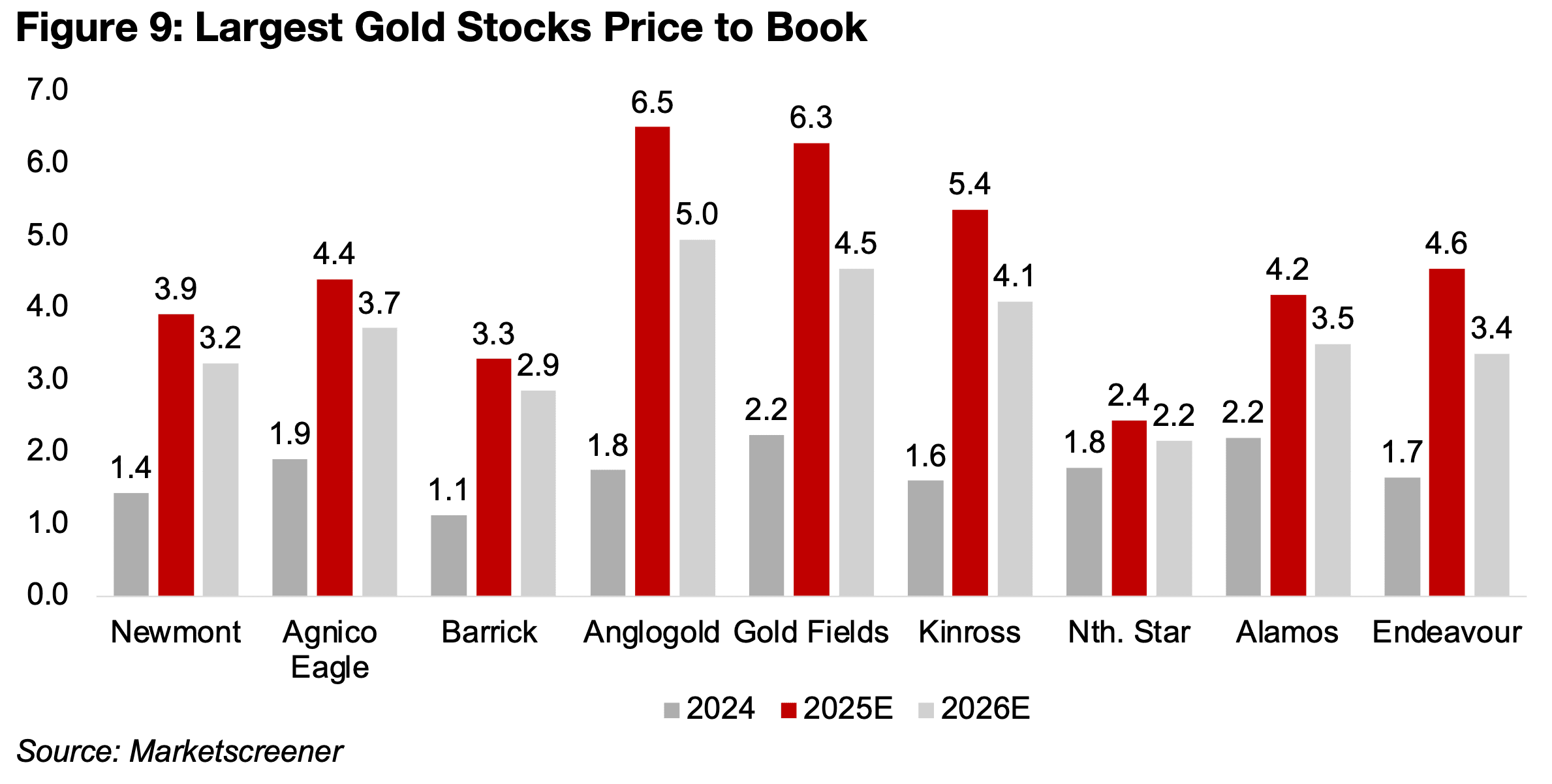

The EV/EBITDA (a measure of the equity and debt of the company versus its earnings

before interest, tax, depreciation and amortization, or roughly its operating income),

price to earnings and price to book valuations of the gold companies have seen

substantial increases from 2024 to 2025E (Figures 7, 8, 9). While the ratios are

expected to decline for 2026E, with earnings likely estimated to increase on a further

rise in the gold price, they remain far above the 2024 levels. The opportunity for big

gains in the sector purely from multiple expansion, which is when markets start to

expect that current growth levels can be sustained for longer, may have passed.

The silver, platinum and palladium prices did not have the same gradual upswing as

gold in 2023 and 2024, and were relatively weak, and their significant increases only

started in 2025. In contrast to gold, which is driven almost entirely by monetary

factors, these three metals have a large component of their demand from industrial

factors. This saw them under pressure from 2022-2024 as the global economy

continued recover from the distortions of 2020-2021. There had been many

companies in these sectors that were still struggling with profitability prior to 2025, in

contrast to the gold companies, which had seen increasingly strong earnings already

from 2020 to 2024 prior to the major jump last year.

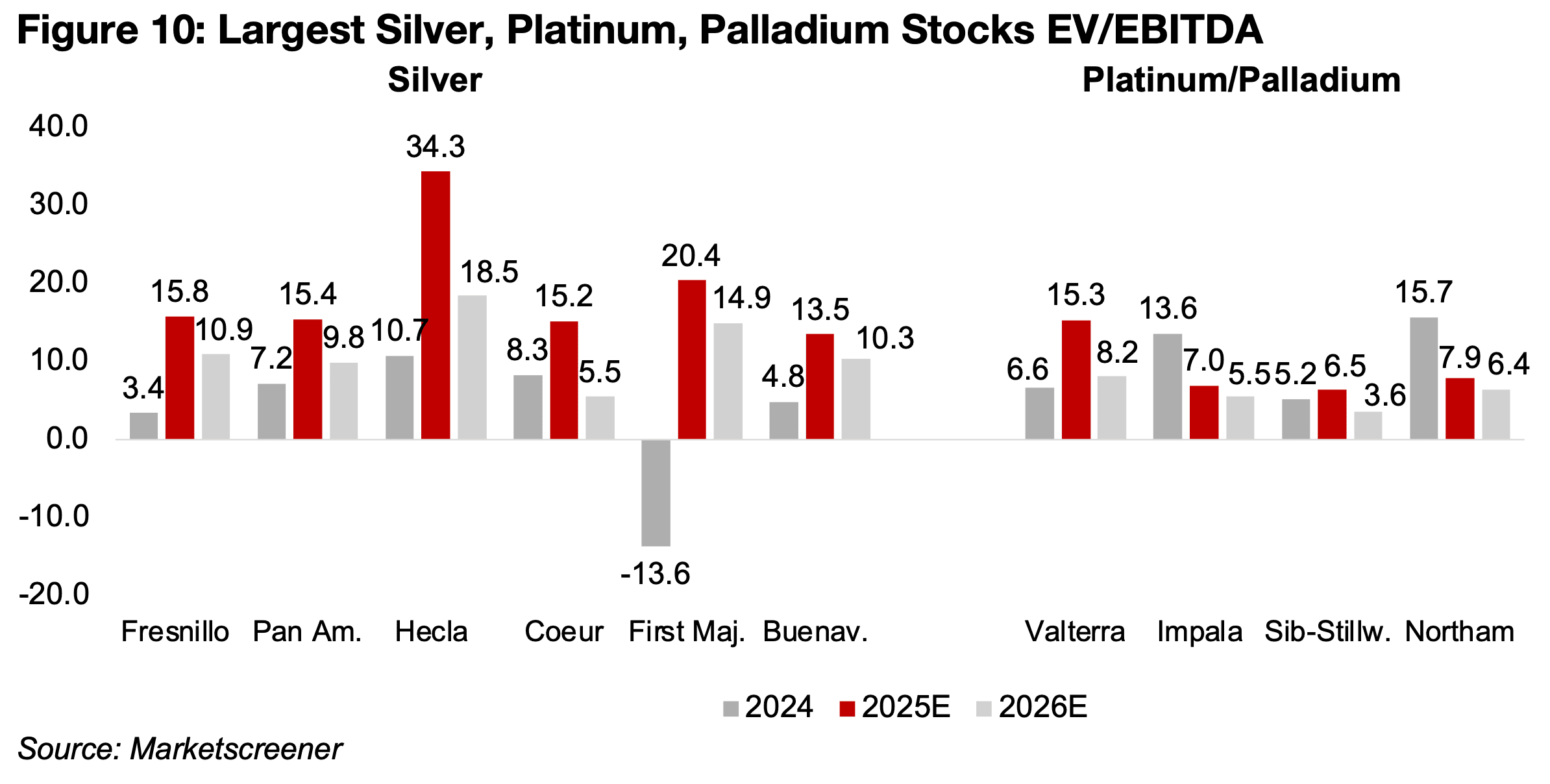

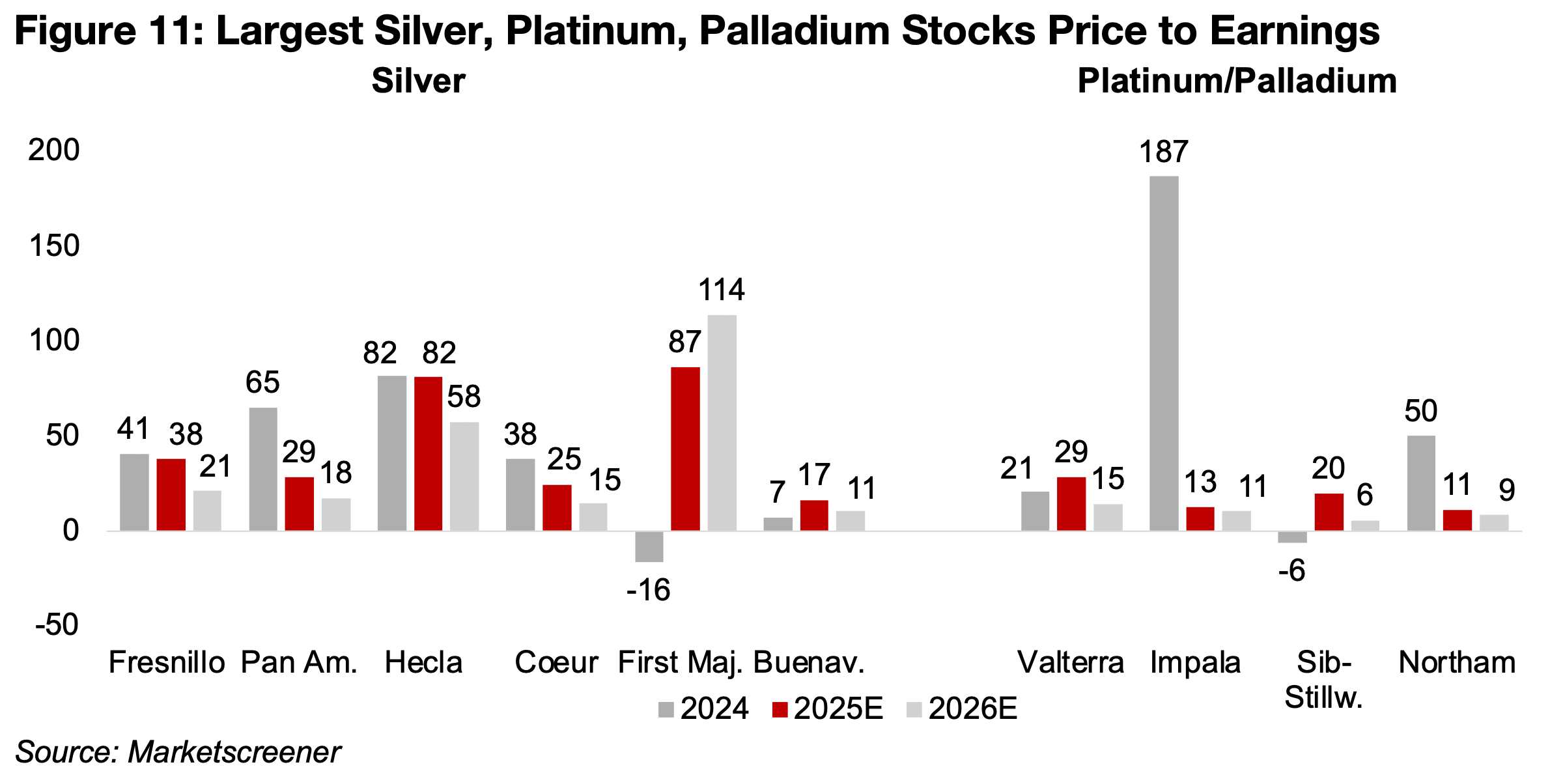

For the silver, platinum and palladium stocks, EV/EBITDA multiples have increased

substantially, from reasonably low levels in 2024 to moderately expensive by 2025

(Figure 10). Similar to the gold stocks, the valuations are expected to decline in 2026

as higher metals prices boost earnings, but they will still remain relatively high versus

the bargain levels of 2024. The price to earnings ratios for many of the companies

have actually declined in 2025 compared to 2024, as net income had been very low,

driving high multiples (Figure 11). These ratios are also expected to decline further in

2026 as net income rises on surging metals prices. For the silver stocks, the market

may hold back on pricing in the current levels of the silver price especially, but also

the platinum and palladium prices, and this could limit further multiple expansion.

Overall the precious metals valuations are certainly not at the clearly attractive levels that they were even just a year ago. However, while they have become moderately elevated, they also do not appear to have reached extremely expensive levels either. There is still some room for multiple expansion, especially if metals prices maintain their current levels through 2026 and drive the market to expect much higher long- term averages for the metal. However, there seems to be a considerable risk of a pullback especially for the silver price, but also platinum and palladium, and even if the gold continues to rise, the gains may not repeat the major jump of last year.

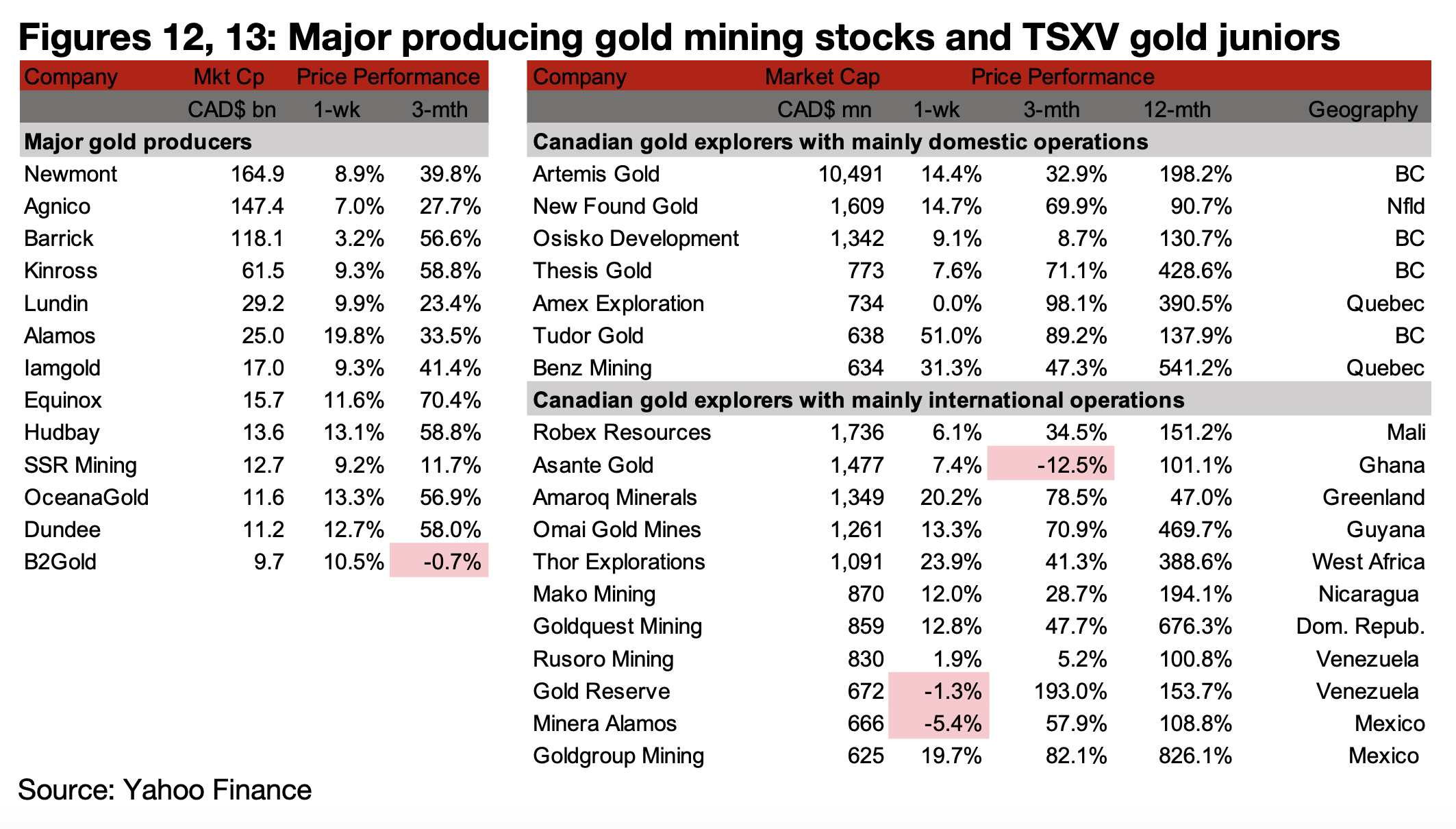

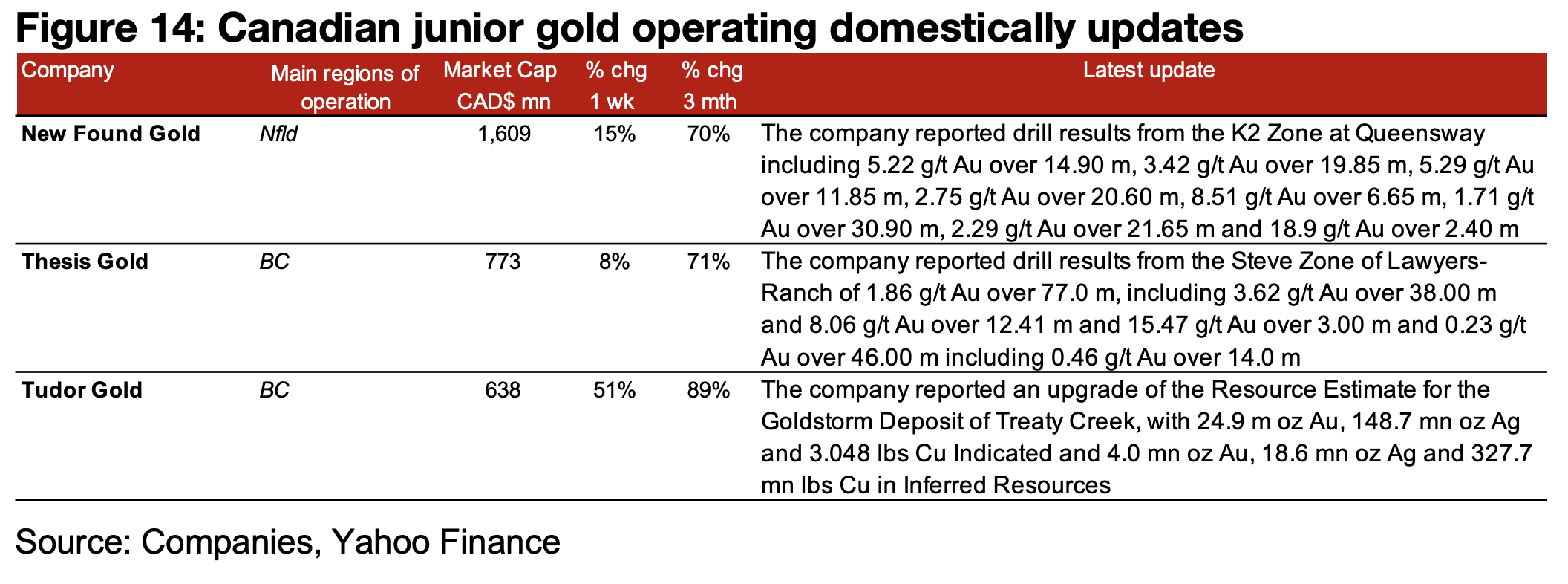

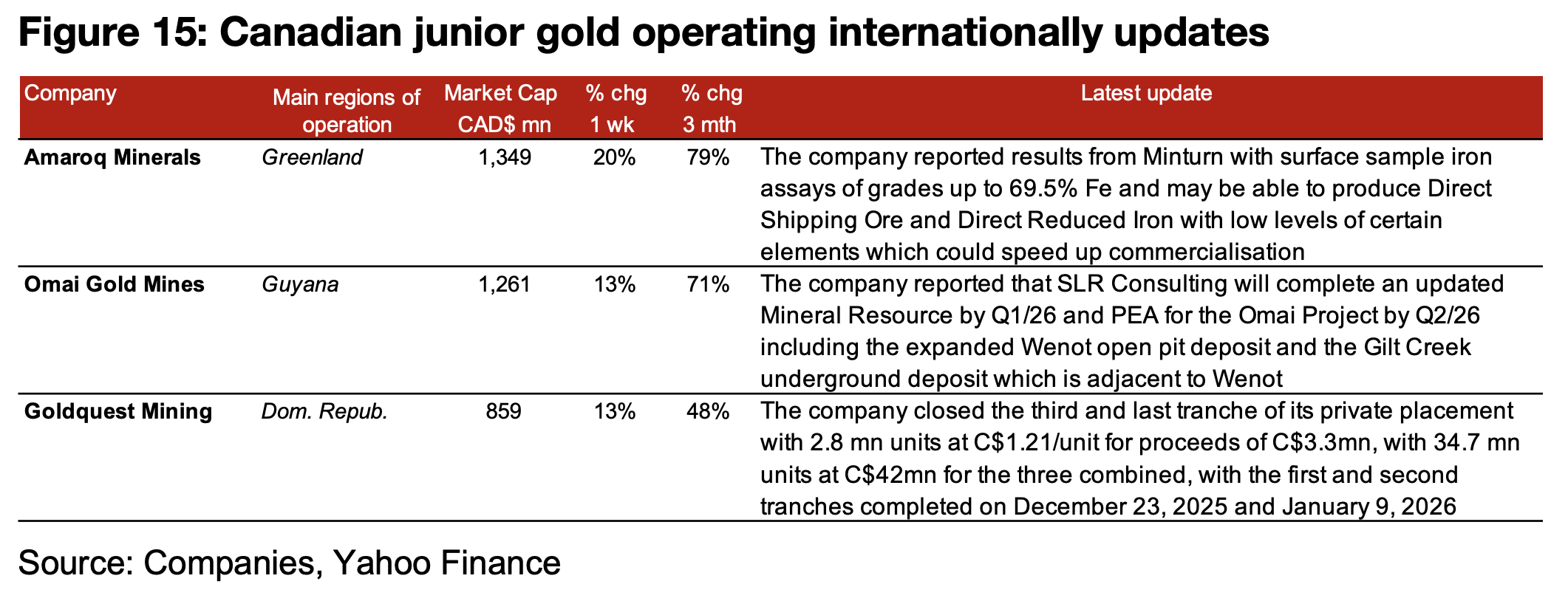

Major producers all rise and most of TSXV gold see strong gains

The major producers rose substantially, with many up over 10%, and most of TSXV gold jumped, with several up 20% or higher (Figures 12, 13). For the TSXV gold companies operating mainly domestically, New Found Gold reported drill results from the K2 Zone at Queensway, Thesis Gold reported drill results from the Steve Zone of Lawyers-Ranch, and Tudor Gold announced an upgrade to the Resource Estimate for the Goldstorm Deposit of Treaty Creek (Figure 14). For the TSXV gold companies operating mainly internationally, Amaroq Minerals reported exploration results from iron ore project Minturn, Omai Gold announced that SLR Consulting will complete an updated Mineral Resource Estimate and PEA for the Omai project and Goldquest closed the third tranche of its private placement, with CAD$3.3mn raised and CAD$42mn raised across the three tranches (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.