February 13, 2023

The Copper Question

Author - Ben McGregor

Subdued gold action after six-week rollercoaster

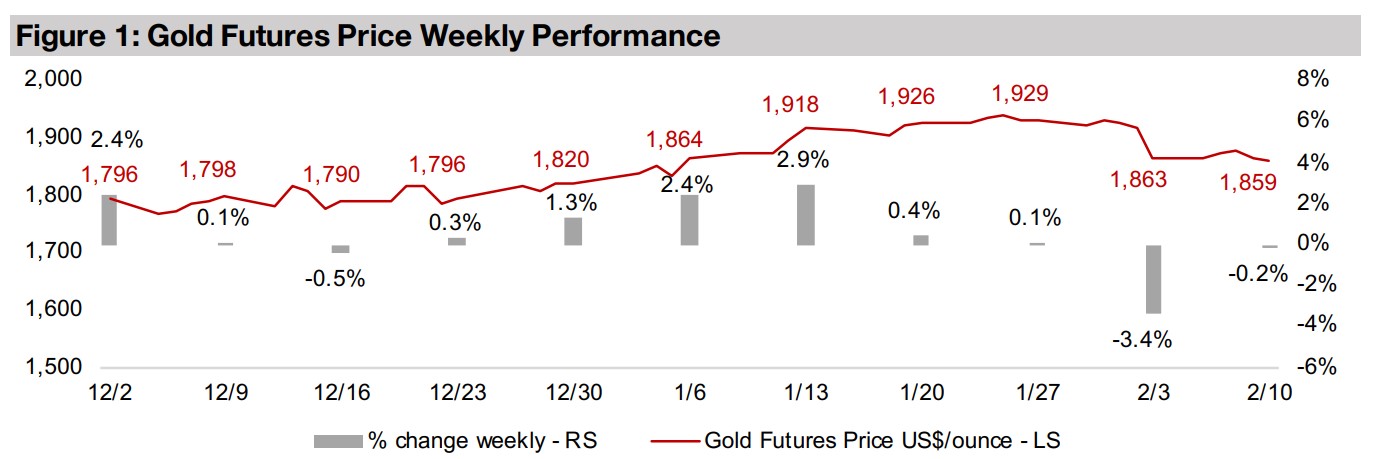

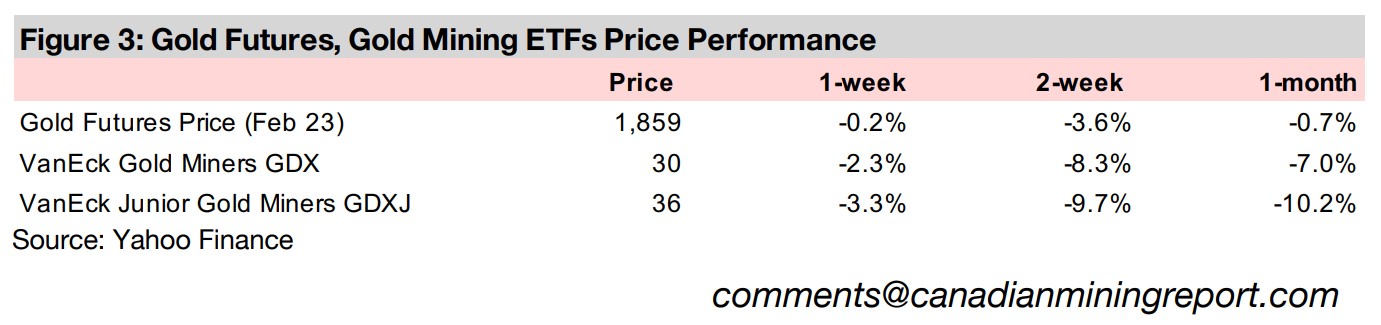

Gold eased -0.2% this week to US$1,859/oz, leaving it back near its level of six weeks ago, after first gaining nearly US$70/oz to peak at US$1,929/oz on hopes of a more dovish Fed before losing about US$70/oz on rekindled concerns of a hawkish Fed.

A look at the copper price and larger TSXV copper juniors

This week we look at the mixed market expectations for the copper price in the short-term, although a longer-term copper supply deficit appears to be the consensus view, and the recent performance and metrics for the large TSXV copper-focussed juniors.

The Copper Question

Gold eased -0.2% to US$1,859/oz this week, as there was limited material economic

news to drive it, and equity markets pulled back, with the S&P 500 down -0.7%. This

brings the gold price roughly back to its level of six weeks ago. There was first a surge

of about US$70/oz to a peak near US$1,930/oz as hopes for a more dovish Fed were

supported by a 'light' rate hike of 25 bps and comments by Chairman Powell.

However, this was followed by an extremely strong US jobs report that led to an

abrupt US$70/oz reversal with the market believing the data would be taken by the

Fed as a sign that the economy was not cooling enough to start to easing.

We remain bullish on the gold price and suspect its main driver will be broader

economic and geopolitical risk, especially in H1/23. Such non-monetary risks were

the drivers the last two times gold surpassed US$2,000/oz, first during the 'peak fear'

of the global health crisis, and the second after Russia's invasion of Ukraine. That is

not to say that monetary drivers won't feature in 2023, as the 'Fed pull backs' story

could come to the fore by H2/23. However, we expect the Fed to keep rates high

through H1/23 given that it is already halfway through Q1/23, at least another 25 bps

rate hike is expected, and the Fed has been clear that it will wait a few months even

after an inflation drop to make sure it is truly crushed before considering easing.

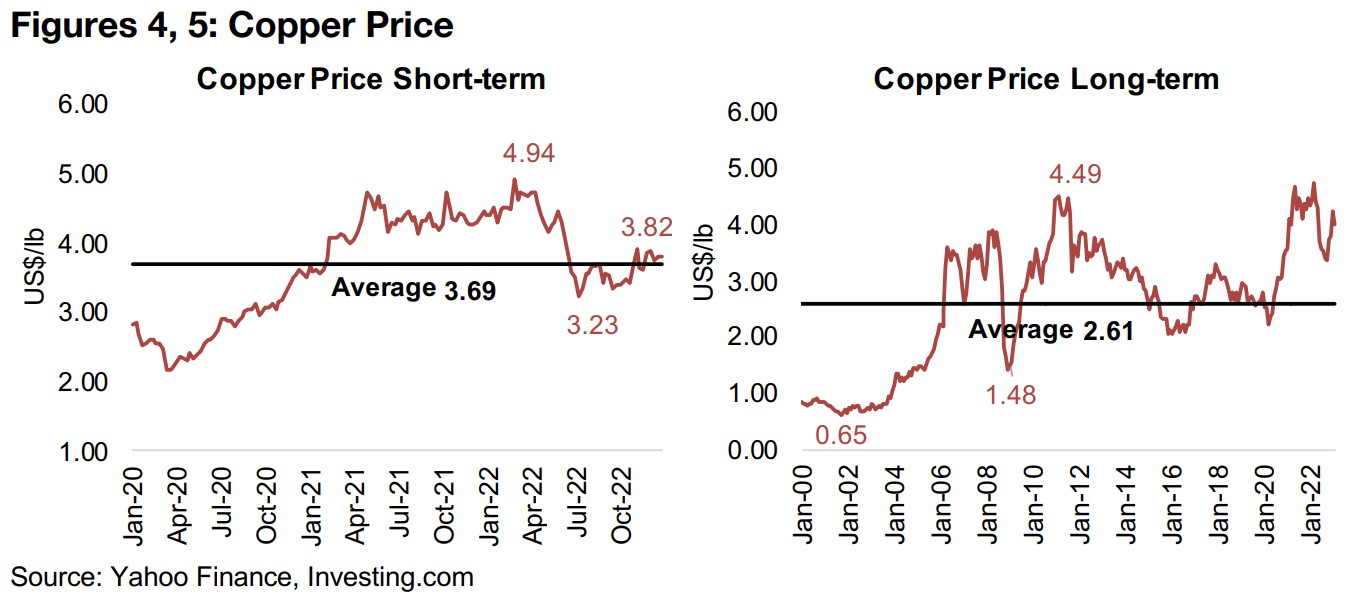

Wide range of outlooks for the copper price short-term

Compared to the outlook for gold, we are less confident about the direction of the copper price, with analysts varying widely in their expectations for the metal in the short-term. However, there seems to be a consensus that longer-term a widening deficit in the copper market is likely, which will support the price. While the copper price has had a substantial 18% rebound off lows of US$3.23/lb set in July 2022 to US$3.82, this puts it just above its average US$3.69/oz price since 2020 (Figure 4).

The bull market that started in mid-2020 followed a long bear market, with the price having peaked in July 2011 at US$4.49/lb and then collapsing from 2012 to 2014 (Figure 5). It then oscillated around its 22-year average of US$2.61/lb from 2014 to 2019. Prior to this was an abrupt dip during the 2008-2009 to a low of US$1.48/lb in January 2009, which ended a long bull market running from 2002, when prices were just US$0.65/lb, to June 2008 highs of US$3.90. While obviously quite volatile since 2000, the trend over the last two decades for copper has been upward, and the price was at its highest level for this entire period at its peak in July 2022.

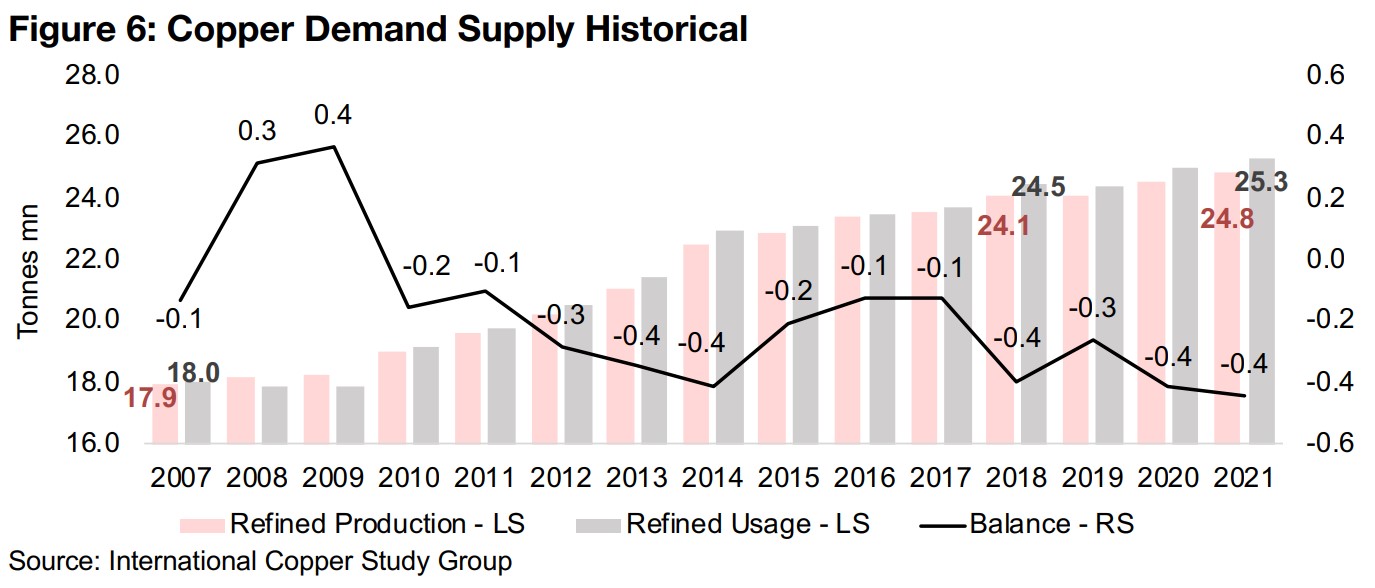

Copper market in deficit since 2010

A key underlying driver of the copper price has been a movement of the market into a deficit, especially since 2018, of around 400k tonnes, with a 300k tonne deficit in 2019 and then 400k tonne deficits in each of 2020 and 2021, according to data from the International Copper Study Group (ICSG) (Figure 6). We can contrast this with the relatively low deficits of just 100k to 200k tonnes from 2015 to 2017, when the copper price was at its lowest point, and the 300k and 400k tonne surplus in 2008 and 2009 when the copper price was collapsing because of a demand slump.

This gives us a general rule that as the copper market moves toward a deficit or

surplus of 300k tonnes or more that this could drive considerable upward, or

downward, moves in the copper price, respectively. The US International Energy

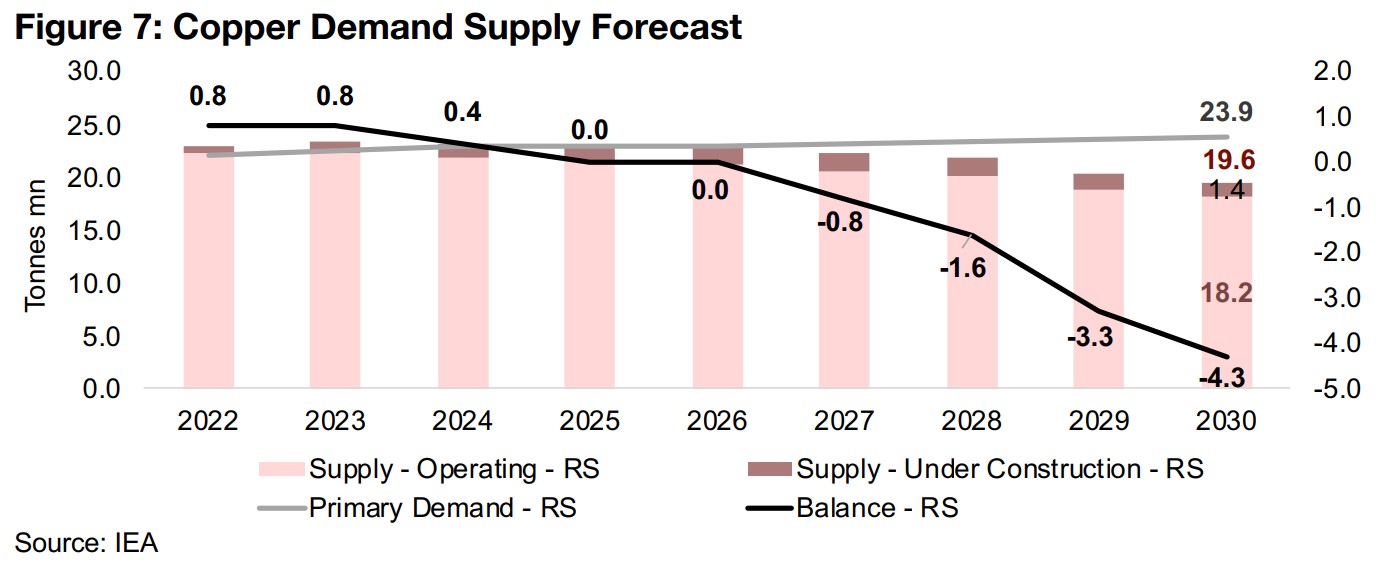

Agency (IEA) provides a demand and supply forecast for copper, and although its

magnitudes are slightly lower than what is implied by the ICSG above, it still offers a

useful picture of the potential long-term trend for supply and demand (Figure 7). The

IEA forecast actually shows a surplus for 2022, and although full data from last year

has still to come in to see if this has proved correct, the abrupt correction in the

copper price in mid-2022 does indicate weakening demand.

The IEA is forecasting an 800k tonne surplus for copper in 2023, although we note

that these numbers are somewhat dated, being from before 2022, and therefore not

encompassing recent information. On the demand side, this includes the ending of

restrictions in China, and on the supply side, political disturbances in key countries

which have limited copper output. In Peru, the second largest global copper producer,

at about 10% of global supply, political action has been interrupting mine supply with

widescale protests after the ouster of the previous president. In the Democratic

Republic of Congo, the third largest producer, at 8% of total global production,

conflict between the government there and a large Chinese firm over royalties for the

huge Tenke Fungurume copper and cobalt project has held back output.

However, offsetting this lower global supply and rise demand from China could be a broader global decline in demand, with a recession widely expected in 2023 given surging interest rates. Some analysts also see any boost to copper from China's reopening as short-lived with the lingering effects of lockdowns still hitting demand. If a recession starts to bite by H2/23, the primary demand forecast for 2023 from the IEA could prove to be high, and the copper surplus could be more than expected, reducing the copper price. Many analysts expect recessionary pressure will offset supply declines from micro political issues this year, and that copper prices will fall, including the World Bank, targeting a -17% decline in 2023 and 1% gain in 2024.

A broader consensus for a widening copper deficit longer-term

While analysts are debating what will happen with the copper price in 2023 and into 2024, there seems to be more consensus on the longer-term outlook. A considerable deficit is expected to emerge especially from 2027 onward by the IEA, with supply estimates even including planned new construction declining by -14.7% from 23.0 mn tonnes in 2025, to 19.6 mn tonnes by 2030. Meanwhile, demand is targeted to rise 3.9% to 23.9mn tonnes over the period, for a 4.3mn tonne deficit by 2030, which would indicate quite strong upside for the copper price over longer-term.

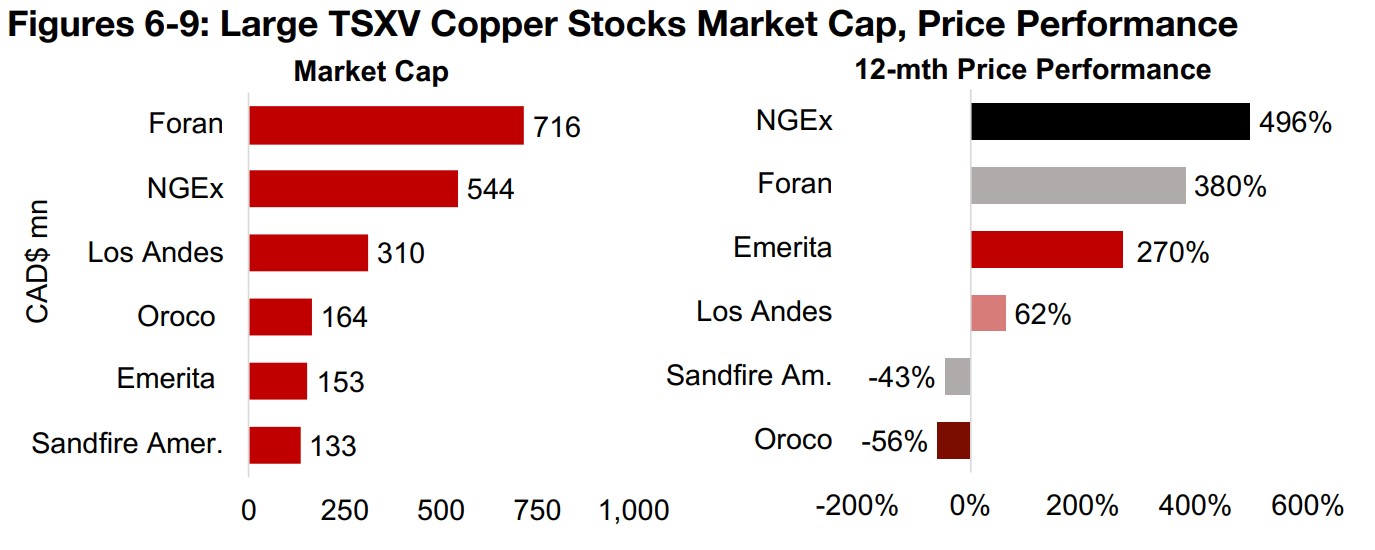

TSXV large copper sees mixed gains from 2021, Foran the largest stock

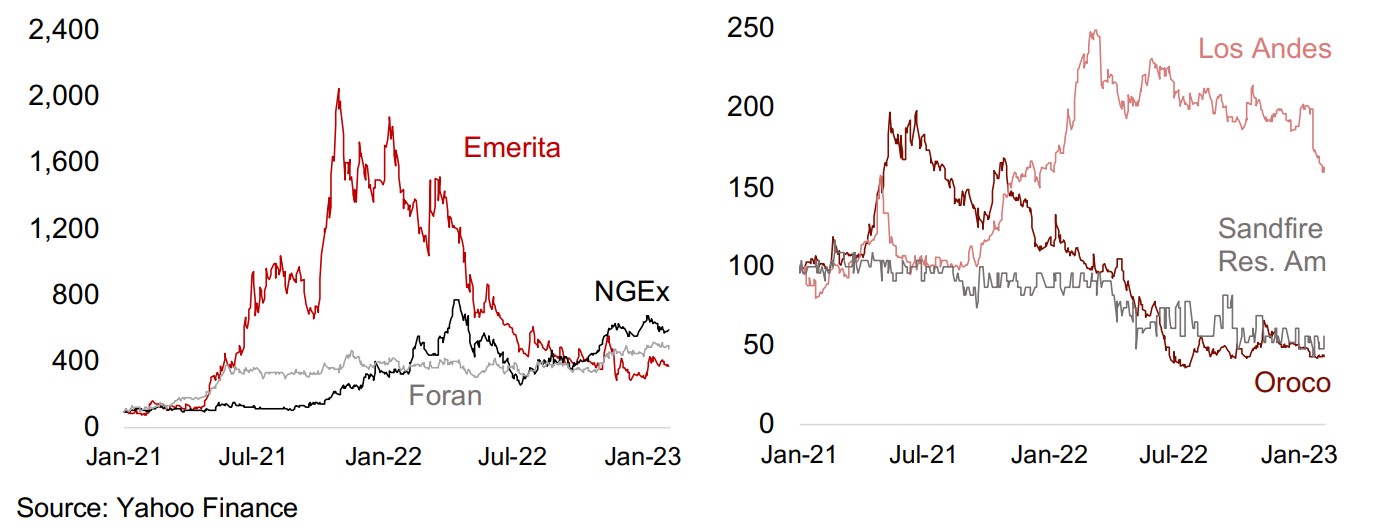

The performance of the large TSXV copper stocks has not been consistently

correlated with the copper price since 2021, with company specific drivers tending

to be more important. The largest TSXV copper stock is Foran Mining at CAD$716mn

(Figure 6), with the second largest gain, up 380% (Figure 7). However, its big jump

was mostly in H1/21, especially from a 70% increase in its Indicated Resources, with

its ascent more gradual since (Figure 8). Foran operates the McIllvenna Bay project

in Saskatchewan, with a larger large contribution from both copper and zinc, for a

combined 2,313k lbs in copper equivalent resources (Figure 11).

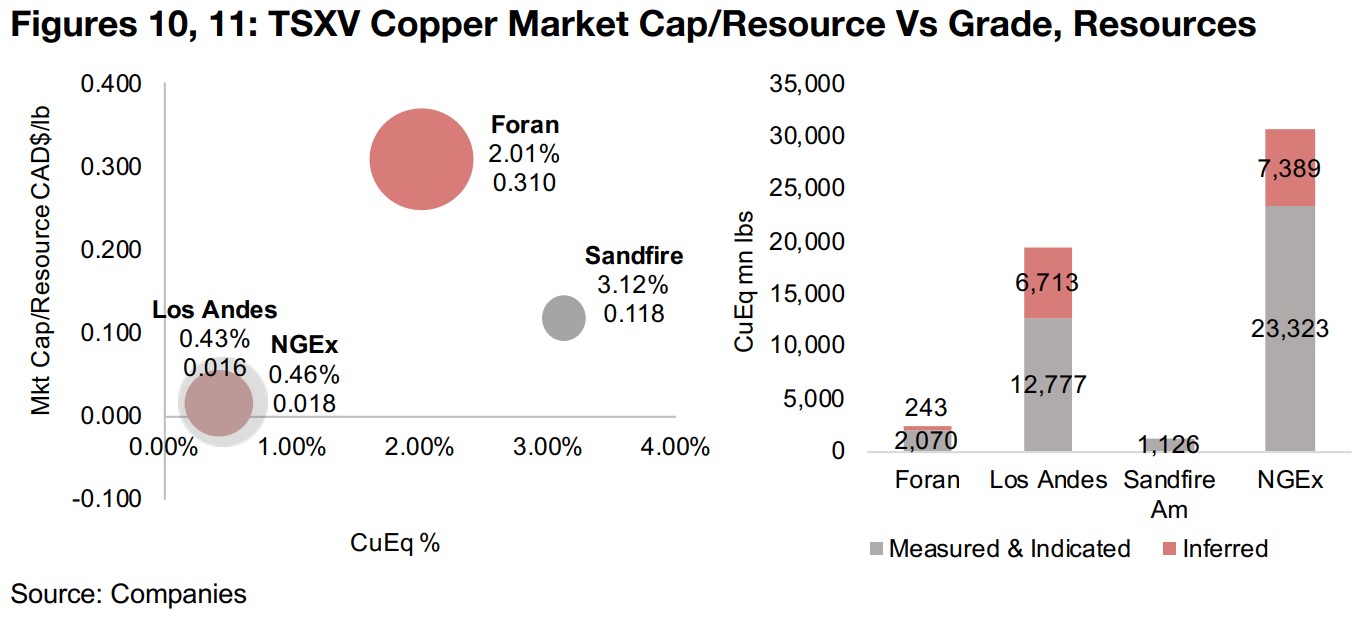

The company is valued the highest of the group based on Market Cap/Resource, at

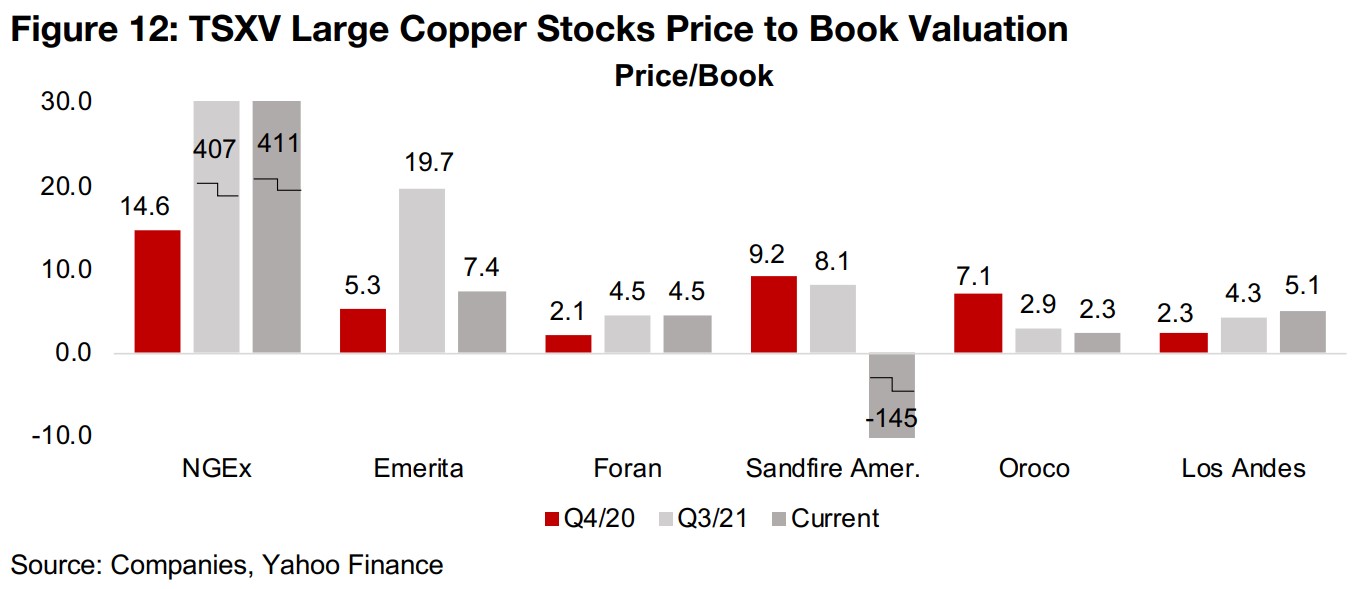

CAD$0.301/lb, given its high average grade of 2.01% CuEq (Figure 10). Its price to

book valuation saw a large gain along with the jump in its share price in 2021, rising

from 2.5x at the end of 2020 to 4.5x by Q3/21, and it remains at a 4.5x price/book

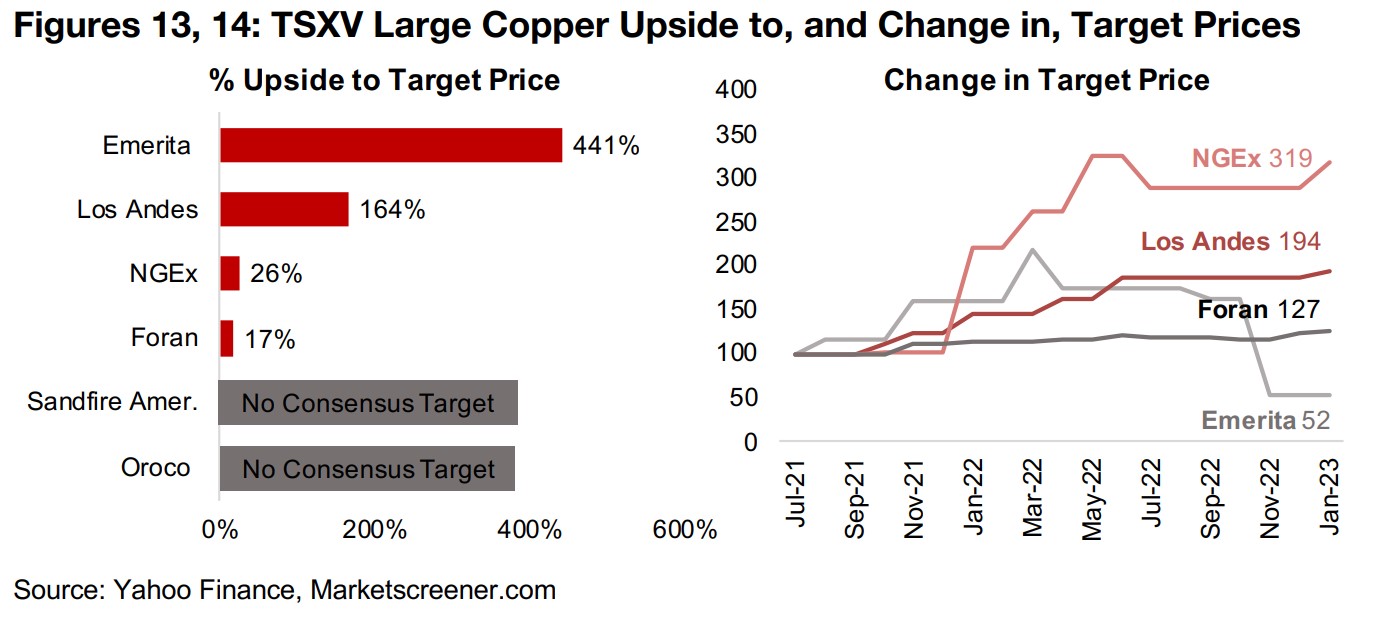

currently (Figure 12). The market sees the company converging toward its full value,

with just 17% upside to its target price (Figure 13), and there have not really been

many 'shocks' to the value proposition over the past two years, with analysts'

consensus target value rising quite gradually, up 27% (Figure 14).

The company continued to make substantial operating progress through 2022,

announcing the Feasibility Study for McIllvenna Bay in February, the receipt of an

approval to operate permit for its advanced exploration decline program in May, a

planned C$200mn investment from the Ontario Teachers' Pension Plan in August,

C$33.4mn in warrant exercises by Fairfax in October and a US$150 mn project

finance credit facility in December.

NGEx has very large resource but moderate grade

NGEx Minerals is the next largest TSXV copper stock, at a CAD$544mn market cap,

and has had the best share price performance since 2021, up 496%. The company

is developing the Los Helados copper-gold project in Chile, with a large resource of

30,712 mn lbs of CuEq equivalent dwarfing the other three in the group which have

Resource Estimates. However, it has only a moderate grade of just 0.46%, about a

quarter of the level of Foran, with the market valuing it at a Market Cap/Resource of

just CAD$0.016. NGEx has seen the strongest correlation of the group to the copper

price, gaining along with the metal from late 2021 to early 2022, which catalyzed a

series of strong drill results from Los Helados, declining along with copper through

mid-2022 and picking up again in the copper rebound of the past four months.

The ongoing exploration had depleted the company’s capital, however, and its equity

declined from CAD$4.4mn as of Q4/20 to just CAD$1.3mn as of Q3/22, even as its

price has risen substantially, sending its price to book multiple soaring to 400x.

However, the company reported a capital raising of CAD$30mn in October 2022, after

the third quarter was reported, which would bring down the P/B to around 17x. While

analysts' have boosted NGEx's target price over 300% since mid-2021, all of this

increase was made by H1/22, and like Foran, it is getting near fully valued, with 25%

upside to the consensus value.

Emerita has huge round trip mainly on Aznalcollar ongoing court case

Emerita Resources has had by far the most extreme round trip of the group since

2021, up 1,900% at its peak in November 2021, and then trending down since, but

is still up 270% currently, the third highest gain of the group. The earlier gains had

been driven especially by news of its Aznalcollar project in Spain, with progress on

ongoing related court cases. There had been a dispute about the legitimacy of the

tender process for the project, with it having been awarded to another party initially,

but the court ruling that there had been criminality in the process, thus disqualifying

them from the tender, leaving the project likely to be awarded to Emerita. There is

also a civil case related to the project expected to be concluded by 2025, which could

eventually allow Emerita the rights to develop Aznalcollar.

However, the initial exuberance over progress on the case faded as the copper price

fell through mid-2022. The shares have also seen some support from other projects,

including strong drill results from Iberian West, but there are no recent resource

estimates or project studies from Emerita on which to base a valuation. While analysts

upgraded the target price as much as 100% through mid-2022, it has been cut to 50%

of mid-2021 levels, although analysts see 441% upside if the court cases clear up.

Los Andes sees more moderate rise than top three gainers

Los Andes has seen a more moderate rise than the top three gainers, at 62% since

2021, and has the third largest market cap at CAD$310mn. The company operates

the Vizcachitas Project in Chile, with a large resource of 19,490 mn lbs. It has almost

the same average grade as NGEx, at 0.46%, with the market paying almost the same

in Market Cap/Resource, at CAD$0.018/oz, as other factors, like jurisdictional risk,

are common across the two as they operate in the same country. Los Andes has seen

an ongoing expansion in its price to book multiple from 2.3x as of Q4/20 to 4.1x as

of Q3/21 to 5.0x currently, indicating a rise in market confidence in the stock.

Further signs of market confidence have been an upgrade in analysts' target price for

the stock by nearly 200% since mid-2021, and while most of this came by mid-2022,

there have been no downgrades since and even a recent uptick, with a strong 164%

upside to the target. The company has reported strong drill results at Vizcachitas over

H1/22, with major announcements in H2/22 and early 2023 mainly related to financing.

A US$5mn investment closed in September 2022, common shares issued to service

interest on a US$14mn debenture were announced in December 2022 and a

CAD$10mn bought deal financing closed in January 2023.

Sandfire Resources America in litigation and in imminent need of financing

Sandfire Resources America is down -43% since 2021 and is the only one of the

group without a substantial rise at least at some point over the past two years. It is

developing the Black Butte copper project in Montana and has been embroiled in a

lawsuit with environmental groups over the project. Court rulings in 2022 went against

Sandfire, and the company is in the process of proposing solutions to the court to

remedy the problems, with further litigation ongoing related to water use at the project,

although the company can still use water at Black Butte under its current permits.

The company had bridge loans of $20mn as of its most recent Q3/22 report, but its

equity went negative, sending its price to book valuation heavily negative versus 8.1x

in Q3/21 and 9.2x as of Q4/20. The company expects to need to raise financing by

the end of Q2/23 to continue operating, although it could see support from Sandfire

Resources, its large Australian parent company, which holds 87% of the company.

While the company has a combined 1,126k lbs of copper between its Johnny Lee

and Lowry deposits at an average grade of 3.12% Cu, much higher than Foran at

2.01%, it still trades below it on a Market Cap/Resource of just CAD$0.118/lb,

because of the litigation and financing risk, and the company has no consensus target.

Oroco Resources continues to drill at Santo Tomas

While Oroco Resources continued to post strong drill results from its Santo Tomas copper project in Mexico over 2022, its share price is still down -56% since 2021, with its market cap the fourth largest of the group at CAD$164mn. The company has yet to release a Resource Estimate for the project, although there was a historical Pre-Feasibility study from 1994 which the company is exploring to confirm and expand. With no resource or consensus target price, Oroco is not easily benchmarked against the group, and in general over the past year we have seen pressure especially on pre-resource companies, given rising risk aversion in markets, which had led to declines even for early-stage explorers with good drill results.

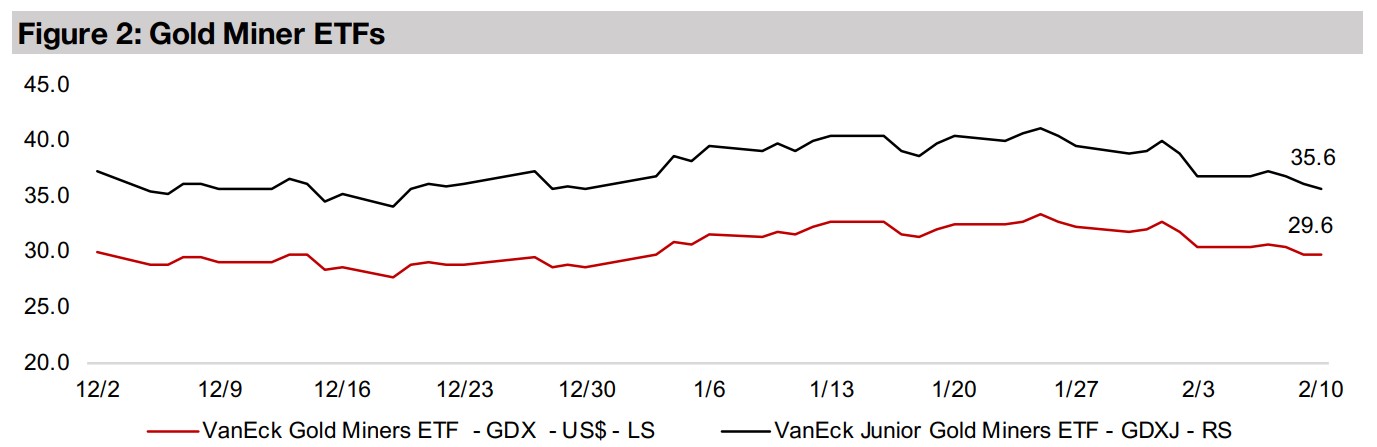

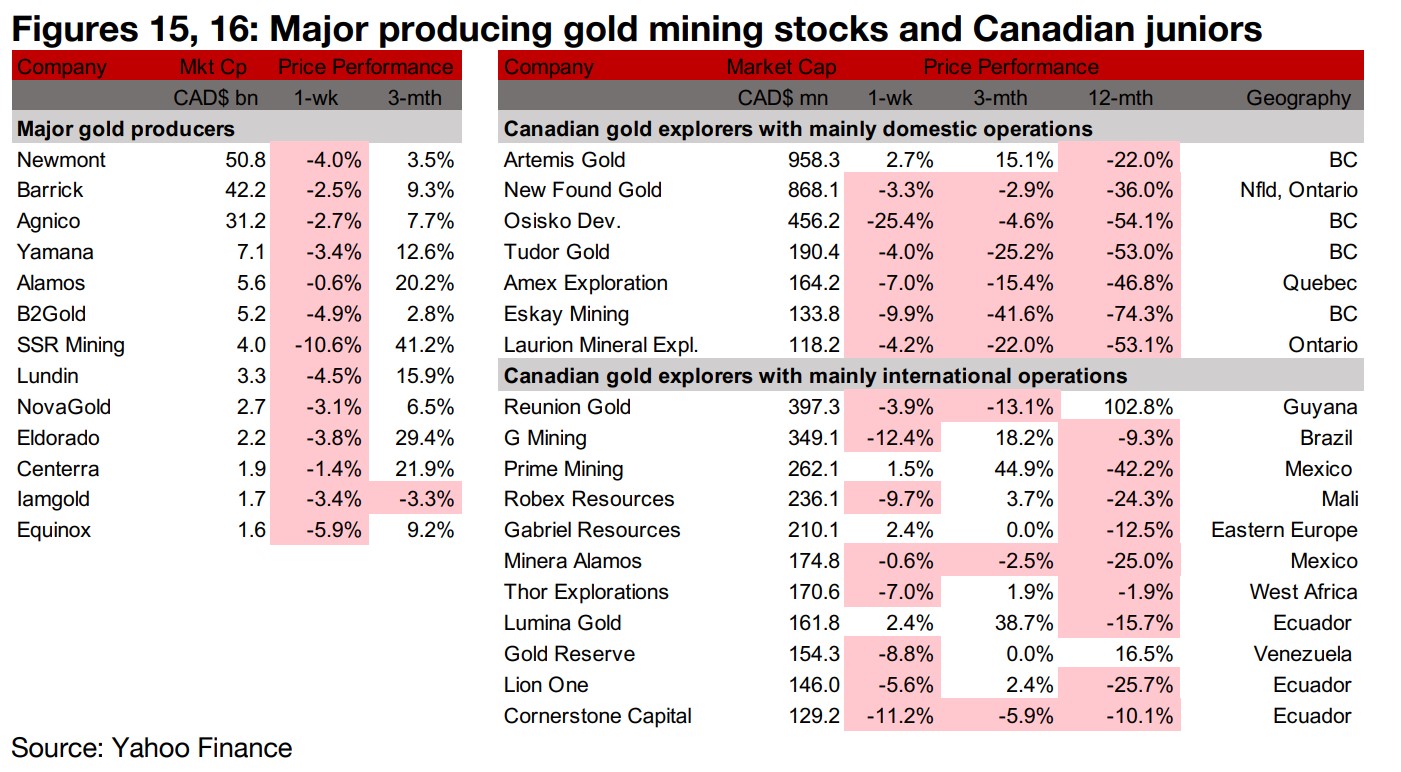

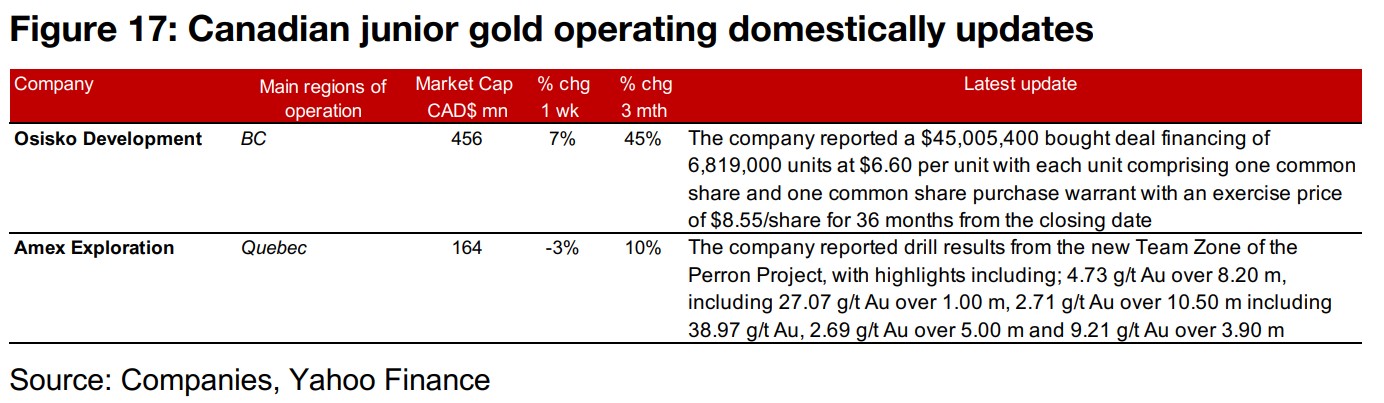

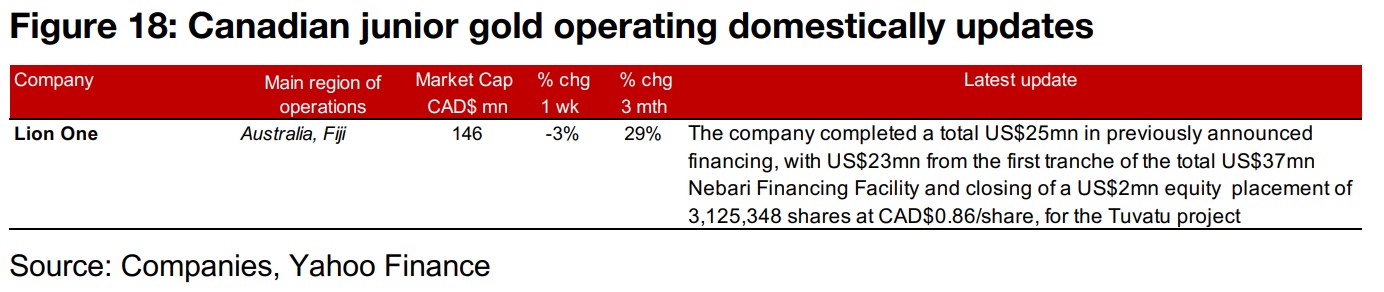

Gold producers decline and most TSXV gold stocks down

The producing gold miners all declined and the TSXV junior gold miners were mostly down as the gold price and equity markets eased for the week (Figures 15, 16). For the Canadian juniors operating mainly domestically, Osisko Development reported a bought deal financing of $45mn of 6,819,000 units at $6.60/unit and Amex Exploration reported drill results from the new Team Zone of the Perron Project (Figure 17). For the Canadian juniors operating mainly internationally, Lion One completed a total US$25mn in previously announced financing for the Tuvatu Project, with US$23mn from the first tranche of the total US$37mn Nebari Financing Facility and the closing of a US$2mn equity placement of 3,125,348 shares at CAD$0.86/share (Figure 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.