December 01, 2025

Second Silver Spike

Author - Ben McGregor

Gold up with Fed cut widely expected

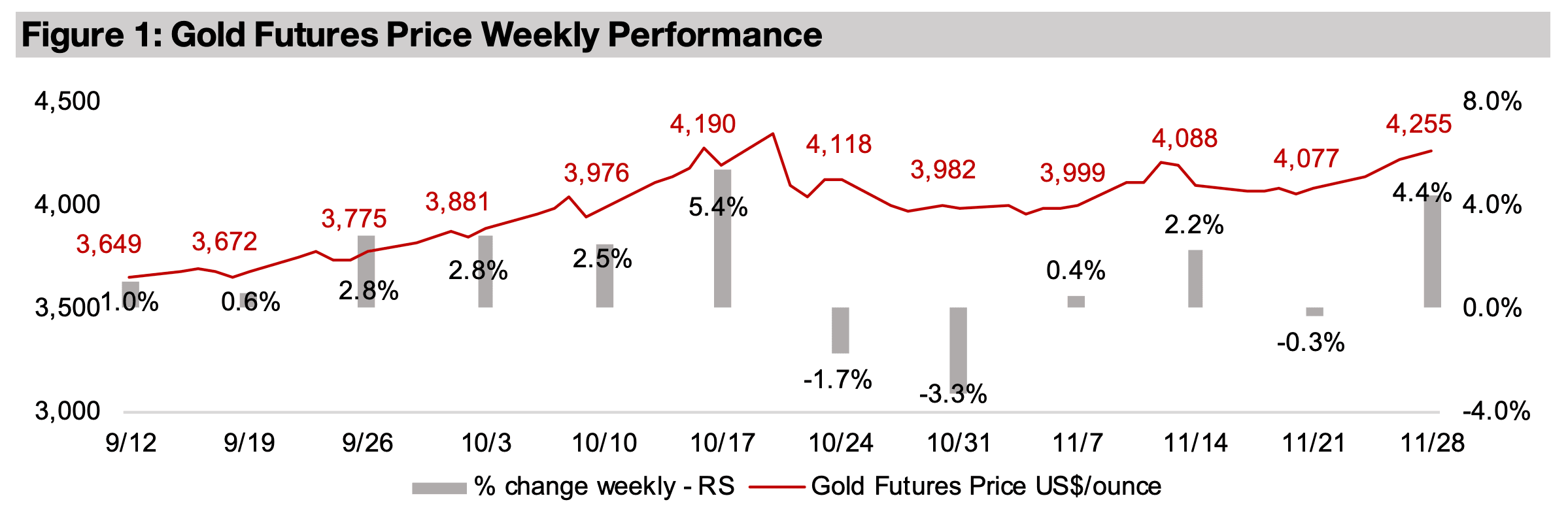

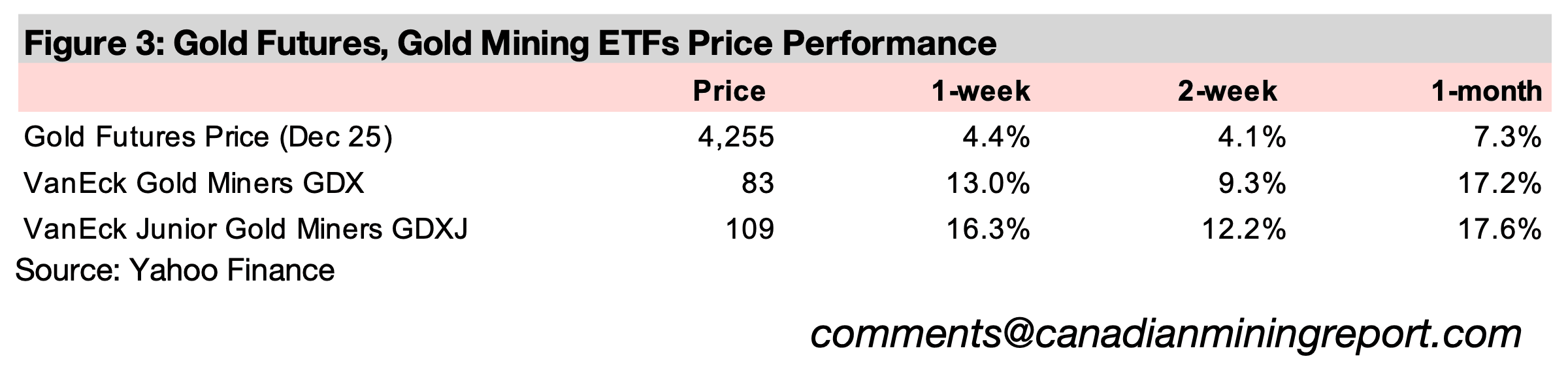

Gold rose 4.4% to US$4,255/oz, breaking out of a range around US$4,000/oz- US$4,100/oz that held for five weeks, but not regaining the US$4,336/oz late-October 2025 peak, with expectations high for another rate cut by the Fed in December.

Second Silver Spike

The gold price jumped 4.4% to US$4,255/oz, moving out of the US$4,000/oz to

US$4,100/oz range that had held for the past two weeks, but not quite regaining the

previous highs of US$4,336/oz on October 20, 2025. This was partly because of a

significant decline in the US$, which tends to move inversely to the metal. With the

Fed widely expected to cut rates for the second time this year in December, 2025,

this could drive some capital outflows as the lower yields make other global assets

relatively more attractive. US employment data this week showed a continued cooling

of the labour market which will provide the Fed increased justification for a rate cut.

The US consumer confidence index reported this week, part of the data considered

when making rate decisions, came in well under expectations and declined

substantially month on month, indicating downward pressure on the economy.

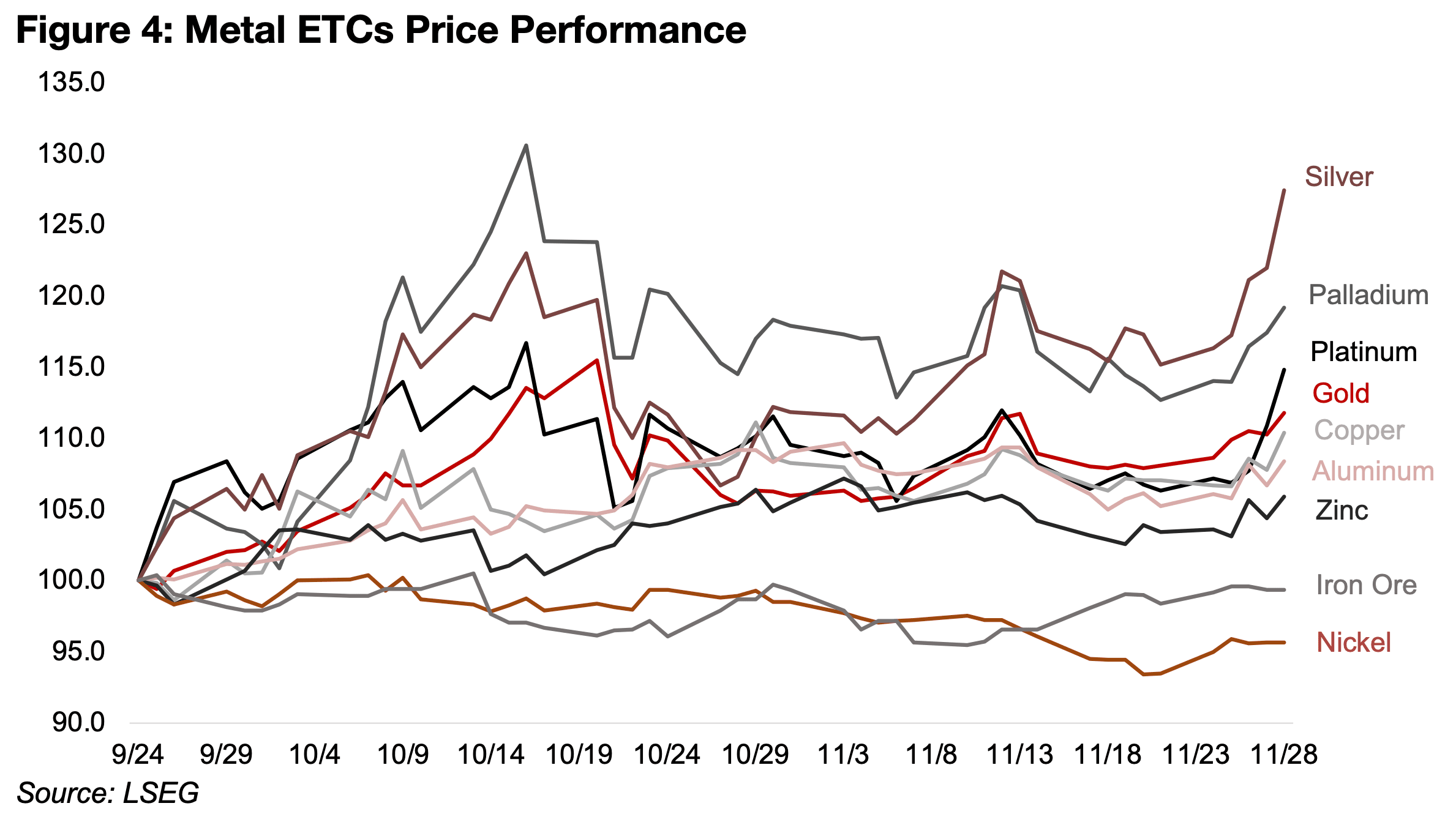

While gold has still not recovered its late October 2025 peak, silver went onto new

highs this week, up 13.1% in the second parabolic spike in just two months on

continued supply constraints for the metal (Figure 4). The platinum price also went

vertical this week, rising 11.3%, and there was a major jump in palladium, up 7.5%.

The gain in the latter two metals may have been partly boosted by the start of trading

of futures contracts on the Guangzhou exchange for both. However, this was likely

not the main driver, given the jump also in gold and silver, which appears to be the

market moving into assets that tend to hold their value in a period of currency

debasement. A second expected US rate in December would see the country clearly

shifting towards monetary easing, joining the rest of the world’s major economies,

most of which have already been in rate cutting cycles since the middle of 2024.

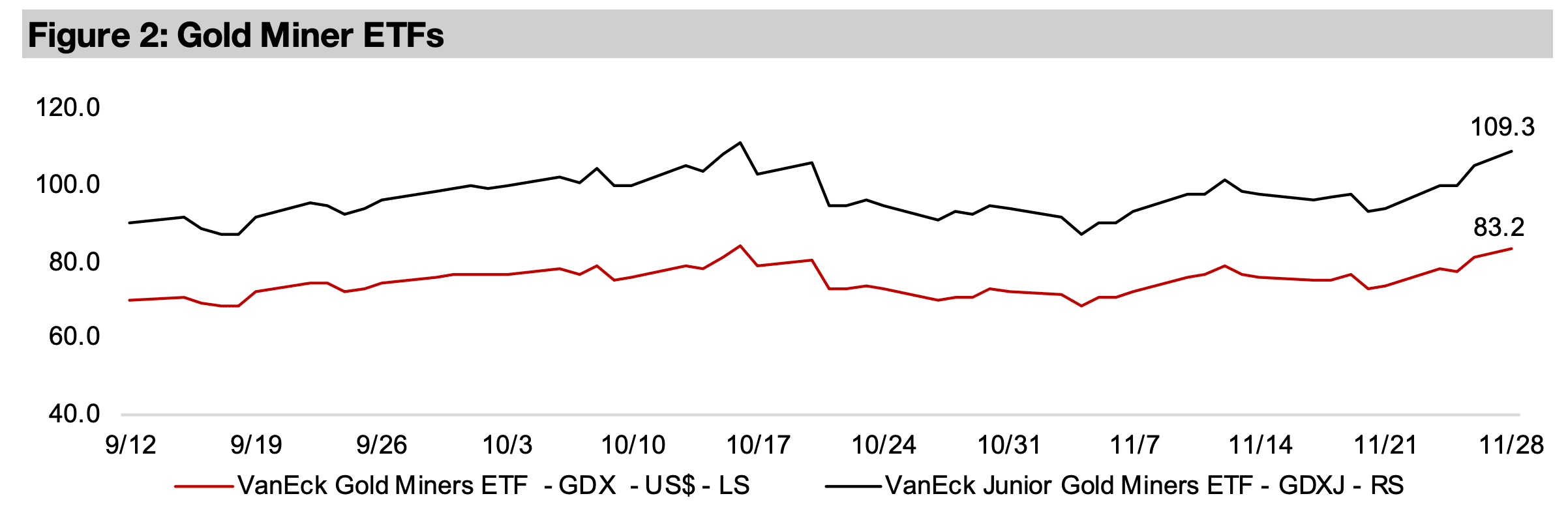

The gold stocks surged on the rise in the metal price, with the GDX up 13.0% and

the GDXJ up 16.0%, the second highest weekly gains for the ETFs this year, only

surpassed by a 19.2% increase for both in the second week of April 2025. The silver

stocks rose even more, with SIL ETF up 20.0% in a week. These gains were also

supported by a rise in equities overall, with the S&P 500 up 4.5%, the Nasdaq rising

5.4% and Russell 2000 adding 8.3%. The simultaneous jump in these risk assets

along with the rise in the precious metals and gold stocks shows that the market

continues to hedge, as they have throughout 2025.

The base metals were mixed, with the strongest gains for copper, up 4.20%, and the

COPX ETF of copper stocks rose substantially, up 12.2%. Aluminum and zinc also

rose, but more moderately, by 2.4% and 2.2%, respectively, while both iron ore and

nickel were nearly flat compared to the gains in many other metals, adding 0.4% and

0.8%. This showed a potentially improved outlook by the markets for the real sector

of the economy, but that it still expected this to be outpaced by monetary growth.

Silver supply shortage continues

The two jumps in the silver price over the past two months have been part of ongoing

supply issues for the metal, which has seen inventory remain relatively low in the UK,

the main trading hub. This has forced imports of the metal from China, which have

risen to their highest levels in years, to cover the shortfalls. The silver market is in its

fifth year of deficit, and while this was forecast to contract to 117.8 mn oz in 2025E

from 149.0 mn oz in 2024 earlier this year in the World Silver Survey, given the recent

action in the silver price, this shortfall may actually be higher than initially expected.

This has been driven by strong demand, partly from the growing electronics sector,

including the high growth of data centers, outpacing the rise in supply.

Output of the metal from the largest silver producer globally, Mexico, which

accounted for nearly 25% of global output in 2024, has declined -0.8% on average

from January 2025 to July 2025. While output from China, the second largest

producer, at well over 10% of the world total, is estimated to have been rising this

year, much of this has been exported, and it has not been enough to replenish

inventories. Production from Peru, which is also over 10% of the world total, has also

been rising, but this had declined to only around 5.6% yoy on average from May 2025

to June 2025 versus 17.3% on average over the first four quarters of the year.

No ‘true’ silver stocks?

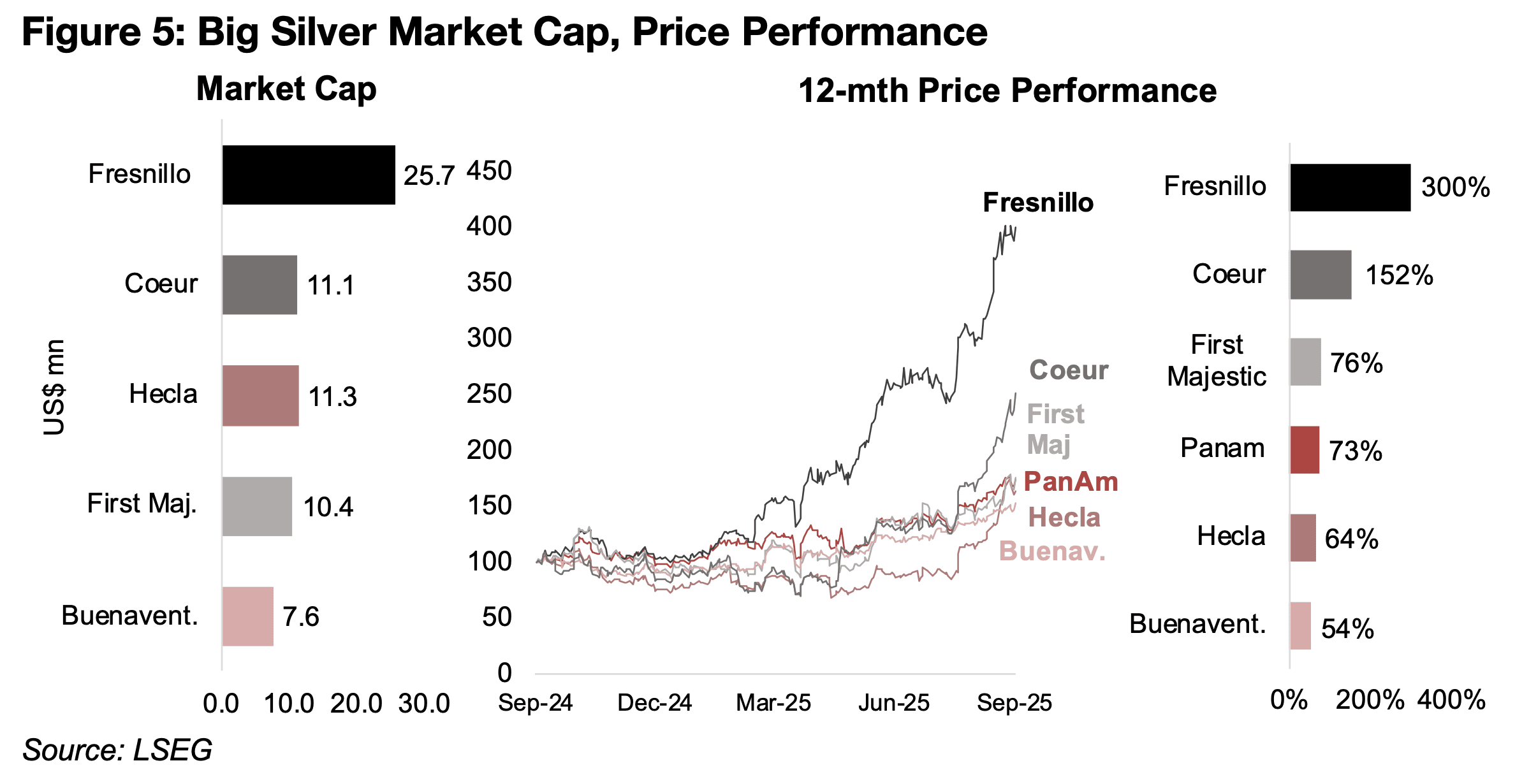

The rise in the metal price has seen the largest silver stocks all generate gains of over

50% this year, with most of this only since around July 2025, with moderate increases

for most over H1/25, with the exception of Fresnillo, which started to move ahead of

the group from March 2025 (Figure 5). However, all of these stocks also have gold as

a significant driver, as there are very few ‘true’ silver stocks where the proportion of

silver revenue is well over half of the total.

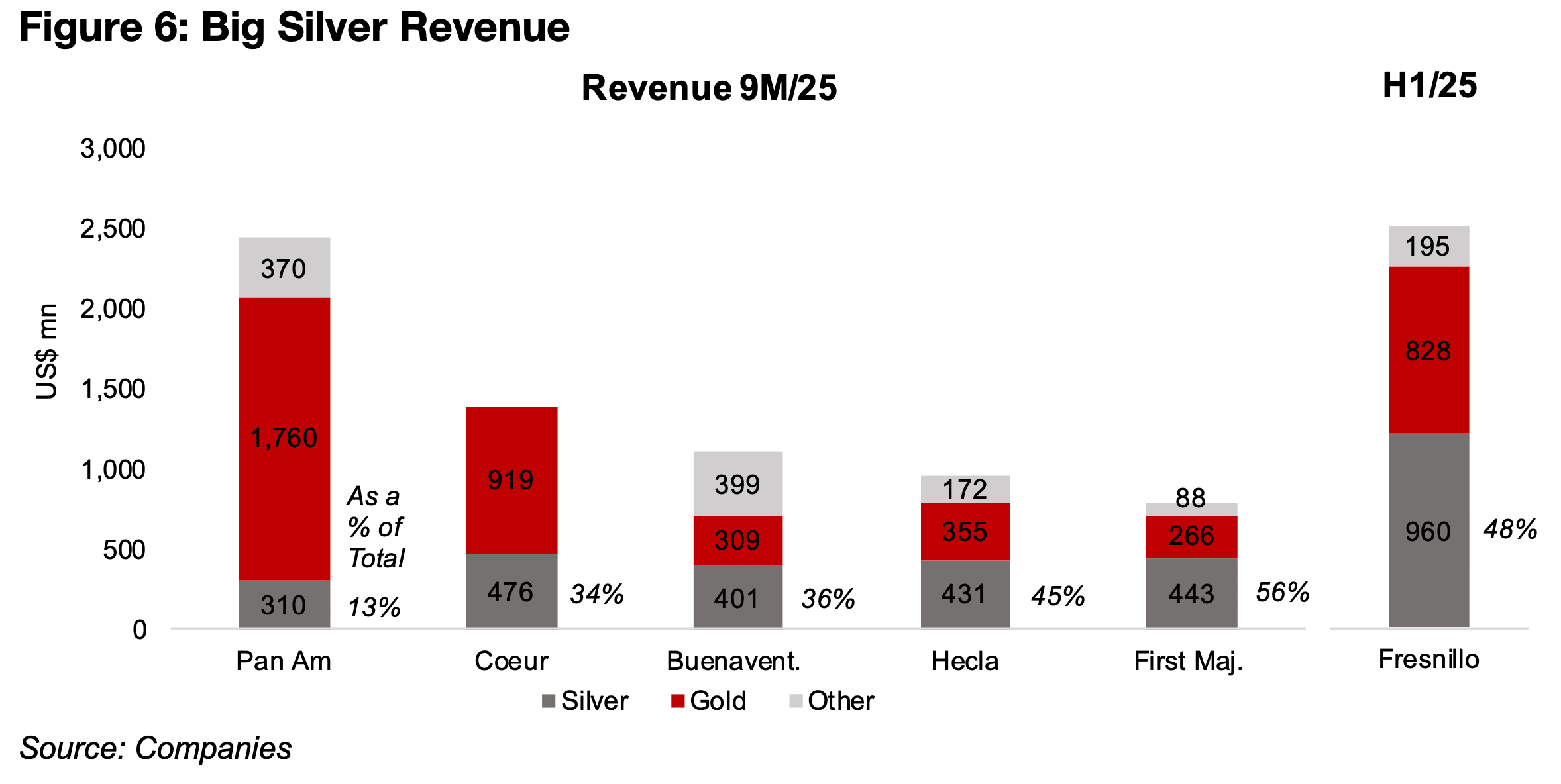

Only First Majestic had over half of its revenue from silver, at 56%, of the largest

companies in the sector (Figure 6). While Fresnillo reports only half yearly financials,

over H1/25, 48% of its revenue was from silver, while Hecla over 9M/25 had a similar

proportion from the metal, at 45%. Both Buenventura and Coeur had similar levels of

silver revenue, at 36% and 34%, respectively, over 9M/25, with Pan American Silver

at just 13%. Therefore the performances of these stocks will all be tied equally or

more to the gold price, and could all be considered hybrids, and not pure silver plays.

With these companies also comprising a significant proportion of the SIL ETF of silver

stocks, and many of its other holdings having large contributions to revenue from

gold, it can also be considered a mixed play on the metals.

Large silver stocks see another strong quarter

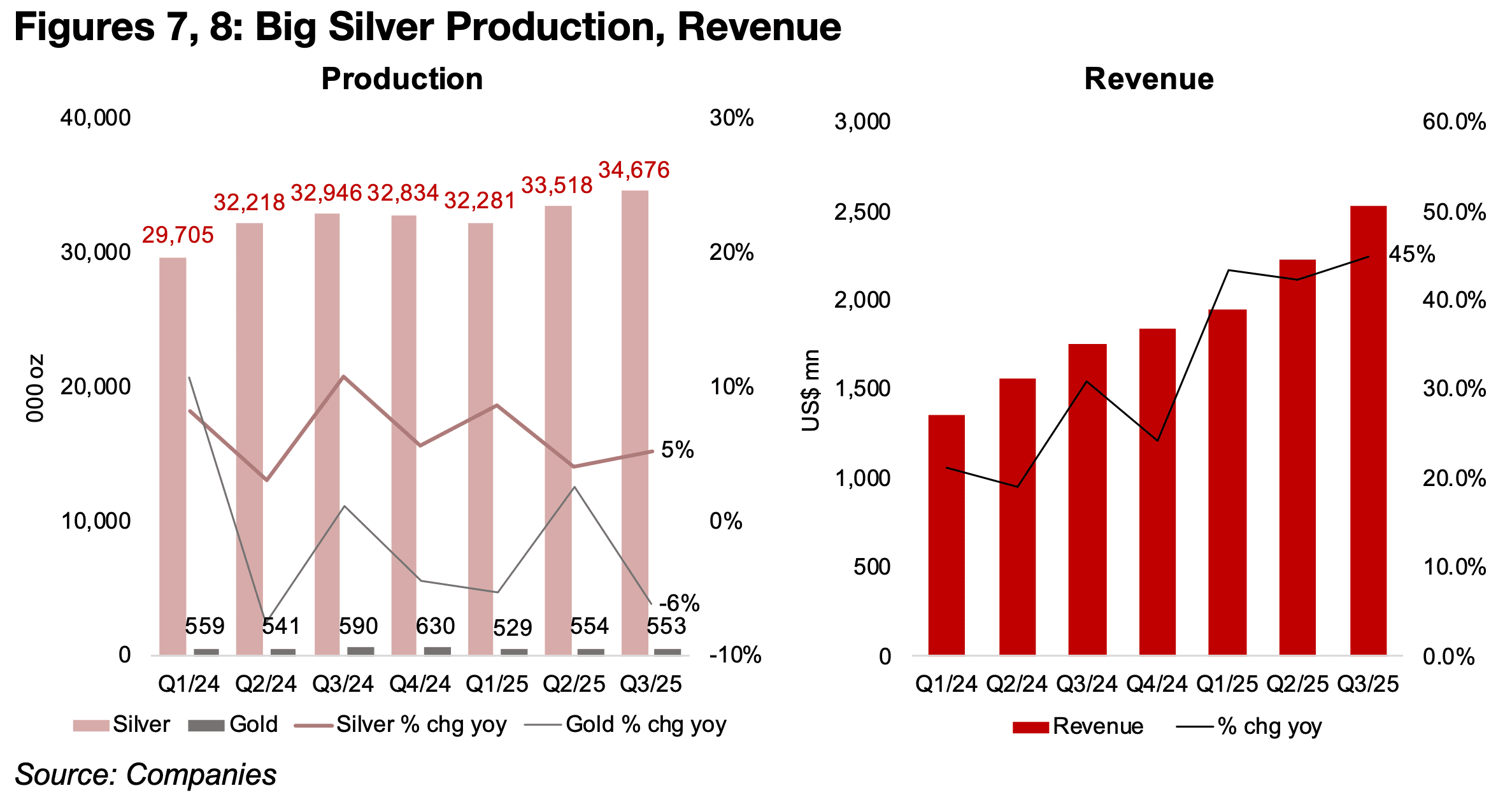

The large silver stocks saw a significant gain in aggregate earnings in Q3/25 for the fourth consecutive quarter. Silver production continued to rise, up 5% yoy in Q3/25, although this was offset by a decline in growth of gold production by -6%, which is often actually a higher proportion of revenue for these companies (Figure 7). However, the rise in the price of these metals offset the relatively neutral net increase in production, with revenue growth of 45%, the strongest of recent quarters (Figure 8).

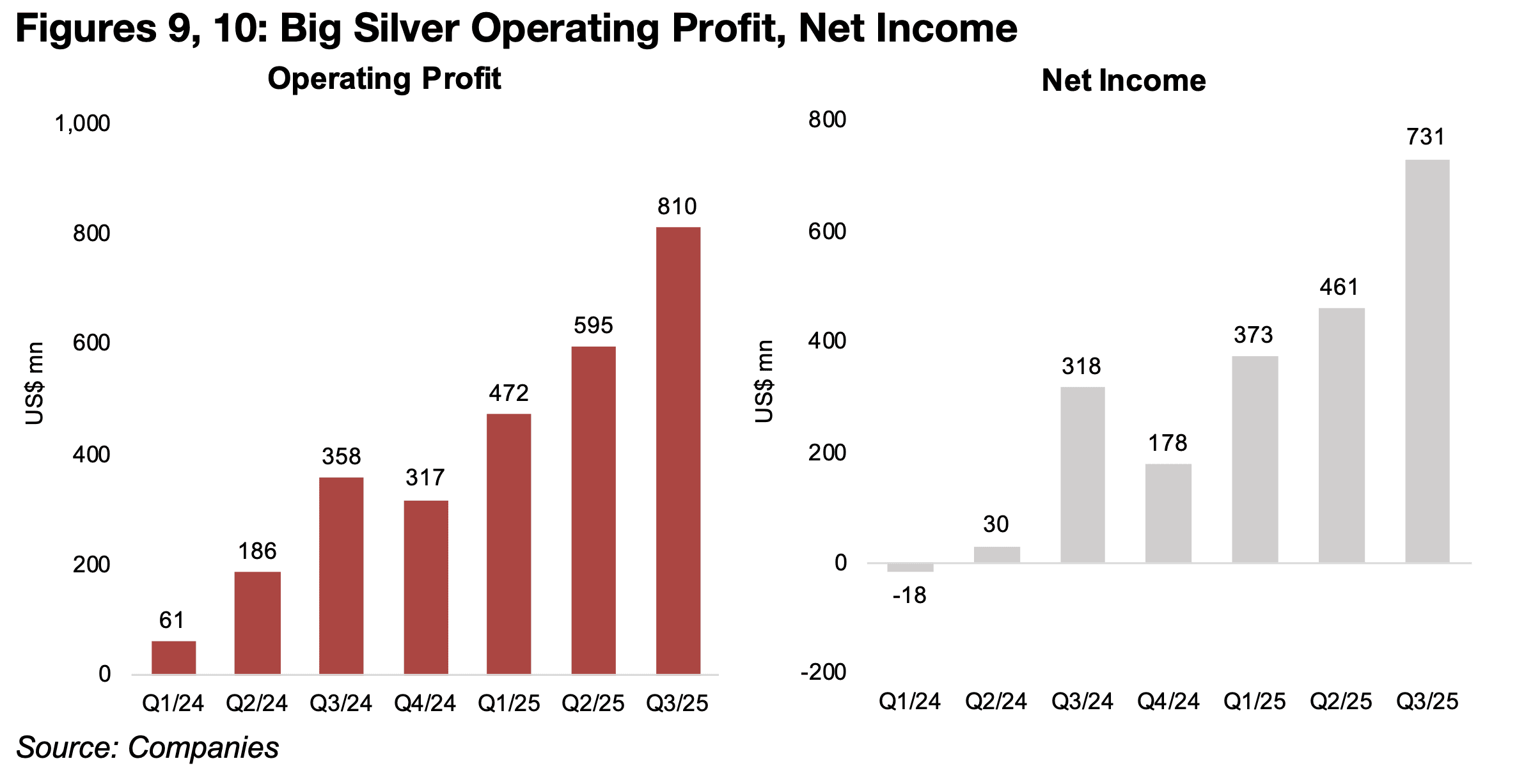

This strong improvement in revenue growth translated to high operating profit growth, which rose well over 30% qoq and more than doubled yoy, as the rise in the metals price far offset the increase in underlying costs per ounce (Figure 9). This also drove strong growth in net income, which jumped nearly 60% versus the previous quarter and was up well over two times the level of the same quarter in 2024 (Figure 10). The relatively low operating profit and negative net income in Q1/24 was a carry over from a weak 2023, when both were negative in every quarter that year. The price of both silver and gold had not been enough to get ahead of cost per ounce for these companies in 2023, with significant profitability really only starting from Q3/24.

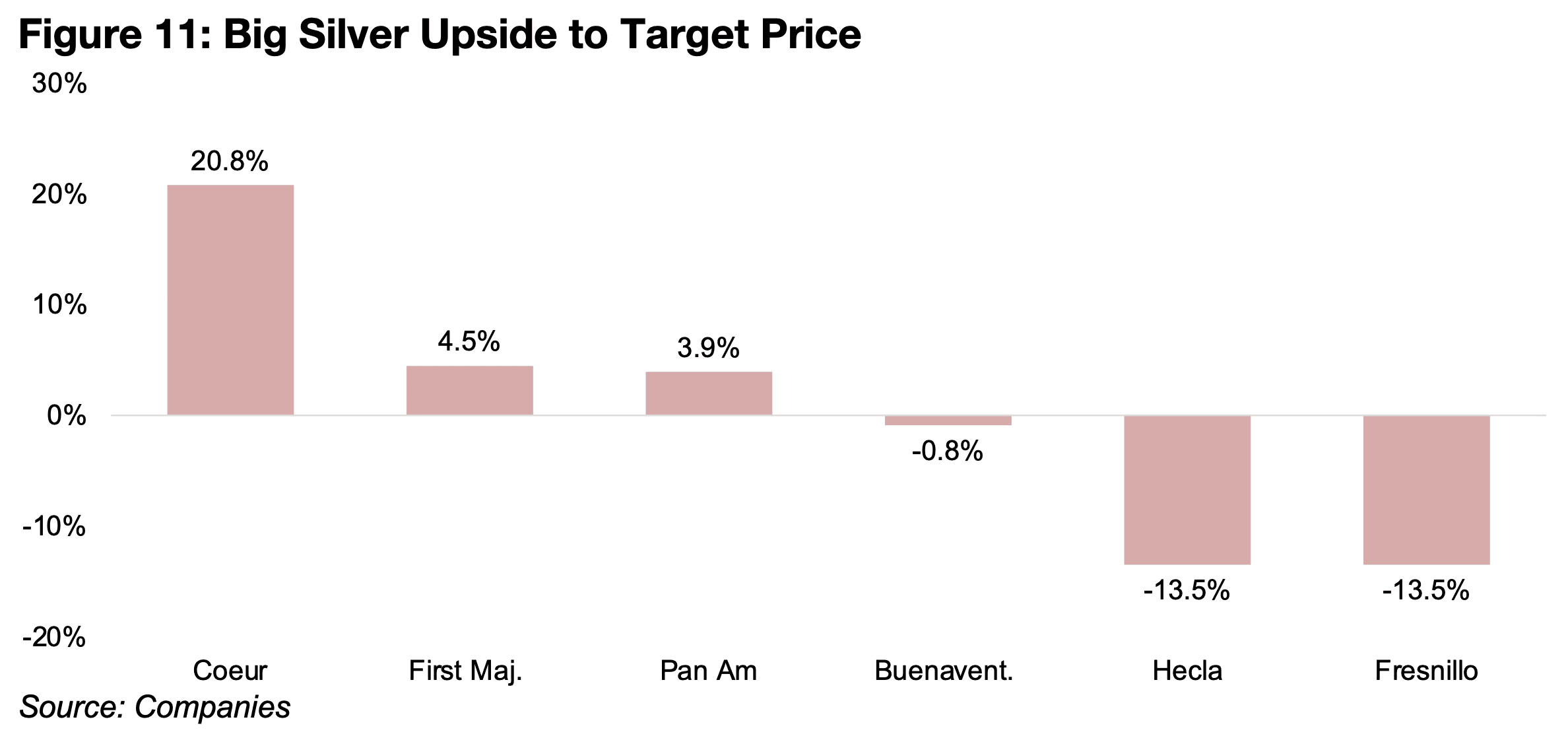

The rise the big silver stocks has seen many of them catch up with their target prices.

There is only significant upside to the consensus target now for Coeur, with First

Majestic, Pan American and Buenaventura all close to their targets, and some

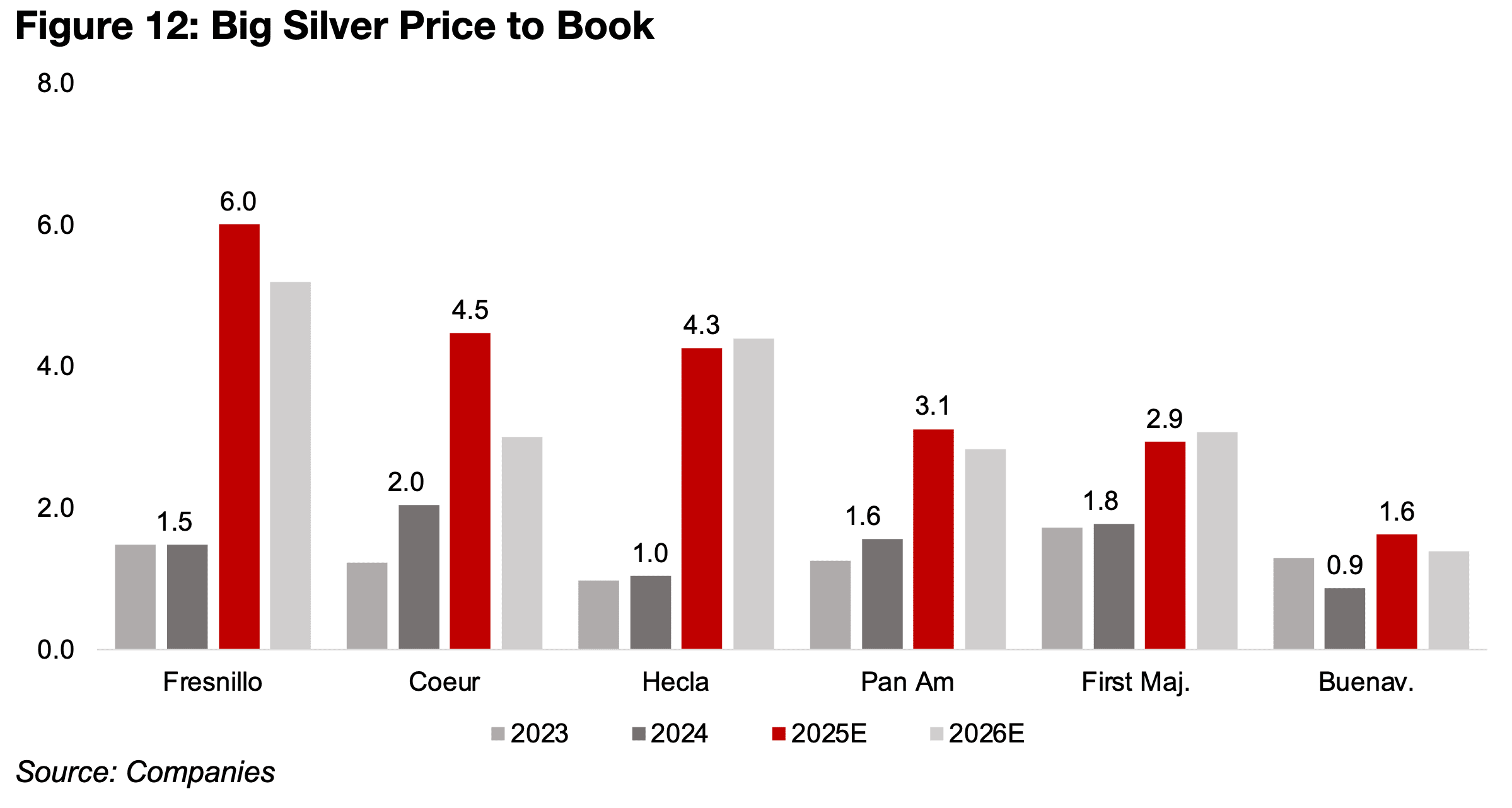

downside expected for Hecla and Fresnillo (Figure 11). This is also reflected in the

quite high price to book (P/B) values for the sector from a year ago, which have risen

from a reasonably low range of around 1.0x-2.0x to a much wider and higher range

of 1.6x-6.0x currently (Figure 12). With P/Bs of over 3.0x generally considered to be

getting relatively high, Fresnillo especially, but also Coeur and Hecla, with P/Bs of

6.0x, 4.5x and 4.3x for 2025E could no longer be considered clearly inexpensive. Pan

American and First Majestic with multiples near 3.0x could be considered just on the

verge of becoming relatively high, with only Buenaventura at 1.6x still with a moderate

valuation.

However, the market in these types of bull markets will tend to lag the actual price of

the metal in calculating these target prices. The average silver and gold prices

incorporated into the current consensus will be unlikely on average to have assumed

that the recent highs are maintained. This could be the case, though, if the major

monetary expansion continues, economic risk rises with a broad recession, or

geopolitical risk again surges, with the first very likely and the latter two still a

reasonably high probability. This could drive up the consensus targets further as

these new risks are incorporated into high prices for the metals, and we could again

see substantial upside to them from current stock prices. Whether there is a pause in

the metals prices may depend especially on whether global central banks continue

their major ongoing rate cutting cycle into early next year, and this scenario currently

seems highly likely.

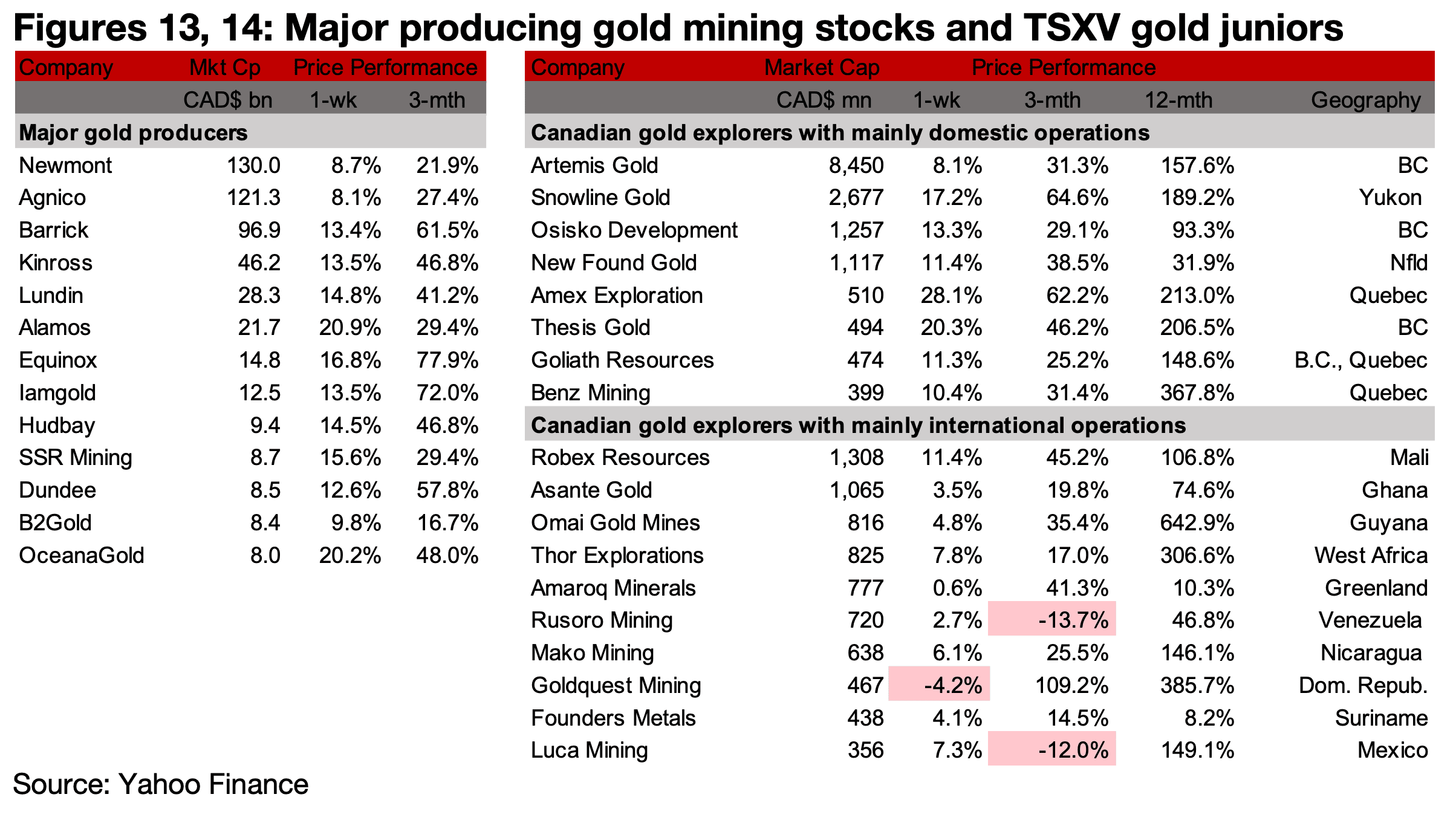

Major producers and domestic-focussed TSXV gold rocket

The major producers and TSXV gold with mainly domestic operations rocketed up with many seeing gains of well over 10%, and while almost all of TSXV gold with mainly international operations also increased, it was by much lower levels (Figures 13, 14) For the TSXV gold companies operating mainly domestically, Snowline Gold began trading on the TSX, Osisko Development announced that it would sell San Antonio to Axo and New Found Gold hired a finance advisory firm for strategies for the initial capex for Queensway (Figure 15). For the TSXV gold companies operating mainly internationally, Mako entered into an agreement with Sailfish Royalty for the acquisition of the Mt. Hamilton Gold-Silver project, Goldquest announced that it would start trading in the US on the OTC market and Founders appointed Mr. Vijay Kirpalani to its Board of Directors (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.