March 18, 2022

US Rate Hikes Begin

Author - Ben McGregor

US Fed makes first rate hike in five years

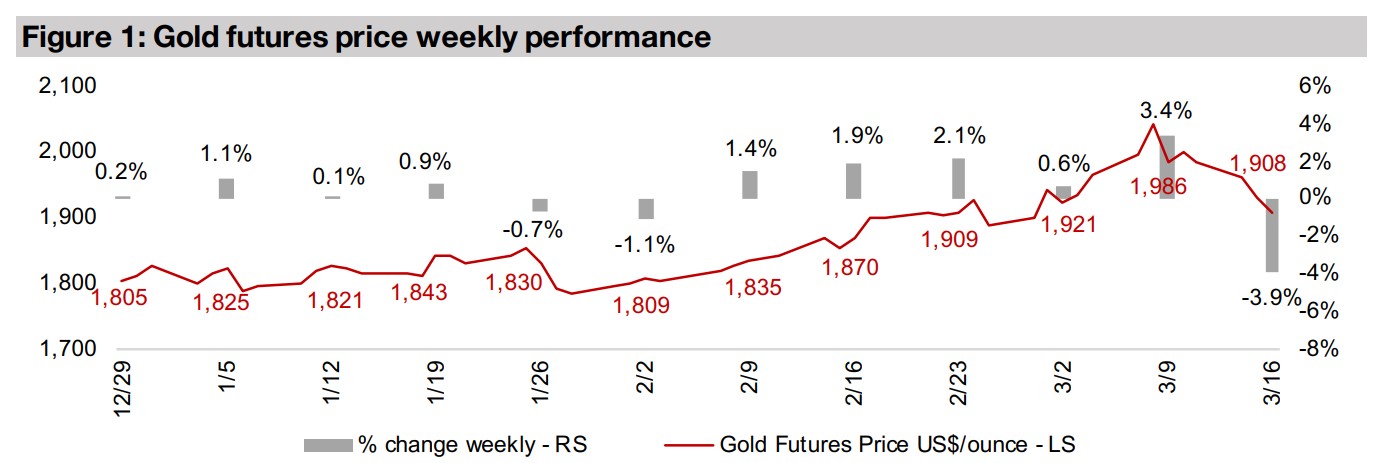

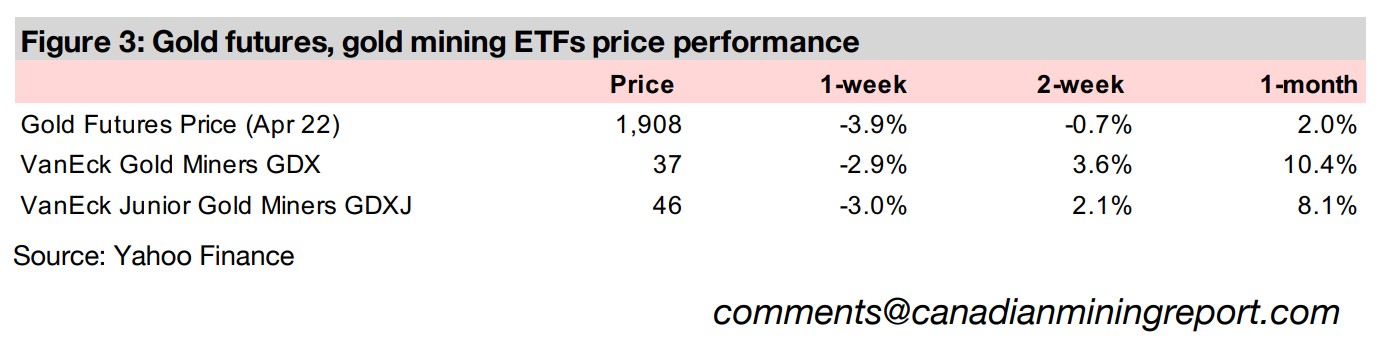

Gold declined -3.9% to US$1,908/oz this week, as the US Fed approved its first rate hike in five years, by 0.25%, seeing its base rate rise to 0.50%, and indicated another six hikes this year, which would see the base rate reach 2.00% by year-end.

Orezone, developer of Bombore in Burkina Faso, In Focus

This week Orezone is In Focus, developer of the Bombore gold project in Burkina Faso, for which financing was secured and construction started in 2021, with first gold expected by Q3/22 and strong recent results from expansion drilling.

US Rate Hikes Begin

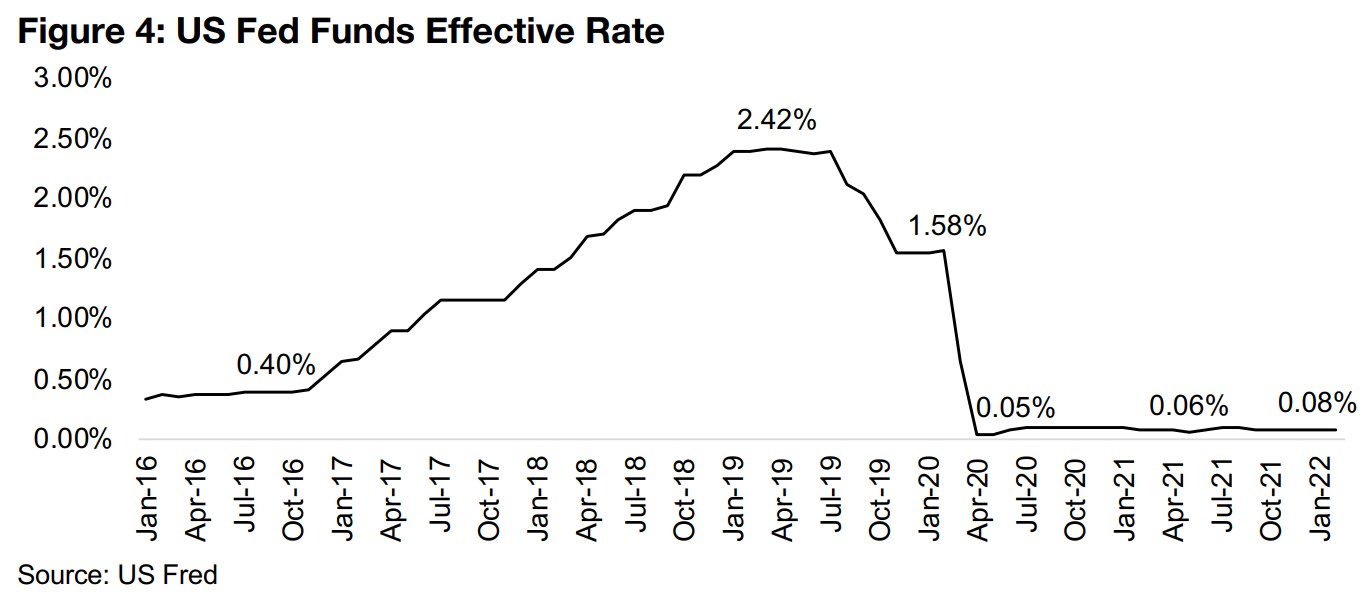

Gold declined -3.9% this week to US$1,908/oz, as the US Fed announced that it

would make its first rake hike in over five years, by 0.25%, increasing its base rate to

0.50% (Figure 4). The Fed also indicated that there were six more planned rate hikes

this year, or one at each of its remaining meetings, which could bring the base rate

to 2.00% by the end of 2022. While this is certainly not high in absolute terms, in

percentage terms, this would mark an 800% rise in the base interest rate in just a

year. We believe that this could prove to be a quite a shock to households and

businesses, with the amounts that they can expect to be paying for loans potentially

surging over the next year. This could in turn drive many to either stop increasing, or

even reduce their borrowing levels, leading to a pullback in credit expansion, which

can slow economic growth. We expect that the Fed may only get through a few of

the proposed hikes before the negative effects in markets and the economy begin to

show, and that this may compel them to reconsider their current rate hike plan.

While these rate hikes are mainly as response to surging CPI inflation, which reached

7.9% in February 2022, we believe that they might not actually be strong enough to

bring inflation down that much, even as they do cause an economic and market

slowdown, otherwise known as stagflation. This was a phenomenon that developed

in 1970s where inflation was surging but growth remained stubbornly low, surprising

economists which at the time believed that economic growth would tend to drive

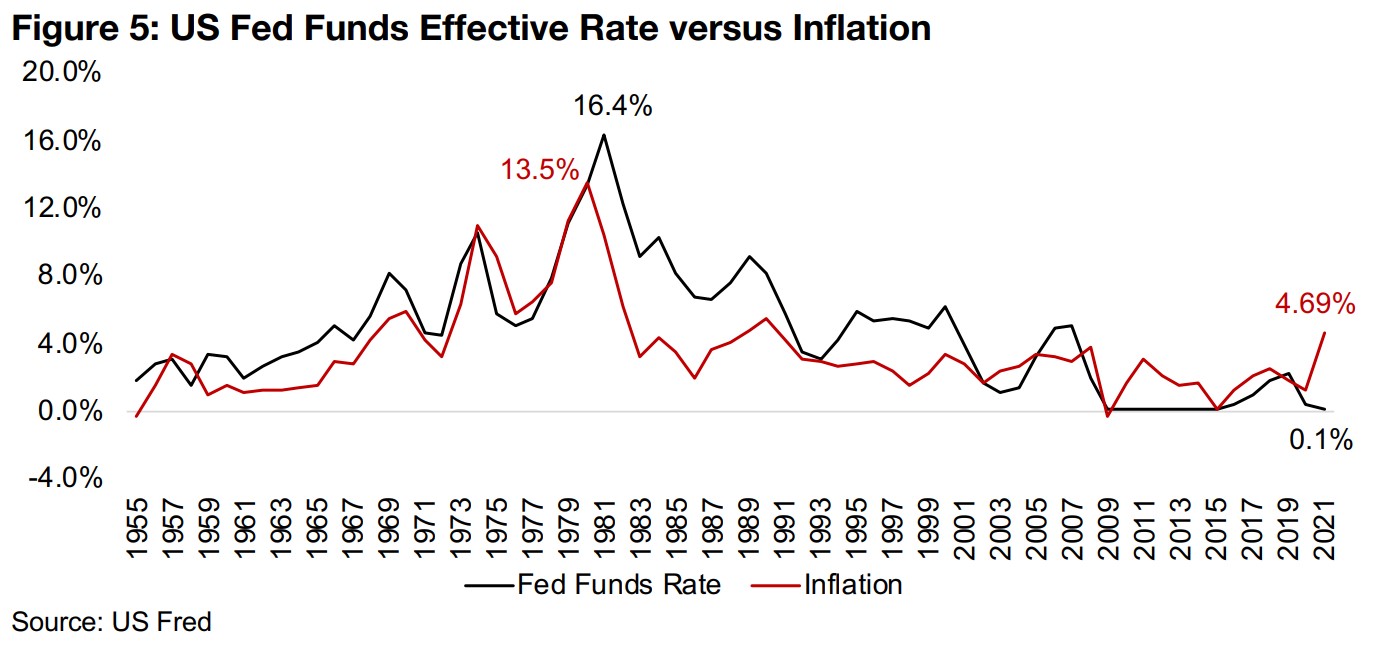

inflation and that economic contraction would tend to cause deflation. We can see in

Figure 5 that historically, the Fed Funds rate has often needed to almost match

inflation before we see it prices decline significantly, and applying that to the current

situation would suggest that the Fed Funds rate could have to head well above 5.0%

to start really having an effect on reducing inflation which is already near 8.0%. We

not expect that the Fed could go anywhere near that level without causing a strong

pullback in the economy and markets.

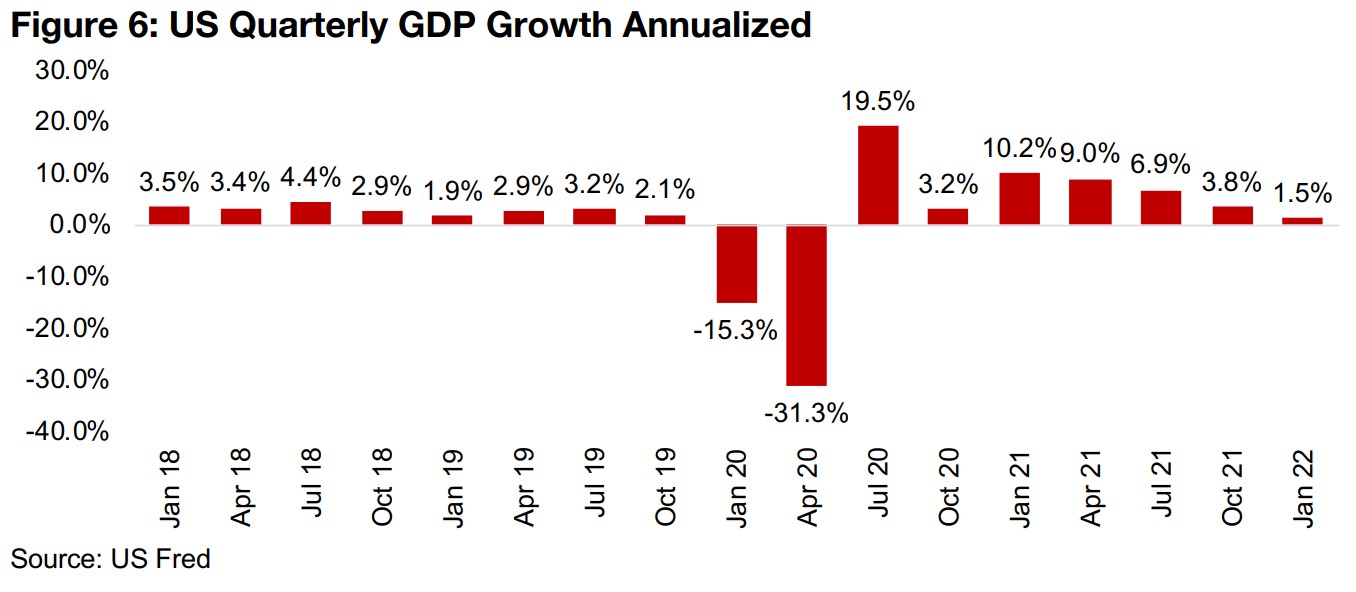

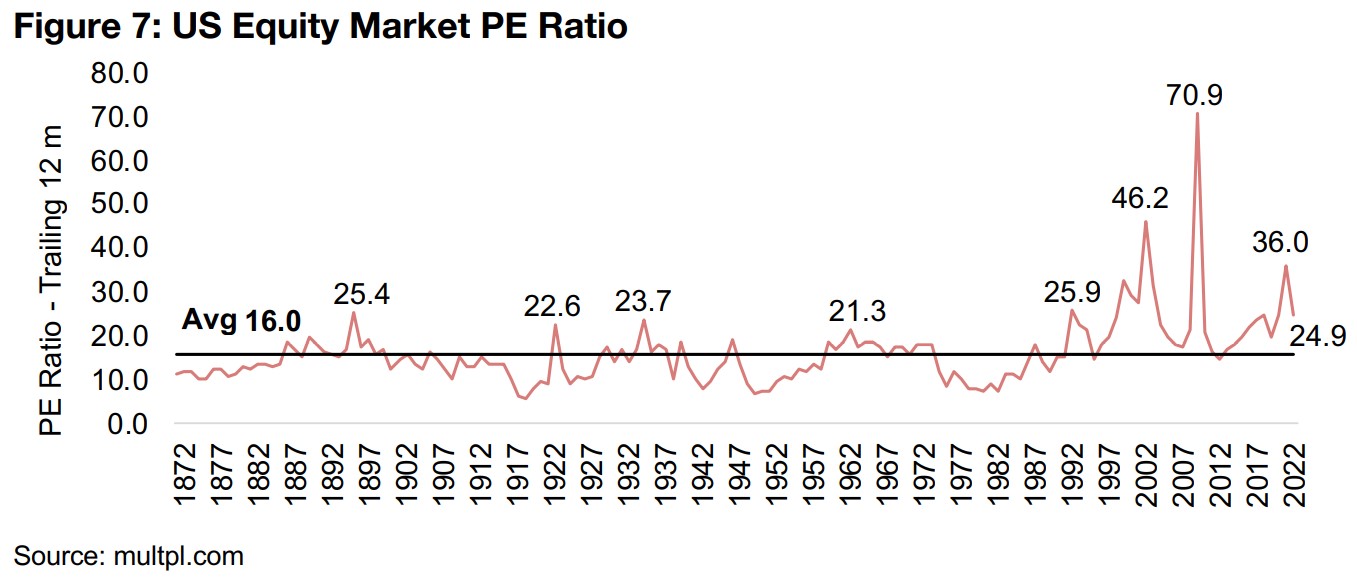

Figure 4 shows how far the Fed was able to go in its last rate hike cycle before the stock market especially started to show a negative reaction, with the Effective Rate peaking at only 2.42% before the Fed needed to start cutting rates. We note that this was also with a relatively strong global economy, without the myriad distortions created by the global health crisis, and without the major surge in geopolitical risk since Russia's invasion of Ukraine. Figure 6 shows that the economy is looking a bit precarious currently, with the post-health-crisis rebound effect driven by pent-up demand seeming to have played itself out, and growth estimates for the annualized January 2022 quarterly GDP for the US at 1.5%, just half the pre-crisis growth averaging 3.0% through 2018 and 2019. Meanwhile, US stock market valuations are still at historically very high levels, with the S&P 500 at a PE of 24.9x, well above the historical average of 16.0x, and this metric has only been at substantially higher levels during three crises, the dot-com crash, the 2008-2009 GFC and in 2020 (Figure 7).

The Fed is therefore in a difficult position, with inflation having spiked so much that it

can no longer be ignored, or explained away as transitory, and yet the economy and

the stock market are unlikely to be able to withstand much in the way of rate hikes

before seeing some damage. For gold, we expect that the overall drivers will remain

balanced, possibly preventing a major breakout, but at least seeing it hold up around

current levels this year, with some potential for gradual upside. First there is the

downward pressure from the rising interest rates, which will increase bond yields and

make them relatively more attractive than yieldless gold. However, currently, because

of the extremely high inflation, real US bonds yields, which account for inflation, are

heavily negative, so at best the rate hikes could make these bond yields less negative,

and therefore more attractive relatively, yet still not a great deal in absolute terms

compared to gold.

Also, this assumes that inflation does not keep rising, and if it does, then even with a

rate hike of a percent or two, if inflation rises more than a percent or two, then real

bond yields could continue to go even lower, which could be strong upside driver for

gold. Overall, we expect that the Fed rate hikes will be unlikely to drive down gold

this year, even if the full plan for six increases is implemented, and that the chances

are high that the economy and markets will see major fallout before they get to the

end of these currently planned hikes. Adding to this the surging geopolitical risk and

gold's role as a safe haven asset, we believe see a high probability that gold is able

to hold up well at least at current levels through 2022.

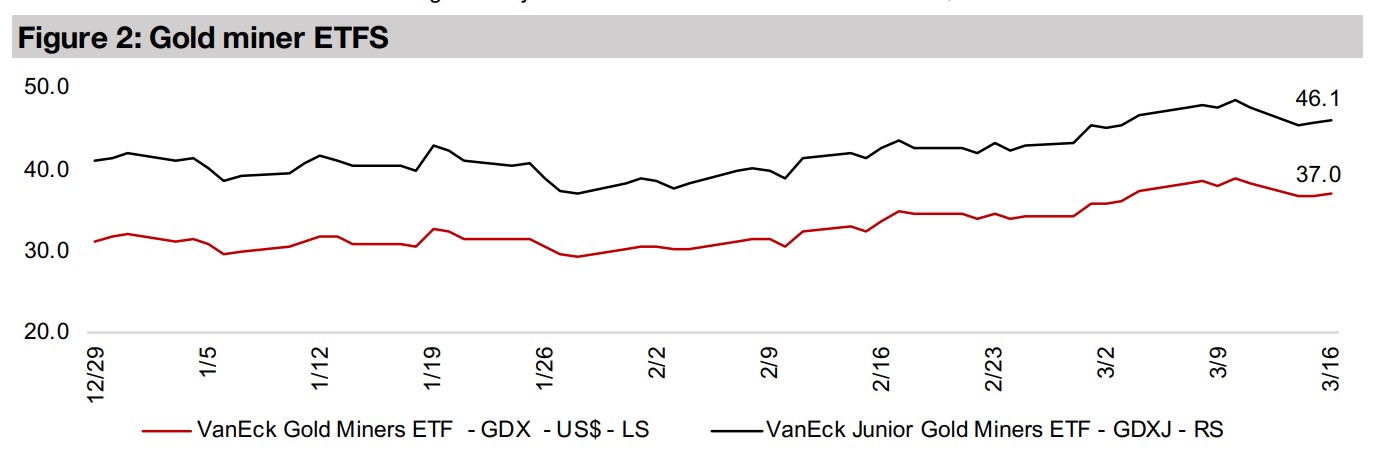

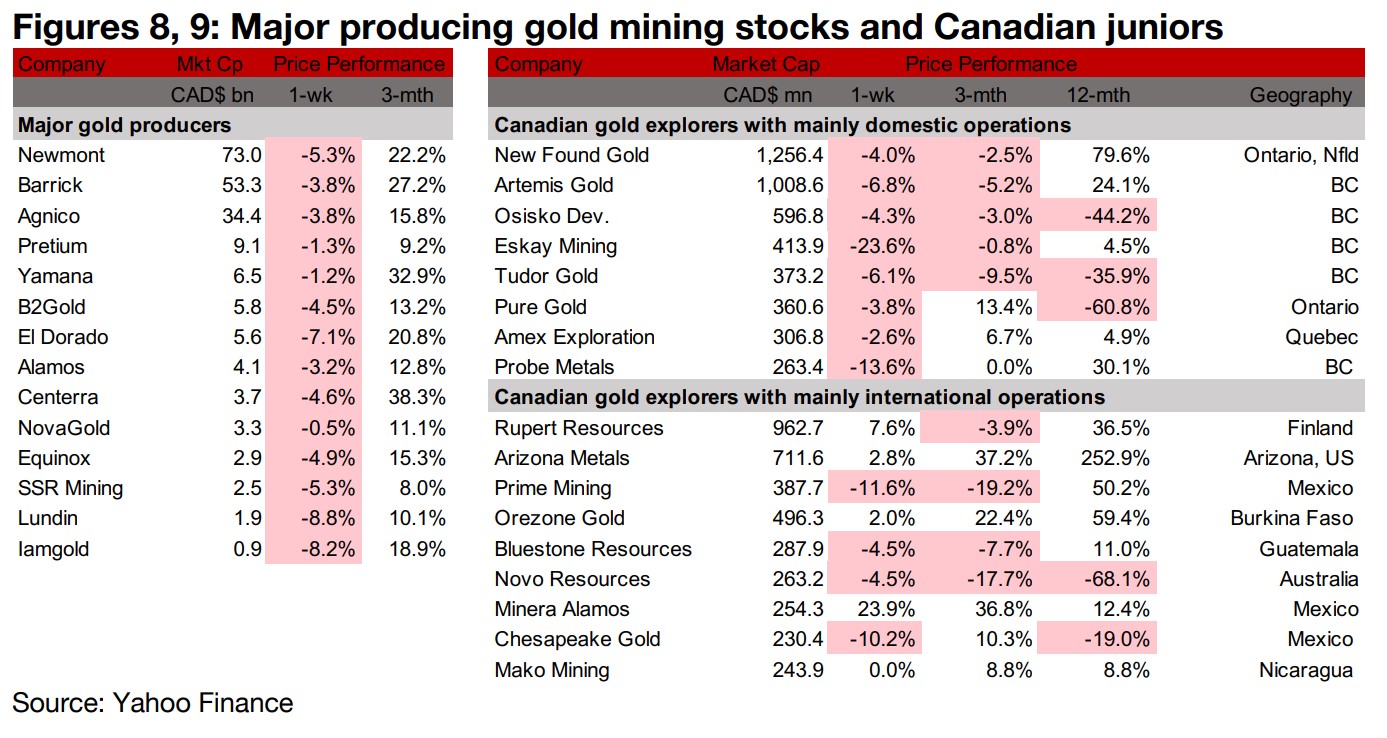

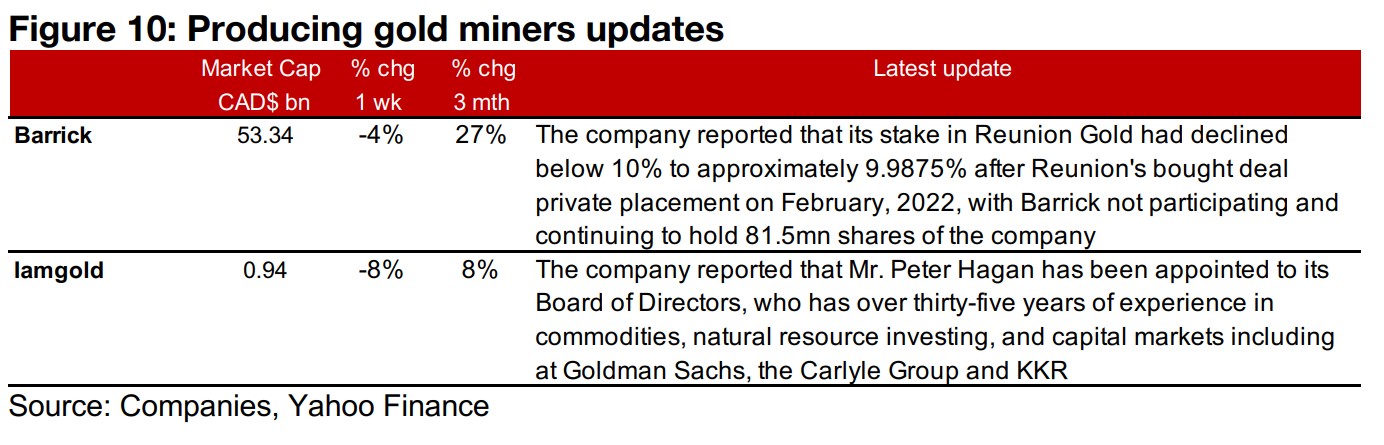

Producers all down as Fed begins rate hikes

The producing gold miners were all down this week as the gold price fell on the Fed's first interest rate hike in over five years, and its plans for six more hikes this year (Figure 8). Barrick reported that its stake in Reunion Gold had declined below 10% after it did not participate in the company's bought deal private placement, with Barrick maintaining its holding of 81.5mn shares. Iamgold reported that Mr. Peter Hagan was appointed to its Board of Directors, who has over thirty-five years of experience in commodities, natural resource investing and capital markets including (Figure 10).

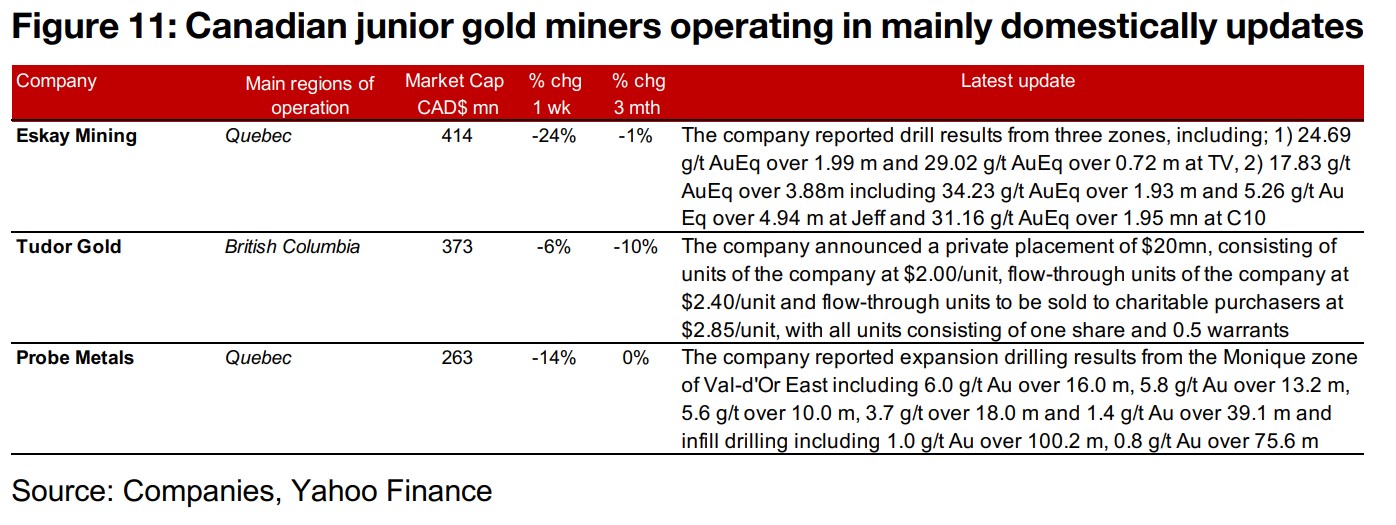

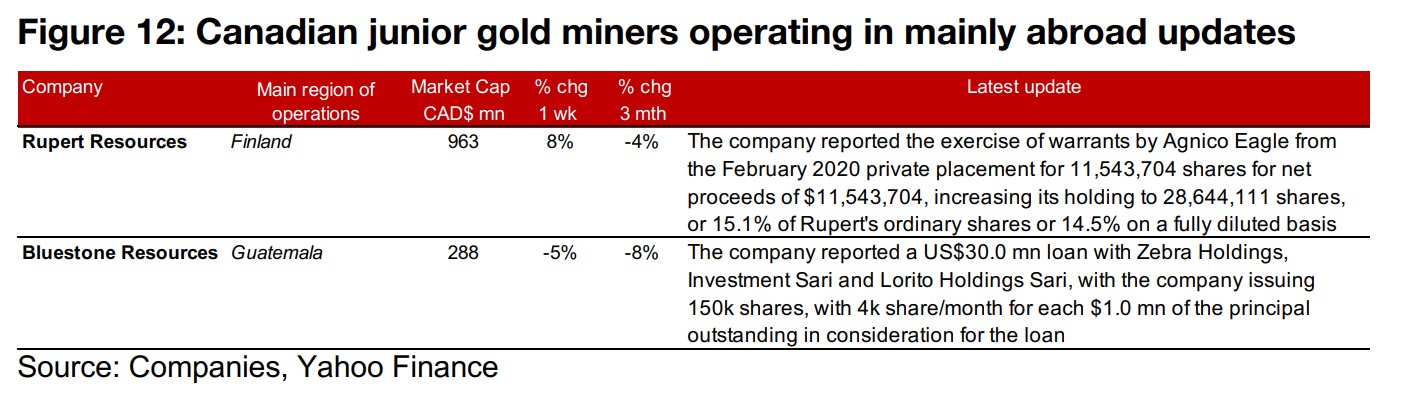

Canadian juniors mostly down on rising rates

The Canadian juniors were mostly down as the gold price fell and equity markets started pricing in the planned Fed rate hikes (Figure 9). For the Canadian juniors operating mainly domestically, Eskay reported drill results from the TV, Jeff and C10 zones at its Eskay VMS project, Tudor Gold announced a $20mn private placement and Probe Metals reported expansion and infill drill results from the Monique zone of the Val-d'Or East project (Figure 11). For the Canadian juniors operating mainly internationally, Rupert reported the exercise of 11.5 mn shares for $11.5mn by Agnico Eagle increasing their fully diluted holding of the company to 14.5% and Bluestone Resources reported a US$30.0mn loan with Zebra Holdings, Investment Sari and Lorito Holdings Sari with the company issuing shares in consideration for the loan (Figure 12).

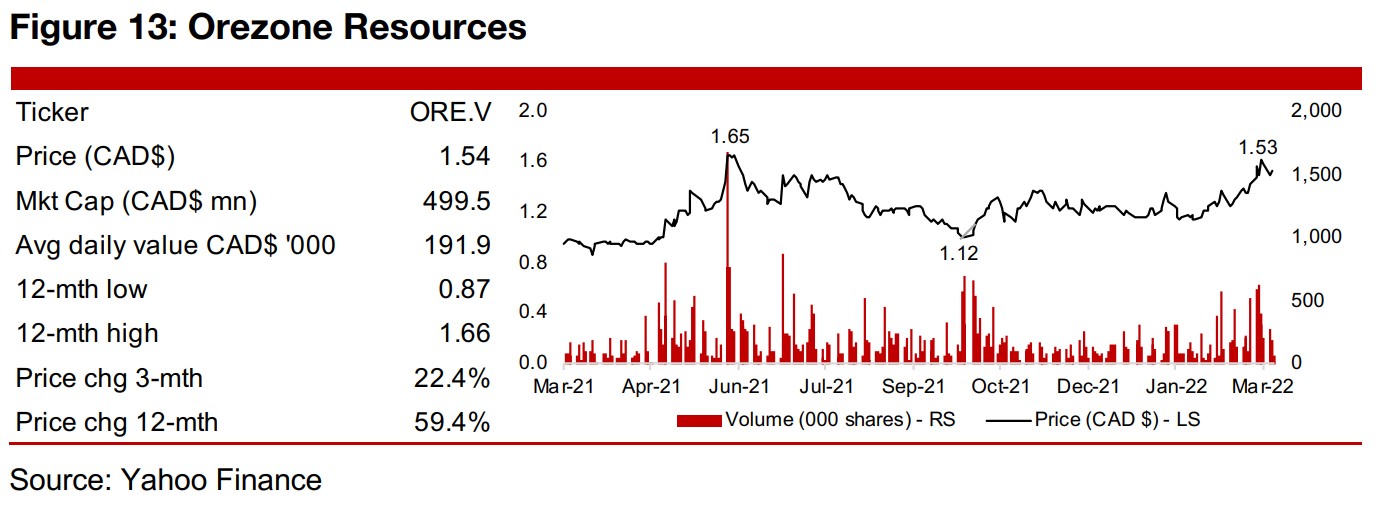

In Focus: Orezone Resources (ORE.V)

Rising in the ranks of the TSXV gold stocks

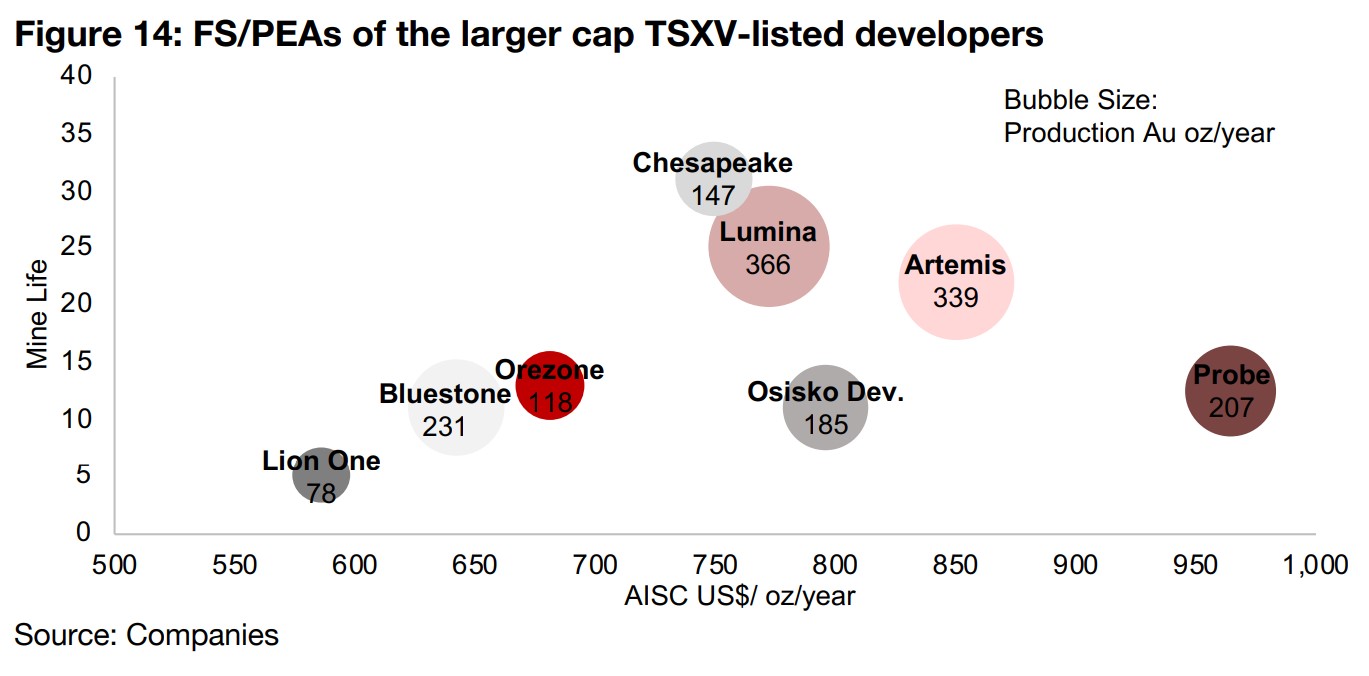

Orezone has recently entered the top ten for TSXV gold stocks, becoming the eighth largest of the group with a market cap of $499.5mn with its share price seeing strong gains over the past two months after nearly six months of stagnation. The company operates the Bombore project in Burkina Faso, which is at an advanced stage, with the financing for the project secured over 2021, construction in progress and first gold targeted by Q3/22. The project is relatively small in the context of the other large TSXV developers, with its June 2019 PEA annual production of 118k oz over a 13- year mine life (Figure 14). However, its costs are reasonably low versus the group, at with an AISC of $681/oz, which could prove an advantage versus other projects as inflation becomes an increasing concern.

New drilling results and rising gold both driving price

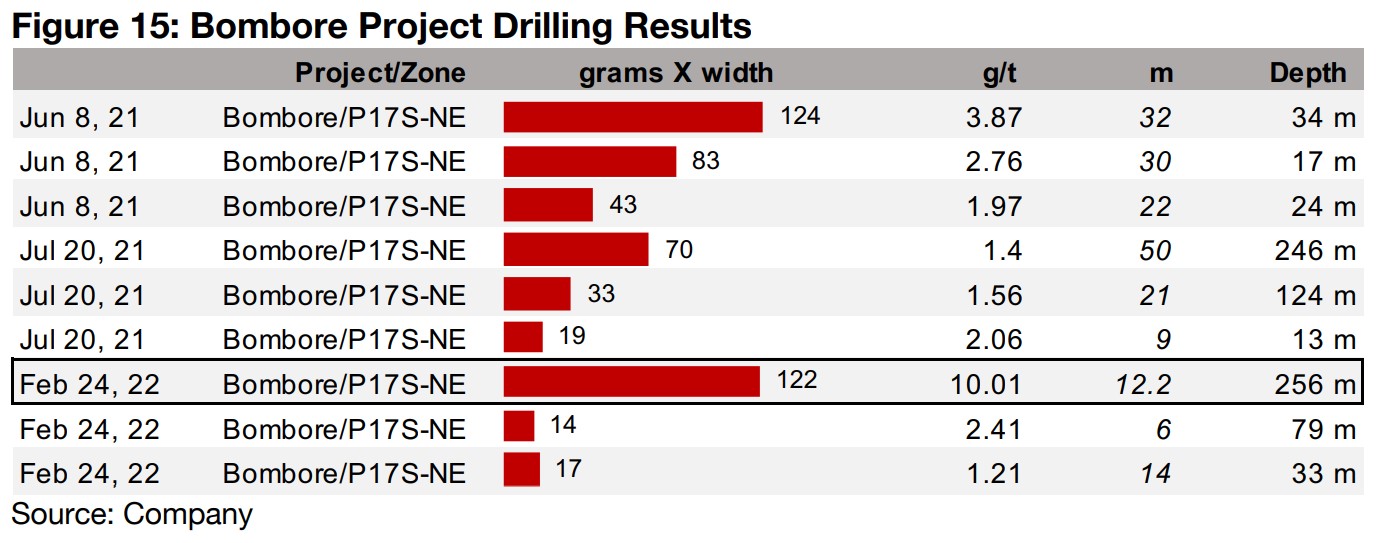

While the rising gold price over the past month likely has had some effect on Orezone's recent gains, we are not seeing similar rises across all of the large TSXV developers from this. It appears rather that most of increase has likely been driven by Orezone's strong drill results released on February 24, 2022, with the company reporting results from the PS17S-NE zone at Bombore, with a highlight of 10.01 g/t over 12.2 m from 256 m, for grams-thickness of 122, nearly as strong as its previous strongest grams-thickness measure of 124 from June 8, 2021 (Figure 15). The company has only released three sets of drilling results over the past year, as the focus over 2021 had been securing financing and starting construction on the project. With these two milestones met, the company has since December 2021 been focused on its Phase II drilling, which targets better defining the continuity between the P17S and P17 zones of the project, and a Phase III is also expected for early 2022, targeting extensions along P17 and again continuity between P17S and P17.

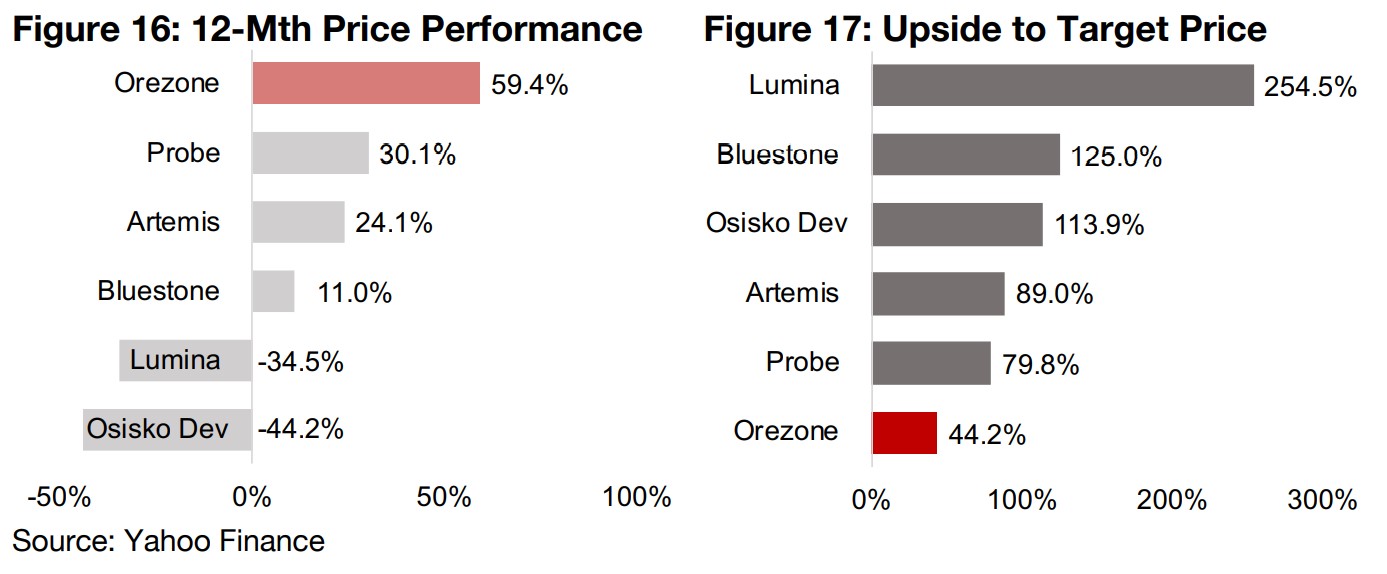

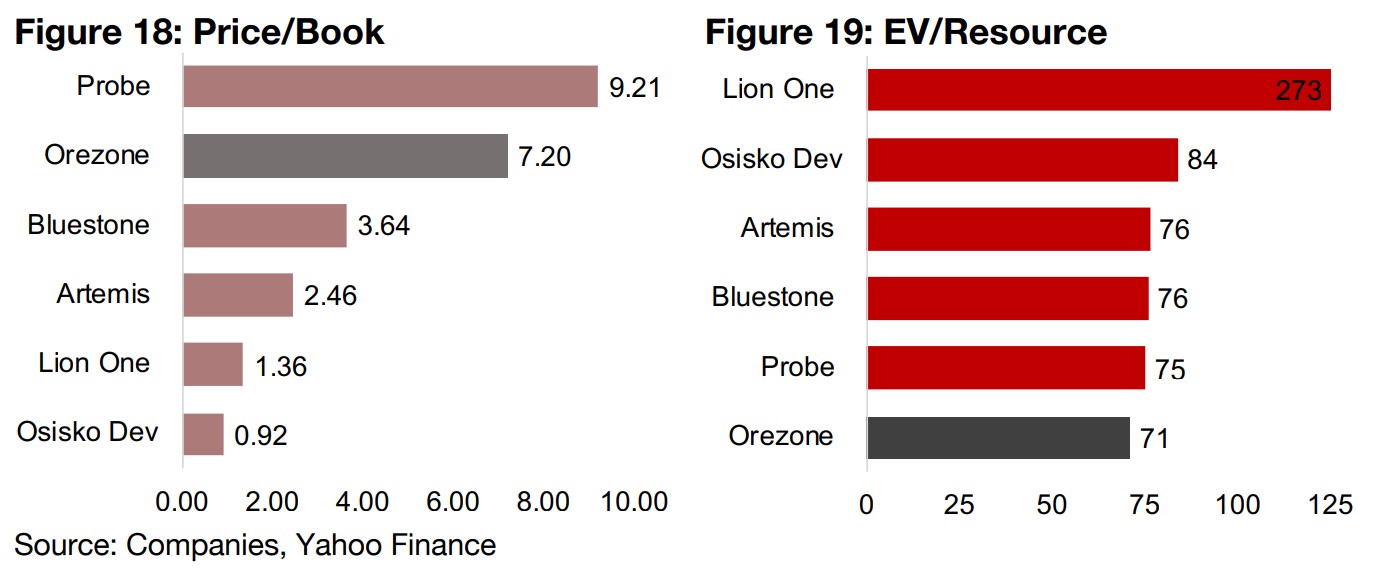

The gains over the past two months have made the company the strongest performer of the large TSXV developers over the past years by far, up 59.4%, with the other large developers seeing more moderate gains, and in the cases of Lumina and Osisko Development, substantial losses (Figure 16). These gains have seen the company reach closer to its consensus target price, although there is still an estimated 44.2% upside for the stock (Figure 17). The largest upside of the group is coming from the big underperformers, suggesting that share targets may have been maintained at similar levels even as share prices have dropped significantly. On a price/book valuation the company trades high versus the group at 7.20x, partly because of the recent large share price gains, but the metric is also somewhat distorted because the company has quite a low equity base because of a large accumulated deficit (Figure 18). On an EV/Resource basis, in contrast, Orezone is trading near the bottom of the group, although this only represents a moderate discount, as the developer peers trade in a relatively tight range from US$71/oz Au to US$84/oz Au, with an average of US$77/oz, excluding outlier Lion One (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.