September 05, 2025

Platinum and Palladium Surge: Opportunity or Overhype?

Contents

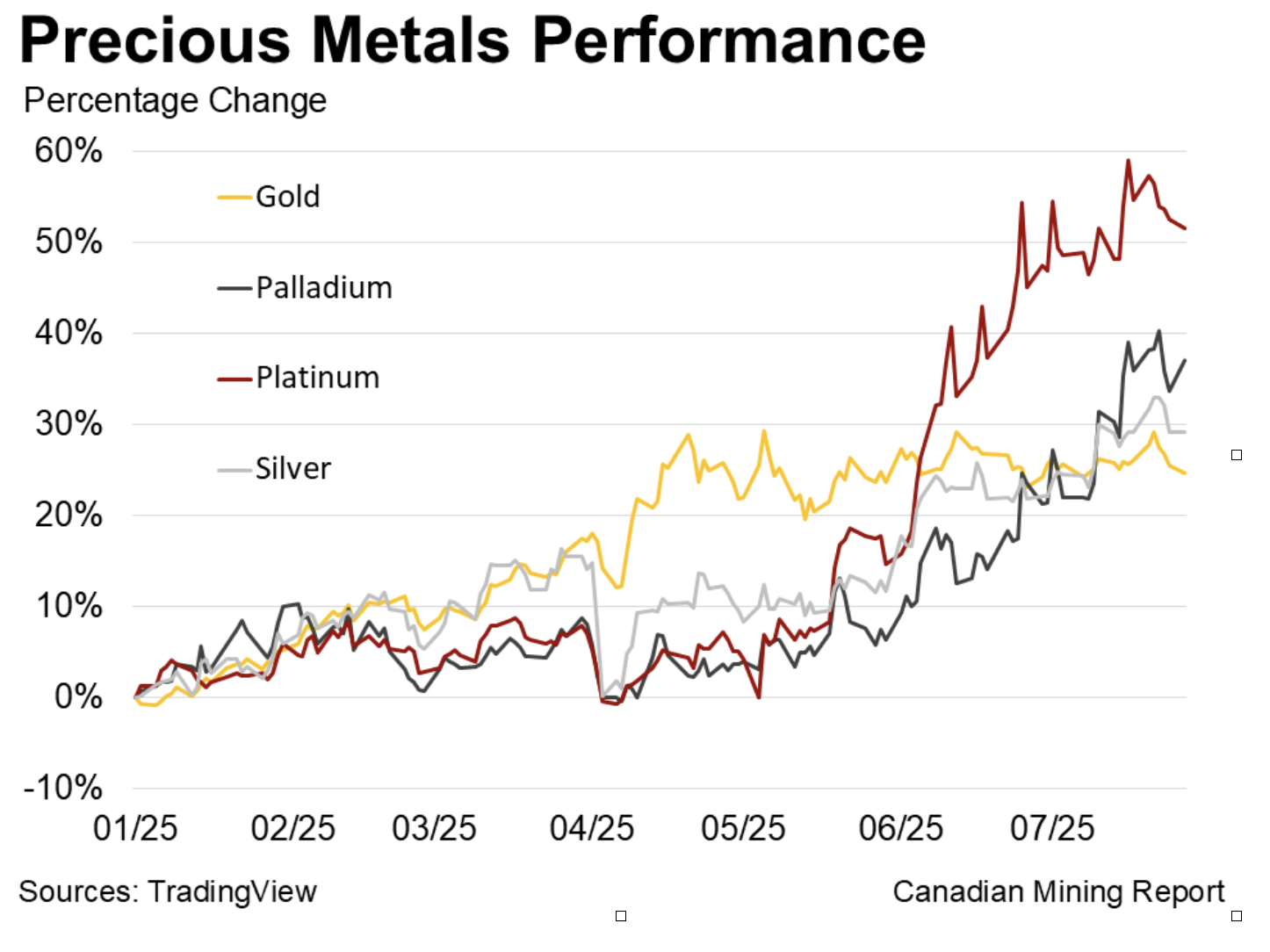

Precious metals have delivered an impressive performance this year.

Gold is testing new record highs. Silver is approaching $40 per ounce, a level last seen in 2011.

Yet other, less-recognized metals are leading the charge — platinum and palladium.

Platinum has already risen more than 50% year to date. Palladium has gained over 36%. These gains surpass those posted by gold and silver. See the chart below.

Platinum Group Metals (PGM)

Platinum and palladium belong to the platinum group metals, or PGM.

These are precious metals used not only in jewelry and luxury goods, but also in a range of industrial applications.

Jewelry accounts for roughly 24% of platinum demand and just around 2% for palladium.

The largest source of demand comes from the automotive industry, particularly catalytic converters. Platinum is mostly used in diesel engine vehicles, while palladium is favored for gasoline-powered cars. Both metals play a critical role in reducing emissions and complying with regulatory standards for clean air.

Beyond cars, PGMs are widely used in glassmaking, chemical manufacturing, and industrial lubricants.

On the supply side, platinum and palladium are sourced from a limited number of countries — primarily South Africa, Zimbabwe, and Russia.

Recycling also contributes to the supply. Approximately 15% of platinum and nearly 28% of palladium come from recycled materials, including scrapped automotive components.

For investors, understanding the geographic concentration and end-uses of PGMs is essential when assessing long-term price trends and investment risks.

Market Balance

Despite this year’s rally, the supply of both metals has remained largely unchanged for years. A key factor behind the sluggish growth is the global transition to electric vehicles, which reduces reliance on traditional combustion engine technologies that use PGMs.

Last year’s auto catalyst demand was virtually flat compared to 2013. That’s over a decade of zero growth — a red flag for those expecting organic demand expansion.

Mining operations have adjusted accordingly. With no clear incentive to scale up production or explore new deposits, miners have mostly maintained output levels.

The result is a concentrated supply chain dependent on regions known for political and economic instability. For investors, this raises questions about future availability and potential disruptions.

Normally, limited supply and steady demand would push prices higher. But one important detail alters this dynamic — the presence of massive above-ground inventories.

According to the World Platinum Investment Council, existing inventories are robust enough to satisfy demand for several years.

These above-ground stocks, including refined metal held by traders, exchanges, and industrial users, act as a cushion that absorbs market deficit shocks.

So while the market has technically been in deficit, prices stayed muted — until now.

This indicates that recent price action is likely driven by an external force, not by traditional supply-demand fundamentals.

Tariffs

A major factor influencing the market right now is U.S. trade policy.

President Trump continues to push aggressive tariff strategies, threatening widespread restrictions on foreign goods.

The intent is to stimulate domestic manufacturing by limiting imports — including raw materials, such as metals.

While these measures could be well-intentioned, mining is not a fast-moving sector. Building a new mine can take anywhere from 10 to 15 years, well beyond any presidential term.

Even with supportive legislation, significant changes to domestic PGM supply aren’t realistic in the near term.

Still, the uncertainty surrounding the US trade policy is already impacting investors’ behavior.

To hedge against supply chain disruptions, commodity traders and industrial buyers are stockpiling physical assets — including platinum and palladium.

For example, the New York Mercantile Exchange (NYMEX) saw a sharp rise in platinum inventory during Q1. Roughly 361,000 ounces flowed into its vaults, raising total stock to 631,000 ounces.

Though public data on palladium inflows is limited, similar stockpiling behavior is likely occurring behind the scenes.

This sudden inflow is not driven by organic demand, but by strategic positioning against policy risk.

Once this fear-driven buying fades, and inventory levels stabilize, prices could pull back.

Takeaway

A lot of investors hope for a continued upside in precious metals, especially in niche categories like platinum and palladium. Smaller, less liquid markets could in theory deliver higher returns because of their higher volatility.

However, a realistic assessment suggests that recent price spikes may be short-lived.

If trade tensions cool and speculative accumulation slows, platinum and palladium are likely to correct.

Gold remains strong due to central bank accumulation and enduring support from retail investors.

Silver also enjoys consistent interest, particularly from speculative buyers who view it as a lower-cost alternative to gold.

In conclusion, PGM investors should proceed with caution. While prices may stay elevated in the short term due to geopolitical uncertainty and fear-based stockpiling, the underlying fundamentals don’t support a long-term breakout.

Meanwhile, gold and silver appear better positioned to retain value as global trade continues to evolve and investors seek safe havens amid economic turbulence.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.