January 22, 2024

Underestimating Gold?

Author - Ben McGregor

Major institutions could be underestimating gold

This week we look at the forecasts by the AOCE and the World Bank, with both looking for declines for most of the major metals this year on an expected recession, although we expect they may be underestimating the potential for a rise in gold.

Underestimating Gold?

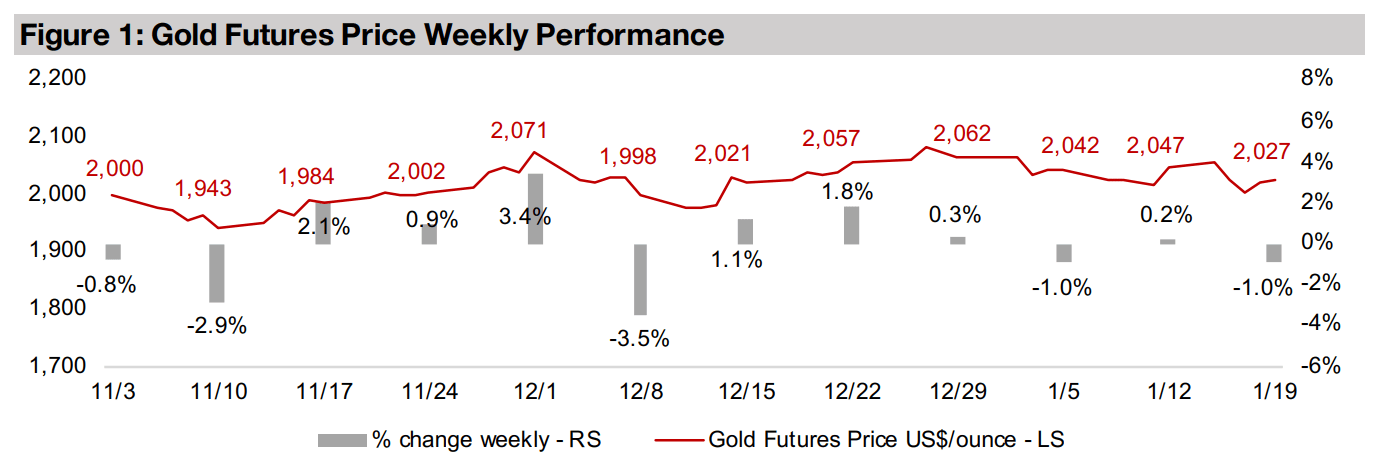

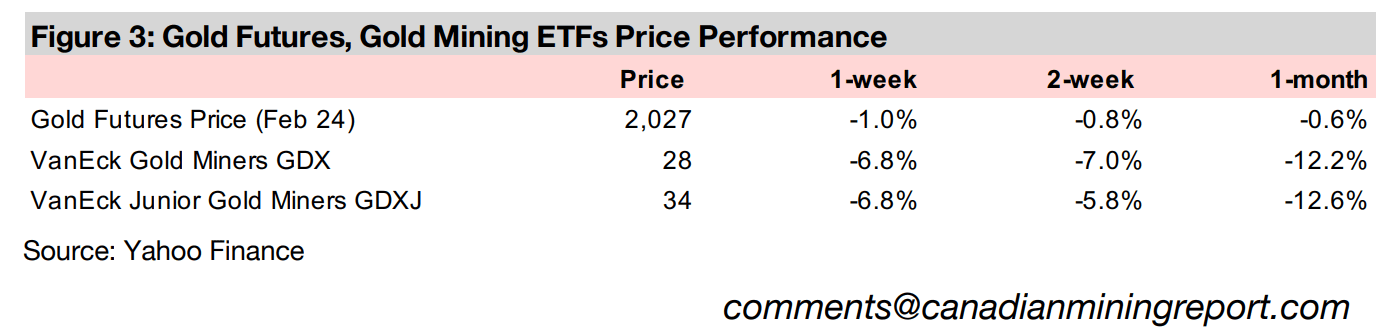

The gold price declined -1.0% to US$2,027/oz, as the risk-off sentiment that prevailed over the first half of January 2024 eased, although the metal still continued a streak above US$2,000/oz since the start of the year. Markets were focussed on bullish economic data this week including US weekly jobless claims at lows not seen since September 2022 and a rise in US consumer sentiment to its highest since July 2021. However, the S&P 500 was up only 1.0% as any upbeat sentiment was tempered by continued hawkish comments from Fed officials since the start of the year. They seem to be indicating that potential rate cuts this year will not be as fast or large as is being currently being priced in by the market.

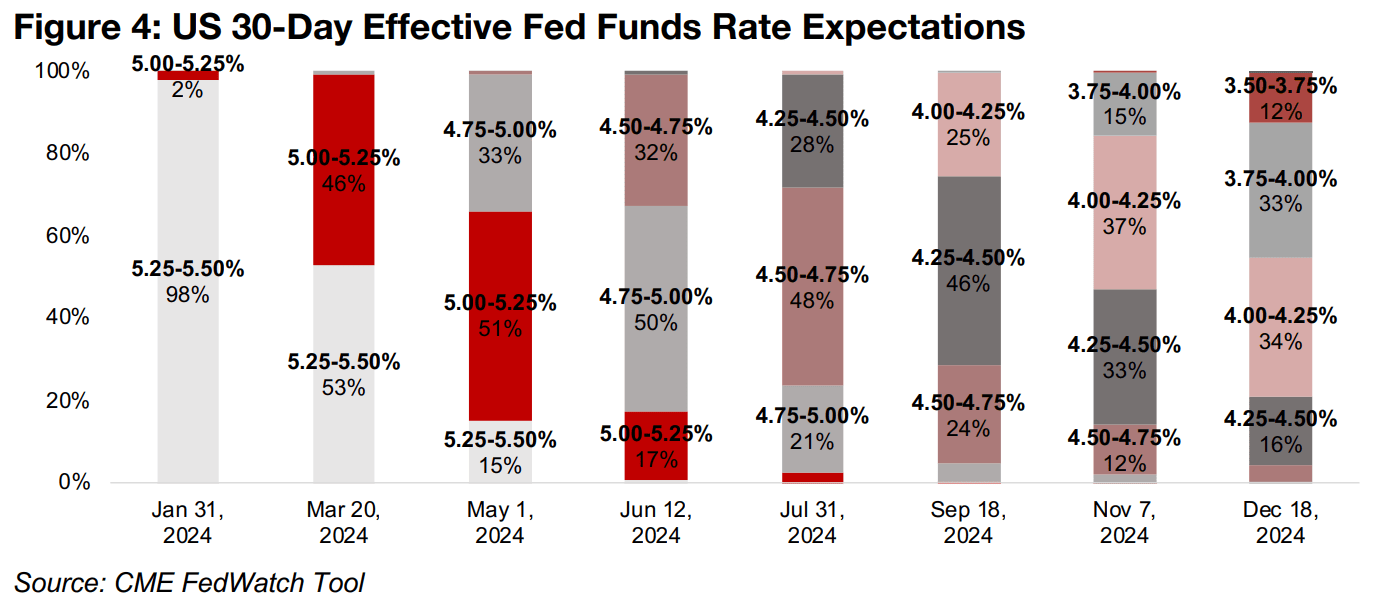

Market expecting aggressive rate cuts this year

The CME’s Fedtracker Tool shows market expectations for quite aggressive cuts this year. For the January 31, 2024 policy meeting there is a 98% probability that the 30- day US Fed Funds Effective Rate is held at the current 5.25%-5.50% level (Figure 4). However, the expectation of cuts by the March 20, 2024 meeting rise substantially, with only a 53% probability that rates are maintained, and a 46% chance of a decline to 5.00%-5.25%. By the July 31, 2024, meeting, expectations that rates will be at current levels are near zero, and there is a 48% probability that they drop 0.75% to 4.50%-4.75%. By year-end the market sees a nearly 100% probability that rates are 4.25%-4.50% or lower, implying at least full percentage decline in rates this year.

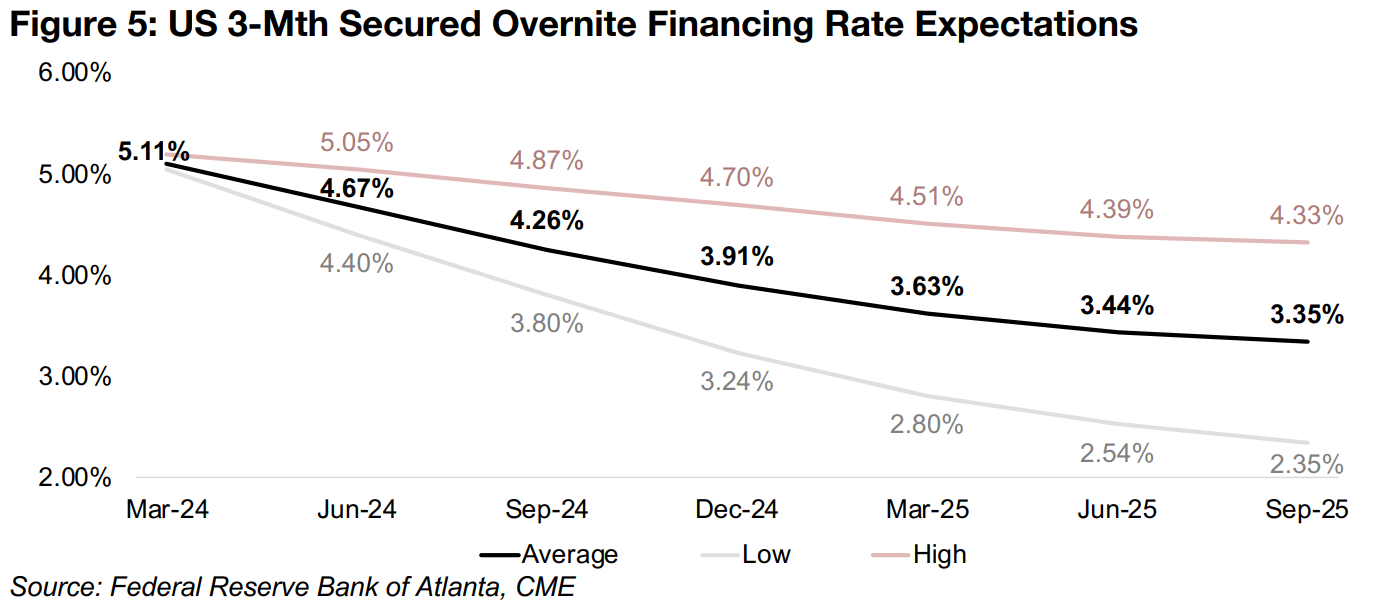

The Federal Reserve Bank of Atlanta’s Market Probability Tracker also shows the

expected path of base US interest rates as far out as 2025, using CME futures data

for the three-month US Secured Overnite Financing Rate (SOFR). This is a key base

rate to price assets denominated in US dollars which in January 2022 replaced the

global benchmark London Interbank Overnite Rate (LIBOR).

The market’s current average expectation is for a 5.11% SOFR by March 2024, but

then a 0.33% decline to 4.67% by June, and then a decline to 3.91% by December

2024, for a full 1.20% drop by the end of the year (Figure 5). The expectation spread

increases considerably by the end of the year, however, ranging from a low of 3.24%,

which would imply nearly a 2.0% drop in rates over the year, to 4.70%, implying only

a 0.40% decline. In both scenarios there are zero expectations for any further rate

hikes this year, similar to the US Fed Funds Rates expectations above.

Recent comments from Fed officials remain hawkish

Comments from Fed officials so far this year do necessarily match what we are seeing

in this data, and they sound far more cautious than these numbers would suggest. In

early January, Richard Barkin said that “the potential for additional rate hikes remains

on the table.” In the second week of January, Michelle Bowman said that in terms of

rate cuts “we are not yet at that point, and important upside inflation risks remain.”

This week Raphael Bostic moved up his “projected time to begin normalizing the

Federal Funds Rate to the third quarter of this year from fourth quarter.” Fed Governor

Christopher Waller this week indicated he did expect cuts this year, but that in “this

cycle, I see no reason to move as quickly or cut as rapidly in the past.”

While these comments are certainly hawkish, the ‘dot plot’ for 2024 which shows the

actual year-end rate expectations for the members of the Federal Open Market

Committee looks more dovish. Most members are looking for a drop in rates, and at

least two expect rates at 4.00% or lower by this year. Nonetheless, the recent

comments seem to indicate that big cuts, if they happen, could be more of a second

half than a first half 2024 outcome. This again raises the spectre of a market getting

ahead of itself on dovish expectations, only to be disappointed by a more hawkish

reality, a pattern that has repeated a few times over the past two years.

If the market’s expectations for big rate cuts are met, it would likely be good for gold,

as it implies lower real rates, a lower US$ and rising money supply, which are all

drivers of the metal. However, even if rates cuts are more gradual than expected,

generating economic fallout, gold could still benefit on a flight to safety, especially if

coupled with continued rising geopolitical risk. The only real negative scenario for

gold we see is a return to a combination of low geopolitical risk, low rates and low

inflation as in the mid-2010s, which we view as particularly unlikely currently.

Major institutions forecasting price declines for most metals

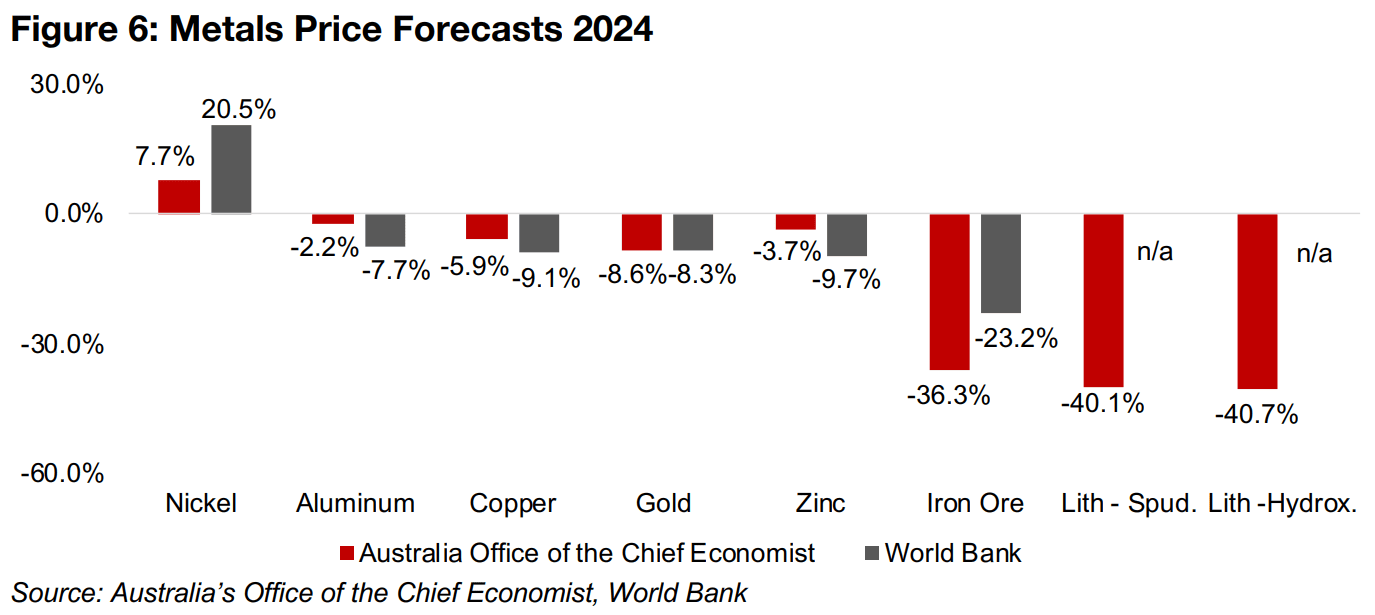

This week we look at the forecasts for the 2024 for the prices of the major metals from two regularly updated sources, Australia’s Office of the Chief Economist (AOCE) and the World Bank (WB). Both are still looking for declines in almost all of the major metals on expectations of rising recessionary pressures this year, with strong gains from both institutions expected only for nickel (Figure 6). The largest losses are expected for iron ore, which is mainly a function of demand in China, and lithium, declining on rising supply, also mainly from China, and lower global EV demand.

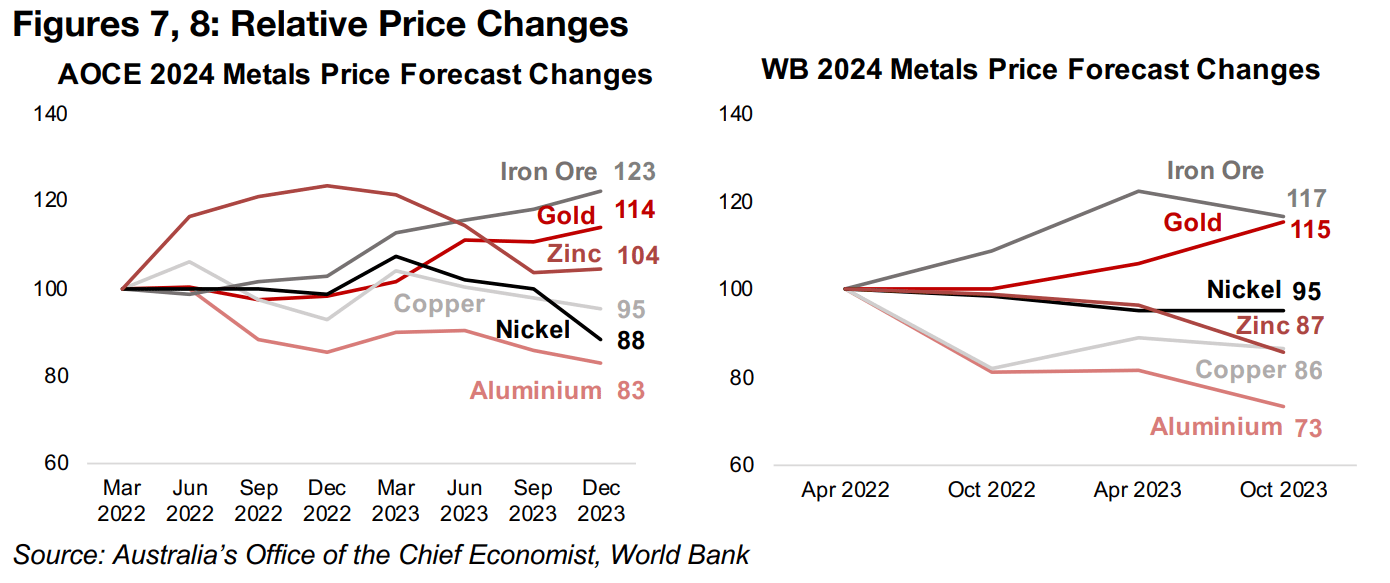

Tracking the forecast paths for the 2024 metals price estimates show a general trend of cuts for most of the metals, with the base metals hit the hardest, including copper, nickel, aluminum and zinc (Figures 7, 8). This is in part because there were price spikes in 2022 for many metals, including nickel and zinc, caused by major supply chain distortions after the global health crisis, which had eased significantly by 2023. However, there have also been rising recession fears that have put pressure on more broadly macro-driven metals like copper and aluminum. The only two metals that have seen consistent upgrades are iron ore and gold. The iron ore estimate upgrades were driven especially by China exiting lockdowns earlier than expected.

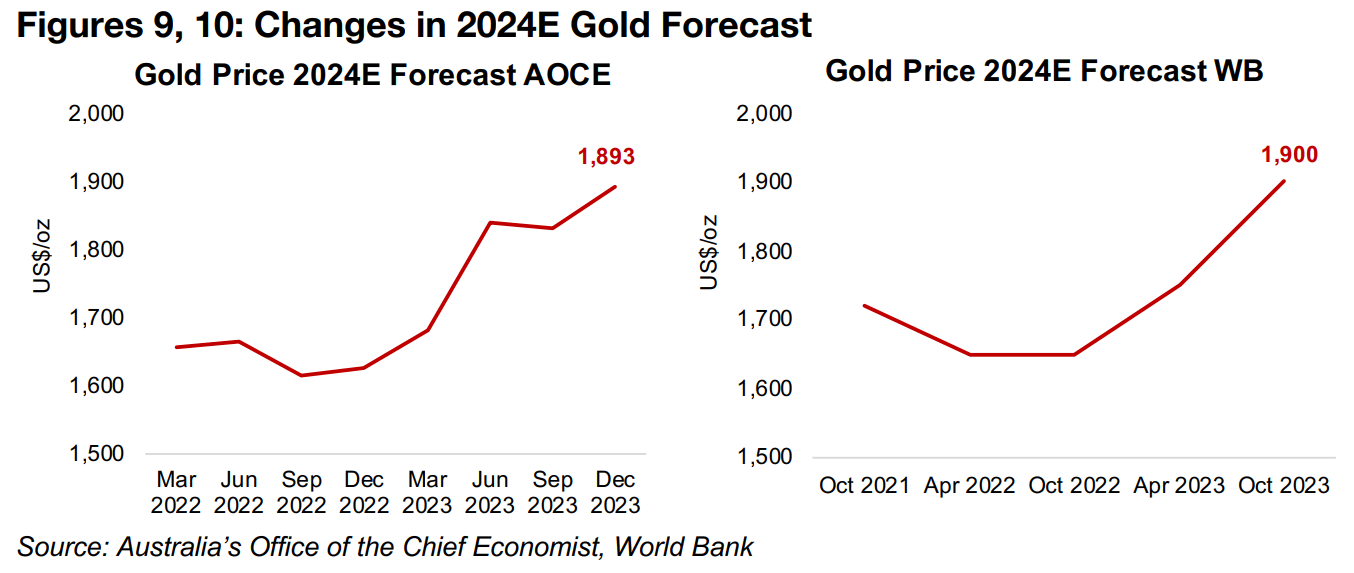

Major institutions’ ‘natural’ negative bias in forecasting gold

For gold, most major institutions forecasting the price have consistently

underestimated it in recent years. The outlook for the metal is key in determining the

outlook for the TSXV mining sector given the high weighting of gold stocks in the

index. The major issue seems to be that with gold an economic risk hedge, a large

rise in the price could imply negative upcoming economic events. As forecasters

generally have a bias towards expectations for an economic improvement in the year

ahead, except in times of severe crisis, the gold price tends to be underestimated.

With its strong start to the year the gold price is already challenging both the AOCE’s

and WB’s forecasts of US$1,893/oz and US$1,900/oz. Both these estimates seem to

imply that geopolitical risk and macroeconomic uncertainly will ease considerably this

year, which we see as unlikely (Figures 7, 8). The forecasts paths show both

institutions continuously upgrading targets, and ‘chasing’ gold over most of the past

two years, and we expect a similar scenario could play out this year (Figures 9, 10).

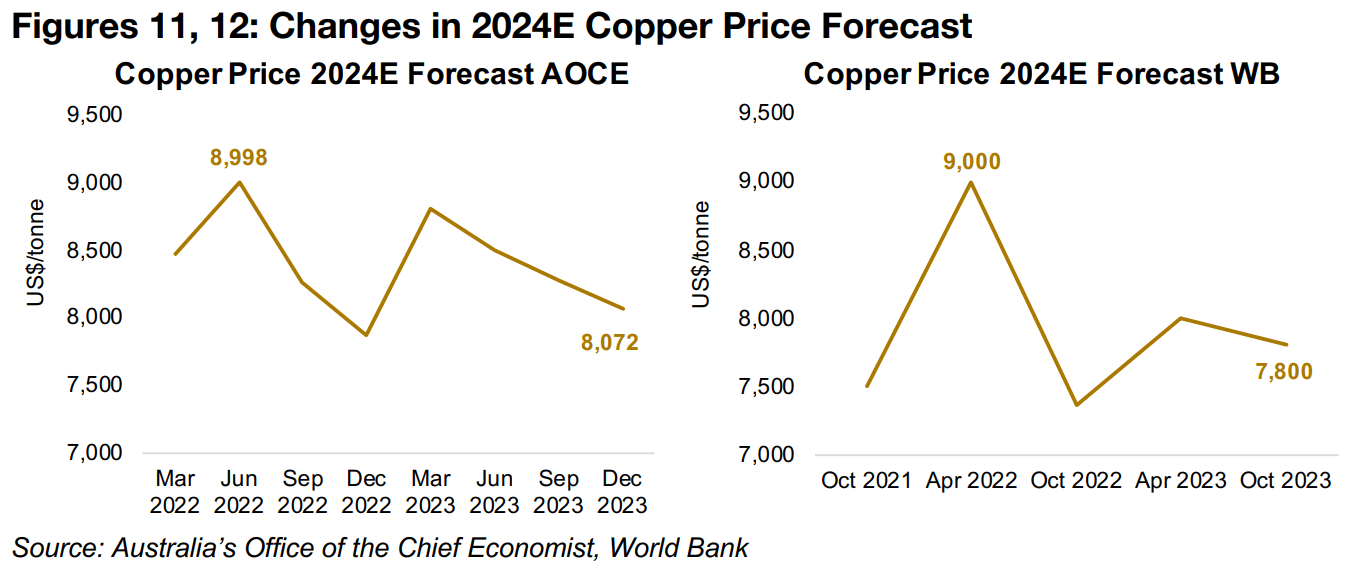

Copper price forecasts swing widely along with market balance

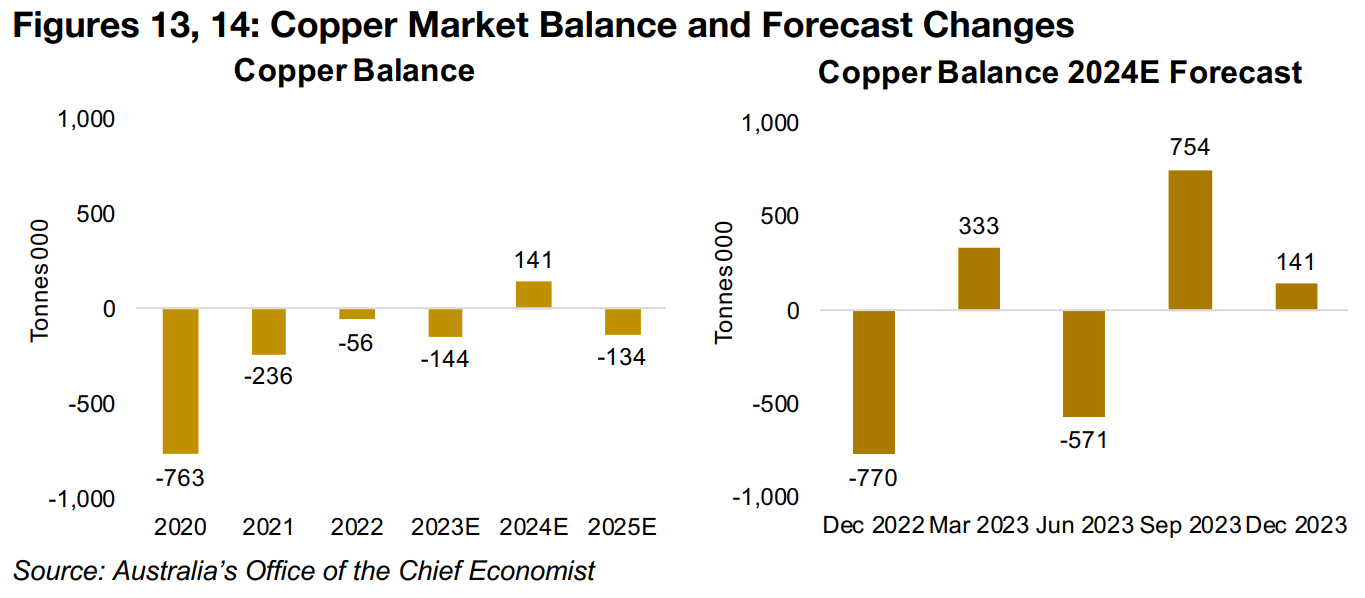

Of the base metals, copper stocks have the largest weighting in the TSXV Mining

sector. The AOCE and WB expect a -5.9% and -9.1% drop in the copper price,

respectively, in 2024, to US$8,072/tonne and US$7,800/tonne (Figures 11, 12). This

is because a market surplus of 141k tonnes is expected, driven by a 29% rise in

versus a 22% demand increase, after several years of deficits (Figure 13).

The forecast path for the copper price has been more volatile than the quite smooth

uptrend for the gold forecasts. This is because the market balance forecast has

jumped around considerably on a combination of geopolitical and macroeconomic

distortions since the global health crisis, leading to large changes in outlook even

from quarter to quarter (Figure 14). This sent the AOCE’s expected market balance

for copper from a major deficit to a large surplus twice since December 2022, with

the estimate finally settling down to a moderate surplus currently.

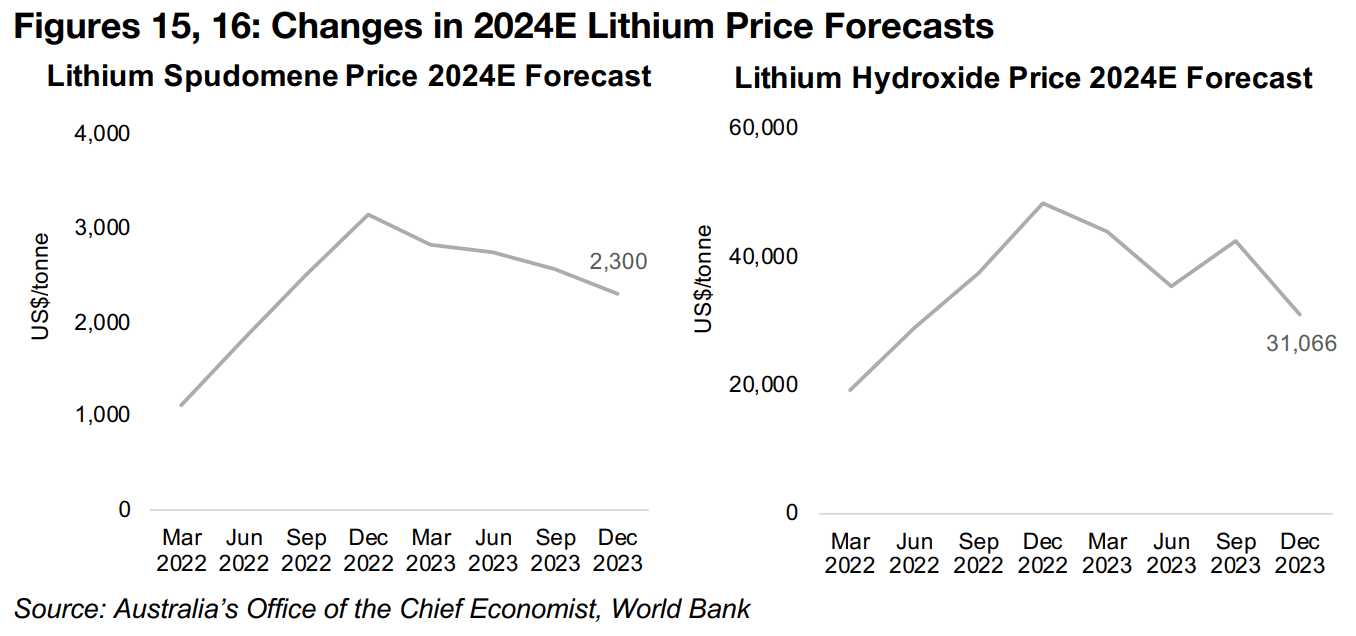

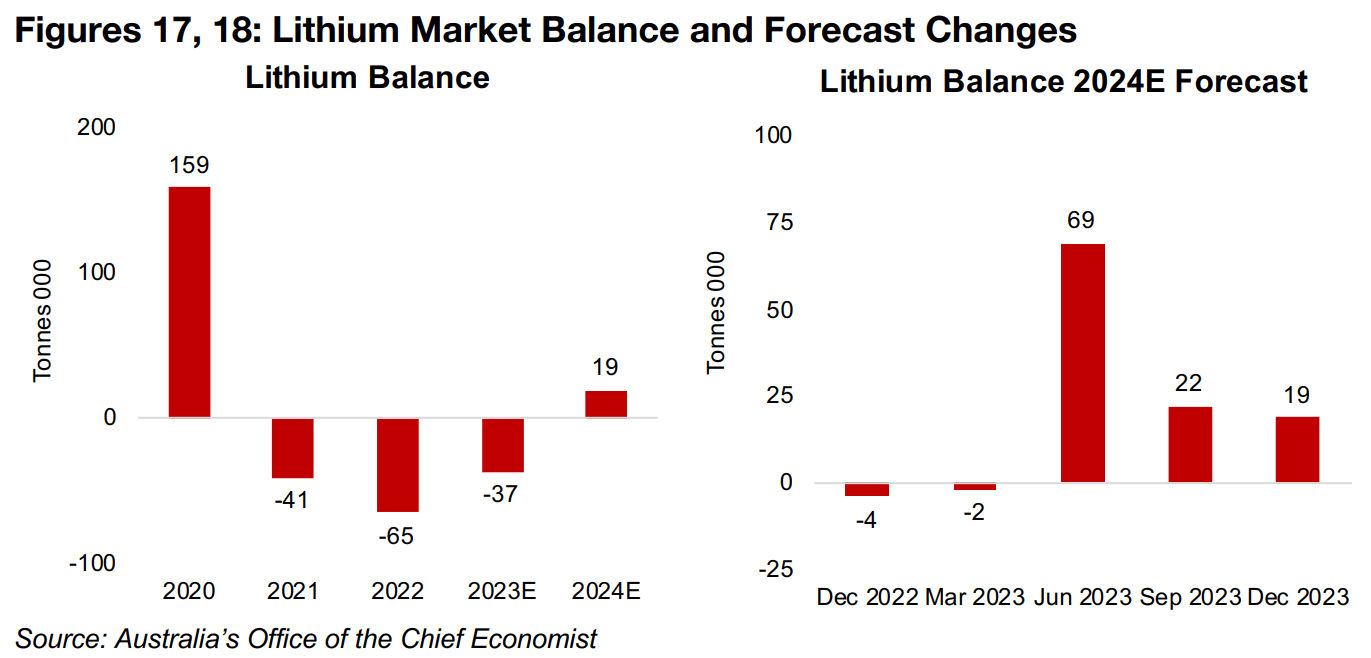

Lithium expected to plunge further this year

The other large sector of TSXV mining is lithium, and in contrast to the more moderate declines for gold and copper expected, the AOCE estimates a major drop in prices for 2024. The AOCE forecasts declines of 40.1% for spudomene and 40.7% hydroxide this year, and the World Bank does not regularly release lithium forecasts. The AOCE’s lithium price expectations peaked at the end of 2022, when supply was particularly tight and EV demand was surging (Figures 15, 16). However, price expectations have been driven down by major lithium chemical supply coming online last year, especially from China, which is over 80% of world output, while on the demand side, EV sales growth has slowed. The AOCE forecasts that the lithium market will move into surplus in 2024E for the first time in three years, at 19k tonnes, although this is down from a 69k tonne surplus forecast in June 2023 (Figures 17, 18).

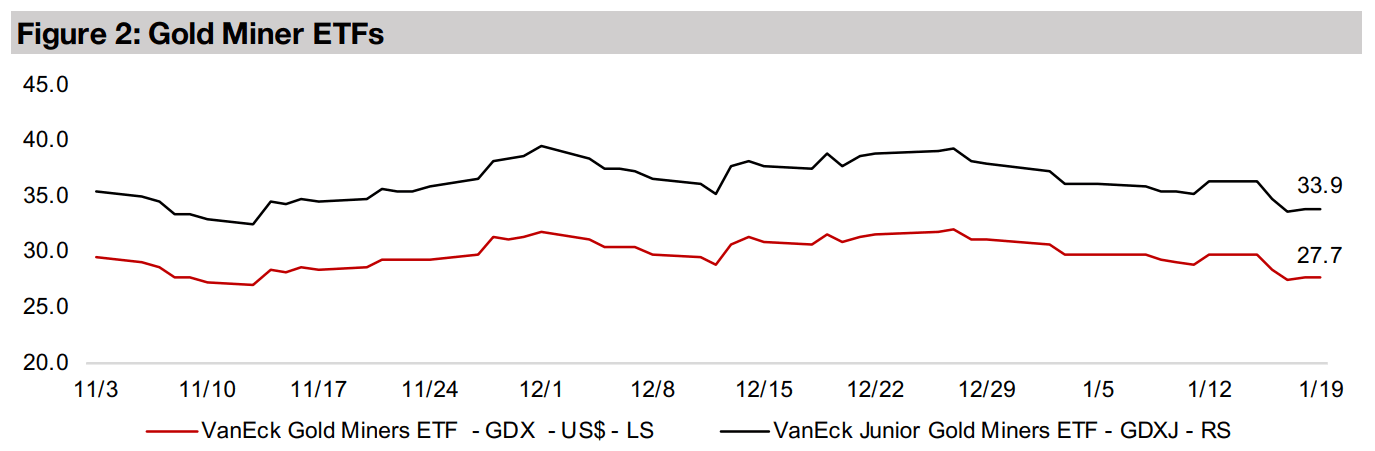

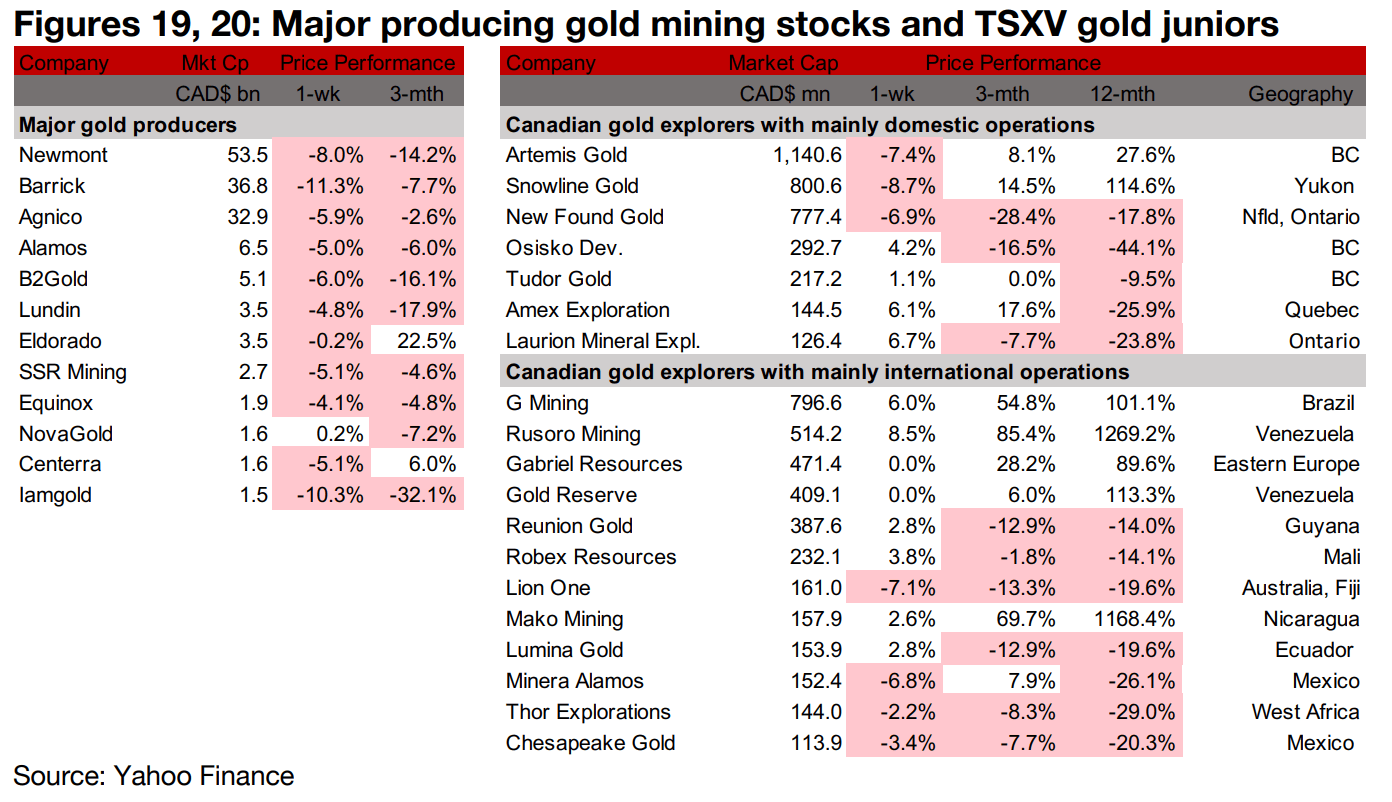

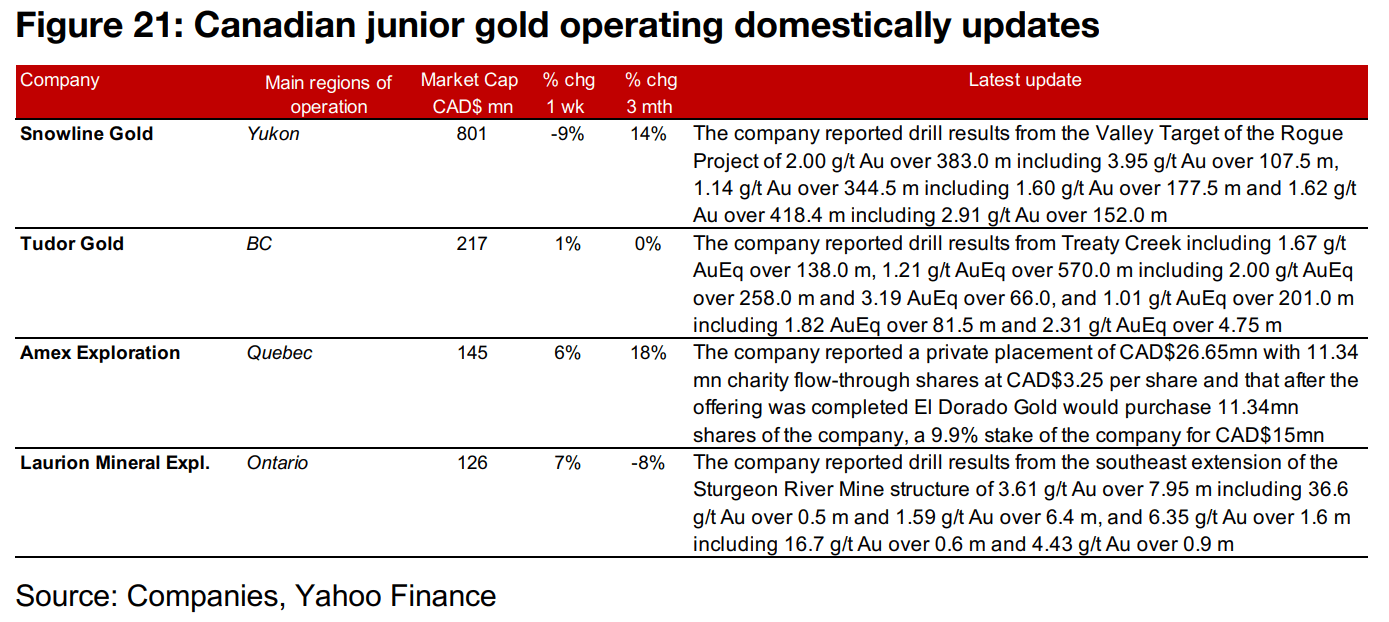

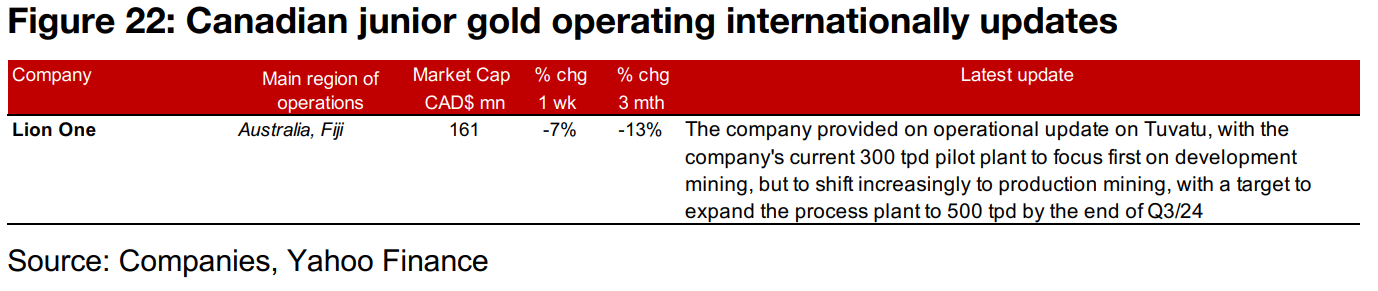

Gold producers and large TSXV gold mixed

The gold producers were nearly all down, although the majority of the larger TSXV gold stocks gained (Figures 19, 20). For the TSXV gold companies operating domestically, Snowline reported drill results from the Valley Target of Rogue and Tudor Gold from Treaty Creek, Amex announced a CAD$26.7mn private placement and Laurion Mineral Exploration reported drill results from the southeast extension of the Sturgeon River Mine structure (Figure 21). For the TSXV gold companies operating internationally, Lion One provided an operational update on Tuvatu with a target to expand its 300 tpd pilot plant by Q3/24 to 500 tpd (Figure 22).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.